Resources

About Us

Hydrogen Fuel Cell Stack Modules Market by Power Output (Below 5kW, 5-10kW, 10-100kW, Above 100kW), Technology (PEMFC, SOFC, AFC, Others), Application (Transport, Stationary, Portable), End User, and Geography—Global Forecast to 2035

Report ID: MREP - 1041595 Pages: 220 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Hydrogen Fuel Cell Stack Modules Market Size?

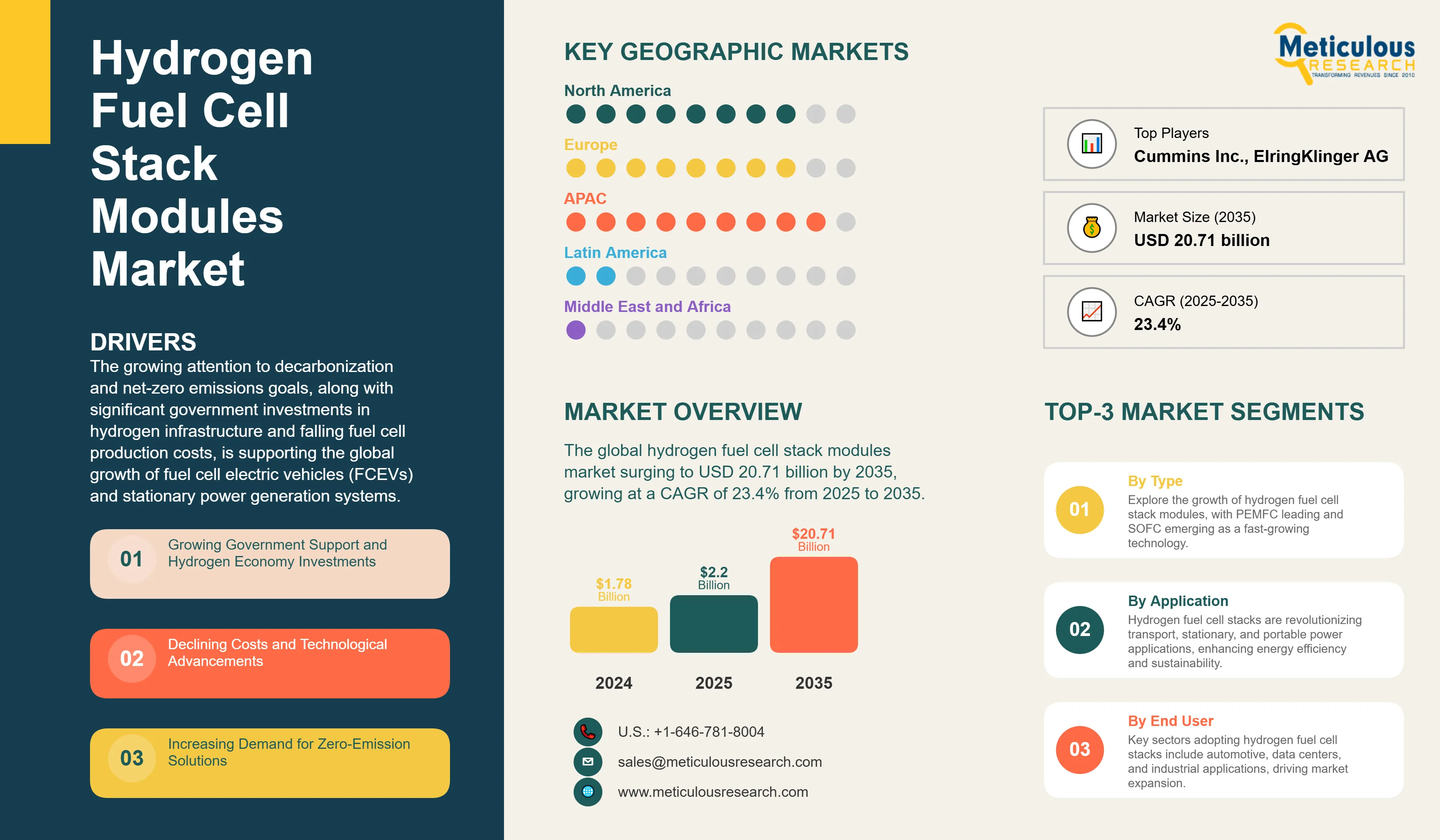

The global hydrogen fuel cell stack modules market size was valued at USD 1.78 billion in 2024 and is expected to increase to approximately USD 2.20 billion in 2025, then expand to around USD 20.71 billion by 2035, growing at a CAGR of 23.4% from 2025 to 2035. The growing attention to decarbonization and net-zero emissions goals, along with significant government investments in hydrogen infrastructure and falling fuel cell production costs, is supporting the global growth of fuel cell electric vehicles (FCEVs) and stationary power generation systems.

Market Highlights: Hydrogen Fuel Cell Stack Modules

Click here to: Get Free Sample Pages of this Report

The hydrogen fuel cell stack modules market involves the design, development, manufacturing, and deployment of integrated fuel cell stack systems. These systems convert hydrogen and oxygen into electricity through an electrochemical reaction. The modules contain multiple individual fuel cells connected in series. They include membrane electrode assemblies (MEAs), bipolar plates, gaskets, current collectors, and end plates that create the main power generation unit.

Unlike traditional combustion engines, fuel cell stacks produce electricity, with only water and heat as byproducts. This results in zero-emission power generation. The market is driven by global efforts to reduce carbon emissions, government subsidies and incentives for clean energy, improvements in stack efficiency and durability, the growth of hydrogen refueling infrastructure, and increasing demand from transportation, stationary power, and portable applications in residential, commercial, and industrial sectors.

How is AI Transforming the Hydrogen Fuel Cell Stack Modules Market?

Artificial intelligence is changing the dynamics of the hydrogen fuel cell stack modules market. It is enabling predictive maintenance, improving stack performance with real-time monitoring and control, enhancing quality control in manufacturing, and speeding up material discovery for better catalyst and membrane development. AI algorithms look at operational data to forecast degradation patterns, optimize hydrogen use, manage thermal dynamics, and extend stack life with smart load management. Machine learning models aid diagnostics by spotting performance issues, predicting failures, and suggesting maintenance schedules, which lowers downtime and operational costs. AI-based simulation tools speed up the design of new stack architectures, enhance flow field designs, and predict performance in different operating conditions. This makes fuel cell systems more efficient, reliable, and cost-effective for commercial use.

What are the Key Trends in the Hydrogen Fuel Cell Stack Modules Market?

Green hydrogen integration: A major trend in the hydrogen fuel cell stack modules market is the growing integration with green hydrogen production from renewable energy sources. This creates a completely carbon-free energy chain from production to consumption. Fuel cell manufacturers are creating stacks that are optimized for green hydrogen purity levels and are working closely with electrolyzer manufacturers to ensure compatibility. This trend supports circular economy principles and boosts the environmental value of fuel cell systems.

Modular and scalable designs: Another key trend driving market growth is the development of modular, scalable fuel cell stack designs that can be easily configured for different power needs. Manufacturers are building standardized components that can be combined to achieve power outputs ranging from kilowatts to megawatts. This approach cuts development costs and speeds up time-to-market for new applications while also improving serviceability and simplifying inventory management.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 20.71 Billion |

|

Market Size in 2025 |

USD 2.2 Billion |

|

Market Size in 2024 |

USD 1.78 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 23.4% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Europe |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Power Output, Technology, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government Policies and Hydrogen Economy Investments

A key factor driving the growth of the hydrogen fuel cell stack modules market is the significant government support and investment in developing the hydrogen economy worldwide. Countries are putting together hydrogen strategies with large funding programs. For example, the EU has a hydrogen strategy that aims for 40GW of electrolyzer capacity by 2030. Japan has a Basic Hydrogen Strategy, and South Korea has a Hydrogen Economy Roadmap. The U.S. Infrastructure Investment and Jobs Act has allocated $9.5 billion for clean hydrogen projects. These policies offer incentives for purchasing fuel cell vehicles, subsidies for stationary fuel cell installations, funding for hydrogen refueling infrastructure, and support for research and development. This creates a positive environment for manufacturers of fuel cell stack modules to increase production and lower costs through economies of scale.

Restraint

High Initial Costs and Infrastructure Limitations

Despite the growth potential, the hydrogen fuel cell stack modules market faces major challenges. The upfront costs are high compared to traditional technologies. Fuel cell stacks use costly materials like platinum catalysts and specialized membranes, leading to a much larger initial investment than internal combustion engines or battery systems. The limited hydrogen refueling network, especially outside major cities, restricts the use of fuel cell vehicles. This creates a catch-22 where infrastructure development relies on vehicle adoption and vice versa. Moreover, the high costs of hydrogen production, storage, and distribution increase the total cost of ownership. As a result, fuel cell systems struggle to compete economically without subsidies.

Opportunity

Heavy-Duty Transportation and Industrial Applications

The growing use of fuel cell technology in heavy-duty transportation and industrial applications offers a strong opportunity for the hydrogen fuel cell stack modules market. Long-haul trucks, buses, trains, ships, and aircraft need high energy density and fast refueling capabilities. Battery-electric solutions struggle with weight, range, and charging time issues. Fuel cell stacks perform better in these areas, providing longer ranges, shorter refueling times, and steady power output no matter the conditions. The industrial sector also needs reliable backup power, combined heat and power systems, and equipment like forklifts in warehouses, which increases the demand for fuel cell stack modules. This is especially true as companies work toward decarbonization goals and look for alternatives to diesel generators.

Power Output Insights

Why are 10-100kW Fuel Cell Stacks Preferred for Commercial Applications?

The 10-100kW segment holds the largest share, accounting for 30-35% of the overall hydrogen fuel cell stack modules market in 2025. This power range is ideal for many commercial uses, including light commercial vehicles, buses, material handling equipment, and distributed power generation systems. This segment strikes the best balance between performance, cost, and efficiency for most commercial applications. It provides enough power for demanding tasks while keeping system complexity and costs manageable. These stacks are especially popular in urban bus fleets and delivery vehicles, offering sufficient range and performance for daily operations without adding too much weight or taking up too much space.

The segment above 100kW is expected to grow at the fastest CAGR in the coming years. This growth is driven by the increasing use of high-power systems in heavy-duty transportation, such as long-haul trucks, trains, marine vessels, and large-scale stationary power generation. These high-power stacks are crucial for applications that need significant continuous power output. They are benefiting from technological advancements that improve power density and lower costs per kilowatt.

Technology Insights

How do PEMFC Stacks Support Market Growth?

The PEMFC (Proton Exchange Membrane Fuel Cell) segment holds the largest share of 60-70% of the overall hydrogen fuel cell stack modules market in 2025. PEMFC technology leads the way because of its low operating temperature, which ranges from 60 to 80°C. It starts up quickly, has high power density, and works well for transportation. Its ability to manage dynamic load changes, compact design, and solid reliability in automotive settings make it the top choice for most mobile and backup power applications. Major car manufacturers have adopted PEMFC technology for their fuel cell vehicles, leading to cost savings and ongoing improvements.

The SOFC (Solid Oxide Fuel Cell) segment is set to grow at the fastest CAGR through 2035. SOFC technology is expanding quickly thanks to its high electrical efficiency of up to 60%. It can use different types of fuel, including natural gas and biogas, and fits well for stationary combined heat and power applications. Operating at high temperatures between 600 and 1000°C allows for internal fuel reforming, making it perfect for consistent power generation in commercial and industrial environments.

Application Insights

How Transport Applications Drive the Fuel Cell Stack Modules Market?

The transport segment commands the largest market share, accounting for nearly 60-65% in 2025. The urgent need to cut emissions and comply with tough environmental rules drives the adoption of fuel cell technology in various types of vehicles. Fuel cell electric vehicles have benefits over battery electric vehicles, such as a longer range, quicker refueling, and steady performance in cold weather. This makes them especially suited for commercial fleets. The segment covers passenger cars, buses, trucks, forklifts, and new uses in rail and marine transport. Commercial vehicle applications are growing the fastest thanks to their operational benefits and favorable costs for vehicles used heavily.

However, the stationary power segment is expected to grow at the fastest CAGR during the forecast period. The rising need for reliable, clean power generation and backup systems boosts adoption in commercial buildings, data centers, telecommunications infrastructure, and industrial sites.

End User Insights

Why has the Automotive Sector Found Maximum Application of Fuel Cell Stack Modules?

The automotive segment will hold the largest share of around 35-40% in 2025. The automotive industry's focus on electrification and zero-emission vehicles drives significant demand for fuel cell stack modules. Major automakers like Toyota, Hyundai, Honda, BMW, and Daimler have active fuel cell vehicle programs with more model offerings and increased production volumes. Government requirements for zero-emission vehicles, especially in California, Europe, China, and Japan, put pressure on automakers to develop fuel cell vehicles along with battery electric options. The segment benefits from substantial research and development investments aimed at lowering costs and improving performance. Next-generation stacks are achieving higher power density and longer lifetimes.

The data centers segment is expected to grow at the fastest CAGR through 2035. Data centers need an uninterrupted power supply and are increasingly committed to sustainability. This drives the adoption of fuel cell systems as primary or backup power sources. Fuel cells have advantages over traditional diesel generators, such as zero local emissions, better efficiency, lower maintenance, and the ability for continuous operation with enough hydrogen supply. This makes them more appealing as data center operators strive for carbon neutrality.

U.S. Hydrogen Fuel Cell Stack Modules Market Size and Growth 2025 to 2035

The U.S. hydrogen fuel cell stack modules market is projected to be worth around USD 3.68 billion by 2035, growing at a CAGR of 24% from 2025 to 2035.

How is the Asia Pacific Hydrogen Fuel Cell Stack Modules Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest market share of nearly 40-45% in 2025. The region's strength comes from strong government support in Japan, South Korea, and China for developing a hydrogen economy. This support includes national strategies and significant funding programs. Japan leads in fuel cell technology, with the largest fleet of residential fuel cells through the ENE-FARM program and growing adoption of fuel cell electric vehicles (FCEVs). South Korea has an ambitious hydrogen economy plan aiming for 6.2 million FCEVs and 1,200 refueling stations by 2040. Major companies like Hyundai, POSCO, and SK Group are investing heavily in fuel cell technology, which boosts the region's position further. China's focus on fuel cell buses and trucks for commercial use, alongside generous subsidies and local content rules, increases demand for stack modules.

Which Factors Support the Europe Hydrogen Fuel Cell Stack Modules Market Growth?

Europe is expected to witness the fastest growth rate from 2025 to 2035. This growth is driven by the European Green Deal and Hydrogen Strategy, which aim for climate neutrality by 2050. Fuel cells are essential for reducing emissions in transportation and industry. Significant funding from initiatives like the Clean Hydrogen Partnership, which offers €2 billion, as well as national hydrogen strategies in Germany, France, the Netherlands, and other countries, supports the development and use of this technology. The region's strong automotive industry, with companies such as Daimler, BMW, Stellantis, and Bosch investing in fuel cell technology for commercial vehicles, creates strong demand. Moreover, Europe's emphasis on producing green hydrogen from renewable energy and developing hydrogen valleys that connect production, distribution, and consumption fosters a good environment for using fuel cell stacks in various applications.

Value Chain Analysis

Research and Development

This stage focuses on advancing fuel cell technology through materials research, stack design optimization, and performance improvement, developing next-generation catalysts, membranes, and bipolar plates for enhanced efficiency and durability.

Key Players: Ballard Power Systems, Toyota Motor Corporation, Hyundai Motor Company, Bosch

Component Manufacturing

This stage involves producing critical components including membrane electrode assemblies, bipolar plates, gas diffusion layers, and other specialized parts requiring precision manufacturing and quality control.

Key Players: ElringKlinger AG, Freudenberg, Dana Incorporated, Advent Technologies

Stack Assembly and Integration

This stage encompasses assembling individual components into complete fuel cell stacks, including quality testing, conditioning, and system integration with balance of plant components.

Key Players:

Recent Developments

Segments Covered in the Report

By Power Output

By Technology

By Application

By End User

By Region

The hydrogen fuel cell stack modules market size is expected to increase from USD 2.2 billion in 2025 to USD 20.71 billion by 2035.

The hydrogen fuel cell stack modules market is expected to grow at a CAGR of 23.4% from 2025 to 2035.

The major players in the hydrogen fuel cell stack modules market include Ballard Power Systems Inc., Plug Power Inc., Bloom Energy Corporation, Cummins Inc., Toyota Motor Corporation, Hyundai Motor Company, Bosch (Robert Bosch GmbH), Nuvera Fuel Cells (Hyster-Yale Materials Handling), SFC Energy AG, Intelligent Energy Holdings plc, PowerCell Sweden AB, Doosan Fuel Cell Co. Ltd., Nedstack Fuel Cell Technology B.V., Horizon Fuel Cell Technologies, ElringKlinger AG, FuelCell Energy Inc., AFC Energy plc, Advent Technologies Holdings Inc., Loop Energy Inc., and Symbio (Michelin Group) among others.

The main factors driving the hydrogen fuel cell stack modules market include the rising global emphasis on reducing carbon emissions and achieving net-zero targets. There are significant government investments in hydrogen infrastructure. Fuel cell manufacturing costs are decreasing. Additionally, the adoption of fuel cell electric vehicles and stationary power systems is picking up speed.

Asia Pacific region will lead the global hydrogen fuel cell stack modules market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Power Output

3.3. Market Analysis, By Technology

3.4. Market Analysis, By Application

3.5. Market Analysis, By End User

3.6. Market Analysis, By Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Hydrogen Fuel Cell Stack Modules Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Growing Government Support and Hydrogen Economy Investments

4.2.2. Declining Costs and Technological Advancements

4.2.3. Increasing Demand for Zero-Emission Solutions

4.3. Global Hydrogen Fuel Cell Stack Modules Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Initial Capital Costs

4.3.2. Limited Hydrogen Infrastructure

4.4. Global Hydrogen Fuel Cell Stack Modules Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Heavy-Duty Transportation Applications

4.4.2. Green Hydrogen Integration

4.5. Global Hydrogen Fuel Cell Stack Modules Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Competition from Battery Electric Technologies

4.5.2. Technical Challenges in Stack Durability and Efficiency

4.6. Global Hydrogen Fuel Cell Stack Modules Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Development of High-Temperature PEM Technology

4.6.2. Modular and Scalable Stack Designs

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Sustainability on the Global Hydrogen Fuel Cell Stack Modules Market

5.1. Introduction to Sustainability in Fuel Cell Technology

5.2. Life Cycle Assessment of Fuel Cell Stack Manufacturing

5.3. Critical Materials and Supply Chain Sustainability

5.4. Green Hydrogen Integration and Carbon Footprint

5.5. Recycling and End-of-Life Management

5.6. Environmental Regulations and Standards

5.7. Corporate Sustainability Commitments

5.8. Impact on Market Growth and Investment Trends

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

7. Global Hydrogen Fuel Cell Stack Modules Market, By Power Output

7.1. Introduction

7.2. Below 5kW

7.3. 5-10kW

7.4. 10-100kW

7.5. 100-500kW

7.6. Above 500kW

8. Global Hydrogen Fuel Cell Stack Modules Market, By Technology

8.1. Introduction

8.2. Proton Exchange Membrane Fuel Cell (PEMFC)

8.2.1. Low-Temperature PEMFC

8.2.2. High-Temperature PEMFC

8.3. Solid Oxide Fuel Cell (SOFC)

8.4. Alkaline Fuel Cell (AFC)

8.5. Phosphoric Acid Fuel Cell (PAFC)

8.6. Molten Carbonate Fuel Cell (MCFC)

8.7. Other Technologies

9. Global Hydrogen Fuel Cell Stack Modules Market, By Application

9.1. Introduction

9.2. Transport

9.2.1. Passenger Vehicles

9.2.2. Commercial Vehicles

9.2.3. Material Handling Equipment

9.2.4. Marine

9.2.5. Rail

9.2.6. Aviation

9.3. Stationary Power

9.3.1. Primary Power

9.3.2. Backup Power

9.3.3. Combined Heat and Power (CHP)

9.4. Portable Power

10. Global Hydrogen Fuel Cell Stack Modules Market, By End User

10.1. Introduction

10.2. Automotive

10.3. Aerospace & Defense

10.4. Marine

10.5. Energy & Power

10.6. Industrial

10.7. Data Centers

10.8. Telecommunications

10.9. Residential

10.10. Commercial Buildings

10.11. Others

11. Hydrogen Fuel Cell Stack Modules Market, By Geography

11.1. Introduction

11.2. Asia-Pacific

11.2.1. Japan

11.2.2. South Korea

11.2.3. China

11.2.4. India

11.2.5. Australia

11.2.6. Rest of Asia-Pacific

11.3. Europe

11.3.1. Germany

11.3.2. France

11.3.3. U.K.

11.3.4. Netherlands

11.3.5. Norway

11.3.6. Spain

11.3.7. Italy

11.3.8. Rest of Europe

11.4. North America

11.4.1. U.S.

11.4.2. Canada

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. Saudi Arabia

11.6.2. UAE

11.6.3. South Africa

11.6.4. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

12.1. Ballard Power Systems Inc.

12.2. Plug Power Inc.

12.3. Bloom Energy Corporation

12.4. Cummins Inc.

12.5. Toyota Motor Corporation

12.6. Hyundai Motor Company

12.7. Bosch (Robert Bosch GmbH)

12.8. Nuvera Fuel Cells (Hyster-Yale Materials Handling)

12.9. SFC Energy AG

12.10. Intelligent Energy Holdings plc

12.11. PowerCell Sweden AB

12.12. Doosan Fuel Cell Co. Ltd.

12.13. Nedstack Fuel Cell Technology B.V.

12.14. Horizon Fuel Cell Technologies

12.15. ElringKlinger AG

12.16. FuelCell Energy Inc.

12.17. AFC Energy plc

12.18. Advent Technologies Holdings Inc.

12.19. Loop Energy Inc.

12.20. Symbio (Michelin Group)

13. Appendix

13.1. Questionnaire

13.2. Available Customization

Published Date: Sep-2025

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates