Resources

About Us

Plant-based Protein Market by Type (Soy Proteins, Wheat Proteins, Pea Proteins, Potato Proteins), Form (Solid, Liquid), Source Process (Conventional, Organic), and Application (Food and Beverages, Animal Feed, Nutritional Supplements) - Global Forecast to 2031

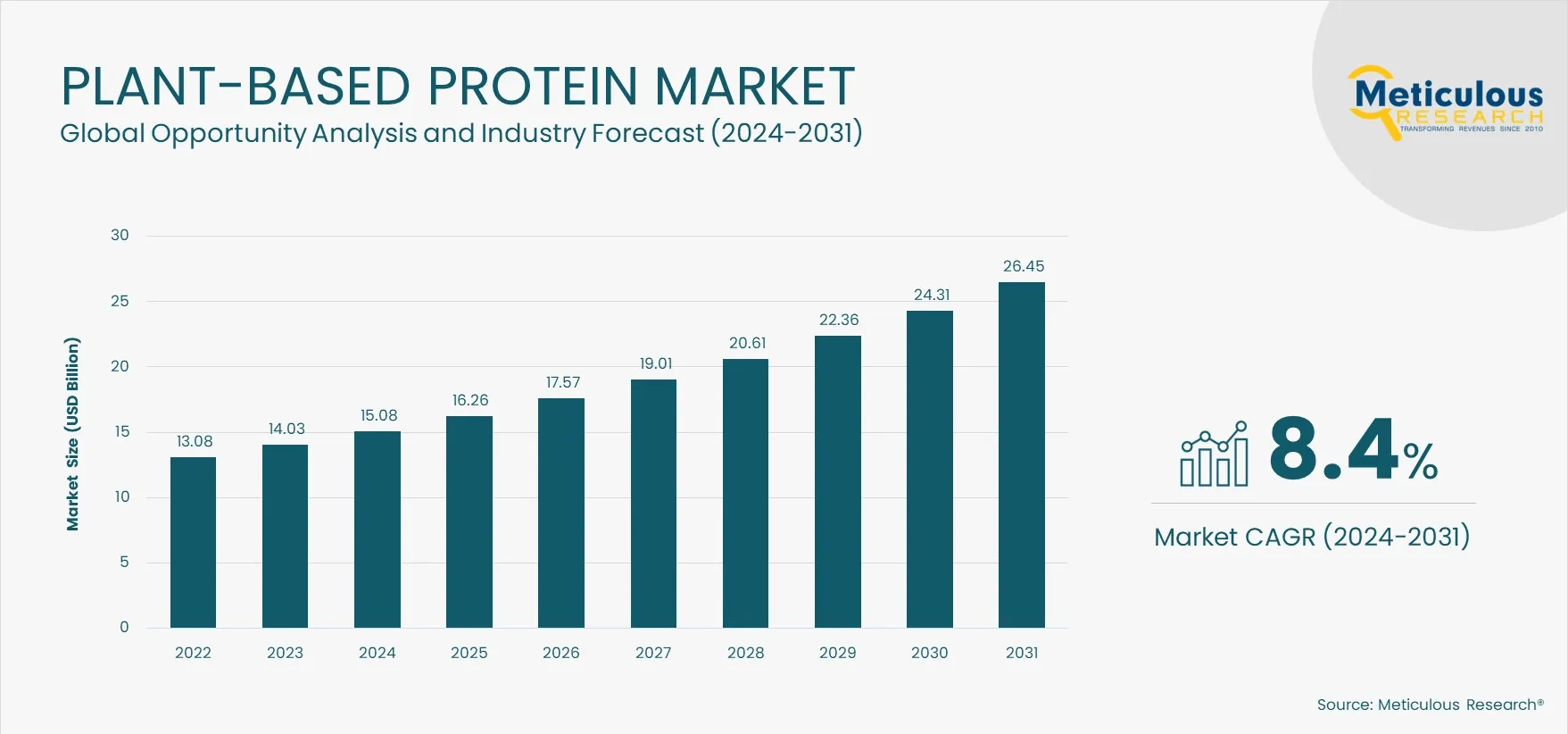

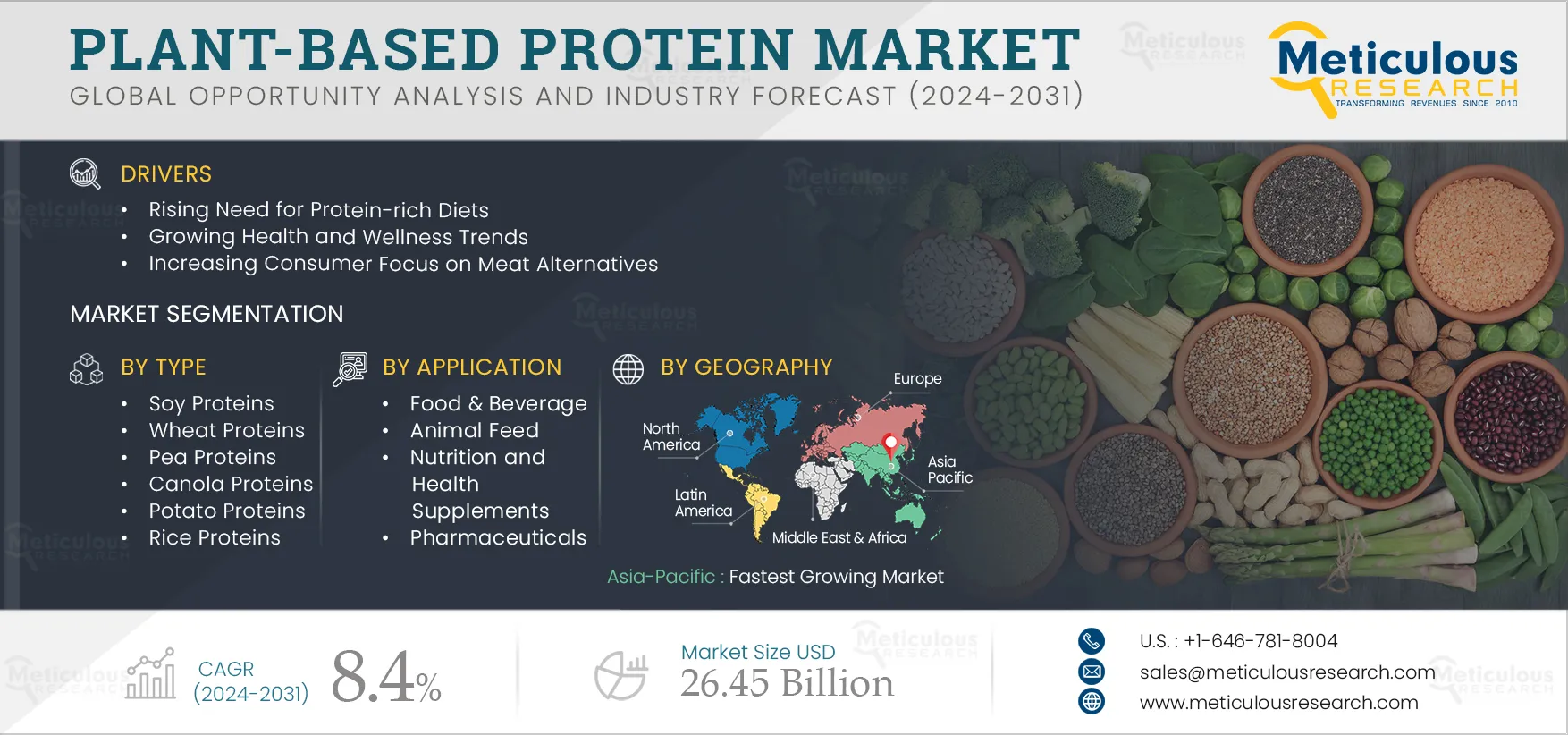

Report ID: MRFB - 104331 Pages: 588 Jan-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the plant-based proteins market is mainly driven by the rising need for protein-rich diets, growing health and wellness trends, increasing consumer focus on meat alternatives, rising demand from the food & beverage industry, and advancements in ingredient technologies, such as microencapsulation. However, the consumer preference for animal-based products and fluctuating raw material prices are expected to hinder the growth of this market.

Furthermore, consumers’ increasing inclination toward plant-based meats, emerging economies, and rising prevalence of intolerance to animal proteins are expected to generate growth opportunities for the players operating in the plant-based proteins market.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them in the last 3–4 years. Some of the key players operating in the global plant-based proteins market are Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances, Inc. (IFF) (U.S.), Now Health Group, Inc. (U.S.), Tate & Lyle Plc (U.K.), Axiom Foods Inc. (U.S.), AMCO Protein (U.S.), Burcon NutraScience Corporation (Canada), BENEO GmbH (A Part of Südzucker AG) (Germany), Glico Nutrition Co., Ltd (Japan), Glanbia Plc (Ireland), Cosucra Groupe Warcoing SA (Belgium), Sotexpro (France), Farbest-Tallman Foods Corporation (U.S.), Crespel & Deiters GmbH & Co. KG (Germany), Wilmar International (Singapore), and CHS Inc. (U.S.).

Well-being is becoming a global movement as consumers seek to ensure healthy lives for as long as possible—particularly as average life spans continue to rise. Diets and lifestyles have changed rapidly due to industrialization, urbanization, economic development, and globalization over the last decade, with a significant impact on the health and nutritional status of populations globally.

Standards of living have improved, food availability has expanded and become more diversified, and access to services has increased. Significant negative consequences have also been observed in terms of inappropriate dietary patterns, decreased physical activity, and a corresponding increase in diet-related chronic diseases, especially among people with low incomes. This has increased people’s focus on healthy living and boosted the demand for innovative H&W products and services. The health supplements market in China grew from USD 36.2 billion in 2020 to USD 44.4 billion in 2022, according to JD Health International Inc (China) and TMO Group (China). Four macroenvironmental trends are contributing to an increased focus on health and wellness: the aging global population, rising chronic disease incidence, a rise in self-care, treatment, and prevention, and increasingly educated & connected consumers.

Currently, the top three most appealing product claims or descriptions are ‘natural/all-natural,’ ‘no artificial ingredients,’ and ‘low or reduced fat/sugar/salt.’ Strong consumer demand and the desire for operational and distribution efficiencies are driving interest in food with simple and easy-to-understand ingredients. In addition, growing health awareness has increased the demand for food products that support better health, especially low-fat and cholesterol, protein-rich, and weight-control products. As a result, the number of foodstuffs containing plant proteins has grown distinctly in recent years. Also, ‘all-natural’ and ‘clean label’ trends in the food and beverage market are boosting the demand for natural ingredients such as plant-based proteins across food industries for the production of natural and clean-label products.

Thus, changing food preferences and increasing health consciousness among consumers are driving the growth of the plant-based proteins market.

Click here to: Get Free Sample Pages of this Report

Based on type, the global plant-based proteins market is segmented into soy proteins, wheat proteins, pea proteins, canola proteins, potato proteins, rice proteins, corn proteins, and other types. In 2024, the soy proteins segment is expected to account for the largest share of the global plant-based proteins market. The large market share of this segment is mainly attributed to its easy availability, lower price of soy protein than other protein sources, increased demand for meat protein alternatives, a wide range of applications in various products, greater consumer awareness, and multiple health benefits.

However, the pea protein segment is expected to record the fastest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to its nutritional qualities and its allergen-free, gluten-free, and lactose-free properties.

Based on form, the global plant-based proteins market is categorized into solid (dry) and liquid. In 2024, the solid segment is expected to account for the larger share of the global plant-based proteins market. The large market share of this segment is attributed to the increasing demand for powdered plant-based protein due to its benefits, such as ease of handling and transport, comparatively lower costs, low chances of formulation errors, and ingredient stability. This segment is also expected to register the highest CAGR during the forecast period.

Based on source process, the global plant-based proteins market is broadly segmented into conventional plant-based protein ingredients and organic plant-based protein ingredients. In 2024, the conventional plant-based protein ingredients segment is expected to account for the larger share of the global plant-based proteins market. However, the organic plant-based protein ingredients segment is expected to register the highest CAGR during the forecast period. The growth of this segment is mainly attributed to the increasing demand for preservative and additive-free products and the rising organic trend supporting the demand for eco-friendly, natural, and organic food products.

Based on application, the global plant-based proteins market is segmented into food & beverage, animal feed, nutrition & health supplements, pharmaceuticals, and other applications. In 2024, the food & beverage segment is expected to account for the largest share of the global plant-based proteins market. The large market share of this segment is mainly attributed to increasing consumer preference for plant-based foods and ingredients, growing awareness and demand for protein-rich food products, plant-based proteins' versatile functionality and compatibility with vegetarian and vegan lifestyles, and the rising clean-label trend.

Based on geography, the plant-based proteins market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of the global plant-based proteins market. The leading position of this region is primarily attributed to the well-established food and beverage industry, rising concerns over animal products and protein, increasing vegan population, growing preference for meat alternatives, and increasing demand for healthy & nutritional products and health & wellness trends.

However, the Asia-Pacific plant-based proteins market is expected to record the highest CAGR during the forecast period. The rapid growth of this region is mainly attributed to the increasing protein-rich diet awareness, increasing health consciousness, booming food & beverages industry, growing economy, rapid urbanization, and a large vegan population.

|

Particular |

Details |

|

Page No. |

588 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

8.4% |

|

Market Size (Value) |

USD 26.45 Billion |

|

Market Size (Volume) |

7,849,408 Tons |

|

Segments Covered |

By Type

By Form

By Source Process

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa. |

|

Key Companies |

Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances, Inc. (IFF) (U.S.), Now Health Group, Inc. (U.S.), Tate & Lyle Plc (U.K.), Axiom Foods Inc. (U.S.), AMCO Protein (U.S.), Burcon NutraScience Corporation (Canada), BENEO GmbH (A Part of Südzucker AG) (Germany), Glico Nutrition Co., Ltd (Japan), Glanbia Plc (Ireland), Cosucra Groupe Warcoing SA (Belgium), Sotexpro (France), Farbest-Tallman Foods Corporation (U.S.), Crespel & Deiters GmbH & Co. KG (Germany), Wilmar International (Singapore), and CHS Inc. (U.S.). |

The global plant-based proteins market is projected to reach $26.45 billion by 2031, at a CAGR of 8.4% during the forecast period.

The pea proteins segment is slated to register the highest growth rate during the forecast period, providing significant opportunities for players operating in this market.

The nutrition & health supplements segment is projected to record the highest CAGR during the forecast period of 2024–2031.

o Rising Need for Protein-rich Diets

o Growing Health and Wellness Trends

o Increasing Consumer Focus on Meat Alternatives

o Rising Demand for Plant Proteins in the Food & Beverage Industry

o Advancements in Ingredient Technologies, Such as Microencapsulation

o Consumer Preference for Animal-based Products

o Fluctuating Raw Material Prices

The key players operating in the global plant-based proteins market are Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances, Inc. (IFF) (U.S.), Now Health Group, Inc. (U.S.), Tate & Lyle Plc (U.K.), Axiom Foods Inc. (U.S.), AMCO Protein (U.S.), Burcon NutraScience Corporation (Canada), BENEO GmbH (A Part of Südzucker AG) (Germany), Glico Nutrition Co., Ltd (Japan), Glanbia Plc (Ireland), Cosucra Groupe Warcoing SA (Belgium), Sotexpro (France), Farbest-Tallman Foods Corporation (U.S.), Crespel & Deiters GmbH & Co. KG (Germany), Wilmar International (Singapore), and CHS Inc. (U.S.).

Asia-Pacific is expected to record the fastest growth rate during the forecast period of 2024–2031. The rapid growth of this region is mainly attributed to the increasing protein-rich diet awareness, increasing health consciousness, booming food & beverages industry, growing economy, rapid urbanization, and a large vegan population.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates