Resources

About Us

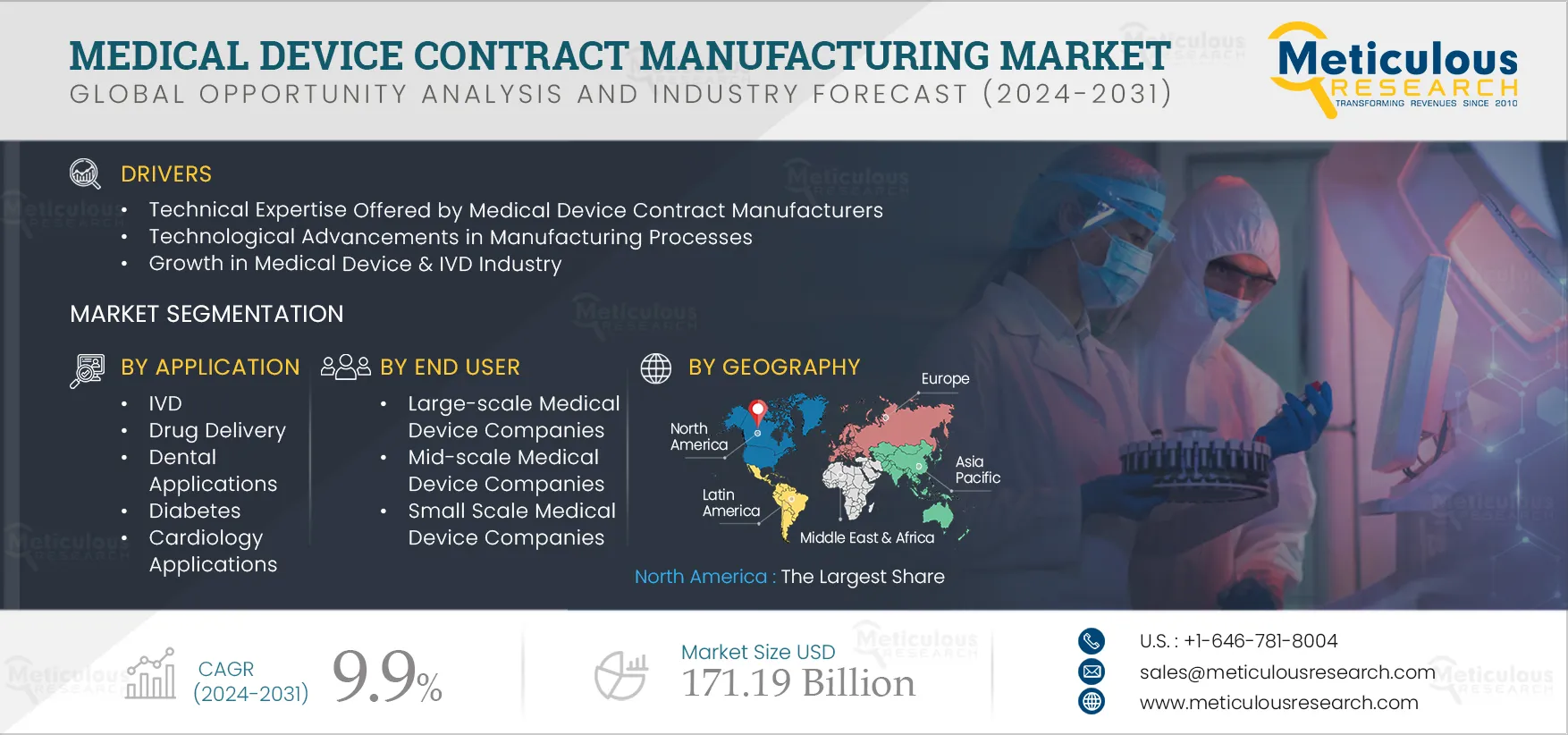

Medical Device Contract Manufacturing Market Size, Share, Forecast, & Trends Analysis by Device (Biochemistry, Immunoassay, CT, MRI, X-ray, Ultrasound, Pacemaker, Defibrillator, Oximeter) Services (Development, Manufacturing, QA) – Global Forecast to 2032

Report ID: MRHC - 1041138 Pages: 450 Sep-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is fueled by the increasing trend of outsourcing design, development, and manufacturing in the MedTech sector. Contract manufacturing offers various benefits, such as reduced development costs and time, flexibility to scale production according to demand fluctuations, and access to specialized manufacturing processes. Additionally, changing regulatory landscapes in the medical device industry compel companies to seek regulatory services and engineering expertise from contract manufacturers. Furthermore, the adoption of industry 4.0 technologies, coupled with rising healthcare expenditure and demand for quality healthcare in developing countries, presents growth opportunities for market players. Moreover, the cost advantages offered by contract manufacturers in emerging economies further contribute to market expansion.

The changing regulatory landscape in medical device contract manufacturing pertains to the dynamic rules and standards governing the production and distribution of medical devices by contract manufacturers. This encompasses updates in regulations concerning quality criteria, safety protocols, documentation requisites, and compliance procedures mandated by regulatory bodies like the FDA (Food and Drug Administration) in the U.S. or the EMA (European Medicines Agency) in Europe. Such alterations necessitate contract manufacturers to adapt their operations, technologies, and quality assurance systems to adhere to the revised regulatory mandates.

Contract manufacturers proactively stay abreast of regulatory revisions across manufacturing, technology, and quality management domains. Equipped with dedicated teams proficient in medical device regulatory affairs, they swiftly implement necessary adjustments in manufacturing and development practices in response to regulatory updates. This proactive approach alleviates the burden on medical device companies, sparing them from frequent modifications to manufacturing processes or technologies prompted by regulatory shifts. Consequently, medical device companies often favor the expertise and adaptability offered by contract manufacturers in navigating the evolving regulatory landscape.

Recent technological advancements have revolutionized the contract manufacturing process, ushering in heightened efficiency, enhanced customization capabilities, and improved communication channels between manufacturers and clients. These advancements empower contract manufacturers to expedite product delivery while upholding superior quality standards. In the realm of medical device contract manufacturing, companies have embraced various technological innovations to optimize their operations, including:

Advanced Automation Integration: Integration of AI and robotics to enhance efficiency.

Contract manufacturers gain a competitive edge in manufacturing processes through the active adoption of advanced technologies. Meanwhile, when medical device companies opt to manufacture products in-house, they often face significant investment requirements, limiting their capacity for other initiatives. Consequently, there is a growing inclination towards outsourcing among medical device companies.

Click here to: Get a Free Sample Copy of this report

Mergers & acquisitions in the medical device contract manufacturing industry help the companies strengthen their core capabilities, expand their services, and diversify their capabilities. M&A can also help companies reduce costs, shorten time to market, and improve return on investment. Additionally, it also helps the companies in:

Vertical integration to optimize supply chains

Following are some of the recent acquisitions:

In the highly competitive healthcare sector, medical device firms recognize the importance of concentrating on core strengths such as research and development (R&D), marketing, and sales to stay ahead. Outsourcing non-core functions like manufacturing to specialized contract manufacturers enables these firms to use resources more effectively, channeling them towards strategic endeavors like R&D and market expansion.

Contract manufacturers often possess specialized knowledge in manufacturing processes, materials, and technologies, providing valuable insights and capabilities to medical device firms. Additionally, outsourcing manufacturing enhances flexibility and scalability, allowing firms to adapt to fluctuations in demand and product lifecycles without significant capital investment. By prioritizing core competencies and outsourcing manufacturing, medical device companies can boost efficiency, flexibility, and innovation while reducing costs and mitigating risks in the healthcare industry.

Industry 4.0 is revolutionizing the medical device contract manufacturing market through the integration of digital technologies such as additive manufacturing, robotics, and the Internet of Things (IoT). These advancements empower contract manufacturers to create intricate medical devices with precision and adaptability, reducing time-to-market and facilitating customization. Digitalization and connectivity improve operational efficiency by enabling real-time monitoring and predictive maintenance, while smart manufacturing systems ensure product quality and compliance with regulations.

Technologies like blockchain enable end-to-end traceability and transparency, while Industry 4.0 facilitates mass customization and personalized manufacturing through digital design tools and virtual simulations. Supply chain optimization is achieved through digital supply chain platforms and predictive analytics, minimizing lead times and mitigating supply chain risks. Overall, Industry 4.0 presents medical device contract manufacturers with opportunities to innovate, streamline operations, and provide value-added services to their clients.

Based on device, the market is segmented into IVD devices, IVD consumables, imaging devices, cardiovascular devices, imaging devices, drug delivery devices, orthopedic devices, endoscopy devices, ophthalmology devices, dental devices, patient monitoring devices, anesthesia devices, mobility aids, surgical systems, consumables, and other devices. In 2025, the IVD devices segment is expected to account for the largest share of 21% of the global medical device contract manufacturing market.

The large market share of this segment is attributed to the high burden of chronic & infectious diseases propelling R&D in IVD. High preference for IVD contract manufacturing to IVD CDMOs. Within the IVD industry, there is a high preference for outsourcing of development and manufacturing of immunoassay analyzers due to the high demand for immunoassay technology contributes to the large segmental share. This high demand for immunoassay can be attributed to the benefits of immunoassay technologies such as rapid, convenient, and accurate results in the detection and quantitation of targets; the continuous development of new biomarkers; the cost-benefit of immunoassay technologies; and the growing adoption of automated platforms for ELISA.

However, the drug delivery devices segment is projected to witness the highest growth rate of 11.2% during the forecast period of 2025–2032. This growth is driven by rising chronic disease incidence, growing adoption of biologic drugs and specialty pharmaceuticals, growing emphasis on patient-centric care, and a trend of self-administration of medications.

Based on risk type, the global medical device contract manufacturing market is segmented into low-risk medical devices, moderate-risk medical devices, and high-risk medical devices. In 2025, the moderate-risk medical devices segment is expected to account for the largest share of the medical device contract manufacturing market. The moderate risk medical devices include catheters, blood pressure cuffs, pregnancy test kits, and blood transfusion kits, among others.

Outsourcing the development and manufacturing of moderate-risk medical devices is feasible with careful attention to regulatory compliance. However, for high-risk devices, concerns about intellectual property and maintaining control often limit outsourcing opportunities. Additionally, factors contributing to the significant share of the segment include the frequent utilization of devices like syringes, the increasing elderly population driving demand for catheters, and widespread adoption of self-pregnancy test kits. Owing to the rising adoption of medical devices falling under the moderate risk category due to the growing adoption of home healthcare and the rising geriatric population, the same segment is expected to register the highest CAGR during the forecast period of 2025-2032.

Based on services, the global medical device contract manufacturing market is segmented into design & development, manufacturing, testing and validation, quality assurance, implementation and maintenance services, packaging services, regulatory affairs services, and other services. In 2025, the design & development segment is expected to account for the largest share of 24% of the global medical device contract manufacturing market. The large market share of this segment is attributed to the growing demand for advanced medical devices and the high cost associated with the design and development of medical devices.

The process of designing and developing a medical device encompasses various expenses, including prototype development, component costs, regulatory compliance testing, clinical trials, and administrative expenses. The overall cost of medical device development varies based on factors such as device complexity and technological sophistication. High-risk devices, requiring extensive clinical trials and safety testing, often incur higher costs due to the expertise needed to ensure their safety and reliability.

The increasing demand for advanced medical devices to support diagnostics, monitoring, and treatment is driving the need for technical expertise in medical device development. Concurrently, there is a trend within the medical technology industry towards outsourcing the development and manufacturing of medical devices. This shift allows companies to leverage the specialized capabilities of contract manufacturers, streamlining the development process and enhancing the overall efficiency of bringing innovative medical devices to market. Owing to this, the same segment is expected to grow with the highest CAGR of 11.7% over the forecast period.

Based on application, the global medical device contract manufacturing market is segmented into IVD, drug delivery, dental applications, diabetes, diagnostic imaging applications, cardiology applications, orthopedic applications, endoscopy applications, surgical applications, and other applications. In 2025, the IVD segment is expected to account for the largest share of the market. This large market share is attributed to the growing demand for IVD tests due to the high burden of communicable and non-communicable diseases, the high adoption of predictive testing, and the growing preference for IVD companies to outsource the development and manufacturing of IVD devices.

However, the drug delivery segment is expected to grow at the highest CAGR during the forecast period of 2025-2032. The factors attributed to this growth are the growing adoption of self-administration of medications, increasing preference for home healthcare, innovations such as smart inhalers, and growing initiatives by contract manufacturers to strengthen their manufacturing capabilities of drug delivery devices.

Based on end user, the global medical device contract manufacturing market is segmented into large-scale medical device companies, mid-scale medical device companies, and small-scale medical device companies. In 2025, large-scale medical device companies are expected to account for the largest share of the market. Large-scale manufacturers benefit from economies of scale, reducing manufacturing costs related to workforce wages, production machinery, and infrastructure. Moreover, they often have the opportunity to diversify into other business segments. Large-scale medical device companies commonly leverage the services of contract manufacturers, particularly for manufacturing accessories and components.

On the other hand, the mid-scale medical device companies segment is poised to experience rapid growth during the forecast period 2025-2032. This growth is driven by the increasing focus of mid-sized industries on innovation and product introduction while adhering to cost constraints. As a result, these companies turn to contract manufacturers for development and manufacturing services. Mid-sized medical device companies typically compete with larger counterparts based on product cost and technological superiority. By partnering with contract manufacturers equipped with advanced manufacturing capabilities, mid-sized companies can offer high-quality products at competitive prices to their customers.

In 2025, North America is expected to account for the largest share of 44% of the global medical device contract manufacturing market. Among the U.S. and Canada, in 2025, the U.S. is expected to account for the largest share of the medical device contract manufacturing market in North America. The large market share is attributed to the well-developed manufacturing infrastructure, the presence of leading contract manufacturers in the U.S., the high adoption of advanced manufacturing technologies, and the high demand for medical devices. Additionally, the academia and industry collaboration in the country leads to technological manufacturing capabilities, further contributing to the large share.

However, Asia-Pacific is slated to register the highest CAGR of 11.9% during the forecast period. The growth of this region is attributed to the availability of skilled labor, rising quality standards in manufacturing as well as finished medical devices, government initiatives for local production of medical devices, and good accessibility and cheaper raw materials for medical devices in the region.

The cost-effectiveness of labor in Asia stands out as a key factor. Labor expenses in the Asia-Pacific region are not only economical but also come with a high level of skill. Additionally, other overhead costs such as rent, utilities, and raw materials tend to be significantly lower in Asia-Pacific compared to the United States and European countries. While China is renowned for its cost-efficient manufacturing, countries like Vietnam and India have emerged as competitive destinations for medical device production, particularly for standard devices.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. The key players operating in the global medical device contract manufacturing market are Jabil Inc. (U.S.), Gerresheimer AG (Germany), Nordson Corporation (U.S.), Teleflex Incorporated (U.S.), Celestica Inc. (Canada), Plexus Corp (U.S.), SteriPack Group Ltd (U.S.), Nortech Systems, Inc. (U.S.), Invetech Pty. Ltd. (Australia), Flextronics International, LTD. (Singapore), Benchmark Electronics Inc. (U.S.), Integer Holdings Corporation (U.S.), STRATEC SE (Germany).

In 2025, Fujirebio Holdings, Inc. (Japan) and Agappe Diagnostics Ltd (India) today announced that they have entered into an agreement of Contract Development and Manufacturing Organization (CDMO) partnership for Cartridge based CLIA system reagents manufacturing project for the immunology equipment Mispa i60 and Mispa i121. The analyzers and reagents will be sold under Agappe’s brand.

In 2024, Sysmex Corporation (Japan) entered into an agreement with Fujirebio Holdings, Inc. (Japan), to expand their Contract Development and Manufacturing Organization (CDMO) partnership for Sysmex's Automated Immunoassay System HISCL.

|

Particular |

Details |

|

Page No |

450 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

9.9% |

|

Market Size (Value) |

$171.19 billion by 2032 |

|

Segments Covered |

By Devices

By Services

By Risk Type

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Sweden, Switzerland, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, Singapore, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) |

|

Key Companies |

Jabil Inc. (U.S.), Gerresheimer AG (Germany), Nordson Corporation (U.S.), Teleflex Incorporated (U.S.), Celestica Inc. (Canada), Plexus Corp (U.S.), SteriPack Group Ltd (U.S.), Nortech Systems, Inc. (U.S.), Invetech Pty. Ltd. (Australia), Flextronics International, LTD. (Singapore), Benchmark Electronics Inc. (U.S.), Integer Holdings Corporation (U.S.), STRATEC SE (Germany). |

The medical device contract manufacturing market covers the market sizes & forecasts of outsourcing high, low, and moderate-risk medical device manufacturing. The medical device contract manufacturing market studied in this report involves the value analysis of various segments and sub-segments of the medical device contract manufacturing market at regional and country levels.

The global medical device contract manufacturing market is projected to reach $171.19 billion by 2032, at a CAGR of 9.9% during the forecast period.

In 2025, the design & development segment is expected to account for the largest share of the medical device contract manufacturing market.

The medical device contract manufacturing market is driven by the growing preference for outsourcing of development & manufacturing of medical devices, technological advancements in manufacturing processes, and the growth in the medical device and IVD industry. Moreover, Industry 4.0 and growing healthcare expenditure & demand for quality healthcare are expected to generate growth opportunities for players operating in the medical device contract manufacturing market.

The key players operating in the global medical device contract manufacturing market are Jabil Inc. (U.S.), Gerresheimer AG (Germany), Nordson Corporation (U.S.), Teleflex Incorporated (U.S.), Celestica Inc. (Canada), Plexus Corp (U.S.), SteriPack Group Ltd (U.S.), Nortech Systems, Inc. (U.S.), Invetech Pty. Ltd. (Australia), Flextronics International, LTD. (Singapore), Benchmark Electronics Inc. (U.S.), Integer Holdings Corporation (U.S.), STRATEC SE (Germany).

The countries India, China, and Singapore are projected to offer significant growth opportunities for the vendors in this market due to factors such as the availability of affordable workforce, growing adoption of advanced manufacturing technologies, government initiatives to promote medical device manufacturing, and availability of raw materials at a lower cost.

1. Overview

1.1. Market Definition and Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of The Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions For the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Market Dynamics

4.2.1.1. Drivers

4.2.1.1.1. Technical Expertise Offered by Medical Device Contract Manufacturers

4.2.1.1.2. Technological Advancements in Manufacturing Processes

4.2.1.1.3. Growth in Medical Device & IVD Industry

4.2.1.1.4. Changing Regulatory Landscape for Medical Devices

4.2.1.2. Restraints

4.2.1.2.1. Stringent Technical & Regulatory Requirements for Medical Devices

4.2.1.3. Opportunities

4.2.1.3.1. Industry 4.0

4.2.1.3.2. Growing Healthcare Expenditure and Demand for Quality Healthcare in Developing Countries

4.2.1.4. Challenges

4.2.1.4.1. Maintaining Product Quality and Protection of Proprietary Information

4.2.1.4.2. Rising Raw Material Costs

4.3. Trends

4.3.1. Pricing pressures in MedTech Influencing Outsourcing

4.3.2. Outsourcing of Wearable Medical Devices

4.4. Porter’s Five Forces Analysis

4.5. Value Chain Analysis

4.6. Case Studies

5. Medical Device Contract Manufacturing Market Assessment—by Device

5.1. Overview

5.2. IVD Devices

5.2.1. IVD Consumables

5.2.2. IVD Instruments

5.2.2.1. Immunoassay Analyzers

5.2.2.2. Biochemistry/Clinical Chemistry Analyzers

5.2.2.3. Molecular Diagnostics Instruments

5.2.2.4. Other IVD Instruments

5.3. Imaging Devices

5.3.1. MRI Scanners

5.3.2. CT Scanners

5.3.3. X-rays

5.3.4. Ultrasounds

5.3.5. Other Imaging Devices

5.4. Drug Delivery Devices

5.4.1. Nasal & Pulmonary Drug Delivery Devices

5.4.2. Parenteral Drug Delivery Devices

5.4.3. Other Drug Delivery Devices

5.5. Cardiovascular Devices

5.5.1. Defibrillators

5.5.2. Pacemakers

5.5.3. Cardiac Monitors

5.6. Orthopedic Devices

5.7. Endoscopy Devices

5.8. Ophthalmology Devices

5.9. Dental Devices

5.10. Patient Monitoring Devices

5.10.1. Patient Monitors

5.10.2. Glucometers

5.10.3. Apnea Monitors

5.10.4. Fetal Monitors

5.10.5. Weight Monitors

5.10.6. Oximeters

5.11. Anesthesia Devices

5.12. Mobility Aids

5.13. Surgical Systems

5.14. Consumables

5.15. Other Devices

6. Medical Device Contract Manufacturing Market Assessment—by Risk Type

6.1. Overview

6.2. Low-risk Medical Devices

6.3. Moderate Risk Medical Devices

6.4. High-risk Medical Devices

7. Medical Device Contract Manufacturing Market Assessment—by Service

7.1. Overview

7.2. Design & Development

7.2.1. Molding

7.2.2. Designing & Engineering

7.3. Manufacturing

7.3.1. Device Manufacturing

7.3.2. Component Manufacturing

7.3.3. Accessories Manufacturing

7.3.4. Assembly Manufacturing

7.4. Testing and Validation

7.5. Quality Assurance

7.6. Implementation and Maintenance Services

7.7. Packaging Services

7.8. Regulatory Affairs Services

7.8.1. Legal Representation Services

7.8.2. Clinical Trial Services

7.8.3. Regulatory Writing & Publishing

7.9. Other Services

8. Medical Device Contract Manufacturing Market Assessment—by Application

8.1. Overview

8.2. IVD

8.3. Drug Delivery

8.4. Dental Applications

8.5. Diabetes

8.6. Diagnostic Imaging Applications

8.7. Cardiology Applications

8.8. Orthopedic Applications

8.9. Endoscopy Applications

8.10. Surgical Applications

8.11. Other Applications

9. Medical Device Contract Manufacturing Market Assessment—by End User

9.1. Overview

9.2. Large-scale Medical Device Companies

9.3. Mid-scale Medical Device Companies

9.4. Small-scale Medical Device Companies

10. Medical Device Contract Manufacturing Market Assessment—by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.3.6. Switzerland

10.3.7. Sweden

10.3.8. Belgium

10.3.9. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. Singapore

10.4.5. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Rest of Latin America

10.6. Middle East & Africa

10.6.1. South Africa

10.6.2. Saudi Arabia

10.6.3. Rest of Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Emerging Companies

11.5. Market Share Analysis/ Market Ranking, by Key Players (2024)

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

12.1. Jabil Inc.

12.2. Gerresheimer AG

12.3. Nordson Corporation

12.4. Teleflex Incorporated

12.5. Celestica Inc.

12.6. Plexus Corp

12.7. SteriPack Group Ltd

12.8. Nortech Systems, Inc.

12.9. Invetech Pty.Ltd.

12.10. Flextronics International, LTD.

12.11. Benchmark Electronics Inc.

12.12. Integer Holdings Corporation

12.13. STRATEC SE

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1 Global Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 2 Global Contract Manufacturing Market for IVD Devices, by Country/Region, 2022–2032 (USD Million)

Table 3 Global Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 4 Global Contract Manufacturing Market for IVD Consumables, by Country/Region, 2022–2032 (USD Million)

Table 5 Global Contract Manufacturing Market for IVD Instruments, by Country/Region, 2022–2032 (USD Million)

Table 6 Global Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 7 Global Contract Manufacturing Market for Immunoassay Analyzers, by Country/Region, 2022–2032 (USD Million)

Table 8 Global Contract Manufacturing Market for Biochemistry/Clinical Chemistry Analyzers, by Country/Region, 2022–2032 (USD Million)

Table 10 Global Contract Manufacturing Market for Molecular Diagnostics Instruments, by Country/Region, 2022–2032 (USD Million)

Table 11 Global Contract Manufacturing Market for Other IVD Instruments, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Contract Manufacturing Market for Imaging Devices, by Country/Region, 2022–2032 (USD Million)

Table 13 Global Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 14 Global Contract Manufacturing Market for MRI Scanners, by Country/Region, 2022–2032 (USD Million)

Table 15 Global Contract Manufacturing Market for CT Scanners, by Country/Region, 2022–2032 (USD Million)

Table 16 Global Contract Manufacturing Market for Ultrasound, by Country/Region, 2022–2032 (USD Million)

Table 17 Global Contract Manufacturing Market for X-rays, by Country/Region, 2022–2032 (USD Million)

Table 18 Global Contract Manufacturing Market for Other Imaging Devices, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Contract Manufacturing Market for Drug Delivery Devices, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 21 Global Contract Manufacturing Market for Nasal & Pulmonary Drug Delivery Devices, by Country/Region, 2022–2032 (USD Million)

Table 22 Global Contract Manufacturing Market for Parenteral Drug Delivery Devices, by Country/Region, 2022–2032 (USD Million)

Table 23 Global Contract Manufacturing Market for Other Drug Delivery Devices, by Country/Region, 2022–2032 (USD Million)

Table 24 Global Contract Manufacturing Market for Cardiovascular Devices, by Country/Region, 2022–2032 (USD Million)

Table 25 Global Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 26 Global Contract Manufacturing Market for Defibrillators, by Country/Region, 2022–2032 (USD Million)

Table 27 Global Contract Manufacturing Market for Pacemakers, by Country/Region, 2022–2032 (USD Million)

Table 28 Global Contract Manufacturing Market for Cardiac Monitors, by Country/Region, 2022–2032 (USD Million)

Table 29 Global Contract Manufacturing Market for Orthopedic Devices, by Country/Region, 2022–2032 (USD Million)

Table 30 Global Contract Manufacturing Market for Endoscopy Devices, by Country/Region, 2022–2032 (USD Million)

Table 31 Global Contract Manufacturing Market for Ophthalmology Devices, by Country/Region, 2022–2032 (USD Million)

Table 32 Global Contract Manufacturing Market for Dental Devices, by Country/Region, 2022–2032 (USD Million)

Table 33 Global Contract Manufacturing Market for Patient Monitoring Devices, by Country/Region, 2022–2032 (USD Million)

Table 34 Global Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 35 Global Contract Manufacturing Market for Patient Monitors, by Country/Region, 2022–2032 (USD Million)

Table 36 Global Contract Manufacturing Market for Glucometers, by Country/Region, 2022–2032 (USD Million)

Table 37 Global Contract Manufacturing Market for Apnea Monitors, by Country/Region, 2022–2032 (USD Million)

Table 38 Global Contract Manufacturing Market for Fetal Monitors, by Country/Region, 2022–2032 (USD Million)

Table 39 Global Contract Manufacturing Market for Oximeters, by Country/Region, 2022–2032 (USD Million)

Table 40 Global Contract Manufacturing Market for Weight Monitors, by Country/Region, 2022–2032 (USD Million)

Table 41 Global Contract Manufacturing Market for Anesthesia Devices, by Country/Region, 2022–2032 (USD Million)

Table 42 Global Contract Manufacturing Market for Mobility Aids, by Country/Region, 2022–2032 (USD Million)

Table 43 Global Contract Manufacturing Market for Surgical Systems, by Country/Region, 2022–2032 (USD Million)

Table 44 Global Contract Manufacturing Market for Consumables, by Country/Region, 2022–2032 (USD Million)

Table 45 Global Contract Manufacturing Market for Other Devices, by Country/Region, 2022–2032 (USD Million)

Table 46 Global Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 47 Global Contract Manufacturing Market for Low-risk Medical Devices, by Country/Region, 2022–2032 (USD Million)

Table 48 Global Contract Manufacturing Market for Moderate Risk Medical Devices, by Country/Region, 2022–2032 (USD Million)

Table 49 Global Contract Manufacturing Market for High-risk Medical Devices, by Country/Region, 2022–2032 (USD Million)

Table 50 Global Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 51 Global Medical Device Design & Development Services Market, by Country/Region, 2022–2032 (USD Million)

Table 52 Global Medical Device Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 53 Global Medical Device Contract Molding Services Market, by Country/Region, 2022–2032 (USD Million)

Table 54 Global Medical Device Contract Design & Engineering Services Market, by Country/Region, 2022–2032 (USD Million)

Table 55 Global Medical Device Contract Manufacturing Services Market, by Country/Region, 2022–2032 (USD Million)

Table 56 Global Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 57 Global Device Manufacturing Services Market, by Country/Region, 2022–2032 (USD Million)

Table 58 Global Medical Component Contract Manufacturing Services Market, by Country/Region, 2022–2032 (USD Million)

Table 59 Global Medical Accessory Contract Manufacturing Services Market, by Country/Region, 2022–2032 (USD Million)

Table 60 Global Medical Assembly Contract Manufacturing Services Market, by Country/Region, 2022–2032 (USD Million)

Table 61 Global Medical Devices Contract Testing and Validation Services Market, by Country/Region, 2022–2032 (USD Million)

Table 62 Global Medical Device Contract Quality Assurance Services Market, by Country/Region, 2022–2032 (USD Million)

Table 63 Global Medical Device Implementation and Maintenance Services Market, by Country/Region, 2022–2032 (USD Million)

Table 64 Global Medical Device Contract Packaging Services Market, by Country/Region, 2022–2032 (USD Million)

Table 65 Global Medical Device Contract Regulatory Affairs Services Market, by Country/Region, 2022–2032 (USD Million)

Table 65 Global Medical Device Contract Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million

Table 66 Global Medical Device Contract Legal Representation Services Market, by Country/Region, 2022–2032 (USD Million)

Table 67 Global Medical Device Contract Clinical Trial Services Market, by Country/Region, 2022–2032 (USD Million)

Table 68 Global Medical Device Contract Regulatory Writing & Publishing Services Market, by Country/Region, 2022–2032 (USD Million)

Table 69 Global Medical Device Other Contract Services Market, by Country/Region, 2022–2032 (USD Million)

Table 70 Global Medical Devices Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 71 Global Medical Devices Contract Manufacturing Market for IVD, 2022–2032 (USD Million)

Table 72 Global Medical Devices Contract Manufacturing Market for Drug Delivery, 2022–2032 (USD Million)

Table 73 Global Medical Devices Contract Manufacturing Market for Dental Applications, 2022–2032 (USD Million)

Table 74 Global Medical Devices Contract Manufacturing Market for Diabetes, 2022–2032 (USD Million)

Table 75 Global Medical Devices Contract Manufacturing Market for Diagnostic Imaging Applications, 2022–2032 (USD Million)

Table 76 Global Medical Devices Contract Manufacturing Market for Cardiology Applications, 2022–2032 (USD Million)

Table 77 Global Medical Devices Contract Manufacturing Market for Orthopedic Applications, 2022–2032 (USD Million)

Table 78 Global Medical Devices Contract Manufacturing Market for Endoscopy Applications, 2022–2032 (USD Million)

Table 79 Global Medical Devices Contract Manufacturing Market for Surgical Applications, 2022–2032 (USD Million)

Table 80 Global Medical Devices Contract Manufacturing Market for Other Applications, 2022–2032 (USD Million)

Table 81 Global Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 82 Global Medical Devices Contract Manufacturing Market for Large-scale Medical Device Companies, 2022–2032 (USD Million)

Table 83 Global Medical Devices Contract Manufacturing Market for Mid-scale Medical Device Companies, 2022–2032 (USD Million)

Table 84 Global Medical Devices Contract Manufacturing Market for Small-scale Medical Device Companies, 2022–2032 (USD Million)

Table 85 Global Medical Device Contract Manufacturing Market, by Country/Region, 2022–2032 (USD Million)

Table 86 North America: Medical Device Contract Manufacturing Market, by Country, 2022–2032 (USD Million)

Table 87 North America: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 88 North America: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 89 North America: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 90 North America: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 91 North America: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 92 North America: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 93 North America: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 94 North America: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 95 North America: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 96 North America: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 97 North America: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 98 North America: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 99 North America: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 100 North America: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 101 North America: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 102 U.S.: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 103 U.S.: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 104 U.S.: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 105 U.S.: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 106 U.S.: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 107 U.S.: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 108 U.S.: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 109 U.S.: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 110 U.S.: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 111 U.S.: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 112 U.S.: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 113 U.S.: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 114 U.S.: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 116 U.S.: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 117 Canada: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 118 Canada: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 119 Canada: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 120 Canada: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 121 Canada: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 122 Canada: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 123 Canada: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 124 Canada: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 125 Canada: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 126 Canada: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 127 Canada: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 128 Canada: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 129 Canada: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 131 Canada: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 132 Europe: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 133 Europe: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 134 Europe: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 135 Europe: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 136 Europe: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 137 Europe: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 138 Europe: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 139 Europe: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 140 Europe: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 141 Europe: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 142 Europe: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 143 Europe: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 144 Europe: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 146 Europe: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 147 Germany: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 148 Germany: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 149 Germany: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 150 Germany: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 151 Germany: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 152 Germany: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 153 Germany: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 154 Germany: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 155 Germany: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 156 Germany: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 157 Germany: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 158 Germany: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 159 Germany: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 160 Germany: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 161 Germany: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 162 France: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 163 France: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 164 France: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 165 France: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 166 France: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 167 France: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 168 France: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 169 France: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 170 France: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 171 France: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 172 France: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 173 France: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 174 France: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 176 France: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 177 U.K.: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 178 U.K.: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 179 U.K.: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 180 U.K.: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 181 U.K.: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 182 U.K.: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 183 U.K.: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 184 U.K.: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 185 U.K.: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 186 North America: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 187 U.K.: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 188 U.K.: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 189 U.K.: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 191 U.K.: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 192 Italy: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 193 Italy: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 194 Italy: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 195 Italy: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 196 Italy: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 197 Italy: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 198 Italy: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 199 Italy: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 200 Italy: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 201 Italy: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 202 Italy: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 203 Italy: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 204 Italy: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 206 Italy: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 207 Spain: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 208 Spain: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 209 Spain: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 210 Spain: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 211 Spain: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 212 Spain: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 213 Spain: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 214 Spain: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 215 Spain: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 216 Spain: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 217 Spain: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 218 Spain: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 219 Spain: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 220 Spain: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 221 Switzerland: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 222 Switzerland: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 223 Switzerland: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 224 Switzerland: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 225 Switzerland: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 226 Switzerland: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 227 Switzerland: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 228 Switzerland: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 229 Switzerland: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 230 Switzerland: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 231 Switzerland: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 232 Switzerland: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 233 Sweden: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 234 Sweden: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 235 Sweden: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 236 Sweden: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 237 Sweden: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 238 Sweden: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 239 Sweden: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 240 Sweden: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 241 Sweden: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 242 Sweden: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 243 Sweden: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 244 Sweden: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 245 Sweden: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 246 Sweden: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 247 Belgium: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 248 Belgium: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 249 Belgium: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 250 Belgium: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 251 Belgium: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 252 Belgium: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 253 Belgium: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 254 Belgium: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 255 Belgium: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 256 Belgium: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 257 Belgium: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 258 Belgium: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 259 Belgium: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 260 Belgium: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 261 Rest of Europe: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 262 Rest of Europe: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 263 Rest of Europe: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 264 Rest of Europe: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 265 Rest of Europe: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 266 Rest of Europe: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 267 Rest of Europe: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 268 Rest of Europe: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 269 Rest of Europe: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 270 Rest of Europe: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 271 Rest of Europe: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 272 Rest of Europe: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 273 Rest of Europe: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 274 Rest of Europe: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 275 Asia-Pacific: Medical Device Contract Manufacturing Market, by Country/Region, 2022–2032 (USD Million)

Table 276 Asia-Pacific: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 277 Asia-Pacific: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 278 Asia-Pacific: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 279 Asia-Pacific: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 280 Asia-Pacific: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 281 Asia-Pacific: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 282 Asia-Pacific: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 283 Asia-Pacific: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 284 Asia-Pacific: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 285 Asia-Pacific: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 286 Asia-Pacific: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 287 Asia-Pacific: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 288 Asia-Pacific: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 289 Asia-Pacific: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 290 China: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 291 China: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 292 China: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 293 China: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 294 China: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 295 China: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 296 China: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 297 China: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 298 China: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 299 China: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 300 China: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 301 China: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 302 China: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 303 China: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 304 Japan: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 305 Japan: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 306 Japan: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 307 Japan: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 308 Japan: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 309 Japan: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 310 Japan: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 311 Japan: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 312 Japan: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 313 Japan: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 314 Japan: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 315 Japan: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 316 Japan: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 317 Japan: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 318 India: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 319 India: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 320 India: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 321 India: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 322 India: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 323 India: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 324 India: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 325 India: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 326 India: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 327 India: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 328 India: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 329 India: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 330 India: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 331 India: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 332 Singapore: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 333 Singapore: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 334 Singapore: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 335 Singapore: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 336 Singapore: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 337 Singapore: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 338 Singapore: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 339 Singapore: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 340 Singapore: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 341 Singapore: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 342 Singapore: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 343 Singapore: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 344 Singapore: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 345 Singapore: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 346 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 347 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 348 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 349 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 350 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 351 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 352 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 353 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 354 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 355 Rest of Asia-Pacific: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 356 Rest of Asia-Pacific: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 357 Rest of Asia-Pacific: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 358 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 359 Rest of Asia-Pacific: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 360 Latin America: Medical Device Contract Manufacturing Market, by Country/Region, 2022–2032 (USD Million)

Table 361 Latin America: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 362 Latin America: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 363 Latin America: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 364 Latin America: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 365 Latin America: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 366 Latin America: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 367 Latin America: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 368 Latin America: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 369 Latin America: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 370 Latin America: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 371 Latin America: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 372 Latin America: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 373 Latin America: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 374 Latin America: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 375 Brazil: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 376 Brazil: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 377 Brazil: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 378 Brazil: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 379 Brazil: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 380 Brazil: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 381 Brazil: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 382 Brazil: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 383 Brazil: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 384 Brazil: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 385 Brazil: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 386 Brazil: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 387 Brazil: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 388 Brazil: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 389 Mexico: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 390 Mexico: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 391 Mexico: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 392 Mexico: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 393 Mexico: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 394 Mexico: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 395 Mexico: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 396 Mexico: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 397 Mexico: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 398 Mexico: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 399 Mexico: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 400 Mexico: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 401 Mexico: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 402 Mexico: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 403 Rest of Latin America: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 404 Rest of Latin America: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 405 Rest of Latin America: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 406 Rest of Latin America: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 407 Rest of Latin America: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 408 Rest of Latin America: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 409 Rest of Latin America: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 410 Rest of Latin America: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 411 Rest of Latin America: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 412 Rest of Latin America: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 413 Rest of Latin America: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 414 Rest of Latin America: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 415 Rest of Latin America: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 416 Rest of Latin America: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 417 Middle East & Africa: Medical Device Contract Manufacturing Market, by Country/Region, 2022–2032 (USD Million)

Table 418 Middle East & Africa: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 419 Middle East & Africa: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 420 Middle East & Africa: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 421 Middle East & Africa: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 422 Middle East & Africa: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 423 Middle East & Africa: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 424 Middle East & Africa: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 425 Middle East & Africa: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 426 Middle East & Africa: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 427 Middle East & Africa: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 428 Middle East & Africa: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 429 Middle East & Africa: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 430 Middle East & Africa: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 431 Middle East & Africa: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 432 South Africa: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 433 South Africa: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 434 South Africa: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 435 South Africa: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 436 South Africa: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 437 South Africa: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 438 South Africa: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 439 South Africa: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 440 South Africa: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 441 South Africa: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 442 South Africa: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 443 South Africa: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 444 South Africa: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)

Table 445 South Africa: Medical Device Contract Manufacturing Market, by End User, 2022–2032 (USD Million)

Table 446 Saudi Arabia: Medical Device Contract Manufacturing Market, by Device, 2022–2032 (USD Million)

Table 447 Saudi Arabia: Medical Device Contract Manufacturing Market for IVD Devices, by Type, 2022–2032 (USD Million)

Table 448 Saudi Arabia: Medical Device Contract Manufacturing Market for IVD Instruments, by Type, 2022–2032 (USD Million)

Table 449 Saudi Arabia: Medical Device Contract Manufacturing Market for Imaging Devices, by Type, 2022–2032 (USD Million)

Table 450 Saudi Arabia: Medical Device Contract Manufacturing Market for Drug Delivery Devices, by Type, 2022–2032 (USD Million)

Table 451 Saudi Arabia: Medical Device Contract Manufacturing Market for Cardiovascular Devices, by Type, 2022–2032 (USD Million)

Table 452 Saudi Arabia: Medical Device Contract Manufacturing Market for Patient Monitoring Devices, by Type, 2022–2032 (USD Million)

Table 453 Saudi Arabia: Medical Device Contract Manufacturing Market, by Risk Type, 2022–2032 (USD Million)

Table 454 Saudi Arabia: Medical Device Contract Manufacturing Market, by Service, 2022–2032 (USD Million)

Table 455 Saudi Arabia: Medical Device Contract Design & Development Services Market, by Type, 2022–2032 (USD Million)

Table 456 Saudi Arabia: Medical Device Contract Manufacturing Services Market, by Type, 2022–2032 (USD Million)

Table 457 Saudi Arabia: Medical Device Regulatory Affairs Services Market, by Type, 2022–2032 (USD Million)

Table 458 Saudi Arabia: Medical Device Contract Manufacturing Market, by Application, 2022–2032 (USD Million)