Resources

About Us

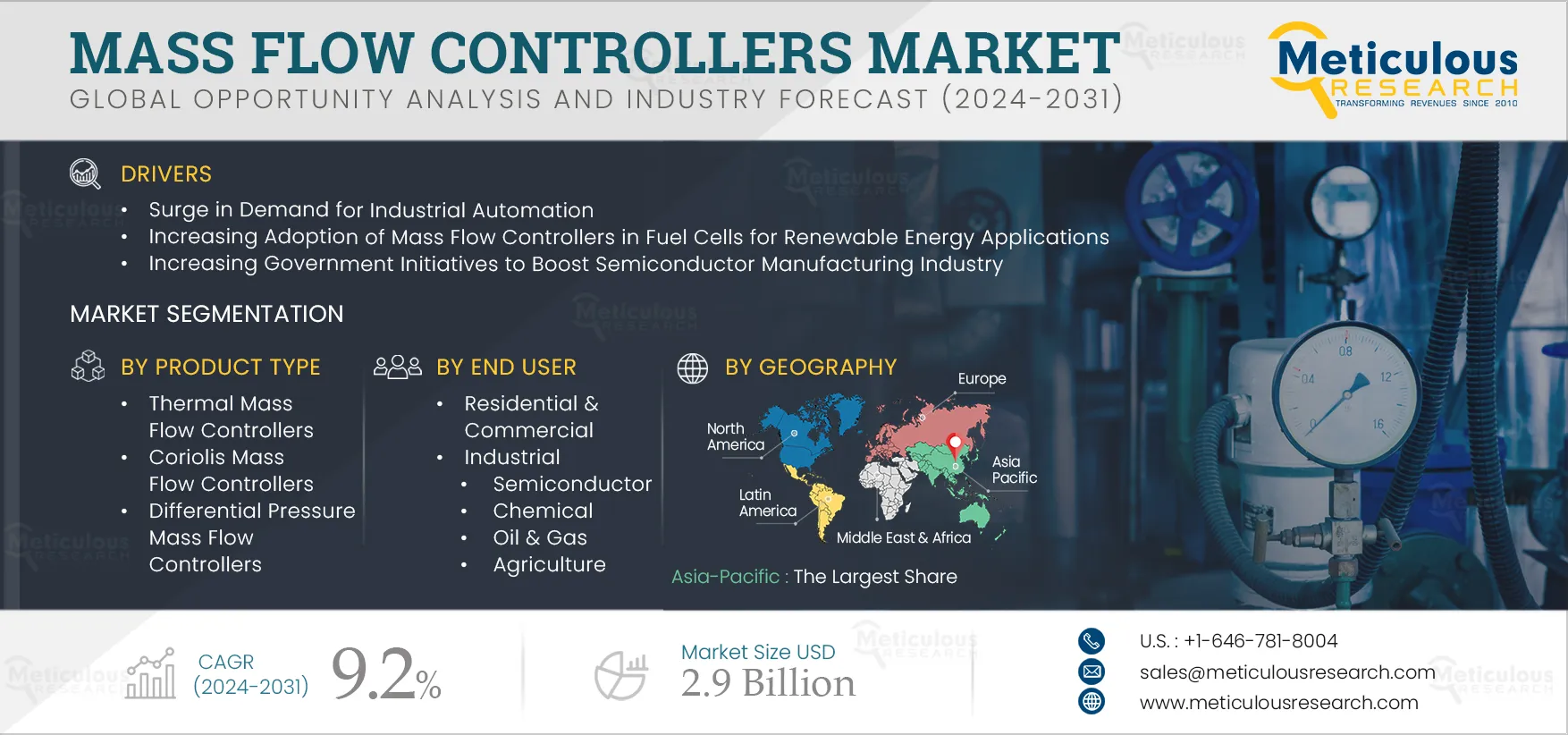

Mass Flow Controllers Market Size, Share, Forecast, & Trends Analysis by Product Type (Thermal, Coriolis, Differential Pressure), Flow Rate (Low, Medium, High), End User (Residential & Commercial, Industrial (Semiconductor, Chemical, Pharmaceutical)), and Geography - Global Forecast to 2032

Report ID: MRSE - 1041210 Pages: 250 May-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Mass Flow Controllers Market is expected to reach $2.9 billion by 2032, at a CAGR of 9.2% from 2025 to 2032. The growth of this market is attributed to the surge in demand for industrial automation, increasing adoption of mass flow controllers in fuel cells for renewable energy applications, and increasing government initiatives to boost the semiconductor manufacturing industry. Moreover, the increasing demand for mass flow controllers in pharmaceutical and medical devices industries and advancements in sensor technology are expected to offer growth opportunities for the players operating in this market.

The industrial sector is focusing on automation, machine learning, and real-time data processing to implement in the manufacturing industries. Considering the significance of automated industrialization, organizations are planning and implementing Industry 4.0 to transform their traditional manufacturing industry into a smart one with the adoption of new and advanced technologies, including IoT, artificial intelligence, robotics, cloud technology, and analytics. With increasing automation in the industrial sector, the demand for MFCs increases in manufacturing industries.

Automated processes involve precise control of gases and liquids for optimal results. MFCs are integrated into automated systems for real-time monitoring and adjustments of flow rates. This ensures that processes remain within the desired parameters. Automation systems collect data from MFCs to analyze the flow rates and process optimization over time. Also, the automation of metering and mixing processes for various chemicals relies on accurate flow control from MFCs. As automation continues to advance, the need for precise and reliable flow control solutions such as MFCs becomes more critical, further driving market growth.

Governments are promoting initiatives supporting the semiconductor industry and are investing heavily in developing a strong domestic supply chain for materials, equipment, and other resources needed for semiconductor manufacturing.

Some of the recent government initiatives are as follows:

With such developments, governments around the globe are prioritizing investments in research and development (R&D) for advanced technologies in the semiconductor manufacturing industry. This includes advancements in areas such as microfluidics, nanotechnology, and advanced materials that heavily rely on precise flow control, leading to increased demand for MFCs. Such factors support the growth of the mass flow controllers market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

The pharmaceutical and medical device industries are increasingly adopting complex processes involving precise control of gases and liquids. As these industries continue to develop advanced processes and prioritize safety and efficiency, the need for MFCs continues to grow. MFCs are used to accurately measure and control the flow of gases and liquids used in various medical processes, such as cell culture, sterilization, and drug delivery. This precise control minimizes the risk of contamination, inconsistencies, and errors. MFCs enable repeatable and consistent flow rates, ensuring the quality and efficacy of pharmaceutical products and medical devices.

Organizations are offering MFCs to control the flow of oxygen, carbon dioxide, and other critical gases for cell cultures used in biopharmaceutical production. For instance, in June 2024, Cytiva (U.S.) launched Xcellerex X-platform bioreactors with Brooks Instrument (U.S.) SLA5800 Series Biotech mass flow controllers that manage the precise flow of pure gasses such as carbon dioxide, nitrogen, air, and oxygen into bioreactor chambers. Such developments offer new opportunities for the adoption of the mass flow controllers market during the forecast period.

The rapid progress in sensor technology is mainly due to the quickly advancing development of micro/nanofabrication, manufacturing techniques, advanced materials, and increasing demand for sensitive measurement techniques. Advancements in sensor technology open doors for MFCs to be used in new and emerging applications across the industrial sector. Various sensors are used in MFCs depending on the desired level of accuracy, flow rate range, and the gas or liquid being measured. Sensors measure the differing thermal conductivity of the flowing gas.

With the advancement of sensor technology, organizations are collaborating to integrate sensor technology with mass flow controllers for various applications. For instance, in June 2021, PHIX B.V. (Netherlands) partnered with Bronkhorst High-Tech BV (Netherlands) to enable volume manufacturing of thermal mass flow sensors to integrate into mass flow meters and controllers. Such developments offer growth opportunities for the mass flow controllers market during the forecast period.

Based on product type, the global mass flow controllers market is segmented into thermal mass flow controllers, coriolis mass flow controllers, and differential pressure mass flow controllers. In 2025, the thermal mass flow controllers segment is expected to account for the largest share of above 48% of the global mass flow controllers market. The large market share of this segment is attributed to the increasing use of thermal MFCs in the chemical, semiconductor, and pharmaceutical industries, advancement in sensor technology, and increasing focus on reducing cost. Thermal MFCs offer various benefits over other MFCs, such as affordability, simple design, and compact size, allowing easier integration.

However, the pressure mass flow controllers segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the increasing demand for low differential pressure MFCs, which offer faster response and better accuracy than other MFCs, and the increasing use of differential pressure MFCs across various industries.

Based on flow rate, the global mass flow controllers market is segmented into low (0-50 slpm), medium (0-300 slpm), and high (0-1500 slpm). In 2025, the low (0-50 slpm) segment is expected to account for the largest share of above 45% of the global mass flow controllers market. The large market share of this segment is attributed to the growing trend towards more affordable thermal MFCs and increasing use of low flow rate MFCs in semiconductor manufacturing.

However, the medium (0-300 slpm) segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the increasing emphasis on automation and centralized control systems in various industries and increasing demand for medium flow rate MFCs in chemical processing and food & beverage production applications.

Based on end user, the global mass flow controllers market is segmented into residential & commercial and industrial. In 2025, the industrial segment is expected to account for the largest share of above 80% of the global mass flow controllers market. The large market share of this segment is attributed to the increasing industrial automation, strict environmental regulations pushing industries to adopt cleaner technologies, increasing demand for low flow rate MFCs in the industrial sector, and advancements in MFC technology such as miniaturization and sensor technology. In June 2022, Sensirion AG (Switzerland) launched the SFC5500 series with four new mass flow controllers and meters for analytical, medical, and industrial applications. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

In 2025, Asia-Pacific is expected to account for the largest share of above 37% of the global mass flow controllers market. The market growth in Asia-Pacific is driven by the increasing government initiatives to boost the semiconductor manufacturing industry in the region, increasing Industry 4.0 practices, strict environmental regulations to adopt cleaner technologies, and the rising demand for cost-effective thermal MFCs in the region. China is a leader in the region for MFC adoption due to its booming manufacturing sector and government initiatives promoting technological advancements. India is rapidly expanding its manufacturing base and increasingly focusing on automation and process control, increasing the market growth. In September 2024, Brooks Instrument (U.S.) opened a new manufacturing facility for producing mass flow controllers (MFCs) in Penang, Malaysia. Moreover, this region is also projected to record the highest CAGR of above 10.5% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the mass flow controllers market are Brooks Instrument (U.S.), MKS Instruments, Inc. (U.S.), HORIBA, Ltd. (Japan), Bronkhorst High-Tech BV (Netherlands), Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (U.S.), Sensirion AG (Switzerland), Hitachi Metals, Ltd. (Japan), Teledyne Hastings Instruments (U.S.), Parker Hannifin Corp (U.S.), Alicat Scientific, Inc (U.S.), FLSmidth A/S (Denmark), Advitech Inc. (U.S.), FCON Co., Ltd. (Japan), and Azbil Corporation (Japan).

In March 2025, Brooks Instrument (U.S.) launched the GF120xHT Series high-temperature thermal mass flow controller, which precisely delivers vapor to the process chamber required in semiconductor manufacturing.

In March 2024, Sensirion AG (Switzerland) launched the SFC6000 mass flow controller for analytical instruments, semiconductor applications, and process automation.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.2% |

|

Market Size (Value) |

USD 2.9 Billion by 2032 |

|

Segments Covered |

By Product Type

By Flow Rate

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Brooks Instrument (U.S.), MKS Instruments, Inc. (U.S.), HORIBA, Ltd. (Japan), Bronkhorst High-Tech BV (Netherlands), Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (U.S.), Sensirion AG (Switzerland), Hitachi Metals, Ltd. (Japan), Teledyne Hastings Instruments (U.S.), Parker Hannifin Corp (U.S.), Alicat Scientific, Inc (U.S.), FLSmidth A/S (Denmark), Advitech Inc. (U.S.), FCON Co., Ltd. (Japan), and Azbil Corporation (Japan) |

The mass flow controllers market study focuses on market assessment and opportunity analysis through the sales of mass flow controllers across different regions and countries across different market segmentations. This study is also focused on competitive analysis for mass flow controllers based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The global mass flow controllers market is projected to reach $2.9 billion by 2032, at a CAGR of 9.2% during the forecast period.

In 2025, the thermal mass flow controllers segment is expected to account for the largest share of above 48% of the mass flow controllers market.

Based on end user, the industrial segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the surge in demand for industrial automation, increasing adoption of mass flow controllers in fuel cells for renewable energy applications, and increasing government initiatives to boost the semiconductor manufacturing industry. Moreover, the increasing demand for mass flow controllers in pharmaceutical and medical devices industries and advancements in sensor technology are expected to offer growth opportunities for the players operating in this market.

The key players operating in the global mass flow controllers market are Brooks Instrument (U.S.), MKS Instruments, Inc. (U.S.), HORIBA, Ltd. (Japan), Bronkhorst High-Tech BV (Netherlands), Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (U.S.), Sensirion AG (Switzerland), Hitachi Metals, Ltd. (Japan), Teledyne Hastings Instruments (U.S.), Parker Hannifin Corp (U.S.), Alicat Scientific, Inc (U.S.), FLSmidth A/S (Denmark), Advitech Inc. (U.S.), FCON Co., Ltd. (Japan), and Azbil Corporation (Japan).

Asia-Pacific is projected to register the highest CAGR of above 10.5% during the forecast period.

Published Date: Jan-2026

Published Date: Jun-2025

Published Date: Jan-2024

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates