Resources

About Us

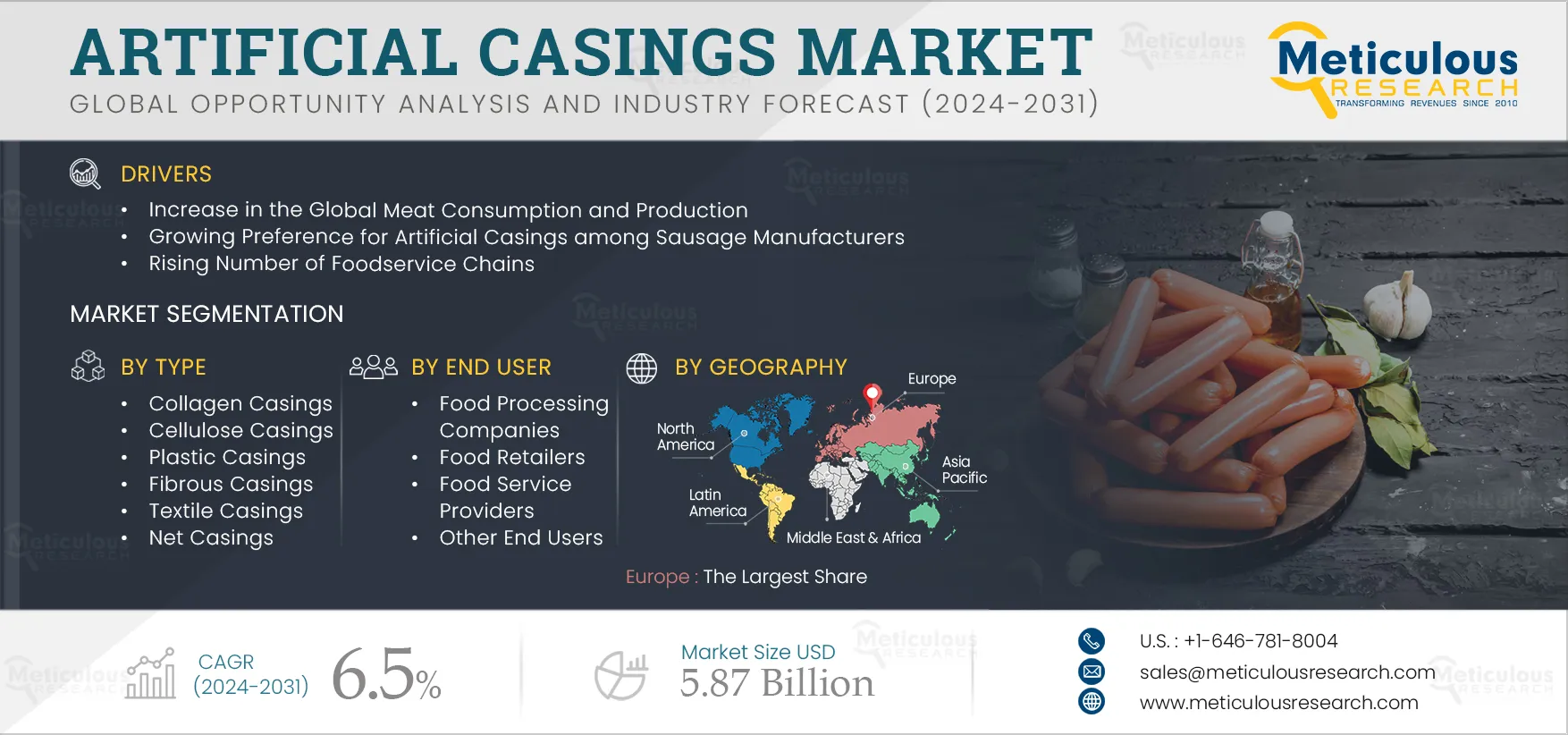

Artificial Casings Market Size, Share, Forecast, & Trends Analysis by Type (Collagen Casing, Vegetarian Casing), Application (Animal Meat Sausages, Vegan Sausages), Distribution Channel (Offline, Online), End User—Global Forecast to 2031

Report ID: MRFB - 104335 Pages: 270 Nov-2025 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is driven by the increase in global meat consumption and production, growing preference for artificial casings among sausage manufacturers, casings manufacturers’ shift from natural casings to artificial casings due to operational challenges, and the rising number of food service chains. In addition, the emerging economies of Southeast Asia, Latin America, and Africa and the surge in the demand for vegetarian sausage casings are expected to create lucrative opportunities for players operating in this market.

However, factors such as consumers' high preference for natural sausage casings over artificial sausage casings are expected to significantly hinder the growth of this market.

Click here to: Get Free Sample Pages of this Report

The growth in the global population, especially the urban population, is playing a key role in boosting the use of artificial casings globally. According to the Department of Economic and Social Affairs of the United Nations (UN DESA), the world population reached 8.1 billion in 2023, an increase of around one billion over 2013. The global population is projected to increase further, to reach 8.5 billion by 2030, 9.7 billion by 2050, and 11.2 billion by 2100. Moreover, according to the World Health Organization, the urban population accounted for 57% of the total global population in 2023, up from 55% in 2014, and continues to grow further. The global urban population grew by approximately 1.84% per year between 2015 and 2020 and is expected to grow by 1.63% per year between 2020 and 2025 and 1.44% per year between 2025 and 2030. Urban consumers have a much wider choice and better availability of sausages than consumers living in rural areas. Urbanization is characterized by improved living standards and rising incomes which influence the affordability of sausages and processed meat products to a great extent.

This rise in the global population has led to a significant increase in meat and sausage consumption and production globally. Moreover, according to data from the OECD-FAO Agricultural Outlook 2023–2033, the global consumption of meat is projected to increase by 12% by 2033 compared to the base period 2021–2023, driven largely by income and population growth. Protein availability from beef, pork, poultry, and sheep meat is projected to grow by 8%, 9%, 21%, and 3%, respectively, from 2023 to 2033. Much of the increase in global meat production is attributed to the U.S.; however, Argentina, India, Mexico, the Russian Federation, and Turkey are also major contributors. In addition, per capita global meat consumption is expected to increase by 2% to reach 28.6 kg RWE (retail weight equivalent) by 2033 from 2023. The rising meat production and consumption are impacting the demand for artificial casings such as collagen casings, cellulose casings, plastic casings, and fibrous casings due to the increased manufacture of sausages globally.

For decades, sausages have been prepared by stuffing meat into natural casings made from the intestines of animals; however, artificial casings are now available in the market due to the tremendous focus on innovation and product development in the casings industry. Natural sausage casings are irregular in size and shape, whereas artificial casings come in different shapes and sizes. If natural sausage casings are not stored properly, they tend to smell bad, making them unusable. Also, the possibility of breakage and microbial contamination is much higher with natural casings compared to artificial casings. In addition, artificial casings may contain coloring agents, spices, smoke flavoring, and other materials that accumulate on the product surface after stuffing and processing, adding taste and texture to the product. The variety offered by artificial casings is almost unlimited.

Furthermore, the cost benefits of using artificial casings, especially collagen casings for sausage manufacturers, can be substantial, with significant savings in time and labor costs, as collagen casing is easy to work with due to its better consistency and stability compared to natural casings. Artificial casings help sausage manufacturers save costs significantly—over 50% in some cases. Also, unlike natural casings, collagen casings are ready for use, and soaking or other preparation is not required. Collagen casings are particularly effective when sausages are filled mechanically with conventional stuffing machines, as the casings are replenished automatically. This factor helps reduce throughput times. These advantages of artificial casings over natural casings have increased their adoption among sausage manufacturers, driving the growth of the artificial casings market.

Due to health concerns, ethics, and the need for sustainability, diets are changing across the globe. While only 6% of Americans are vegetarian and 3% vegan, almost 40% are inclined toward eating plant-based foods (Source: American Vegan Society). The rapid growth in urbanization, changing lifestyles, increasing industrialization, economic development, health & wellness trends, and rising consumer awareness about the health concerns originating from the long-term use of animal proteins have created immense growth opportunities for the manufacturers of plant-based protein products. This traction in the plant-based protein products market is also supported by food security challenges. In 2022, the Mediterranean Diet (a meal pattern with a high proportion of plant-based foods) was ranked the ‘Best Overall Diet’ in the U.S. News & World Report.

Furthermore, there has been significant growth in vegetarianism and veganism across the globe due to increasing health awareness, environmental concerns, and compassion for animals. According to the Good Food Institute, U.S., retail sales of plant-based foods reached $8.1 billion in 2023, up from $5.5 billion in 2019. Plant-based meat and seafood is a rapidly growing segment, with retail sales reaching $1.24 billion in 2023. According to vegan statistics (2022), more than 40% of people in the U.S. are adding more vegan options to their daily food intake. In 2022, 42% of millennials identified as vegan, and baby boomers and Generation X accounted for 21% each, with only 2.5% of seniors labeling themselves vegan. Plant-based foods have gained tremendous popularity among consumers. Planned vegetarian and vegan diets are nutritionally adequate for everyone, from pregnant women to children and athletes. Plant-based diets reduce the risk of health conditions, such as heart disease, type 2 diabetes, hypertension, certain types of cancer, and obesity. Plant-based diets are high in fiber and provide all the necessary nutrients when planned well.

The growing vegan population and health benefits offered by plant-based products support the demand for plant-based foods. This presents growth opportunities for leading meat producers to expand their existing product portfolios with vegan sausages and meat alternatives, which is expected to drive the demand for vegetarian artificial casings.

Based on type, the artificial casings market is segmented into collagen casings, cellulose casings, plastic casings, fibrous casings, textile casings, net casings, and vegetarian casings. In 2024, the collagen casings segment is expected to account for the largest share of 42.9% of the market. Collagen casings can be produced at lower costs than other artificial sausage casings as they can be produced in a short span with less labor engagement. In addition, collagen casings are edible and offer standard diameter, uniformity, and strength.

However, the vegetarian casings segment is projected to record the highest CAGR of 9.4% during the forecast period. This segment's growth is driven by advancements in food technology, rising cases of allergy to animal protein, increasing investments in plant-based companies, and growing vegetarian and vegan populations.

Based on application, the artificial casings market is segmented into animal-based sausages and plant-based sausages. In 2024, the animal-based sausages segment is expected to account for the largest share of the market. This segment’s large market share is primarily attributed to the heightening consumption of meat, the high acceptance of collagen casings, and increased consumer preference for a protein-rich diet.

However, the plant-based sausages segment is anticipated to register the highest CAGR during the forecast period. The growth of this segment is driven by the changing consumer preference for healthy, flavorsome, sustainable, and environment-friendly sausage options.

Based on distribution channel, the artificial casings market is segmented into offline and online. In 2024, the offline segment is expected to account for a larger share of 84.3% of the artificial casings market. This segment's large market share is primarily attributed to factors such as the availability of a wide range of food products and the modernization of grocery stores to enhance the shopping experience.

However, the online segment is anticipated to register the highest CAGR of 8.6% during the forecast period. This segment's growth is driven by convenience and cost-effectiveness, increasing internet and smartphone penetration, and rising disposable income.

Based on end user, the artificial casings market is segmented into food-processing companies, food service providers, food retailers, and other end users. In 2024, the food-processing companies segment is expected to dominate the market. The increasing consumer preference for sausages has spurred bulk manufacturing. This is also propelling the demand for artificial casings. Moreover, the growing consumer demand for modern food options and the integration of automation in sausage manufacturing to maximize output augments this segment's market growth.

However, the food service providers segment is anticipated to register the highest CAGR during the forecast period. This segment's growth is driven by the growing demand for cooked meals due to the hectic routine of the employed population and expanding distribution channels of food service providers.

Based on geography, the artificial casings market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Europe is expected to hold the largest share of 30.8% of the artificial casings market. The market in Europe is estimated to be worth $1.16 billion in 2024. The growth of this regional market is attributed to the demand for artificial sausage casings from leading sausage manufacturers in the region for food integrity and safety, the expanding meat processing industry, and the increased average meat consumption.

However, the Asia-Pacific region is expected to record the fastest CAGR of 8.1% during the forecast period. This segment's rapid growth is due to the increasing demand for fast food outlets and the growing consumption of cross-cultural food.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the artificial casings market are Viscofan, S.A. (Spain), SARIA SE & Co. KG (Germany), Selo B.V. (Netherlands), Shenguan Holdings (Group) Limited (China), DAT-Schaub Group (Part of Danish Crown AmbA) (Denmark), ViskoTeepak Holding Ab Ltd (Finland), Fibran S.A. (Spain), Viskase Companies, Inc. (U.S.), Nippi. Inc. (Japan), FABIOS S.A. (Poland), Kalle GmbH (Germany), Oversea Casing Company (U.S.), Nutra Produkte AG (Switzerland), Ruitenberg Ingredients B.V. (Netherlands), and Ennio International (Australia).

|

Particulars |

Details |

|

Number of Pages |

270 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.5% |

|

Market Size (Value) |

$5.87 Billion by 2031 |

|

Segments Covered |

By Type

By Application

By Distribution Channel

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Poland, Netherlands, Russia, Austria, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Chile, Argentina, Colombia, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa) |

|

Key Companies |

Viscofan, S.A. (Spain), SARIA SE & Co. KG (Germany), Selo B.V. (Netherlands), Shenguan Holdings (Group) Limited (China), DAT-Schaub Group (Part of Danish Crown AmbA) (Denmark), ViskoTeepak Holding Ab Ltd (Finland), Fibran S.A. (Spain), Viskase Companies, Inc. (U.S.), Nippi. Inc. (Japan), FABIOS S.A. (Poland), Kalle GmbH (Germany), Oversea Casing Company (U.S.), Nutra Produkte AG (Switzerland), Ruitenberg Ingredients B.V. (Netherlands), and Ennio International (Australia). |

This study focuses on market analysis and opportunity assessment based on the sales of artificial casings across various countries, regions, and market segments. The study also includes a competitive analysis based on key market players’ product portfolios, geographic presence, and growth strategies adopted in the last 3 to 4 years.

The artificial casings market study provides valuable insights, market sizes, and forecasts in terms of both value and volume by type and geography. However, the study provides insights, market sizes, and forecasts only in terms of value based on application, distribution channel, and end user.

The artificial casings market is projected to reach $5.87 billion by 2031, at a CAGR of 6.5% during the forecast period.

In 2024, the collagen casings segment is expected to hold a major share of the artificial casings market.

The plant-based sausages segment is expected to witness the fastest growth during the forecast period of 2024–2031.

In 2024, the offline segment is expected to hold a major share of the artificial casings market.

The food service providers segment is expected to witness the fastest growth during the forecast period.

The increase in global meat consumption and production, growing preference for artificial casings among sausage manufacturers, casings manufacturers’ shift from natural casings to artificial casings due to operational challenges, and rising number of foodservice chains are the key factors supporting the growth of this market. Moreover, the developing countries in Southeast Asia, Latin America, and Africa and the emergence of vegetarian sausage casings create opportunities for players operating in this market.

The key players operating in the artificial casings market are Viscofan, S.A. (Spain), SARIA SE & Co. KG (Germany), Selo B.V. (Netherlands), Shenguan Holdings (Group) Limited (China), DAT-Schaub Group (Part of Danish Crown AmbA) (Denmark), ViskoTeepak Holding Ab Ltd (Finland), Fibran S.A. (Spain), Viskase Companies, Inc. (U.S.), Nippi. Inc. (Japan), FABIOS S.A. (Poland), Kalle GmbH (Germany), Oversea Casing Company (U.S.), and Nutra Produkte AG (Switzerland).

Asia-Pacific is expected to witness significant growth during the forecast period, mainly due to factors such as the increasing demand for fast food, rising expenditure on processed products, growing westernization culture, and growing population and urbanization.

Published Date: Jul-2024

Published Date: Aug-2023

Published Date: Feb-2023

Published Date: Sep-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates