Resources

About Us

Electronic Clinical Outcome Assessment (eCOA) Solutions Market by Component (Software, Services, Devices), by Type (ePRO, eClinRO, eObsRO, ePerfO), by Delivery Mode (Cloud-Based, Web-Hosted, On-Premise), by Device Strategy (BYOD, Provisioned Device, Site-Based), and by End User — Global Forecast to 2036

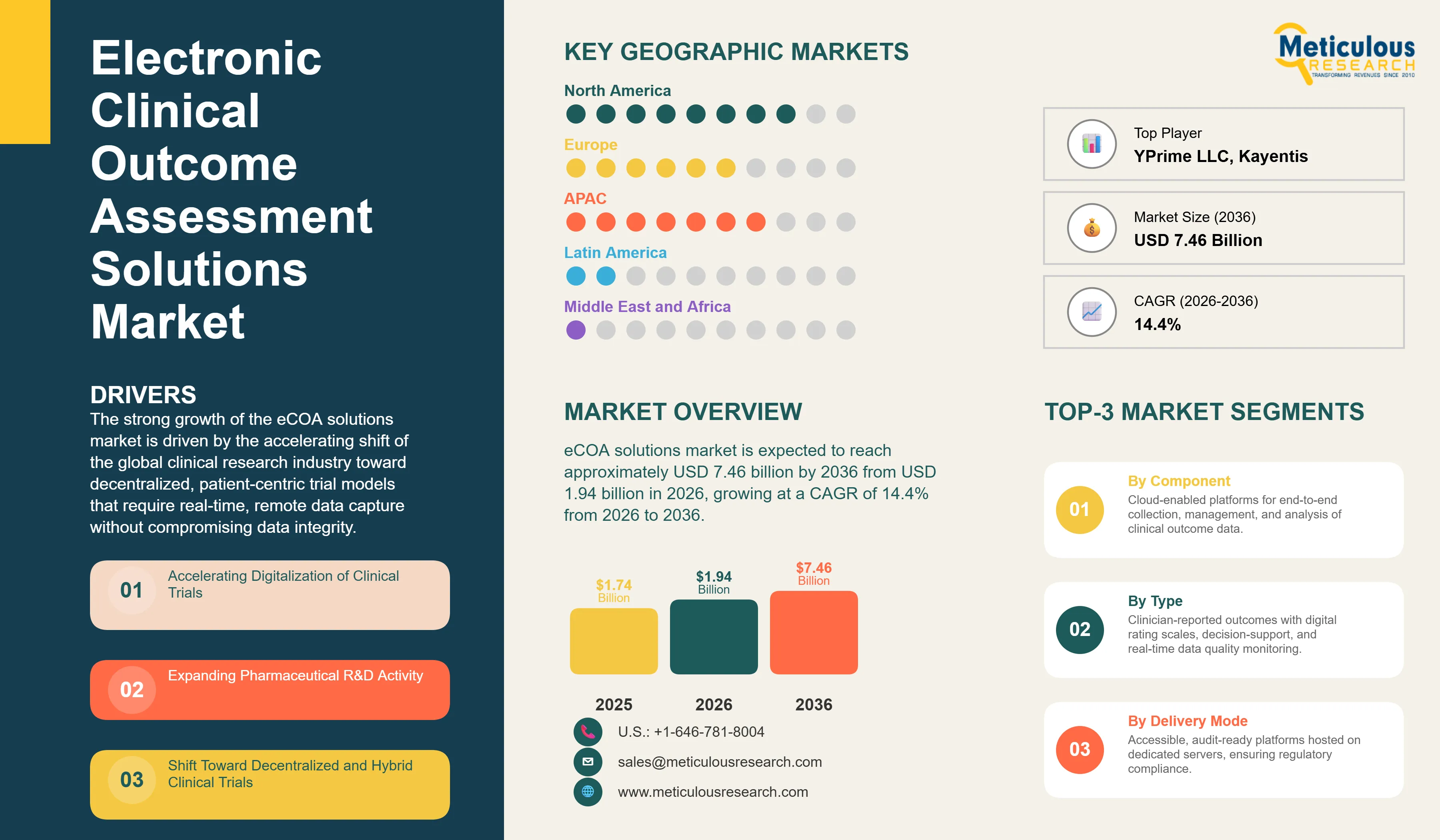

Report ID: MRHC - 1041790 Pages: 284 Feb-2026 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe global electronic clinical outcome assessment (eCOA) solutions market was valued at USD 1.74 billion in 2025. The market is expected to reach approximately USD 7.46 billion by 2036 from USD 1.94 billion in 2026, growing at a CAGR of 14.4% from 2026 to 2036. The strong growth of the overall eCOA solutions market is driven by the accelerating shift of the global clinical research industry toward decentralized, patient-centric trial models that require real-time, remote data capture without compromising data integrity. As pharmaceutical sponsors and contract research organizations seek to manage increasingly complex multi-site trials across diverse geographies, eCOA platforms have become essential for maintaining high-quality endpoint data and improving participant engagement throughout the clinical trial lifecycle. The rising demand for digital health technologies, expanding regulatory support for electronic data collection, and the rapid integration of artificial intelligence and wearable devices into clinical trial workflows continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Electronic clinical outcome assessment (eCOA) solutions are digital platforms and tools that enable the systematic collection, management, and analysis of clinical outcome data directly from patients, clinicians, observers, or through standardized performance tasks during clinical trials and real-world studies. These systems replace traditional paper-based questionnaires and manual data entry processes with technology-driven workflows that ensure greater data accuracy, reduced protocol deviations, and improved participant compliance throughout the study lifecycle. The market is defined by a diverse set of solution types, ranging from electronic patient-reported outcome (ePRO) applications deployed on smartphones and tablets to complex clinician-rating platforms with integrated rater training, decision-support prompts, and real-time data quality monitoring capabilities. These solutions are indispensable for clinical trial sponsors seeking to meet stringent regulatory requirements while reducing trial timelines and overall data management costs.

The market encompasses a broad range of offerings, from simple single-endpoint electronic diaries for patient symptom tracking to comprehensive, multi-modal endpoint management platforms that seamlessly integrate eCOA, electronic consent (eConsent), randomization and trial supply management (RTSM), and real-world evidence generation within a single unified environment. These systems are increasingly embedded with advanced components such as artificial intelligence algorithms and wearable sensor integrations that provide services such as automated compliance alerts, predictive patient adherence monitoring, and passive collection of digital biomarkers between scheduled site visits. The ability to deliver high-quality, regulatory-compliant outcome data while supporting remote and decentralized trial participation has made eCOA technology the solution of choice for pharmaceutical companies, contract research organizations, and medical device manufacturers operating in competitive, high-stakes drug development environments.

The global clinical research industry is under significant pressure to accelerate drug development timelines, reduce costs, and demonstrate meaningful patient outcomes to regulators and payers. This drive has accelerated the adoption of digital data capture solutions, with advanced eCOA platforms helping to standardize endpoint collection across multi-site, multi-country studies while supporting decentralized trial models that reduce the burden on clinical sites and patients alike. At the same time, the growing complexity of clinical trial protocols, particularly in therapeutic areas such as oncology, central nervous system disorders, and rare diseases, is reinforcing the need for specialized, validated eCOA instruments capable of supporting novel digital endpoints and real-world evidence strategies.

Rapid Adoption of Decentralized and Hybrid Clinical Trial Models

Clinical trial sponsors across the industry are increasingly moving away from fully site-centric research models, embracing decentralized and hybrid approaches that allow patients to participate in studies from their homes or local clinics. IQVIA's Orchestrated eCOA platform and Medidata's Rave Clinical Cloud are both evolving to support flexible, multi-modal data capture environments that can accommodate site-based, remote, and hybrid participation within a single study framework. The real transformation comes with eCOA platforms that are tightly integrated with telemedicine, home nursing, and patient payment capabilities, enabling sponsors to maintain data quality and regulatory compliance even when the vast majority of trial interactions occur outside the traditional clinical site setting. According to a June 2025 article by Lifebit, the integration of decentralized methods can reduce required site visits by up to 80%, underscoring the scale of this operational shift and the critical role that reliable eCOA infrastructure plays in enabling it. These advancements make high-quality remote data collection practical and compliant for trials ranging from early-phase oncology studies to large-scale outcomes research programs.

AI-Powered Data Quality Management and Integration of Digital Biomarkers

Innovation in artificial intelligence and connected wearable technology is rapidly advancing the capabilities of eCOA platforms, as sponsors move beyond subjective patient recall toward objective, continuous real-time measurement. Solution providers such as Clario are now designing endpoint platforms that combine the precision of validated clinical rating scales with AI-driven anomaly detection and sensor-based data streams within a single integrated environment, significantly reducing the time burden on clinical sites while improving the fidelity of endpoint data. These platforms often involve advanced digital biomarker capture from wearable devices, including gait speed, heart rate variability, and sleep pattern data, which can be seamlessly integrated alongside traditional patient-reported and clinician-rated instruments. According to YPrime's February 2025 article on connected devices and eCOA, internal research shows that connected devices are now used in over 36% of clinical studies, signaling a broad structural shift toward protocol designs that require robust, sensor-enabled data acquisition to support primary efficacy claims. By combining high-quality subjective outcome data with objective digital endpoints, these next-generation eCOA suites are supporting both technological advancement and the clinical research industry's broader shift toward precision medicine and patient-centered drug development.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 7.46 Billion |

|

Market Size in 2026 |

USD 1.94 Billion |

|

Market Size in 2025 |

USD 1.74 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 14.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Component, Type, Delivery Mode, Device Strategy, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Accelerating Digitalization of Clinical Trials and Expanding Pharmaceutical R&D

A key driver of the eCOA solutions market is the sustained increase in global clinical trial activity and the pharmaceutical industry's growing commitment to digital data collection as a means of improving trial efficiency, data quality, and regulatory compliance. Global demand for real-time endpoint monitoring, remote patient engagement tools, and centralized data management has created powerful incentives for the adoption of eCOA infrastructure. According to Anju Software's Mid-Year 2025 Clinical Trial Wrap report published in July 2025, the number of initiated Phase I–III interventional trials in the first half of 2025 reached 6,071, representing a 20% increase compared to the same period in 2024. This expansion in trial volume translates directly into higher demand for eCOA platforms capable of managing large, geographically diverse patient populations without sacrificing data integrity. The Association of Clinical Research Professionals noted in its March 2025 report that research coordinators currently spend up to 12 hours per week on redundant data entry, reinforcing the operational case for integrated eCOA solutions that eliminate manual processes and reduce the risk of data errors across complex multi-site studies.

Opportunity: Real-World Evidence Generation and Integration with Electronic Health Records

The rapidly growing demand for real-world evidence (RWE) in regulatory submissions, market access negotiations, and post-marketing surveillance provides a significant opportunity for eCOA solution providers. As regulatory agencies including the U.S. Food and Drug Administration and the European Medicines Agency increasingly accept RWE to support drug approvals and label expansions, pharmaceutical companies require validated tools that can capture structured patient outcome data in routine clinical settings outside of formal trial environments. The integration of eCOA platforms with electronic health records (EHR) offers a compelling pathway to fulfill this requirement, enabling the extraction of structured outcome data directly from routine medical encounters and supplementing it with real-time patient-reported inputs captured through mobile applications. This unified approach would provide clinicians and sponsors with a more comprehensive view of patient health, combining quality-of-life data, treatment response assessments, and clinical ratings within a single data environment. Furthermore, the growing adoption of eCOA for observational study designs and patient registry management is broadening the addressable market well beyond traditional interventional clinical trials, creating substantial incremental revenue opportunities for platform providers with flexible, scalable software architectures.

Why Does the Software Segment Lead the Market?

The software segment accounts for the largest share of the overall eCOA solutions market in 2026. This dominance is primarily attributable to the central role that platform software plays in enabling end-to-end clinical outcome data collection, management, validation, and reporting across the full trial lifecycle. eCOA platform software provides the foundational infrastructure through which all patient interactions, clinician ratings, and data quality checks are managed, making it the most critical and highest-value component of any eCOA deployment. Leading platforms such as Medidata Rave Clinical Cloud, IQVIA's Orchestrated eCOA, and Clario's Endpoint Platform are continuously expanding their software capabilities to support AI-driven analytics, multi-lingual instrument libraries, and seamless integrations with electronic data capture (EDC), RTSM, and eConsent systems. The services segment is, however, expected to grow at a solid pace through 2036, driven by increasing demand for regulatory consulting, linguistic validation, rater training programs, and ongoing technical support as sponsors deploy increasingly complex and multi-modal eCOA study designs.

How Does the ePRO Segment Dominate the Market?

Based on outcome assessment type, the ePRO (electronic patient-reported outcomes) segment holds the largest share of the overall market in 2026. This leadership is primarily attributable to the growing regulatory and scientific emphasis on incorporating the patient's perspective directly into the measurement of treatment benefit, both for new drug approvals and for health technology assessments that inform reimbursement decisions. Regulators now mandate the inclusion of patient-centered endpoint data in many therapeutic areas, and ePRO instruments directly fulfill these requirements in a way that observer-based or clinician-administered tools cannot. Patient-reported outcome data is also particularly well-suited to remote and decentralized collection via smartphone applications and web portals, enabling continuous symptom reporting between clinic visits and reducing the reliance on recall bias that affects paper-based instruments.

The eClinRO (electronic clinician-reported outcomes) segment is expected to witness strong growth during the forecast period. The increasing complexity of clinical rating scales used in central nervous system trials, oncology, and rare disease research is driving adoption of digital clinician-rated instruments that incorporate decision-support prompts, standardized scoring guides, and real-time rater performance monitoring to ensure consistent, high-quality endpoint data across geographically dispersed investigator sites.

Why Does the Web-Hosted Segment Lead the Market?

The web-hosted segment commands the largest share of the global eCOA solutions market in 2026. This dominance reflects the strong preference among pharmaceutical sponsors and CROs for hosted deployment models that combine the accessibility and collaborative features of internet-based platforms with the data localization and audit-readiness assurances provided by dedicated server infrastructure. Web-hosted eCOA solutions involve lower upfront technology investment for end users and offer proven compatibility with global data privacy regulations, including GDPR and HIPAA, as data can be hosted within jurisdiction-specific data centers to minimize cross-border transfer compliance risks. This combination of cost-effectiveness, regulatory predictability, and implementation familiarity continues to underpin the segment's leadership position.

However, the cloud-based segment is expected to grow at the fastest pace through 2036, driven by its superior scalability, operational flexibility, and support for real-time data sharing across large, multinational trial networks. Cloud-native eCOA platforms enable sponsors to rapidly scale capacity across new study sites and geographies without the need for additional infrastructure investment, making them increasingly attractive for the decentralized and hybrid trial models that are reshaping the clinical research landscape.

How Does the BYOD Approach Shape Market Dynamics?

Based on device strategy, the BYOD (bring your own device) segment is gaining significant momentum within the overall eCOA solutions market. The BYOD model allows trial participants to use their own smartphones or tablets to complete eCOA assessments through purpose-built mobile applications, eliminating the logistical complexity and cost associated with provisioning, shipping, and recovering dedicated study devices at scale. This approach significantly reduces the per-patient technology cost of eCOA deployments and improves participant convenience, which in turn supports higher compliance rates and better data completeness across geographically dispersed trial populations. Leading eCOA providers including Medidata, Signant Health, and Medable have invested heavily in BYOD-compatible platform architectures that deliver a consistent, validated data collection experience across a wide range of consumer device types and operating systems.

The provisioned device segment remains significant, particularly for studies in therapeutic areas requiring specialized hardware integrations, such as respiratory trials requiring connected spirometry devices, or neurology studies requiring validated cognitive testing interfaces that must be controlled for screen size and interaction design.

Why Does the Pharmaceutical and Biotechnology Companies Segment Lead the Market?

The pharmaceutical and biotechnology companies segment commands the largest share of the global eCOA solutions market in 2026. This dominance stems from the segment's direct accountability for the quality and regulatory integrity of endpoint data submitted in support of marketing authorization applications, making it the primary decision-maker and budgetary authority for eCOA platform investments across all trial phases. Large pharmaceutical companies running multinational Phase II and Phase III programs require enterprise-grade eCOA solutions capable of supporting dozens of languages, hundreds of investigator sites, and complex multi-instrument endpoint strategies simultaneously. Leading companies in this space, including those partnering with Medidata, IQVIA, and Clario, depend on these platforms to ensure that primary and key secondary endpoints are captured consistently and in compliance with regulatory expectations across every market where registration is sought.

The contract research organizations (CROs) segment is, however, poised for the fastest growth through 2036, fueled by the expanding outsourcing of clinical operations by pharmaceutical and biotechnology companies that seek to concentrate internal resources on core drug discovery and portfolio strategy activities. CROs are increasingly offering eCOA as a bundled component of their full-service trial management propositions, combining outcome data capture with randomization, patient payment, and site support services within integrated digital trial ecosystems.

How is North America Maintaining Dominance in the Global eCOA Solutions Market?

North America holds the largest share of the global eCOA solutions market in 2026. This leadership position is primarily attributable to the region's concentration of major pharmaceutical and biotechnology research activities, high clinical research expenditure, and early institutional adoption of digital data collection technologies in clinical trials. The United States alone accounts for a significant portion of global eCOA investment, driven by the presence of the world's largest pharmaceutical companies, a dense network of contract research organizations, and a regulatory environment at the FDA that actively supports electronic endpoint collection through published guidances on patient-reported outcome development and the Computer Software Assurance framework for clinical trial systems. The presence of leading eCOA platform providers including IQVIA Inc., Medidata Solutions Inc., Clario, Signant Health, and Medable Inc. within the region also provides a robust ecosystem for both standard and highly specialized digital endpoint solutions.

Which Factors Support Europe and Asia-Pacific Market Growth?

Europe accounts for a substantial share of the global eCOA solutions market, driven by the high volume of clinical research activity in key pharmaceutical markets such as Germany, the United Kingdom, France, Switzerland, and the Netherlands. The European Medicines Agency's ongoing commitment to patient-centered medicine evaluation and its guidance on the use of patient-reported outcomes in regulatory submissions are reinforcing demand for validated eCOA instruments across therapeutic areas. Countries across the region also benefit from well-established clinical trial infrastructure and a growing emphasis on multi-stakeholder data sharing frameworks that position eCOA as a critical enabler of both regulatory and real-world evidence strategies.

Asia-Pacific is expected to grow at the fastest pace during the forecast period. The region's expanding clinical research ecosystem, supported by large and diverse patient populations, competitive site costs, and growing regulatory harmonization in countries such as China, Japan, India, and South Korea, is attracting a rising share of global trial activity. Government-led digital health initiatives and the growing involvement of regional CROs and technology partners in multinational studies are accelerating eCOA platform adoption across both established and emerging clinical research hubs in the region.

Companies such as IQVIA Inc., Medidata Solutions Inc. (a Dassault Systèmes SE company), Clario, Signant Health, and ICON Plc lead the global eCOA solutions market with comprehensive end-to-end platform offerings, deep clinical science expertise, and strong regulatory track records, particularly for large-scale pharmaceutical and biotechnology trial programs. Meanwhile, players including Veeva Systems Inc., Oracle Corporation, Parexel International Corporation, ArisGlobal, and Merative L.P. focus on specialized platform integration capabilities, enterprise software ecosystems, and managed clinical data services targeting CRO and biopharmaceutical sponsors. Emerging platform providers and technology-focused innovators such as Medable Inc., YPrime LLC, Kayentis, Suvoda LLC, Castor, and Cloudbyz are strengthening the market through innovations in BYOD-first platform design, AI-powered compliance monitoring, and modular low-code eCOA configuration environments that accelerate study start-up timelines for sponsors of all sizes.

The global eCOA solutions market is expected to grow from USD 1.94 billion in 2026 to USD 7.46 billion by 2036.

The global eCOA solutions market is projected to grow at a CAGR of 14.4% from 2026 to 2036.

The software segment is expected to dominate the market in 2026 due to its foundational role in enabling end-to-end clinical outcome data collection, validation, and regulatory submission readiness. However, the services segment is projected to grow at a healthy pace owing to increasing demand for linguistic validation, rater training, regulatory consulting, and ongoing technical support as eCOA deployments grow in complexity.

Decentralized clinical trials and AI are transforming the eCOA landscape by demanding higher data accessibility, stronger patient engagement, and more automated quality management. These forces drive the adoption of BYOD-compatible mobile applications, AI-driven compliance monitoring, and wearable-integrated endpoint platforms, enabling sponsors to support complex, geographically distributed studies while maintaining the data quality and audit integrity required for regulatory submissions.

North America holds the largest share of the global eCOA solutions market in 2026. This leadership is primarily attributable to the region's high concentration of pharmaceutical R&D activity, early adoption of digital clinical trial technologies, and a well-established regulatory environment that encourages electronic data collection and patient-centered trial designs.

The leading companies include IQVIA Inc., Medidata Solutions Inc. (Dassault Systèmes SE), Clario, Signant Health, ICON Plc, Veeva Systems Inc., and Oracle Corporation.

1. Introduction

1.1. Market Definition

1.2. Market Scope

1.3. Research Methodology

1.4. Assumptions & Limitations

2. Executive Summary

3. Market Overview

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Impact of Decentralized Clinical Trials and Digital Health Technologies on eCOA Adoption

3.4. Regulatory Landscape and Data Integrity Standards

3.5. Porter's Five Forces Analysis

4. Global eCOA Solutions Market, by Component

4.1. Introduction

4.2. Software

4.2.1. eCOA Platform Software

4.2.2. Data Management and Analytics Software

4.3. Services

4.3.1. Implementation and Regulatory Consulting Services

4.3.2. Linguistic Validation and Translation Services

4.3.3. Rater Training and Support Services

4.4. Devices

4.4.1. Provisioned Handheld Devices (Smartphones and Tablets)

4.4.2. Wearables and Connected Biosensor Devices

5. Global eCOA Solutions Market, by Type

5.1. Introduction

5.2. Electronic Patient-Reported Outcomes (ePRO)

5.3. Electronic Clinician-Reported Outcomes (eClinRO)

5.4. Electronic Observer-Reported Outcomes (eObsRO)

5.5. Electronic Performance Outcomes (ePerfO)

6. Global eCOA Solutions Market, by Delivery Mode

6.1. Introduction

6.2. Cloud-Based

6.3. Web-Hosted

6.4. On-Premise

7. Global eCOA Solutions Market, by Device Strategy

7.1. Introduction

7.2. Bring Your Own Device (BYOD)

7.3. Provisioned Device

7.4. Site-Based

8. Global eCOA Solutions Market, by End User

8.1. Introduction

8.2. Pharmaceutical and Biotechnology Companies

8.2.1. Large Pharmaceutical Companies

8.2.2. Small and Mid-Size Biotech Companies

8.3. Contract Research Organizations (CROs)

8.3.1. Full-Service CROs

8.3.2. Functional Service Provider (FSP) CROs

8.4. Medical Device Companies

8.5. Hospitals and Healthcare Providers

8.6. Academic and Research Institutes

9. Global eCOA Solutions Market, by Region

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Switzerland

9.3.5. Netherlands

9.3.6. Spain

9.3.7. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. UAE

9.6.3. South Africa

9.6.4. Rest of Middle East & Africa

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Ranking / Positioning Analysis of Key Players, 2025

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

11.1. IQVIA Inc.

11.2. Medidata Solutions Inc. (Dassault Systèmes SE)

11.3. Clario

11.4. Signant Health

11.5. ICON Plc

11.6. Veeva Systems Inc.

11.7. Oracle Corporation

11.8. Parexel International Corporation

11.9. Medable Inc.

11.10. YPrime LLC

11.11. Kayentis

11.12. Suvoda LLC

11.13. ArisGlobal

11.14. Merative L.P.

12. Appendix

12.1. Questionnaire

12.2. Related Reports

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Jun-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates