Resources

About Us

HVAC Services Market Size, Share & Forecast 2025-2035 | Analysis by Service Type (Retrofit, IoT Integration), System Type (Integrated), End-User & Geography

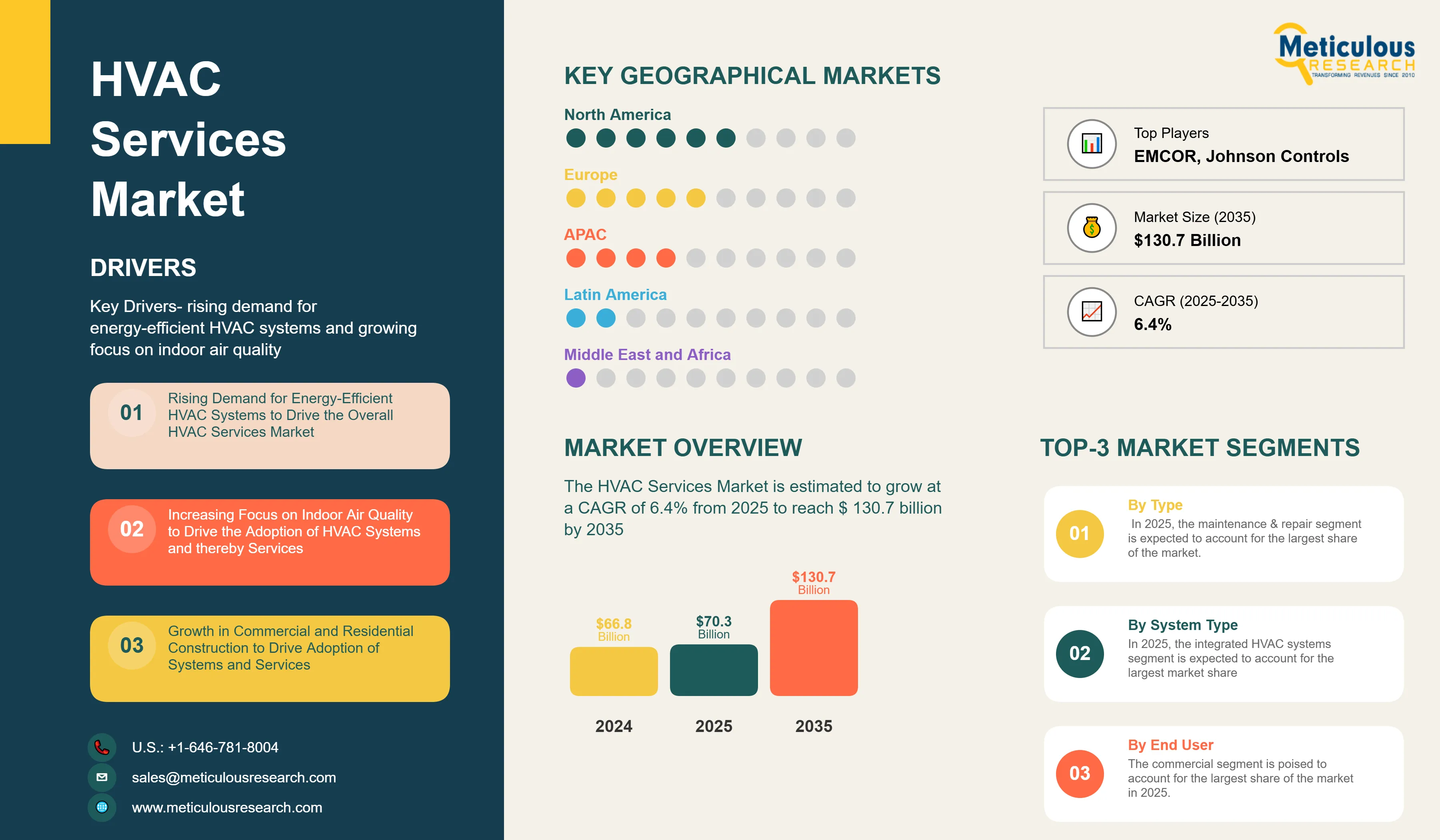

Report ID: MREP - 1041535 Pages: 280 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportSome of the key factors driving the growth of the HVAC services market include the rising demand for energy-efficient HVAC systems, growing focus on indoor air quality, growing commercial & residential construction, mandatory maintenance regulations, and integration of IoT & smart HVAC technologies. However, the challenges the market faces include compliance with stringent energy efficiency standards (e.g., ASHRAE, SEER ratings, MEPS), shortage of skilled technicians, and fluctuations in seasonal demand. Additionally, opportunities in emerging markets, retrofitting and upgrading services for aging infrastructure, integration with building automation systems, and preventive maintenance service contracts provide immense growth opportunities for players operating in this market. The use of predictive maintenance with AI and machine learning, remote monitoring and diagnostic services, sustainability and green HVAC solutions, and mobile service management applications is becoming an important trend in this market.

Market Drivers

Rising Demand for Energy-Efficient HVAC Systems

The demand for HVAC service upgrades is growing rapidly due to a greater emphasis on energy efficiency and sustainability. Modern building operators focus on lowering operational costs and reducing environmental impact through better HVAC system performance. This drives the need for energy-efficient retrofit services, improved control systems, and effective maintenance programs. The HVAC services market benefits as operators aim for significant energy savings and compliance with changing environmental regulations.

The rise of green building certifications and sustainability efforts, along with increasing energy costs and greater environmental awareness, supports this demand. Energy-efficient HVAC services, which offer smart controls, advanced diagnostics, system optimization, and preventive maintenance programs, appeal to building owners who value operational efficiency and environmental responsibility.

The sustainable building market has gained traction in recent years. Facility managers are seeking service solutions that cut energy use, lower environmental impact, and meet changing efficiency standards for performance optimization and cost savings.

Increasing Focus on Indoor Air Quality

According to the U.S. Environmental Protection Agency (EPA), indoor air can be 2–5 times more polluted than outdoor air, and Americans spend 90% of their time indoors. HVAC service providers face higher demand for indoor air quality solutions. This is due to a growing awareness of health and wellness in indoor spaces. The emphasis on air quality includes better filtration systems, improved ventilation, and air purification services, which enhance occupant health, productivity, and comfort. Research indicates that professional HVAC services can lead to better indoor air quality because of proper system maintenance, advanced filtration technologies, and thorough air quality monitoring.

Demand is rising for advanced ventilation solutions (e.g., ERVs, HRVs) that bring in filtered fresh air while conserving energy. Older systems are being replaced or retrofitted to meet ASHRAE 62.1 standards for ventilation. Professional maintenance keeps systems efficient while improving air quality and health benefits. This makes them especially appealing to commercial buildings, healthcare facilities, and residential customers. HVAC service providers are expanding offerings to include IAQ audits, smart sensor integration, and wellness-focused building upgrades.

Growth in Commercial and Residential Construction

By 2030, global construction spending is projected to reach $15.5 trillion, with significant activity in Asia-Pacific, North America, and the Middle East (Source: Oxford Economics). The HVAC services segment is growing faster as new projects require full installation, commissioning, and ongoing maintenance services. More buildings mean more long-term service contracts for routine maintenance, filter replacements, system diagnostics, and repairs.

According to the U.S. Census Bureau, new private residential construction spending in the U.S. exceeded $900 billion in 2024, a strong indicator of HVAC installation growth. The construction market is driven by urbanization, population growth, infrastructure development, and rising demand for modern buildings with advanced HVAC systems. HVAC services are recognized as vital infrastructure with many operational benefits, positioning the sector to capture a large share of this expanding construction market.

Additionally, building codes and regulations increasingly emphasize modern HVAC standards for their energy efficiency and indoor air quality benefits. The push toward net-zero buildings further fuels HVAC system upgrades, especially in government and institutional buildings. This further boosts the demand for professional HVAC installation and maintenance services.

By Type

Based on type, the HVAC services market is segmented into installation & system integration, maintenance & repair, upgrade/replacement, energy-efficiency & retrofit, controls upgrade & integration, and consulting & other services.

In 2025, the maintenance & repair segment is expected to account for the largest share of the market. The ongoing need for HVAC system upkeep, increased frequency of extreme climate events, adoption of smart and IoT-enabled HVAC systems, rising awareness of indoor air quality (IAQ), and expansion of residential and commercial buildings are some of the factors driving the growth of this segment.

However, the energy efficiency and retrofit segment is predicted to show the highest growth rate during the period from 2025 to 2035. This growth is fueled by the increasing emphasis on sustainability, rising energy costs, government support for energy-efficient upgrades, and a heightened awareness of environmental concerns.

By System Type

Based on system type, the HVAC services market is segmented into heating systems, ventilation systems, air conditioning systems, integrated HVAC systems, specialty systems, and others. In 2025, the integrated HVAC systems segment is expected to account for the largest market share due to overall service demands, the complex maintenance requirements of these systems, and the focus on system optimization and performance. On the other hand, the air conditioning systems segment is expected to witness notable growth during the forecast period, driven by higher cooling needs, the effects of climate change, increasing temperatures, and more commercial air conditioning installations.

By End User

Based on end user, the HVAC services market is segmented into residential, commercial, industrial, and institutional. The commercial segment is poised to account for the largest share of the market in 2025. This is due to the complex nature of commercial HVAC systems, the need to meet regulations, and the requirement for professional maintenance services.

Regional Market Analysis

Based on geography, the HVAC services market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, the North American region is expected to account for the largest market for HVAC services. Factors such as the aging infrastructure that needs maintenance, increased focus on energy efficiency, commercial construction, and growing demand for indoor air quality services are driving the growth of this regional segment. North America's leadership in HVAC services is also supported by major service providers, established industry standards, and a solid regulatory framework that backs professional service needs.

On the other hand, Asia-Pacific is projected to grow at the highest CAGR during the forecast period. This growth is fueled by rapid urbanization, more construction activity, rising disposable incomes, greater awareness of indoor air quality, and expanding commercial infrastructure development.

Competitive Landscape

The HVAC services market consists of large service providers, specialized HVAC contractors, equipment manufacturers with service divisions, and regional service companies. Some leading players in the global HVAC services market are EMCOR Group Inc., Johnson Controls International plc, Comfort Systems USA Inc., Trane Technologies plc, Carrier Global Corporation, ABM Industries Incorporated, Honeywell International Inc., Daikin Industries Ltd., Lennox International Inc., Southland Industries, Service Logic Corporation, Siemens AG (Building Technologies), Schneider Electric SE, Mitsubishi Electric Corporation, and Rheem Manufacturing Company. These companies are concentrating on strategies like developing digital service platforms, integrating IoT, improving predictive maintenance, offering energy efficiency solutions, and expanding geographically to strengthen their position in the market.

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.4% |

|

Market Size (Value)in 2025 |

USD 66.8 Billion |

|

Market Size (Value) in 2035 |

USD 130.7 Billion |

|

Segments Covered |

By Type

By System Type

By End User

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

EMCOR Group, Inc., Johnson Controls International plc, Comfort Systems USA, Inc., Trane Technologies plc, Carrier Global Corporation, ABM Industries Incorporated, Honeywell International Inc., Daikin Industries, Ltd., Lennox International Inc., Southland Industries, Service Logic Corporation, Siemens AG (Building Technologies), Schneider Electric SE, Mitsubishi Electric Corporation, Rheem Manufacturing Company, American Standard (Trane Technologies), York International Corporation (Johnson Controls), Goodman Manufacturing Company, Ingersoll Rand Inc., Emerson Electric Co. |

The HVAC services market is projected to reach USD 130.7 billion by 2035 from USD 70.5 billion in 2025, at a CAGR of 6.4% during the forecast period.

Which service type segment is projected to hold the major share of the HVAC services market in 2025?

In 2025, the maintenance & repair segment is projected to hold the major share of the HVAC services market.

The commercial segment is slated to record significant growth during the forecast period of 2025-2035.

Key factors driving the growth include rising demand for energy-efficient HVAC systems, increasing focus on indoor air quality, growth in commercial and residential construction, mandatory maintenance regulations, and integration of IoT and smart HVAC technologies.

Major opportunities include expansion in emerging markets, retrofit and upgrade services for aging infrastructure, integration with building automation systems, and preventive maintenance service contracts.

North America leads the market with the highest share, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for HVAC service providers.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. HVAC Services Market, by Type

3.2.2. HVAC Services Market, by System Type

3.2.3. HVAC Services Market, by End User

3.2.4. HVAC Services Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Demand for Energy-Efficient HVAC Systems

4.2.1.2. Increasing Focus on Indoor Air Quality

4.2.1.3. Growth in Commercial and Residential Construction

4.2.1.4. Mandatory Maintenance Regulations and Compliance

4.2.1.5. Integration of IoT and Smart HVAC Technologies

4.2.2. Restraints

4.2.2.1. High Initial Investment and Service Costs

4.2.2.2. Skilled Technician Shortage

4.2.2.3. Seasonal Demand Fluctuations

4.2.3. Opportunities

4.2.3.1. Expansion in Emerging Markets

4.2.3.2. Retrofit and Upgrade Services for Aging Infrastructure

4.2.3.3. Integration with Building Automation Systems

4.2.3.4. Preventive Maintenance Service Contracts

4.2.4. Trends

4.2.4.1. Predictive Maintenance Using AI and Machine Learning

4.2.4.2. Remote Monitoring and Diagnostic Services

4.2.4.3. Sustainability and Green HVAC Solutions

4.2.4.4. Mobile Service Management Applications

4.2.5. Challenges

4.2.5.1. Regulatory Compliance Across Different Jurisdictions

4.2.5.2. Managing Service Quality and Consistency

4.2.5.3. Technology Integration and Training Requirements

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on the HVAC Services Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy-Efficient Service Practices

4.4.1.2. Refrigerant Management and Recovery

4.4.1.3. Waste Reduction in Service Operations

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Regulatory Compliance and Green Service Initiatives

4.4.2.2. Service Provider-led Sustainability Programs

4.4.3. Market Opportunities Created by Sustainability Focus

4.4.3.1. Green Building Certification Support Services

4.4.3.2. Challenges in Sustainable Service Delivery

5. HVAC Services Market Assessment—By Type

5.1. Overview

5.2. Installation & System Integration

5.3. Maintenance & Repair

5.4. Upgrade/Replacement

5.5. Energy-Efficiency & Retrofit

5.6. Controls Upgrade & Integration

5.7. Consulting & Other Services

6. HVAC Services Market Assessment—By System Type

6.1. Overview

6.2. Heating Systems

6.3. Ventilation Systems

6.4. Air Conditioning Systems

6.5. Integrated HVAC Systems

6.6. Specialty Systems

6.7. Others

7. HVAC Services Market Assessment—By End User

7.1. Overview

7.2. Residential

7.3. Commercial

7.4. Industrial

7.5. Institutional

8. HVAC Services Market Assessment—By Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Netherlands

8.3.7. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. South Korea

8.4.5. Australia

8.4.6. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

8.6.1. Saudi Arabia

8.6.2. United Arab Emirates (UAE)

8.6.3. Rest of Middle East & Africa (RoMEA)

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Contemporary Stalwarts

9.5. Market Share/Ranking Analysis, by the Key Players, 2024

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

10.1. EMCOR Group, Inc.

10.2. Johnson Controls International plc

10.3. Comfort Systems USA, Inc.

10.4. Trane Technologies plc

10.5. Carrier Global Corporation

10.6. ABM Industries Incorporated

10.7. Honeywell International Inc.

10.8. Daikin Industries, Ltd.

10.9. Lennox International Inc.

10.10. Southland Industries

10.11. Service Logic Corporation

10.12. Siemens AG (Building Technologies)

10.13. Schneider Electric SE

10.14. Mitsubishi Electric Corporation

10.15. Rheem Manufacturing Company

10.16. American Standard (Trane Technologies)

10.17. York International Corporation (Johnson Controls)

10.18. Goodman Manufacturing Company

10.19. Ingersoll Rand Inc.

10.20. Emerson Electric Co.

11. Appendix

11.1. Available Customization

11.2. Related Reports

LIST OF TABLES

Table 1. Global HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 2. Global Installation & System Integration Services Market, by Country/Region, 2025–2035 (USD Million)

Table 3. Global Maintenance & Repair Services Market, by Country/Region, 2025–2035 (USD Million)

Table 4. Global Upgrade/Replacement Services Market, by Country/Region, 2025–2035 (USD Million)

Table 5. Global Energy-Efficiency & Retrofit Services Market, by Country/Region, 2025–2035 (USD Million)

Table 6. Global Controls Upgrade & Integration Services Market, by Country/Region, 2025–2035 (USD Million)

Table 7. Global Consulting & Other Services Market, by Country/Region, 2025–2035 (USD Million)

Table 8. Global HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 9. Global Heating Systems Services Market, by Country/Region, 2025–2035 (USD Million)

Table 10. Global Ventilation Systems Services Market, by Country/Region, 2025–2035 (USD Million)

Table 11. Global Air Conditioning Systems Services Market, by Country/Region, 2025–2035 (USD Million)

Table 12. Global Integrated HVAC Systems Services Market, by Country/Region, 2025–2035 (USD Million)

Table 13. Global Specialty Systems Services Market, by Country/Region, 2025–2035 (USD Million)

Table 14. Global Other Services Market, by Country/Region, 2025–2035 (USD Million)

Table 15. Global HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 16. Global HVAC Services Market for Residential Users, by Country/Region, 2025–2035 (USD Million)

Table 17. Global HVAC Services Market for Commercial Users, by Country/Region, 2025–2035 (USD Million)

Table 18. Global HVAC Services Market for Industrial Users, by Country/Region, 2025–2035 (USD Million)

Table 19. Global HVAC Services Market for Institutional Users, by Country/Region, 2025–2035 (USD Million)

Table 20. North America: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 21. North America: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 22. North America: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 23. U.S.: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 24. U.S.: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 25. U.S.: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 26. Canada: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 27. Canada: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 28. Canada: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 29. Europe: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 30. Europe: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 31. Europe: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 32. Germany: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 33. Germany: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 34. Germany: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 35. France: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 36. France: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 37. France: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 38. U.K.: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 39. U.K.: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 40. U.K.: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 41. Italy: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 42. Italy: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 43. Italy: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 44. Spain: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 45. Spain: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 46. Spain: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 47. Netherlands: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 48. Netherlands: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 49. Netherlands: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 50. Rest of Europe: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 51. Rest of Europe: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 52. Rest of Europe: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 53. Asia-Pacific: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 54. Asia-Pacific: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 55. Asia-Pacific: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 56. China: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 57. China: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 58. China: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 59. Japan: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 60. Japan: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 61. Japan: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 62. India: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 63. India: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 64. India: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 65. South Korea: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 66. South Korea: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 67. South Korea: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 68. Australia: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 69. Australia: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 70. Australia: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 71. Rest of Asia-Pacific: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 72. Rest of Asia-Pacific: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 73. Rest of Asia-Pacific: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 74. Latin America: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 75. Latin America: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 76. Latin America: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 77. Brazil: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 78. Brazil: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 79. Brazil: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 80. Mexico: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 81. Mexico: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 82. Mexico: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 83. Rest of Latin America: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 84. Rest of Latin America: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 85. Rest of Latin America: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 86. Middle East & Africa: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 87. Middle East & Africa: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 88. Middle East & Africa: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 89. Saudi Arabia: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 90. Saudi Arabia: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 91. Saudi Arabia: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 92. United Arab Emirates: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 93. United Arab Emirates: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 94. United Arab Emirates: HVAC Services Market, by End User, 2025–2035 (USD Million)

Table 95. Rest of Middle East & Africa: HVAC Services Market, by Type, 2025–2035 (USD Million)

Table 96. Rest of Middle East & Africa: HVAC Services Market, by System Type, 2025–2035 (USD Million)

Table 97. Rest of Middle East & Africa: HVAC Services Market, by End User, 2025–2035 (USD Million)

LIST OF FIGURES

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Maintenance And Repair segment to Account for the Largest Share

Figure 8. In 2025, the Integrated HVAC Systems segment to Account for the Largest Share

Figure 9. In 2025, the HVAC Services Market for Commercial Users to Account for the Largest Share

Figure 10. Asia-Pacific to be the Fastest-growing Regional Market

Figure 11. Impact Analysis of Market Dynamics

Figure 12. Global HVAC Services Market: Porter's Five Forces Analysis

Figure 13. Global HVAC Services Market, by Type, 2025 Vs. 2035 (USD Million)

Figure 14. Global HVAC Services Market, by System Type, 2025 Vs. 2035 (USD Million)

Figure 15. Global HVAC Services Market, by End User, 2025 Vs. 2035 (USD Million)

Figure 16. Global HVAC Services Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 17. North America: HVAC Services Market Snapshot (2025)

Figure 18. Europe: HVAC Services Market Snapshot (2025)

Figure 19. Asia-Pacific: HVAC Services Market Snapshot (2025)

Figure 20. Latin America: HVAC Services Market Snapshot (2025)

Figure 21. Middle East & Africa: HVAC Services Market Snapshot (2025)

Figure 22. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 23. Global HVAC Services Market Competitive Benchmarking, by Type

Figure 24. Competitive Dashboard: Global HVAC Services Market

Figure 25. Global HVAC Services Market Share/Ranking, by Key Player, 2024 (%)

Figure 26. EMCOR Group, Inc.: Financial Overview (2024)

Figure 27. Johnson Controls International plc (2024)

Figure 28. Comfort Systems USA, Inc.: Financial Overview (2024)

Figure 29. Trane Technologies plc: Financial Overview (2024)

Figure 30. Carrier Global Corporation: Financial Overview (2024)

Published Date: Jul-2025

Published Date: Jul-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates