Resources

About Us

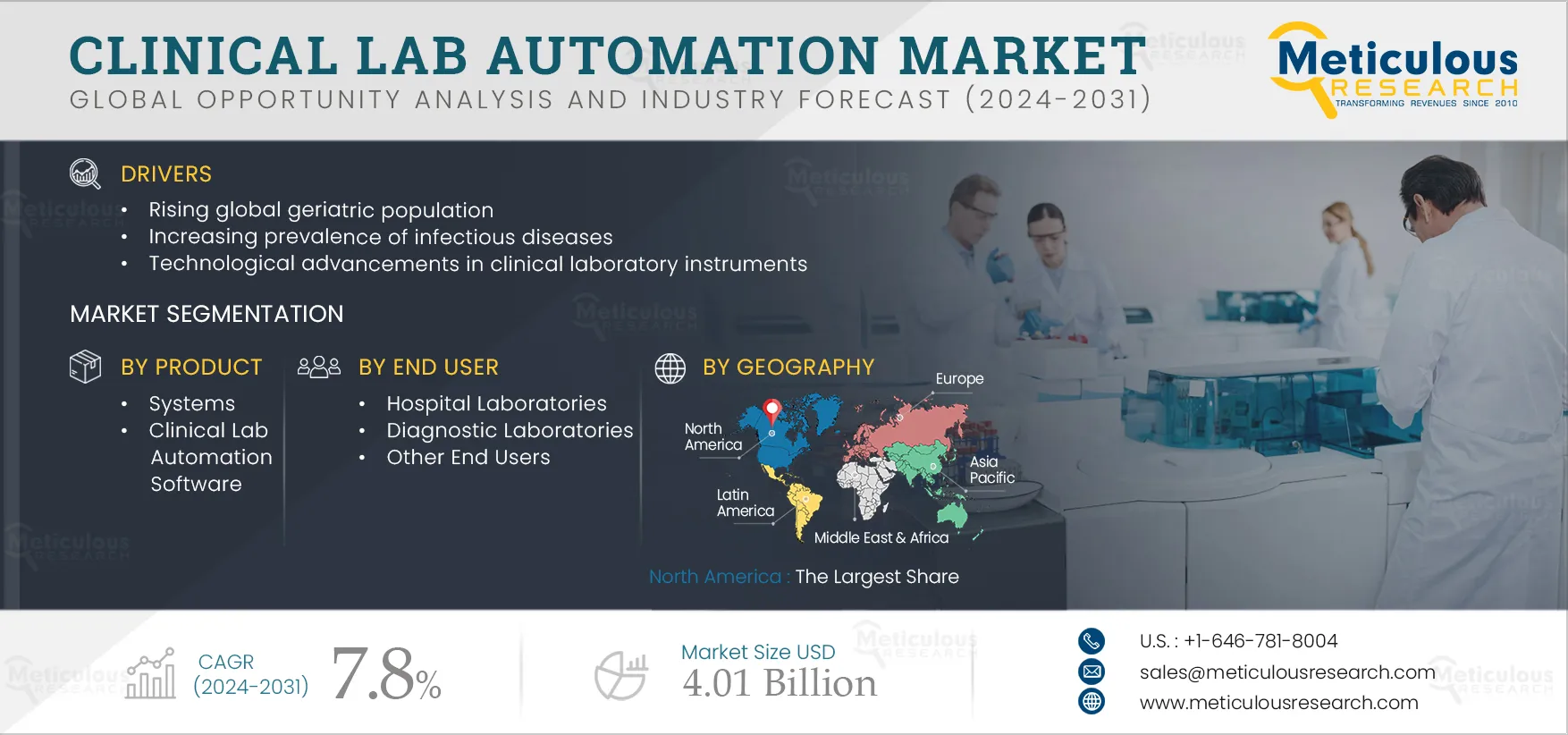

Clinical Lab Automation Market Size, Share, Forecast, & Trends Analysis by Product (Liquid Handling, Nucleic Acid Purification System, Microplate Reader, Automated ELISA, Software), End User (Hospitals, Diagnostic Laboratories) – Global Forecast to 2031

Report ID: MRHC - 1041079 Pages: 209 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including the rising global geriatric population, increasing prevalence of infectious diseases, and technological advancements in clinical laboratory instruments. Moreover, the increasing demand for automated instruments, technological advancements in molecular diagnostics, and emerging economies are expected to offer growth opportunities for the players operating in the market.

The world is becoming increasingly connected, and infectious diseases are spreading rapidly due to cross-border travel. For instance, according to the World Health Organization (WHO), in 2021, an estimated 10.6 million people fell ill with tuberculosis (TB), an increase of 4.5% over 2020. In the same year, approximately 1.6 million people died from TB. The burden of Drug-resistant TB (DR-TB) also increased by 3% between 2020 and 2021, with 450,000 cases of Rifampicin-resistant TB (RR-TB) recorded in 2021. Globally, there were approximately 38.4 million people with HIV in 2021, a significant increase from 33.6 million in 2015. Of these, 36.7 million were adults, and 1.7 million were children (<15 years old). Diagnostic tests are crucial in the medical care of patients who have these diseases. Thus, the increasing prevalence of infectious & chronic diseases is expected to boost the demand for diagnostics, increasing the adoption of automated diagnostic devices and products.

In recent years, laboratories and healthcare institutions have witnessed a major shortage of laboratory workers/professionals. According to the U.S. Bureau of Labor Statistics, the demand for clinical laboratory technicians and technologists is expected to grow by 5% from 2022 to 2032. This increasing demand is attributed to the aging workforce and the decreasing number of accredited training programs. To tackle this challenge, laboratories and hospitals can opt for automated devices such as automated PCR instruments and automated analyzers. The utilization of automated systems has increased since the COVID-19 pandemic. Market players are also focused on the development of automated systems for clinical laboratories.

Automation can significantly increase the efficiency of laboratories. For instance, Clear Labs, Inc. (U.S.), a private genomic testing company, offers a fully automated, next-generation sequencing platform for clinical diagnostics.

Click here to: Get Free Sample Pages of this Report

Next-generation sequencing (NGS) technology has significantly reduced DNA sequencing costs. Moreover, it has revolutionized the field of genetic disease diagnostics with rapid, high-throughput, and cost-effective approaches. NGS can simultaneously analyze hundreds of genes, the whole exome, and the whole genome, enabling researchers to gain a deeper understanding of unknown species and complex diseases. This technology has recently gained much traction in diagnosing infectious diseases, immunological disorders, and hereditary disorders. It is also widely used for non-invasive prenatal diagnosis and therapeutic decision-making for somatic cancers.

The use of automated NGS instruments in clinical diagnosis offers several advantages. It enables shorter turnaround times, minimizes the need for manual intervention, provides fast and accurate results, and reduced the risk of contamination of nucleic acid crossover between sample runs.

Clinical laboratories are turning towards artificial intelligence (AI) to deal with incomplete and imprecise information. This integration of AI will help to facilitate workflows, enhance operational decision-making, and also reduce the number of working professionals. For instance, in September 2022, GE Healthcare (U.S.) launched a first ‘Made in India’ AI-powered Cath Lab – Optima IGS 320, which provides advanced cardiac care. This technology uses AI to automatically optimize image and dose parameters in real time, enabling clinicians to focus majorly on patients.

AI can also be used for quality control, predictive analytics, and data integration in laboratories, therefore increasing the demand for clinical lab automation instruments and driving the growth of the market.

The quality of healthcare in emerging economies and developing countries has increased due to use of automated instruments in clinical laboratories and hospitals even with limited resources, insufficient funding, and a shortage of skilled professionals. According to the Ministry of Health & Family Welfare of the Government of India, in 2021, the total number of tuberculosis patients were 19,33,381 as compared to 16,28,161 in 2020. For instance, in November 2022, MyLab Discovery Solutions Pvt Ltd. (India) received CDSCO, TB Expert Committee and ICMR approval for a Made in India TB Detection Kit that can detect tuberculosis using the automated MyLab Compact device that allows complete automated testing of multiple samples within 2 hours.

Such developments in developing and emerging economies will create opportunities for clinical lab automation instruments and services and drive the growth of the market.

Based on product, the clinical lab automation market is segmented into systems and clinical lab automation software. In 2024, the systems segment is expected to account for the largest share of 84.3% of the clinical lab automation market. The large market share of this segment is attributed to the benefits of clinical lab automation systems, which facilitate procedures without manual intervention, enhancing laboratory testing capabilities. These systems mitigate repetitive tasks and errors, resulting in increased throughput and efficiency, ultimately improving the quality of test results.

Based on end users, the clinical lab automation market is segmented into hospital laboratories, diagnostic laboratories, and other end users. In 2024, the hospital laboratories segment is expected to account for the largest share of 49.6% of the clinical lab automation market. Hospital laboratories automate clinical diagnostics to minimize human interventions in laboratory procedures. Automation improves the ordering, testing, and reporting of diagnostic tests in hospitals. Furthermore, the rising healthcare expenditures, the increasing prevalence of chronic diseases, increasing sample loads in hospitals, and improving healthcare infrastructure in developing countries drive the demand for lab automation systems. These factors contribute to the large market share of this segment.

In 2024, North America is expected to account for the largest share of 40.4% of the clinical lab automation market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The large market share of this region is primarily attributed to the high demand for automation due to the rising prevalence of various diseases, the growth in the healthcare sector, the increasing awareness regarding early disease diagnosis, the increasing healthcare expenditure, and the high adoption of advanced innovative diagnostic instruments.

Asia-Pacific is slated to register the highest CAGR of 9.0% in the clinical lab automation market during the forecast period. The growth of this market is primarily driven by the increasing investment by healthcare providers towards infrastructure improvement, the need to manage the growing burden of infectious diseases, the rising demand for clinical testing, supportive government initiatives to improve the accessibility to diagnostic services, and the need to establish more diagnostic laboratories.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the clinical lab automation market are Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Revvity, Inc. (Formerly known as PerkinElmer, Inc.) (U.S.), F. Hoffmann-La Roche AG (Switzerland), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), Tecan Group Ltd. (Switzerland), Siemens Healthineers AG (Germany), Becton, Dickinson, and Company (U.S.), Abbott Laboratories (U.S.), Hudson Robotics, Inc. (U.S.), and Hamilton Company (U.S.). As of 2023, Danaher Corporation (U.S.), Hamilton Company (U.S.), Abbott Laboratories (U.S.), and F. Hoffmann La-Roche AG (Switzerland) collectively hold a share of 44%-46% in the global clinical lab automation market.

In October 2023, Molecular Devices, LLC (U.S.) launched the CellXpress.ai automated cell culture system, which is an end-to-end machine learning-enabled solution that automates demanding feeding and has an integrated incubator, liquid handler, and imager.

In August 2023, Abbott Laboratories received FDA approval for the ALINITY h-Series, which includes an automated hematology analyzer that uses the multi-angle polarized scatter separation (MAPSS) technology to better identify blood cells.

|

Particulars |

Details |

|

Number of Pages |

209 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

7.8% |

|

Estimated Market Size (Value) |

$4.01 billion by 2031 |

|

Segments Covered |

By Product

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, RoE), Asia-Pacific (China, Japan, India, RoAPAC), Latin America, and the Middle East & Africa. |

|

Key Companies |

Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Revvity, Inc. (Formerly known as PerkinElmer, Inc.) (U.S.), F. Hoffmann-La Roche AG (Switzerland), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), Tecan Group Ltd. (Switzerland), Siemens Healthineers AG (Germany), Becton, Dickinson, and Company (U.S.), Abbott Laboratories (U.S.), Hudson Robotics, Inc. (U.S.), and Hamilton Company (U.S.) |

This market study covers the market sizes & forecasts of the clinical lab automation market based on product, end user, and geography. This market study also provides the value analysis of various segments and subsegments of the global clinical lab automation market at country levels.

The global clinical lab automation market is projected to reach $4.01 billion by 2031, at a CAGR of 7.8% during the forecast period.

Based on product, the clinical lab automation market is segmented into systems and clinical lab automation software. In 2024, the systems segment is expected to account for the largest share of 84.3% of the market.

Based on end user, the clinical lab automation market is segmented into hospital laboratories, diagnostic laboratories, and other end users. In 2024, the hospital laboratories segment is expected to account for the largest share of 49.6% of the market.

The growth of this market can be attributed to several factors, including the rising global geriatric population, increasing prevalence of infectious diseases, and technological advancements in clinical laboratory instruments. Moreover, the increasing demand for automated instruments, technological advancements in molecular diagnostics, and emerging economies are expected to offer growth opportunities for the players operating in the market.

The key players operating in the global clinical lab automation market are Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Revvity, Inc. (Formerly known as PerkinElmer, Inc.) (U.S.), F. Hoffmann-La Roche AG (Switzerland), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), Tecan Group Ltd. (Switzerland), Siemens Healthineers AG (Germany), Becton, Dickinson, and Company (U.S.), Abbott Laboratories (U.S.), Hudson Robotics, Inc. (U.S.), and Hamilton Company (U.S.).

Emerging economies like Brazil and India are expected to witness significant demand for clinical lab automation systems and offer significant growth opportunities for market players in the coming years.

Published Date: Jun-2024

Published Date: Jun-2024

Published Date: Feb-2024

Published Date: Jan-2024

Published Date: Jun-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates