Resources

About Us

Pharmaceutical Cold Storage Market Size, Share & Forecast 2025-2035 | Growth Analysis by Equipment Type, Temperature Range, Application, End-User & Geography

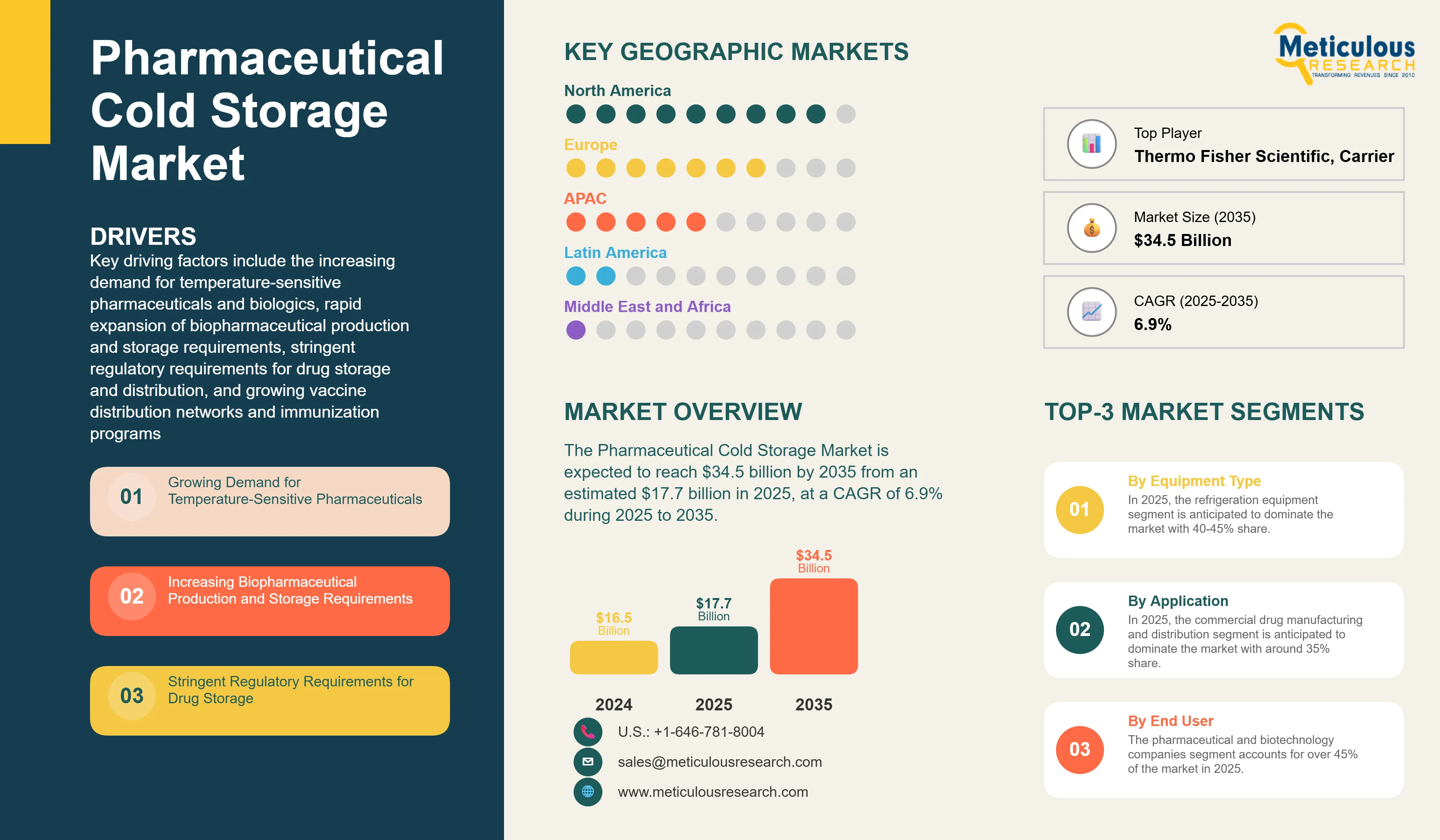

Report ID: MRHC - 1041515 Pages: 175 Jun-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the pharmaceutical cold storage market include the increasing demand for temperature-sensitive pharmaceuticals and biologics, rapid expansion of biopharmaceutical production and storage requirements, stringent regulatory requirements for drug storage and distribution, growing vaccine distribution networks and immunization programs, rising adoption of personalized medicine and cell & gene therapies, and expansion of clinical trials requiring specialized storage solutions. However, this growth is restrained by high capital investment and operational costs, complex regulatory compliance requirements across different regions, energy-intensive operations and environmental sustainability concerns, and risks associated with equipment failure and potential product loss.

Additionally, emerging opportunities in developing markets and healthcare infrastructure expansion, integration of IoT and advanced monitoring technologies, development of ultra-low temperature storage solutions for next-generation therapies, growth in home healthcare and direct-to-patient delivery models, and increasing focus on automated cold storage systems are poised to offer significant growth opportunities for market players. The adoption of blockchain technology for supply chain transparency and development of sustainable, energy-efficient cold storage solutions are emerging as notable trends in this market.

Market Drivers

Growing Demand for Temperature-Sensitive Pharmaceuticals and Biologics

The demand for pharmaceutical cold storage is experiencing unprecedented growth due to the increasing development and commercialization of temperature-sensitive drugs, including biologics, vaccines, insulin, and other protein-based therapeutics. Modern pharmaceutical companies are increasingly focused on developing complex molecules that require precise temperature control throughout the supply chain, driving demand for sophisticated cold storage solutions with advanced monitoring capabilities. The pharmaceutical cold storage market benefits from this trend as drug manufacturers seek reliable storage systems that can maintain product efficacy and comply with regulatory requirements.

The rise of personalized medicine and targeted therapies, coupled with growing investment in biopharmaceutical research and development, is driving this trend. Advanced cold storage solutions, featuring multi-temperature zones, real-time monitoring systems, and automated backup systems, appeal to pharmaceutical companies who prioritize product integrity and regulatory compliance while managing complex distribution networks.

The biologics revolution has gained significant momentum in recent years, with manufacturers demanding sophisticated storage solutions that can accommodate various temperature requirements, maintain precise environmental control, and provide comprehensive documentation for regulatory compliance.

Stringent Regulatory Requirements and Compliance Standards

Pharmaceutical cold storage solutions offer enhanced compliance capabilities compared to traditional storage methods due to their ability to maintain precise temperature control, provide continuous monitoring, and generate comprehensive documentation for regulatory authorities. The regulatory compliance process, which includes FDA, EMA, and other international guidelines, results in improved product safety and supply chain integrity. Research suggests that modern cold storage systems may provide better reliability and traceability due to advanced sensors, IoT connectivity, and automated documentation systems.

Pharmaceutical cold storage is regarded as a critical infrastructure component due to its role in maintaining drug efficacy, ensuring patient safety, and meeting regulatory requirements. Modern cold storage solutions maintain operational excellence while providing enhanced monitoring capabilities, making them particularly attractive to pharmaceutical manufacturers, distributors, and healthcare providers who must demonstrate compliance with Good Distribution Practice (GDP) guidelines.

The growing emphasis on supply chain transparency and traceability, combined with increasing regulatory scrutiny of pharmaceutical distribution, has led to increased adoption among companies seeking to minimize compliance risks and ensure product quality throughout the distribution process.

Expansion of Vaccine Distribution Networks and Immunization Programs

In recent decades, the global focus on vaccination programs has intensified, with the COVID-19 pandemic highlighting the critical importance of robust cold chain infrastructure. This trend was further accelerated during the pandemic with significant investments in vaccine storage and distribution capabilities. The vaccine cold storage segment is experiencing rapid growth as governments and healthcare organizations increasingly prioritize immunization programs and pandemic preparedness.

The vaccine distribution market is being driven by expanding childhood immunization programs, growing adult vaccination initiatives, increasing focus on pandemic preparedness, and development of new vaccine technologies requiring ultra-low temperature storage. Pharmaceutical cold storage solutions, being recognized as essential infrastructure for public health, are positioned to capture significant investment from both public and private sectors.

Furthermore, international health organizations and governments are increasingly emphasizing vaccine accessibility and distribution equity, further driving demand for specialized cold storage solutions that can support global immunization efforts and emergency response capabilities.

Market Segmentation Analysis

By Equipment/Solution Type

Based on equipment/solution type, the pharmaceutical cold storage market is segmented into refrigeration equipment, temperature-controlled containers/packaging, monitoring and control systems, cold storage services, and other solutions. In 2025, the refrigeration equipment segment is anticipated to dominate the market, accounting for approximately 40-45% of the total pharmaceutical cold storage market. The dominance of refrigeration equipment is attributed to the fundamental need for temperature-controlled environments, ongoing facility expansion, and replacement of aging equipment with advanced systems.

However, the monitoring and control systems segment is projected to record the highest CAGR during the forecast period of 2025-2035. This exceptional growth is driven by increasing regulatory requirements for continuous monitoring, growing adoption of IoT-enabled systems, demand for real-time data analytics, and emphasis on predictive maintenance capabilities.

The cold storage services segment is also experiencing robust growth due to outsourcing trends among pharmaceutical companies, specialized expertise requirements, and the need for scalable storage solutions without significant capital investment.

By Temperature Range

The pharmaceutical cold storage market is segmented into 2°C to 8°C (standard refrigeration), -15°C to -25°C (freezer storage), -40°C to -80°C (ultra-low freezer storage), below -80°C (cryogenic storage), and controlled room temperature (15°C to 25°C). In 2025, the 2°C to 8°C segment is expected to dominate the market due to the large volume of vaccines, insulin, and other biologics requiring standard refrigeration conditions.

However, the ultra-low temperature segments (-40°C to -80°C and below -80°C) are anticipated to record the highest growth rates during the forecast period, driven by increasing development of mRNA vaccines, cell and gene therapies, and other advanced therapeutics requiring extreme cold storage conditions.

By Application

Based on application, the pharmaceutical cold storage market is segmented into commercial drug manufacturing and distribution, clinical trials and investigational products, vaccine distribution and immunization programs, biologics and cell & gene therapy storage, blood and plasma storage, hospital and healthcare facility storage, pharmacy and retail distribution, and research and academic storage. In 2025, the commercial drug manufacturing and distribution segment is anticipated to dominate the market with a share of around 35%, reflecting the large-scale commercial pharmaceutical industry.

The biologics and cell & gene therapy storage segment is projected to record the highest CAGR of 9.2% during the forecast period of 2025-2035, driven by rapid advancement in personalized medicine, increasing approvals of cell and gene therapies, growing investment in regenerative medicine, and expansion of CAR-T cell therapy applications.

By End-User

The pharmaceutical cold storage market is segmented into pharmaceutical and biotechnology companies, contract research organizations (CROs), third-party logistics providers (3PL), hospitals and healthcare providers, research institutes and academic centers, pharmacies and distributors, and other end users. The pharmaceutical and biotechnology companies segment accounts for over 45% of the market in 2025, attributed to direct storage needs for manufacturing, distribution, and quality control activities.

The third-party logistics providers segment shows strong growth driven by outsourcing trends, specialized cold chain expertise, and the need for scalable solutions without significant capital investment.

Regional Analysis

Based on geography, the pharmaceutical cold storage market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is anticipated to account for the major share of around 40% of the pharmaceutical cold storage market, reflecting the region's established pharmaceutical industry, advanced healthcare infrastructure, and stringent regulatory environment requiring sophisticated cold storage solutions.

The market in North America is slated to record a strong CAGR of 6.9% during the forecast period of 2025-2035. This growth is fueled by continued biopharmaceutical innovation, expanding personalized medicine applications, growing vaccine manufacturing capabilities, and increasing focus on supply chain resilience. For pharmaceutical cold storage specifically, North America's leadership is further strengthened by the presence of major pharmaceutical companies, advanced logistics infrastructure, and strong regulatory framework supporting cold chain integrity.

Europe follows as the second-largest market, driven by robust pharmaceutical manufacturing, stringent regulatory requirements, expanding biologics production, and growing emphasis on sustainable cold storage solutions. The region's focus on pharmaceutical exports and advanced healthcare systems contributes significantly to market growth.

Asia-Pacific is emerging as the fastest-growing region for pharmaceutical cold storage, with a projected CAGR of 8.3% during 2025-2035, driven by expanding pharmaceutical manufacturing in countries like China and India, growing healthcare infrastructure investments, increasing vaccine production capabilities, and rising domestic demand for temperature-sensitive medications.

Competitive Landscape

The pharmaceutical cold storage market is characterized by a mix of specialized cold storage equipment manufacturers, logistics service providers, and integrated cold chain solution companies. Leading players in the global pharmaceutical cold storage market include Thermo Fisher Scientific Inc., Carrier Global Corporation, Daikin Industries, Ltd., PHC Holdings Corporation (formerly Panasonic Healthcare Co., Ltd.), Haier Biomedical, Eppendorf AG, Cryoport, Inc., Cold Chain Technologies, Inc., Envirotainer AB, va-Q-tec AG, DHL International GmbH, FedEx Corporation, United Parcel Service, Inc., Americold Realty Trust, Lineage Logistics Holdings, LLC, World Courier International Ltd., Marken Ltd., Tippmann Group, [Kuehne + Nagel International AG, DB Schenker, Maersk, Vetter Pharma International GmbH, and among others. These companies are focusing on strategies such as advanced technology integration, capacity expansion in key markets, strategic partnerships with pharmaceutical companies, sustainability initiatives, and development of specialized solutions for emerging therapeutic modalities to strengthen their market position.

|

Particulars |

Details |

|

Number of Pages |

175 |

|

Forecast Period |

2025-2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.9% |

|

Market Size 2024 |

USD 16.5 billion |

|

Market Size 2025 |

USD 17.7 billion |

|

Market Size 2035 |

USD 34.5 billion |

|

Segments Covered |

By Equipment/Solution Type, Temperature Range, Application, End-User |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Switzerland, Italy, Netherlands, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, and Rest of Middle East & Africa) |

The pharmaceutical cold storage market is projected to reach USD 34.5 billion by 2035 from USD 17.7 billion in 2025, at a CAGR of 6.9% during the forecast period.

In 2025, the refrigeration equipment segment is projected to hold the major share of the pharmaceutical cold storage market.

The biologics and cell & gene therapy storage segment is slated to record the highest growth rate during the forecast period of 2025-2035.

Key factors driving the growth include increasing demand for temperature-sensitive pharmaceuticals, stringent regulatory requirements, expanding vaccine distribution networks, growing biopharmaceutical production, rising adoption of personalized medicine, and development of advanced therapeutic modalities.

Major opportunities include emerging markets expansion, IoT and advanced monitoring integration, ultra-low temperature storage development, home healthcare growth, and automated cold storage systems implementation.

North America leads the market with the highest share, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for pharmaceutical cold storage providers.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency & Pricing

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Market Overview

3.2. Segmental Analysis

3.2.1. Pharmaceutical Cold Storage Market, by Equipment/Solution Type

3.2.2. Pharmaceutical Cold Storage Market, by Temperature Range

3.2.3. Pharmaceutical Cold Storage Market, by Application

3.2.4. Pharmaceutical Cold Storage Market, by End User

3.2.5. Pharmaceutical Cold Storage Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Market Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Demand for Temperature-Sensitive Pharmaceuticals

4.2.1.2. Increasing Biopharmaceutical Production and Storage Requirements

4.2.1.3. Stringent Regulatory Requirements for Drug Storage

4.2.1.4. Expansion of Vaccine Distribution Networks

4.2.1.5. Rising Adoption of Personalized Medicine

4.2.2. Restraints

4.2.2.1. High Capital Investment and Operational Costs

4.2.2.2. Complex Regulatory Compliance Requirements

4.2.2.3. Energy-Intensive Operations and Environmental Concerns

4.2.2.4. Risk of Equipment Failure and Product Loss

4.2.3. Opportunities

4.2.3.1. Emerging Markets Expansion and Healthcare Infrastructure Development

4.2.3.2. Integration of IoT and Advanced Monitoring Technologies

4.2.3.3. Development of Ultra-Low Temperature Storage Solutions

4.2.3.4. Growth in Home Healthcare and Direct-to-Patient Delivery

4.2.4. Trends

4.2.4.1. Strategic Partnerships Between Pharmaceutical Companies and Cold Chain Providers

4.2.4.2. Implementation of Blockchain Technology for Supply Chain Transparency

4.2.4.3. Development of Automated Cold Storage Systems

4.2.4.4. Focus on Sustainable and Energy-Efficient Cold Storage Solutions

4.2.5. Challenges

4.2.5.1. Maintaining Temperature Integrity Throughout the Supply Chain

4.2.5.2. Skilled Workforce Requirements for Cold Chain Management

4.2.5.3. Infrastructure Limitations in Developing Regions

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Impact of Sustainability on the Pharmaceutical Cold Storage Market

4.4.1. Energy Efficiency and Carbon Footprint Reduction

4.4.2. Sustainable Refrigeration Technologies

4.4.3. Green Building Certifications for Cold Storage Facilities

4.4.4. Waste Reduction and Circular Economy Practices

5. Pharmaceutical Cold Storage Market Assessment—by Equipment/Solution Type

5.1. Refrigeration Equipment

5.1.1. Walk-in Cold Rooms

5.1.2. Cold Storage Freezers

5.1.3. Ultra-Low Temperature Freezers

5.1.4. Cryogenic Storage Systems

5.2. Temperature-Controlled Containers/Packaging

5.2.1. Active Containers (Powered)

5.2.2. Passive Containers (Insulated, Phase Change Materials)

5.2.3. Reusable vs. Single-Use Containers

5.3. Monitoring and Control Systems

5.3.1. IoT-Enabled Temperature Monitoring

5.3.2. Data Loggers

5.3.3. Cloud-Based Monitoring Platforms

5.4. Cold Storage Services

5.4.1. Cold Chain Logistics (Transportation, Warehousing)

5.4.2. Third-Party Storage and Handling

5.4.3. Validation and Qualification Services

5.5. Other Solutions

5.5.1. Automated Storage and Retrieval Systems

5.5.2. Green/Carbon-Neutral Storage Solutions

6. Pharmaceutical Cold Storage Market Assessment—by Temperature Range

6.1. 2°C to 8°C (Standard Refrigeration)

6.2. -15°C to -25°C (Freezer Storage)

6.3. -40°C to -80°C (Ultra-Low Freezer Storage)

6.4. Below -80°C (Cryogenic Storage)

6.5. Controlled Room Temperature (15°C to 25°C)

7. Pharmaceutical Cold Storage Market Assessment—by Application

7.1. Commercial Drug Manufacturing and Distribution

7.2. Clinical Trials and Investigational Products

7.3. Vaccine Distribution and Immunization Programs

7.4. Biologics and Cell & Gene Therapy Storage

7.5. Blood and Plasma Storage

7.6. Hospital and Healthcare Facility Storage

7.7. Pharmacy and Retail Distribution

7.8. Research and Academic Storage

8. Pharmaceutical Cold Storage Market Assessment—by End User

8.1. Pharmaceutical and Biotechnology Companies

8.2. Contract Research Organizations (CROs)

8.3. Third-Party Logistics Providers (3PL)

8.4. Hospitals and Healthcare Providers

8.5. Research Institutes and Academic Centers

8.6. Pharmacies and Distributors

8.7. Other End Users

9. Pharmaceutical Cold Storage Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. United Kingdom

9.3.3. France

9.3.4. Switzerland

9.3.5. Italy

9.3.6. Netherlands

9.3.7. Belgium

9.3.8. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Singapore

9.4.7. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Argentina

9.5.4. Colombia

9.5.5. Rest of Latin America (RoLATAM)

9.6. Middle East & Africa

9.6.1. United Arab Emirates (UAE)

9.6.2. Saudi Arabia

9.6.3. South Africa

9.6.4. Egypt

9.6.5. Rest of Middle East & Africa (RoMEA)

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Players

10.5. Market Share/Ranking Analysis, by Key Players, 2024

11. Company Profiles

Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis

11.1. Thermo Fisher Scientific Inc.

11.2. Carrier Global Corporation

11.3. Daikin Industries, Ltd.

11.4. PHC Holdings Corporation (formerly Panasonic Healthcare Co., Ltd.)

11.5. Haier Biomedical

11.6. Eppendorf AG

11.7. Cryoport, Inc.

11.8. Cold Chain Technologies, Inc.

11.9. Envirotainer AB

11.10. va-Q-tec AG

11.11. DHL International GmbH

11.12. FedEx Corporation

11.13. United Parcel Service, Inc.

11.14. Americold Realty Trust

11.15. Lineage Logistics Holdings, LLC

11.16. World Courier International Ltd.

11.17. Marken Ltd.

11.18. Tippmann Group

11.19. Kuehne + Nagel International AG

11.20. DB Schenker

11.21. Maersk

11.22. Vetter Pharma International GmbH

11.23. Others

12. Appendix

12.1. Available Customizations

12.2. Related Reports

12.3. Glossary of Terms

List of Tables

Table 1 Temperature Requirements for Different Pharmaceutical Products

Table 2 Global Pharmaceutical Cold Storage Standards and Regulations

Table 3 Indicative List of Cold Storage Equipment Manufacturers and their Product Offerings

Table 4 List of Major Refrigeration Equipment Providers

Table 5 List of Temperature-Controlled Packaging Solutions Providers

Table 6 List of Monitoring and Control Systems Manufacturers

Table 7 List of Third-Party Cold Storage Service Providers

Table 8 Average Pricing of Walk-in Cold Rooms, by Country, 2023-2035 (USD/Unit)

Table 9 Average Pricing of Ultra-Low Temperature Freezers, by Country, 2023-2035 (USD/Unit)

Table 10 Average Pricing of Cryogenic Storage Systems, by Country, 2023-2035 (USD/Unit)

Table 11 Average Pricing of Active Temperature-Controlled Containers, by Country, 2023-2035 (USD/Unit)

Table 12 Average Pricing of IoT Monitoring Systems, by Country, 2023-2035 (USD/Unit)

Table 13 Average Pricing of Cold Chain Logistics Services, by Country, 2023-2035 (USD/Shipment)

Table 14 Capital Investment vs. Operational Cost Comparison for Cold Storage Facilities

Table 15 Regulatory Compliance Requirements by Region

Table 16 Energy Consumption and Efficiency Metrics for Different Storage Systems

Table 17 Cold Storage Capacity and Lead Times by Equipment Type

Table 18 Global: Pharmaceutical Cold Storage Standards by Application

Table 19 Global Pharmaceutical Cold Storage Market, by Equipment/Solution Type, 2023-2035 (USD Million)

Table 20 Global Refrigeration Equipment Market, by Country, 2023-2035 (USD Million)

Table 21 Global Temperature-Controlled Containers Market, by Country, 2023-2035 (USD Million)

Table 22 Global Monitoring and Control Systems Market, by Country, 2023-2035 (USD Million)

Table 23 Global Cold Storage Services Market, by Country, 2023-2035 (USD Million)

Table 24 Global Other Solutions Market, by Country, 2023-2035 (USD Million)

Table 25 Global Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 26 Global Pharmaceutical Cold Storage Market for 2°C to 8°C Storage, by Country, 2023-2035 (USD Million)

Table 27 Global Pharmaceutical Cold Storage Market for -15°C to -25°C Storage, by Country, 2023-2035 (USD Million)

Table 28 Global Pharmaceutical Cold Storage Market for -40°C to -80°C Storage, by Country, 2023-2035 (USD Million)

Table 29 Global Pharmaceutical Cold Storage Market for Below -80°C Storage, by Country, 2023-2035 (USD Million)

Table 30 Global Pharmaceutical Cold Storage Market for Controlled Room Temperature Storage, by Country, 2023-2035 (USD Million)

Table 31 Global Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 32 Global Pharmaceutical Cold Storage Market for Commercial Drug Manufacturing, by Country, 2023-2035 (USD Million)

Table 33 Comparison of Storage Requirements by Application Type

Table 34 Global Pharmaceutical Cold Storage Market for Clinical Trials, by Country, 2023-2035 (USD Million)

Table 35 Global Pharmaceutical Cold Storage Market for Vaccine Distribution, by Country, 2023-2035 (USD Million)

Table 36 Global Pharmaceutical Cold Storage Market for Biologics and Cell & Gene Therapy, by Country, 2023-2035 (USD Million)

Table 37 Global Pharmaceutical Cold Storage Market for Blood and Plasma, by Country, 2023-2035 (USD Million)

Table 38 Global Pharmaceutical Cold Storage Market for Hospital, by Country, 2023-2035 (USD Million)

Table 39 Global Pharmaceutical Cold Storage Market for Pharmacy and Retail, by Country, 2023-2035 (USD Million)

Table 40 Global Pharmaceutical Cold Storage Market for Research and Academic Storage, by Country, 2023-2035 (USD Million)

Table 41 Global Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 42 Global Pharmaceutical Cold Storage Market for Pharmaceutical Companies, by Country, 2023-2035 (USD Million)

Table 43 Global Pharmaceutical Cold Storage Market for CRO, by Country, 2023-2035 (USD Million)

Table 44 Global Pharmaceutical Cold Storage Market for 3PL, by Country, 2023-2035 (USD Million)

Table 45 Global Pharmaceutical Cold Storage Market for Hospitals, by Country, 2023-2035 (USD Million)

Table 46 Global Pharmaceutical Cold Storage Market for Research Institutes, by Country, 2023-2035 (USD Million)

Table 47 Global Pharmaceutical Cold Storage Market for Pharmacies and Distributors, by Country, 2023-2035 (USD Million)

Table 48 Global Pharmaceutical Cold Storage Market for Other End Users, by Country, 2023-2035 (USD Million)

Table 49 Global Pharmaceutical Cold Storage Market, by Region, 2023-2035 (USD Million)

Table 50 Key Cold Storage Buyers in North America

Table 51 North America: Pharmaceutical Cold Storage Market, by Country, 2023-2035 (USD Million)

Table 52 North America: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 53 North America: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 54 North America: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 55 North America: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 56 U.S.: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 57 U.S.: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 58 U.S.: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 59 U.S.: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 60 Canada: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 61 Canada: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 62 Canada: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 63 Canada: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 64 Europe: Pharmaceutical Cold Storage Market, by Country/Region, 2023-2035 (USD Million)

Table 65 Europe: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 66 Europe: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 67 Europe: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 68 Europe: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 69 Germany: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 70 Germany: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 71 Germany: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 72 Germany: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 73 United Kingdom: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 74 United Kingdom: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 75 United Kingdom: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 76 United Kingdom: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 77 France: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 78 France: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 79 France: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 80 France: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 81 Switzerland: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 82 Switzerland: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 83 Switzerland: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 84 Switzerland: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 85 Italy: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 86 Italy: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 87 Italy: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 88 Italy: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 89 Netherlands: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 90 Netherlands: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 91 Netherlands: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 92 Netherlands: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 93 Belgium: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 94 Belgium: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 95 Belgium: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 96 Belgium: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 97 Rest of Europe: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 98 Rest of Europe: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 99 Rest of Europe: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 100 Rest of Europe: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 101 Asia-Pacific: Pharmaceutical Cold Storage Market, by Country/Region, 2023-2035 (USD Million)

Table 102 Asia-Pacific: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 103 Asia-Pacific: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 104 Asia-Pacific: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 105 Asia-Pacific: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 106 China: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 107 China: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 108 China: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 109 China: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 110 Japan: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 111 Japan: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 112 Japan: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 113 Japan: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 114 India: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 115 India: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 116 India: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 117 India: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 118 South Korea: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 119 South Korea: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 120 South Korea: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 121 South Korea: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 122 Australia: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 123 Australia: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 124 Australia: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 125 Australia: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 126 Singapore: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 127 Singapore: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 128 Singapore: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 129 Singapore: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 130 Rest of Asia-Pacific: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 131 Rest of Asia-Pacific: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 132 Rest of Asia-Pacific: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 133 Rest of Asia-Pacific: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 134 Latin America: Pharmaceutical Cold Storage Market, by Country/Region, 2023-2035 (USD Million)

Table 135 Latin America: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 136 Latin America: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 137 Latin America: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 138 Latin America: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 139 Brazil: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 140 Brazil: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 141 Brazil: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 142 Brazil: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 143 Mexico: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 144 Mexico: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 145 Mexico: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 146 Mexico: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 147 Argentina: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 148 Argentina: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 149 Argentina: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 150 Argentina: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 151 Colombia: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 152 Colombia: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 153 Colombia: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 154 Colombia: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 155 Rest of Latin America: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 156 Rest of Latin America: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 157 Rest of Latin America: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 158 Rest of Latin America: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 159 Middle East & Africa: Pharmaceutical Cold Storage Market, by Country/Region, 2023-2035 (USD Million)

Table 160 Middle East & Africa: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 161 Middle East & Africa: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 162 Middle East & Africa: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 163 Middle East & Africa: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 164 UAE: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 165 UAE: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 166 UAE: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 167 UAE: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 168 Saudi Arabia: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 169 Saudi Arabia: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 170 Saudi Arabia: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 171 Saudi Arabia: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 172 South Africa: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 173 South Africa: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 174 South Africa: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 175 South Africa: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 176 Egypt: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 177 Egypt: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 178 Egypt: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 179 Egypt: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

Table 180 Rest of Middle East & Africa: Pharmaceutical Cold Storage Market, by Equipment Type, 2023-2035 (USD Million)

Table 181 Rest of Middle East & Africa: Pharmaceutical Cold Storage Market, by Temperature Range, 2023-2035 (USD Million)

Table 182 Rest of Middle East & Africa: Pharmaceutical Cold Storage Market, by Application, 2023-2035 (USD Million)

Table 183 Rest of Middle East & Africa: Pharmaceutical Cold Storage Market, by End-User, 2023-2035 (USD Million)

________________________________________

List of Figures

Figure 1 Research Process for Pharmaceutical Cold Storage Market

Figure 2 Secondary Sources Referenced for Pharmaceutical Cold Storage Study

Figure 3 Primary Research Techniques for Cold Storage Market Analysis

Figure 4 Key Executives Interviewed in Pharmaceutical Cold Storage Industry

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach for Pharmaceutical Cold Storage

Figure 7 In 2024, the Refrigeration Equipment Segment to Dominate the Global Cold Storage Market

Figure 8 In 2024, the 2°C to 8°C Temperature Range to Show Largest Market Share

Figure 9 In 2024, the Commercial Drug Manufacturing Segment to Lead Cold Storage Applications

Figure 10 In 2024, the Pharmaceutical Companies Segment to Dominate the Cold Storage Market

Figure 11 North America and Europe Lead the Pharmaceutical Cold Storage Market Growth

Figure 12 Benefits of Advanced Pharmaceutical Cold Storage Systems

Figure 13 Cold Chain Process Flow for Pharmaceutical Products

Figure 14 Pharmaceutical Cold Storage Market: Value Chain Analysis

Figure 15 Pharmaceutical Cold Storage Market: Porter's Five Forces Analysis

Figure 16 Impact Analysis of Cold Storage Market Dynamics

Figure 17 Temperature Range Requirements vs. Storage Technology Comparison

Figure 18 Global Pharmaceutical Cold Storage Market, by Equipment Type, 2025 Vs. 2035 (USD Million)

Figure 19 Global Pharmaceutical Cold Storage Market, by Temperature Range, 2025 Vs. 2035 (USD Million)

Figure 20 Global Pharmaceutical Cold Storage Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 21 Cold Storage Supply Chain: Equipment Manufacturer to End User Flow

Figure 22 Cold Storage Services: Third-Party Logistics Provider Flow

Figure 23 Global Pharmaceutical Cold Storage Market, by End-User, 2025 Vs. 2035 (USD Million)

Figure 24 Global Pharmaceutical Cold Storage Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 25 Impact of Cold Storage Technology on Pharmaceutical Product Integrity

Figure 26 Global Pharmaceutical Cold Storage Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 27 North America: Pharmaceutical Cold Storage Market Snapshot (2024)

Figure 28 Europe: Pharmaceutical Cold Storage Market Snapshot (2025)

Figure 29 Asia-Pacific: Pharmaceutical Cold Storage Market Snapshot (2025)

Figure 30 Latin America: Pharmaceutical Cold Storage Market Snapshot (2025)

Figure 31 Middle East & Africa: Pharmaceutical Cold Storage Market Snapshot (2025)

Figure 32 Key Growth Strategies Adopted by Leading Cold Storage Players (2022-2025)

Figure 33 Global Pharmaceutical Cold Storage Market Competitive Benchmarking, by Application

Figure 34 Competitive Dashboard: Global Pharmaceutical Cold Storage Market

Figure 35 Global Pharmaceutical Cold Storage Market Ranking/Positioning of Key Players, 2025

Figure 36 Thermo Fisher Scientific Inc.: Financial Overview (2024)

Figure 37 Carrier Global Corporation: Financial Overview (2024)

Figure 38 Daikin Industries Ltd.: Financial Overview (2024)

Figure 39 Panasonic Healthcare Co. Ltd.: Financial Overview (2024)

Figure 40 Advanced vs. Standard Cold Storage Systems: Technology Comparison (2024)

Figure 41 Pharmaceutical Cold Storage Regulatory Timeline and Compliance Costs

Figure 42 Cold Storage Manufacturing: Sustainability and Energy Efficiency Impact Analysis

Published Date: Jan-2021

Published Date: Sep-2013

Published Date: Sep-2013

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates