Resources

About Us

Medical Sensors Market by Type (Temperature Sensors, Pressure Sensors, Biosensors, Image Sensors, Accelerometers, Flow Sensors), Technology (MEMS-based, Optical, Piezoelectric, Capacitive), Placement (Wearable, Implantable, Invasive, Non-invasive), Application (Diagnostics, Therapeutics, Patient Monitoring, Imaging), and End-use - Global Forecast to 2036

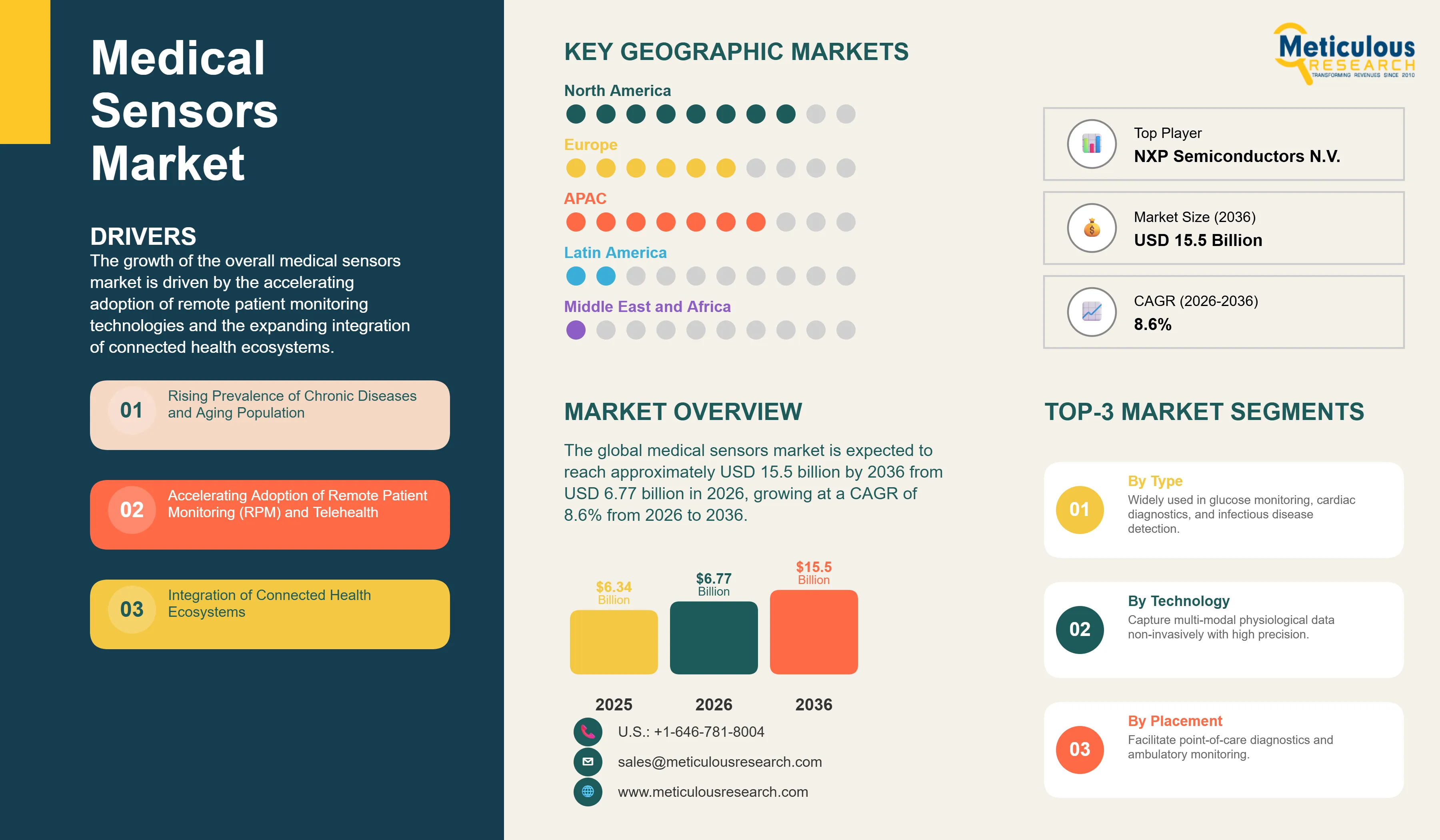

Report ID: MRHC - 1041786 Pages: 297 Feb-2026 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe global medical sensors market was valued at USD 6.34 billion in 2025. The market is expected to reach approximately USD 15.5 billion by 2036 from USD 6.77 billion in 2026, growing at a CAGR of 8.6% from 2026 to 2036. The growth of the overall medical sensors market is driven by the accelerating adoption of remote patient monitoring technologies and the expanding integration of connected health ecosystems. As healthcare providers seek to deliver more personalized and data-driven care, medical sensor technology has become essential for enabling real-time physiological monitoring and advancing diagnostic precision. The rapid expansion of wearable health devices and the increasing prevalence of chronic diseases continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Medical sensors are critical healthcare technologies that leverage advanced detection and measurement capabilities to provide accurate physiological data collection and improved patient outcomes through connected monitoring infrastructure. These systems include integrated transducers, signal processors, and communication modules designed to enable continuous health tracking and enhance clinical decision-making across the care continuum. The market is defined by high-precision technologies such as micro-electromechanical systems and AI-powered analytics, which significantly enhance detection accuracy and enable proactive intervention in patient care environments. These systems are indispensable for healthcare providers seeking to optimize their clinical workflows and meet ambitious quality of care and patient safety targets.

The market includes a diverse range of solutions, ranging from simple temperature sensors for basic vital sign monitoring to complex multi-parameter biosensor platforms and AI-enabled continuous glucose monitoring systems. These systems are increasingly integrated with advanced capabilities such as wireless connectivity and cloud-based data analytics to provide services such as real-time trend analysis and remote patient surveillance. The ability to provide reliable, high-precision measurements while maintaining patient comfort has made medical sensor technology the choice for institutions where clinical accuracy and operational efficiency are paramount.

The global healthcare sector is pushing hard to transform care delivery capabilities, aiming to meet value-based care objectives and patient-centric experience goals. This drive has increased the adoption of high-performance monitoring solutions, with advanced digital sensors helping to enable continuous physiological tracking for personalized medicine applications. At the same time, the rapid growth in the aging population and preventive healthcare markets is increasing the need for accessible, user-friendly medical devices.

Miniaturization and Integration of Multi-Parameter Sensing Capabilities

Healthcare technology developers across the industry are rapidly advancing toward miniaturized multi-parameter platforms, moving well beyond single-function measurement devices. Medtronic's latest Guardian Connect systems deliver significantly higher glucose monitoring precision, while Abbott's recent FreeStyle Libre installations have transformed diabetes management in ambulatory care settings. The real game-changer comes with "patch" sensor systems featuring integrated vital sign monitoring that maintains clinical-grade accuracy even in active patient populations. These advancements make comprehensive health tracking practical and cost-effective for everyone from individual patients to large health systems chasing excellence in chronic disease management and lower hospitalization rates.

Advancement in Flexible and Biocompatible Sensor Materials

Innovation in nanomaterial engineering and biocompatible substrates is rapidly driving the medical sensors market, as detection methods become more sensitive and patient interfaces more comfortable. Equipment manufacturers like TE Connectivity are now designing units that combine the precision of clinical-grade monitoring with the convenience of consumer-friendly wearables in a single platform, improving patient compliance and simplifying care coordination. These systems often involve advanced materials like graphene-based electrodes and stretchable polymers capable of conforming to body contours without compromising measurement accuracy or device reliability.

At the same time, growing focus on patient safety is pushing manufacturers to develop sensor solutions tailored to biocompatibility and hypoallergenic principles. These systems help reduce adverse reactions through the use of medical-grade materials and skin-friendly adhesives. By combining high-fidelity signal acquisition with superior patient comfort, these new designs support both clinical effectiveness and treatment adherence, strengthening the resilience of the broader healthcare value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 15.5 Billion |

|

Market Size in 2026 |

USD 6.77 Billion |

|

Market Size in 2025 |

USD 6.34 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 8.6% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Technology, Placement, Application, End-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Rising Prevalence of Chronic Diseases and Aging Population

A key driver of the medical sensors market is the rapid increase in chronic disease burden and demographic aging across global populations. Global demand for continuous health monitoring, early disease detection, and patient-centered care delivery has created significant incentives for the adoption of medical sensor infrastructure. The trend toward "connected health" and the integration of sensing technologies into unified digital health platforms drive healthcare providers toward scalable solutions that medical sensors can uniquely provide. It is estimated that as the global population aged 65 and above expands and chronic conditions like diabetes and cardiovascular disease become more prevalent through 2036, the need for robust, intelligent monitoring systems increases significantly; therefore, high-performance biosensors and wearable platforms, with their ability to enable proactive disease management, are considered a crucial enabler of modern healthcare delivery strategies.

Opportunity: Expansion of Remote Patient Monitoring and Telehealth Services

The rapid growth of the telehealth market and remote care technologies provides great opportunities for the medical sensors market. Indeed, the global acceleration in virtual care adoption has created a compelling demand for systems that can capture accurate physiological data outside traditional clinical settings and provide secure transmission to care teams. These applications require high reliability, data security, and the ability to integrate with electronic health record systems, all attributes that are met with advanced medical sensor solutions. The remote patient monitoring market is set to expand significantly through 2036, with medical sensors poised for an expanding share as healthcare organizations seek to reduce readmissions and improve care accessibility. Furthermore, the increasing investment in AI-driven diagnostic algorithms and predictive analytics is stimulating demand for high-quality sensor data that provides precise inputs for clinical decision support.

Why Does the Biosensors Segment Lead the Market?

The biosensors segment accounts for a significant portion of the overall medical sensors market in 2026. This is mainly attributed to the widespread use of this technology in supporting glucose monitoring applications, cardiac biomarker detection, and infectious disease screening within modern healthcare environments. These systems offer the most comprehensive way to enable rapid, point-of-care diagnostics across diverse clinical applications. The diabetes care and critical care sectors alone consume a large share of biosensors, with major deployments in North America and Europe demonstrating the technology's capability to deliver actionable clinical insights. However, the image sensors segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for advanced medical imaging, minimally invasive procedures, and diagnostic precision in complex surgical interventions.

How Does the MEMS-based Sensors Segment Dominate?

Based on technology, the MEMS-based sensors segment holds the largest share of the overall market in 2026. This is primarily due to the extensive integration of these devices across diagnostic equipment and the rigorous performance standards required for modern patient monitoring. Current medical device platforms are increasingly specifying micro-scale sensor technologies to ensure compliance with clinical accuracy requirements and healthcare provider expectations for reliable measurement environments.

The optical sensors segment is expected to witness significant growth during the forecast period. The shift toward non-invasive monitoring and the complexity of multi-modal diagnostic systems are pushing the requirement for advanced optical technologies that can capture diverse physiological parameters and high-resolution biological data while ensuring patient comfort for continuous monitoring applications.

Why Does the Hospitals & Clinics Segment Lead the Market?

The hospitals and clinics segment commands the largest share of the global medical sensors market in 2026. This dominance stems from its superior ability to support intensive care units, surgical environments, and acute patient monitoring, making it the end-use of choice for high-performance medical sensors. Large-scale deployments in tertiary care facilities, emergency departments, and specialty clinics drive demand, with advanced systems from providers like GE Healthcare and Medtronic enabling reliable performance in complex clinical environments.

However, the home care settings segment is poised for substantial growth through 2036, fueled by expanding applications in chronic disease management and elderly care. Healthcare systems face mounting pressure to optimize costs for ambulatory monitoring and preventive care applications, where medical sensors provide a cost-effective solution for extending clinical oversight beyond hospital walls.

How is North America Maintaining Dominance in the Global Medical Sensors Market?

North America holds the largest share of the global medical sensors market in 2026. The largest share of this region is primarily attributed to the advanced healthcare infrastructure and the presence of leading medical device innovators, particularly in the United States. The U.S. alone accounts for a significant portion of global medical sensor adoption, with its position as a frontrunner in digital health initiatives and value-based care models driving sustained growth. The presence of leading manufacturers like Medtronic and GE Healthcare and a well-developed regulatory framework provides a robust market for both standard and specialized sensor solutions.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific and Europe together account for a substantial share of the global medical sensors market. The growth of the Asia-Pacific market is mainly driven by the increasing healthcare expenditure and rising disease burden in countries like China, India, and Japan. The demand for advanced monitoring systems in Asia-Pacific is mainly due to the expanding middle class, growing health awareness, and government initiatives promoting digital health adoption.

In Europe, the leadership in medical technology innovation and the emphasis on patient safety are driving the adoption of high-precision sensor solutions. Countries like Germany, the United Kingdom, and France are at the forefront, with significant focus on integrating smart monitoring devices into clinical workflows and preventive care programs to ensure the highest levels of healthcare quality and patient outcomes.

The companies such as Medtronic plc, TE Connectivity Ltd., NXP Semiconductors N.V., and STMicroelectronics N.V. lead the global medical sensors market with a comprehensive range of sensing and monitoring solutions, particularly for implantable devices and critical care applications. Meanwhile, players including Honeywell International Inc., Smiths Medical (ICU Medical, Inc.), GE Healthcare Technologies Inc., and Analog Devices, Inc. focus on specialized vital sign monitoring, respiratory care sensors, and imaging platforms targeting the acute care and diagnostic sectors. Emerging manufacturers and technology innovators such as Texas Instruments Incorporated, Sensirion AG, Amphenol Corporation, and First Sensor AG (TE Connectivity) are strengthening the market through innovations in MEMS technology and miniaturized sensor platforms.

The global medical sensors market is expected to grow from USD 6.77 billion in 2026 to USD 15.5 billion by 2036.

The global medical sensors market is projected to grow at a CAGR of 8.6% from 2026 to 2036.

Biosensors are expected to dominate the market in 2026 due to their widespread application in glucose monitoring and cardiac diagnostics. However, the image sensors segment is projected to be among the fastest-growing segments owing to the increasing adoption of advanced imaging modalities and minimally invasive procedures.

Miniaturization and multi-parameter sensing are transforming the medical sensors landscape by enabling comprehensive health monitoring in compact, wearable formats. These technologies drive the adoption of advanced platforms like continuous vital sign tracking and integrated chronic disease management systems, enabling healthcare providers to deliver personalized care and support the complex requirements of preventive medicine and remote patient monitoring.

North America holds the largest share of the global medical sensors market in 2026. The largest share of this region is primarily attributed to the advanced healthcare infrastructure and the presence of leading medical device manufacturers.

The leading companies include Medtronic plc, TE Connectivity Ltd., NXP Semiconductors N.V., STMicroelectronics N.V., and Honeywell International Inc.

Published Date: Feb-2026

Published Date: Feb-2026

Published Date: Feb-2026

Published Date: Feb-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates