Resources

About Us

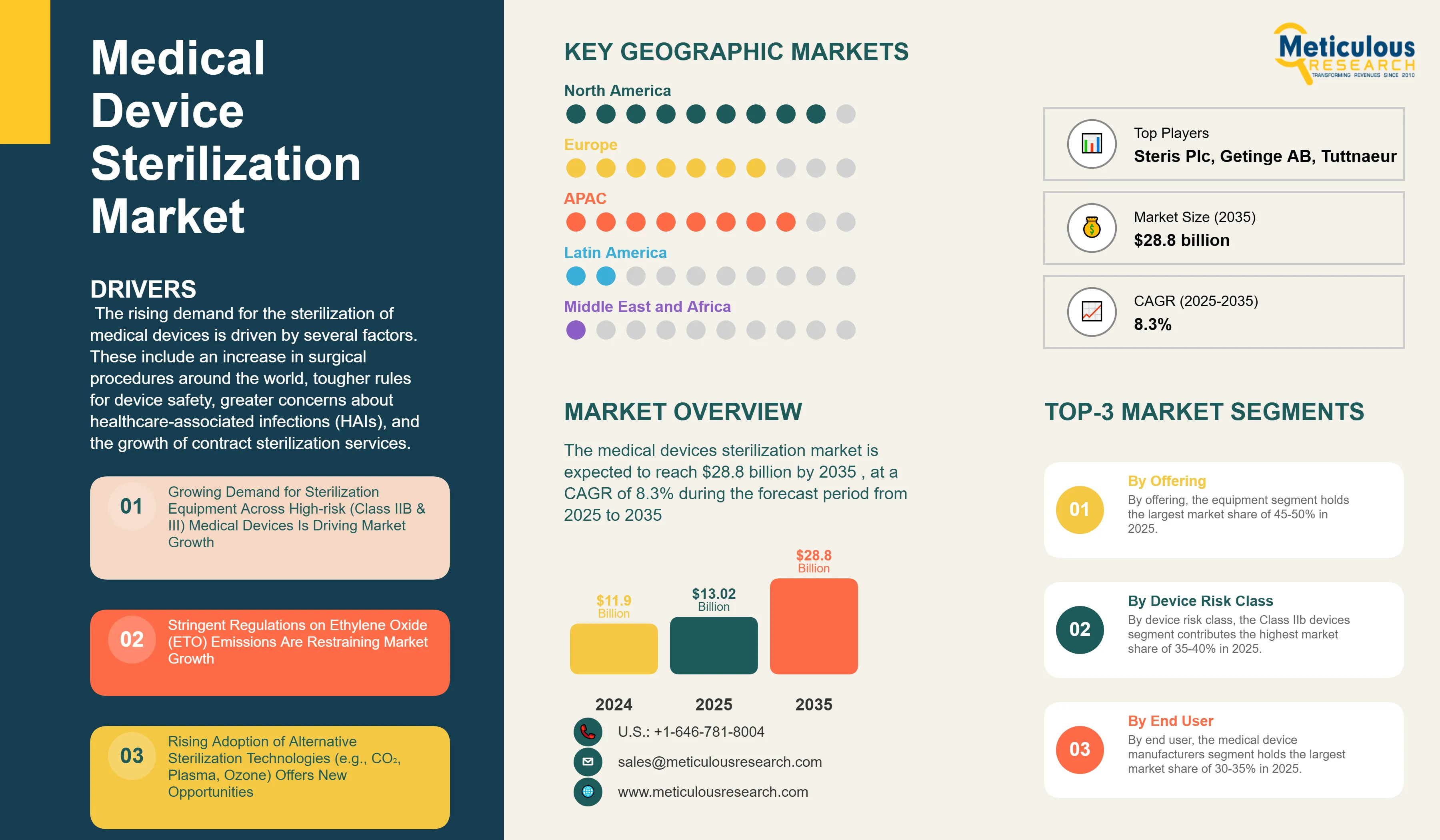

Medical Device Sterilization Market by Offering (Equipment, Services, Consumables & Accessories), Device Risk Class (Class I, IIA, IIB, III), End User (Medical Device Manufacturers, Hospitals & Clinics, Contract Sterilization Service Providers), and Geography - Global Forecast to 2035

Report ID: MRHC - 1041620 Pages: 215 Oct-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Medical Device Sterilization Market Size?

The medical devices sterilization market was valued at USD 11.9 billion in 2024. This market is expected to reach $28.8 billion by 2035 from an estimated $13.02 billion in 2025, at a CAGR of 8.3% during the forecast period from 2025 to 2035. The rising demand for the sterilization of medical devices is driven by several factors. These include an increase in surgical procedures around the world, tougher rules for device safety, greater concerns about healthcare-associated infections (HAIs), and the growth of contract sterilization services. As a result, hospitals, medical device manufacturers, and pharmaceutical facilities worldwide are steadily adopting new sterilization technologies.

Market Highlights: Medical Device Sterilization

Click here to: Get Free Sample Pages of this Report

The medical device sterilization market involves producing, distributing, and using sterilization equipment, services, and supplies. These are necessary to eliminate all forms of microbial life, including bacteria, viruses, fungi, and spores from medical devices and instruments. Sterilization is essential in healthcare and medical device manufacturing. It ensures patient safety by preventing healthcare-associated infections and maintaining the effectiveness of devices.

The market includes various sterilization methods. These methods comprise heat and steam sterilization (autoclaves), low-temperature options (ethylene oxide, hydrogen peroxide, ozone), radiation sterilization (gamma, e-beam, X-ray), and filtration techniques. Each method works best with different device materials, configurations, and sensitivity levels.

The market serves a range of stakeholders. Medical device manufacturers need validated sterilization processes before they can release products. Hospitals and surgical centers reprocess reusable instruments. Contract sterilization organizations offer outsourced services. Pharmaceutical companies sterilize drug delivery devices and combination products. The industry is heavily regulated by entities like the FDA in the U.S., EMA in Europe, and ISO standards. These regulations, especially ISO 11135 for ethylene oxide, ISO 11137 for radiation, and ISO 17665 for steam sterilization, require strict validation, monitoring, and documentation.

Market dynamics are influenced by the increasing complexity of modern medical devices. This includes implantables, minimally invasive instruments, and combination drug-device products that need gentler, low-temperature sterilization methods. The demand for these services is rising. Factors include the growing global number of surgeries, aging populations needing more medical care, expansion of healthcare infrastructure in emerging markets, and increased awareness of infection control after the COVID-19 pandemic. Additionally, environmental and regulatory concerns related to ethylene oxide emissions are driving innovation. New sterilization technologies such as supercritical CO₂, vaporized hydrogen peroxide, and ozone-based systems are being developed as alternatives.

How is Technological Innovation Transforming the Medical Device Sterilization Market?

Technological innovation is transforming the medical device sterilization market. It is introducing new, environmentally friendly sterilization methods that work well with devices and overcome the limits of traditional methods. The industry is shifting towards low-temperature sterilization technologies. These technologies can handle heat-sensitive materials like polymers, electronics, and biological components, which are increasingly common in modern medical devices. Vaporized hydrogen peroxide (VHP) and gas plasma systems now offer faster cycle times, better material compatibility, and lower residual toxicity compared to ethylene oxide. This makes them suitable for hospital-based terminal sterilization and quick instrument reprocessing.

Supercritical CO₂ sterilization is becoming an appealing green alternative. It uses carbon dioxide under high pressure and moderate temperatures to eliminate microbes without leaving toxic residues or harmful emissions. This method is especially attractive to manufacturers looking for sustainable options amid stricter environmental regulations. Ozone-based sterilization systems are also gaining popularity. They can sterilize moisture-sensitive devices at low temperatures and break down into oxygen, leaving no toxic leftovers.

Automation and digital technology are transforming sterilization processes with smart systems that have IoT sensors, real-time monitoring, automated documentation, and predictive maintenance features. These innovations make processes more reliable, improve regulatory compliance, ensure traceability, and boost operational efficiency while minimizing human error. Data analytics and artificial intelligence help optimize sterilization parameters, develop cycles, and set quality assurance protocols.

Radiation sterilization technology is advancing, too. The use of e-beam and X-ray systems is increasing. These systems provide faster processing times, better dose uniformity, and a smaller environmental impact compared to traditional gamma irradiation. They also support the sterilization of complex shapes, high-density packaging, and new biomaterials. Innovations in single-use sterilization packaging, such as antimicrobial barrier materials and breathable films for gas sterilization, are improving sterility maintenance while addressing environmental issues.

What are the Key Trends in the Medical Device Sterilization Market?

Shift from In-House to Outsourced Contract Sterilization Services: A significant trend in the medical device sterilization market is the growing preference among device manufacturers for outsourcing sterilization to specialized contract sterilization organizations (CSOs) instead of keeping in-house capabilities. This change is driven by the high capital investment needed for sterilization equipment, facility validation, regulatory compliance, and training personnel. CSOs provide economies of scale, access to various sterilization methods, established validation protocols, and expertise in dealing with complex regulatory issues across different markets. Small and medium-sized medical device companies gain the most from outsourcing. It allows them to focus on product development and commercialization while taking advantage of the CSO's infrastructure and know-how. The trend speeds up due to increasing regulatory scrutiny of sterilization processes, rising compliance costs, and the need for flexible capacity to handle production changes. CSOs are growing their global presence by opening facilities near manufacturing hubs and key markets, and by investing in various sterilization technologies to meet different customer needs. This creates a strong growth path for the contract services segment.

Environmental Sustainability and Transition from Ethylene Oxide: Another critical trend shaping the market is the industry's movement toward environmentally friendly sterilization methods and the gradual phase-out of ethylene oxide (EtO) sterilization due to environmental and regulatory concerns. EtO is the most common method for sterilizing heat-sensitive medical devices. However, it faces increasing restrictions because it is classified as a carcinogen and hazardous air pollutant. The U.S. EPA and state regulators are imposing stricter emission controls and facility monitoring requirements. Several EtO facilities have faced shutdowns or limitations, leading to capacity issues and supply chain problems. This regulatory pressure is prompting significant investment in alternative sterilization technologies, including vaporized hydrogen peroxide, supercritical CO₂, nitrogen dioxide, and ozone-based systems. These alternatives provide similar effectiveness with less environmental impact and a lighter regulatory load. Medical device manufacturers are redesigning products and packaging to fit alternative sterilization methods. They are conducting extensive validation studies and partnering with sterilization service providers to transition their offerings. This trend is creating substantial opportunities for companies that develop and commercialize next-generation sterilization technologies, while also challenging traditional EtO-dependent infrastructure and business models.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 28.8 Billion |

|

Market Size in 2025 |

USD 13.02 Billion |

|

Market Size in 2024 |

USD 12.01 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 8.3% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Offering, Device Risk Class, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Sterilization Equipment Across High-Risk (Class IIB & III) Medical Devices

A key factor driving growth in the medical device sterilization market is the rising amount and complexity of high-risk medical devices, especially Class IIB and Class III devices. These devices include implantable products, life-supporting equipment, cardiovascular devices, orthopedic implants, and surgical instruments that need strict sterilization protocols. The global increase in chronic diseases, aging populations, and surgical procedures is driving the demand for these advanced medical devices. They must achieve very high sterility assurance levels (SAL), typically requiring a 10⁻⁶ probability of non-sterile units.

Class III devices are in the highest risk category and need rigorous regulatory scrutiny. They are seeing rapid growth due to innovations in cardiac implants like pacemakers, stents, and heart valves. There are also advances in neurostimulation devices, drug-eluting devices, and combination products. These complex devices often use multiple materials, including polymers, electronics, biologics, and metal parts. This variety requires validated sterilization processes that can kill microbes without affecting how well the devices work, their material integrity, or their compatibility with biological systems.

The rising number of minimally invasive surgical procedures calls for specialized, often single-use instruments with complicated shapes and sensitive materials. Robotic surgical systems, advanced endoscopic tools, and catheter-based intervention devices need sterilization methods capable of reaching complex lumens and uneven surfaces while protecting delicate components. Regulatory requirements demand thorough sterilization validation, which includes assessing bioburden, testing sterilization effectiveness, analyzing residues, and verifying package integrity. This creates significant demand for sterilization equipment, consumables, and services. The move towards personalized medicine and patient-specific implants, especially 3D-printed devices with complex interiors, adds more sterilization challenges that require new solutions and drive market growth.

Opportunity

Rising Adoption of Alternative Sterilization Technologies

The environmental and regulatory challenges facing ethylene oxide sterilization are creating significant opportunities for alternative sterilization technologies. These include vaporized hydrogen peroxide (VHP), supercritical CO₂, ozone-based systems, and radiation methods. These new technologies address the sustainability concerns and regulatory burdens linked to EtO while providing comparable or better effectiveness for many uses. The global movement towards green technologies and eco-friendly manufacturing practices fosters favorable market conditions for these alternatives.

Vaporized hydrogen peroxide plasma sterilization has already been established in hospitals for instrument reprocessing. Now, it is expanding into terminal sterilization applications for manufacturers. This technology has several advantages. It operates at low temperatures (typically 40-50°C), offers short cycle times (30-75 minutes), leaves no toxic residues that require aeration, and is compatible with a variety of materials. This makes it appealing for electronics, polymers, and combination devices. Ongoing innovations in VHP systems are enhancing penetration capabilities for complex device shapes and improving compatibility with cellulose-based materials, broadening its market potential.

Ozone-based sterilization systems are becoming popular for low-temperature sterilization of moisture-sensitive devices. They offer quick cycle times and break down into oxygen without leaving toxic residues. Advanced radiation technologies, such as e-beam and X-ray sterilization, provide alternatives to traditional gamma irradiation. These methods feature benefits like on-demand operation, which eliminates the need to manage radioactive sources, faster processing, and better dose uniformity. The combination of regulatory pressure on EtO, the maturation of technological alternatives, and market demand for sustainable solutions offers significant growth opportunities for companies developing, validating, and commercializing next-generation sterilization technologies throughout the forecast period.

Offering Insights

Why Does Equipment Dominate the Market?

On the basis of offering, the equipment segment holds the largest share of 45-50% of the overall medical device sterilization market in 2025. Sterilization equipment is leading the market because hospitals, surgical centers, and medical device manufacturers invest heavily in in-house sterilization capabilities. Heat and steam sterilization equipment, especially autoclaves and high-speed pre-vacuum sterilizers, is the largest category. These tools are commonly used in hospitals to reprocess surgical instruments. They are cost-effective and suitable for heat-stable devices. Low-temperature sterilization equipment, such as hydrogen peroxide plasma systems, ethylene oxide sterilizers, and ozone-based units, continues to be in high demand for processing heat-sensitive devices in both healthcare facilities and manufacturing settings.

However, the consumables and accessories segment is expected to grow at the fastest rate through 2035. This growth is mainly attributed to the ongoing need for consumables for each sterilization cycle, which creates steady revenue streams regardless of the equipment installed. Sterilization indicators, such as biological and chemical indicators, are high-volume consumables required by regulations for regular monitoring and validating sterilization processes. These indicators must be used often to confirm sterilization effectiveness, leading to a constant demand that increases with sterilization activity.

Device Risk Class Insights

How Do Class IIB Devices Lead the Market?

On the basis of device class, the Class IIB devices segment holds the largest share of about 35-40% in 2025. These devices include high-risk active or implantable devices like surgical tools for invasive procedures, short-term implants, therapeutic devices, diagnostic equipment, drug delivery systems, and items containing biological substances. Due to their invasive nature and potential impact on patients, these devices need strict sterilization validation. They require detailed sterility assurance protocols, biocompatibility testing after sterilization, and comprehensive validation to show that the processes work effectively without affecting the device's function.

The high volume of surgical and diagnostic procedures performed worldwide with Class IIB devices, including endoscopic instruments, laparoscopic tools, catheterization devices, and components for surgical robotics is further driving the growth of this market. The rise of minimally invasive surgical techniques increases the demand for specialized sterilizable instruments, which often have complex shapes and heat-sensitive materials. Class IIB devices cover various therapeutic areas, such as cardiovascular interventions, orthopedic surgery, gastroenterology, urology, and gynecology, making their market applicability broad.

Additionally, many Class IIB devices are reusable tools that need repeated sterilization cycles during their lifespan, leading to consistent sterilization demand compared to single-use devices. Hospital central sterile processing departments handle large amounts of Class IIB surgical instruments daily to meet operating room needs, which creates steady demand for sterilization equipment, supplies, and validation services.

End User Insights

Why Do Medical Device Manufacturers Dominate the Market?

Based on end user, the medical device manufacturers segment holds the largest share of 30-35% of the overall medical device sterilization market in 2025. Device manufacturers are a primary customer base for sterilization solutions. They require validated terminal sterilization processes before product release to meet regulatory standards and ensure patient safety. This segment includes large multinational companies that produce diverse device portfolios across various therapeutic areas, specialized manufacturers that focus on specific device categories or technologies, and emerging companies that develop innovative medical devices.

Regulatory requirements demand strict sterilization validation, process monitoring, and detailed documentation. This creates ongoing demand for sterilization products and services throughout device lifecycles, from development to commercial production. Medical device manufacturers invest heavily in sterilization development during product design, needing access to equipment, validation services, and technical know-how to set up and maintain validated processes. The rising complexity of modern medical devices, including combination products, implantables with drug coatings, and devices that use biological materials, requires advanced sterilization methods and significant manufacturer investment.

In contrast, the contract sterilization service providers segment is expected to grow at the fastest CAGR through 2035. This segment includes specialized companies that offer dedicated sterilization services to device manufacturers, pharmaceutical companies, and healthcare facilities. Contract service providers are growing rapidly as manufacturers increasingly choose to outsource rather than maintain expensive in-house sterilization systems. This is especially true for methods like ethylene oxide, gamma radiation, and e-beam sterilization, which require substantial capital and specialized facilities.

U.S. Medical Device Sterilization Market Size and Growth 2025 to 2035

The U.S. medical device sterilization market is projected to be worth around USD 11.5 billion by 2035, growing at a CAGR of 7.5% from 2025 to 2035.

How is North America Maintaining Dominance in the Medical Device Sterilization Market?

North America commands the largest share of the global medical device sterilization market, accounting for about 45-50% in 2025. The U.S. represents nearly 40% of global medical device production. The country is home to many multinational manufacturers, innovative medical technology firms, and a strong healthcare system that needs extensive sterilization for both device production and hospital reprocessing.

The U.S. has the most advanced medical device regulations through the FDA. The agency imposes strict sterilization validation requirements, quality system regulations, and good manufacturing practices. This ensures thorough oversight of sterilization processes. The regulatory framework requires significant investment in validation, monitoring, and compliance systems, fostering market growth and increasing the demand for equipment, services, and supplies.

North America's leading position is further supported by high healthcare spending. The U.S. spends around 17% of its GDP on healthcare, which drives considerable demand for medical devices and their sterilization. The volume of advanced surgical procedures, including those that require complex sterile instruments and implantable devices, creates ongoing demand for sterilization. The region emphasizes patient safety and infection control through hospital quality improvement initiatives, Joint Commission accreditation standards, and Centers for Medicare & Medicaid Services reimbursement policies. These measures encourage strict sterilization practices and investments in related infrastructure.

Which Factors Support the Asia-Pacific Medical Device Sterilization Market Growth?

Asia-Pacific is expected to grow at the fastest CAGR from 2025 to 2035. This growth is primarily attributed to the rapid expansion of medical device manufacturing in the region, especially in China, India, South Korea, Malaysia, Thailand, and Vietnam. Key factors include lower labor costs, decreased operational expenses, a skilled workforce, supportive government policies and incentives for medical device industries, and access to growing healthcare markets. The region is becoming a favored location for multinational manufacturers looking to set up production facilities to serve local and global markets, which increases the need for sterilization infrastructure.

Major medical device companies are moving manufacturing operations to Asia-Pacific using greenfield investments, joint ventures, and contract manufacturing partnerships. This shift requires local sterilization capabilities that meet international quality standards. China has become the world's second-largest medical device market and a key manufacturing hub, supported by government initiatives like "Made in China 2025" and "Healthy China 2030," which encourage the development and improvement of domestic industries, driving investments in sterilization infrastructure.

Rising healthcare spending across Asia-Pacific, expanding hospital infrastructure, increasing surgical procedures, and better access to healthcare for large populations are driving the demand for sterile medical devices and hospital sterilization capabilities. The significant and aging populations in this region, especially in Japan, China, and South Korea, are increasing the rates of chronic diseases that need surgical treatments and implantable devices, which further supports market growth. Government healthcare initiatives, expanded insurance coverage, and a growing middle class with more purchasing power enhance access to advanced medical procedures that require sterile devices.

Recent Developments

Segments Covered in the Report

By Offering

By Device Risk Class

By End User

By Region

The medical device sterilization market is expected to grow from USD 13.02 billion in 2025 to USD 28.8 billion by 2035.

The medical device sterilization market is expected to grow at a CAGR of 8.3% from 2025 to 2035.

The major players in the medical device sterilization market include STERIS plc, Getinge AB, Advanced Sterilization Products Inc. (Fortive Corporation), Sotera Health Company, Steelco S.p.A., Belimed AG, Tuttnauer Ltd., Consolidated Sterilizer Systems, Matachana Group, Stryker Corporation, among others.

The main factors driving the medical device sterilization market include growing demand for sterilization across high-risk medical devices, increasing surgical procedures globally, stringent regulatory requirements for device safety, rising healthcare-associated infection concerns, expansion of contract sterilization services, and technological innovations in low-temperature and alternative sterilization methods.

The North America region will lead the global medical device sterilization market during the forecast period 2025 to 2035.

Published Date: Nov-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates