Resources

About Us

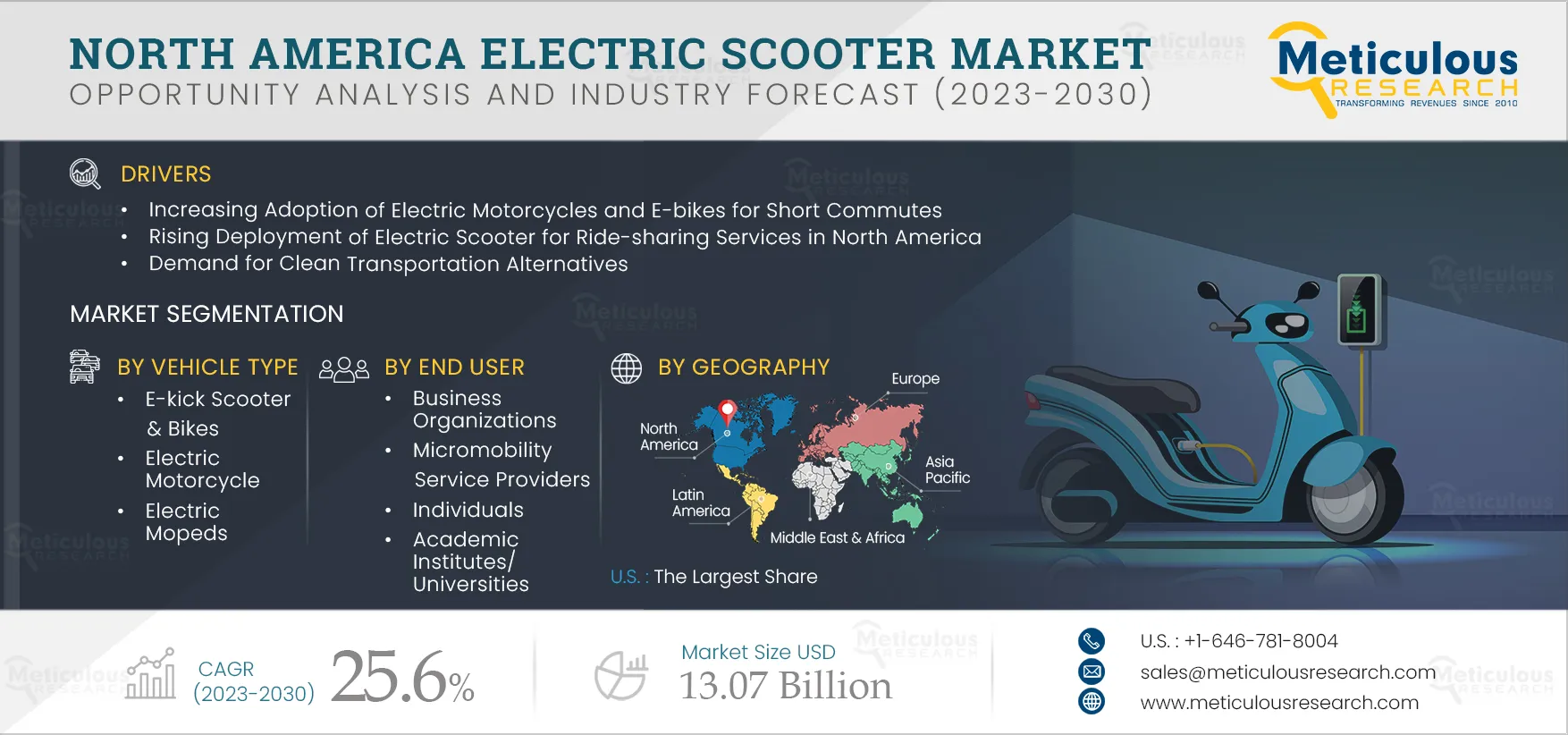

North America Electric Scooter Market by Vehicle Type (Electric Motorcycles, Electric Mopeds, E-scooters & Bikes), Power Output (Less than 3.6kW, 3.6kW to 7.2kW), Battery Technology, Motor Type, Charging Type, End User, and Country - Forecast to 2030

Report ID: MRAUTO - 104558 Pages: 180 Aug-2023 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 48 Hours Download Free Sample ReportThe North America Electric Scooter Market is projected to reach $13.07 billion by 2030, at a CAGR of 25.6% from 2023–2030. By Volume, this market is projected to reach 11.8 million units by 2030, at a CAGR of 26.1% from 2023–2030. The growth of the North America electric scooter market is driven by the factors such as the increasing adoption of electric motorcycles and E-bikes for short commutes, the rising deployment of electric scooter for ride-sharing services in North America, and the demand for clean transportation alternatives. Furthermore, rising health awareness among millennials, the emergence of advanced fleet management technologies, and advancements in battery technology are expected to offer lucrative opportunities for players operating in the North America electric scooter market.

However, the high costs of electric two-wheelers, E-scooter, and bikes and the short lifespan of batteries are expected to restrain the growth of this market. The lack of regulations in the electric two-wheelers and micromobility space poses a challenge to the growth of this market.

In addition, the integration of electric scooter with mobile apps is a major trend for players operating in the North America electric scooter market.

Click here to: Get Free Request Sample Copy of this report

The ever-increasing traffic congestion leading to extremely long commutes is paving the way for commuters to look for convenient, time-efficient, and affordable options. Micro-mobility is the most common travel solution for short distances at a particular speed range. Its solutions usually include bicycles, skateboards, E-bikes, scooter, skates, and small electric vehicles, generally running on charged batteries. As micro-mobility has been picking up pace, players in the industry have come up with vehicle-sharing alternatives.

Electric scooter are available in more than 100 cities across the globe and have been flooding streets since the introduction in recent years of sharing schemes similar to the cycle hire projects. E-vehicles are growing in popularity due to their low environmental impact compared with other modes of transport. The electric scooter market has grown over the past ten years, and North America has seen huge rises in E-scooter adoption. North America is increasingly adopting Bike share, E-scooter, and other micromobility systems. This become a crucial part of urban transportation networks in North America. North American companies such as Spin Mobility Inc. (Canada), Superpedestrian, Inc. (U.S.), and Ride GOAT Inc. (U.S.) are taking initiatives for the adoption of E-scooter. By 2023, electric two-wheelers are expected to hold up to 8% share of all two-wheelers on the road. Currently, this number stands at 2.5%. The monthly installs of E-scooter sharing apps like Bird and Lime increased by 580% during 2018–2019. This number will continue to increase as E-scooter sharing services continue to gain popularity. North America was quick to grab the E-scooter trend. Some of the major developments in the region include:

Thus, the developments, as well as increasing fleet sharing service, are expected to encourage the adoption of private E-scooter across the region.

The Electric Motorcycles Segment to be the Fastest-growing Segment between 2023 to 2030

Based on vehicle type, the North America electric scooter market is segmented into E-kick scooter & bikes, electric mopeds, and electric motorcycles. The electric motorcycles segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to growing government policies aimed at promoting electric mobility, increasing awareness regarding the need to reduce greenhouse gas emissions and environmental pollution, rising demand for electric motorcycles among consumers, rising gasoline prices, and stringent emission norms.

The 20 kW to 100kW Segment to be the Fastest-growing Segment During the Forecast Period

Based on power output, the North America electric scooter market is segmented into less than 3.6 kW, 3.6 kW to 7.2 kW, and 20 kW to 100 kW. The 20 kW To 100 KW segment is expected to grow at the highest CAGR of 37.4% during the forecast period. The growth of the segment is attributed to the increasing adoption of electric motorcycles in emerging economies, the high growth of the electric two-wheelers market in North America during the pandemic, favorable incentives and tax benefits, and growing demand for fast and powerful electric two-wheelers among the young generation.

The Lithium-ion Polymer Battery Segment to be the Fastest-growing Segment between 2023 to 2030

Based on battery technology, the North America electric scooter market is segmented into sealed lead acid battery, lithium-ion battery, and lithium-ion polymer battery. The lithium-ion polymer battery segment is expected to grow at the highest CAGR during the forecast period. Lithium-ion polymer (LiPo) batteries are known for their cost-effectiveness and reliable performance compared to lithium batteries. These batteries employ solid, colloidal polymers or organic electrolytes. LiPo batteries offer several advantages, including large capacity and fast charging capabilities. They deliver high power output quickly, making them suitable for applications like E-bikes, where immediate power assistance is required during startup.

The Hub Motor Segment to Dominate the North America Electric Scooter Market in 2023

Based on motor type, the North America electric scooter market is segmented into hub motors and mid-drive motors. In 2023, the hub motors segment is expected to account for the largest share of the North America electric scooter market. Hub motors offer flexibility since they can power rear-wheel, front-wheel, or all-wheel-drive vehicles. An electric bike with a rear hub motor is easier to operate than an electric bike with a front hub motor since electric bikes with rear hub motors provide more stability. One of the biggest advantages of hub motors is that they require little or no maintenance. They are an independent drive system that retains all components inside the motor casing.

The Business Organizations Segment to Dominate the North America Electric Scooter Market in 2023

Based on end user, the North America electric scooter market is segmented into government institutions, academic institutes/universities, business organizations, micromobility service providers, individuals, and other end users. In 2023, the business organizations segment is expected to account for the largest share of the North America electric scooter market. Business organizations use E-scooter mostly for logistics. Some use E-scooter for courier and delivery services. Emco electroroller GmbH provides delivery E-scooter supplemented with practical transport boxes for pizza services, pharmacies, florists, and craftsmen. The benefits of using E-scooter for delivery are that the person can deliver in sensitive areas without noise pollution, saving operating costs.

U.S. is Expected to Dominate the North America Electric Scooter Market in 2023

Based on country, the North America electric scooter market is segmented into U.S. and Canada. In 2023, the U.S. is expected to account for the largest share of the North America electric scooter market. The large market share of this region is attributed to the actions taken by the local and state governments and utility stakeholders across the country to reduce consumer barriers and the increasing number of policies, grants, and incentives on E-mobilities.

Key Players:

The key players operating in the North America electric scooter market are Energica Motor Company S.p.A. (Italy), Yamaha Motor Co., Ltd. (Japan), Niu Technologies (China), Riese & Müller GmbH (Germany), Leon Cycle (Germany), Govecs AG (Germany), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Zero Motorcycles, Inc. (U.S.), and emco electroroller GmbH (Germany).

Scope of the Report

North America Electric Scooter Market Assessment, by Vehicle Type

North America Electric Scooter Market Assessment, by Power Output

North America Electric Scooter Market Assessment, by Battery Technology

North America Electric Scooter Market Assessment, by Motor Type

North America Electric Scooter Market Assessment, by Charging Type

North America Electric Scooter Market Assessment, by End User

North America Electric Scooter Market Assessment, by Country

Key Questions Answered in the Report:

The North America electric scooters market report provides insights into the market based on vehicle type, power output, battery technology, motor type, charging type, end user, and country. The study also evaluates industry competitors and analyses the country-level markets.

The North America electric scooters market is projected to reach $13.07 billion by 2030, at a CAGR of 25.6% from 2023–2030. By Volume, this market is projected to reach 11.8 million units by 2030, at a CAGR of 26.1% from 2023–2030.

Based on vehicle type, in 2023, the electric motorcycle segment is expected to account for the largest share of the North America electric scooter market.

Based on power output, in 2023, the less than 3.6 kW segment is expected to account for the largest share of the North America electric scooter market.

Based on battery technology, in 2023, the lithium-ion polymer battery segment is expected to account for the largest share of the North America electric scooter market.

Based on end user, in 2023, the business organization segment is expected to account for the largest share of the North America electric scooters market.

The growth of the North America electric scooters market is driven by the factors such as the increasing adoption of electric motorcycles and E-bikes for short commutes, the rising deployment of electric scooters for ride-sharing services in North America, and the demand for clean transportation alternatives. Furthermore, rising health awareness among millennials, the emergence of advanced fleet management technologies, and advancements in battery technology are expected to offer lucrative opportunities for players operating in the North America electric scooters market.

The key players operating in the North America electric scooters market are Energica Motor Company S.p.A. (Italy), Yamaha Motor Co., Ltd. (Japan), Niu Technologies (China), Riese & Müller GmbH (Germany), Leon Cycle (Germany), Govecs AG (Germany), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Zero Motorcycles, Inc. (U.S.), and emco electroroller GmbH (Germany).

The market in the U.S. is expected to register the highest growth rate during the forecast period. It is attributed to the actions taken by the local and state governments and utility stakeholders across the country to reduce consumer barriers and the increasing number of policies, grants, and incentives on E-mobilities.

Published Date: Jun-2024

Published Date: Apr-2024

Published Date: Feb-2024

Published Date: Jul-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates