Resources

About Us

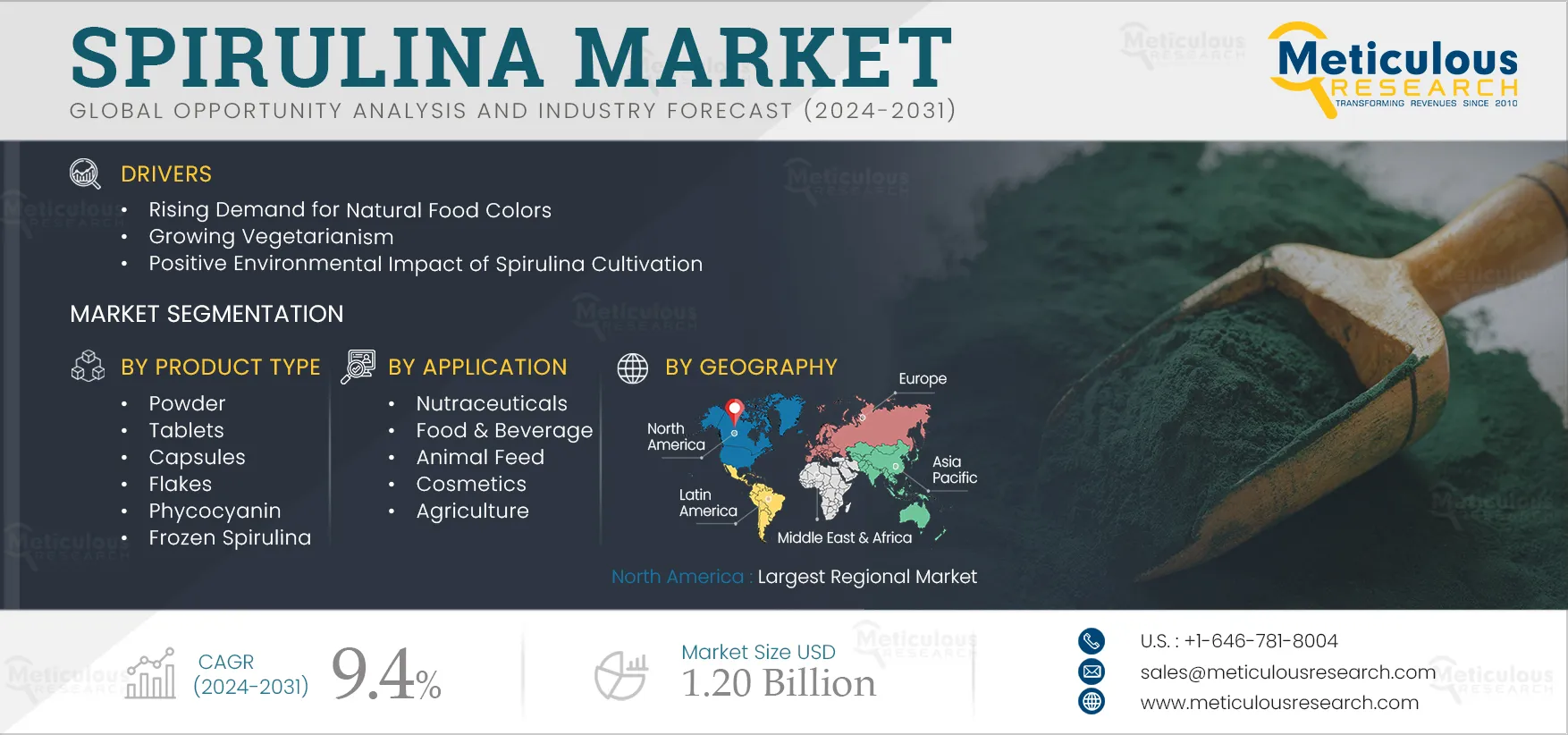

Spirulina Market Size, Share, Forecast, & Trends Analysis by Product Type (Powder, Capsules, Flakes, Phycocyanin), Production Technique (Ponds), Category (Organic), Distribution Channel (B2B, B2C), Application (Nutraceuticals) - Global Forecast to 2031

Report ID: MRFB - 104371 Pages: 293 Sep-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 48 Hours Download Free Sample ReportKey factors driving the growth of this market include increasing consumer focus on health & wellness, the expanding dietary supplements industry, a shift towards natural food colorants, a growing vegetarian population, the environmental benefits of spirulina cultivation, strict regulations on the use of synthetic additives, and rising investments by natural color manufacturers in spirulina production. However, this growth is restrained by the limited awareness of spirulina’s benefits, production complexities, and contamination risks.

Additionally, new application areas for spirulina, high demand for phycocyanin, rising utilization of spirulina in biorefineries, and growing interest in fresh/frozen spirulina are poised to offer significant growth opportunities for market players. Additionally, the adoption of advanced production technologies (photobioreactors) is emerging as a notable trend in this market.

The demand for natural food colors is increasing due to increasing awareness about organic products among consumers, concerns about the health risks associated with synthetic colors, and the perceived health benefits of natural alternatives. The adverse effects of synthetic additives, coupled with a rise in health consciousness and a preference for environmentally friendly products, are driving this trend. In response, food manufacturers are increasingly incorporating natural food colors to enhance the appeal of processed foods and beverages. In the U.S., the Food and Drug Administration (FDA) has restricted the use of certain artificial color additives due to their potential links to health issues, further accelerating the shift toward natural colorants.

Spirulina, known for its vibrant blue-green color, is an effective natural colorant that provides vivid blue and green hues. The FDA has approved phycocyanin, extracted from spirulina, as a natural colorant for use in food and beverages. As a major source of phycocyanin, spirulina's demand has surged, especially in North America and Europe. In North America, spirulina is widely used in various applications, including beverages, dairy products, confectionery, frosting, ice cream, dry beverage mixes, and yogurt. Therefore, the growing preference for natural food colors is driving the growth of the spirulina market.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

In recent decades, the use of dietary supplements, including vitamins, minerals, and nutritional and herbal supplements, has been on the rise. This trend was further accelerated during the COVID-19 pandemic, with a notable increase in supplement sales. According to the American National Standards Institute, global dietary supplement sales reached USD 220 billion in 2021. This figure is projected to reach USD 252 billion by 2025. Key factors contributing to this growth include an aging population, heightened consumer awareness of preventive healthcare, a shift towards self-diagnosis, the proliferation of marketing channels and e-commerce, and a trend towards broader brand positioning that emphasizes comprehensive health benefits rather than individual ingredients.

Spirulina is recognized as generally safe (GRAS) by the U.S. FDA for all age groups. Spirulina is often used for increased energy, nutritional support, weight management, and detoxification. Beyond its role in addressing nutritional deficiencies, spirulina is gaining recognition as a nutraceutical. It was used by NASA as a dietary supplement for astronauts due to its ability to modulate immune functions and its anti-inflammatory properties.

Spirulina is regarded as a nutritional powerhouse due to its high protein content, which includes all eight essential amino acids in balanced proportions. It is also rich in beta-carotene, vitamin E, and iron. The combination of its diverse nutritional benefits and antioxidant properties has led to growing interest among health-conscious consumers, thereby driving the growth of the global spirulina market.

Spirulina offers a unique 'true blue' color option for food & beverage manufacturers, free from green or purple undertones, which is rare in the natural food colorant market. The U.S. FDA has approved spirulina as a colorant for a broad range of food products beyond just gums and candies. It is commonly used in applications such as dessert coatings and toppings, frostings, yogurts, puddings, custards, gelatin, breadcrumbs, ice creams, and frozen desserts. As a result, the demand for spirulina is expected to grow significantly in the coming years.

While the market for microalgae-based food and feed products shows substantial growth potential, their current contribution to human and animal nutrition remains relatively limited due to small-scale production and high production costs compared to traditional commodities. However, spirulina has the potential to produce valuable compounds like omega-3 fatty acids, offering a viable alternative to increasingly expensive traditional sources such as fish.

Additionally, spirulina is emerging as a promising biomass feedstock for biofuel production. It presents a viable option for biodiesel due to its sustainability and non-competition with food sources. With the rising global population, depletion of fossil fuels, environmental issues, and fluctuating crude oil prices, biofuels are gaining attention as an alternative energy source. Spirulina-based biofuels could play a significant role in the energy sector, presenting a major application area for spirulina.

Other application areas, such as sports drinks and dyes, are also creating market growth opportunities.

Currently, spirulina is primarily available and consumed in tablet, flake, or powder forms. However, these processing methods can degrade thermolabile vitamins, minerals, and proteins, reducing the nutritional value of the final products. High-temperature processing, in particular, diminishes phycocyanin, the compound responsible for spirulina's anti-inflammatory and antioxidant properties.

In contrast, fresh, raw spirulina retains its full nutritional value as all nutrients remain 100% bioavailable. It is nearly tasteless and provides a comprehensive array of nutrients, making it an exceptionally powerful superfood. Fresh spirulina paste is more nutrient-dense compared to other forms. Many users freeze fresh spirulina paste in ice cube trays for convenience, using the frozen cubes in smoothies or other recipes. When properly refrigerated, fresh spirulina can remain viable for up to three weeks after harvest. Its use as a smoothie ingredient is becoming increasingly popular worldwide.

Additionally, frozen spirulina serves as a high-quality food source for herbivorous and omnivorous tropical fish. Combining frozen spirulina with fresh seafood replicates the nutritional value of a natural diet, offering essential energy and nutrients to various fish species. Unlike other products, frozen spirulina retains its vitamins, fatty acids, and amino acids without the need for preservatives. This nutrient-rich blend supports easy digestion, reduces waste production and helps maintain cleaner aquarium environments.

As awareness of these benefits grows, the demand for fresh and frozen spirulina is increasing, creating new business opportunities for producers and stakeholders in the spirulina market.

Based on product type, the spirulina market is segmented into powder, tablets, capsules, flakes, phycocyanin, and frozen spirulina. In 2024, the powder segment is anticipated to dominate the spirulina market, with a share of 46.6%. The growing demand for spirulina powder among nutraceutical producers, the increasing use of spirulina powder in various food and beverages, the rising trend of veganism, and the increasing incorporation of herbal ingredients in cosmetic products are factors contributing to the segment’s dominant position in the market.

However, the phycocyanin segment is slated to record the highest CAGR of 27.5% during the forecast period. This growth is fueled by the rising incorporation of phycocyanin into medicinal formulations, increasing consumer preference for natural over artificial colorants, heightened demand for natural blue dyes, and substantial investments from major color companies in phycocyanin development.

Based on production techniques, the global spirulina market is segmented into ponds and other production techniques. In 2024, the ponds segment is anticipated to dominate the spirulina market. The widespread adoption of pond-based spirulina cultivation due to its simplicity, cost-efficiency, low investment requirements, minimal energy use, lower operational costs, and high biomass production contribute to the segment’s dominant position in the market.

Based on category, the spirulina market is segmented into non-organic and organic. In 2024, the non-organic spirulina segment is anticipated to dominate the spirulina market. The segment’s major share is due to the lower production costs associated with non-organic spirulina, which is produced through traditional cultivation methods. These conventional techniques generally lead to higher yields and improved availability, driving their increased adoption.

However, the organic spirulina segment is slated to record a higher CAGR during the forecast period of 2024–2031. The rising demand for organic spirulina in industries such as food and beverage and cosmetics, increased consumer awareness of the benefits of clean-label products, and a growing number of vegetarians are factors contributing to the growth of this market segment.

Based on distribution channel, the spirulina market is segmented into consumer channel (B2C) and business channel (B2B). In 2024, the business channel (B2B) segment is anticipated to dominate the spirulina market, with a share of 83.5%. The segment’s major share is due to the bulk purchasing of spirulina by producers in industries such as animal feed, food and beverage, and nutraceuticals. The direct procurement of high-quality spirulina from suppliers facilitates efficient supply chain management and maintains product consistency.

Moreover, the B2B segment is slated to record a higher CAGR during the forecast period of 2024–2031. This growth is fueled by the rising demand for spirulina in various industrial applications and the continuous research and development aimed at discovering new uses, such as biofuels.

Based on application, the global spirulina market is segmented into nutraceuticals, food & beverages, animal feed, cosmetics, and agriculture. In 2024, the nutraceuticals segment is anticipated to dominate the spirulina market, with a share of 50.4%. Growing consumer awareness about the connection between nutrition and health, rising health concerns among the aging population, and an increasing preference for natural alternatives to traditional pharmaceuticals are factors contributing to the segment’s dominant position in the market.

However, the food & beverages segment is slated to record a higher CAGR of 11.3% during the forecast period of 2024–2031. This growth is fueled by the increasing use of spirulina extract as a natural colorant across various food & beverage products. Spirulina’s global appeal as a dietary ingredient is also rising due to its availability, sustainability, outstanding nutritional and bioactive benefits, and functional qualities. Furthermore, the FDA has approved spirulina extract as a natural blue coloring agent for food and beverage products, further boosting its adoption.

Based on geography, the spirulina market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is anticipated to account for the major share of 51.1% of the spirulina market, followed by Asia-Pacific and Europe. The spirulina market in North America is anticipated to be worth USD 327.2 million in 2024. North America's major market share can be attributed to the rising awareness of the health benefits of consuming natural foods, stringent regulations on the use of artificial colors, the rising demand for nutraceuticals, the high preference for natural protein sources among consumers, and the presence of prominent spirulina producers with substantial production capabilities, especially in the U.S.

However, the market in Europe is slated to record the highest CAGR of 13.7% during the forecast period of 2024–2031. This growth is fueled by the shift towards natural colorants, an increased emphasis on preventive health measures, a rising consumption of functional foods, a growing demand for environmentally sustainable products, an increasing utilization of phycocyanin in health & nutrition, and significant investments from major color companies in Europe in phycocyanin production.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them over the past three to four years. The leading players in this market include Clos Sainte Aurore (France), SPIFORM (France), Spirulina La Capitelle (France), Aurospirul (India), Far East Microalgae Industries, Co., Ltd. (Taiwan), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), DIC Corporation (Japan), E.I.D. - Parry (India) Limited (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), Yunnan Green A Biological Project Co., Ltd. (a Subsidiary of Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan Comp Spirulina Co., Ltd (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals Co., Ltd. (China), Taiwan Chlorella Manufacturing Company (TCMC) (Taiwan), Roquette Klötze GmbH & Co. KG (Germany), Vedan Biotechnology Corporation (Taiwan), AlgoSource SA (France), Tianjin Norland Biotech Co., Ltd. (China), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), JUNE Spirulina (a Part of JUNE Group of Companies) (Myanmar), Ordos Xinyuli Spirulina Industry Group Co., Ltd. (China), Qingdao Haizhijiao Biotechnology Co., Ltd. (China), BlueBioTech Group (Germany), Sea & Sun Organic GmbH (subsidiary of Sea & Sun Technology GmbH) (Germany), Pond Technologies Inc. (Canada), Far East Bio-Tec. Co., Ltd. (FEBICO) (Taiwan), Givaudan SA (Switzerland), Nutragreenlife Biotechnology Co. Ltd. (branch of Greenlife Biotechnology Co., Ltd.) (China), Xi’an Fengzu Biological Technology Co., Ltd. (FZBIOTECH) (China), and Necton S.A. (Portugal).

|

Particulars |

Details |

|

Number of Pages |

293 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

9.4% |

|

Market Size (Value) |

USD 1.20 billion by 2031 |

|

CAGR (Volume) |

7.6% |

|

Market (Volume) |

108,824 Tons by 2031 |

|

Segments Covered |

By Product Type

By Production Technique

By Category

By Distribution Channel

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, U.K., Italy, Spain, Netherlands, Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Thailand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Egypt, Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa) |

|

Key Companies |

Clos Sainte Aurore (France), Spirulina Viva (Mexico), SPIFORM (France), Spirulina La Capitelle (France), Aurospirul (India), Far East Microalgae Industries, Co., Ltd. (Taiwan), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), DIC Corporation (Japan), E.I.D. - Parry (India) Limited (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), Yunnan Green A Biological Project Co., Ltd. (a Subsidiary of Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan Comp Spirulina Co., Ltd (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals Co., Ltd. (China), Taiwan Chlorella Manufacturing Company (TCMC) (Taiwan), Roquette Klötze GmbH & Co. KG (Germany), Vedan Biotechnology Corporation (Taiwan), AlgoSource SA (France), Tianjin Norland Biotech Co., Ltd. (China), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), JUNE Spirulina (a Part of JUNE Group of Companies) (Myanmar), Ordos Xinyuli Spirulina Industry Group Co., Ltd. (China), Qingdao Haizhijiao Biotechnology Co., Ltd. (China), BlueBioTech Group (Germany), Sea & Sun Organic GmbH (subsidiary of Sea & Sun Technology GmbH) (Germany), Pond Technologies Inc. (Canada), Far East Bio-Tec. Co., Ltd. (FEBICO) (Taiwan), Givaudan SA (Switzerland), Nutragreenlife Biotechnology Co. Ltd. (branch of Greenlife Biotechnology Co., Ltd.) (China), Xi’an Fengzu Biological Technology Co., Ltd. (FZBIOTECH) (China), and Necton S.A. (Portugal) |

The spirulina market study provides comprehensive insights, market sizes, and forecasts in terms of both value and volume for the product and geography market segments. However, it focuses solely on value-based insights, market sizes, and forecasts for the production technique, category, distribution channel, and application market segments.

The spirulina market is projected to reach $1.20 billion by 2031, at a CAGR of 9.4% during the forecast period.

In 2024, the powder segment is projected to hold the major share of the Spirulina market.

The food & beverages segment is slated to record the highest growth rate during the forecast period of 2024–2031.

Key factors driving the growth of this market include increasing consumer focus on health & wellness, the expanding dietary supplements industry, a shift towards natural food colorants, a growing vegetarian population, the environmental benefits of spirulina cultivation, strict regulations on the use of synthetic additives, and rising investments by natural color manufacturers in spirulina production.

Additionally, new application areas for spirulina, high demand for phycocyanin, rising utilization of spirulina in biorefineries, and growing interest in fresh/frozen spirulina are poised to offer significant growth opportunities for market players.

Some of the leading players in the spirulina market are Clos Sainte Aurore (France), Spirulina Viva (Mexico), SPIFORM (France), Spirulina La Capitelle (France), Aurospirul (India), Far East Microalgae Industries, Co., Ltd. (Taiwan), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), DIC Corporation (Japan), E.I.D. - Parry (India) Limited (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), Yunnan Green A Biological Project Co., Ltd. (a Subsidiary of Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan Comp Spirulina Co., Ltd (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals Co., Ltd. (China), Taiwan Chlorella Manufacturing Company (TCMC) (Taiwan), Roquette Klötze GmbH & Co. KG (Germany), Vedan Biotechnology Corporation (Taiwan), AlgoSource SA (France), Tianjin Norland Biotech Co., Ltd. (China), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), JUNE Spirulina (a Part of JUNE Group of Companies) (Myanmar), Ordos Xinyuli Spirulina Industry Group Co., Ltd. (China), Qingdao Haizhijiao Biotechnology Co., Ltd. (China), BlueBioTech Group (Germany), Sea & Sun Organic GmbH (subsidiary of Sea & Sun Technology GmbH) (Germany), Pond Technologies Inc. (Canada), Far East Bio-Tec. Co., Ltd. (FEBICO) (Taiwan), Givaudan SA (Switzerland), Nutragreenlife Biotechnology Co. Ltd. (branch of Greenlife Biotechnology Co., Ltd.) (China), Xi’an Fengzu Biological Technology Co., Ltd. (FZBIOTECH) (China), and Necton S.A. (Portugal).

The market in Europe is slated to record the highest growth rate during the forecast period, subsequently offering significant growth opportunities for vendors in this market.

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Apr-2023

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates