Resources

About Us

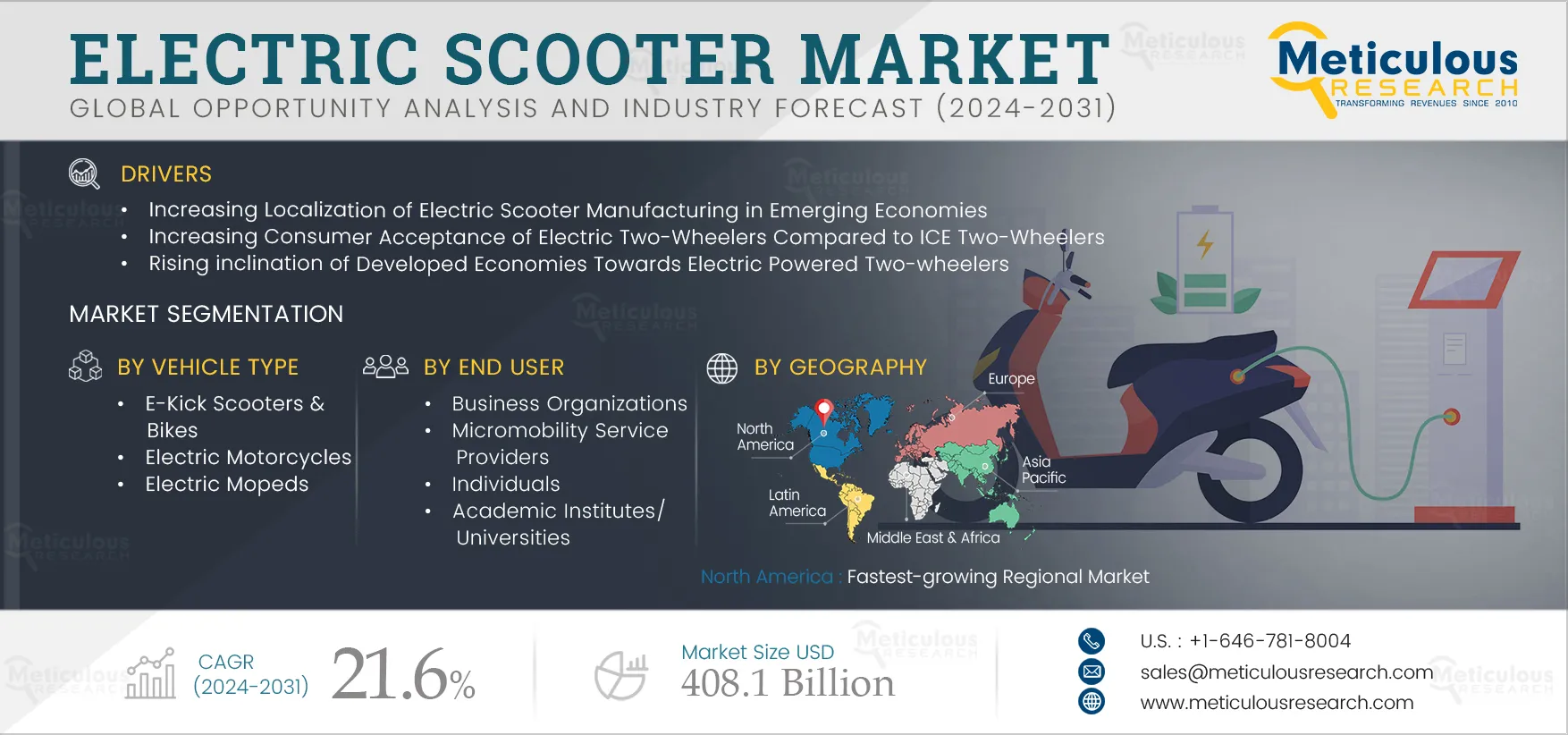

Electric Scooter Market by Vehicle Type (Electric Motorcycles, E-Kick scooters & Bikes, Electric Mopeds), Power Output (Less Than 3.6kW, 3.6kW to 7.2kW), Battery Technology, Motor Type, Charging Type, End-user, and Geography - Global Forecast to 2031

Report ID: MRAUTO - 104497 Pages: 262 Feb-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Electric Scooter Market is expected to reach $408.1 billion by 2031, at a CAGR of 21.6% from 2024 to 2031. By volume, this market is expected to reach 298.5 million units by 2031 at a CAGR of 18.1% during the forecast period 2024 to 2031. The growth of the global electric Scooter market is driven by the increasing localization of electric scooter manufacturing in emerging economies, the increasing consumer acceptance of electric two-wheelers compared to ICE two-wheelers, and the rising inclination of developed economies toward electric-powered two-wheelers. However, the growing reliability issues among consumers due to increasing incidents of accidents involving electric two-wheelers and inadequate investment by legacy two-wheeler manufacturers toward electric Scooter restrain the growth of this market.

The rise in government initiatives to mitigate traffic congestion and pollution is expected to generate market growth opportunities. However, the lack of charging infrastructure poses a major challenge for the market’s growth.

The EV Scooter market is experiencing a boost in consumer acceptance, attributed to the compelling combination of lower total cost of ownership (TCO) and superior performance dynamics compared to traditional Internal Combustion Engine (ICE) two-wheelers. This shift is propelled by the decreasing cost of electric vehicle components, advancements in battery technology, and supportive government incentives. Additionally, the range of electric two-wheelers is no longer a constraint owing to substantial advancements in battery technology. The present energy density of lithium-iron-phosphate (LFP) and nickel-manganese-cobalt (NMC) batteries stands at approximately 180 and 250 Wh/kg, respectively, enabling a range of 80 to 120 kms per charge. The expenses associated with batteries, traditionally constituting around 35% of the two-wheeler's bill of materials (BoM) value, are decreasing notably due to manufacturers achieving economies of scale, production efficiencies, and a broader transition to lower-cost lithium-iron-phosphate (LFP) batteries.

Click here to: Get Free Sample Pages of this Report

Electric two-wheelers are benefitting from regulatory measures such as consumer subsidies, accounting for up to 25% of their costs, rising fuel prices, and the ongoing reduction of conventional fossil fuel subsidies in various nations. In countries such as Indonesia, the total cost of ownership (TCO) for locally assembled electric two-wheelers has now reached a breakeven point. It is anticipated to further decrease as the electric vehicle industry continues to advance.

Hence, factors such as lower maintenance costs, minimal fuel expenses, and longer product lifespans contribute significantly to reduced TCO. Simultaneously, electric Scooter showcase superior performance dynamics as compared to ICE vehicles, with instant acceleration and reduced environmental impact, positioning them as attractive alternatives in the evolving landscape of personal transportation.

Based on vehicle type, the global electric Scooter market is segmented into electric motorcycles, electric mopeds, and e-kick Scooter & bikes. The electric motorcycles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to increasing government policies aimed at promoting electric mobility, growing awareness regarding the need to reduce greenhouse gas emissions and environmental pollution, rising demand for electric motorcycles among consumers, increasing gasoline prices, and stringent emission norms.

Based on power output, the global electric Scooter market is segmented into less than 3.6 kW, 3.6 kW to 7.2 kW, and 20 kW to 100 kW. The 3.6 kW to 7.2 kW segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing adoption of electric Scooter in emerging economies, favorable incentives and tax benefits, and increasing initiatives by key players in the electric two-wheeler segment.

Based on battery technology, the global electric Scooter market is segmented into sealed lead-acid battery, lithium-ion battery, and lithium-ion polymer battery. The lithium-ion polymer battery segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising adoption of lithium-ion polymer batteries due to their superior performance. These batteries provide a higher power-to-weight ratio, faster charging capabilities, and increased cycle life compared to traditional lithium-ion batteries, contributing to enhanced efficiency and range for electric two-wheelers.

Based on motor type, the global electric Scooter market is segmented into hub motors and mid-drive motors. The hub motors segment is expected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to government initiatives aimed at promoting the adoption of electric vehicles and the growing adoption of electric two-wheelers.

Based on end user, the global electric Scooter market is segmented into government institutions, academic institutes/universities, business organizations, micro-mobility service providers, individuals, and other end users. The business organizations segment is expected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to government initiatives aimed at promoting EV adoption and reducing road congestion.

Based on geography, the global electric Scooter market is segmented into Asia–Pacific, Europe, North America, Latin America, and Middle East & Africa. The market in North America is projected to register the highest growth rate during the forecast period. The growth of this regional market can be attributed to rapid urbanization, increasing environmental consciousness, and the need for flexible and sustainable transportation options. Cities across the U.S. and Canada have embraced electric Scooter as a viable solution to address the challenges of traffic congestion and the last-mile commute.

The key players operating in the global electric Scooter market are Fuji-Ta Bicycle Co., Ltd. (China), Trek Bicycle Corporation (U.S.), Yamaha Motor Co., Ltd. (Japan), Yadea Group Holdings Ltd. (China), Riese & Müller GmbH (Germany), Leon Cycles (Germany), Niu Technologies (China), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Magnum Bikes (U.S.), Pedego Electric Bikes (U.S.), Aventon Bikes (U.S.), Govecs AG (Germany), Zhejiang Minimotors Bike Co Ltd (China), Zero Motorcycle Inc. (U.S.), Gogoro Inc. (Taiwan), Ather Energy Pvt. Ltd (India), Energica Motor Company (Italy), Revolt Motors (India), Hero MotoCorp Ltd. (India), and Rad Power Bikes Inc. (U.S.).

|

Particular |

Details |

|

Number of Pages |

262 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

21.6% |

|

Estimated Market Size (Value) |

$408.1 billion by 2031 |

|

Segments Covered |

By Vehicle Type

By Power Output

By Battery Technology

By Motor Type

By Charging Type

By End User

By Geography

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Netherlands, Italy, Spain, U.K., Switzerland, Sweden, Norway, Denmark, Rest of Europe), Asia-Pacific (China, India, Thailand, Japan, South Korea, Singapore, Rest of Asia-Pacific), Latin America, and Middle East & Africa |

|

Key Companies |

Fuji-Ta Bicycle Co., Ltd. (China), Trek Bicycle Corporation (U.S.), Yamaha Motor Co., Ltd. (Japan), Yadea Group Holdings Ltd. (China), Riese & Müller GmbH (Germany), Leon Cycles (Germany), Niu Technologies (China), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Magnum Bikes (U.S.), Pedego Electric Bikes (U.S.), Aventon Bikes (U.S.), Govecs AG (Germany), Zhejiang Minimotors Bike Co Ltd (China), Zero Motorcycle Inc. (U.S.), Gogoro Inc. (Taiwan), Ather Energy Pvt. Ltd (India), Energica Motor Company (Italy), Revolt Motors (India), Hero MotoCorp Ltd. (India), and Rad Power Bikes Inc. (U.S.) |

This study offers a detailed assessment of the electric scooter market, including the market size & forecasts for various segmentations like vehicle type, power output, battery technology, motor type, charging type, end user, and geography. The study also evaluates industry competitors and analyses the country-level markets.

The global electric scooter market is projected to reach $408.1 billion by 2031, at a CAGR of 21.6% from 2024 to 2031.

Based on offering, in 2024, the e-kick scooters & bikes segment is expected to account for the largest share of the global electric scooter market.

Based on power output, in 2024, the less than 3.6 kW segment is expected to account for the largest share of the global electric scooter market.

Based on battery technology, in 2024, the lithium-ion battery segment is expected to account for the largest share of the global electric scooter market.

Based on motor type, in 2024, the hub motors segment is expected to account for the largest share of the global electric scooter market.

Based on charging type, in 2024, the connector charging segment is expected to account for the largest share of the global electric scooter market.

Based on end user, in 2024, the business organizations segment is expected to account for the largest share of the global electric scooters market.

The growth of the global electric scooter market is driven by the increasing localization of electric scooter manufacturing in emerging economies, the increasing consumer acceptance of electric two-wheelers compared to ICE two-wheelers, and the rising inclination of developed economies toward electric-powered two-wheelers.

Furthermore, the rise in government initiatives to mitigate traffic congestion and pollution is expected to generate market growth opportunities.

The key players operating in the global electric scooter market are Fuji-Ta Bicycle Co., Ltd. (China), Trek Bicycle Corporation (U.S.), Yamaha Motor Co., Ltd. (Japan), Yadea Group Holdings Ltd. (China), Riese & Müller GmbH (Germany), Leon Cycles (Germany), Niu Technologies (China), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Magnum Bikes (U.S.), Pedego Electric Bikes (U.S.), Aventon Bikes (U.S.), Govecs AG (Germany), Zhejiang Minimotors Bike Co Ltd (China), Zero Motorcycle Inc. (U.S.), Gogoro Inc. (Taiwan), Ather Energy Pvt. Ltd (India), Energica Motor Company (Italy), Revolt Motors (India), Hero MotoCorp Ltd. (India), and Rad Power Bikes Inc. (U.S.).

The market in North America is projected to register the highest growth rate during the forecast period, subsequently offering significant opportunities to market players. The growth of this regional market can be attributed to rapid urbanization, increasing environmental consciousness, and the need for flexible and sustainable transportation options. Cities across the U.S. and Canada have embraced electric scooters as a viable solution to address the challenges of traffic congestion and the last-mile commute.

1. Market Definition & Scope

1.1. Market Definition

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of The Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for The Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Increasing Localization of Electric Scooter Manufacturing in Emerging Economies to Support Market Growth

4.2.2. Increasing Consumer Acceptance of Electric Two-Wheelers Compared to Ice Two-Wheelers

4.2.3. Rising Inclination of Developed Economies Toward Electric-Powered Two-Wheelers

4.2.4. Inadequate Investment by Legacy Two-Wheeler Manufacturers Toward Electric Scooter

4.2.5. Reliability Issues Among Consumers Arise with Increasing Incidents of Accidents Involving Electric Two-Wheelers

4.2.6. Rise in Government Initiatives to Mitigate Traffic Congestion and Pollution Provide Growth Opportunities for Electric Two-Wheelers

4.2.7. Lack of Charging Infrastructure Poses a Significant Challenge for ETW Players

4.3. Porter's Five Forces Analysis

4.4. Bargaining Power of Buyers

4.5. Bargaining Power of Suppliers

4.6. Threat of Substitutes

4.7. Threat of New Entrants

4.8. Degree of Competition

4.9. Value Chain Analysis

5. Global Electric Scooter Market, by Vehicle Type

5.1. Overview

5.2. E-Kick Scooter & Bikes

5.3. Electric Motorcycles

5.4. Electric Mopeds

6. Global Electric Scooter Market, by Power Output

6.1. Overview

6.2. Less Than 3.6 Kw

6.3. 3.6 Kw to 7.2 Kw

6.4. 20 Kw to 100 Kw

7. Global Electric Scooter Market, by Battery Technology

7.1. Overview

7.2. Lithium-Ion Battery

7.3. Sealed Lead-Acid Battery

7.4. Lithium-Ion Polymer Battery

8. Global Electric Scooter Market, by Motor Type

8.1. Overview

8.2. Hub Motors

8.2.1. Gearless Hub Motors

8.2.2. Geared Hub Motors

8.3. Mid-Drive Motors

9. Global Electric Scooter Market, by Charging Type

9.1. Overview

9.2. Connector Charging

9.3. Wireless Charging

10. Global Electric Scooter Market, by End User

10.1. Overview

10.2. Business Organizations

10.3. Micromobility Service Providers

10.4. Individuals

10.5. Academic Institutes/Universities

10.6. Government Institutions

10.7. Other End Users

11. Electric Scooter Market Assessment, by Geography

11.1. Overview

11.2. Asia-Pacific

11.2.1. China

11.2.2. India

11.2.3. Thailand

11.2.4. Japan

11.2.5. South Korea

11.2.6. Singapore

11.2.7. Rest of Asia-Pacific

11.3. Europe

11.3.1. Germany

11.3.2. France

11.3.3. Netherlands

11.3.4. Italy

11.3.5. Spain

11.3.6. U.K.

11.3.7. Switzerland

11.3.8. Sweden

11.3.9. Norway

11.3.10. Denmark

11.3.11. Rest of Europe

11.4. North America

11.4.1. U.S.

11.4.2. Canada

11.5. Latin America

11.6. Middle East & Africa

12. Competition Analysis

12.1. Introduction

12.2. Key Growth Strategies

12.3. Competitive Benchmarking

12.4. Competitive Dashboard

12.4.1. Industry Leaders

12.4.1.1. Market Ranking by The Key Players

12.4.2. Market Differentiators

12.4.3. Vanguards

12.4.4. Emerging Companies

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

13.1. Key Market Players of The Global Electric Scooter Market

13.1.1. Yamaha Motor Co., Ltd.

13.1.2. Yadea Group Holdings Ltd.

13.1.3. Niu Technologies

13.1.4. Hero MotoCorp Ltd.

13.1.5. Energica Motor Company S.P.A.

13.1.6. Fuji-Ta Bicycle Co., Ltd.

13.1.7. Riese & Müller GmbH

13.1.8. Zero Motorcycles, Inc.

13.1.9. Gogoro Inc.

13.1.10. Magnum Bikes

13.2. Other Market Players

13.2.1. Leon Cycle Ltd.

13.2.2. Aventon Bikes

13.2.3. Govecs AG

13.2.4. Walberg Urban Electrics GmbH

13.2.5. Zhejiang Minimotors Bike Co., Ltd.

13.2.6. Mystromer AG

13.2.7. Pedego Electric Bikes

13.2.8. Rad Power Bikes Inc.

13.2.9. Ather Energy Pvt. Ltd.

13.2.10. Revolt Motors

13.2.11. Trek Bicycle Corporation

14. Appendix

14.1. Available Customization

14.2. Related Reports

List of Tables

Table 1 Currency Conversion Rate (2018–2022)

Table 2 Global Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 3 Global Electric Scooter Market Volume, by Vehicle Type, 2022–2031 (Units)

Table 4 Global E-Kick Scooter & Bikes Market, by Country/Region, 2022–2031 (USD Million)

Table 5 Global E-Kick Scooter & Bikes Market Volume, by Country/Region, 2022–2031 (Units)

Table 6 Global Electric Motorcycles Market, by Country/Region, 2022–2031 (USD Million)

Table 7 Global Electric Motorcycles Market Volume, by Country/Region, 2022–2031 (Units)

Table 8 Global Electric Moped Market, by Country/Region, 2022–2031 (USD Million)

Table 9 Global Electric Moped Market Volume, by Country/Region, 2022–2031 (Units)

Table 10 Global Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 11 Global Less Than 3.6 Kw Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 12 Global 3.6 Kw to 7.2 Kw Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 13 Global 20 Kw to 100 Kw Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 14 Global Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 15 Global Lithium-Ion Battery Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 16 Global Sealed Lead-Acid Battery Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 17 Global Lithium-Ion Polymer Battery Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 18 Global Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 19 Global Hub Motor Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 20 Global Hub Motor Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 21 Gearless Hub Motor Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 22 Geared Hub Motors Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 23 Global Mid-Drive Motor Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Electric Scooter Market, by Charging Type, 2022–2031 (USD Million)

Table 25 Global Connector Charging Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 26 Global Wireless Charging Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 27 Global Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 28 Global Electric Scooter Market for Business Organizations, by Country/Region, 2022–2031 (USD Million)

Table 29 Global Electric Scooter Market for Micromobility Service Providers, by Country/Region, 2022–2031 (USD Million)

Table 30 Global Electric Scooter Market for Individuals, by Country/Region, 2022–2031 (USD Million)

Table 31 Global Electric Scooter Market for Academic Institutes/Universities, by Country/Region, 2022–2031 (USD Million)

Table 32 Global Electric Scooter Market for Government Institutions, by Country/Region, 2022–2031 (USD Million)

Table 33 Global Electric Scooter Market for Other End Users, by Country/Region, 2022–2031 (USD Million)

Table 34 Global Electric Scooter Market, by Country/Region, 2022-2031 (USD Million)

Table 35 Global Electric Scooter Market, by Country/Region, 2022-2031 (Units)

Table 36 Asia-Pacific: Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 37 Asia-Pacific: Electric Scooter Market, by Country/Region, 2022–2031 (Units)

Table 38 Asia-Pacific: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 39 Asia-Pacific: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 40 Asia-Pacific: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 41 Asia-Pacific: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 42 Asia-Pacific: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 43 Asia-Pacific: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 44 Asia-Pacific: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 45 Asia-Pacific: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 46 China: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 47 China: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 48 China: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 49 China: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 50 China: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 51 China: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 52 China: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 53 China: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 54 India: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 55 India: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 56 India: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 57 India: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 58 India: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 59 India: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 60 India: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 61 India: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 62 Thailand: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 63 Thailand: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 64 Thailand: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 65 Thailand: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 66 Thailand: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 67 Thailand: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 68 Thailand: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 69 Thailand: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 70 Japan: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 71 Japan: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 72 Japan: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 73 Japan: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 74 Japan: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 75 Japan: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 76 Japan: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 77 Japan: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 78 South Korea: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 79 South Korea: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 80 South Korea: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 81 South Korea: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 82 South Korea: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 83 South Korea: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 84 South Korea: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 85 South Korea: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 86 Singapore: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 87 Singapore: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 88 Singapore: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 89 Singapore: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 90 Singapore: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 91 Singapore: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 92 Singapore: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 93 Singapore: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 94 Rest of Asia-Pacific: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 95 Rest of Asia-Pacific: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 96 Rest of Asia-Pacific: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 97 Rest of Asia-Pacific: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 98 Rest of Asia-Pacific: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 99 Rest of Asia-Pacific: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 100 Rest of Asia-Pacific: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 101 Rest of Asia-Pacific: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 102 Europe: Electric Scooter Market, by Country/Region, 2022–2031 (USD Million)

Table 103 Europe: Electric Scooter Market, by Country/Region, 2022–2031 (Units)

Table 104 Europe: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 105 Europe: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 106 Europe: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 107 Europe: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 108 Europe: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 109 Europe: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 110 Europe: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 111 Europe: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 112 Germany: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 113 Germany: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 114 Germany: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 115 Germany: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 116 Germany: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 117 Germany: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 118 Germany: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 119 Germany: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 120 France: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 121 France: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 122 France: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 123 France: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 124 France: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 125 France: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 126 France: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 127 France: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 128 Netherlands: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 129 Netherlands: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 130 Netherlands: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 131 Netherlands: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 132 Netherlands: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 133 Netherlands: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 134 Netherlands: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 135 Netherlands: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 136 Italy: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 137 Italy: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 138 Italy: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 139 Italy: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 140 Italy: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 141 Italy: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 142 Italy: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 143 Italy: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 144 Spain: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 145 Spain: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 146 Spain: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 147 Spain: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 148 Spain: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 149 Spain: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 150 Spain: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 151 Spain: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 152 U.K.: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 153 U.K.: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 154 U.K.: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 155 U.K.: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 156 U.K.: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 157 U.K.: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 158 U.K.: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 159 U.K.: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 160 Switzerland: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 161 Switzerland: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 162 Switzerland: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 163 Switzerland: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 164 Switzerland: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 165 Switzerland: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 166 Switzerland: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 167 Switzerland: Electric Scooter Market, by End User, 2022–2031 | (USD Million)

Table 168 Sweden: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 169 Sweden: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 170 Sweden: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 171 Sweden: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 172 Sweden: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 173 Sweden: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 174 Sweden: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 175 Sweden: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 176 Norway: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 177 Norway: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 178 Norway: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 179 Norway: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 180 Norway: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 181 Norway: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 182 Norway: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 183 Norway: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 184 Denmark: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 185 Denmark: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 186 Denmark: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 187 Denmark: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 188 Denmark: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 189 Denmark: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 190 Denmark: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 191 Denmark: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 192 Rest of Europe: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 193 Rest of Europe: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 194 Rest of Europe: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 195 Rest of Europe: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 196 Rest of Europe: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 197 Rest of Europe: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 198 Rest of Europe: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 199 Rest of Europe: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 200 North America: Electric Scooter Market, by Country/Region, 2022–2031

Table 201 North America: Electric Scooter Market, by Country/Region, 2022–2031 (Units)

Table 202 North America: Electric Scooter Market, by Vehicle Type, 2022–2031

Table 203 North America: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 204 North America: Electric Scooter Market, by Power Output, 2022–2031

Table 205 North America: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 206 North America: Electric Scooter Market, by Motor Type, 2022–2031

Table 207 North America: Hub Motors Electric Scooter Market, by Type, 2022–2031

Table 208 North America: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 209 North America: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 210 U.S.: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 211 U.S.: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 212 U.S.: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 213 U.S.: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 214 U.S.: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 215 U.S.: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 216 U.S.: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 217 U.S.: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 218 Canada: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 219 Canada: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 220 Canada: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 221 Canada: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 222 Canada: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 223 Canada: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 224 Canada: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 225 Canada: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 226 Latin America: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 227 Latin America: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 228 Latin America: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 229 Latin America: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 230 Latin America: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 231 Latin America: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 232 Latin America: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 233 Latin America: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 234 Middle East & Africa: Electric Scooter Market, by Vehicle Type, 2022–2031 (USD Million)

Table 235 Middle East & Africa: Electric Scooter Market, by Vehicle Type, 2022–2031 (Units)

Table 236 Middle East & Africa: Electric Scooter Market, by Power Output, 2022–2031 (USD Million)

Table 237 Middle East & Africa: Electric Scooter Market, by Battery Technology, 2022–2031 (USD Million)

Table 238 Middle East & Africa: Electric Scooter Market, by Motor Type, 2022–2031 (USD Million)

Table 239 Middle East & Africa: Hub Motors Electric Scooter Market, by Type, 2022–2031 (USD Million)

Table 240 Middle East & Africa: Electric Scooter Market, by Charging Type, 2021–2030 (USD Million)

Table 241 Middle East & Africa: Electric Scooter Market, by End User, 2022–2031 (USD Million)

Table 242 Recent Developments by Major Market Players (2021–2024)

Table 243 Top Companies in The Electric Scooter Market

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Sources

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 8 Market Sizing and Growth Forecast Approach

Figure 9 Key Insights

Figure 10 Global Electric Scooter Market, by Vehicle Type, 2024 Vs. 2031 (USD Million)

Figure 11 Global Electric Scooter Market, by Vehicle Type, 2024 Vs. 2031 (Units)

Figure 12 Global Electric Scooter Market, by Power Output, 2024 Vs. 2031 (USD Million)

Figure 13 Global Electric Scooter Market, by Battery Technology, 2024 Vs. 2031 (USD Million)

Figure 14 Global Electric Scooter Market, by Motor Type, 2024 Vs. 2031 (USD Million)

Figure 15 Global Electric Scooter Market, by Charging Type, 2024 Vs. 2031 (USD Million)

Figure 16 Global Electric Scooter Market, by End User, 2024 Vs. 2031 (USD Million)

Figure 17 Geographic Snapshot: Global Electric Scooter Market (Value Share & CAGR)

Figure 18 Geographic Snapshot: Global Electric Scooter Market (Volume Share & CAGR)

Figure 19 Impact Analysis of Market Dynamics

Figure 20 Porter's Five Forces Analysis

Figure 22 Global Electric Scooter Market, by Vehicle Type, 2024–2031 (USD Million)

Figure 23 Global Electric Scooter Market, by Vehicle Type, 2024–2031 (Units)

Figure 24 Global Electric Scooter Market, by Power Output, 2024–2031 (USD Million)

Figure 25 Global Electric Scooter Market, by Battery Technology, 2024–2031 (USD Million)

Figure 26 Global Electric Scooter Market, by Motor Type, 2024–2031 (USD Million)

Figure 27 Global Electric Scooter Market, by Charging Type, 2024–2031 (USD Million)

Figure 28 Global Electric Scooter Market, by End User, 2024–2031 (USD Million)

Figure 29 Global Electric Scooter Market, by Geography, 2024-2031 (USD Million)

Figure 30 Global Electric Scooter Market, by Geography, 2024-2031 (Units)

Figure 31 Asia-Pacific: Electric Scooter Market Snapshot

Figure 32 Europe: Electric Scooter Market Snapshot

Figure 33 North America: Electric Scooter Market Snapshot

Figure 34 Growth Strategies Adopted by The Key Players (2021–2024)

Figure 35 Vendor Market Positioning Analysis (2021–2023)

Figure 36 Competitive Dashboard: Electric Scooter Market

Figure 37 Yamaha Motor Co., Ltd.: Financial Overview, 2022

Figure 38 Yamaha Motor Co., Ltd.: Swot Analysis

Figure 39 Yadea Group Holdings Ltd.: Financial Overview, 2022

Figure 40 Yadea Group Holdings Ltd.: Swot Analysis

Figure 41 Niu Technologies: Financial Overview, 2022

Figure 42 Niu Technologies: Swot Analysis

Figure 43 Hero MotoCorp Ltd.: Financial Overview, 2022

Figure 44 Hero MotoCorp Ltd.: Swot Analysis

Figure 45 Ideanomics, Inc.: Financial Overview (2022)

Figure 46 Energica Motor Company S.P.A.: Swot Analysis

Published Date: Jun-2024

Published Date: May-2024

Published Date: Apr-2024

Published Date: Jan-2024

Published Date: Aug-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates