Resources

About Us

Microalgae Market Size, Share, Forecast, & Trends Analysis by Type (Spirulina, Chlorella, Dunaliella Salina, Nannochloropsis), Production Technique (Ponds, Fermenters, PBR), Distribution Channel (B2B), Application (Nutraceuticals)—Global Forecast to 2035

Report ID: MRFB - 104504 Pages: 264 Nov-2025 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportMicroalgae Market Size & Forecast

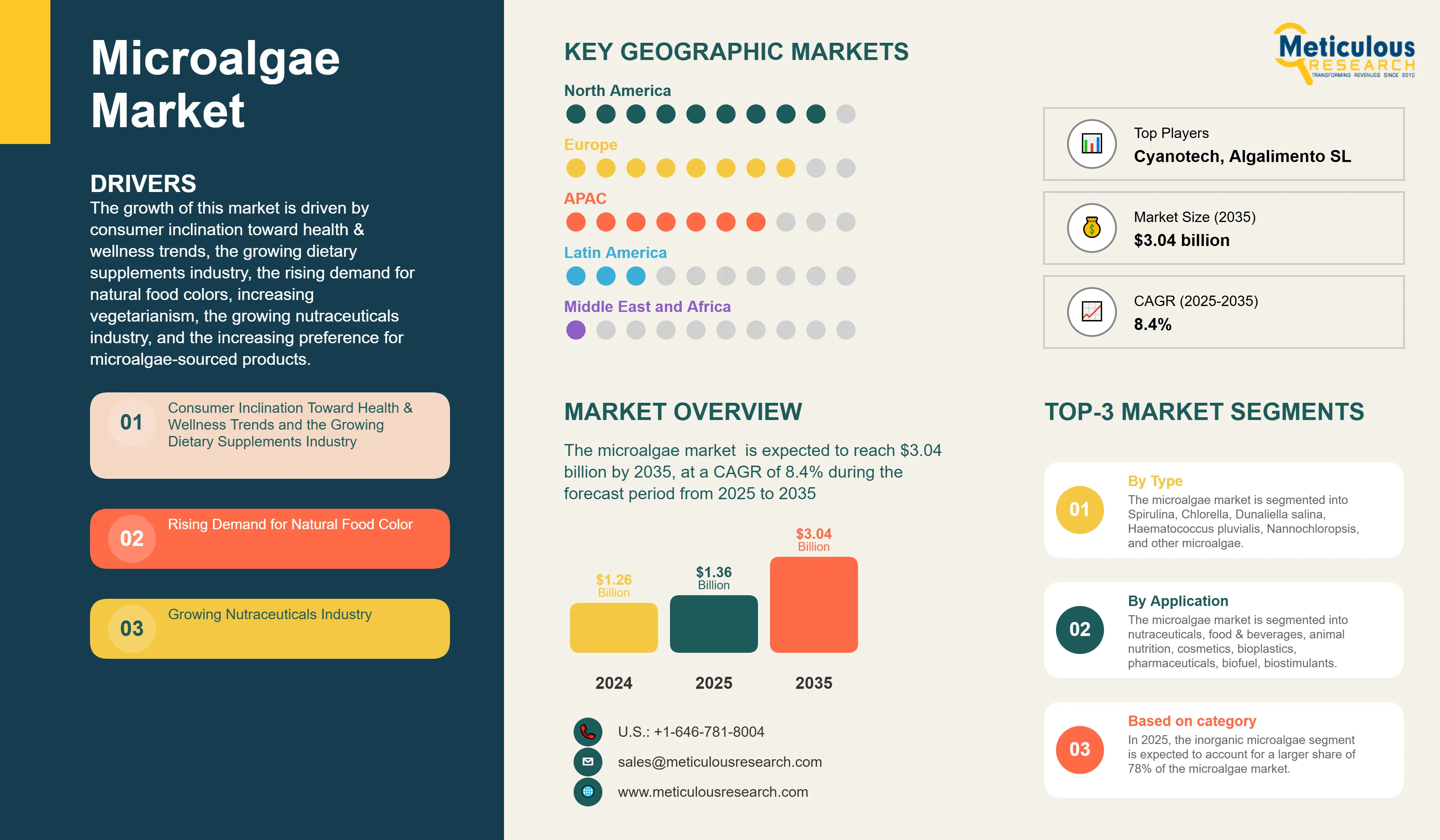

The microalgae market was valued at $1.26 billion in 2024. This market is expected to reach $3.04 billion by 2035 from an estimated $1.36 billion in 2025, at a CAGR of 8.4% during the forecast period from 2025 to 2035

The growth of this market is driven by consumer inclination toward health & wellness trends, the growing dietary supplements industry, the rising demand for natural food colors, increasing vegetarianism, the growing nutraceuticals industry, and the increasing preference for microalgae-sourced products. However, low awareness regarding the benefits of microalgae and the complexities in the production of algae products are expected to restrain the growth of this market.

The rising demand for phycocyanin and the growing demand for microalgae among biorefineries are expected to create market growth opportunities. However, contamination risks are a major challenge for the players operating in this market. Moreover, the growing adoption of new production technologies (photobioreactors) is a prominent trend in the microalgae market.

Click here to: Get Free Sample Pages of this Report

Rising Demand for Natural Food Colors

Nowadays, consumers have become more aware of health and environmental issues. As a result, they increasingly prefer naturally sourced colorants and dyes over synthetic alternatives. Microalgae are microscopic unicellular organisms that are major photosynthesizers that efficiently convert available solar energy into chemical energy. Due to their distinct advantages over terrestrial plants, such as faster growth rates, ability to grow on nonarable land, and diversity in the production of various natural bioactive compounds (e.g., lipids, proteins, carbohydrates, and pigments), microalgae are gradually being recognized as a sustainable source for the production of natural food-grade colorants.

Furthermore, consumers' rising health consciousness and inclination toward environment-friendly products are driving the demand for naturally grown food products across the globe. As a result, food manufacturers widely use natural food colors to restore the attractiveness of food & beverage products after processing. Also, in the U.S., the FDA has banned the use of any artificial color additives linked to cancer in either animal or human applications. All these factors are driving the adoption of natural food colors.

Spirulina has a blue-green color, provides bright, vivid blue and green shades, and hence, can be used in various types of confectionery and chewing gums. The USFDA has approved the use of phycocyanin as a natural colorant in food & beverage products. Hence, the demand for phycocyanin has risen dramatically, particularly in the Americas and Europe. The demand for spirulina, as a natural food color source, is high in the North American food processing industry. It is used in various applications, including beverages, dairy, confectionery, and other food segments such as frosting, ice cream, dry beverage mixes, yogurt, and gelatin.

Moreover, there are concerns about the safety of using synthetic astaxanthin for direct human consumption due to its different stereochemistry and the potential carryover of synthesis intermediates. These concerns make natural astaxanthin derived from the haematococcus pluvialis microalgae a preferred choice for high-end markets. Haematococcus pluvialis has already been approved as a color additive in salmon feeds and as a dietary supplement ingredient for human consumption in the U.S., Japan, and several European countries. However, it is not yet approved by the EFSA (European Food Safety Authority) for use in therapeutic applications.

Supercritical CO2 extracts from haematococcus pluvialis have been granted novel food status by the U.K. Food Standards Agency (FSA), while the FDA has granted astaxanthin from haematococcus pluvialis the GRAS (Generally Recognized as Safe) status. Thus, astaxanthin is a high-value product in the carotenoid marketplace and is also used as a pigmentation source for salmon, shrimp, trout, and poultry applications.

Thus, the rising demand for natural food colors drives the growth of the microalgae market.

Growing Nutraceuticals Industry

Consistent growth in the aging population, increased consumer awareness regarding preventative healthcare, the rising number of self-directed consumers (preferring self-diagnosis over health practitioner diagnosis), channel proliferation (variety of marketing techniques and eCommerce platforms), and the shift from ingredient-focused messaging to broader brand positioning (grouping of supplements together to form a healthy benefits package) are the key factors driving the growth of the supplements industry. The sales of vitamins, minerals, and nutritional & herbal supplements (VMHS) are growing globally.

According to recent market analysis, the global nutraceuticals market was valued at approximately USD 591 billion in 2024 and is projected to reach USD 919 billion by 2030, growing at a CAGR of 7.6%. This growth is mainly attributed to the increasing popularity of natural nutraceuticals. Also, natural nutraceuticals are cheaper compared to prescription drugs and more easily available.

Moreover, according to recent industry reports (2024-2025), the nutritional supplements industry continues to experience strong growth, driven by consumers' increasing preference for natural alternatives to nutraceuticals and functional foods and drinks. According to the International Trade Administration, India's nutraceutical industry is expected to hold at least 3.5% of the global market share in 2025. Therefore, the nutraceuticals market in India is expected to continue its robust growth trajectory through 2030. Thus, the growing nutraceuticals industry and the rising demand for natural supplements are expected to drive the microalgae market.

Furthermore, chlorella is one of the most scientifically researched algae, with many publications from medical & research institutions and universities. It is the best-selling health food supplement in Japan, with over 30% of the population consuming it as a principal health supplement. Chlorella has also been found to boost the immune system, reduce the intensity of many chronic health problems, and reduce the side effects of medications. Its detoxifying, nourishing, and revitalizing properties enable the body's natural defenses and repair systems to function more efficiently. Thus, the growing nutraceuticals industry is expected to boost the demand for microalgae, driving the growth of this market.

Microalgae Market Opportunity

Growing Demand for Microalgae Among Biorefineries

Microalgae biorefinery systems have been extensively studied regarding resources, energy expenditure, biofuel production potential, and high-value products. Among these, the genus Spirulina stands out for its commercial importance, representing over 30% of the global microalgae biomass production due to its high protein content and significant levels of carotenoids and phycocyanin. Additionally, Spirulina cultivation contributes to environmental benefits, such as reducing greenhouse gases and assisting in effluent treatment.

Biorefining is a process that sustainably converts biomass into value-added products and energy. The effectiveness of a biorefinery depends significantly on the choice of raw materials and the technologies used to produce these value-added products. Microalgae are considered a cost-effective raw material for this process due to their unique properties. Unlike terrestrial plants, microalgae do not have highly resistant cell walls, stems, or roots, which facilitates easier degradation.

The interest in using microalgae as a biofuel feedstock has increased in response to the energy crisis, climate change, and the depletion of natural resources. To enhance the economic viability of microalgae biofuels, it is crucial to maximize algal biomass production while reducing operational and maintenance costs. Achieving economically viable algal fuels will require at least another decade of research and development.

ExxonMobil partnered with Synthetic Genomics, Inc., with the goal of producing 10,000 barrels of algae-based fuels per day by 2025. While algal biofuels are not yet commercially feasible, several companies in the U.S., Europe, and other regions are already producing algal fuels on a commercial scale. In addition, Earthrise is engaged in research collaborations with major algae biofuel and bioproduct companies worldwide. The development of microalgal biofuels from microalgae is not economically feasible, given the overwhelming capital investments and operational costs. Hence, high-value co-products are produced by extracting a fraction of algae to improve the economics of a microalgae biorefinery.

Microalgae are considered living-cell factories with simple growth requirements due to their efficient sunlight utilization. Their potential for the production of energy and value-added products is widely recognized. The versatility and high potential of microalgae can support microalgae biorefineries and microalgae-based bio economies, creating opportunities for the players operating in this market.

Microalgae Market Analysis: Key Findings

The Spirulina Segment to Dominate the Microalgae Market in 2025

Based on type, the microalgae market is segmented into Spirulina, Chlorella, Dunaliella salina, Haematococcus pluvialis, Nannochloropsis, and other microalgae. In 2025, the spirulina segment is expected to account for the largest share of 50% of the microalgae market. The substantial market share of this segment is primarily driven by the escalating health and wellness trends, the expanding dietary supplements sector, and the rising demand for natural food colors. Additionally, the increasing prevalence of vegetarianism, stringent regulations on synthetic colors and flavors, and the growing concern over malnutrition contribute to this segment's growth. The heightened preference for Spirulina-based products, especially those rich in Omega-3 fatty acids, coupled with its growing application in aquaculture and substantial investments from major color companies, further bolster its market position. However, limited awareness of Spirulina's benefits and production challenges may somewhat impede the segment's growth.

However, the Haematococcus pluvialis segment is expected to register the highest CAGR of 13% during the forecast period. This segment's growth is attributed to the increasing demand for natural astaxanthin in nutraceuticals, natural food colorants, and awareness about clean-label products. Furthermore, the growing use of natural astaxanthin in poultry and aquaculture is further expected to support the growth of this market.

The Ponds Segment to Dominate the Microalgae Market in 2025

Based on production technique, the microalgae market is segmented into ponds, photobioreactors (PBR), and fermenters. In 2025, the ponds segment is expected to account for the largest share of the microalgae market. This segment’s large market share is primarily due to the large number of key players involved in the pond cultivation of microalgae. Open ponds, also known as raceway ponds, offer lower investment and operational costs, reduced energy expenses, and the potential for higher biomass production. These advantages are anticipated to further drive market growth.

However, the photobioreactors (PBR) segment is anticipated to register the highest CAGR of 10% during the forecast period due to the increasing demand for algal biomass across various sectors—such as nutraceuticals, pharmaceuticals, cosmetics, food and beverage, and biofuels—contributes to this market segment's growth. Additionally, the benefits of photobioreactor microalgae cultivation, including reduced susceptibility to species contamination, enhanced productivity, lower harvesting costs, decreased water and carbon dioxide losses, and improved control over cultivation conditions like temperature and pH, are expected to further support the growth of this segment.

The Inorganic Microalgae Segment to Witness High Demand During the Forecast Period

Based on category, the microalgae market is segmented into inorganic and organic. In 2025, the inorganic microalgae segment is expected to account for a larger share of 78% of the microalgae market. This segment’s large market share is primarily attributed to the cost-effective production and high availability of microalgae grown through traditional methods.

However, the organic microalgae segment is expected to record a higher CAGR during the forecast period. This segment's high growth is driven by the increasing demand for certified organic products in the food industry and the growing demand for natural food colorants. Furthermore, the increasing demand for organic growth media among microalgae manufacturers is expected to support its growth.

The Business Channel (B2B) Segment to Dominate the Microalgae Market in 2025

Based on distribution channel, the microalgae market is segmented into consumer channel (B2C) and business channel (B2B). In 2025, the business channel (B2B) segment is expected to account for a larger share of the microalgae market. The large market share of this segment is mainly attributed to the direct bulk purchasing of microalgae by manufacturers from various industries, such as nutraceuticals, food & beverage, and animal feed, for further product development.

The Nutraceuticals Segment to Dominate the Microalgae Market in 2025

Based on application, the microalgae market is segmented into nutraceuticals, food & beverages, animal nutrition, cosmetics, bioplastics, pharmaceuticals, biofuel, biostimulants. In 2025, the nutraceuticals segment is expected to account for the largest share of 54% of the microalgae market. The large market share of this segment is primarily attributed to the booming nutraceuticals sector, growing health concerns of the aging population worldwide, the rising need for natural alternatives for traditional pharmaceutical products, and increasing consumer awareness regarding the link between nutrition and health.

However, bioplastics is expected to be the fastest growing segment in the microalgae market, driven by stringent global regulations on fossil-based plastics and the rapid push toward sustainable, biodegradable alternatives. Microalgae-derived biopolymers, particularly PHA and PLA blends, are gaining strong traction as they offer lower environmental impact, reduced carbon emissions, and the potential to replace petroleum-based materials in packaging and consumer goods. While still relatively nascent in terms of commercial capacity, the segment is witnessing accelerated R&D investment, pilot-plant scale-ups, and collaborations between algae biomass producers and packaging manufacturers. As technological advancements reduce production costs and improve polymer yield, adoption is projected to rise rapidly, giving the bioplastics segment one of the highest growth rates within the overall microalgae application landscape.

Geographical Analysis

North America Dominates the Microalgae Market

Based on geography, the microalgae market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 43% of the microalgae market, followed by Asia-Pacific and Europe. The North American microalgae market is estimated to be worth USD 584 million in 2025. North America's significant market share can be attributed to several key factors, such as huge consumption of health supplements, stringent regulations against the use of synthetic colors, growth of subsidiary industries like cosmetics and biofertilizers, increasing preference for natural protein sources, and presence of key algae biomass manufacturers with huge production capacities, especially in the U.S.

However, Europe is expected to record the highest CAGR during the forecast period due to the increased adoption of microalgae, especially Spirulina and Chlorella, in the manufacturing of therapeutic & nutritional products, growing reluctance towards the usage of synthetic colors, rising demand for natural blue colorants, and investments from leading color stakeholders in the phycocyanin space.

Microalgae Market: Key Companies

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the microalgae market are Fuqing King Dnarmsa Spirulina Co., Ltd. (China), Earthrise Nutritionals, LLC, (U.S.), E.I.D. - PARRY (INDIA) LIMITED (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), YUNNAN GREEN A BIOLOGICAL PROJECT CO., LTD. (Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan COMP SPIRULINA CO., LTD. (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals CO., LTD. (China), Taiwan Chlorella Manufacturing Company(TCMC) (Taiwan), Sun Chlorella corporation (Japan), Roquette Klötze GmbH & Co. KG (Germany), Gong Bih Enterprise Co., Ltd. (Taiwan), Yaeyama Shokusan Co., Ltd. (Euglena Co Ltd) (Japan), Vedan Biotechnology Corporation (Taiwan), AlgoSource (France), Tianjin Norland Biotech CO., LTD (China), Phycom BV (Netherlands), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Daesang Corporation (Korea), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), and Shaanxi Rebecca Bio-Tech Co., Ltd (China).

Microalgae Industry Overview: Latest Developments from Key Industry Players

Microalgae Market Research Summary

|

Particulars |

Details |

|

Number of Pages |

258 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2025 |

|

CAGR (Value) |

8.4% |

|

Market Size (Value), 2025 |

USD 1.36 Billion |

|

Market Size (Value), 2035 |

USD 3.04 Billion |

|

CAGR (Volume) |

8.5% |

|

Market (Volume) |

1,61,503.7 tons by 2035 |

|

Segments Covered |

By Type

By Production Technique

By Category

By Distribution Channel

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (Egypt, Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa) |

|

Key Companies |

Fuqing King Dnarmsa Spirulina Co., Ltd. (China), Earthrise Nutritionals, LLC, (U.S.), E.I.D. - PARRY (INDIA) LIMITED (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), YUNNAN GREEN A BIOLOGICAL PROJECT CO., LTD. (Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan COMP SPIRULINA CO., LTD. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals CO., LTD. (China), Taiwan Chlorella Manufacturing Company(TCMC) (Taiwan), Sun Chlorella corporation (Japan), Roquette Klötze GmbH & Co. KG (Germany), Gong Bih Enterprise Co., Ltd. (Taiwan), Yaeyama Shokusan Co., Ltd. (Euglena Co Ltd) (Japan), Vedan Biotechnology Corporation (Taiwan), AlgoSource (France), Tianjin Norland Biotech CO., LTD (China), Phycom BV (Netherlands), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Daesang Corporation (Korea), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), and Shaanxi Rebecca Bio-Tech Co., Ltd (China) |

Microalgae, also known as microphytes, are microscopic algae found in marine systems and freshwater. They vary in shape and size, ranging from micrometers to hundred micrometers. Microalgae convert sunlight, carbon dioxide, and water into algal biomass. They impart high nutrition and comprise high-value compounds, including pigments, fatty acids, and antioxidants and are gaining popularity as a promising nutrient source.

The microalgae market study provides valuable insights, market sizes, and forecasts in terms of value and volume by type, and geography. However, the study provides insights, market sizes, and forecasts only in terms of value based on production technique, category, distribution channel, and application.

The microalgae market is projected to reach $3.04 billion by 2035, at a CAGR of 8.4% during the forecast period.

In 2025, the spirulina segment is expected to hold a major share of the microalgae market.

The bioplastic segment is expected to witness the fastest growth during the forecast period of 2025–2035.

The consumer inclination toward health & wellness trends and the growing dietary supplements industry, the rising demand for natural food colors, increasing vegetarianism, the growing nutraceuticals industry, and the increasing preference for microalgae-sourced products are the key factors supporting the growth of this market. Moreover, the rising demand for phycocyanin and the growing demand for microalgae among biorefineries create opportunities for players operating in this market.

The key players operating in the microalgae market are Fuqing King Dnarmsa Spirulina Co., Ltd. (China), Earthrise Nutritionals, LLC, (U.S.), E.I.D. - PARRY (INDIA) LIMITED (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), YUNNAN GREEN A BIOLOGICAL PROJECT CO., LTD. (Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan COMP SPIRULINA CO., LTD. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals CO., LTD. (China), Taiwan Chlorella Manufacturing Company(TCMC) (Taiwan), Sun Chlorella corporation (Japan), Roquette Klötze GmbH & Co. KG (Germany), Gong Bih Enterprise Co., Ltd. (Taiwan), Yaeyama Shokusan Co., Ltd. (Euglena Co Ltd) (Japan), Vedan Biotechnology Corporation (Taiwan), AlgoSource (France), Tianjin Norland Biotech CO., LTD (China), Phycom BV (Netherlands), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Daesang Corporation (Korea), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), and Shaanxi Rebecca Bio-Tech Co., Ltd (China).

Europe is expected to witness significant growth during the forecast period, mainly due to the increased adoption of microalgae, especially spirulina and Chlorella, in the manufacturing of therapeutic & nutritional products, growing reluctance towards the usage of synthetic colors, rising demand for natural blue colorants, and investments from leading color stakeholders in the phycocyanin space.

Published Date: Jan-2025

Published Date: Apr-2023

Published Date: Jan-2024

Published Date: Feb-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates