Resources

About Us

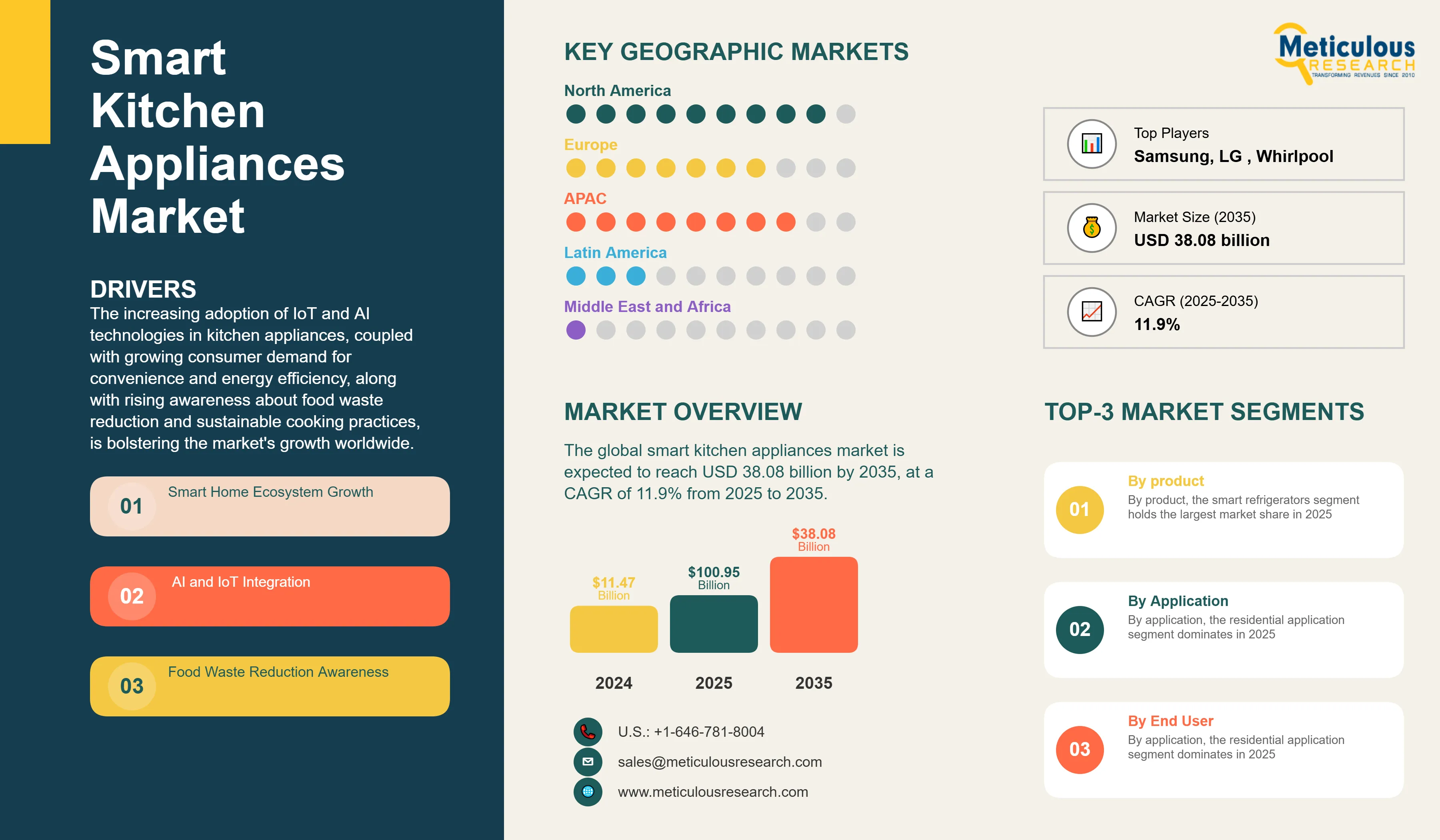

Smart Kitchen Appliances Market by Product (Smart Refrigerators, Smart Ovens, Smart Dishwashers), Technology (IoT, AI, Voice Control), Application (Residential, Commercial), End User, and Geography—Global Forecast to 2035

Report ID: MRSE - 1041622 Pages: 220 Oct-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Smart Kitchen Appliances Market Size?

The global smart kitchen appliances market was valued at USD 11.47 billion in 2024. This market is expected to reach USD 38.08 billion by 2035 from USD 12.88 billion in 2025, at a CAGR of 11.9% from 2025 to 2035. The increasing adoption of IoT and AI technologies in kitchen appliances, coupled with growing consumer demand for convenience and energy efficiency, along with rising awareness about food waste reduction and sustainable cooking practices, is bolstering the market's growth worldwide.

Smart Kitchen Appliances Market Key Takeaways

Click here to: Get Free Sample Pages of this Report

The smart kitchen appliances market involves designing, developing, manufacturing, and distributing internet-connected kitchen devices that use IoT (Internet of Things), artificial intelligence, and automation to improve cooking efficiency, food management, and user experience. These systems include connected refrigerators with internal cameras and food recognition, AI-powered ovens that adjust cooking settings automatically, voice-controlled dishwashers, robotic cooking systems, smart scales and thermometers, and integrated home automation platforms. Unlike traditional kitchen appliances, smart kitchen devices allow remote control through smartphones, provide maintenance alerts, optimize energy use, suggest recipes based on available ingredients, and work seamlessly with voice assistants like Alexa and Google Home. The overall smart kitchen appliances market is expected to grow due to increased adoption of smart home technologies, rising consumer demand for convenience and time-saving solutions, more awareness about reducing food waste, expanding automation in commercial kitchens, advancements in AI and machine learning, and government support for energy-efficient appliances.

How is AI Transforming the Smart Kitchen Appliances Market?

AI is transforming the smart kitchen appliances market by improving convenience, personalization, efficiency, and connectivity. AI-powered appliances, like smart refrigerators, ovens, dishwashers, and cooking machines, now offer more than basic automation. They learn user preferences, track inventory, suggest recipes based on what is available, and automatically adjust cooking times or temperatures for better results. These features help cut down on food waste, save time, and increase energy efficiency with smart energy management.

Key factors driving this growth include more people adopting smart home systems, increasing health awareness where appliances offer dietary tracking and nutritional advice, and rising incomes in developing areas that allow for investment in high-end, AI-integrated appliances. Voice and gesture control make it even easier to interact with these kitchen devices.

Large appliance makers like Samsung, LG, GE, and Xiaomi are investing heavily in AI. They often partner with IoT and cloud service providers to boost their appliances' capabilities. There are still challenges, such as high initial costs, concerns about data privacy, and making sure devices work well together across different smart home platforms. However, these issues are likely to lessen as technology develops and more people adopt it. Overall, AI is turning kitchen appliances from passive tools into smart assistants that support modern lifestyles and evolving consumer needs.

What are the Key Trends in the Smart Kitchen Appliances Market?

Food Waste Reduction and Sustainability Technologies

Food waste is a major problem in many households. Smart refrigerators help tackle this issue by tracking food inventory and expiration dates. They reduce spoilage with timely alerts and notifications. These fridges can also suggest recipes based on the ingredients you have, encouraging efficient use of food and cutting down on waste. This supports more sustainable living. Some smart refrigerators now come with internal cameras, allowing users to check their contents remotely while shopping. This helps avoid buying duplicates and reduces waste. Linking with meal planning apps and grocery delivery services creates a system that optimizes food use and minimizes spoilage.

Commercial Kitchen Automation and Robotics

Another major trend driving market growth is the use of robotic cooking systems in commercial kitchens. Labor costs are increasing, and the food service industry is feeling the pressure. Kitchen automation, especially robotics, provides a strong solution to the labor challenges and rising expenses in the food service sector. Companies like Moley Robotics, Chef Robotics, and Miso Robotics are creating AI-powered cooking robots that can prepare thousands of meals each day with consistent quality. These systems cut labor costs by 30-40% while also improving food safety and consistency. Integrating with existing kitchen equipment makes it easier for restaurants and food service operators to adopt these technologies.

The global smart kitchen appliances market was valued at USD 11.47 billion in 2024. This market is expected to reach USD 38.08 billion by 2035 from USD 12.88 billion in 2025, at a CAGR of 11.9% from 2025 to 2035

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 38.08 Billion |

|

Market Size in 2025 |

USD 12.88 Billion |

|

Market Size in 2024 |

USD 11.47 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 11.9% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Product, Technology, Application, Distribution Channel, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Smart Home Adoption and Connected Living

With over 60% of U.S. consumers using connected home technology, AI-powered appliances are quickly becoming common in smart homes. The growth of smart home ecosystems increases the demand for kitchen appliances that work well with other connected devices, allowing centralized control through a single platform. Compatibility with voice assistants like Alexa, Google Assistant, and Siri enables hands-free operation. This feature is particularly useful during cooking when hands are busy or dirty. The rollout of 5G networks improves connectivity and allows for real-time data processing, enabling advanced features like video streaming from refrigerator cameras. Younger consumers, especially millennials and Gen Z, expect all home appliances to have connected features, which pushes manufacturers to focus on smart capabilities. The COVID-19 pandemic sped up smart home adoption as consumers spent more time cooking at home and looked for technologies to make meal preparation easier.

Restraint

High Initial Costs and Technical Complexity

Despite increasing demand, the market faces hurdles due to the high prices of smart appliances compared to traditional ones. A luxury smart fridge can cost $3,000 or more, which makes it unaffordable for many households. The complicated installation process, which requires a stable Wi-Fi network, smartphone apps, and possible integration with smart home hubs, can put off less tech-savvy consumers. Privacy issues regarding data collection from connected appliances, like tracking dietary habits and usage patterns, create hesitation among buyers. Cybersecurity risks tied to IoT devices, such as the potential hacking of kitchen appliances, raise safety concerns. The lack of uniformity among manufacturers causes compatibility problems between different brands and systems. Maintenance and software updates lead to ongoing costs and complexity, unlike traditional appliances that can last for decades with little upkeep.

Opportunity

Energy Efficiency and Sustainability Initiatives

Environmental concerns and sustainability issues offer major opportunities for the global market. As consumers become more aware of environmental issues, they increasingly want eco-friendly appliances that have a low impact on the environment throughout their lifecycle. Government incentives and rebates for energy-efficient appliances make smart kitchen devices cheaper for consumers. Using renewable energy sources with smart appliances allows for load shifting to times of peak solar or wind generation. Smart sensors and AI algorithms improve energy consumption, cutting electricity use by 20-30% compared to traditional appliances. Features that track carbon footprints attract environmentally aware consumers who want to lower their environmental impact. The circular economy trend boosts the demand for appliances with modular designs that allow for component upgrades instead of complete replacements.

Product Insights

Why do Smart Refrigerators Dominate the Market?

Smart refrigerators hold the largest share of the overall smart kitchen appliances market in 2025. These refrigerators act as the main hub for kitchen tasks, and offer more than just food storage; they also help with inventory management, meal planning, and grocery ordering. LG's ThinQ food management system and a built-in AI-powered camera can identify stored items, suggest recipes based on available ingredients, track inventory and expiration dates, and provide personal insights based on dietary preferences. The high replacement value and long lifespan of refrigerators justify the higher prices for smart features that improve everyday use. Connecting with other smart home devices and voice assistants turns refrigerators into command centers for kitchen automation. Features like adjustable temperature zones, humidity control, and door-in-door designs add practical benefits beyond connectivity.

Smart cookware and cooktops are expected to grow at the fastest CAGR during the forecast period. This is mainly driven by the need for precise cooking and the advantages of energy efficiency. Induction cooktops that connect to apps and automatically adjust temperature ensure perfect cooking results while also cutting down energy use.

Technology Insights

How does Wi-Fi Connectivity Lead Integration?

Based on technology, Wi-Fi leads the overall smart kitchen appliances market in 2025. Wi-Fi offers enough bandwidth for data-heavy tasks like streaming video from internal cameras and downloading recipes in real time. Its universal compatibility with home routers means there is no need for special hubs or extra hardware. Cloud connectivity through Wi-Fi supports features like AI processing, voice recognition, and software updates over the air. The well-established ecosystem of Wi-Fi-enabled devices ensures they are broadly compatible and easy to set up.

AI and machine learning technologies are poised for rapid growth. They will enable features like predictive cooking, automatic adjustments, and personalized suggestions based on user preferences and habits.

End user Insights

Why does the Residential Segment Lead Adoption?

The residential application segment holds the largest share of the global smart kitchen appliances market in 2025. Individual households represent the largest volume market, with billions of potential customers worldwide looking for convenience and efficiency in daily cooking. The shift to remote work has increased the time spent at home, which encourages investment in kitchen upgrades and smart appliances. Growing health awareness promotes home cooking over restaurant meals, making smart kitchen appliances important for meal preparation. Direct-to-consumer sales channels and e-commerce platforms further help expand the residential market.

How is the North America Smart Kitchen Appliances Market Growing Dominantly Across the Globe?

North America commands the largest share of the global smart kitchen appliances market in 2025. The smart kitchen appliance market in this region is growing due to the increasing number of restaurants, pubs, and hotels. This market is further driven by the high disposable incomes in this region that make it possible for consumers to buy premium appliances, with the average household income in the U.S. and Canada exceeding $70,000.

The early use of smart home technologies has also created a solid foundation for integrating smart kitchens. Major tech companies like Google, Amazon, and Apple play a key role in driving innovation in voice assistants and IoT platforms. The strong retail infrastructure allows consumers to test smart features before making a purchase. Additionally, significant venture capital investment in food tech startups boosts innovation in kitchen automation and robotics. Strict energy efficiency standards and utility rebate programs further encourage the use of smart appliances.

Which Factors Support the Asia Pacific Smart Kitchen Appliances Market Growth?

Recent Developments

Segments Covered in the Report

By Product Type

By Technology

By Distribution Channel

By End User

By Geography

The market is expected to increase from USD 12.88 billion in 2025 to USD 38.08 billion by 2035.

The market is expected to grow at a CAGR of 11.9% from 2025 to 2030.

Major players include Samsung Electronics, LG Electronics, Whirlpool Corporation, GE Appliances (Haier), Bosch Home Appliances, Panasonic Corporation, Electrolux AB, Miele & Cie. KG, Siemens, and Philips.

Driving factors include increasing adoption of smart home technologies, growing consumer demand for convenience, rising awareness about food waste reduction, commercial kitchen automation needs, and government incentives for energy-efficient appliances.

North America currently leads the market, while Asia Pacific is expected to witness the fastest growth during the forecast period.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Product Type

3.3. Market Analysis, By Technology

3.4. Market Analysis, By Application

3.5. Market Analysis, By End User

3.6. Market Analysis, By Distribution Channel

3.7. Market Analysis, By Geography

3.8. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Market Drivers (2025–2035)

4.2.1. Smart Home Ecosystem Growth

4.2.2. AI and IoT Integration

4.2.3. Food Waste Reduction Awareness

4.2.4. Commercial Kitchen Automation

4.3. Market Restraints (2025–2035)

4.3.1. High Initial Investment

4.3.2. Technical Complexity

4.3.3. Privacy and Security Concerns

4.4. Market Opportunities (2025–2035)

4.4.1. Energy Efficiency Initiatives

4.4.2. Robotic Kitchen Systems

4.4.3. Personalized Nutrition

4.5. Market Challenges (2025–2035)

4.5.1. Interoperability Issues

4.5.2. Consumer Education

4.6. Market Trends (2025–2035)

4.6.1. Voice-Controlled Cooking

4.6.2. Sustainability Features

4.7. Porter's Five Forces Analysis

5. The Impact of AI and Automation

5.1. AI in Recipe Recommendation

5.2. Computer Vision for Food Recognition

5.3. Predictive Maintenance

5.4. Robotic Process Automation

5.5. Natural Language Processing

5.6. Machine Learning Optimization

5.7. Market Growth Through Innovation

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.3. Competitive Dashboard

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

6.6. Mergers and Acquisitions

6.7. Product Launches

6.8. Strategic Partnerships

7. Smart Kitchen Appliances Market, By Product Type

7.1. Introduction

7.2. Smart Refrigerators

7.3. Smart Ovens & Ranges

7.4. Smart Dishwashers

7.5. Smart Cooktops & Cookware

7.6. Small Appliances

7.6.1. Coffee Makers

7.6.2. Blenders

7.6.3. Food Processors

7.6.4. Air Fryers

7.6.5. Others

7.7. Robotic Kitchen Systems

8. Smart Kitchen Appliances Market, By Technology

8.1. Introduction

8.2. IoT (Internet of Things)

8.3. Artificial Intelligence

8.4. Voice Control

8.5. Wi-Fi Connectivity

8.6. Bluetooth

8.7. Other Technologies

9. Smart Kitchen Appliances Market, By End User

9.1. Introduction

9.2. Residential

9.3. Commercial

9.3.1. Restaurants

9.3.2. Hotels

9.3.3. QSRs & Cafes

9.3.4. Cloud Kitchens

9.3.5. Others

10. Smart Kitchen Appliances Market, By Distribution Channel

10.1. Introduction

10.2. Online

10.3. Offline

11. Smart Kitchen Appliances Market, By Geography

11.1. Introduction

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. South Korea

11.4.5. Southeast Asia

11.4.6. Rest of Asia-Pacific

11.5. Latin America

11.6. Middle East & Africa

12. Company Profiles

12.1. Samsung Electronics Co. Ltd.

12.2. LG Electronics Inc.

12.3. Whirlpool Corporation

12.4. GE Appliances (Haier)

12.5. Bosch Home Appliances

12.6. Panasonic Corporation

12.7. Electrolux AB

12.8. Miele & Cie. KG

12.9. Siemens Home Appliances

12.10. Philips N.V.

12.11. Miso Robotics

12.12. Moley Robotics

12.13. Chef Robotics

12.14. Others

13. Appendix

13.1. Questionnaire

13.2. Available Customization

Published Date: Apr-2025

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates