Resources

About Us

IoT Medical Devices Market by Device Type (Wearable Medical Devices, Implantable Medical Devices, Stationary Medical Devices, Ingestible Medical Devices), Component (Hardware, Software, Services), Connectivity Technology (Bluetooth/BLE, Wi-Fi, Cellular, Zigbee, NFC, Others), Application, and End User — Global Forecast to 2036

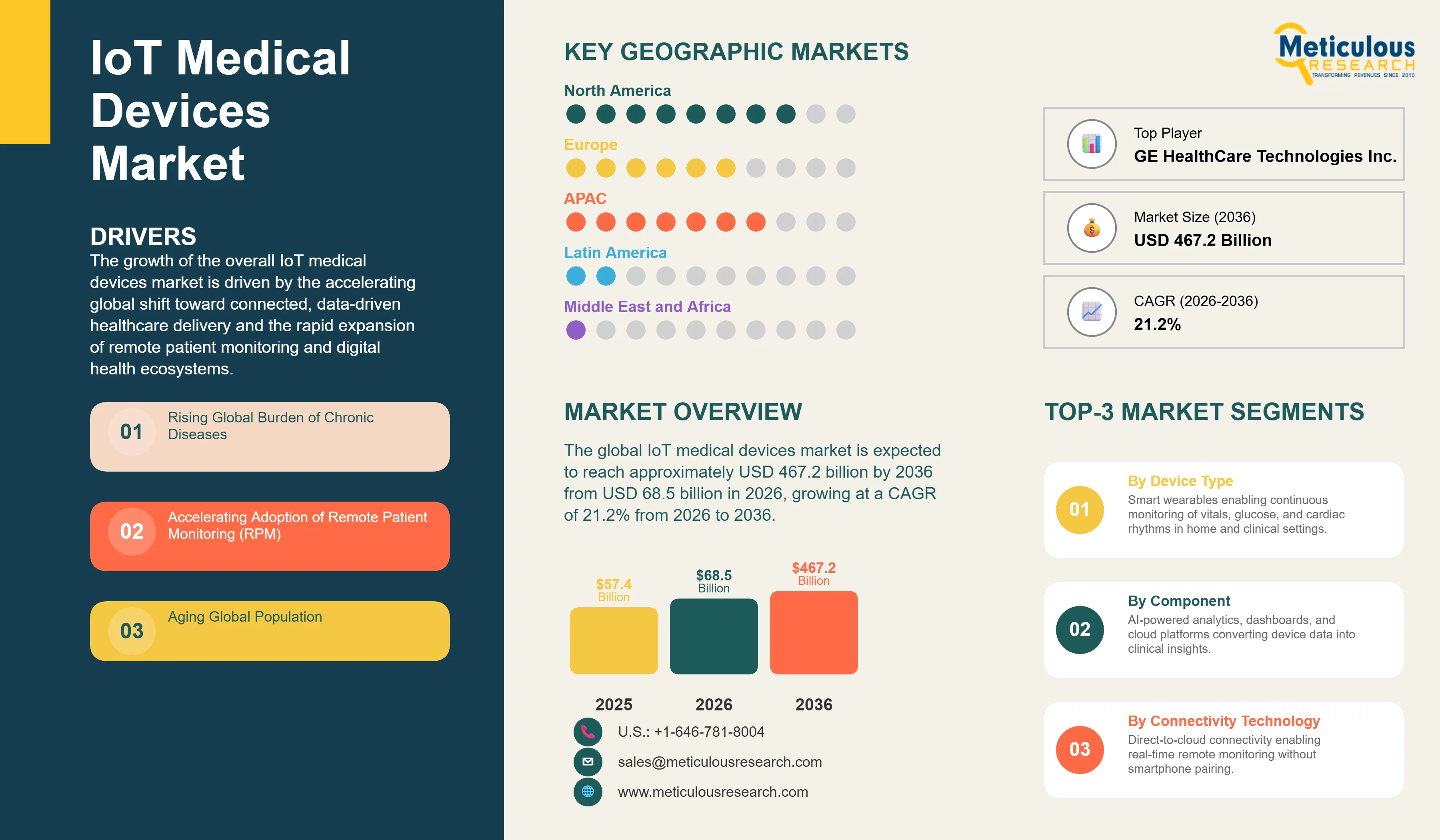

Report ID: MRHC - 1041792 Pages: 278 Feb-2026 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe global IoT medical devices market was valued at USD 57.4 billion in 2025. The market is expected to reach approximately USD 467.2 billion by 2036 from USD 68.5 billion in 2026, growing at a CAGR of 21.2% from 2026 to 2036. The growth of the overall IoT medical devices market is driven by the accelerating global shift toward connected, data-driven healthcare delivery and the rapid expansion of remote patient monitoring and digital health ecosystems. As healthcare providers seek to integrate continuous monitoring capabilities and intelligent analytics into clinical and home care workflows, IoT-enabled medical devices have become essential for improving patient outcomes, reducing hospital readmissions, and lowering the overall cost of care. The rapid expansion of chronic disease populations, aging demographics, and the growing preference for home-based healthcare continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

IoT medical devices are connected healthcare instruments that leverage embedded sensors, wireless communication, and cloud-based analytics to enable real-time health data collection, transmission, and actionable insights across clinical and home care environments. These devices encompass a broad spectrum of technologies, including wearable vital sign monitors, smart implantables, connected imaging systems, and stationary hospital-grade monitoring platforms, all designed to support continuous patient oversight and data-driven clinical decision-making. The market is defined by high-precision technologies such as continuous glucose monitoring (CGM) systems, AI-enabled cardiac monitors, and 5G-connected patient tracking platforms, which significantly enhance diagnostic accuracy and care coordination across complex healthcare networks. These systems have become indispensable for healthcare organizations seeking to shift from reactive, episodic care to proactive, personalized treatment models.

The market includes a diverse range of solutions, from consumer-grade fitness wearables and remote blood pressure monitors for home healthcare settings to sophisticated implantable cardiac defibrillators and neurostimulation systems for long-term chronic disease management. These devices are increasingly integrated with advanced components such as AI-powered predictive analytics engines, secure cloud storage platforms, and interoperable electronic health record (EHR) systems to deliver services such as real-time arrhythmia detection, continuous glucose trend reporting, and remote therapeutic adjustments. The ability to provide continuous, high-quality health data while enabling timely clinical interventions has made IoT medical technology the preferred choice for institutions where patient safety, operational efficiency, and care quality are paramount.

The global healthcare sector is under sustained pressure to modernize care delivery capabilities, driven by the dual goals of improving patient outcomes and reducing systemic cost burdens. This pressure has accelerated the adoption of connected health solutions, with advanced IoT medical devices helping to bridge the gap between in-hospital and out-of-hospital care for conditions ranging from diabetes and heart failure to chronic obstructive pulmonary disease (COPD) and hypertension. At the same time, the rapid proliferation of telehealth platforms, the expansion of value-based care reimbursement models, and the surge in AI-driven health analytics are intensifying the demand for high-reliability, interoperable connected medical device solutions.

Convergence of AI-Powered Analytics and Next-Generation Remote Patient Monitoring Platforms

Healthcare providers and medical device manufacturers are rapidly moving toward AI-integrated connected platforms, moving well beyond traditional store-and-forward monitoring models. Medtronic's CareLink network and Dexcom's G7 continuous glucose monitoring system represent a new generation of devices that deliver real-time predictive insights directly to clinicians, enabling proactive intervention before adverse events occur. The real paradigm shift is emerging with AI-embedded wearable platforms capable of simultaneously tracking multiple physiological parameters — heart rate, blood oxygen saturation, respiratory rate, and skin temperature — with clinical-grade accuracy. Companies like iRhythm Technologies, with its Zio cardiac monitoring patch, and Abbott Laboratories, with the FreeStyle Libre 3 CGM system, are demonstrating how long-duration, patch-based monitoring can replace traditional episodic diagnostics with continuous, data-rich clinical oversight. These advances make high-precision remote monitoring practical and economically viable for health systems managing large populations of patients with chronic conditions, driving both improved outcomes and measurable reductions in emergency healthcare utilization.

5G Connectivity and Edge Computing Transforming Real-Time Medical Data Transmission

The rollout of 5G networks and the maturation of edge computing infrastructure are rapidly transforming the operational capabilities of IoT medical devices, enabling ultra-low latency data transmission and real-time clinical responsiveness at scale. Device manufacturers including GE HealthCare and Siemens Healthineers are now designing connected imaging platforms and patient monitoring systems that leverage 5G's high bandwidth to transmit large medical datasets — including high-resolution imaging files and complex waveform data — instantaneously between care settings. Philips Healthcare's integration of 5G and edge analytics into its hospital-grade patient monitoring systems has enabled seamless data sharing between intensive care units and remote clinical teams, reducing response times for critical deterioration alerts. These advancements are enabling new care delivery models, including ambulance-based real-time diagnostics and connected surgical environments where device data streams inform intraoperative decision-making. The convergence of 5G with AI-powered analytics at the device edge is also reducing dependence on centralized cloud processing, improving performance in bandwidth-constrained environments such as rural hospitals and home care settings.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 467.2 Billion |

|

Market Size in 2026 |

USD 68.5 Billion |

|

Market Size in 2025 |

USD 57.4 Billion |

|

Market Growth Rate (2026–2036) |

CAGR of 21.2% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Device Type, Component, Connectivity Technology, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Rising Chronic Disease Burden and the Accelerating Shift to Remote Patient Monitoring

A key driver of the IoT medical devices market is the mounting global prevalence of chronic diseases, which is creating an urgent and sustained need for continuous, connected health monitoring solutions. According to the World Health Organization (WHO), chronic non-communicable diseases including cardiovascular disease, diabetes, chronic respiratory disease, and cancer account for approximately 74% of all global deaths annually, with the burden expected to intensify as populations age. The International Diabetes Federation projects that the number of adults living with diabetes globally will rise from 537 million in 2021 to 783 million by 2045, creating enormous demand for connected glucose monitoring systems, smart insulin delivery devices, and remote endocrinology support platforms. This epidemiological reality is fundamentally reshaping healthcare delivery models, pushing providers, payers, and governments to invest in scalable remote patient monitoring infrastructure. IoT medical devices, with their ability to generate continuous streams of actionable health data outside the hospital, are uniquely positioned to address this demand, enabling healthcare systems to manage larger patient populations more effectively without proportionate increases in clinical staffing or facility costs.

Opportunity: Expansion of Home Healthcare and Telehealth Ecosystems

The rapid growth of the home healthcare sector and the institutionalization of telehealth reimbursement frameworks present significant opportunities for the IoT medical devices market. The U.S. Centers for Medicare & Medicaid Services (CMS) has progressively expanded reimbursement coverage for remote patient monitoring services, creating a structural financial incentive for healthcare providers to deploy connected monitoring devices at scale across home-based patient populations. This policy evolution, replicated in varying forms across European and Asia-Pacific healthcare systems, is fundamentally altering the addressable market for wearable vital sign monitors, connected blood pressure cuffs, smart spirometers, and home-based cardiac monitoring patches. Furthermore, the integration of IoT device data into leading telehealth platforms and electronic health record systems is creating end-to-end connected care workflows that significantly enhance the clinical utility of remote monitoring data. As home healthcare provider networks expand and the technical infrastructure for device connectivity and data security matures, the IoT medical devices market is positioned to capture an increasingly substantial share of total global healthcare spending through 2036.

Why Does the Wearable Medical Devices Segment Lead the Market?

The wearable medical devices segment accounts for a significant portion of the overall IoT medical devices market in 2026. This is primarily attributed to the widespread adoption of wearable technologies for continuous monitoring of vital signs, cardiac rhythms, and metabolic markers across both clinical and consumer health settings. These devices offer the most accessible and patient-friendly approach to continuous health data collection, operating seamlessly in daily life without disrupting normal patient activity. The chronic disease management and remote cardiac monitoring segments alone consume a substantial share of wearable IoT medical devices, with leading products including the Dexcom G7 CGM, the Abbott FreeStyle Libre 3, and the iRhythm Zio Patch demonstrating the technology's capability to deliver clinical-grade continuous monitoring at scale. However, the implantable medical devices segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing adoption of smart cardiac implants, connected neurostimulation systems, and advanced drug-delivery implants that require long-term physiological monitoring with minimal patient burden.

How Does the Hardware Segment Dominate?

Based on component, the hardware segment holds the largest share of the overall IoT medical devices market in 2026. This is primarily due to the foundational role of connected sensors, microprocessors, wireless communication modules, and power management units in enabling the core data collection and transmission functions of all IoT medical device categories. The hardware ecosystem continues to evolve rapidly, with miniaturization of high-performance biosensors and the development of low-power, high-bandwidth wireless chipsets driving both clinical-grade accuracy and extended device battery life improvements.

The software segment is expected to witness the fastest growth during the forecast period. The proliferation of AI-powered health analytics platforms, cloud-based remote monitoring dashboards, and interoperable data management systems is increasingly differentiating IoT medical device offerings, as manufacturers compete on the intelligence and usability of their software layers rather than hardware specifications alone. Integration of machine learning algorithms capable of detecting early physiological deterioration and personalized health trend analysis is emerging as a primary differentiator across both wearable and implantable device categories.

Why Does Bluetooth/BLE Lead the Connectivity Segment?

The Bluetooth/Bluetooth Low Energy (BLE) segment commands the largest share of the global IoT medical devices market by connectivity technology in 2026. This dominance is driven by BLE's optimal combination of low power consumption, affordable hardware implementation costs, and broad compatibility with smartphones, tablets, and dedicated medical monitoring hubs. Wearable vital sign monitors, continuous glucose monitors, cardiac patches, and home blood pressure devices overwhelmingly rely on BLE for short-range data transmission to paired patient-facing devices or clinical data hubs. The cellular segment encompassing both 4G LTE and emerging 5G connectivity is expected to be the fastest-growing connectivity technology during the forecast period, driven by the expansion of dedicated-connectivity medical devices designed for direct-to-cloud data transmission without dependency on a paired smartphone or local gateway device.

Why Does the Patient Monitoring Segment Lead the Market?

The patient monitoring segment commands the largest share of the global IoT medical devices application market in 2026. This dominance reflects the fundamental value proposition of IoT medical devices: continuous, real-time health data capture enabling timely clinical intervention. Large-scale deployments in intensive care units, post-surgical recovery wards, and chronic disease home monitoring programs drive demand, with advanced monitoring platforms from providers such as Philips Healthcare, GE HealthCare, and Masimo Corporation enabling reliable performance across complex, multi-parameter clinical monitoring environments. However, the disease management application segment is poised for rapid growth through 2036, fueled by the expanding use of connected devices for end-to-end chronic condition management across diabetes, cardiovascular disease, and respiratory disorders.

Why Does the Hospitals & Clinics Segment Lead the Market?

The hospitals & clinics segment commands the largest share of the global IoT medical devices end user market in 2026. This dominance stems from hospitals' superior capacity to deploy, manage, and integrate large-scale connected device networks within established clinical workflows, and from the high density of IoT devices from smart infusion pumps and connected imaging systems to bedside patient monitoring platforms and asset tracking solutions — required to support complex inpatient care environments. Large-scale healthcare network deployments and institutional digital transformation programs drive significant volume demand, with integrated solutions from providers like Drägerwerk AG & Co. KGaA and Baxter International enabling reliable connected device performance across critical and acute care settings.

However, the home healthcare segment is poised for the fastest growth through 2036, fueled by expanding remote patient monitoring reimbursement frameworks, rising patient preference for home-based care, and the increasing clinical acceptance of consumer-grade wearable devices delivering medically validated continuous health data.

How is North America Maintaining Dominance in the Global IoT Medical Devices Market?

North America holds the largest share of the global IoT medical devices market in 2026. This leadership position is primarily attributed to the combination of high healthcare expenditure, a well-established digital health infrastructure, and the presence of the world's leading MedTech innovators, particularly in the United States. The U.S. alone accounts for a substantial portion of global IoT medical device adoption, supported by progressive CMS reimbursement policies for remote patient monitoring services, active FDA Digital Health Center of Excellence (DHCoE) guidance facilitating faster regulatory pathways for connected devices, and the concentrated presence of leading manufacturers including Medtronic plc, Abbott Laboratories, Dexcom, Inc., Masimo Corporation, and Boston Scientific Corporation. The structured integration of IoT device data into interoperable electronic health record platforms and the strong institutional focus on value-based care outcomes further reinforce North America's market leadership position.

Which Factors Support Europe and Asia-Pacific Market Growth?

Europe accounts for a substantial share of the global IoT medical devices market. The growth of the European market is primarily driven by progressive national digital health strategies, including Germany's Digital Healthcare Act (Digitale-Versorgung-Gesetz), which has established formal reimbursement pathways for certified digital health applications and connected medical devices. The U.K.'s NHS Long Term Plan and similar frameworks across France, the Netherlands, and the Nordic countries are actively driving large-scale remote patient monitoring deployments in chronic disease management programs. The presence of leading European medical device manufacturers, including Siemens Healthineers AG, Koninklijke Philips N.V., and Drägerwerk AG & Co. KGaA, combined with rigorous EU Medical Device Regulation (MDR) compliance standards, further strengthens the region's market foundation.

Asia-Pacific is expected to be the fastest-growing regional market during the forecast period. The rapid expansion of healthcare infrastructure across China, India, Japan, and South Korea, combined with aggressive government investment in national digital health initiatives, is creating significant demand for IoT medical device solutions across both hospital and community care settings. China's Healthy China 2030 initiative and India's Ayushman Bharat Digital Mission are directly stimulating connected health technology adoption at scale. The region also benefits from a large and growing patient population managing chronic conditions, including the world's largest diabetes patient base, creating structural long-term demand for connected monitoring and disease management solutions.

The companies such as Medtronic plc, Koninklijke Philips N.V., GE HealthCare Technologies Inc., and Abbott Laboratories lead the global IoT medical devices market with comprehensive portfolios of connected monitoring, diagnostic, and therapeutic devices, particularly for large-scale hospital deployments and chronic disease management programs. Meanwhile, players including Siemens Healthineers AG, Boston Scientific Corporation, Dexcom, Inc., and iRhythm Technologies, Inc. focus on specialized connected implantables, continuous metabolic monitoring, and long-duration cardiac patch platforms targeting ambulatory and home care settings. Established manufacturers and integrated platform players such as Masimo Corporation, Insulet Corporation, Becton, Dickinson and Company (BD), Stryker Corporation, Drägerwerk AG & Co. KGaA, and Baxter International Inc. are strengthening the market through innovations in connected critical care monitoring, smart infusion therapy, and hospital asset management platforms.

The global IoT medical devices market is expected to grow from USD 68.5 billion in 2026 to USD 467.2 billion by 2036.

The global IoT medical devices market is projected to grow at a CAGR of 21.2% from 2026 to 2036.

Wearable medical devices are expected to dominate the market in 2026 due to their widespread adoption for continuous vital sign monitoring, cardiac rhythm tracking, and metabolic monitoring in both clinical and home care settings. However, the implantable medical devices segment is projected to be the fastest-growing segment, driven by increasing adoption of connected cardiac implants, smart neurostimulation devices, and advanced drug-delivery systems requiring long-term physiological monitoring.

AI-powered analytics and 5G connectivity are transforming the IoT medical devices landscape by enabling real-time predictive diagnostics, ultra-low latency data transmission, and continuous multi-parameter health monitoring at clinical-grade accuracy. These technologies drive the adoption of advanced platforms including continuous glucose monitors with predictive low alerts, AI-embedded cardiac patch monitors capable of detecting atrial fibrillation, and 5G-connected hospital monitoring systems enabling seamless remote specialist consultation, supporting the transition from reactive to proactive healthcare delivery models.

North America holds the largest share of the global IoT medical devices market in 2026. This dominance is primarily attributed to high healthcare expenditure, progressive remote patient monitoring reimbursement policies, FDA Digital Health Center of Excellence-led regulatory pathways, and the concentrated presence of leading MedTech manufacturers in the U.S.

The leading companies include Medtronic plc, Koninklijke Philips N.V., GE HealthCare Technologies Inc., Abbott Laboratories, Siemens Healthineers AG, Boston Scientific Corporation, Dexcom, Inc., iRhythm Technologies, Inc., and Masimo Corporation.

Published Date: Feb-2026

Published Date: Oct-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates