Resources

About Us

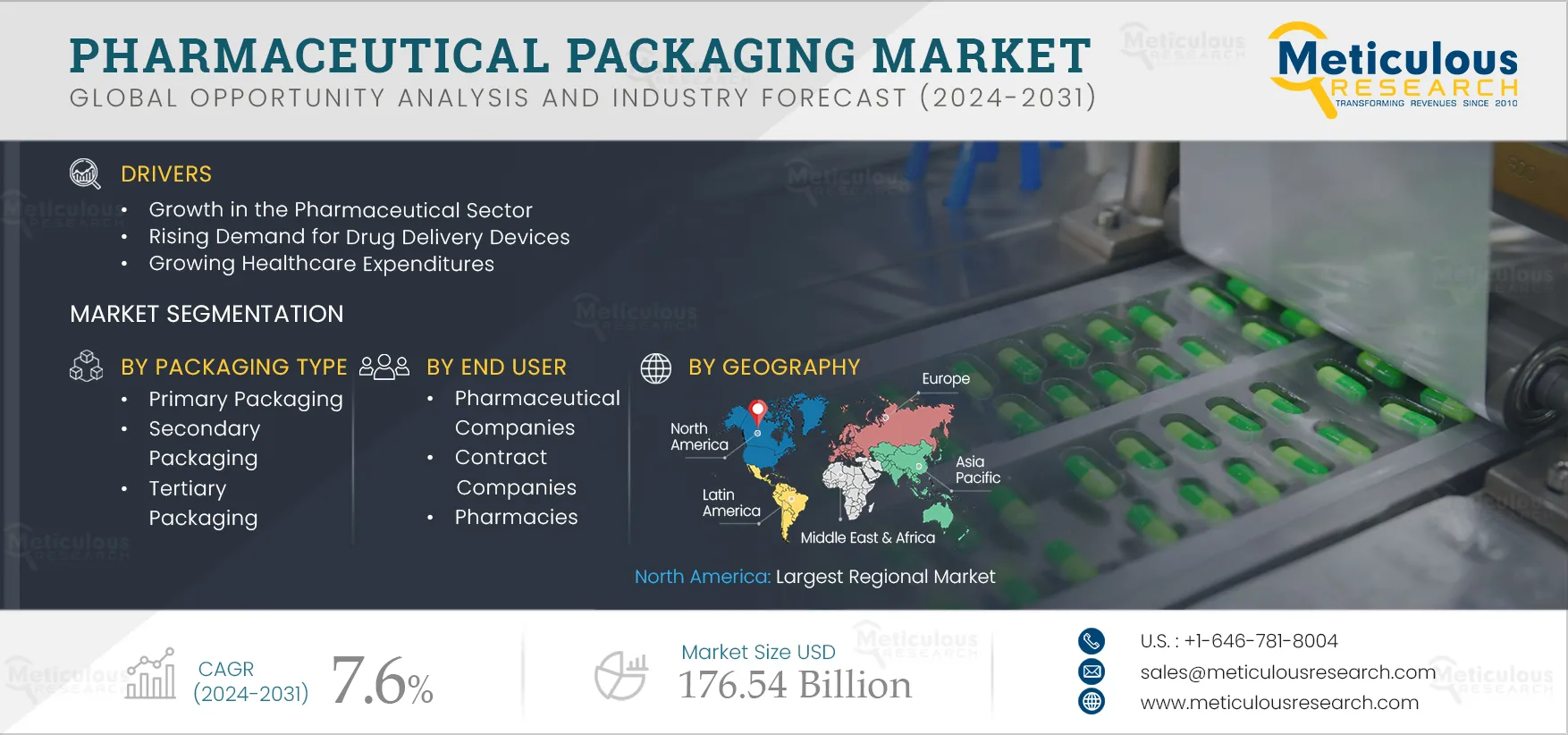

Pharmaceutical Packaging Market by Material (Polymer [PE, PP, PET], Glass, Paper, Metal) Type (Bottles, Blister, PFS, Caps, Vials, Ampoules, Sachet, Inhaler, Secondary, Tertiary) Dosage Form (Oral, Parenteral, Topical), End User - Global Forecast to 2031

Report ID: MRHC - 104612 Pages: 348 Apr-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportPharmaceutical packaging, also known as drug packaging or medical packaging, involves the use of appropriate materials or containers for storing and distributing pharmaceutical preparations. In addition to storing and protecting drugs, pharmaceutical packaging is also used for identification purposes, marketing, and promoting different brands. The types of pharmaceutical packaging include primary, secondary, and tertiary. Primary drug packaging surrounds the pharmaceutical product, while secondary and tertiary packaging provide additional external protection.

The pharmaceutical industry has witnessed rapid growth over the years. According to the India Brand Equity Foundation (India), the pharmaceutical industry in India is expected to reach USD 130 billion by 2030 from USD 42 billion in 2021. The rising need for novel therapies, increasing pharmaceutical R&D expenditures, the rising prevalence of chronic diseases, and increasing funding for drug discovery are some of the factors driving the growth of the pharmaceutical industry.

In June 2023, the Commonwealth Government’s Medical Research Future Fund (MRFF) (Australia) invested USD 9.75 million in establishing MedChem Australia, a new national medicinal chemistry initiative, to accelerate the identification of early-stage drug candidates. Similarly, in July 2022, the Council of Scientific and Industrial Research (CSIR) (India) invested USD 6.73 million in R&D activities for drug discovery and development. Increasing funding for drug discovery & development is expected to increase the availability of new medicines, boosting the demand for packaging.

Pharmaceutical preparations are considered important in enhancing patients’ quality of life. Their consumption is increasing due to the growing need to treat age-related & chronic diseases and changes in clinical practices.

Further, according to the European Federation of Pharmaceutical Industries and Associations (Belgium), the pharmaceutical R&D expenditure growth rate in China increased to 15.6% between 2018-2022 from 13.6% in 2013-2017. Also, in Europe, the pharmaceutical R&D expenditure growth rate increased to 4.6% in 2018-2022 from 3.2% in 2013-2017.

Thus, increasing pharmaceutical R&D expenditure, growth in the pharmaceutical industry, and rising funding for drug discovery & development are driving the demand for drug packaging.

Click here to: Get Free Sample Pages of this Report

Personalized/precision medicine uses an individual’s genomic information to offer targeted treatments. As precision medicine is based on individuals’ genetic makeup, it can overcome the limitations of traditional medicines and provide effective treatment. The growing interest in personalized medication, particularly in the fields of gene therapy, cancer, and cell therapy, has increased the need for custom drug delivery systems and pharmaceutical primary packaging. The smaller batch sizes and high costs of personalized medicines are increasing the need for intelligent packaging to ensure supply chain visibility and prevent counterfeiting.

Personalized medicine packaging also requires custom labeling for patient education. The label should include the patient’s name, formulation, and dosage requirement to avoid the mixing of medicines and reduce the chances of potential health hazards. Thus, the rising adoption of personalized medicines is increasing the need for customized packaging, driving the pharmaceutical packaging market.

Patients who prefer to self-medicate require reliable and simple drug delivery solutions that can support effective treatment outcomes. Drug delivery systems and pharmaceutical containment solutions must be created to prevent medication errors and make drug delivery easier. Thus, the trend of self-medication has increased the demand for drug delivery solutions like nasal sprays and autoinjectors. Additionally, healthcare staff shortages, growth in the aging population, and financial pressures are further supporting the self-medication trend, boosting the demand for pharmaceutical packaging solutions.

Based on material, the pharmaceutical packaging market is segmented into polymer, glass, paper & paperboard, metal, and other materials. In 2024, the polymer segment is expected to account for the largest share of the pharmaceutical packaging market. The segment’s large share is attributed to the wide availability of polymers, the cost-effectiveness of polymers compared to other packaging materials, such as glass and metal, and the effectiveness of polymers in protecting pharmaceutical preparations against external damage and contamination. The use of eco-friendly/recycled/biodegradable polymers in pharmaceutical packaging is a recent trend in pharmaceutical packaging. For instance, In August 2022, Röchling Medical (Germany), a pharmaceutical packaging company, collaborated with LyondellBasell Industries N.V. (Netherlands). The companies created eye drop containers made by Röchling Medical using CirculenRenew polymers. LyondellBasell and Röchling used LDPE for the packaging.

Based on packaging type, the pharmaceutical packaging market is segmented into primary packaging, secondary packaging, and tertiary packaging. The primary packaging segment is projected to register the highest CAGR during the forecast period. The highest CAGR of the segment is attributed to the growing volume of production of pharmaceuticals and advancements in primary packaging and drug delivery devices. Additionally, with the rising number of drug approvals, the demand for primary packaging is increasing which is supporting the demand for pharmaceutical packaging market. For instance, in 2023, the U.S. FDA approved 55 drugs in comparison to 37 drugs in 2022.

Based on dosage form, the pharmaceutical packaging market is segmented into oral dosage form, parenteral dosage form, and other dosage forms. In 2024, the oral dosage form segment is expected to account for the largest share of the pharmaceutical packaging market. The large market share of this segment can be attributed to patients' inclination towards oral medications, the reliable and efficient delivery of drugs via oral administration, and ongoing innovations in oral drug packaging solutions. Recent advancements in oral drug formulation packaging include the introduction of child-resistant and senior-friendly packaging, sustainable packaging solutions, and designs tailored to meet patient needs. For instance, in February 2023, Berry Global Group, Inc. (U.S.) launched a new PET bottle combination designed for pharmaceutical syrups. This packaging solution aims to assist customers in meeting the growing demand for child-resistant and tamper-evident packaging.

Based on end user, the pharmaceutical packaging market is segmented into pharmaceutical companies, contract companies, and pharmacies. The contract companies’ segment is projected to register the highest CAGR during the forecast period. Pharmaceutical companies are increasingly outsourcing their drug packaging to contract companies due to the increasing cost of product development, rising pricing constraints, and the lack of extensive in-house R&D infrastructure among small and medium-sized companies. The increasing number of clinical trials and rapid growth in the healthcare and life sciences industries are driving packaging outsourcing to ensure quick and cost-effective pharmaceutical packaging. According to a report published by the Association for Packaging and Processing Technologies (U.S.) in 2022, 60% of pharmaceutical manufacturers outsource at least a portion of their operations to a third-party contractor.

In 2024, North America is expected to account for the largest share of the pharmaceutical packaging market. North America's significant market share can be attributed to several factors, including increased manufacturing capacities of pharmaceutical and biopharmaceutical companies in the region, the adoption of advanced digital tools approved by regulatory authorities to enhance the packaging process, and well-organized regulations governing packaging and labeling in the pharmaceutical industry. Additionally, the presence of major pharmaceutical packaging companies, including Catalent, Inc. (U.S.), Corning Inc. (U.S.), Berry Global Group, Inc. (U.S.), Drug Plastics Group (U.S.), and AptarGroup, Inc. (U.S.) in the U.S. further contributes to the region's large market share.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years 2021–2024. The key players operating in the global pharmaceutical packaging market are Amcor plc (Switzerland), AptarGroup, Inc. (U.S.), Becton, Dickinson and Company (U.S.), Gerresheimer AG (Germany), Schott Pharma AG & Co. KGaA (Germany), Berry Global Group, Inc. (U.S.), Drug Plastics Group (U.S.), Catalent, Inc. (U.S.), SGD Pharma (France), Corning Inc. (U.S.), WestRock Company (U.S.), and West Pharmaceutical Services, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

348 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

7.6% |

|

Estimated Market Size (Value) |

$176.54 billion by 2031 |

|

Segments Covered |

By Material

By Packaging Type

By Dosage Form

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Switzerland, Italy, Germany, France, U.K., Ireland, Belgium, Spain, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Amcor plc (Switzerland), AptarGroup, Inc. (U.S.), Becton, Dickinson and Company (U.S.), Gerresheimer AG (Germany), Schott Pharma AG & Co. KGaA (Germany), Berry Global Group, Inc. (U.S.), Drug Plastics Group (U.S.), Catalent, Inc. (U.S.), SGD Pharma (France), Corning Inc. (U.S.), WestRock Company (U.S.), and West Pharmaceutical Services, Inc. (U.S.). |

The global pharmaceutical packaging market covers the study of various materials used for pharmaceutical packaging manufacturing, along with the packaging type, dosage form, and end user. This report also involves the analysis of various segments of pharmaceutical packaging at the regional and country levels.

The global pharmaceutical packaging market is projected to reach $176.54 billion by 2031 at a CAGR of 7.6% from 2024 to 2031.

Among all the materials studied in this report, in 2024, the polymer segment is expected to account for the largest share of the pharmaceutical packaging market. The segment’s large share is attributed to the wide availability of polymers, the cost-effectiveness of polymers compared to other packaging materials, such as glass and metal, and the effectiveness of polymers in protecting pharmaceutical preparations against external damage and contamination.

Among all the packaging types studied in this report, in 2024, the primary packaging segment is expected to account for the largest share of the pharmaceutical packaging market. This large share is attributed to the high volume of pharmaceutical production and advancements in primary packaging and drug delivery devices. Additionally, with the rising number of drug approvals, the demand for primary packaging is increasing.

The growth of the pharmaceutical packaging market is driven by growth in the pharmaceutical sector, the rising demand for drug delivery devices, growing healthcare expenditures, the increasing focus on biosimilars, the growing trend of contract manufacturing & packaging in the pharmaceutical sector, and growth in the aging population & the consequent rise in chronic disease prevalence.

Furthermore, the rising adoption of personalized medicines & self-medication, improving healthcare provisions in emerging economies, the growth in pharmaceutical R&D spending, and the increasing focus on vaccine development & vaccination coverage are expected to generate growth opportunities for the players operating in this market.

The key players operating in the global pharmaceutical packaging market are Amcor plc (Switzerland), AptarGroup, Inc. (U.S.), Becton, Dickinson and Company (U.S.), Gerresheimer AG (Germany), Schott Pharma AG & Co. KGaA (Germany), Berry Global Group, Inc. (U.S.), Drug Plastics Group (U.S.), Catalent, Inc. (U.S.), SGD Pharma (France), Corning Inc. (U.S.), WestRock Company (U.S.), and West Pharmaceutical Services, Inc. (U.S.).

The countries in Asia-Pacific are projected to offer significant growth opportunities for the vendors in this market. Countries such as India and South Korea are expected to grow with considerable CAGR in the pharmaceutical packaging market. The growth of the pharmaceutical packaging market in India is driven by the growth in domestic consumption of pharmaceuticals and the increasing manufacturing of several pharmaceutical products in the country. Furthermore, government initiatives supporting the growth of pharmaceutical manufacturing in the country are expected to drive the market's growth. Additionally, companies operating in South Korea are actively focusing on increasing their presence in the country due to the potential market opportunities and supportive government initiatives. For instance, in August 2021, ExoCoBio, Inc. (South Korea) started building its drug manufacturing and research & development facilities in South Korea.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates