Resources

About Us

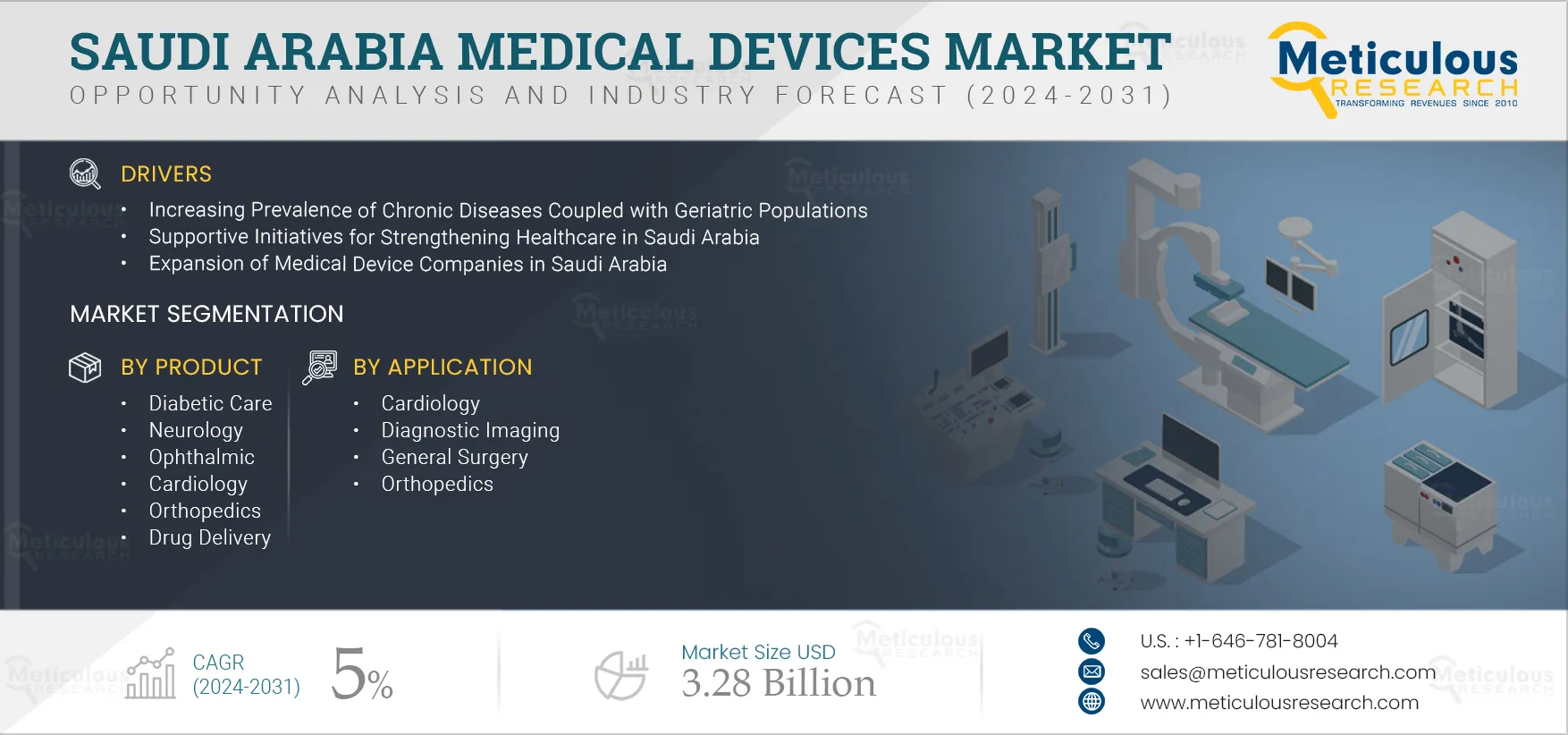

Saudi Arabia Medical Devices Market Size, Share, Forecast, & Trends Analysis by Product (IVD, Monitoring, Neurology, Diabetic Care, Orthopedic, Cardiology) Risk Type, Application (Cardiology, General Surgery, Orthopedics) End User - Forecast to 2032

Report ID: MRHC - 1041416 Pages: 240 Nov-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the Saudi Arabia medical devices market is primarily driven by the growing prevalence of chronic diseases coupled with the geriatric population, supportive initiatives for strengthening healthcare in Saudi Arabia, and the expansion of medical device companies in Saudi Arabia. Furthermore, the development and transformation of Saudi’s healthcare services and the growing emphasis on medical tourism are expected to generate growth opportunities for the stakeholders in this market.

Key Findings in the Saudi Arabia Medical Devices Market

Click here to: Get Free Sample Copy of this report

The Government of Saudi Arabia is making ongoing investments to enhance the country's healthcare infrastructure. Key outcomes of these investments include the increasing number of hospitals and healthcare systems, the growing adoption of digital health technologies, and improved access to healthcare services. Under Vision 2032, the government has committed to investing over USD 65 billion to develop healthcare infrastructure. In addition, the Ministry of Health (MoH) and other government agencies are supporting public-private partnerships (PPP) to develop healthcare facilities while minimizing financial burdens.

As part of these efforts, the MoH, in collaboration with private sector entities, is driving initiatives to strengthen healthcare services. For example, in June 2024, the Ministry granted Altakassusi Alliance Medical LLC—a joint venture between Alliance Medical Group, King Faisal Specialist Hospital & Research Center, and Nexus Gulf Healthcare—a project to enhance radiology and imaging services across seven hospitals in Saudi Arabia. This collaboration aims to transfer knowledge, upskill the local healthcare workforce through training programs, and improve the quality of care. The expansion of imaging services requires advanced diagnostic devices, further contributing to the growth of the medical device market in the region.

The expansion of healthcare and medical device companies in Saudi Arabia is driving growth in the medical device sector. Companies are increasing their presence in the country due to strong government support, health initiatives, and a rapidly growing healthcare ecosystem. This expansion enhances accessibility to medical devices, allowing companies to meet the needs of an underserved customer base. Several medical device companies have already strengthened their foothold in Saudi Arabia. For example:

Saudi Arabia's healthcare sector is rapidly evolving, driven by advanced technologies, new programs, and infrastructure improvements aimed at enhancing the quality of care. The Ministry of Health has launched a health sector transformation program to improve access to services and attract more investments. As part of Vision 2032, the country has prioritized the acceleration of emergency services to reduce patient wait times, expanded the number of surgeries performed weekly from 2,000 to 8,400, and ensured timely access to critical interventions to address the growing healthcare needs of the population. This transformation in healthcare delivery is driving the demand for medical devices across the distribution network, fueling growth in Saudi Arabia's medical device market.

Based on product type, the Saudi Arabia Medical Devices Market is segmented into Monitoring Devices, Diabetic Care, Invitro Diagnostics (IVD), Neurology, Ophthalmic, Diagnostic Imaging, Cardiology, Orthopedics, Drug Delivery, General and Plastic Surgery, Dental, Wound Management, Endoscopy, Ear, Nose & Throat, Nephrology, General Hospital & Healthcare, Skin Care & Aesthetics, Other Products. In 2025, the Monitoring Devices segment is expected to account for the largest share of the Saudi Arabia Medical Devices Market.

The large share of this segment is driven by the increasing burden of chronic diseases, widespread adoption of advanced medical practices, and high population density. As the population grows, coupled with a higher incidence of chronic conditions, there is a growing need for healthcare solutions to monitor health status and access real-time data. This demand is fueling the growth of the in vitro diagnostics (IVD) devices market.

However, the diabetic care devices segment is slated to register the highest CAGR during the forecast period. The increasing prevalence of diabetes in Saudi Arabia, coupled with technological advancements in diabetic care devices, is driving market growth. The rising number of hospital admissions and growing awareness about diabetes among patients further contribute to the demand for diabetic care devices. For example, a study published in the *Cureus* journal indicates that approximately 49.9% of hospitalized patients in Riyadh have diabetes. This high rate of diabetes-related hospitalizations is prompting healthcare providers to invest in and adopt the latest diabetic care devices, thereby accelerating market growth.

The report includes a competitive landscape based on an extensive assessment of the product offerings, geographic presence, and key strategic developments of leading market players. The key players operating in the Saudi Arabia medical devices market are Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S.), Smith+Nephew. (U.K.), Zimmer Biomet. (U.S), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company (U.S), Olympus Corporation (Japan), Johnson & Johnson (U.S.), Medtronic plc (Ireland), Drägerwerk AG & Co. KGaA (Germany) and Abbott Laboratories (U.S.).

|

Particulars |

Details |

|

Number of Pages |

350 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

5% |

|

Estimated Market Size (Value) |

$3.28 Billion by 2032 |

|

Segments Covered |

By Product

By Risk Type

By Application

By End User

|

|

Key Companies Profiled |

Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S.), Smith+Nephew. (U.K.), Zimmer Biomet. (U.S), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company (U.S), Olympus Corporation (Japan), Johnson & Johnson (U.S.), Medtronic plc (Ireland), Drägerwerk AG & Co. KGaA (Germany) and Abbott Laboratories (U.S.). |

The Saudi Arabia medical devices market size was valued at $ 2.19 billion in 2024.

The market is projected to grow from $2.33 billion in 2025 to $3.28 billion by 2032.

The Saudi Arabia medical devices market analysis indicates significant growth, reaching $3.28 billion by 2032 at a compound annual growth rate (CAGR) of 5.0% from 2025 to 2032.

The key players operating in the Saudi Arabia medical devices market are Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S.), Smith+Nephew. (U.K.), Zimmer Biomet. (U.S), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company (U.S), Olympus Corporation (Japan), Johnson & Johnson (U.S.), Medtronic plc (Ireland), Drägerwerk AG & Co. KGaA (Germany) and Abbott Laboratories (U.S.).

A prominent market trend in Saudi Arabia medical devices is the growing investment by key players in medical devices, the integration of AI and Robotics in medical devices, and the rising demand for wearable devices.

By Product, the monitoring devices segment is forecasted to hold the largest market share.

By Risk type, the low-risk medical devices segment is forecasted to hold the largest market share.

By Applications, the diagnostic imaging segment is expected to dominate the market.

By end users, the Hospitals segment is poised to record the dominant position in the market.

The primary drivers of Saudi Arabia medical devices Market Growth include the rising prevalence of chronic diseases and the rising geriatric population, supportive initiatives for strengthening Saudi Arabia's healthcare, and the expansion of medical device manufacturing companies in Saudi Arabia.

Published Date: Oct-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates