Resources

About Us

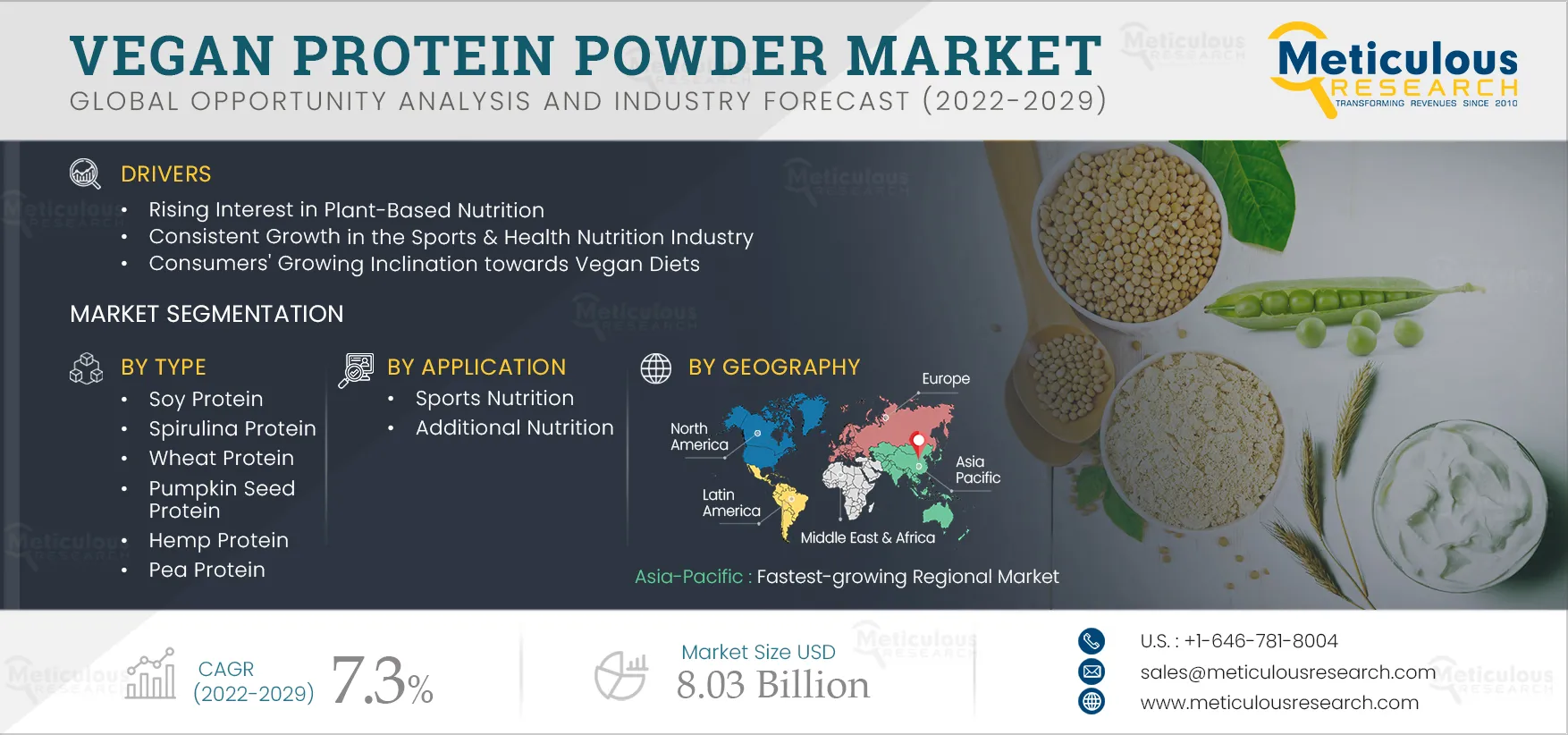

Vegan Protein Powder Market by Type (Soy Protein, Rice Protein), Application (Sports Nutrition, Additional Nutrition), and Distribution Channel (Hypermarket/Supermarket, E-Commerce, Pharmacies) - Global Forecast to 2029

Report ID: MRFB - 104604 Pages: 140 Jun-2022 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Vegan Protein Powder Market is expected to reach $8.03 billion by 2029, at a CAGR of 7.3% during the forecast period of 2022 to 2029. The growth of this market is driven by the rising interest in plant-based nutrition among consumers, consistent growth in the sports & health nutrition industry, consumers' growing inclination towards vegan diets, and the increasing adoption of personalized nutrition.

In addition, the growing demand from emerging economies—Asia-Pacific, Latin America, and the Middle East & Africa and the increasing launches of new plant-based protein supplements are expected to provide lucrative opportunities for players operating in this market. However, the significant preference for whey-based protein supplements and soy-free and gluten-free products are expected to hinder the growth of this market to a notable extent.

The outbreak of the COVID-19 pandemic significantly impacted public health and the supply chain across various industries. Since the COVID-19 outbreak in December 2019, the disease has spread to almost 100 countries worldwide, with the World Health Organization declaring it a public health emergency. The Vegan Protein Powder Market is expected to witness consistent growth following the outbreak of the COVID-19 pandemic.

However, during the beginning of the COVID-19 pandemic, it was difficult for the companies to supply their products in the market. In addition, the production of plant-based protein powder products faced numerous challenges due to disruptions in the supply chain. Consumers emphasized crucial products such as groceries, medicines, and other essentials. As the effects of the COVID-19 pandemic subsided and the situation began to normalize, companies resumed operations to meet the demand for plant-based protein powders.

The outbreak of the COVID-19 pandemic negatively affected the functional food and nutraceutical industries. The outbreak of the COVID-19 pandemic highlighted the importance of consuming healthy diets, resulting in the increased demand for vegan protein powders to enable good health and optimum functioning of the body. Plant-based protein powders provide essential proteins for the growth and repair of cells and tissues. Furthermore, vegan proteins provide lower calories and fats compared to animal proteins but are higher in fiber and essential nutrients.

According to The Good Food Institute, the vegan protein products market witnessed a spike in sales during the first quarter of 2020. Furthermore, according to an article published by Nutrition Outlook, dietary supplement sales increased significantly during the COVID-19 pandemic. In the U.S, the sales growth for overall dietary supplements skyrocketed to more than 35.0% during the last week of March 2020.

Click here to: Get Free Sample Copy of this report

Consistent Growth in the Sports & Health Nutrition Industry Drives the Growth of the Vegan Protein Powder Market

According to the International Health Racquet and Sportsclub Association, in 2016, there were nearly 38,477 health clubs in the U.S. In 2018, health club memberships reached 183 million users worldwide, and it's expected to reach 230 million by 2030. In the U.S., the health club membership increased from 58 million in 2010 to 73.6 million in 2019 (an increase of 27%), indicating a rise in awareness regarding physical fitness among the U.S. population. Thus, the rising number of people joining health clubs and adopting healthy lifestyles drive the demand for health and nutritional products.

Furthermore, the participation rate of consumers in fitness sports or fitness activities is growing at a rapid pace. According to the Physical Activity Council, in 2018, almost 64% of the U.S. population aged six and above is engaged in activities such as high-intensity training, running, and jogging. Thus, consumers are increasingly adopting healthy and active lifestyles, boosting the demand for protein supplements.

Protein powders are gaining prominence among health-conscious consumers due to their high nutritional content. The rising fitness trends are expected to increase the demand for vegan protein powders, as they play a major role in providing essential nutrients, particularly for vegetarian and vegan consumers.

Thus, the increasing awareness about the importance of active lifestyles and the growing demand from athletes and health-conscious consumers drive the growth of the vegan protein powders market.

In 2022, the Soy Protein Segment is Estimated to Account for the Largest Share of the Vegan Protein Powder Market

Based on type, the vegan protein powder market is segmented into soy protein, rice protein, pea protein, spirulina protein, pumpkin seed protein, hemp protein, and other vegan protein powders. In 2022, the soy protein segment is expected to account for the largest share of the vegan protein powders market. The large market share of this segment is attributed to factors such as the easy availability of raw materials, cheaper alternative to other sources of protein powder supplements, higher nutritional value than other sources, and the high level of acceptance among consumers.

However, the pea protein segment is expected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is driven by the rising demand for pea protein powder worldwide due to its growing popularity among the vegetarian and vegan population, high nutritional content, and allergen-free, gluten-free, and lactose-free properties.

In 2022, the Sports Nutrition Segment is Estimated to Account for the Largest Share of the Vegan Protein Powder Market

Based on application, the vegan protein powder market is segmented into sports nutrition and additional nutrition. In 2022, the sports nutrition segment is estimated to account for a larger share of the plant-based protein powders market. The large market share of this segment is mainly attributed to the increasing product development by market players, the increasing number of people choosing sports as a career, and the rise in national and international sports events. This segment is also expected to grow at a higher CAGR during the forecast period. The rapid growth of this segment is driven by the rising demand for balanced and nutrient-rich diets from athletes.

In 2022, the Modern Groceries Segment is Estimated to Account for the Largest Share of the Vegan Protein Powder Market

Based on distribution channel, the plant-based protein powder market is segmented into modern groceries, natural & specialty retail, online retail, health food stores, pharmacies & drug stores, convenience stores, and other distribution channels. In 2022, the modern groceries segment is expected to account for the largest share of the plant-based protein powders market. The large market share of this segment is attributed to the huge base of supermarkets and hypermarkets and significant consumer preference for shopping from these outlets.

However, the online retail/e-commerce segment is expected to grow at the highest CAGR during the forecast period. Online plant-based protein powder sales are growing faster than other offline distribution channels due to the benefits offered by online retailers, such as doorstep delivery, attractive discounts, greater product selection experience, and price comparison availability.

Asia-Pacific: Fastest-growing Regional Market

Based on geography, in 2022, North America is estimated to account for the largest share of the plant-based protein powders market. North America's large market share is attributed to factors such as the high demand for nutritional supplements, the increasing health awareness among consumers, the well-established nutraceutical & functional food industry, highly established gyms and sports clubs, and growing health & wellness and clean label trends.

However, the market in Asia-Pacific is expected to register the highest growth rate during the forecast period. The high market growth in Asia-Pacific is attributed to the increasing number of people participating in recreational activities, the rising living standards in developing countries, such as China and India, the increasing number of fitness centers and sports clubs, the growing vegetarian population, and the rapid growth in population and urbanization.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by leading market participants in the plant-based protein powder market between 2019 and 2022.

The key players profiled in the vegan protein powder market study are Glanbia plc. (Ireland), Now Health Group, Inc. (U.S.), Nutiva Inc (U.S.), The Simply Good Food Co (U.S.), Iovate Health Sciences International Inc. (Canada), MusclePharm Corporation (U.S.), Kerry Group Plc (Ireland), CytoSport, Inc. (U.S.), The Nature's Bounty Co. (U.S.), Reliance Vitamin Company, Inc. (U.S.), Herbalife Nutrition, Inc. (U.S.), Danone SA (France), General Nutrition Centers (GNC) Holdings, Inc. (U.S.), Orgain Inc. (U.S.), and True Nutrition (U.S.).

Scope of the Report:

Vegan Protein Powder Market, by Type

Vegan Protein Powder Market, by Application

Vegan Protein Powder Market, by Distribution Channel

Vegan Protein Powder Market, by Geography

Key questions answered in the report:

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.1.3. Growth Forecast

2.4. Assumptions for the Study

2.5. Limitations for the Study

3. Executive Summary

3.1. Introduction

3.2. Segment Analysis

3.2.1. Vegan Protein Powder Market, by Type Analysis

3.2.2. Vegan Protein Powder Market, by Application Analysis

3.2.3. Vegan Protein Powder Market, by Distribution Channel Analysis

3.3. Vegan Protein Powder Market Regional Analysis

3.4. Market Competitors

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Rising Interest in Plant-Based Nutrition

4.2.2. Consistent Growth in the Sports & Health Nutrition Industry

4.2.3. Consumers' Growing Inclination towards Vegan Diets

4.2.4. Increasing Adoption of Personalized Nutrition

4.3. Restraints

4.3.1. Preference for Whey-based Protein Supplements

4.3.2. Growing Preference for Soy-free and Gluten-free Products

4.4. Opportunities

4.4.1. Growing Demand from Emerging Economies—Asia-Pacific, Latin America, and the Middle East & Africa

4.4.2. Increasing Launches of New Plant-based Protein Supplements

4.5. Trends

4.5.1. Increased Preference for Online Purchases

5. Impact of COVID-19 on the Plant-based Protein Powders Market

6. Global Vegan Protein Powder Market, by Type

6.1. Introduction

6.2. Soy Protein

6.3. Spirulina Protein

6.4. Wheat Protein

6.5. Pumpkin Seed Protein

6.6. Hemp Protein

6.7. Pea Protein

6.8. Rice Protein

6.9. Other Plant-based Protein Powders

7. Global Vegan Protein Powder Market, by Application

7.1. Introduction

7.2. Sports Nutrition

7.3. Additional Nutrition|

8. Global Vegan Protein Powder Market, by Distribution Channel

8.1. Introduction

8.2. Modern Groceries (Hypermarkets/Supermarkets)

8.3. Online Retail/E-commerce

8.4. Natural & Specialty Retail

8.5. Pharmacies & Drug Stores

8.6. Health Food Stores

8.7. Convenience Stores

8.8. Other Distribution Channels

9. Vegan Protein Powder Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. U.K.

9.3.2. Germany

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. Rest of Asia-Pacific

9.5. Latin America

9.6. Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking of Key Players

10.3.1. By Product Offerings

10.3.2. By Geographic Presence

11. Company Profiles

11.1. Glanbia Plc.

11.2. Now Health Group, Inc.

11.3. Nutiva Inc.

11.4. The Simply Good Food Co.

11.5. Iovate Health Sciences International Inc.

11.6. Musclepharm Corporation

11.7. Kerry Group PLC

11.8. Cytosport, Inc.

11.9. The Nature's Bounty Co.

11.10. Reliance Vitamin Company, Inc. (Reliance Private Label Supplements)

11.11. Herbalife Nutrition, Inc.

11.12. DANONE SS

11.13. GNC Holdings, Inc.

11.14. Orgain Inc.

11.15. True Nutrition

12. Appendix

12.1. Questionnaire

12.2. Available Customization

List of Tables

Table 1 Global Vegan Protein Powder Market Drivers: Impact Analysis (2022–2029)

Table 2 Global Vegan Protein Powder Market Restraints: Impact Analysis (2022–2029)

Table 3 Global Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 4 Global Vegan Protein Powder Market Size, by Type, 2022-2029 ((Thousand MT)

Table 5 Soy Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 6 Soy Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 7 Spirulina Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 8 Spirulina Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 9 Wheat Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 10 Wheat Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 11 Pumpkin Seed Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 12 Pumpkin Seed Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 13 Hemp Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 14 Hemp Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 15 Pea Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 16 Pea Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 17 Rice Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 18 Rice Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 19 Other Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 20 Other Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 21 Global Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 22 Global Vegan Protein Powder Market Size for Sports Nutrition, by Country/Region, 2022-2029 (USD Million)

Table 23 Global Vegan Protein Powder Market Size for Additional Nutrition, by Country/Region, 2022-2029 (USD Million)

Table 24 Global Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 25 Vegan Protein Powder Market Size for Modern Groceries, by Country/Region, 2022-2029 (USD Million)

Table 26 Vegan Protein Powder Market Size for Online Retail, by Country/Region, 2022-2029 (USD Million)

Table 27 Vegan Protein Powder Market Size for Natural and Specialty Retail, by Country/Region, 2022-2029 (USD Million)

Table 28 Vegan Protein Powder Market Size for Pharmacies & Drug Stores, by Country/Region, 2022-2029 (USD Million)

Table 29 Vegan Protein Powder Market Size for Health Food Stores, by Country/Region, 2022-2029 (USD Million)

Table 30 Vegan Protein Powder Market Size for Convenience Stores, by Country/Region, 2022-2029 (USD Million)

Table 31 Vegan Protein Powder Market Size for Other Distribution Channels, by Country/Region, 2022-2029 (USD Million)

Table 32 Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 33 Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 34 North America: Vegan Protein Powder Market Size, by Country, 2022-2029 (USD Million)

Table 35 North America: Vegan Protein Powder Market Size, by Country, 2022-2029 (Thousand MT)

Table 36 North America: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 37 North America: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 38 North America: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 39 North America: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 40 U.S.: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 41 U.S.: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 42 U.S.: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 43 U.S.: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 44 Canada: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 45 Canada: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 46 Canada: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 47 Canada: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 48 Europe: Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 49 Europe: Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 50 Europe: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 51 Europe: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 52 Europe: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 53 Europe: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 54 U.K.: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 55 U.K.: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 56 U.K.: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 57 U.K.: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 58 Germany: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 59 Germany: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 60 Germany: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 61 Germany: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 62 France: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 63 France: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 64 France: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 65 France: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 66 Italy: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 67 Italy: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 68 Italy: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 69 Italy: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 70 Spain: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 71 Spain: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 72 Spain: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 73 Spain: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 74 Rest of Europe: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 75 Rest of Europe: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 76 Rest of Europe: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 77 Rest of Europe: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 78 Asia-Pacific: Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (USD Million)

Table 79 Asia-Pacific: Vegan Protein Powder Market Size, by Country/Region, 2022-2029 (Thousand MT)

Table 80 Asia-Pacific: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 81 Asia-Pacific: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 82 Asia-Pacific: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 83 Asia-Pacific: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 84 Japan: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 85 Japan: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 86 Japan: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 87 Japan: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 88 China: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 89 China: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 90 China: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 91 China: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 92 India: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 93 India: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 94 India: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 95 India: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 96 Rest of Asia-Pacific: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 97 Rest of Asia-Pacific: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 98 Rest of Asia-Pacific: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 99 Rest of Asia-Pacific: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 100 Latin America: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 101 Latin America: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 102 Latin America: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 103 Latin America: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

Table 104 Middle East & Africa: Vegan Protein Powder Market Size, by Type, 2022-2029 (USD Million)

Table 105 Middle East & Africa: Vegan Protein Powder Market Size, by Type, 2022-2029 (Thousand MT)

Table 106 Middle East & Africa: Vegan Protein Powder Market Size, by Application, 2022-2029 (USD Million)

Table 107 Middle East & Africa: Vegan Protein Powder Market Size, by Distribution Channel, 2022-2029 (USD Million)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 7 Market Sizing and Growth Forecast Approach

Figure 8 Pea Protein Segment to Witness Significant Market Growth During 2022–2029

Figure 9 Sport Nutrition Segment to Witness Significant Market Growth During 2022–2029

Figure 10 Online Retail Segment to Witness Significant Market Growth During 2022–2029

Figure 11 Global Vegan Protein Powder Market Scenario, by Geography (2022)

Figure 12 Market Dynamics

Figure 13 Global Vegan Protein Powder Market Size, by Type, 2022–2029 (USD Million)

Figure 14 Global Vegan Protein Powder Market Size, by Type, 2022–2029 (Thousand MT)

Figure 15 Global Vegan Protein Powder Market Size, by Application, 2022–2029 (USD Million)

Figure 16 Global Vegan Protein Powder Market Size, by Region, 2022–2029 (USD Million)

Figure 17 North America: Vegan Protein Powder Market Snapshot

Figure 18 Europe: Vegan Protein Powder Market Snapshot

Figure 19 Asia-Pacific: Vegan Protein Powder Market Snapshot

Figure 20 Latin America: Vegan Protein Powder Market Snapshot

Figure 21 Middle East & Africa: Vegan Protein Powder Market Snapshot

Figure 22 Key Growth Strategies Adopted by Leading Players (2019-2022)

Figure 23 Global Vegan Protein Powder Market: Competitive Benchmarking, by Type

Figure 24 Glanbia Plc: Financial Overview (2021)

Figure 25 The Simply Good Foods Company: Financial Overview (2021)

Figure 26 MusclePharm Corporation: Financial Overview (2021)

Figure 27 Kerry Group Plc: Financial Overview (2021)

Figure 28 PepsiCo Inc.: Financial Overview (2021)

Figure 29 FiHerbalife Nutrition, Inc.: Financial Overview (2021)

Figure 30 Danone SA: Financial Overview (2021)

Figure 31 GNC Holdings, Inc.: Financial Overview (2021)

Published Date: Feb-2025

Published Date: Oct-2024

Published Date: Aug-2024

Published Date: Aug-2024

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates