Resources

About Us

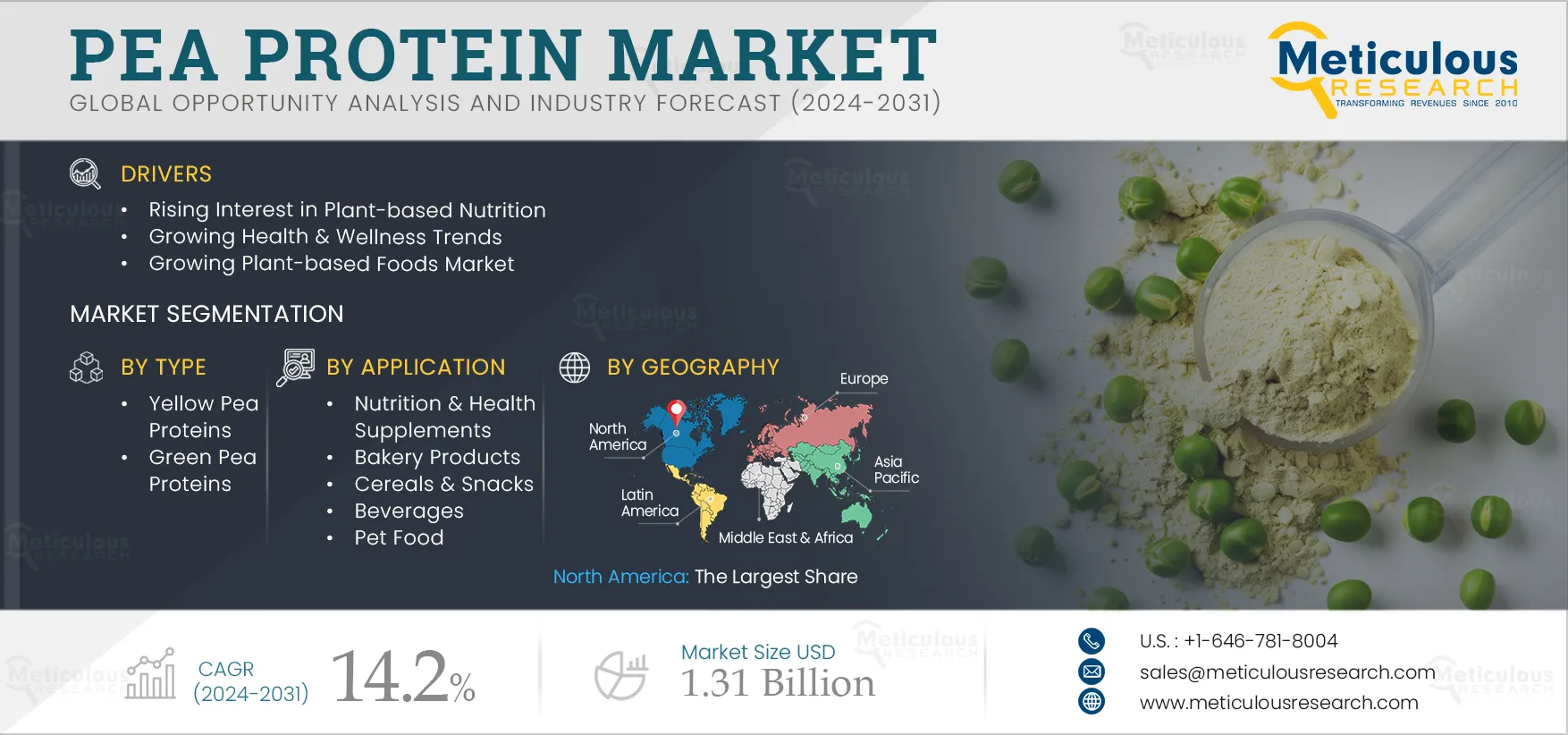

Pea Protein Market Size, Share, Forecast & Trends Analysis by Type (Yellow, Green Pea Protein), Source (Conventional, Organic), Processing Method (Dry, Wet Processing), Form (Solid, Liquid), Application (Nutrition, Bakery Products) - Global Forecast to 2031

Report ID: MRFB - 104355 Pages: 198 Aug-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market can be attributed to the rising preference for plant-based nutrition, the growing health and wellness trends, the growing plant-based food market, the growing consumer awareness regarding the nutritional benefits offered by pea-based products, and the growing focus of key players on the development of innovative pea protein ingredients.

However, the high preference for animal-based protein restrains the market’s growth.

Moreover, emerging economies and innovation & enhancements in the new launches of pea protein-based products are expected to offer growth opportunities for the players operating in this market. However, consumer preference for other plant proteins over pea protein poses challenges to the market's growth.

Pea protein, with its ability to enhance the nutritional and functional properties of food & beverage products, is a promising ingredient. It is gaining traction as a preferred alternative to traditional proteins like animal, wheat, and soy proteins. Its versatility, sustainability, availability, affordability, and hypoallergenic properties make it a compelling choice over other protein ingredients. The key to successful pea protein processing lies in striking the right balance between gentle handling and effective extraction, ensuring the purity of the final product while maximizing yield.

The purification or extraction process involves separating protein from non-protein components and isolating the target protein from other proteins. It is also crucial to minimize energy & water use, control costs, and reduce the environmental impact. Pea protein ingredients can be produced through wet extraction, dry fractionation, or mild fractionation. Commercial pea protein products include flour (20-25% protein), concentrate (50-75% protein), and isolate (more than 80% protein).

Apart from protein content, these ingredients vary in their chemical composition, which influences their functionality.

Click here to: Get Free Sample Pages of this Report

Recent advancements in pea protein ingredients have significantly enhanced their performance and reliability in the food industry. Innovations in processing technologies have improved the purity and functionality of pea proteins, making them more effective as a plant-based alternative in various applications. These developments also ensure a more stable and consistent supply, addressing previous concerns about sourcing and availability. To align with consumer expectations for plant-based protein ingredients, manufacturers are focused on developing products with pea protein as an ingredient. Overall, these improvements support the broader adoption of pea proteins in both mainstream and specialty food products.

As the pea protein market continues to evolve, plant protein manufacturers are expanding their production capabilities to include pea protein products. For instance, in February 2024, Louis Dreyfus Company (LDC) announced plans to build a new pea protein isolate production facility at its existing industrial complex in Saskatchewan, Canada, as part of its Plant Proteins division.

Also, in November 2021, Roquette (France) established a pea protein processing plant in Manitoba, Canada, to address the growing demand for alternative protein ingredients. The 200,000-square-foot facility is designed to process 125,000 tons of yellow peas annually.

In July 2024, Ingredion Incorporated (U.S.) introduced Vitessence Pea 100 HD, a pea protein specifically designed for cold-pressed bars. This ingredient enhances the softness of cold-pressed bars throughout their shelf life, meets desired texture and sensory qualities, and increases nutritional value to enhance consumer appeal.

Additionally, in October 2022, Roquette Frères (France) launched a new range of organic pea ingredients, including organic pea protein, to meet the growing demand for organic plant-based products.

Such developments are driving the growth of the pea protein market.

Health & wellness have emerged as a global movement, with more individuals seeking to maintain healthy lives to improve life expectancy. Over the last decade, industrialization, urbanization, economic development, and globalization have rapidly driven changes in diets and lifestyles. These factors have significantly influenced the health and nutritional status of the general population, particularly in developing countries.

Living standards have improved, resulting in greater food availability and diversity. Access to services has increased, and there is a growing awareness regarding the negative impacts of poor dietary habits, reduced physical activity, and diet-related chronic diseases. Consequently, consumers are becoming more proactive about healthy living with a rising demand for innovative health & wellness products and services. According to a 2023 study by Ingredion Inc. (Chicago), 78% of surveyed consumers were willing to pay a premium for clean labels containing natural, organic, or non-artificial ingredients.

The top three preferred ingredient descriptions in products are ‘natural/all-natural,’ ‘no artificial ingredients,’ and ‘low or reduced fat/sugar/salt.

Rising health awareness among consumers has increased the demand for food products offering health benefits, particularly those that are low-fat, cholesterol-free, high-protein, and beneficial for weight management. Consequently, the availability of food products containing pea proteins has significantly increased in recent years.

Moreover, growth in the ‘all natural’ and ‘clean label’ trends is driving the demand for natural ingredients such as plant-based proteins.

Thus, the changing food preferences and increasing health consciousness among consumers are driving the growth of the pea protein market.

Several emerging economies in Southeast Asia, the Middle East & Africa, and Latin America have witnessed rapid & significant changes in food consumption levels and patterns in recent years. This shift is primarily attributed to the increasing availability of food sources and the growing health & wellness trends. Rising living standards, the growing demand for functional foods, and increasing per capita incomes are driving the demand for plant-based proteins in these regions.

The growth of the pea protein market is largely driven by urbanization and population growth in Asia and Africa. According to the United Nations Department of Economic and Social Affairs (UN DESA), the most significant urban growth is expected in India, China, and Nigeria, representing 35% of the projected increase in the global urban population from 2019 to 2050. By 2050, India is anticipated to add 416 million urban residents, while China is 255 million, and Nigeria is 189 million. People living in urban areas have access to a wider choice and availability, which supports the adoption of pea protein products.

Leading pea protein manufacturers are actively investing and expanding their operations. These initiatives are set to boost production capacity and extend market reach, allowing them to capitalize on opportunities in emerging markets such as Southeast Asia, Latin America, and the Middle East & Africa.

In October 2021, Roquette established a new pea protein plant in Portage La Prairie, Manitoba, Canada, to strengthen its global supply capacity.

In December 2022, Burson’s joint venture company, Merit Functional Foods Corporation (Canada), launched its first USDA Certified Organic pea protein ingredient, Organic Peazazz C 850.

Such developments are expected to drive the market growth.

Based on type, the pea protein market is segmented into yellow pea proteins and green pea proteins. In 2024, the yellow pea proteins segment is expected to account for the larger share of 94.7% of the pea protein market. The large market share of this segment is attributed to the high protein content of yellow peas, the role of yellow pea protein as a key constituent of pea protein isolates, and a larger production volume of yellow pea protein compared to green pea protein.

Additionally, this segment is projected to register the higher CAGR of 14.3% during the forecast period due to the versatility of yellow pea proteins in a wide array of applications in the F&B industry, especially as an alternative to meat products.

Based on source, the pea protein market is segmented into conventional pea protein and organic pea protein. In 2024, the conventional pea protein segment is expected to account for the larger share of the pea protein market. The large market share of this segment is attributed to the lower pricing of conventionally grown peas, the longer shelf life of conventional pea proteins, and the substantial availability of crop varieties.

However, the organic pea protein segment is projected to register the higher CAGR during the forecast period 2024–2031. The growth of this segment is driven by the growing demand for organic products with the rising trend of clean-label products and the increasing number of certified organic pea producing farms. The growing trend of clean-label products, as consumers opt for natural ingredients with fewer chemicals and additives, is driving the growth of the organic pea protein market. Consumers in developed countries are growing increasingly conscious of product specifications such as grass-fed, hormone-free, antibiotic-free, and organic.

Based on processing method, the pea protein market is segmented into dry processing and wet processing. In 2024, the dry processing segment is expected to account for the larger share of the pea protein market. The large market share of this segment is attributed to the low capital requirement for dry processing, lower energy and water consumption compared to wet extraction, and high demand for dry protein ingredients among food & beverage manufacturers. Dry processing involves drying, grinding, and milling whole or dehulled peas to separate protein and starch fractions. This is achieved by using air streams to sort the components based on their mass and particle sizes.

However, the wet processing segment is projected to register the higher CAGR during the forecast period as this process helps obtain higher yield and purity than the dry processing method.

Based on form, the pea protein market is segmented into solid and liquid. In 2024, the solid segment is expected to account for the larger share of the pea protein market. The large market share of this segment is attributed to low bulk weight, ease of use, versatility in applications, higher stability, and potential for high production rates.

However, the liquid segment is projected to register the highest CAGR during the forecast period as liquid form helps to improve viscosity, mouthfeel, product stability, texture, and pleasant taste.

Based on application, the pea protein market is segmented into nutrition & health supplements, meat & meat alternatives, bakery products, dairy & dairy alternatives, cereals & snacks, beverages, pet food, and other applications. In 2024, the nutrition & health supplements segment is expected to account for the largest share of 36.4% of the pea protein market. The large market share of this segment is attributed to the increased demand for nutritious foods, the benefits of pea protein in increasing the nutritional content of processed food products and sports supplements, and growing health & wellness trends.

However, the meat & meat alternatives segment is projected to register the highest CAGR of 15.8% during the forecast period as the direct utilization of pea protein in the manufacture of meat products and meat alternatives has been increasing due to the global shortage of animal protein, the increasing consumer preference for meat substitutes is driven by concerns over animal disease contamination in meat products, the strong demand for wholesome and Halal food, and increasing veganism.

Based on geography, the pea protein market is segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of 42.4% of the pea protein market, followed by Europe and Asia-Pacific. North America's pea protein market is estimated to be worth $219.9 million in 2024. North America's large market share is attributed to the well-established food & beverage industry, increasing concerns over animal products and protein, growing vegan population, rising preference for meat alternatives, increasing demand for healthy & nutritional products, huge pea production, and strong presence of pea protein manufacturers in the region.

However, Asia-Pacific is projected to register the highest growth rate of 16.0% during the forecast period. The growth of this regional market is driven by the increasing awareness of protein-rich food, rising health consciousness, the profiting food & beverage industry, rapid urbanization, growing veganism, and food & beverage manufacturers’ focus on launching products fortified with pea protein.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the leading players operating in the pea protein market are Roquette Freres (France), AGT Food and Ingredients Inc. (Canada), Cargill, Inc (U.S.), Ingredion Incorporated (U.S.), Archer Daniels Midland Company (U.S.), Axiom Foods Inc. (U.S.), Burcon NutraScience Corporation (Canada), Glanbia Plc. (Ireland), Cosucra Groupe Warcoing SA (Belgium), Sotexpro Sa (a part of GEMEF Industries) (France), Farbest-Tallman Foods Corporation (U.S.), Shandong Jianyuan Foods Co., Ltd. (China), The Emsland Group (Germany), and Nutri-Pea Ltd. (Canada).

|

Particulars |

Details |

|

Number of Pages |

198 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

14.2% |

|

Market Size (Value) |

$1.31 Billion by 2031 |

|

Segments Covered |

By Type

By Source

By Processing Method

By Form

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Roquette Freres (France), AGT Food and Ingredients Inc. (Canada), Cargill, Inc (U.S.), Ingredion Incorporated (U.S.), Archer-Daniels-Midland Company (U.S.), Axiom Foods Inc. (U.S.), Burcon NutraScience Corporation (Canada), Glanbia Plc. (Ireland), Cosucra Groupe Warcoing SA (Belgium), Sotexpro Sa (a part of GEMEF Industries) (France), Farbest-Tallman Foods Corporation (U.S.), Shandong Jianyuan Foods Co., Ltd. (China), The Emsland Group (Germany), and Nutri-Pea Ltd. (Canada) |

The pea protein market study provides valuable insights, market sizes, and forecasts in terms of value and volume by type and geography. Moreover, the study provides market insights, market sizes, and forecasts in terms of value based on source, processing method, form, and application.

The pea protein market is projected to reach $1.31 billion by 2031, at a CAGR of 14.2% during the forecast period.

In 2024, the yellow pea protein segment is expected to account for the large share of this market.

The meat & meat alternative segment is expected to witness the fastest growth from 2024 to 2031.

The rising interest in plant-based nutrition, growing health & wellness trends, the expanding plant-based food market, rising consumer awareness regarding the nutritional benefits offered by pea and pea-based products, and the growing focus of key players on the development of innovative pea protein ingredients are supporting the growth of this market. Moreover, growth opportunities in emerging markets and the rising launches of pea protein-based products are likely to generate opportunities for the players operating in this market.

The key players operating in the pea protein market are Roquette Freres (France), AGT Food and Ingredients Inc. (Canada), Cargill, Incorporated (U.S.), Ingredion Incorporated (U.S.), Archer-Daniels-Midland Company (U.S.), Axiom Foods Inc. (U.S.), Burcon NutraScience Corporation (Canada), Glanbia Plc. (Ireland), Cosucra Groupe Warcoing SA (Belgium), Sotexpro Sa (a part of GEMEF Industries) (France), Farbest-Tallman Foods Corporation (U.S.), Shandong Jianyuan Foods Co., Ltd. (China), The Emsland Group (Germany), and Nutri-Pea Ltd. (Canada).

Asia-Pacific is projected to register the highest CAGR of 16.0% during the forecast period. This regional market’s growth is driven by the growing awareness of protein-rich diets, rising health consciousness, the booming growth of the food & beverage industry, rapid urbanization, a large vegan population, and new launches of products containing pea protein.

Published Date: Feb-2025

Published Date: Nov-2024

Published Date: Jan-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates