Resources

About Us

Non-alcoholic Wine Market Size, Share, Forecast, & Trends Analysis by Product (Sparkling, Still), Technology (Dealcoholization), Packaging (Bottle, Can), Distribution Channel (Supermarkets, Online Stores, QSR) - Global Forecast to 2035

Report ID: MRFB - 1041331 Pages: 212 Jan-2026 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportNon-Alcoholic Wine Market Size & Forecast

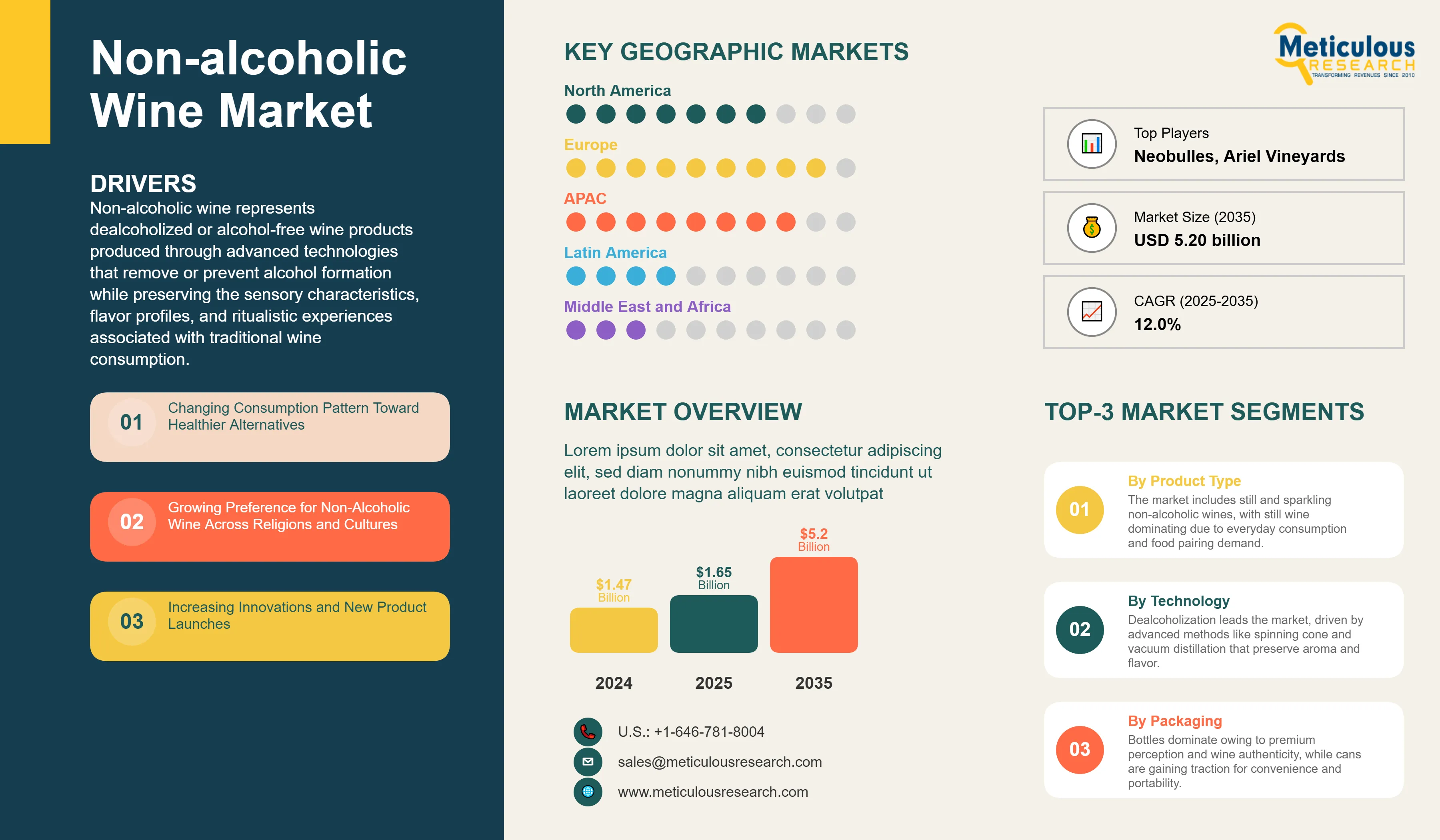

The global non-alcoholic wine market is projected to reach USD 5.20 billion by 2035 from an estimated USD 1.65 billion in 2025, at a CAGR of 12.0% during the forecast period from 2025 to 2035.

Non-alcoholic wine represents dealcoholized or alcohol-free wine products produced through advanced technologies that remove or prevent alcohol formation while preserving the sensory characteristics, flavor profiles, and ritualistic experiences associated with traditional wine consumption. These products, typically containing less than 0.5% alcohol by volume (ABV) or 0.0% ABV depending on regional regulations and production methods, serve consumers seeking wine-like experiences without alcohol for health, religious, cultural, lifestyle, or social reasons.

Key drivers of this market include changing consumption patterns toward healthier alternatives driven by wellness consciousness and moderation trends, growing preference for non-alcoholic wine across religions and cultures that restrict alcohol consumption, increasing innovations and new product launches utilizing advanced dealcoholization technologies, and rising acceptance in social drinking gatherings as hospitality venues normalize zero-proof beverage programs. The "sober curious" movement has gained mainstream acceptance, particularly among Generation Z and Millennials who account for a substantial share of incremental buyers, while scientific research validates benefits such as improved physical health, better sleep quality, and enhanced mental clarity from reduced alcohol consumption.

Non-alcoholic wine production employs sophisticated dealcoholization technologies including vacuum distillation, spinning cone column systems, reverse osmosis, and membrane filtration, alongside restricted fermentation techniques that limit alcohol formation during winemaking. At the 2023 World Alcohol-Free Awards, spinning cone technology accounted for eight of nine gold medals, underscoring advancement in premium production quality. The category encompasses both still wines (red, white, rosé) and sparkling wines across multiple varietals including Cabernet Sauvignon, Chardonnay, Pinot Noir, Sauvignon Blanc, and prosecco-style offerings, with products increasingly positioned as premium lifestyle beverages rather than mere substitutes for traditional wine.

With advances in production techniques including spinning cone technology and aroma-capture systems that preserve flavor authenticity, increasing demand for premium non-alcoholic wines positioned at the intersection of health, indulgence, and sophistication, expansion of online retail channels, and growing focus on low-calorie and no-sugar options, the non-alcoholic wine market is expected to expand significantly, driven by wellness trends, social acceptance, and technological innovation in an increasingly health-conscious global beverage landscape.

Click here to: Get Free Sample Pages of this Report

Changing Consumption Pattern Toward Healthier Alternatives

A key driver of growth in the non-alcoholic wine market is the structural shift in consumer behavior toward healthier lifestyle choices and moderation in alcohol consumption. Research indicates that nearly half of consumers actively seek zero-alcohol alternatives, motivated by wellness considerations, while a significant majority of millennials aim to reduce their alcohol intake. This behavioral transformation reflects heightened awareness of health risks associated with alcohol, including liver disease, mental health disorders, cardiovascular complications, and addiction concerns.

The "sober curious" movement has gained mainstream acceptance, particularly among Generation Z and Millennials, who account for a substantial share of incremental buyers in the non-alcoholic wine category. Scientific research further validates this trend, highlighting benefits such as improved physical health, better sleep quality, and enhanced mental clarity from reduced alcohol consumption. Cultural initiatives like Dry January and Sober October have evolved from short-term challenges into year-round mindful drinking practices, with a growing proportion of consumers expressing interest in zero-alcohol beverages.

Additionally, the preference for low-calorie options provides further momentum for non-alcoholic wine adoption. Dealcoholized wines typically contain fewer calories than traditional wines due to the absence of alcohol, which contributes approximately seven calories per gram. Health-conscious consumers, particularly those monitoring sugar intake or following calorie-controlled diets, increasingly view non-alcoholic wine as a positive lifestyle choice rather than simply an abstinence alternative. This positioning reinforces its appeal as part of a balanced, health-oriented lifestyle, driving sustained market growth across demographics and consumption occasions.

Growing Preference for Non-Alcoholic Wine Across Religions and Cultures

Non-alcoholic wine is unlocking significant market opportunities among populations where religious or cultural norms restrict or prohibit alcohol consumption. Countries with large Muslim populations such as Saudi Arabia, the United Arab Emirates, Indonesia, Malaysia, and other Middle Eastern and Southeast Asian nations represent high-potential markets where alcohol-free wine enables consumers to enjoy the sophistication of wine culture without violating religious principles. Demand for compliant beverage alternatives continues to rise in these regions as consumers seek premium experiences aligned with their values.

Beyond religious considerations, cultural factors also drive adoption among individuals who abstain from alcohol for personal or health reasons but still wish to participate in social drinking occasions. This includes pregnant women, designated drivers, individuals with medical conditions that contraindicate alcohol, and those in recovery from alcohol dependency. Brands are increasingly recognizing these segments; for example, French Bloom positioned its non-alcoholic sparkling wine launch in March 2024 as an elegant option for pregnant women seeking celebratory beverages during life milestones.

Globalization of wine culture further amplifies demand for non-alcoholic alternatives, particularly in Asia-Pacific markets where Western lifestyle trends are gaining traction among urban populations. Countries such as Japan, China, India, and South Korea are witnessing growing interest in wine experiences, with non-alcoholic options serving as accessible entry points for consumers unfamiliar with traditional wine or seeking moderation. As product quality approaches parity with alcoholic counterparts, cultural acceptance of non-alcoholic wine continues to expand, legitimizing the category across diverse social and cultural contexts.

Increasing Innovations and New Product Launches

Innovation continues to be a defining growth driver for the non-alcoholic wine market, with momentum accelerating into 2025 and beyond. Manufacturers are responding to consumer demand for authenticity, premium quality, and variety by introducing advanced dealcoholization technologies, heritage-style aging, and functional enhancements. More than 60 SKUs were launched globally in 2023-2024, and this trend has intensified with high-profile releases and trade events in 2025, signaling a new era of category sophistication.

Recent examples underscore this evolution. In May 2025, St. Buena Vida debuted its dry sparkling Chardonnay, crafted from organic Spanish vineyards and dealcoholized in Germany using Solos aroma-capture technology, which preserves complexity and depth of flavor. At Wine Paris 2025, the non-alcoholic wine segment expanded its footprint by 30%, with 75% of traditional producers showcasing alcohol-free variants. Notable launches included Zerinomo's 20-year-aged dealcoholized red wine, targeting connoisseurs seeking mature flavors without alcohol, and Villa Noria Levin's lacto-fermented grape must Pet Nat-style beverage, which leverages upcycled grape pressings for added aromatic sophistication.

Looking ahead, Wine Paris 2026 will introduce "Be No," the first dedicated global platform for alcohol-free wines, spirits, and RTDs—underscoring the category's rapid mainstreaming. Innovation is also diversifying beyond traditional grape-based wines to include exotic fruit blends, botanical infusions, and functional ingredients. Producers are experimenting with herbs and spices such as rosemary, cinnamon, and vanilla, while premium segments increasingly incorporate adaptogens and antioxidants to deliver added health benefits. These advancements position non-alcoholic wine as more than an abstinence alternative, evolving into a premium lifestyle choice aligned with wellness, sustainability, and cultural inclusivity.

Rising Acceptance in Social Drinking Gatherings

Social acceptance of non-alcoholic wine has accelerated, transforming its perception from a niche abstinence product into a mainstream beverage choice. Recent consumer research indicates that more than 22% of drinkers now alternate between full-strength and alcohol-free wine options, signaling a shift toward moderation rather than binary choices between drinking and abstaining. This behavioral evolution expands the total addressable market beyond committed abstainers, creating new consumption occasions centered on flexibility and wellness.

Hospitality adoption has further legitimized non-alcoholic wine in premium on-premise settings. By late 2025, nearly one-third of luxury hotels in Europe and the Middle East featured curated zero-alcohol wine lists, while Michelin-starred restaurants began offering dedicated non-alcoholic pairings alongside traditional wine programs. Weddings and celebratory events are also embracing inclusivity: industry surveys show that over 20% of weddings in France, the UK, and the U.S. now include non-alcoholic sparkling wine options for guests who prefer moderation or abstinence.

Corporate and professional environments are reinforcing this trend. Business dinners, client entertainment, and high-profile networking events increasingly feature premium non-alcoholic wine selections, driven by organizational awareness of alcohol-related risks and a commitment to inclusivity. This institutional acceptance reduces the stigma historically associated with non-alcoholic beverages, positioning them as sophisticated alternatives suitable for diverse social and cultural contexts. As these practices become normalized, non-alcoholic wine is emerging as a lifestyle choice integrated seamlessly into social rituals worldwide.

Advances in Production Techniques

Technological innovation in non-alcoholic wine production continues to present significant opportunities for quality enhancement and market expansion. In 2025, industry efforts have centered on preserving flavor and aroma through advanced dealcoholization methods such as vacuum distillation, membrane-based processes (reverse osmosis, nanofiltration, pervaporation), and spinning cone column technology—all of which operate at lower temperatures or under reduced pressure to better retain volatile compounds.

Spinning cone technology, in particular, is gaining prominence in premium segments. Brands like St. Buena Vida have adopted related aroma-preserving innovation: their May 2025 dry sparkling Chardonnay uses Solos Aromatic Recovery System, capturing authentic aromatic profiles through advanced aroma recovery processes. Meanwhile, major technology providers are scaling infrastructure and introducing next-generation systems. Solos opened a 2,400 m² facility in Valencia in mid-2025, combining vacuum distillation with aroma recovery tools capable of processing 16 million liters annually.

BevZero, in partnership with Tomsa Destil, launched the ClearAlc vacuum distillation system in early 2025—a single-pass, highly energy-efficient unit capable of reducing alcohol to 0.05% ABV while preserving aromatic integrity. This system received the 2025 WINnovation Award at WIN Expo. Emerging membrane-pervaporation techniques are also gaining traction. These allow aroma-selective extraction without heating, making them ideal for preserving delicate fruit and botanical notes and are already being applied at commercial scale. Castel Frères is piloting cold-dealcoholization retrofits expected to capture up to 90% of original aroma compounds—a promising advance in sensory preservation. Together, these innovations are narrowing the sensory gap between non-alcoholic and traditional wines, enabling producers to offer premium-quality, flavor-authentic products that resonate with discerning consumers.

Increasing Demand for Premium Non-Alcoholic Wines

Premiumization is emerging as one of the strongest growth opportunities in the non-alcoholic wine market, driven by consumers seeking sophisticated alternatives that replicate the complexity and elegance of traditional wines. Recent industry surveys indicate that over 65% of manufacturers and distributors are prioritizing premium offerings, signaling a clear shift toward quality-focused innovation. This trend is reinforced by strong performance in established premium segments—Giesen 0%, for example, continues to dominate the U.S. premium still wine category, demonstrating consumer willingness to pay for authenticity and craftsmanship.

Luxury positioning is gaining traction globally. French Bloom, which targets high-end celebratory occasions, expanded its portfolio in 2025 with limited-edition sparkling cuvées priced above GBP 100 per bottle, following Moët Hennessy's strategic investment in late 2024. Similarly, Bordeaux's Château Edmus introduced Zero Edmus, a 0% ABV still wine crafted from Merlot and Cabernet Franc, signaling fine wine estates' entry into the alcohol-free category. Pernod Ricard's Pierre Zéro brand continues to strengthen its luxury positioning through partnerships with premium hospitality venues across Europe and Asia.

Premium non-alcoholic wines are also finding strong demand in wellness tourism and luxury hospitality channels. Global wellness travel surpassed 350 million trips in 2025, with resorts in Bali, Maldives, and Phuket reporting increased uptake of curated non-alcoholic wine menus. High-end hotels and Michelin-starred restaurants are incorporating premium alcohol-free pairings into tasting experiences, creating new distribution opportunities for brands positioned at the intersection of health, indulgence, and sophistication.

By Product Type: The Still Wine Segment Dominated the Non-Alcoholic Wine Market in 2025

Based on product type, the non-alcoholic wine market is segmented into still wine and sparkling wine. In 2025, the still non-alcoholic wine segment accounted for the largest share of 67.1% of the non-alcoholic wine market. The large market share is attributed to rising demand for alcohol-free alternatives for regular consumption, increasing awareness of moderation trends, expanding availability across retail and foodservice channels, and continuous advancements in dealcoholization technologies that have improved product quality, particularly in terms of aroma preservation, taste balance, and mouthfeel.

Red non-alcoholic wines account for the largest share of the still wine segment, driven by consumer preference for richer flavor profiles and compatibility with a wide range of food applications, with commonly available varietals including Cabernet Sauvignon, Merlot, and Pinot Noir. The still wine segment is increasingly positioned as suitable for everyday dining and food pairing occasions.

However, the sparkling wine segment is expected to register significant growth at a CAGR of 13.5% during the forecast period, driven by strong association with celebratory and social occasions including weddings, corporate events, holidays, and informal gatherings where effervescence and toasting rituals remain important. Sparkling non-alcoholic wines demonstrate strong performance in premium positioning, with products increasingly targeted at consumers seeking indulgent, alcohol-free alternatives for special occasions.

By Technology: The Dealcoholization Segment Dominated the Non-Alcoholic Wine Market in 2025

Based on technology, the non-alcoholic wine market is segmented into dealcoholization and restricted fermentation. In 2025, the dealcoholization segment accounted for the largest share of 79.0% of the non-alcoholic wine market. Dealcoholization represents the dominant production methodology, enabling producers to create authentic wine experiences by starting with traditionally fermented wines and subsequently removing alcohol content while preserving the complex chemical matrix developed during conventional winemaking, including flavor compounds, tannins, and aromatic elements that define varietal character.

Distillation-based methods, particularly vacuum distillation including spinning cone column (SCC) technology, represent the benchmark for premium non-alcoholic wine production due to superior aroma retention capabilities. Leading suppliers such as BevZero operate production facilities in major wine-producing regions, while significant investments by producers like Giesen Group (over USD 8 million since 2020) and Torres (EUR 6 million) demonstrate growing confidence in distillation-based technologies.

Moreover, the dealcoholization segment is also expected to register the highest CAGR of 12.6% during the forecast period, driven by continuous technological improvements, increasing investments in advanced equipment, and growing consumer demand for authentic wine-like experiences.

By Packaging: The Bottles Segment Dominated the Non-Alcoholic Wine Market in 2025

Based on packaging, the non-alcoholic wine market is segmented into bottles and cans. In 2025, the bottle segment accounted for the largest share of 85.1% of the non-alcoholic wine market. The large market share is attributed to traditional consumer associations between bottled presentation and wine authenticity, superior preservation performance of glass as an inert material that prevents chemical interaction and ensures flavor integrity, strong premium perception enabling luxury positioning and higher price points, and compatibility with established wine service rituals in both retail and hospitality settings.

Glass bottles convey quality perceptions aligned with conventional wine categories, with premium producers like French Bloom leveraging bottled formats to support ultra-premium positioning at prices exceeding GBP 100 per bottle.

However, the can segment is projected to grow at the fastest CAGR of 15.8% during the forecast period, driven by convenience-oriented consumers, outdoor activity enthusiasts, and younger demographics who prioritize portability, single-serve portions, and sustainable packaging attributes. Recent product launches illustrate accelerating adoption: TÖST Beverages expanded its portfolio in early 2025 by introducing 250ml aluminum cans specifically targeting portability-driven occasions, while Eisberg launched its "Be Free" canned range featuring sparkling white and rosé variants.

By Distribution Channel: The Off-Trade Segment Dominated the Non-Alcoholic Wine Market in 2025

Based on distribution channel, the non-alcoholic wine market is segmented into off-trade and on-trade channels. In 2025, the off-trade segment accounted for the largest share of 82.8% of the non-alcoholic wine market. The large market share is attributed to strategic emphasis on product visibility in retail environments, greater accessibility across diverse retail formats, improved shopping experiences in modern retail that enable product evaluation, wider product selection facilitating consumer experimentation, and cost advantages compared to on-premise pricing.

Within off-trade, supermarkets and hypermarkets represent the largest sub-channel, with major retailers like Target establishing national partnerships and Walmart reporting consistent grocery growth including expanded alcohol-free assortments. E-commerce has emerged as a strategically significant channel, with more than half of millennial buyers now purchasing non-alcoholic wine online, benefiting from convenience, home delivery, subscription programs, and access to specialty brands unavailable through local retail.

Moreover, the off-trade segment is also expected to register the highest CAGR of 12.5% during the forecast period, driven by expanding retail distribution, growing e-commerce penetration, and increasing consumer preference for at-home consumption occasions.

Europe Dominated the Non-Alcoholic Wine Market in 2025

Based on geography, the global non-alcoholic wine market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Europe accounted for the largest share of approximately 45% of the global non-alcoholic wine market. Europe's dominance is attributed to the continent's deep-rooted wine culture and strong presence of major wine producers who have invested significantly in dealcoholization technology and non-alcoholic product development, well-developed retail and e-commerce infrastructure supporting broad consumer access, early regulatory adaptation through EU Regulation 2021/2117 that established standardized terminology for dealcoholized wine products, and strong consumer acceptance in Western and Northern Europe where health consciousness and moderation trends are well-established.

Leading wine-producing countries including Germany, France, the United Kingdom, Spain, and Italy are at the forefront of regional development, with Germany recognized for its long tradition of dealcoholized beverage offerings and France demonstrating rapid innovation with nearly 40-50 new SKUs entering the market between 2023 and 2025.

North America follows with approximately 28% market share in 2025, driven primarily by the United States market where health consciousness and moderation trends have achieved mainstream acceptance. The US represents the dominant market within North America, with an estimated 36 million bottles sold annually. Consumer engagement with Dry January, Sober October, and year-round "sober curious" lifestyles has transitioned from niche behaviors to mainstream consumption patterns.

However, Asia-Pacific is expected to register the highest CAGR of approximately 13.7% during the forecast period, outpacing global averages. The rapid growth is driven by rising disposable incomes, increasing health consciousness among urbanized populations, growing adoption of Western lifestyle products including wine culture, and expanding e-commerce infrastructure facilitating consumer access.

Key Companies

Major companies in the global non-alcoholic wine market have implemented various strategies to expand their product offerings and augment their market shares. The key strategies followed by most companies include product launches and enhancements leveraging spinning cone technology and aroma-capture systems, strategic partnerships with specialty retailers and hospitality venues, mergers and acquisitions including luxury conglomerate investments, significant capital investments in dealcoholization infrastructure, and premiumization through luxury positioning and terroir-driven branding.

Some of the prominent players operating in the global non-alcoholic wine market include Schloss Wachenheim AG, Sutter Home Fre, Giesen Group Ltd, Domaines Pierre Chavin, Ariel Vineyards, Torres Natureo, Carl Jung Winery, Weingut Leitz KG, Thomson & Scott Ltd, Neobulles SA, Australian Vintage Limited, Hill Incorporated, Le Petit Béret SAS, and Tost Beverages, Inc.

Non-Alcoholic Wine Market Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

212 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

12.0% |

|

Market Size (Value) in 2025 |

USD 1.65 Billion |

|

Market Size (Value) in 2035 |

USD 5.20 Billion |

|

Segments Covered |

By Product Type

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, and Rest of Middle East & Africa) |

|

Key Companies |

Schloss Wachenheim AG, Sutter Home Fre, Giesen Group Ltd, Domaines Pierre Chavin, Ariel Vineyards, Torres Natureo, Carl Jung Winery, Weingut Leitz KG, Thomson & Scott Ltd, Neobulles SA, Australian Vintage Limited, Hill Incorporated, Le Petit Béret SAS, and Tost Beverages, Inc. |

The global non-alcoholic wine market size is projected to reach USD 1.65 billion in 2025.

The market is projected to grow from USD 1.65 billion in 2025 to USD 5.10 billion by 2035, at a CAGR of 12.0%.

The non-alcoholic wine market analysis indicates substantial growth, with projections indicating the market will reach USD 5.10 billion by 2035, at a compound annual growth rate (CAGR) of 12.0% from 2025 to 2035.

The key companies operating in this market include Schloss Wachenheim AG, Sutter Home Fre, Giesen Group Ltd, Domaines Pierre Chavin, Ariel Vineyards, Torres Natureo, Carl Jung Winery, Weingut Leitz KG, Thomson & Scott Ltd, Neobulles SA, Australian Vintage Limited, Hill Incorporated, Le Petit Béret SAS, and Tost Beverages, Inc.

Growing focus on low-calorie and no-sugar options, expansion of online retail channels, and premiumization through luxury positioning are prominent trends in the non-alcoholic wine market.

By product type, the still wine segment is forecasted to hold the largest market share during 2025-2035; by technology, the dealcoholization segment is expected to dominate; by packaging, the bottles segment is expected to hold the largest share; by distribution channel, the off-trade segment is expected to dominate; and by geography, Europe is expected to hold the largest share of the market during 2025-2035.

By region, Europe held the largest share of the non-alcoholic wine market in 2025. The large share is attributed to the continent's deep-rooted wine culture, strong presence of major wine producers, and early regulatory adaptation. However, Asia-Pacific is expected to register the highest growth rate during the forecast period, driven by rising disposable incomes and increasing health consciousness.

Key drivers include changing consumption patterns toward healthier alternatives driven by wellness consciousness, growing preference for non-alcoholic wine across religions and cultures, increasing innovations and new product launches utilizing advanced dealcoholization technologies, and rising acceptance in social drinking gatherings. These factors are collectively driving the adoption of non-alcoholic wine across consumer segments and consumption occasions.

Published Date: Mar-2025

Published Date: Aug-2024

Published Date: Jan-2025

Published Date: Mar-2024

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates