Resources

About Us

Europe IVD Market by Offering (Kits, Software), Technology (Immunoassay, Molecular Diagnostics [PCR, NGS, Microarray], Rapid Tests, Biochemistry), Application (Infectious Diseases, Oncology), Diagnostic Approach (Lab, PoC) - Forecast to 2032

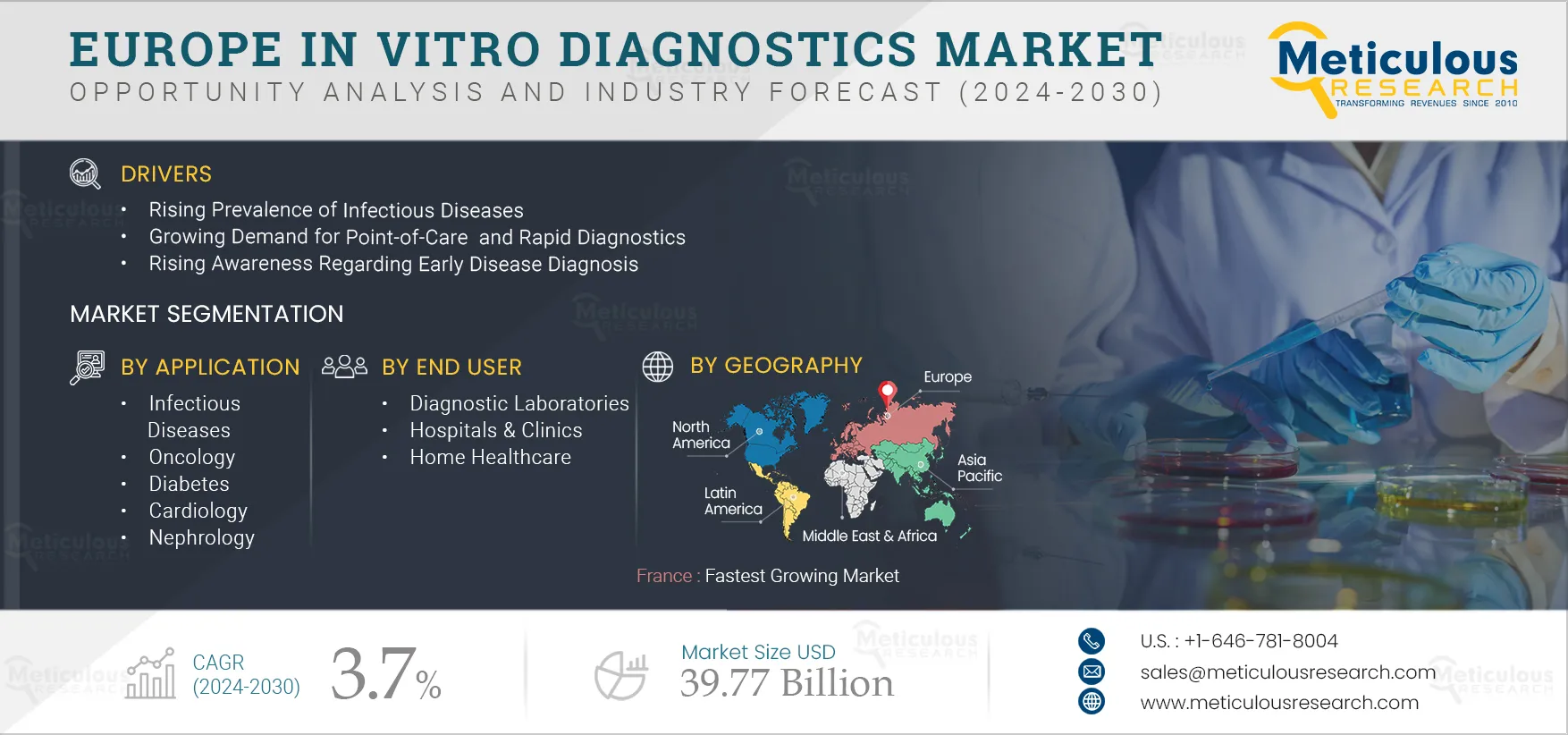

Report ID: MRHC - 1041035 Pages: 250 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe IVD Market is expected to reach $39.77 billion by 2032 at a CAGR of 3.7% from 2025 to 2032. In vitro diagnostics (IVD) are tests performed on biological samples such as blood, saliva, and other tissues taken from the human body to detect a wide range of diseases. IVD tests are used to screen biological samples to monitor individuals’ health and prevent or diagnose diseases. These consist of various tests based on techniques such as enzyme-linked immunosorbent assay (ELISA), radioimmunoassay, polymerase chain reaction (PCR), isothermal nucleic acid amplification, and next-generation sequencing. These tests can be performed in laboratories, homes, and healthcare facilities.

The growth of the Europe IVD market is attributed to the rising prevalence of chronic diseases coupled with the increasing geriatric population, the rising prevalence of infectious diseases, the growing demand for point-of-care (PoC) and rapid diagnostics, rising awareness regarding early disease diagnosis, rising healthcare expenditures, and increasing funding for research activities.

However, stringent technical requirements and regulatory processes for high/moderate-complexity tests and the variance in test results observed in rapid IVD tests restrain the growth of the IVD market. The increasing inclination toward personalized medicine and advancements in genomics and proteomics are expected to create growth opportunities for the players operating in this market. However, the evolving regulatory landscape is a major challenge for market growth.

Click here to: Get Free Sample Pages of this Report

The prevalence of chronic diseases and conditions such as cancer, diabetes, arthritis, and heart disease is on the rise in European countries. According to Eurostat, 35.2% of Europeans reported suffering from chronic illnesses in 2021. The growth in the geriatric population and social behaviors such as tobacco and alcohol consumption, physical inactivity, and unhealthy diets are major factors driving a steady increase in the number of people suffering from chronic diseases. According to the International Diabetes Federation, the prevalence of diabetes in Europe will increase by 13% by 2045.

Chronic diseases are often associated with the elderly population due to the declining bodily functions and immunity among this population segment. Aging is associated with progressive deterioration in the structure and functioning of organs. The elderly population is more prone to various chronic diseases. According to the European Commission, in 2022, more than one-fifth (21.1%) of the European population was aged 65 and over. This remarkable growth in the elderly population is driven by declining fertility rates and improvements in longevity.

The growth in the elderly population and associated chronic disease is increasing the demand for IVD testing.

Early diagnosis of infectious diseases leads to better treatment and future care. It helps healthcare professionals and patients make important medical decisions regarding care and support. There is a growing awareness about early disease diagnosis due to its advantages. Diagnosing a disease in its early stages can help patients save significantly on treatment costs. For instance, according to the WHO, studies conducted in some high-income countries have revealed that the treatment of cancer patients diagnosed early leads to cost savings by two to four times. Additionally, early diagnosis can be lifesaving for patients with critical diseases such as cancer.

Laboratory examination is one of the most effective and popularly practiced testing techniques for disease diagnosis. Immunoassays, biochemical characterization, polymerase chain reaction, isothermal nucleic acid amplification, and next-generation sequencing are performed to identify a comprehensive range of chronic and infectious diseases. Organizations are undertaking initiatives to promote early diagnosis and prevent/eradicate mortalities associated with infectious diseases.

Based on offering, the Europe IVD market is segmented into reagents and kits, systems, and software & services. In 2025, the kits & reagents segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the frequent use of reagents and kits in the detection of various chronic diseases, the commercial availability of a diverse range of reagents and consumables for the diagnosis of various diseases, the increase in the volume of testing for infectious diseases such as COVID-19 and influenza, and the growing awareness about self-testing among the general population.

Based on technology, the Europe IVD market is segmented into immunoassay/immunochemistry, biochemistry/clinical chemistry, molecular diagnostics, point-of-care (POC) diagnostics, whole blood glucose monitoring, microbiology, hematology, coagulation/hemostasis, urinalysis, and other technologies. In 2025, the molecular diagnostics segment is expected to account for the largest share of the market. The segment’s large share is mainly attributed to the technological innovations and the advantages of molecular diagnostics tests, such as cost-effectiveness, rapid results, and high sensitivity and specificity over laboratory tests.

Additionally, the growing prevalence of infectious diseases is also increasing the demand for molecular diagnostics. In Europe, several factors driving the growth in the genomic sector increase the adoption of molecular diagnostic products. For instance, the establishment of national programs or pan-European programs, such as the “1+ Million Genomes” initiative, which involves 23 countries across Europe and aims to improve the uptake of genomics by healthcare systems and in personalized healthcare.

Based on application, the Europe in vitro diagnostics (IVD) market is segmented into infectious diseases, oncology, diabetes, cardiology, nephrology, autoimmune disorders, and other applications. The cardiology segment is expected to register the highest CAGR during the forecast period. Cardiovascular diseases (CVD) remain the leading cause of death globally. According to the American Heart Association, in 2020 highest mortality rates due to cardiovascular diseases were reported in Eastern Europe and Central Asia. Thus, the high prevalence of cardiovascular diseases is increasing the demand for IVD testing in the region. IVD testing is used for the biomarker measurement. The early-stage biomarkers of CVD can potentially save many lives and help alleviate the global burden of CVD.

Based on diagnostic approach, the Europe IVD market is segmented into laboratory testing, OTC/self-testing, and point-of-care testing. In 2025, the laboratory testing segment is expected to account for the largest share of the market. The laboratory testing approach for IVD has many advantages over other approaches. It has higher accuracy and reliability when compared to point-of-care testing. The laboratory equipment and analyzers have a high sensitivity and specificity. Unlike point-of-care testing, laboratory testing can be performed on all IVD tests. Such factors support the large market share of the segment.

Based on end user, the Europe in vitro diagnostics (IVD) market is segmented into diagnostic laboratories, hospitals & clinics, home healthcare, and other end users, which includes nursing homes, academic & research institutes, ambulatory care centers, and transfusion laboratories. The hospitals & clinics segment is expected to register the highest CAGR during the forecast period. The highest CAGR of this segment is attributed to the increasing number of hospitalizations due to various diseases requiring molecular diagnosis and the proliferation of hospitals and clinics in the region, leading to growth in the utilization of molecular diagnostic products.

France is expected to register the highest CAGR during the forecast period. The highest CAGR of this regional market is attributed to the increasing prevalence of infectious diseases, growth in the geriatric population, rising prevalence of cancer, and government initiatives to improve healthcare infrastructure in France. For instance, in June 2021, the Government of France launched the Health Innovation Plan to improve the healthcare system of France with a total budget of USD 6.2 billion (EUR 7.5 billion). Of this, USD 0.8 billion (EUR 1 billion) is allocated to R&D infrastructures, cross-cutting research support, attracting high-level scientists, clusters, and translational research. The fund of USD 1.2 billion (EUR 1.5 billion) was allocated for national projects and an Important Project of Common European Interest (IPCEI) to accelerate the development of healthcare innovations. Additionally, USD 1.9 billion (EUR 2.4 billion) for improving medical technologies, biotherapies, emerging infectious diseases, digital health, and CBRN (Chemical, Biological, Radiological, Nuclear) sectors.

Key Players

The report offers a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments adopted by leading market players in the industry over the years . The key players operating in the Europe IVD market are Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), bioMérieux SA (France), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (U.S.), QuidelOrtho Corporation (U.S.), Agilent Technologies Inc. (U.S.), and DiaSorin S.p.A. (Italy).

Scope of the Report:

Key questions answered in the report:

The Europe IVD market is segmented based on product & solution (reagents & kits, systems, and software & services) and a wide range of technologies (immunoassay/immunochemistry, biochemistry/clinical chemistry, molecular diagnostics, microbiology, hematology, coagulation/hemostasis, urinalysis, and other technologies) offered by key companies to various end users, such as diagnostic laboratories, hospitals & clinics, home healthcare, and other end users. The Europe IVD market studied in this report involves the value analysis of various segments and sub-segments of in-vitro diagnostics at regional and country levels.

The Europe IVD market is projected to reach $39.77 billion by 2032, at a CAGR of 3.7% during the forecast period.

The kits & reagents segment is estimated to account for the largest share of the Europe IVD market in 2025. Factors such as the high burden of diseases, the high adoption of rapid diagnostic test kits, and the presence of initiatives supporting early disease diagnosis are responsible for the largest market share.

Based on the technology, the molecular diagnostics segment is projected to create more traction attributed to the technological innovations and the advantages of rapid immunoassay tests, such as cost-effectiveness, rapid results, and high sensitivity & specificity over laboratory tests.

Based on application, the cardiology segment is projected to create more traction during the forecast period due to the growing burden of cardiovascular diseases and rising demand for early diagnosis.

Based on end user, the hospitals & clinics segment is projected to create more traction during the forecast period due to a large number of hospitalization in various diseases, the rising geriatric population, increasing healthcare access & expenditure, and the rising prevalence of healthcare-associated infections (HAIs).

Rising prevalence of chronic and infectious diseases, growing awareness for early disease diagnosis, a shift in the focus from centralized to point-of-care testing, and technological innovations. Further, the emergence of the COVID-19 pandemic and advancements in genomics and proteomics offer significant growth opportunities for the players operating in this market.

The key players operating in the Europe IVD market are Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), bioMérieux SA (France), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (U.S.), Ortho-Clinical Diagnostics, Inc. (U.S.), Agilent Technologies Inc. (U.S.), and DiaSorin S.p.A. (Italy).

France is expected to offer significant growth opportunities owing to the government initiatives to improve the healthcare infrastructure in the country, the rising prevalence of infectious diseases, and the growth in the geriatric population.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions for this Study

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. Rising Prevalence of Chronic Diseases Coupled with the Increasing Geriatric Population

4.2.2. Rising Prevalence of Infectious Diseases

4.2.3. Growing Demand for Point-of-Care and Rapid Diagnostics

4.2.4. Rising Awareness Regarding Early Disease Diagnosis

4.2.5. Rising Healthcare Expenditure

4.2.6. Increasing Funding for Research Activities

4.3. Restraints

4.3.1. Stringent Technical Requirements and Regulatory Processes for High/Moderate Complexity Tests

4.3.2. Variance in Test Results Observed in Rapid IVD Tests

4.4. Opportunities

4.4.1. Increasing Inclination Toward Personalized Medicine

4.4.2. Advancements in Genomics and Proteomics

4.5. Challenges

4.5.1. Concerns Pertaining to False Positive Results in Immunoassays and POC

4.6. Trends

4.7. Pricing Analysis

4.8. Regulatory Analysis

4.9. Porters Five Force Analysis

4.9.1. Bargaining Power of Buyers

4.9.2. Bargaining Power of Suppliers

4.9.3. Threat of Substitute

4.9.4. Threat of New Entrant

4.9.5. Degree of Competition

5. Europe In Vitro Diagnostics Market Assessment—by Offering

5.1. Overview

5.2. Reagents & Kits

5.3. Instruments

5.4. Software & Services

6. Europe In Vitro Diagnostics Market Assessment—by Technology

6.1. Overview

6.2. Molecular Diagnostics

6.2.1. Polymerase Chain Reaction (PCR)

6.2.2. Hybridization

6.2.3. Isothermal Nucleic Acid Amplification Technology

6.2.4. DNA Sequencing & Next-generation Sequencing

6.2.5. Microarrays

6.2.6. Mass Spectrometry

6.2.7. Other Molecular Diagnostic Technologies

6.3. Point of Care Diagnostics

6.3.1. Lateral Flow Assays/Rapid Tests

6.3.2. PoC Molecular Diagnostics

6.3.3. Other POC

6.4. Immunoassay/Immunochemistry

6.4.1. Enzyme-linked Immunosorbent Assays (ELISA)

6.4.2. Enzyme-linked Immunospot Assays (ELISPOT)

6.4.3. Western Blotting

6.4.4. Radioimmunoassay

6.5. Biochemistry/Clinical Chemistry

6.5.1. Metabolic Panels

6.5.2. Electrolyte Panels

6.5.3. Liver Panels

6.5.4. Lipid Profiles

6.5.5. Renal Profiles

6.5.6. Thyroid Function Panels

6.6. Whole Blood Glucose Monitoring

6.7. Hematology

6.8. Microbiology

6.9. Coagulation & Hemostasis

6.10. Urinalysis

6.11. Other IVD Technologies

7. Europe In Vitro Diagnostics Market Assessment—by Application

7.1. Overview

7.2. Infectious Diseases

7.2.1. COVID-19 Testing

7.2.2. Sexually Transmitted Diseases Testing

7.2.3. Healthcare-associated Infections

7.2.4. Hepatitis

7.2.5. HIV

7.2.6. Tropical Diseases

7.2.7. Influenza

7.2.8. Respiratory Infections (Excluding Influenza)

7.2.9. Other Infectious Diseases

7.3. Oncology

7.4. Cardiology

7.5. Diabetes

7.6. Autoimmune Disorders

7.7. Nephrology

7.8. Other Applications

8. Europe In Vitro Diagnostics Market Assessment—by Diagnostic Approach

8.1. Overview

8.2. Lab Testing

8.3. OTC/Self-testing

8.4. Point-of-care Testing

9. Europe In Vitro Diagnostics Market Assessment—by End User

9.1. Overview

9.2. Hospitals & Clinics

9.3. Diagnostic Laboratories

9.4. Home Healthcare

9.5. Other End Users

10. Europe In Vitro Diagnostics Market Assessment—by Country/Region

10.1. Overview

10.2. Germany

10.3. U.K.

10.4. France

10.5. Italy

10.6. Spain

10.7. Switzerland

10.8. Netherlands

10.9. Denmark

10.10. Rest of Europe

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Emerging Companies

11.5. Market Share Analysis/Market Ranking (2022)

12. Company Profiles (Company Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

12.1. Abbott Laboratories

12.2. Bio-Rad Laboratories, Inc.

12.3. bioMérieux SA

12.4. Danaher Corporation

12.5. F. Hoffmann-La Roche Ltd.

12.6. QIAGEN N.V.

12.7. Siemens Healthineers AG (A Subsidiary of Siemens AG)

12.8. Thermo Fisher Scientific, Inc.

12.9. Bio-Rad Laboratories, Inc.

12.10. Illumina, Inc.

12.11. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

12.12. QuidelOrtho Corporation

12.13. Agilent Technologies Inc.

12.14. DiaSorin S.p.A.

(Note: SWOT Analysis will be provided for the top 5 companies operating in the market.)

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Table

Table 1 Europe In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 2 Europe In Vitro Diagnostics Reagents & Kits Market, by Country/Region, 2021–2032 (USD Million)

Table 3 Europe In Vitro Diagnostics Instruments Market, by Country/Region, 2021–2032 (USD Million)

Table 4 Europe In Vitro Diagnostics Software & Services Market, by Country/Region, 2021–2032 (USD Million)

Table 5 Europe In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 6 Europe Molecular Diagnostics Market, by Type, 2021–2032 (USD Million)

Table 7 Europe Molecular Diagnostics Market, by Country/Region, 2021–2032 (USD Million)

Table 8 Europe Polymerase Chain Reaction Market, by Country/Region, 2021–2032 (USD Million)

Table 9 Europe Hybridization Market, by Country/Region, 2021–2032 (USD Million)

Table 10 Europe Isothermal Nucleic Acid Amplification Technology Market, by Country/Region, 2021–2032 (USD Million)

Table 11 Europe DNA Sequencing & Next-Generation Sequencing Market, by Country/Region, 2021–2032 (USD Million)

Table 12 Europe Microarrays Market, by Country/Region, 2021–2032 (USD Million)

Table 13 Europe Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 14 Europe Other Molecular Diagnostics Market, by Country/Region, 2021–2032 (USD Million)

Table 15 Europe Point-of-care Diagnostics Market, by Type, 2021–2032 (USD Million)

Table 16 Europe Point-of-care Diagnostics Market, by Country/Region, 2021–2032 (USD Million)

Table 17 Europe Point-of-care Diagnostics Market for Lateral Flow Assays/Rapid Tests, by Country/Region, 2021–2032 (USD Million)

Table 18 Europe Molecular POC Diagnostics Market, by Country/Region, 2021–2032 (USD Million)

Table 19 Europe Other Point-of-care Diagnostics Market, by Country/Region, 2021–2032 (USD Million)

Table 20 Europe Immunoassay/Immunochemistry Market, by Type, 2021–2032 (USD Million)

Table 21 Europe Immunoassay/Immunochemistry Market, by Country/Region, 2021–2032 (USD Million)

Table 22 Europe Enzyme-linked Immunosorbent Assays (ELISA) Market, by Country/Region, 2021–2032 (USD Million)

Table 23 Europe Enzyme-linked Immunospot Assays (ELISPOT) Market, by Country/Region, 2021–2032 (USD Million)

Table 24 Europe Western Blotting Market, by Country/Region, 2021–2032 (USD Million)

Table 25 Europe Radioimmunoassay Market, by Country/Region, 2021–2032 (USD Million)

Table 26 Europe Biochemistry/Clinical Chemistry Market, by type, 2021–2032 (USD Million)

Table 27 Europe Biochemistry/Clinical Chemistry Market, by Country/Region, 2021–2032 (USD Million)

Table 28 Europe Metabolic Panels Market, by Country/Region, 2021–2032 (USD Million)

Table 29 Europe Electrolyte Panels Market, by Country/Region, 2021–2032 (USD Million)

Table 30 Europe Liver Panels Market, by Country/Region, 2021–2032 (USD Million)

Table 31 Europe Lipid Profiles Market, by Country/Region, 2021–2032 (USD Million)

Table 32 Europe Renal Profiles Market, by Country/Region, 2021–2032 (USD Million)

Table 33 Europe Thyroid Functional Panels Market, by Country/Region, 2021–2032 (USD Million)

Table 34 Europe Whole Blood Glucose Monitoring Market, by Country/Region, 2021–2032 (USD Million)

Table 35 Europe Microbiology Market, by Country/Region, 2021–2032 (USD Million)

Table 36 Europe Hematology Market, by Country/Region, 2021–2032 (USD Million)

Table 37 Europe Coagulation and Hemostasis Market, by Country/Region, 2021–2032 (USD Million)

Table 38 Europe Urinalysis Market, by Country/Region, 2021–2032 (USD Million)

Table 39 Europe Other IVD Technologies Market, by Country/Region, 2021–2032 (USD Million)

Table 40 Europe In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 41 Europe In Vitro Diagnostics Market for Infectious Diseases, by Type, 2025–2032 (USD Million)

Table 42 Europe In Vitro Diagnostics Market for Infectious Diseases, by Country/Region, 2025–2032 (USD Million)

Table 43 Europe In Vitro Diagnostics Market for COVID-19 Testing, by Country/Region, 2025–2032 (USD Million)

Table 44 Europe In Vitro Diagnostics Market for Sexually Transmitted Diseases Testing, by Country/Region, 2025–2032 (USD Million)

Table 45 Europe In Vitro Diagnostics Market for Healthcare-associated Infections, by Country/Region, 2025–2032 (USD Million)

Table 46 Europe In Vitro Diagnostics Market for Hepatitis, by Country/Region, 2025–2032 (USD Million)

Table 47 Europe In Vitro Diagnostics Market for Tropical Diseases, by Country/Region, 2025–2032 (USD Million)

Table 48 Europe In Vitro Diagnostics Market for Influenza, by Country/Region, 2025–2032 (USD Million)

Table 49 Europe In Vitro Diagnostics Market for Respiratory Infections (Excluding Influenza), by Country/Region, 2025–2032 (USD Million)

Table 50 Europe In Vitro Diagnostics Market for Other Infectious Diseases, by Country/Region, 2025–2032 (USD Million)

Table 51 Europe In Vitro Diagnostics Market for Oncology, by Country/Region, 2025–2032 (USD Million)

Table 52 Europe In Vitro Diagnostics Market for Diabetes, by Country/Region, 2025–2032 (USD Million)

Table 53 Europe In Vitro Diagnostics Market for Cardiology, by Country/Region, 2025–2032 (USD Million)

Table 54 Europe In Vitro Diagnostics Market for Nephrology, by Country/Region, 2025–2032 (USD Million)

Table 55 Europe In Vitro Diagnostics Market for Autoimmune Disorders, by Country/Region, 2025–2032 (USD Million)

Table 56 Europe In Vitro Diagnostics Market for Other Applications, by Country/Region, 2025–2032 (USD Million)

Table 57 Europe In Vitro Diagnostics Market, by Diagnostic Approach, 2021–2032 (USD Million)

Table 58 Europe In Vitro Diagnostics Market for Laboratory Testing, by Country/Region, 2025–2032 (USD Million)

Table 59 Europe In Vitro Diagnostics Market for OTC/Self-testing, by Country/Region, 2025–2032 (USD Million)

Table 60 Europe In Vitro Diagnostics Market for Point-of-care Testing, by Country/Region, 2025–2032 (USD Million)

Table 61 Europe In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 62 Europe In Vitro Diagnostics Market for Hospitals & Clinics, by Country/Region, 2021–2032 (USD Million)

Table 63 Europe In Vitro Diagnostics Market for Diagnostic Laboratories, by Country/Region, 2021-2032 (USD Million)

Table 64 Europe In Vitro Diagnostics Market for Home Healthcare, by Country/Region, 2021-2032 (USD Million)

Table 65 Europe In Vitro Diagnostics Market for Other End Users, by Country/Region, 2021-2032 (USD Million)

Table 66 Germany In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 67 Germany In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 68 Germany In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 69 Germany In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 70 Germany In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 71 Germany In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 72 Germany In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 73 Germany In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 74 Germany In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 75 Germany In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 76 U.K. In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 77 U.K. In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 78 U.K. In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 79 U.K. In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 80 U.K. In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 81 U.K. In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 82 U.K. In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 83 U.K. In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 84 U.K. In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 85 U.K. In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 86 France In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 87 France In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 88 France In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 89 France In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 90 France In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 91 France In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 92 France In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 93 France In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 94 France In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 95 France In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 96 Italy In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 97 Italy In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 98 Italy In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 99 Italy In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 100 Italy In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 101 Italy In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 102 Italy In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 103 Italy In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 104 Italy In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 105 Italy In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 106 Spain In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 107 Spain In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 108 Spain In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 109 Spain In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 110 Spain In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 111 Spain In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 112 Spain In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 113 Spain In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 114 Spain In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 115 Spain In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 116 Switzerland In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 117 Switzerland In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 118 Switzerland In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 119 Switzerland In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 120 Switzerland In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 121 Switzerland In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 122 Switzerland In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 123 Switzerland In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 124 Switzerland In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 125 Switzerland In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 126 Netherlands In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 127 Netherlands In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 128 Netherlands In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 129 Netherlands In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 130 Netherlands In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 131 Netherlands In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 132 Netherlands In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 133 Netherlands In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 134 Netherlands In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 135 Netherlands In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 136 Denmark In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 137 Denmark In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 138 Denmark In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 139 Denmark In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 140 Denmark In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 141 Denmark In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 142 Denmark In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 143 Denmark In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 144 Denmark In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 145 Denmark In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 146 Rest of Europe In Vitro Diagnostics Market, by Offering, 2021–2032 (USD Million)

Table 147 Rest of Europe In Vitro Diagnostics Market, by Technology, 2021–2032 (USD Million)

Table 148 Rest of Europe In Vitro Diagnostics Market for Molecular Diagnostics, by Type, 2021–2032 (USD Million)

Table 149 Rest of Europe In Vitro Diagnostics Market for Point-of-Care Diagnostics, by Type, 2021–2032 (USD Million)

Table 150 Rest of Europe In Vitro Diagnostics Market for Immunoassay/Immunochemistry, by Type, 2021–2032 (USD Million)

Table 151 Rest of Europe In Vitro Diagnostics Market for Biochemistry/Clinical Chemistry, by Type, 2021–2032 (USD Million)

Table 152 Rest of Europe In Vitro Diagnostics Market, by Application, 2021–2032 (USD Million)

Table 153 Rest of Europe In Vitro Diagnostics Market for Infectious Diseases, by Type, 2021–2032 (USD Million)

Table 154 Rest of Europe In Vitro Diagnostics Market, by Diagnostics Approach, 2021–2032 (USD Million)

Table 155 Rest of Europe In Vitro Diagnostics Market, by End User, 2021–2032 (USD Million)

Table 156 Recent Developments, by Company (2020-2025)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Size Estimation

Figure 7 Europe In Vitro Diagnostics Market, by Offering, 2025 VS. 2032 (USD Million)

Figure 8 Europe In Vitro Diagnostics Market, by Technology, 2025 VS. 2032 (USD Million)

Figure 9 Europe In Vitro Diagnostics Market, by Application, 2025 VS. 2032 (USD Million)

Figure 10 Europe In Vitro Diagnostics Market, by Diagnostic Approach, 2025 VS. 2032 (USD Million)

Figure 11 Europe In Vitro Diagnostics Market, by End User, 2025 VS. 2032 (USD Million)

Figure 12 Europe In Vitro Diagnostics Market, by Country, 2025 VS. 2032 (USD Million)

Figure 13 Factors Affecting Market Growth

Figure 14 Europe In Vitro Diagnostics Market, by Offering, 2025 VS. 2032 (USD Million)

Figure 15 Europe In Vitro Diagnostics Market, by Technology, 2025 VS. 2032 (USD Million)

Figure 16 Europe In Vitro Diagnostics Market, by Application, 2025 VS. 2032 (USD Million)

Figure 17 Europe In Vitro Diagnostics Market, by Diagnostic Approach, 2025 VS. 2032 (USD Million)

Figure 18 Europe In Vitro Diagnostics Market, by End User, 2025 VS. 2032 (USD Million)

Figure 19 Europe In Vitro Diagnostics Market, by Country, 2025 VS. 2032 (USD Million)

Figure 20 Europe: In Vitro Diagnostics Market Snapshot

Figure 21 Key Growth Strategies Adopted by Leading Players, 2020—2025

Figure 22 Europe In Vitro Diagnostics Market: Competitive Benchmarking, by Offering

Figure 23 Europe In Vitro Diagnostics Market: Competitive Dashboard

Figure 24 Europe In Vitro Diagnostics Market: Market Share Analysis (2022)

Figure 25 Abbott Laboratories: Financial Snapshot (2022)

Figure 26 Becton, Dickinson and Company: Financial Snapshot (2022)

Figure 27 bioMérieux SA: Financial Snapshot (2022)

Figure 28 Bio-Rad Laboratories, Inc.: Financial Snapshot (2022)

Figure 29 Danaher Corporation: Financial Snapshot (2022)

Figure 30 F. Hoffmann-La Roche Ltd.: Financial Snapshot (2022)

Figure 31 Illumina, Inc.: Financial Snapshot (2022)

Figure 32 QIAGEN N.V.: Financial Snapshot (2022)

Figure 33 Shenzhen Mindray Bio-Medical Electronics Co., Ltd: Financial Snapshot (2022)

Figure 34 Siemens Healthineers AG: Financial Snapshot (2022)

Figure 35 Thermo Fisher Scientific Inc.: Financial Snapshot (2022)

Figure 36 Ortho-Clinical Diagnostics, Inc.: Financial Snapshot (2022)

Figure 37 Agilent Technologies Inc.: Financial Snapshot (2022)

Figure 38 DiaSorin S.p.A.: Financial Snapshot (2022)

Published Date: Jun-2025

Published Date: Apr-2025

Published Date: Apr-2025

Published Date: Apr-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates