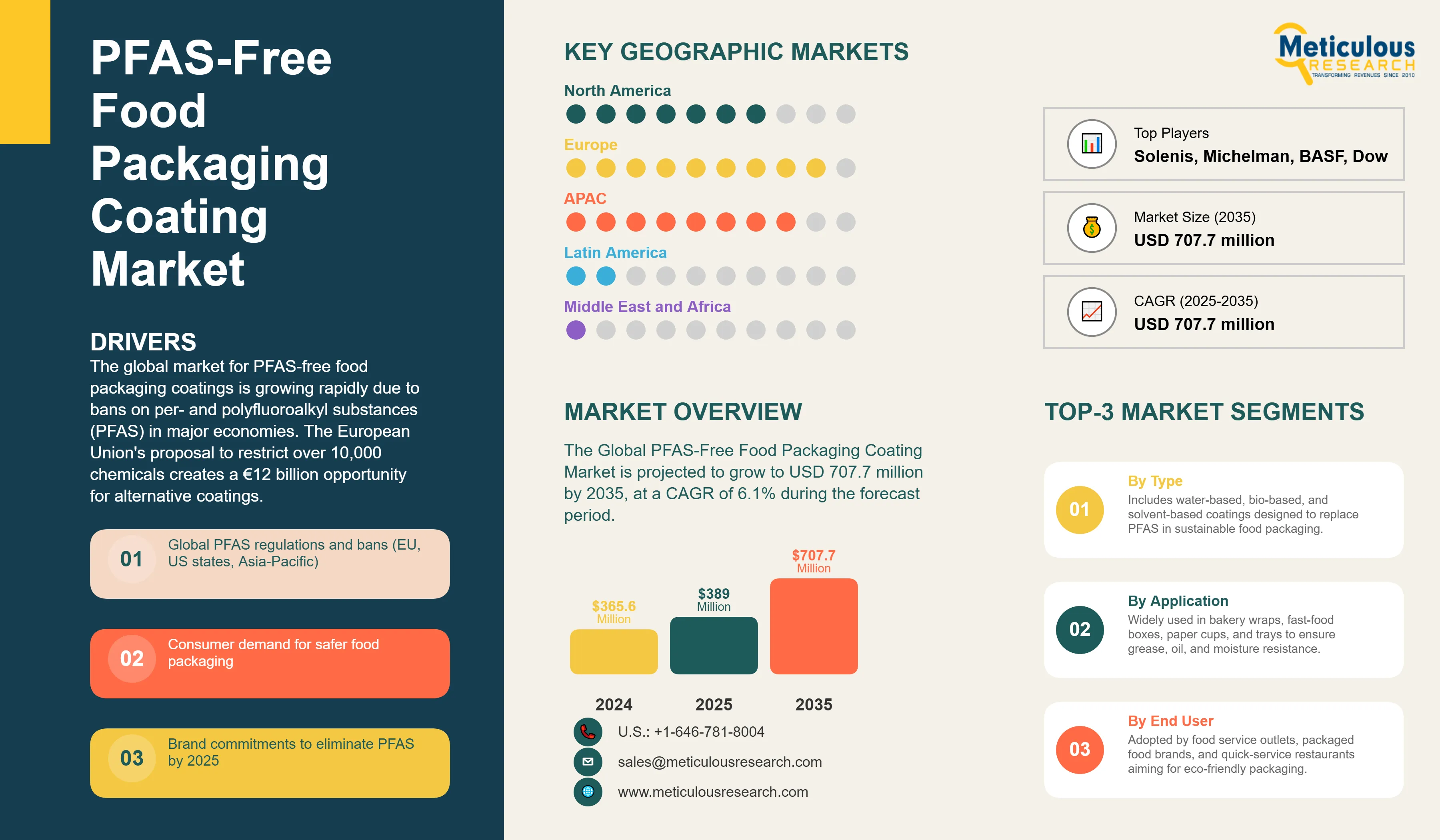

The Global PFAS-Free Food Packaging Coating Market was valued at USD 365.6 million in 2024. The PFAS-free coating market for food packaging is estimated to reach USD 389.0 million in 2025 and is projected to grow to USD 707.7 million by 2035, at a CAGR of 6.1% during the forecast period.

Global PFAS-Free Food Packaging Coating Market 2025 - Key Statistics

|

Metric

|

Value

|

|

Market Value (2025)

|

USD 389 million

|

|

Market Value (2035)

|

USD 707.7 million

|

|

CAGR (2025-2035)

|

6.1%

|

|

Largest Coating Type

|

Water-Based Dispersions (30-40% share)

|

|

Fastest Growing Segment

|

Bio-Based Coatings (8.7% CAGR)

|

|

Leading Application

|

Quick Service Restaurants (40-50% share)

|

|

Dominant Substrate

|

Paper and Paperboard (60-65% share)

|

|

Top Region by Market Size

|

Europe (35-40% share)

|

|

Fastest Growth Region

|

Asia-Pacific (7.8% CAGR)

|

Global PFAS-Free Food Packaging Coating Market Overview

Click here to: Get Free Sample Pages of this Report

Why is the Global PFAS-Free Food Packaging Coating Market Growing Rapidly?

- The global market for PFAS-free food packaging coatings is growing rapidly due to bans on per- and polyfluoroalkyl substances (PFAS) in major economies. The European Union's proposal to restrict over 10,000 chemicals creates a €12 billion opportunity for alternative coatings. States in the US, including California, Maine, Minnesota, and New York, have implemented PFAS bans in food packaging that take effect between 2023 and 2025. This requires immediate changes in the $45 billion food packaging industry.

- Major brands are pushing for market changes, with McDonald's, Burger King, Wendy's, and Starbucks committing to completely eliminate PFAS by 2025. Amazon's global packaging standards ban PFAS in all food contact materials for its more than 300 million products. Walmart also requires PFAS-free certification from over 100,000 suppliers. These corporate policies impact more than $500 billion in annual food packaging procurement, generating significant demand for PFAS alternatives.

- Innovations in bio-based barrier coatings achieve 95% of PFAS performance at commercially viable costs. Water-based acrylic dispersions reinforced with nano-clay offer 48-hour grease resistance that rivals fluorochemicals. Coatings made from plant-derived materials, sourced from agricultural waste, cut raw material costs by 30% and are fully biodegradable within 90 days.

- Increased consumer awareness drives market growth. Recently conducted surveys show that 78% of consumers are willing to pay extra for PFAS-free packaging. The "Dark Waters" effect and extensive media coverage on PFAS contamination boost demand for safer options. Retailers notice a 25% increase in sales for products specifically labeled as PFAS-free, encouraging quick adoption throughout supply chains.

- Innovation in coating technologies is closing performance gaps, with new formulations achieving oil resistance ratings of Kit 12 without using fluorochemicals. Multi-layer barrier systems that blend bio-polymers, minerals, and waxes match PFAS performance while allowing for recycling and composting. Improved application methods decrease coating usage by 40%, enhancing cost-effectiveness while ensuring protection.

- Circular economy initiatives support PFAS-free solutions that make packaging recyclable and compostable. The EU’s Circular Economy Action Plan emphasizes chemical-free packaging design and provides €2 billion in funding for innovation. PFAS-free coatings enable fiber recovery worth $3.5 billion each year, which was previously hindered by fluorochemical residues.

Global PFAS-Free Food Packaging Coating Market Size, Growth Projections and Forecast Analysis

|

Metric

|

Value

|

|

Global PFAS-Free Coating Market Value (2025)

|

USD 389 million

|

|

PFAS Alternative Coating Market Forecast (2035)

|

USD 707.7 million

|

|

Forever Chemical-Free Packaging CAGR (2025-2035)

|

6.1%

|

Market Segmentation - Global PFAS-Free Food Packaging Coating Market

The global PFAS-free food packaging coating market is divided into several categories. These include coating type, substrate material, application technology, end-use application, industry vertical, and geographic region. The types of coatings are water-based dispersions, bio-based polymers, wax coatings, clay-based barriers, and silicone alternatives. The substrates include paper/paperboard, molded fiber, flexible films, metal, and glass. The technologies used are extrusion coating, dispersion application, solution coating, and vacuum deposition. The applications involve QSR packaging, retail food, E-commerce delivery, and institutional service.

Water-Based Dispersions Lead PFAS-Free Coating Market with 30-40% Share in 2025

- Water-based dispersion coatings dominate the PFAS-free food packaging market with 30-40% share in 2025 due to their balance of performance, cost-efficiency, and regulatory compliance.

- Formulated mainly with acrylic and polyurethane, they achieve high oil and grease resistance (Kit 8–10) while meeting FDA, EU, and other global food safety standards.

- Leading products like Michelman’s Michem Coat and Solenis’ TopScreen deliver 24–48 hours of hot oil resistance at 60°C, meeting the needs of high-grease fast-food packaging.

Quick Service Restaurant Applications Drive 40-50% of PFAS-Free Coating Demand

Quick service restaurants (QSR) will account for 40-50% of global PFAS-free coating demand in 2025. This demand is driven by the need for high-volume packaging and direct food contact standards. The QSR industry uses over 250 billion food packaging units each year. It faces strict performance requirements for hot, greasy foods, which creates technical challenges for PFAS alternatives.

McDonald's has publicly committed to removing PFAS chemicals from all guest packaging worldwide by 2025. This decision comes after pressure from public health advocates and campaigns that highlighted the presence of PFAS in common packaging, like Big Mac boxes and fries bags. The company has also been phasing out other harmful chemicals such as BPA, BPS, and phthalates from its packaging as part of a wider push for sustainability and product responsibility. With over 38,000 restaurants globally, this commitment will significantly impact the reduction of PFAS in food packaging worldwide.

European Market Leads Global PFAS-Free Food Packaging Coating Market with 35-40% Market Share

- Europe dominates the global PFAS-free food packaging coating market with 35-40% share in 2025, driven by comprehensive regulatory frameworks and strong consumer environmental consciousness.

- The EU's proposed universal PFAS restriction under REACH, submitted by five Member States in January 2023, aims to ban the manufacture, sale, and use of all PFAS substances except for essential uses. This is one of the broadest chemical restrictions ever proposed in the EU, covering thousands of PFAS chemicals in various sectors, including food packaging.

- The scientific and socio-economic assessments by ECHA’s committees are expected to finish in 2026. Legislative decision-making will then take place at both the European Commission and Member State levels. This process will likely lead to enforcement between 2026 and 2028, with phased implementation and possible temporary exemptions for critical uses.

- The restriction is expected to affect over 500,000 tons of PFAS-containing food packaging each year in Europe. This makes it the largest chemical substitution mandate in Europe, significantly pushing the shift towards safer, PFAS-free alternatives.

- In addition to regulatory measures, the EU is helping the industry transition through innovation funding, targeted R&D, and stakeholder engagement. These efforts aim to promote alternative substances and cut down on environmental emissions of PFAS.

Key Market Drivers, Restraints, and Emerging Trends in PFAS-Free Food Packaging Coating Market

The global PFAS-free food packaging coating market is mainly driven by the new regulations, consumer preferences, technological advancements, and company pledges to be more sustainable. Challenges involve improving performance, managing costs, and changing supply chains. New trends highlight the use of bio-based materials, applications of nanotechnology, and circular design principles.

Impact of Key Growth Drivers and Restraints on PFAS-Free Coating Market

Base CAGR: 6.1%

PFAS-Free Coating Market Drivers

|

Driver

|

CAGR Impact

|

Key Factors

|

|

Regulatory Bans & Restrictions

|

+2.1%

|

- EU universal PFAS ban

- US state regulations

- Global treaty discussions

|

|

Brand & Retailer Commitments

|

+1.5%

|

- 2025 phase-out pledges

- Supply chain mandates

- Private label requirements

|

|

Consumer Health Awareness

|

+1.2%

|

- PFAS contamination coverage

- Health impact studies

- Premium willingness

|

|

Technology Innovation

|

+1.1%

|

- Bio-based breakthroughs

- Performance improvements

- Cost reductions

|

PFAS-Free Packaging Market Restraints

|

Restraint

|

CAGR Impact

|

Mitigation Strategies

|

|

Performance Limitations

|

-1.6%

|

- Multi-layer systems

- Hybrid formulations

- Application optimization

|

|

Cost Premiums

|

-1.3%

|

- Scale economies

- Process efficiency

- Raw material alternatives

|

|

Technical Adoption Barriers

|

-0.9%

|

- Equipment modifications

- Training programs

- Transition support

|

Competitive Landscape - Leading PFAS-Free Coating Manufacturers and Innovators

The global PFAS-free food packaging coating market is highly competitive. It includes specialty chemical companies, coating manufacturers, bio-material innovators, and packaging converters that are creating sustainable solutions.

Solenis is a leading company in specialty chemicals. They offer a range of eco-friendly, PFAS-free barrier coatings for food and beverage packaging. Their TopScreen™ technology features multi-layer barrier coatings designed for molded pulp and paper packaging applications. These coatings provide resistance to water, oil, and grease while ensuring recyclability and compostability. Solenis also helps converters and brands meet changing sustainability and regulatory needs with their expertise and resources.

Michelman is a known supplier of water-based barrier coatings that are PFAS-free and safe for food contact. Their Michem Coatings include options that resist oil and grease while maintaining recyclability and printability for fiber-based flexible and rigid packaging. Michelman works closely with packaging converters and industry partners to create solutions that replace polyethylene (PE) and other non-recyclable materials. They aim for circular packaging designs.

Large chemical companies like BASF, Dow, and Arkema are making significant investments in bio-based, sustainable barrier technologies. BASF's ecovio® portfolio combines biodegradable polymers with mineral fillers to provide effective barrier performance for frozen food packaging. Dow’s RHOBARR® series emphasizes recyclability while effectively blocking oil and moisture.

Bio-material companies such as Novamont offer agricultural-based coatings like Mater-Bi®, which is made from corn starch. This product provides industrial compostability and grease resistance for food packaging. Cargill develops plant-based barrier coatings, leveraging extensive agricultural supply chains to ensure sourcing of sustainable raw materials.

Packaging converters and paper producers like Stora Enso and Sappi incorporate PFAS-free coatings directly into their fiber products. They provide complete solutions that reduce costs and improve quality control. Their integrated approach speeds up adoption by offering technical support and performance optimization services.

New startups like Notpla, which focuses on seaweed-based edible coatings, and Xampla, known for developing plant protein-based films, have gained significant investments and formed partnerships with major brands. They are pushing forward the commercialization of innovative, biodegradable, and PFAS-free packaging materials.

Recent Developments in Global PFAS-Free Food Packaging Coating Market 2024-2025

March 2025: Solenis LLC expanded its partnership with Zume to scale production of sustainable, PFAS-free molded fiber packaging for food service applications. The collaboration leverages Solenis’ expertise in functional additives and barrier coatings combined with Zume’s patented molded-fiber manufacturing.

September 2024: Heidelberg and Solenis announced a collaboration to develop a cost-effective process to integrate PFAS-free barrier coatings directly into flexible fibre-based paper packaging via roll-fed flexo printing using Heidelberg’s Boardmaster press.

Global PFAS-Free Food Packaging Coating Market Report - Comprehensive Coverage Summary

|

Report Coverage

|

Details

|

|

Market Size (2025)

|

USD 389 Million

|

|

Coating Types

|

Water-Based, Bio-Based, Wax, Clay, Silicone Alternatives

|

|

Substrate Materials

|

Paper/Paperboard, Molded Fiber, Flexible Films, Metal, Glass

|

|

Technologies

|

Extrusion, Dispersion, Solution Coating, Vacuum Deposition

|

|

Applications

|

QSR, Retail Food, E-commerce, Institutional Service

|

|

End-Use Industries

|

Food Service, Manufacturing, Retail, Delivery Services

|

|

Geographic Coverage

|

North America, Europe, Asia-Pacific, LATAM, MEA

|

|

Key Companies

|

Solenis, Michelman, BASF, Dow, Arkema, DSM, Cargill, Novamont

|

|

Analysis Includes

|

Regulatory impact, technology trends, sustainability metrics, competitive strategies, company profiles, market share/ranking analysis, Porter’s Five Forces analysis, key market trends and drivers

|

Frequently Asked Questions