Resources

About Us

Smart Meter Market by Meter Type (Smart Electricity Meter, Smart Gas Meter, Smart Water Meter, Multi-Utility Smart Meter), Technology (AMI, AMR, MDM), Communication Technology (RF, PLC, Cellular, LPWAN, Wired/Ethernet), Component, Phase, End-User, and Geography—Global Forecast to 2035

Report ID: MREP - 1041611 Pages: 228 Oct-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Smart Meter Market Size?

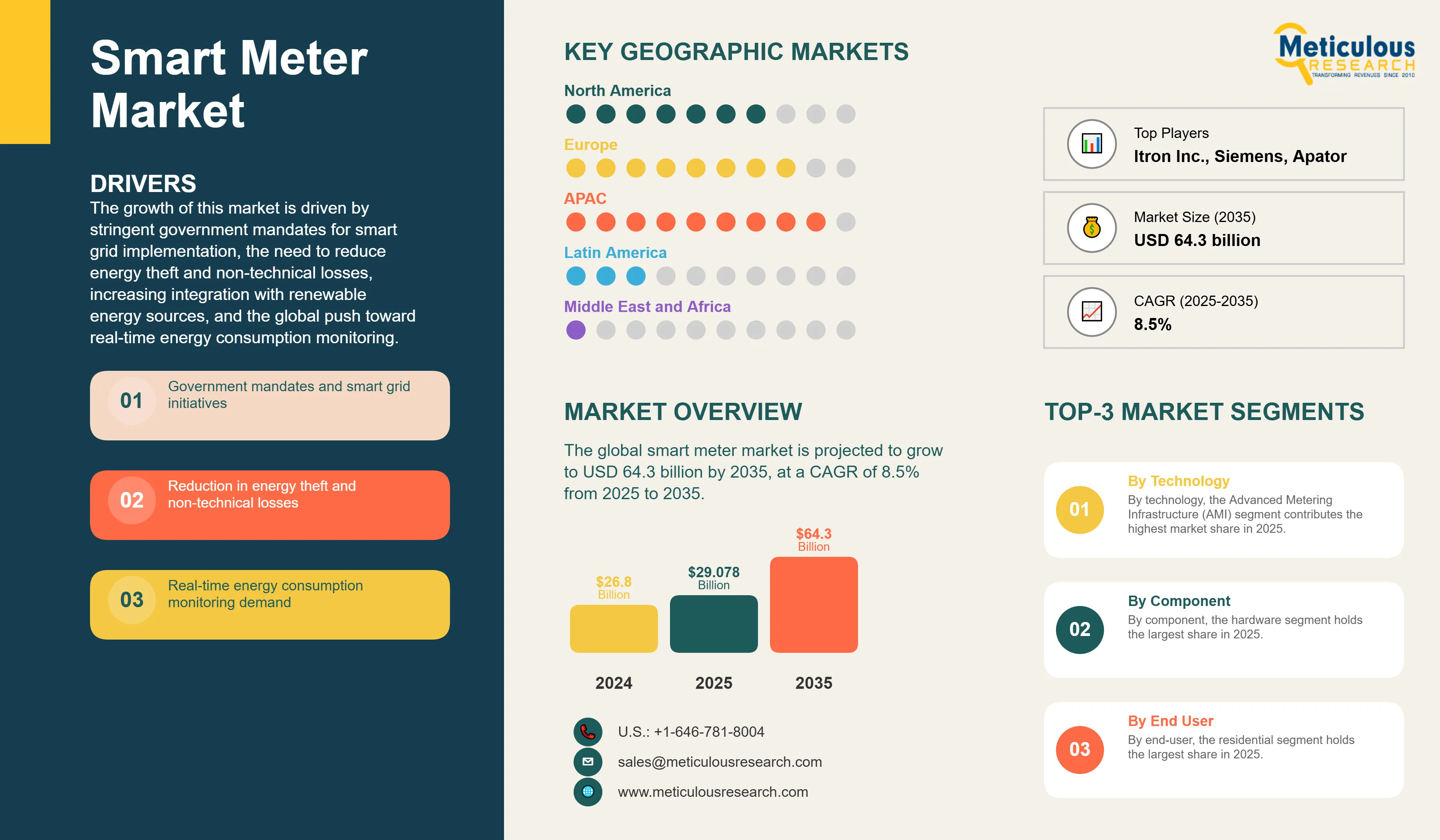

The global smart meter market was valued at USD 26.8 billion in 2024. This market is projected to grow to USD 64.3 billion by 2035, at a CAGR of 8.5% from 2025 to 2035. The growth of this market is driven by stringent government mandates for smart grid implementation, the need to reduce energy theft and non-technical losses, increasing integration with renewable energy sources, and the global push toward real-time energy consumption monitoring. The rapid deployment of Advanced Metering Infrastructure (AMI) across utilities, coupled with declining hardware costs and enhanced data analytics capabilities, is accelerating the adoption of smart meters worldwide.

Market Highlights: Smart Meter Market

Click here to: Get Free Sample Pages of this Report

The smart meter market involves the design, production, and management of digital meters that allow two-way data exchange between energy providers and consumers. Unlike traditional analog meters that need manual readings, smart meters automatically and continuously send data on electricity, gas, or water usage. They use technologies like radio frequency (RF), power line communication (PLC), cellular networks, and Low Power Wide Area Networks (LPWAN).

This market includes both hardware, such as meters, communication modules, data concentrators, and network infrastructure, and software, including Meter Data Management Systems (MDMS), Head-End Systems (HES), Customer Information Systems (CIS), and analytics platforms. Services involve installation, system integration, consulting, maintenance, and managed support.

Smart meters give utilities better grid monitoring, fault detection, prevention of energy theft, load management, and flexible pricing options. Consumers benefit from tracking their energy use in real time, which helps them participate in demand response programs and energy-saving efforts.

Market growth largely comes from government requirements for smart meter installations and the need to modernize grids to support distributed energy resources. Automated meter reading lowers utility costs and increases billing accuracy, while real-time data sharing boosts customer engagement. The integration of IoT platforms, AI-driven predictive analytics, and blockchain for peer-to-peer energy trading is creating new opportunities and speeding up market growth.

How is AI Transforming the Smart Meter Market?

Artificial intelligence is transforming the smart meter market by making energy management smarter and more efficient. AI analyzes large amounts of meter data to find problems, detect energy theft, predict equipment failures, and improve grid operations in real time. Machine learning helps with demand forecasting by recognizing consumption patterns, which allows utilities to manage load distribution better and lower peak demand charges.

AI systems can identify unusual usage that may indicate meter tampering or unauthorized connections, helping utilities recover lost revenue. For consumers, AI provides personalized energy-saving tips, suggests the best times to use appliances, and alerts users to sudden increases in consumption. Natural language processing lets consumers interact with their smart meters through voice assistants and chatbots, making energy management easy and accessible.

Dynamic pricing models driven by AI predict grid conditions in real time. This encourages load shifting to off-peak hours with flexible rates. Computer vision improves maintenance by automatically spotting infrastructure faults during installation and servicing. Deep learning enhances forecasting accuracy by considering weather, historical data, grid status, and user behavior, leading to more efficient energy generation and distribution. Overall, AI is making smart meters more intelligent, responsive, and user-friendly. This is driving faster adoption and smarter energy systems.

What are the Key Trends in the Smart Meter Market?

Integration with Distributed Energy Resources (DER): A key trend in the smart meter market is the growing connection between smart meters and distributed energy resources like rooftop solar panels, battery storage, and electric vehicle charging stations. Modern smart meters can track energy flow in both directions. This allows for accurate measurement of energy production, consumption, and export. This ability supports programs such as net metering, time-of-use tariffs, and peer-to-peer energy trading. Utilities are using advanced meters with better features to manage the increasing number of prosumers, who are consumers that also generate energy. They also aim to keep the grid stable as the use of renewable energy rises.

Multi-Utility Smart Metering Platforms: A key trend creating new market opportunities is the development of multi-utility smart metering solutions that measure electricity, gas, and water consumption on integrated platforms. By sharing communication networks, reducing installation costs, and offering unified data management, these converged systems deliver significant savings. Utilities across energy, gas, and water sectors are adopting this multi-utility approach to streamline operations, improve customer service with consolidated billing, and leverage cross-commodity analytics for better resource monitoring. This trend is especially prominent in smart city initiatives, where integrated utility management forms the backbone of modern urban infrastructure.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 64.3 Billion |

|

Market Size in 2025 |

USD 28.5 Billion |

|

Market Size in 2024 |

USD 26.8 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 8.5% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Europe |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Meter Type, Technology, Communication Technology, Component, Phase, End-User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government Mandates and Smart Grid Initiatives

The smart meter market is driven by strong government regulations and global smart grid modernization plans. Countries are setting mandatory rollout targets to improve energy efficiency and cut carbon emissions. For example, the EU requires at least 80% smart meter coverage by 2025. The U.S. supports infrastructure upgrades through the Smart Grid Investment Grant program. China's 14th Five Year Plan and India's National Smart Meter Program also promote widespread smart meter adoption. These initiatives provide funding, regulations, and guidelines that support market growth. Additionally, integrating renewables and implementing demand response programs make smart meters crucial for utilities to meet regulatory demands.

Reduction in Energy Theft and Non-Technical Losses

A major reason for smart meter adoption in emerging markets is the need to lower revenue losses from energy theft and other non-technical problems. Traditional meters are easy to tamper with, and they can lead to unauthorized connections and billing mistakes. These issues result in substantial financial losses for utilities. Smart meters come with features like tamper detection, real-time monitoring, and remote disconnect capabilities. These tools help utilities quickly identify and address theft. Immediate alerts significantly reduce response times compared to manual readings done periodically. In regions with high theft rates, utilities have managed to cut non-technical losses by 10-15% after installing smart meters. Remote disconnects also lower field visit costs and enhance payment collection. Moreover, automated readings prevent billing errors, which cuts down on disputes and improves customer satisfaction and revenue.

Restraints

High Initial Deployment and Infrastructure Costs

While smart meters provide long-term benefits, their high upfront costs remain a significant challenge. Expenses include not just the meters, but also communication networks, data management, installation, and customer education. For large utilities that serve millions, initial investments can reach billions. This creates challenges especially for smaller utilities or those in developing regions with limited capital.

Supporting infrastructure, such as cybersecurity and data centers, further increases the cost. Utilities often need regulatory approval to recover expenses through higher rates, which can meet public resistance. Financial viability depends on factors like the condition of infrastructure, customer density, and levels of theft, making the business case uncertain in some markets. Additionally, long payback periods of 7 to 10 years complicate investment decisions amid competing priorities.

Opportunities

IoT and Smart City Integration

A major growth opportunity in the smart meter market comes from its integration with IoT ecosystems and smart city projects. Smart meters are essential for smart cities, providing real-time data needed for effective urban management. When connected to IoT platforms, they work with devices like smart streetlights, EV chargers, building systems, and distributed energy resources, forming urban intelligence networks.

This connectivity allows for features like automated demand response, grid-interactive buildings, and vehicle-to-grid services. Cities that focus on smart city strategies view smart meter deployment as crucial for improving energy efficiency, sustainability, resilience, and citizen services. The rise of 5G and edge computing also enhances real-time applications and advanced data insights. Partnerships among utilities, tech companies, and city governments are expanding the role of smart meters beyond utilities and creating new revenue opportunities and business models.

Meter Type Insights

Why are Smart Electricity Meters the Most Widely Deployed Meter Type?

In 2025, smart electricity meters hold the largest share of the overall market in 2025, due to the widespread use of electricity and the development of smart grids. Electricity meters led the shift toward smart technology because these grids need real-time monitoring for stability, load balancing, and integrating renewables. Strong government requirements and national rollout programs have sped up adoption. Established standards and reliable technology have lowered costs and improved reliability. Smart electricity meters support essential functions like time-of-use pricing, demand response, outage detection, and integrating distributed generation, which are vital for modern grids.

At the same time, smart water meters are expected to grow at the fastest CAGR from 2025 to 2035. Aging infrastructure, water losses, and leakage issues often account for 20-30% of water production and drive the demand for smart water metering. These meters help detect leaks, bursts, and theft in real time, saving water and cutting treatment costs. Increasing rules on water conservation, along with improvements in battery life, low-power communication such as NB-IoT and LoRaWAN, and falling hardware prices are fueling growth in this sector.

Technology Insights

How does Advanced Metering Infrastructure (AMI) Drive Market Growth?

In 2025, the Advanced Metering Infrastructure (AMI) segment leads the market with its two-way communication between meters and utilities. This capability allows for much more than simple meter reading. AMI supports real-time data collection, remote connect or disconnect, outage alerts, demand response, and dynamic pricing. Its infrastructure includes smart meters, communication networks (RF mesh, cellular, PLC), data concentrators, and head-end systems. Driven by grid modernization, renewable energy integration, and improved customer engagement, AMI is widely backed by government smart grid initiatives as the new standard.

The Smart Meter Data Management (MDM) segment is growing at the fastest CAGR as utilities strive to unlock the full value of meter data. MDM platforms process and validate millions of readings each day to ensure accurate billing and enable advanced analytics like consumption forecasting, theft detection, and grid optimization. As many utilities move beyond their initial meter rollouts, cloud-based MDM solutions, which offer scalability, lower costs, and regular updates, are becoming more popular. Combined with AI and machine learning, MDM opens up new possibilities for predictive maintenance, automated anomaly detection, and smarter customer engagement.

Communication Technology Insights

How do Radio Frequency (RF) Technologies Support Smart Meter Deployments?

In 2025, the Radio Frequency (RF) segment leads the smart meter market. RF mesh networks are preferred for their reliability, scalability, and affordability. They establish continuous and resilient communication paths by connecting meters to nearby ones, which works well in crowded urban settings. Operating on licensed or license-free bands, RF offers good building penetration, decent range, and low power consumption, which helps extend battery life in gas and water meters. With established ecosystems, successful deployments, and standard protocols, RF solutions are generally cheaper than cellular options, making them a favorite among cost-conscious utilities.

At the same time, the cellular segment, including 4G LTE, 5G, NB-IoT, and LTE-M, is expected to grow at the fastest CAGR through 2035. Cellular technology uses existing carrier networks, so utilities do not have to build their own infrastructure. NB-IoT and LTE-M support low power, indoor coverage, and small data transmissions, which are perfect for smart meters. The global rollout of 5G allows for higher bandwidth, lower latency, and edge computing for more advanced smart meter applications. Cellular systems make it easier to deploy by eliminating the need for data concentrators or mesh setups, which reduces complexity. They are particularly appealing for rural areas, mobile sites, and utilities that prefer subscription-based costs. Lower prices for cellular modules and competitive data plans are driving the adoption of cellular smart meters.

Component Insights

Why Does Hardware Represent the Largest Share in the Smart Meter Market?

In 2025, the hardware segment leads the smart meter market in value and visibility. It includes metering devices, communication modules (RF, cellular, PLC), data concentrators, and network infrastructure such as routers and repeaters. Large-scale national rollout programs create high demand. These programs lead to economies of scale that lower unit costs and increase affordability. Hardware providers prioritize accuracy, long battery life, security, smaller sizes, and additional sensors for power quality and tamper detection. However, as the technology matures, the segment encounters pricing pressure and demand fluctuations related to new meter installations.

The software segment is growing at the fastest CAGR as utilities move from deployment to optimizing and extracting value from smart meter data. This includes Meter Data Management Systems (MDMS), Head-End Systems (HES), Customer Information Systems (CIS), and advanced analytics platforms. With most hardware in place, utilities depend on software to improve operations, enhance customer engagement, and develop new services. Cloud-based Software-as-a-Service (SaaS) solutions are becoming popular because of their scalability, continuous updates, and lower upfront costs. By integrating AI, machine learning, and advanced analytics, these platforms become more predictive and insightful.

End-User Insights

Why is the Residential Segment the Largest End-User for Smart Meters?

In 2025, the residential segment holds the largest share of the overall smart meter market because of the large number of households around the world. Governments often focus on smart meter installation in homes due to the significant potential for energy savings, load management, and operational efficiency. Smart meters provide consumers with detailed usage data through apps and portals, which encourages energy-saving habits and allows for shifting consumption to off-peak times to save money. Utilities benefit from reduced manual readings, more accurate billing, fewer truck rolls, and easier remote management. National campaigns in countries like the U.S., UK, Germany, China, and India have driven strong demand in the residential sector. New smart home solutions, such as energy management systems, solar integration, EV charging, and home automation, are making residential smart meters even more attractive.

At the same time, the utilities segment is growing at the fastest CAGR through 2035 as electric, gas, and water providers view smart meters as essential for modernizing their operations. Beyond helping customers, smart meters enhance grid management, outage detection, asset optimization, and renewable energy integration. They give utilities real-time visibility into system conditions, which enables predictive maintenance, better capital planning, and improved reliability. Smart meters are also installed on transformers and substations, creating networks for comprehensive grid monitoring. Regulatory drives, efficiency targets, and the move toward distributed renewables are spurring strong growth in this utility-focused segment.

How is the Asia Pacific Smart Meter Market Growing Dominantly Across the Globe?

The Asia Pacific region holds the largest share of the global smart meter market in 2025, largely because of China's rollout of hundreds of millions of meters through smart grid projects. China’s State Grid Corporation has invested heavily in smart grid upgrades. This allows for renewable integration and modernization. Japan has nearly 100% smart meter coverage in urban areas because of utility mandates. South Korea’s smart grid initiatives, such as the Jeju Test-Bed, provide solid market support. India’s ambitious Smart Meter National Programme aims to replace 250 million traditional meters, creating significant growth opportunities.

The region benefits from competitive hardware production, government policies, financial incentives, and increasing urban electricity demand. Moreover, cutting technical and commercial losses, especially in India and Southeast Asia, drives strong smart meter adoption.

Which Factors Support Europe's Smart Meter Market Growth?

Europe is expected to grow at the fastest CAGR between 2025 and 2035. This growth is fueled by strong EU regulations. The Energy Efficiency Directive and Clean Energy Package require member states to install smart meters in at least 80% of households by 2025 if it is cost-effective. Many countries are aiming even higher. Italy has completed its rollout ahead of schedule and is upgrading to next-generation meters. Countries like Finland, Sweden, Spain, the UK, France, Germany, and the Netherlands are implementing major rollout plans.

The push for net-zero emissions by 2050 in the European Green Deal makes smart meters vital for integrating renewable energy, managing electric vehicle charging, and supporting demand-response programs. Strict data privacy laws, such as GDPR, have led to robust security measures that increase consumer trust. Europe also benefits from top technology firms, research institutions, and strong ties with smart city projects. Financially stable utilities, skilled employees, and regulatory support for cost recovery through tariffs further promote the region’s smart meter growth.

Value Chain Analysis

Recent Developments

Segments Covered in the Report

By Meter Type

By Technology

By Communication Technology

By Component

By Phase

By End-User

By Region

The smart meter market is expected to increase from USD 28.5 billion in 2025 to USD 64.3 billion by 2035.

The smart meter market is expected to grow at a CAGR of 8.5% from 2025 to 2035.

The major players in the smart meter market include Landis+Gyr Group AG, Itron Inc., Honeywell International Inc. (includes Elster), Siemens AG, Schneider Electric SE, Sagemcom SAS, Osaki Electric Co., Ltd. (EDMI Limited), Badger Meter Inc., Wasion Group Holdings Limited, Aclara Technologies LLC (Hubbell Incorporated), Kamstrup A/S, Xylem Inc. (includes Sensus), Iskraemeco d.d., Genus Power Infrastructures Limited, Holley Technology Ltd., Diehl Metering GmbH, Zenner International GmbH & Co. KG, Apator S.A., Secure Meters Limited, Neptune Technology Group Inc., Tantalus Systems Corp., and Trilliant Holdings Inc., among others.

The main factors driving the smart meter market include stringent government mandates and smart grid initiatives worldwide, the need to reduce energy theft and non-technical losses, growing demand for real-time energy consumption monitoring, increasing integration with renewable energy sources, and operational cost reduction for utilities through automated meter reading and improved grid management.

The Asia Pacific region will lead the global smart meter market during the forecast period 2025 to 2035, driven by massive deployment programs in China, India, Japan, and South Korea, along with strong government support and urbanization-driven electricity demand growth.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Global Smart Meter Market, by Meter Type

3.2.2. Global Smart Meter Market, by Technology

3.2.3. Global Smart Meter Market, by Communication Technology

3.2.4. Global Smart Meter Market, by Component

3.2.5. Global Smart Meter Market, by Phase

3.2.6. Global Smart Meter Market, by End-User

3.2.7. Global Smart Meter Market, by Region

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Government mandates and smart grid initiatives

4.2.1.2. Reduction in energy theft and non-technical losses

4.2.1.3. Real-time energy consumption monitoring demand

4.2.1.4. Integration with renewable energy sources

4.2.1.5. Operational cost reduction for utilities

4.2.2. Restraints

4.2.2.1. High initial deployment and infrastructure costs

4.2.2.2. Data privacy and cybersecurity concerns

4.2.2.3. Interoperability challenges with legacy systems

4.2.2.4. Consumer resistance and awareness gaps

4.2.3. Opportunities

4.2.3.1. IoT and smart city integration

4.2.3.2. Prepaid metering solutions expansion

4.2.3.3. Advanced analytics and AI-driven insights

4.2.3.4. Emerging markets adoption

4.2.4. Trends

4.2.4.1. Cloud-based meter data management systems

4.2.4.2. Multi-utility smart metering platforms

4.2.4.3. 5G and LPWAN communication adoption

4.2.4.4. Blockchain for energy trading

4.2.5. Challenges

4.2.5.1. Standardization across regions

4.2.5.2. Skilled workforce shortage

4.2.5.3. Long replacement cycles

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Regulatory and Standards Framework

4.4.1. Regional Regulatory Mandates

4.4.1.1. North America (NERC CIP, FERC)

4.4.1.2. Europe (EU Energy Directives, GDPR)

4.4.1.3. Asia-Pacific (National smart meter programs)

4.4.2. Industry Standards

4.4.2.1. IEC standards (IEC 62056, IEC 62052, IEC 62053)

4.4.2.2. ANSI standards (ANSI C12.19, ANSI C12.22)

4.4.2.3. DLMS/COSEM protocol

4.4.3. Data Security and Privacy Regulations

4.4.3.1. Cybersecurity frameworks

4.4.3.2. Consumer data protection

5. Global Smart Meter Market Assessment—By Meter Type

5.1. Overview

5.2. Smart Electricity Meters

5.3. Smart Gas Meters

5.4. Smart Water Meters

5.5. Multi-Utility Smart Meters

6. Global Smart Meter Market Assessment—By Technology

6.1. Overview

6.2. Advanced Metering Infrastructure (AMI)

6.3. Automatic Meter Reading (AMR)

6.4. Smart Meter Data Management (MDM)

7. Global Smart Meter Market Assessment—By Communication Technology

7.1. Overview

7.2. Radio Frequency (RF)

7.3. Power Line Communication (PLC)

7.4. Cellular

7.5. Low Power Wide Area Network (LPWAN)

7.6. Wired/Ethernet

8. Global Smart Meter Market Assessment—By Component

8.1. Overview

8.2. Hardware

8.3. Software

8.4. Services

9. Global Smart Meter Market Assessment—By Phase

9.1. Overview

9.2. Single-Phase Meters

9.3. Three-Phase Meters

10. Global Smart Meter Market Assessment—By End User

10.1. Overview

10.2. Residential

10.3. Commercial

10.4. Industrial

10.5. Utilities

10.6. Government and Municipal

10.7. Others

11. Global Smart Meter Market Assessment —By Geography

11.1. Overview

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. France

11.3.3. U.K.

11.3.4. Italy

11.3.5. Spain

11.3.6. Netherlands

11.3.7. Rest of Europe (RoE)

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. South Korea

11.4.5. Australia

11.4.6. Rest of Asia-Pacific (RoAPAC)

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Rest of Latin America (RoLATAM)

11.6. Middle East & Africa

11.6.1. Saudi Arabia

11.6.2. United Arab Emirates (UAE)

11.6.3. Rest of Middle East & Africa (RoMEA)

12. Competitive Landscape

12.1. Overview

12.2. Key Growth Strategies

12.3. Competitive Benchmarking

12.4. Competitive Dashboard

12.4.1. Industry Leaders

12.4.2. Market Differentiators

12.4.3. Vanguards

12.4.4. Contemporary Stalwarts

12.5. Market Share/Ranking Analysis, by the Key Players, 2024

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

13.1. Landis+Gyr Group AG

13.2. Itron Inc.

13.3. Honeywell International Inc. (includes Elster)

13.4. Siemens AG

13.5. Schneider Electric SE

13.6. Sagemcom SAS

13.7. Osaki Electric Co., Ltd. (EDMI Limited)

13.8. Badger Meter Inc.

13.9. Wasion Group Holdings Limited

13.10. Aclara Technologies LLC (Hubbell Incorporated)

13.11. Kamstrup A/S

13.12. Xylem Inc. (includes Sensus)

13.13. Iskraemeco d.d.

13.14. Genus Power Infrastructures Limited

13.15. Holley Technology Ltd.

13.16. Diehl Metering GmbH

13.17. Zenner International GmbH & Co. KG

13.18. Apator S.A.

13.19. Secure Meters Limited

13.20. Neptune Technology Group Inc.

13.21. Tantalus Systems Corp.

13.22. Trilliant Holdings Inc.

13.23. Other Key Players

14. Appendix

14.1. Available Customization

14.2. Related Reports

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates