Resources

About Us

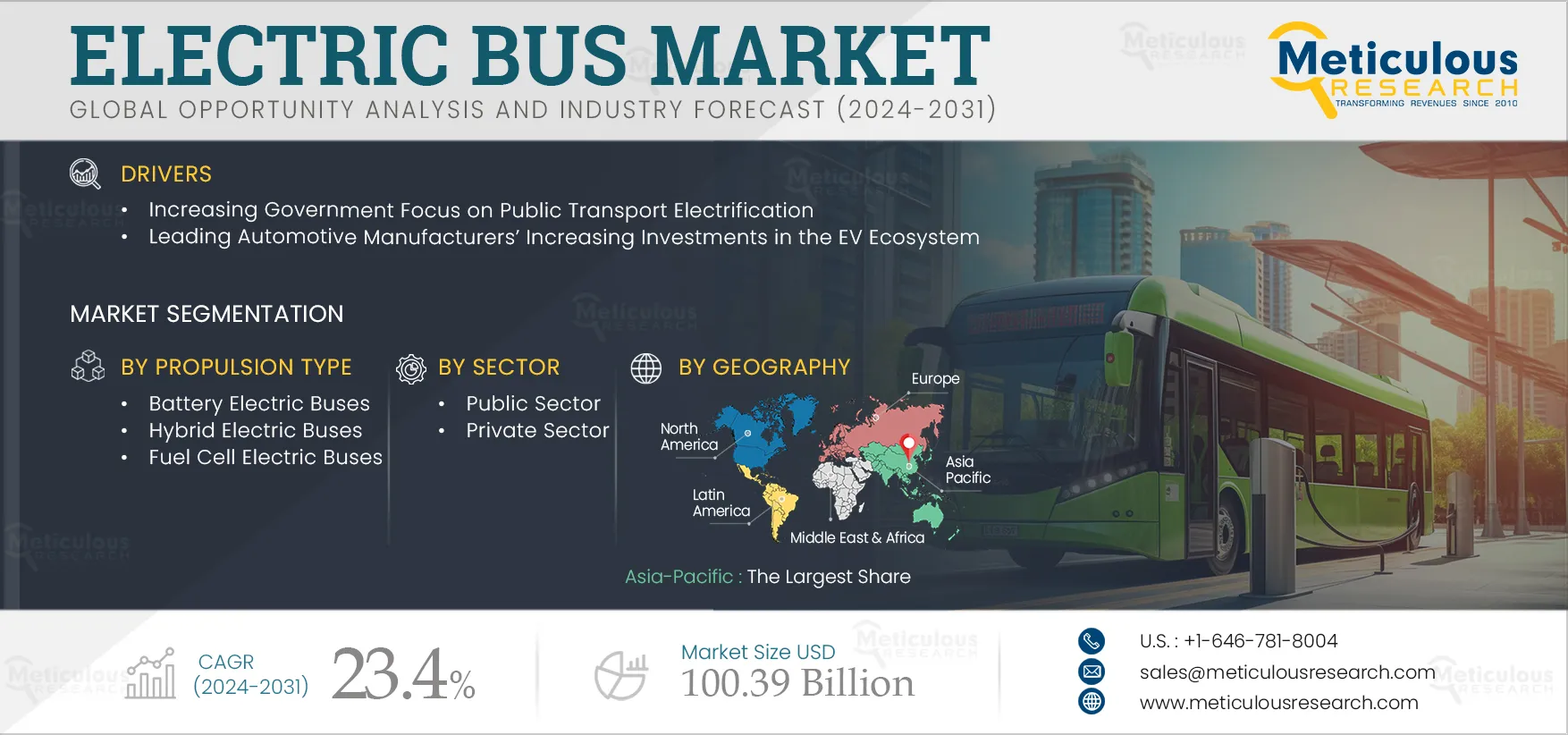

Electric Bus Market Size, Share, Forecast, & Trends Analysis by Propulsion Type (Battery Electric, Hybrid, Fuel Cell), Battery Type (NMC, LFP, Others), Bus Length (Less than 9 m, 9 m-12 m, more than 12 m), Power Output, Sector (Public, Private) & Geography - Global Forecast to 2031

Report ID: MRAUTO - 1041124 Pages: 219 Apr-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Electric Bus Market is expected to reach $100.39 billion by 2031, at a CAGR of 23.4% from 2024 to 2031, while in terms of volume, the market is expected to reach 3,41,601 units by 2031, at a CAGR of 22.4% from 2024 to 2031. The growth of the electric buses market is driven by the increasing government focus on public transport electrification and leading automotive manufacturers’ increasing investments in the Electric Vehicle (EV) ecosystem. However, the high purchasing costs of electric buses and the difficulties in building charging infrastructure for electric buses are factors restraining the growth of this market.

Furthermore, the growth in smart city & infrastructure projects and the rising demand for electric buses in emerging economies are expected to generate growth opportunities for the stakeholders in this market. However, the range limitations of electric buses are a major challenge impacting market growth. Additionally, the increasing adoption of fuel cell electric buses is a prominent trend in the electric buses market.

Government policies have a significant influence on the adoption of Electric Vehicles (EVs), including electric buses. As countries strive to reduce carbon emissions and transition to sustainable transportation, policy frameworks have emerged as powerful tools to drive the uptake of EVs. Electric buses have already penetrated key cities around the world, supported by national and local policies to curb air pollution. Policy measures promoting electric buses are diverse, including competitive tenders, green public procurement programs, purchase subsidies, direct support for the deployment of charging infrastructure, and effective pollutant emissions standards.

In addition, various countries are promoting the electrification of commercial vehicles for cleaner transport. For instance, in February 2024, the state-run Thailand Board of Investment announced tax incentives for the introduction of electric trucks and buses in company fleets. Also, in 2021, the Maharashtra Electric Vehicle Policy was approved to promote Battery Electric Vehicles (BEVs) in the State of Maharashtra, India. The policy targets six urban agglomerations, i.e., Mumbai, Pune, Nagpur, Nashik, Aurangabad, and Amravati in the state of Maharashtra, to achieve 25% electrification of public transport by 2025. Thus, government policies for reducing the upfront acquisition costs of battery-electric buses and electrifying public transport are encouraging the adoption of electric buses, driving the growth of this market.

Click here to: Get a Free Sample Copy of this report

The automotive industry is moving toward electrification, driven by technological advancements and changes in regulations and consumer behavior. Leading automotive manufacturers’ increasing investments in the development and production of electric buses are also boosting the growth of the electric buses market. Automotive manufacturers are aiming for complete decarbonization and a rapid transition from combustion vehicles to zero-emission mobility.

Automotive players are investing heavily in battery technology, charging infrastructure, production bases, and electric battery recycling to boost the transition from combustion vehicles to zero-emission mobility. For instance, in March 2021, Hyundai Auto Canada Corp. (“Hyundai”) (Canada) signed an agreement with Lithion Recycling (Canada) to recover and recycle batteries from some of its hybrid, plug-in hybrid, and pure electric vehicles. In addition, several players are also focusing on the production of fuel cell electric vehicles to reduce the dependency on electricity grids. Such ambitious goals of automotive manufacturers are expected to support the growth of the electric buses market.

Some of the recent developments in this space are as follows:

Such developments are expected to boost the production and adoption of electric buses, driving the growth of this market.

Several countries are racing toward a greener future. The global transport sector is undergoing a significant transformation. Zero-emission buses, both battery electric and fuel cell electric buses, are quickly becoming the backbone of public transit across major markets worldwide. Transit agencies are also increasingly choosing hydrogen buses for their fleets due to their longer operational range, quick refueling, and robust performance in a variety of climates.

Furthermore, the scalability of hydrogen fuelling infrastructures and the potential for green hydrogen production make hydrogen buses not just a transitional technology but a long-term sustainable solution for public transit. Several transit authorities are looking to incorporate fuel cell electric buses to eliminate emissions from their fleets.

Some of the recent developments are as follows:

Several emerging economies have set ambitious targets for the deployment of electric buses under their national plans. For instance, in 2022, India introduced the National Electric Bus Program with an aim to deploy 50,000 e‑buses in the country over the next five years. Thailand and Indonesia are also strengthening their policy support schemes, providing valuable guidance to other emerging economies seeking to foster EV adoption.

Moreover, several organizations and developed countries are also undertaking initiatives to help emerging economies accelerate the transition to zero-emission road transport. In 2022, the World Business Council for Sustainable Development (WBCSD), the U.S., and the U.K. launched the Zero-Emission Vehicle Emerging Markets Initiative, which aims to enhance cooperation between public and private actors in EMDEs to accelerate the transition to zero-emission road transport. In emerging economies, governments are also promoting electric buses to reduce air pollution, mitigate climate impacts, and decrease reliance on energy imports, which is expected to create growth opportunities for players operating in the electric buses market.

Based on propulsion type, the global electric buses market is segmented into battery electric buses, hybrid electric buses, and fuel cell electric buses. In terms of value, in 2024, the battery electric buses segment is expected to account for the largest share of the global electric buses market. The segment’s large market share is mainly attributed to increasingly stringent emission standards, the rising need for increased fuel efficiency, the growing demand for zero-emission buses, and government initiatives supporting the adoption of electric buses for public transport. For instance, in August 2023, the Government of India launched the PM-eBus Sewa Scheme with the aim of augmenting bus operations by deploying 10,000 electric buses under the PPP model. The Government of India will be spending USD 2.4 billion to deploy and operate e-buses across up to 169 eligible cities. The buses will be deployed from 2024 to 2026.

However, the hybrid electric buses segment is expected to record the highest CAGR during the forecast period. The growth of this segment is mainly driven by the increasing need to reduce greenhouse gases, the growing demand for clean mobility & transportation solutions, and stringent government regulations to limit carbon emissions from conventional vehicles.

Based on bus length, the global electric buses market is segmented into less than 9 m, 9 m–12 m, and more than 12 m. In 2024, the 9 m–12 m segment is expected to account for the largest share of the global electric buses market. The segment’s large share is mainly attributed to the increasing orders of electric buses from this category for public transport and key market players’ increasing focus on the development of electric buses.

However, the more than 12 m segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by the increasing focus on incorporating large electric buses into public transport and their potential to alleviate congestion by efficiently transporting a large number of passengers.

Based on battery type, the global electric buses market is segmented into lithium nickel manganese cobalt oxide (NMC) batteries, lithium iron phosphate (LFP) batteries, and other batteries. In 2024, the lithium iron phosphate (LFP) batteries segment is expected to account for the largest share of the global electric buses market. The segment’s large share is mainly attributed to the benefits of LFP batteries, such as long life span and reliable performance, and the growing use of LFP batteries in EV applications.

Moreover, the lithium iron phosphate (LFP) batteries segment is expected to record the highest CAGR during the forecast period. This segment's growth is mainly driven by its ability to provide long life and reliable performance under adverse conditions, the increasing use of LFP batteries in commercial electric vehicles, and the ease of recycling LFP batteries.

Based on power output, the global electric buses market is segmented into less than 200 kW, 200 kW to 400 kW, and more than 400 kW. In 2024, the 200 kW to 400 kW segment is expected to account for the largest share of the global electric buses market. The segment’s large share is mainly attributed to the growing adoption of electric buses across several countries and the increasing development and deployment of fast chargers.

Moreover, the 200 kW to 400 kW segment is expected to record the highest CAGR during the forecast period. The segment’s growth is mainly driven by key players’ increasing focus on the development of electric buses with power capacities between 200 kW to 400 kW.

Based on sector, the global electric buses market is segmented into the public sector and private sector. In 2024, the public sector segment is expected to account for the larger share of 81.9% of the global electric buses market. The segment’s large market share is mainly attributed to the rising need for increased fuel efficiency in public transport, the growing demand for zero-emission buses, and increasing government initiatives to incorporate electric buses in public transit systems.

Moreover, the public sector segment is expected to record a higher CAGR during the forecast period. The growth of this segment is mainly driven by the increasing adoption of electric buses in the public sector and the growing government focus on the development of charging infrastructure to support electric bus fleets. For instance, in November 2023, the Land Transport Authority (LTA) of Singapore awarded two contracts to procure a total of 360 electric buses and another two contracts for the deployment of charging systems at bus depots in Sengkang West, East Coast, and Gali Batu.

In terms of value, in 2024, Asia-Pacific is expected to account for the largest share of 83.3% of the global electric buses market. The large market share of this segment is attributed to favorable government policies, environmental concerns, increasing incorporation of electric buses in public transportation, strong demand for sustainable transportation, and the presence of major electric bus manufacturers. In addition, many countries in the region are integrating electric buses into their public transportation systems to curb emissions. For instance, in February 2023, BYD Japan Co., Ltd. (Japan) delivered a batch of electric buses to Hokkaido, Japan, amid the region's electrification and carbon-neutral efforts.

Asia-Pacific is also slated to record the highest CAGR during the forecast period. Factors such as increasing investment by electric bus manufacturers in EV technology and collaborative efforts by the government and automotive manufacturers for favorable, environment-friendly transportation are expected to drive the growth of the electric bus market in the coming years.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the electric buses market are BYD Company Limited (China), Yutong Bus Co., Ltd. (China), Volvo Group (Sweden), NFI Group Inc. (Canada), Solaris Bus & Coach sp. z o.o. (Poland), Daimler Truck Group (Germany), Tata Motors Limited (India), Hyundai Motor Company (South Korea), Ebusco B.V. (Netherlands), Olectra Greentech Limited (India), Xiamen King Long United Automotive Industry Co., Ltd (China), Anhui Ankai Automobile Co., Ltd. (China), Zhongtong Bus Holding Co., Ltd. (China), MAN Truck & Bus SE (Germany), and Switch Mobility Limited (U.K.).

In March 2024, Solaris launched a new version of the Urbino 12 electric bus, featuring an innovative propulsion design and new batteries. This latest model has enhanced performance parameters.

In November 2023, Alexander Dennis, a subsidiary of NFI Group Inc. and one of the world’s leading independent global bus manufacturers, launched its next-generation of battery-electric buses for the U.K. and Ireland with the unveiling of the new Enviro100EV small bus and Enviro400EV double-decker.

|

Particulars |

Details |

|

Number of Pages |

219 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

23.4% |

|

CAGR (Volume) |

22.4% |

|

Market Size (Value) |

USD 100.39 Billion by 2031 |

|

Market Size (Volume) |

3,41,601 Units by 2031 |

|

Segments Covered |

By Propulsion Type

By Bus Length

By Power Output

By Battery Type

By Sector

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Netherlands, Sweden, Norway, Rest of Europe), Asia-Pacific (China, India, South Korea, Japan, Singapore, Thailand, Rest of Asia-Pacific), North America (U.S., Canada), Latin America, and the Middle East & Africa |

|

Key Companies |

BYD Company Limited (China), Yutong Bus Co., Ltd. (China), Volvo Group (Sweden), NFI Group Inc. (Canada), Solaris Bus & Coach sp. z o.o. (Poland), Daimler Truck Group (Germany), Tata Motors Limited (India), Hyundai Motor Company (South Korea), Ebusco B.V. (Netherlands), Olectra Greentech Limited (India), Xiamen King Long United Automotive Industry Co., Ltd (China), Anhui Ankai Automobile Co., Ltd. (China), Zhongtong Bus Holding Co., Ltd. (China), MAN Truck & Bus SE (Germany), and Switch Mobility Limited (U.K.). |

The electric buses market study focuses on market assessment and opportunity analysis through the sales of electric buses across different regions and countries across different market segmentations. This study is also focused on competitive analysis for electric buses based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Electric Bus Market is expected to reach $ 100.39 billion by 2031, at a CAGR of 23.43% from 2024 to 2031, while in terms of volume, the market is expected to reach 3,41,601 units by 2031, at a CAGR of 22.4% from 2024 to 2031.

In 2024, the public sector segment is expected to hold the largest share in the electric buses market.

The hybrid electric buses segment is expected to register the highest CAGR during the forecast period.

The growth of the electric buses market is driven by the increasing government focus on public transport electrification and leading automotive manufacturers’ increasing investments in the Electric Vehicle (EV) ecosystem. Furthermore, the growth in smart city & infrastructure projects and the rising demand for electric buses in emerging economies are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the electric buses market are BYD Company Limited (China), Yutong Bus Co., Ltd. (China), Volvo Group (Sweden), NFI Group Inc. (Canada), Solaris Bus & Coach sp. z o.o. (Poland), Daimler Truck Group (Germany), Tata Motors Limited (India), Hyundai Motor Company (South Korea), Ebusco B.V. (Netherlands), Olectra Greentech Limited (India), Xiamen King Long United Automotive Industry Co., Ltd (China), Anhui Ankai Automobile Co., Ltd. (China), Zhongtong Bus Holding Co., Ltd. (China), MAN Truck & Bus SE (Germany), and Switch Mobility Limited (U.K.).

Asia-Pacific is expected to record a higher CAGR during the forecast period.

Published Date: Aug-2024

Published Date: Jun-2024

Published Date: May-2024

Published Date: Feb-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates