Resources

About Us

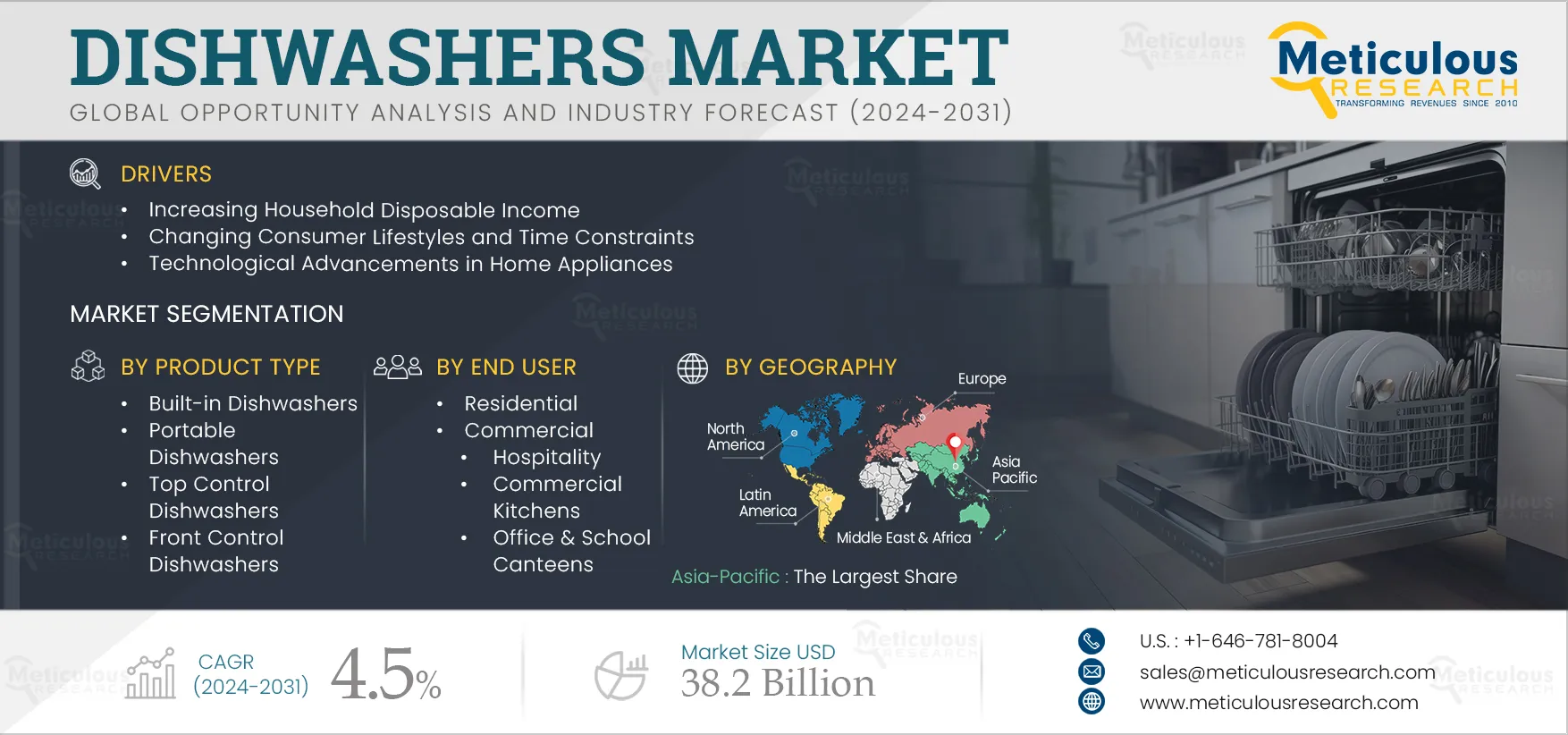

Dishwashers Market Size, Share, Forecast, & Trends Analysis by Product Type (Built-in, Portable), Dishwasher Size (Compact, Standard), Distribution Channel (Offline, Online), End User (Residential, Commercial (Hospitality, Commercial Kitchens)), and Geography - Global Forecast to 2032

Report ID: MRSE - 1041204 Pages: 250 May-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Dishwashers Market is expected to reach $38.2 billion by 2032, at a CAGR of 4.5% from 2025 to 2032. The growth of this market is attributed to the increasing household disposable income, changing consumer lifestyles and time constraints, and technological advancements in home appliances. Moreover, the rising adoption of modular kitchens and connected home appliances and the rising number of mini cafes and restaurants are expected to offer growth opportunities for the players operating in this market.

With the rise of long working hours of individuals leaves people with less time for household tasks. Dishwashers eliminate the need for manual dishwashing, saving significant time and effort. It helps individuals reclaim time for hobbies, socializing, and relaxation. Dishwashers automate the dishwashing process, reducing the burden on busy individuals.

Changing consumer preferences and increasing concern about hygiene and sanitation further increase the demand for dishwashers. Dishwashers offer a more effective way to clean and sanitize dishes, especially in areas with water quality concerns. Owning a dishwasher enhances the functionality and overall appeal of a kitchen space. Modern dishwashers offer better cleaning performance compared to hand-washing, especially for heavily soiled dishes and greasy cookware. Manufacturers are developing dishwashers with features that meet the growing needs of the residential sector. For instance, in June 2021, BSH Hausgerate GmbH (Germany) launched 20 dishwashers for Indian families to provide a hassle-free and hygienic cleaning experience. Such developments support the growth of the dishwasher market during the forecast period.

Technological advancements are rapidly transforming the landscape of home appliances, making them smarter, more efficient, and more convenient for users. These appliances include a microwave, air conditioner, dishwasher, refrigerator, washing machine, air purifier, and television, among others. Sensors are integrated into appliances to optimize performance and resource usage. Consumers are increasingly opting for smart appliances for convenience and efficiency, thus supporting the growth of the dishwasher market.

Modern dishwashers utilize advanced spray technology and innovative wash cycles to deliver superior cleaning performance. Dishwashers with automatic detergent dispensers eliminate the need for manual measurement and ensure the proper amount of detergent is used for each cycle. Manufacturers are integrating sensor technology to optimize water usage and offer energy efficiency in dishwashers. Advances in motor design and insulation materials have led to significantly quieter dishwashers. Manufacturers are also integrating Wi-Fi connectivity to dishwashers, allowing remote monitoring and control via smartphones to help users start or stop cycles, check remaining time, and even receive maintenance alerts. Thus, the technological advancement in home appliances supports the growth of the dishwasher market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

With the technological advances, smart dishwashers are expected to offer additional features such as personalized recommendations for wash cycles. The growing consumer preference for convenience, efficiency, and integration of modern smart homes is further increasing the trend of smart dishwashers. Smart dishwashers are connected to the Wi-Fi network and controlled remotely via a smartphone app or voice assistant. This allows users to start, stop, and monitor the dishwasher cycle from anywhere, as well as receive notifications when the cycle is complete.

Some smart dishwashers offer additional features such as:

Some of the recent developments in this market space are as follows:

Such developments support the growth of the dishwasher market during the forecast period.

With the rising disposable incomes, people are investing in premium appliances and home improvement projects. Modular kitchens are designed for specific needs to maximize storage and counter space, leaving room for essential appliances. This allows for better integration of connected appliances, creating a seamless workflow. As technology continues to advance, the adoption of modular kitchens and connected home appliances is transforming the consumer lifestyle.

Modular kitchens allow for personalized layouts, allowing the incorporation of dishwashers of various sizes and styles to fit specific needs and preferences. Modular kitchens boast clean, modern lines and free up valuable counter space, making dishwashers a more attractive option compared to bulky dish racks. Built-in dishwashers seamlessly integrate into the design, creating a clean and modern aesthetic. These dishwashers offer features such as high-temperature washes and sanitizing cycles for health-conscious consumers. Such factors, combined with the time-saving and hygienic benefits of dishwashers, fuel the growing demand for dishwashers in modern kitchens.

The number of working individuals is increasing, and thus, people have busy lives and crave quick and convenient dining options. Mini cafes & restaurants cater to specific dietary needs and offer unique cuisine. This allows for exploration and personalization of the dining experience. Mini cafes and restaurants often have limited space. Thus, these cafes create a demand for compact or under-counter dishwashers to clean dishes without taking up valuable floor space. This allows mini cafes and restaurants to clean dishes quickly and get them back into service faster. It also helps mini cafes and restaurants operate with a smaller staff.

Some of the recent developments in this market space are as follows:

Such developments and the increasing number of mini cafes and restaurants offer growth opportunities for the dishwashers market during the forecast period.

Based on product type, the dishwashers market is segmented into built-in dishwashers, portable dishwashers, top control dishwashers, front control dishwashers, and other product types. In 2025, the built-in dishwashers segment is expected to account for the largest share of above 62% of the dishwashers market. The large market share of this segment is attributed to the increasing disposable income and time constraints, compact living spaces in urban areas, and the rising adoption of modular kitchens. In February 2024, AB Electrolux (Sweden) launched a built-in range of appliances, including microwaves, ovens, hobs, cookers, dishwashers, and coffee makers in the Indian market.

However, the portable dishwashers segment is projected to register the highest CAGR during the period. The segment's growth is attributed to the rise of renting and mobile lifestyles, the fact that portable dishwashers are generally less expensive, and the increasing demand for portable dishwashers in developing regions where urbanization is accelerating. As technology advances and features improve, manufacturers are focusing on portable dishwashers to cater to a wider range of consumers, particularly in urban environments.

Based on dishwasher size, the dishwashers market is segmented into compact dishwasher, standard dishwasher, and oversized dishwasher. In 2025, the standard dishwasher segment is expected to account for the largest share of above 55% of the dishwashers market. The large market share of this segment is attributed to the rising number of mini cafes and restaurants, changing consumer preferences, and increasing focus on hygiene and sanitization of dishes. Modern standard dishwashers are becoming more water and energy-efficient, addressing environmental concerns and promoting cost savings on utility bills.

However, the compact dishwasher segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to increasing kitchen renovations, compact apartment developments, and budget-conscious consumers. Compact dishwashers offer a space-saving solution for compact apartments, studios, and tiny homes. In February 2022, Godrej & Boyce Manufacturing Company Limited (India) launched the Godrej Eon Magnus Counter-Top Dishwasher to manage the dishwashing requirements of smaller families.

Based on distribution channel, the dishwashers market is segmented into offline and online. In 2025, the offline segment is expected to account for the larger share of above 85% of the dishwashers market. The large market share of this segment is attributed to the increasing preference for in-store guidance to buy dishwashers as it provides demo stations for testing out products, thus, engaging experience for customers. Also, offline stores offer the advantage of immediate takeaway of products. It allows customers to walk out with their purchase right away, eliminating waiting times for deliveries.

However, the online segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the rapid growth of the e-commerce industry, the availability of online stores 24/7, and a larger selection of dishwasher products by brand. Online stores offer various advantages, such as easy comparison of features, prices, and customer reviews across different retailers, helping consumers find the best deal. Also, many online retailers offer exclusive discounts, coupons, and flash sales that can significantly reduce the cost of dishwashers.

Based on end user, the dishwashers market is segmented into residential and commercial. In 2025, the commercial segment is expected to account for the larger share of above 60% of the dishwashers market. The large market share of this segment is attributed to the rising number of mini cafes and restaurants, restaurants and food service businesses facing staffing challenges, and strict regulations & evolving food safety standards across various commercial spaces. Modern commercial dishwashers are designed to use less water and energy while maintaining hygiene and cleanliness.

However, the residential segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the rising disposable income and living standards, increasing focus on hygiene and sanitization of dishes due to busy lifestyles, technological advancements in home appliances, and increasing use of portable dishwashers in the residential sector. In July 2022, Samsung Electronics Co., Ltd. (South Korea) launched a dishwasher in its existing range of home appliances for cleaner homes to elevate the lifestyles of Singaporean households.

In 2025, Asia-Pacific is expected to account for the largest share of above 37% of the dishwashers market. The market growth in Asia-Pacific is driven by the presence of key market players in the region, rapid urbanization, increasing disposable incomes of the urban population, and technological advancements in home appliances. The growing popularity of compact dishwashers caters perfectly to space limitations in many Asian households. Government bodies in the region are introducing policies to promote water conservation. Manufacturers are offering water-efficient dishwashers for commercial spaces. In October 2021, Samsung Electronics Co., Ltd. (South Korea) launched IntensiveWash Dishwasher to meet the hygiene needs of consumers and create modern kitchen space in Indian homes. Moreover, this region is also projected to record the highest CAGR of above 6% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the dishwashers market are Robert Bosch GmbH (Germany), Midea Group (China), Asko Appliances AB (Sweden), Siemens AG (Germany), Fagor Electrodomestico (Spain), AB Electrolux (Sweden), Arcelik A.S. (Turkey), LG Electronics Inc. (South Korea), Whirlpool Corporation (U.S.), GE Appliances (U.S.), Samsung Electronics Co., Ltd. (South Korea), IFB Appliances (India), Panasonic Holdings Corporation (Japan), Miele & Cie. KG (Germany), and The Middleby Corporation (U.S.).

In February 2025, LG Electronics Inc. (South Korea) launched the 14-person LG Dios Objet Collection Dishwasher, which can wash up to 110 dishes at once to enhance space efficiency and convenience.

In November 2024, Whirlpool Corporation (U.S.) launched the MaxiSpace dishwasher, which features a third loading rack with integrated spray jets for cleaning bowls, mugs, and glasses.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.5% |

|

Market Size (Value) |

USD 38.2 Billion by 2032 |

|

Segments Covered |

By Product Type

By Dishwasher Size

By Distribution Channel

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Singapore, Australia & New Zealand, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Robert Bosch GmbH (Germany), Midea Group (China), Asko Appliances AB (Sweden), Siemens AG (Germany), Fagor Electrodomestico (Spain), AB Electrolux (Sweden), Arcelik A.S. (Turkey), LG Electronics Inc. (South Korea), Whirlpool Corporation (U.S.), GE Appliances (U.S.), Samsung Electronics Co., Ltd. (South Korea), IFB Appliances (India), Panasonic Holdings Corporation (Japan), Miele & Cie. KG (Germany), and The Middleby Corporation (U.S.) |

The dishwashers market study focuses on the market assessment and opportunity analysis through the sales of dishwashers across different regions, and countries across different market segmentation. This study is also focused on competitive analysis for dishwashers based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The dishwashers market is projected to reach $38.2 billion by 2032, at a CAGR of 4.5% during the forecast period.

In 2025, the built-in dishwashers segment is expected to account for the largest share of above 62% of the dishwashers market.

Based on end user, the residential segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the increasing household disposable income, changing consumer lifestyles and time constraints, and technological advancements in home appliances. Moreover, the rising adoption of modular kitchens and connected home appliances and the rising number of mini cafes and restaurants are expected to offer growth opportunities for the players operating in this market.

The key players operating in the dishwashers market are Robert Bosch GmbH (Germany), Midea Group (China), Asko Appliances AB (Sweden), Siemens AG (Germany), Fagor Electrodomestico (Spain), AB Electrolux (Sweden), Arcelik A.S. (Turkey), LG Electronics Inc. (South Korea), Whirlpool Corporation (U.S.), GE Appliances (U.S.), Samsung Electronics Co., Ltd. (South Korea), IFB Appliances (India), Panasonic Holdings Corporation (Japan), Miele & Cie. KG (Germany), and The Middleby Corporation (U.S.).

Asia-Pacific is projected to register the highest CAGR of above 6% during the forecast period.

Published Date: Oct-2025

Published Date: Oct-2024

Published Date: Apr-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates