Resources

About Us

Europe Pharmaceutical Processing & Packaging Equipment Market by Mode of Delivery (Oral, Parenteral, Topical), Secondary Packaging (Cartoning, Labelling, Serialization, Wrapping) and End-of-Line Packaging (Palletizing, Case Packaging) - Forecast to 2032

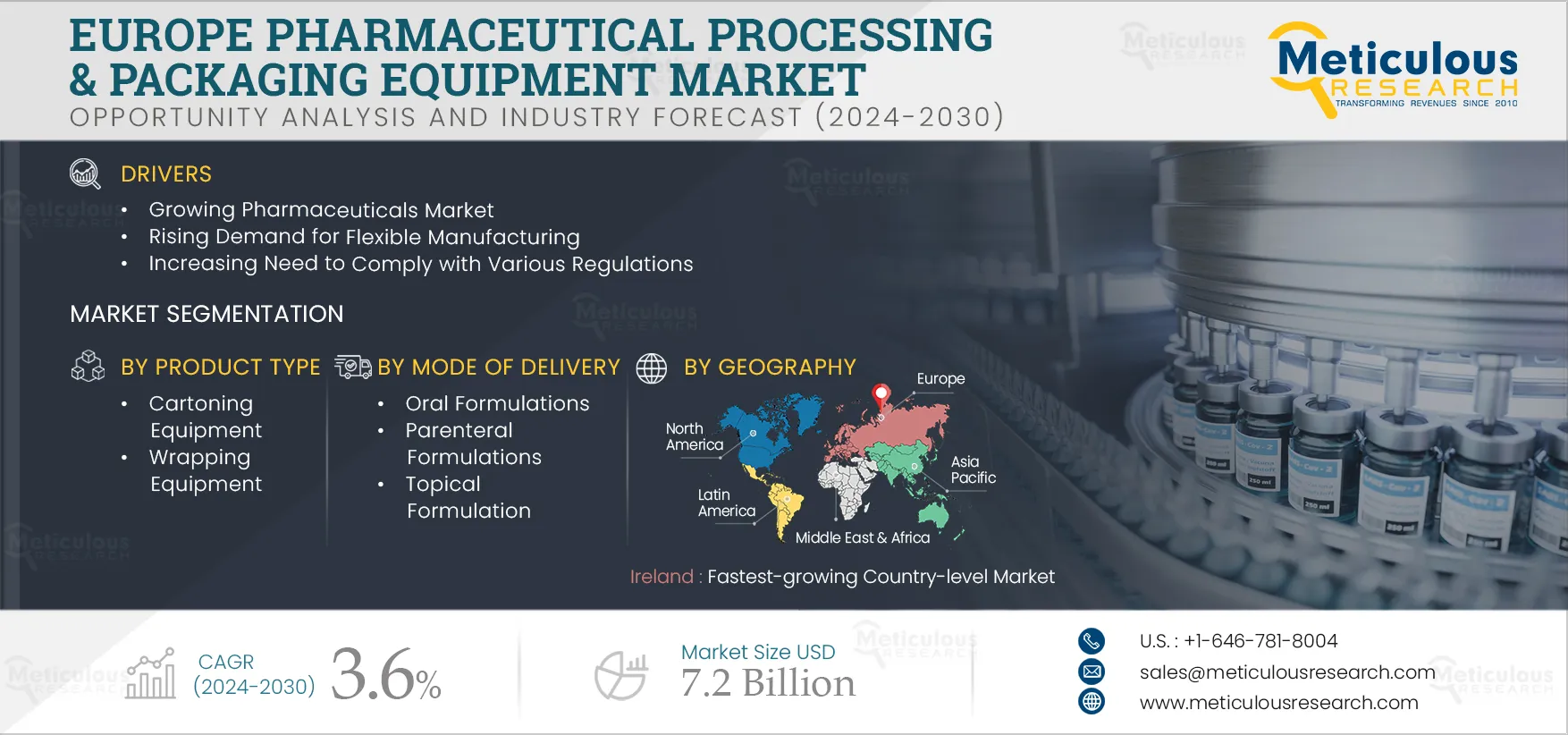

Report ID: MRHC - 104865 Pages: 250 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Pharmaceutical Processing and Packaging Equipment Market is projected to reach $7.2 billion by 2032, at a CAGR of 3.6% from 2025 to 2032. Pharmaceutical processing and packaging equipment plays a crucial role in ensuring the quality and safety of pharmaceutical products. These machines are designed to meet strict industry standards and regulations, ensuring that the drugs produced are safe, effective, and high-quality. Packaging equipment provides protective barriers that safeguard the integrity of drugs during storage, transportation, and distribution.

The growth of this market is driven by the growing pharmaceuticals market, rising demand for flexible manufacturing, increasing need to comply with various regulations, and growing trend of contract manufacturing in the pharmaceutical sector. However, the preference for refurbished equipment restrains this market's growth to a significant extent. Additionally, emerging pharmaceutical manufacturing hotspots and growing pharmaceutical R&D spending offer opportunities for market growth. However, changing market demands in the constantly evolving pharmaceutical space is the major challenge for market growth.

Recent pharmaceutical trends support the development of specialized products for small groups of patients. Regulatory agencies support this trend by expediting drug approvals. Further, the increasing focus of pharmaceutical companies on cost control coupled with unpredictable demand for pharmaceuticals has created a need for more agile and flexible pharmaceutical manufacturing facilities. The emergence of continuous manufacturing and single-use technologies has supported the development of flexible manufacturing facilities, allowing for pharmaceutical processing and packaging innovation.

Fast-track drug approval programs and the need for operational flexibility among pharmaceutical companies and CMOs further support adopting flexible manufacturing processes. Orphan drug development is gaining traction due to its incentivization by regulatory authorities, accelerated drug approvals, and the exclusivity of molecules. Orphan drug developers focus on shortening the clinical development phase, wherein processes involving chemistry, manufacturing, control development, scale-up, validation, tech transfer, and stability testing must be completed rapidly after securing initial regulatory approval. Moreover, orphan drug development programs contribute to the increased adoption of orphan drugs. For instance, The European Medicines Agency (EMA) offers financial incentives for orphan drug development, including funding through the EU's research and innovation program, Horizon 2020. Such factors have increased the demand for flexible manufacturing in the pharmaceutical sector.

Thus, the increasing preference for specialized therapies among patients has boosted the adoption of flexible manufacturing practices involving single-use systems, continuous manufacturing systems, and modular facilities.

Click here to: Get Free Sample Pages of this Report

Growth in the aging population and the rapid increase in the burden of chronic and infectious diseases have increased the demand for pharmaceuticals. According to Eurostat, the population of Europe in 2021 was 747.8 million, out of which around 22.8% share was contributed by elderly people (above 65), which is expected to increase to 40.6% by 2050. In 2022, the geriatric population (aged 65 or over) accounted for a share of 21.1% of the total population in Europe, which increased from 20.8% in 2021. In 2022, Italy (23.8%), Portugal (23.7%), Finland (23.1%), Greece (22.7%), and Croatia (22.5%) had the highest share of the geriatric population. Consistent growth in the aging population is increasing the burden of chronic diseases. Common conditions affecting the geriatric population include osteoarthritis, diabetes, heart diseases, chronic obstructive pulmonary disorders, depression, and dementia. The rising prevalence of these conditions is increasing the demand for pharmaceuticals, thereby driving the pharmaceutical processing and packaging equipment market.

Chronic diseases are a leading cause of disability, illness, and death globally, with cardiovascular diseases, cancer, diabetes, and chronic obstructive pulmonary diseases (COPD) being the most common chronic disorders. Cancer is the leading cause of death globally. According to the GLOBOCAN, in Europe, the new cancer cases will reach 3,830,683 cases in 2032 from 3,266,461 cases in 2020, for the age group of 60 to 85+ years of age. Thus, the growing burden of chronic diseases has increased the consumption of pharmaceuticals, positively impacting the demand for pharmaceutical processing and packaging equipment.

Key Findings of the Europe Pharmaceutical Processing and Packaging Equipment Market Study:

In 2025, the Oral Formulations Segment is Expected to Dominate the Europe Pharmaceutical Processing and Packaging Equipment Market

Among the mode of drug delivery, in 2025, the oral formulations segment is expected to account for the largest share of the Europe pharmaceutical processing and packaging equipment market. Oral formulations include oral solid dosages and oral liquid dosages. Factors contributing to the segment’s largest share include patients' high preference for oral formulations due to their advantages, including ease of administration, high patient compliance, non-painful and better safety, lowest variability, and accurate dosing.

In 2025, the Cartoning Equipment Segment is Expected to Dominate the Europe Secondary Packaging Equipment Market

Among the types of secondary packaging equipment, in 2025, the cartoning equipment segment is expected to account for the largest share of the Europe pharmaceutical processing and packaging equipment market. Cartoning equipment is used to pack the primarily packaged pharmaceuticals to provide extra protection. It helps protect the products during shipment in a very cost-effective & efficient way. Regulatory agencies, such as U.S. FDA, also recommend using secondary packaging of pharmaceuticals, such as cartons, to protect the medicines from moisture, light, or any possible contaminants. Hence, cartons are considered an ideal secondary packaging for product handling, increasing their utilization and contributing to the segment’s largest share.

In 2025, the Case Packaging Equipment Segment is Expected to Dominate the Europe End-of-Line Packaging Equipment Market

Among the types of end-of-line packaging equipment, in 2025, the case packaging equipment segment is expected to account for the largest share of the Europe pharmaceutical processing and packaging equipment market. Factors such as the importance of case packaging in bulk packaging, supply chain efficiency, automation benefits, versatility, and the overall growth of the pharmaceutical industry contribute to the segment’s growth. Moreover, regulatory compliance also contributed to the segment’s growth as according to European Medicines Agency (EMA), there are guidelines and regulations related to Good Manufacturing Practice (GMP) for the manufacturing of pharmaceutical products, including requirements for processing and packaging equipment which are needed to be followed by the companies.

Ireland: Fastest-growing Country-level Market

Based on geography, Ireland is slated to record the highest growth rate during the forecast period. The growth of this market is mainly driven by the growing population in the country and the need for drugs by the growing population due to the prevalence of chronic disorders. For instance, the Ireland population reached 5.03 million in 2021 from 4,93 million in 2019. Moreover, the rising government activities to support research and innovation, availability of skilled professionals, increasing export of pharmaceuticals, and the rising pharmaceutical contract development and manufacturing partnerships in the country contribute to this region's market growth.

Key Players

The key players profiled in the sample preparation market report are Bausch+Ströbel (Germany), Korber AG (Germany), KORSCH AG (Germany), M.A.R. S.p.A. Macchine Automatiche Riempitrici (Italy), MAQUINARIA INDUSTRIAL DARA, SL (Spain), Marchesini Group S.p.A. (Italy), OPTIMA packaging group GmbH (Germany), Syntegon Technology GmbH (Germany), ANTARES VISION S.p.A. (Italy), BREVETTI CEA S.P.A. (Italy), CAM Packaging IT (Italy), Coesia S.p.A. (Italy), Fette Compacting (Germany), GEA GROUP (Germany), Glatt GmbH (Germany), LINXIS GROUP (France), Harro Höfliger Verpackungsmaschinen GmbH (Germany), I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy), Uhlmann PacSysteme GmbH & Co. KG (Germany), and Tecnomaco Italia SRL (Italy).

Scope of the Report:

Europe Pharmaceutical Processing and Primary Packaging Equipment Market, by Mode of Delivery

Europe Pharmaceutical Secondary Packaging Equipment Market, by Product Type

Europe Pharmaceutical End-of-Line Packaging Equipment Market, by Product Type

Europe Pharmaceutical Processing and Packaging Equipment Market, by Country

Key questions answered in the report:

The Europe pharmaceutical processing & packaging equipment market study covers the market sizes & forecasts for various processing & packaging equipment used in pharmaceutical industries. The report includes the value analysis of various segments of the Europe pharmaceutical processing & packaging market at the country levels.

The Europe pharmaceutical processing & packaging equipment market is projected to reach $7.2 billion by 2032, at a CAGR of 3.6% during the forecast period.

Based on mode of drug delivery, the parenteral formulations segment is expected to grow at the highest CAGR due to their advantages over oral formulations, such as faster onset of action, precise drug delivery, increased drug stability, and greater absorption capacity.

Based on secondary packaging equipment, the wrapping equipment segment is expected to grow at the highest CAGR. Shrink-wrapping and over-wrapping are two major equipment used in the secondary pharmaceutical packing market, where both are important for protecting the product from external damage. Wrapping equipment also holds the cartons or bottles together, providing additional protection during handling, thus contributing to segment growth.

Based on end-of-line packaging equipment, the case packaging equipment segment is expected to grow at the highest CAGR. The growth in the pharmaceutical trade activities is a major factor contributing to the segment’s growth.

The growth of this market is driven by the advancements in sample preparation techniques, increasing adoption of process automation, development of bio-clusters to foster research, and increasing R&D investments among the end users. Additionally, emerging economies and personalized medicine offering growth potential are creating opportunities for market growth.

The key players operating in the sample preparation market are Bausch+Ströbel (Germany), Korber AG (Germany), KORSCH AG (Germany), M.A.R. S.p.A. Macchine Automatiche Riempitrici (Italy), MAQUINARIA INDUSTRIAL DARA, SL (Spain), Marchesini Group S.p.A. (Italy), OPTIMA packaging group GmbH (Germany), Syntegon Technology GmbH (Germany), ANTARES VISION S.p.A. (Italy), BREVETTI CEA S.P.A. (Italy), CAM Packaging IT (Italy), Coesia S.p.A. (Italy), Fette Compacting (Germany), GEA GROUP (Germany), Glatt GmbH (Germany), LINXIS GROUP (France), Harro Höfliger Verpackungsmaschinen GmbH (Germany), I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy), Uhlmann PacSysteme GmbH & Co. KG (Germany), and Tecnomaco Italia SRL (Italy).

Countries such as Ireland and Denmark are projected to offer significant growth opportunities for vendors operating in this market due to increasing focus on pharmaceutical product development and manufacturing, growing adoption of technologically advanced products, and the rising export of products.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitation

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Factors Affecting Market Growth

4.1. Overview

4.2. Drivers

4.2.1. Growing Pharmaceuticals Market

4.2.1.1. Rising Geriatric Population

4.2.1.2. Recent Pandemic Outbreaks

4.2.1.3. Patent Expirations and Rising Consumption of Generics

4.2.2. Rising Demand for Flexible Manufacturing

4.2.3. Increasing Need to Comply with Various Regulations

4.2.4. Growing Trend of Contract Manufacturing in the Pharmaceutical Sector

4.3. Restraints

4.3.1. Preference for Refurbished Equipment

4.4. Opportunities

4.4.1. Emerging Pharmaceutical Manufacturing Hotspots

4.4.2. Growing Pharmaceutical R&D Spending

4.5. Challenges

4.5.1. Changing Market Demands in the Constantly Evolving Pharmaceutical Space

4.6. Trends

4.7. Regulatory Analysis

4.8. Pricing Analysis

4.9. Porter’s 5 Force Analysis

5. Europe Pharmaceutical Processing & Primary Packaging Equipment Market, By Mode of Drug Delivery

5.1. Overview

5.2. Oral Formulations

5.2.1. Oral Solid Dosages

5.2.1.1. Processing Equipment

5.2.1.1.1. Capsule-making Equipment

5.2.1.1.2. Blending Equipment

5.2.1.1.3. Fluidized Bed Machines

5.2.1.1.4. Coating Equipment

5.2.1.1.5. Milling Equipment

5.2.1.1.6. Capsule Filling Equipment

5.2.1.1.7. Compression/Press Equipment

5.2.1.1.8. Other Processing Equipment

5.2.1.2. Primary Packaging Equipment

5.2.1.2.1. Blister Packaging Equipment

5.2.1.2.2. Bottle Filling & Capping Equipment

5.2.1.2.3. Bottle Labeling Equipment

5.2.1.2.4. Powder Sachet Filling & Packaging Equipment

5.2.1.2.5. Strip Packaging Equipment

5.2.1.2.6. Tablet Counting Equipment

5.2.2. Oral Liquid Dosages

5.2.2.1. Processing Equipment

5.2.2.1.1. Stirrers and Homogenizers

5.2.2.1.2. Preparation Vessels, Melting Vessels, and Storage Tanks

5.2.2.1.3. Filtration Units

5.2.2.1.4. Sugar Charging/Transfer Systems

5.2.2.1.5. Other Equipment

5.2.2.2. Primary Packaging Equipment

5.2.2.2.1. Bottle Filling & Capping Equipment

5.2.2.2.2. Bottle Labeling Equipment

5.3. Parenteral Formulations

5.3.1. Processing Equipment

5.3.1.1. Mixing Equipment, Preparation Tanks, and Other Containers

5.3.1.2. Process Systems (SVP, LVP)

5.3.1.3. Filtration Units

5.3.1.4. Sterilization Tunnels

5.3.1.5. Clean-In-Place (CIP) and Steam-In-Place (SIP) System

5.3.1.6. Aseptic Inspection Systems

5.3.1.7. Other Processing Equipment

5.3.2. Primary Packaging Equipment

5.3.2.1. Blow-Fill-Seal (BFS) Equipment

5.3.2.2. Aseptic Filling Equipment

5.3.2.3. Parenteral Labeling Equipment

5.3.2.4. Washing & Drying Equipment

5.3.2.5. Nested Filling Systems

5.4. Topical Formulations

5.4.1. Processing Equipment

5.4.1.1. Planetary and Homogenizer Mixer

5.4.1.2. Agitator/Stirrer

5.4.1.3. Preparation Vessels, Reactors, and Storage Tanks

5.4.1.4. Colloid Mills

5.4.1.5. Other Processing Equipment

5.4.2. Primary Packaging Equipment

5.4.2.1. Tube Filling Equipment

5.4.2.2. Cream Filling Equipment

5.4.2.3. Sachet Packaging Equipment

5.5. Other Formulations

5.5.1. Processing Equipment

5.5.2. Primary Packaging Equipment

5.5.2.1. Blow-Fill-Seal (BFS) Equipment

5.5.2.2. Pharmaceutical Spray Filling Equipment

5.5.2.3. Other Packaging Equipment

6. Europe Pharmaceutical Secondary Packaging Equipment Market, By Product Type

6.1. Overview

6.2. Cartoning Equipment

6.3. Carton Labeling & Serialization Equipment

6.4. Wrapping Equipment

6.5. Other Equipment

7. Europe Pharmaceutical End-Of-Line Packaging Equipment Market, By Product Type

7.1. Overview

7.2. Case Packaging Equipment

7.3. Palletizing and De-palletizing Equipment

7.4. Other Equipment

8. Europe Pharmaceutical Processing and Packaging Equipment Market, by Geography

8.1. Overview

8.2. Switzerland

8.3. Italy

8.4. Germany

8.5. U.K.

8.6. France

8.7. Ireland

8.8. Spain

8.9. Denmark

8.10. Belgium

8.11. Rest of Europe

9. Competitive Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Vendor Dashboard

9.5. Market Share Analysis (2022)

10. Company Profiles (Business Overview, Financial Snapshot, Product Portfolio, Strategic Developments, and SWOT Analysis)

10.1. Bausch+Ströbel

10.2. Korber AG

10.3. KORSCH AG

10.4. M.A.R. S.p.A. Macchine Automatiche Riempitrici

10.5. MAQUINARIA INDUSTRIAL DARA, SL

10.6. Marchesini Group S.p.A.

10.7. OPTIMA packaging group GmbH

10.8. Syntegon Technology GmbH

10.9. ANTARES VISION S.p.A.

10.10. BREVETTI CEA S.P.A.

10.11. CAM Packaging IT

10.12. Coesia S.p.A.

10.13. Fette Compacting

10.14. GEA GROUP

10.15. Glatt GmbH

10.16. LINXIS GROUP

10.17. Harro Höfliger Verpackungsmaschinen GmbH

10.18. I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

10.19. Uhlmann PacSysteme GmbH & Co. KG

10.20. Tecnomaco Italia SRL

(Note: SWOT analysis is provided for the leading 5 companies)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Europe Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 2 Europe Pharmaceutical Processing & Primary Packaging Equipment Market Oral Formulation, by Form, 2021–2032 (USD Million)

Table 3 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Formulations, by Country/Region, 2021–2032 (USD Million)

Table 4 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 5 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Country/Region, 2021–2032 (USD Million)

Table 6 Europe Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 7 Europe Processing Equipment Market for Oral Solid Dosages, by Country/Region, 2021–2032 (USD Million)

Table 8 Europe Pharmaceutical Blending Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 9 Europe Pharmaceutical Fluid Bed Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 10 Europe Pharmaceutical Milling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 11 Europe Pharmaceutical Compression / Press Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 12 Europe Pharmaceutical Coating Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 13 Europe Capsule Making Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 14 Europe Capsule Filling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 15 Europe Other Oral Solid Dosages Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 16 Europe Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 17 Europe Pharmaceutical OSD Primary Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 18 Europe Pharmaceutical Counting Equipment Market, by Country/Region, 201-202(USD Million)

Table 19 Europe Pharmaceutical Blister Pack Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 20 Europe Pharmaceutical Strip Pack Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 21 Europe Pharmaceutical Powder Sachet Filling & Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 22 Europe Pharmaceutical Bottle Filling & Capping Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 23 Europe Pharmaceutical Bottle Labelling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 24 Europe Pharmaceutical Oral Liquid Dosage Processing & Primary Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 25 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Country/Region, 2021–2032 (USD Million)

Table 26 Europe Pharmaceutical Oral Liquid Dosage Processing Equipment Market, by Type, 2021–2032 (USD Million)

Table 27 Europe Pharmaceutical Oral Liquid Dosage Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 28 Europe Pharmaceutical Sugar Charging/Transfer System Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 29 Europe Pharmaceutical Preparation Vessels, Melting Vessels, and Storage Tanks Market, by Country/Region, 2021–2032 (USD Million)

Table 30 Europe Pharmaceutical Stirrers and Homogenizers Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 31 Europe Pharmaceutical Filtration Units Market, by Country/Region, 2021–2032 (USD Million)

Table 32 Europe Other Oral Liquid Dosage Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 33 Europe Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 34 Europe Pharmaceutical Oral Liquid Dosage Primary Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 35 Europe Pharmaceutical Bottle Filling & Capping Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 36 Europe Pharmaceutical Bottle Labelling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 37 Europe Pharmaceutical Parenteral Formulation Processing & Primary Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 38 Europe Pharmaceutical Parenteral Formulation Processing & Primary Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 39 Europe Pharmaceutical Parenteral Formulation Processing Equipment Market, by Type, 2021–2032 (USD Million)

Table 40 Europe Pharmaceutical Parenteral Formulation Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 41 Europe Parenteral Formulation Mixing Equipment, Preparation Tank and Other Containers Market, by Country/Region, 2021–2032 (USD Million)

Table 42 Europe Process Systems (SVP, LVP) Market, by Country/Region, 2021–2032 (USD Million)

Table 43 Europe Pharmaceutical Parenteral Filtration Units Market, by Country/Region, 2021–2032 (USD Million)

Table 44 Europe Pharmaceutical Sterilization Tunnel Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 45 Europe Pharmaceutical CIP and SIP System Market, by Country/Region, 2021–2032 (USD Million)

Table 46 Europe Pharmaceutical Aseptic Inspection Systems Market, by Country/Region, 2021–2032 (USD Million)

Table 47 Europe Other Parenteral Formulation Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 48 Europe Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 49 Europe Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Country/Region, 2021–2032 (USD Million)

Table 50 Europe Pharmaceutical Aseptic Filling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 51 Europe Pharmaceutical Washing & Drying Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 52 Europe Pharmaceutical Nested Filling System Market, by Country/Region, 2021–2032 (USD Million)

Table 53 Europe Pharmaceutical Blow-Fill-Seal (BFS) Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 54 Europe Pharmaceutical Parenteral Labelling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 55 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 56 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Country/Region, 2021–2032 (USD Million)

Table 57 Europe Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 58 Europe Topical Formulation Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 59 Europe Pharmaceutical Planetary and Homogenizer Mixer Market for Topical Formulations, by Country/Region, 2021–2032 (USD Million)

Table 60 Europe Pharmaceutical Preparation Vessels, Reactor and Storage Tanks Market, by Country/Region, 2021–2032 (USD Million)

Table 61 Europe Pharmaceutical Colloid Mill Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 62 Europe Pharmaceutical Agitator-Stirrer Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 63 Europe Other Topical Formulation Processing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 64 Europe Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 65 Europe Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Country/Region, 2021–2032 (USD Million)

Table 66 Europe Pharmaceutical Tube Filling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 67 Europe Pharmaceutical Cream Filling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 68 Europe Sachet Filling Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 69 Europe Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 70 Europe Other Pharmaceutical Formulation Processing & Primary Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 71 Europe Pharmaceutical Processing Equipment Market for Other Formulations, by Country/Region, 2021–2032 (USD Million)

Table 72 Europe Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 73 Europe Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Country/Region, 2021–2032 (USD Million)

Table 74 Europe Pharmaceutical Blow-Fill-Seal (BFS) Equipment Market for Other Formulations, by Country/Region, 2021–2032 (USD Million)

Table 75 Europe Pharmaceutical Spray Filling Machine Market, by Country/Region, 2021–2032 (USD Million)

Table 76 Europe Other Equipment Market for Other Formulations, by Country/Region, 2021–2032 (USD Million)

Table 77 Europe Pharmaceutical Secondary Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 78 Europe Pharmaceutical Secondary Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 79 Europe Pharmaceutical Cartoning Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 80 Europe Pharmaceutical Wrapping Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 81 Europe Pharmaceutical Cartoning Labelling & Serialization Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 82 Europe Pharmaceutical Other Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 83 Europe Pharmaceutical End-of-Line Equipment Market, by Type, 2021–2032 (USD Million)

Table 84 Europe Pharmaceutical End-of-Line Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 85 Europe Pharmaceutical Case Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 86 Europe Pharmaceutical Palletizing and De-Palletizing Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 87 Europe Other End-of-Line Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 88 Europe Pharmaceutical Processing & Packaging Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 89 Switzerland: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 90 Switzerland: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 91 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 92 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 93 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 94 Switzerland: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 95 Switzerland: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 96 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 97 Switzerland: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 98 Switzerland: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 99 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 100 Switzerland: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 101 Switzerland: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 102 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 103 Switzerland: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 104 Switzerland: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 105 Switzerland: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 106 Switzerland: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 107 Switzerland: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 108 Switzerland: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 109 France: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 110 France: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 111 France: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 112 France: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 113 France: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 114 France: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 115 France: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 116 France: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 117 France: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 118 France: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 119 France: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 120 France: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 121 France: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 122 France: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 123 France: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 124 France: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 125 France: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 126 France: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 127 France: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 128 France: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 129 Italy: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 130 Italy: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 131 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 132 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 133 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 134 Italy: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 135 Italy: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 136 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 137 Italy: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 138 Italy: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 139 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 140 Italy: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 141 Italy: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 142 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 143 Italy: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 144 Italy: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 145 Italy: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 146 Italy: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 147 Italy: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 148 Italy: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 149 Germany: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 150 Germany: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 151 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 152 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 153 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 154 Germany: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 155 Germany: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 156 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 157 Germany: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 158 Germany: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 159 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 160 Germany: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 161 Germany: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 162 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 163 Germany: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 164 Germany: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 165 Germany: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 166 Germany: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 167 Germany: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 168 Germany: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 169 U.K.: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 170 U.K.: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 171 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 172 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 173 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 174 U.K.: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 175 U.K.: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 176 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 177 U.K.: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 178 U.K.: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 179 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 180 U.K.: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 181 U.K.: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 182 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 183 U.K.: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 184 U.K.: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 185 U.K.: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 186 U.K.: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 187 U.K.: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 188 U.K.: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 189 Ireland: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 190 Ireland: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 191 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 192 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 193 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 194 Ireland: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 195 Ireland: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 196 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 197 Ireland: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 198 Ireland: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 199 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 200 Ireland: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 201 Ireland: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 202 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 203 Ireland: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 204 Ireland: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 205 Ireland: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 206 Ireland: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 207 Ireland: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 208 Ireland: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 209 Belgium: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 210 Belgium: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 211 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 212 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 213 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 214 Belgium: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 215 Belgium: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 216 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 217 Belgium: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 218 Belgium: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 219 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 220 Belgium: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 221 Belgium: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 222 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 223 Belgium: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 224 Belgium: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 225 Belgium: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 226 Belgium: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 227 Belgium: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 228 Belgium: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 229 Denmark: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 230 Denmark: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 231 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 232 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 233 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 234 Denmark: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 235 Denmark: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 236 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 237 Denmark: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 238 Denmark: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 239 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 240 Denmark: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 241 Denmark: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 242 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 243 Denmark: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 244 Denmark: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 245 Denmark: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 246 Denmark: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 247 Denmark: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 248 Denmark: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 249 Spain: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 250 Spain: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 251 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 252 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 253 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 254 Spain: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 255 Spain: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 256 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 257 Spain: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 258 Spain: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 259 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 260 Spain: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 261 Spain: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 262 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 263 Spain: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 264 Spain: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 265 Spain: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 266 Spain: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 267 Spain: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 268 Spain: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 269 Rest of Europe: Pharmaceutical Processing & Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 270 Rest of Europe: Pharmaceutical Packaging Equipment Market, by Type, 2021-2032 (USD Million)

Table 271 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market, by Mode of Drug Delivery, 2021–2032 (USD Million)

Table 272 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by form, 2021–2032 (USD Million)

Table 273 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 274 Rest of Europe: Pharmaceutical Processing Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 275 Rest of Europe: Pharmaceutical Primary Packaging Equipment Market for Oral Solid Dosages, by Type, 2021–2032 (USD Million)

Table 276 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 277 Rest of Europe: Pharmaceutical Processing Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 278 Rest of Europe: Pharmaceutical Primary Packaging Equipment Market for Oral Liquid Dosages, by Type, 2021–2032 (USD Million)

Table 279 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 280 Rest of Europe: Pharmaceutical Processing Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 281 Rest of Europe: Pharmaceutical Primary Packaging Equipment Market for Parenteral Formulations, by Type, 2021–2032 (USD Million)

Table 282 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 283 Rest of Europe: Pharmaceutical Processing Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 284 Rest of Europe: Pharmaceutical Primary Packaging Equipment Market for Topical Formulations, by Type, 2021–2032 (USD Million)

Table 285 Rest of Europe: Pharmaceutical Processing & Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 286 Rest of Europe: Pharmaceutical Primary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 287 Rest of Europe: Pharmaceutical Secondary Packaging Equipment Market for Other Formulations, by Type, 2021–2032 (USD Million)

Table 288 Rest of Europe: Pharmaceutical End of Line Packaging Equipment Market, by Type, 2021–2032 (USD Million)

Table 289 Recent Developments by Company, 2020-2025

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Europe Pharmaceutical Processing & Packaging Equipment Market, by Mode of Delivery, 2025 VS. 2032 (USD Million)

Figure 8 Europe Pharmaceutical Secondary Packaging Equipment Market, by Type, 2025 VS. 2032 (USD Million)

Figure 9 Europe Pharmaceutical End-of-Line Packaging Equipment Market, by Type, 2025 VS. 2032 (USD Million)

Figure 10 Europe Pharmaceutical Processing and Packaging Equipment Market, by Country, 2025 VS. 2032 (USD Million)

Figure 11 Europe Pharmaceutical Processing & Packaging Equipment Market, by Mode of Delivery, 2025 VS. 2032 (USD Million)

Figure 12 Europe Pharmaceutical Secondary Packaging Equipment Market, by Type, 2025 VS. 2032 (USD Million)

Figure 13 Europe Pharmaceutical End-of-Line Packaging Equipment Market, by Type, 2025 VS. 2032 (USD Million)

Figure 14 Europe Pharmaceutical Processing and Packaging Equipment Market, by Country, 2025 VS. 2032 (USD Million)

Figure 15 Europe: Pharmaceutical Processing and Packaging Equipment Market Snapshot

Figure 16 Key Growth Strategies Adopted by Leading Players, 2020—2025

Figure 17 Europe Pharmaceutical Processing and Packaging Equipment Market: Competitive Dashboard

Figure 18 Europe Pharmaceutical Processing and Packaging Equipment Market: Competitive Benchmarking, by Product

Figure 19 Europe Pharmaceutical Processing and Packaging Equipment Market: Market Share Analysis (2022)

Figure 20 Körber AG: Financial Overview (2022)

Figure 21 Marchesini Group S.p.A.: Financial Overview (2021)

Figure 22 Robert Bosch GmbH: Financial Overview (2022)

Figure 23 ANTARES VISION S.p.A.: Financial Overview (2022)

Figure 24 Coesia S.p.A: Financial Overview (2021)

Figure 25 GEA Group: Financial Overview (2022)

Figure 26 LINXIS Group: Financial Overview (2021)

Figure 27 I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.: Financial Overview (2022)

Figure 28 Uhlmann Pac-Systeme GmbH & Co. KG: Financial Overview (2022)

Published Date: Apr-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates