Resources

About Us

Asia-Pacific Pharmaceutical Contract Development and Manufacturing Market By Service {Manufacturing [API, FDF (Parenteral, Tablet, Capsule, Oral Liquid)], Drug Development, Biologics Manufacturing, Packaging}, End User [Large Pharma] - Forecast to 2032

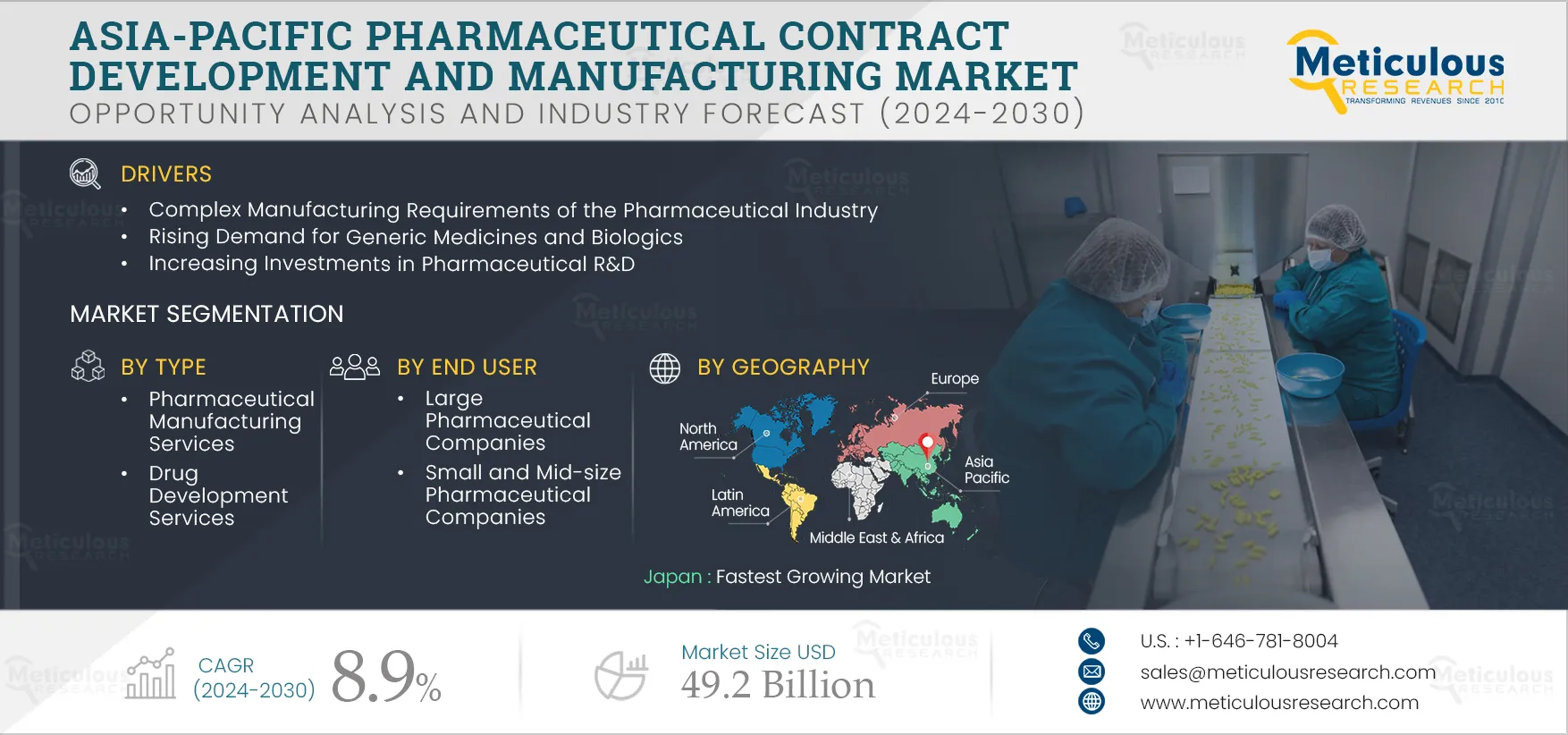

Report ID: MRHC - 104864 Pages: 150 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Pharmaceutical Contract Development and Manufacturing Market is expected to reach $49.2 billion by 2032 at a CAGR of 8.9% from 2025 to 2032. Pharmaceutical contract development and manufacturing organizations offer various services based on a contract to small or large pharmaceutical companies. These services include active pharmaceutical ingredient (API) manufacturing, finished dosage form (FDF) manufacturing, drug development & drug discovery services, and biologics manufacturing services. The COVID-19 pandemic positively impacts the pharmaceutical contract development and manufacturing market due to the increased demand for pharmaceutical products such as tablets, capsules, drugs, and vaccines.

The growth of the Asia-Pacific pharmaceutical contract development and manufacturing market is attributed to the complex manufacturing requirements of the pharmaceutical industry, manufacturers' growing inclination toward the use of cutting-edge technologies, patent expiration, increasing investments in pharmaceutical R&D, and the rising demand for generic medicines & biologics. In addition, the growing demand for cell and gene therapies and personalized medicines and growth in high potency active pharmaceutical ingredients (HPAPI) and antibody-drug conjugates (ADC) markets is expected to offer significant opportunities for the growth of the pharmaceutical contract development and manufacturing market. However, the lack of skilled professionals and the introduction of serialization are some of the challenges to the growth of this market.

The pharmaceutical industry is largely driven by scientific discovery, development, and toxicological and clinical experience. Pharmaceutical manufacturing operations may be categorized as primary production of bulk drug substances (APIs) and manufacturing of dosage form products (formulations).

In addition to the complexity of the pharmaceutical manufacturing process, many countries globally have specific legal protections for proprietary drugs and manufacturing processes, known as intellectual property rights. When legal protections are limited or nonexistent, some companies specialize in manufacturing and marketing generic drugs. The pharmaceutical industry requires large capital investments due to the high expenses associated with R&D, regulatory approvals, manufacturing, quality assurance & control, marketing, and sales.

Many countries have extensive government regulations affecting the development and approval of drugs for commercial sale. These countries have strict requirements for good manufacturing practices to ensure the integrity of drug manufacturing operations and pharmaceutical products' quality, safety, and efficacy. These challenges have led pharmaceutical companies to partner with contract manufacturing and development organizations to develop and manufacture pharmaceuticals and biologics, driving the growth of the pharmaceutical contract development and manufacturing market.

Click here to: Get Free Sample Pages of this Report

The increasing prevalence of cancer, autoimmune, cardiovascular, and infectious diseases in Asia-Pacific has resulted in the emergence of biopharmaceuticals or biologics as an important therapeutic class for treating these diseases. Biologics offer numerous advantages over synthetic drugs by targeting specific sites and rarely causing side effects, resulting in the increasing number of approvals and the demand for biologics, such as therapeutic proteins and monoclonal antibodies (MAbs).

According to GLOBOCAN, in Asia, the cancer cases in 2020 were 9,503,710 million, which is expected to increase by 59.2% by 2040. Furthermore, the COVID-19 pandemic, the Ebola epidemic, and the rising incidences of infectious diseases significantly burden the healthcare sector and boost the demand for vaccines. For instance, in 2020, the outbreak of the COVID-19 pandemic imposed a huge burden on the pharmaceutical industry and increased the demand for vaccines and breakthrough drugs. Due to this increase, the demand for biopharmaceutical products has risen with the subsequent growth in the Asia-Pacific pharmaceutical contract development and manufacturing market.

Key Findings of the Market Study:

In 2025, the Pharmaceutical Manufacturing Services Segment is Expected to Dominate this Market

Based on type, the Asia-Pacific pharmaceutical contract development and manufacturing market is segmented into pharmaceutical manufacturing services, drug development services, and biologics manufacturing services. In 2025, the pharmaceutical manufacturing services segment is expected to account for the largest share of the market. The pharmaceutical manufacturing services segment is further segmented into active pharmaceutical ingredient (API) manufacturing services and finished dosage forms (FDF) manufacturing services. The largest share of this segment is attributed to the need to reduce manufacturing costs, to bring a new drug to the market quickly at the lowest possible cost, the requirement for high-quality bulk manufacturing and the growing demand for generic drugs. Additionally, contract manufacturing organizations conduct the manufacturing process by governing all the environmental and regulatory norms driving the market.

In 2025, the Large Pharmaceutical Companies Segment is Expected to Account for the Largest Share of the Market

Based on end user, the Asia-Pacific pharmaceutical contract development and manufacturing market is segmented into large pharmaceutical companies, small & mid-size pharmaceutical companies, and generic pharmaceutical companies. In 2025, the large pharmaceutical companies segment is expected to account for the largest share of the market. Factors such as the increasing need for cost control amid increasing pricing pressure, rising complex manufacturing requirements and inclination towards cutting-edge technologies, and sponsors strategically focusing on core business functions such as marketing & R&D support the largest share of the market.

Japan: Fastest Growing Market

Japan is expected to register the highest CAGR during the forecast period. Capacity expansion by key pharmaceutical manufacturers, favorable government regulations supporting the approval of new pharmaceuticals, and the prevalence of chronic illness and other infectious diseases amid the growing geriatric population are the major drivers for the Japanese pharmaceutical contract development and manufacturing market. According to the Population Division, Department of Economic and Social Affairs (DESA), United Nations, in Japan, the percentage of the population aged 65 and above has dramatically increased. It is estimated that this population will account for 37.3% of the total population in Japan by 2032, compared to 23.3% in 2000. This significant growth in the geriatric population has increased the burden of chronic diseases such as cancer and cardiovascular diseases, driving the need for contract development and manufacturing.

Key Players

The report offers a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments adopted by leading market players in the industry over the years. The key players operating in the Asia-Pacific pharmaceutical contract development and manufacturing market are Samsung Biologics Co., Ltd. (South Korea), FUJIFILM Diosynth Biotechnologies (Japan), AbbVie Inc. (U.S.), Aenova Group (Germany), Wuxi Biologics, Inc. (China), Vetter Pharma International GmbH (Germany), Catalent Inc. (U.S.), Lonza Group Ltd (Switzerland), Recipharm AB (Sweden), Almac Group (U.K.), C.H. Boehringer Sohn Ag & Co. KG. (Germany), Piramal Enterprises Limited (India), Eurofins Scientific (France), Curia Global, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Evonik Industries AG (Germany), Jubilant Life Sciences Limited (India), IDT Australia (Australia), Nipro Pharma Corporation (Japan), Shanghai ChemPartner Co., Ltd. (China), and Aurobindo Pharma, Ltd. (India).

Scope of the Report:

Asia-Pacific Pharmaceutical Contract Development and Manufacturing Market Assessment, by Type

Asia-Pacific Pharmaceutical Contract Development and Manufacturing Market Assessment, by End User

Asia-Pacific Pharmaceutical Contract Development and Manufacturing Market Assessment , by Country

Key questions answered in the report:

The Asia-Pacific pharmaceutical contract development and manufacturing market studies different types of services, such as pharmaceutical manufacturing services, drug development services, and biologics manufacturing services used by end users. The Asia-Pacific pharmaceutical contract development and manufacturing market studied in this report involves the analysis of various segments at country levels.

The Asia-Pacific pharmaceutical contract development and manufacturing market is projected to reach $49.2 billion by 2032 at a CAGR of 8.9% from 2025 to 2032

Among all the types studied in the report, the pharmaceutical manufacturing services segment is expected to account for the largest share of the market in 2025. The largest share of the segment is attributed to the growing need to reduce manufacturing costs, to bring a new drug to the market quickly at the lowest possible cost, the requirement for high-quality bulk manufacturing and the growing demand for generic drugs.

The growth of this market is driven by the complex manufacturing requirements of the pharmaceutical industry, manufacturers' growing inclination toward the use of cutting-edge technologies, patent expiration, increasing investments in pharmaceutical R&D, and the rising demand for generic medicines & biologics. In addition, the growing demand for cell and gene therapies and personalized medicines and growth in high potency active pharmaceutical ingredients (HPAPI) and antibody-drug conjugates (ADC) markets is expected to offer significant opportunities for the growth of the pharmaceutical contract development and manufacturing market.

The key players operating in the Asia-Pacific pharmaceutical contract development and manufacturing market are Samsung Biologics Co., Ltd. (South Korea), FUJIFILM Diosynth Biotechnologies (Japan), AbbVie Inc. (U.S.), Aenova Group (Germany), Wuxi Biologics, Inc. (China), Vetter Pharma International GmbH (Germany), Catalent Inc. (U.S.), Lonza Group Ltd (Switzerland), Recipharm AB (Sweden), Almac Group (U.K.), C.H. Boehringer Sohn Ag & Co. KG. (Germany), Piramal Enterprises Limited (India), Eurofins Scientific (France), Curia Global, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Evonik Industries AG (Germany), Jubilant Life Sciences Limited (India), IDT Australia (Australia), Nipro Pharma Corporation (Japan), Shanghai ChemPartner Co., Ltd. (China), and Aurobindo Pharma, Ltd. (India)

China and Japan are expected to offer significant growth opportunities owing to the government initiatives to create favorable pharmaceutical drug approval programs, increase investment from existing pharmaceutical manufacturers in the country for infrastructure development, and grow investments towards biosimilar manufacturing.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates