Resources

About Us

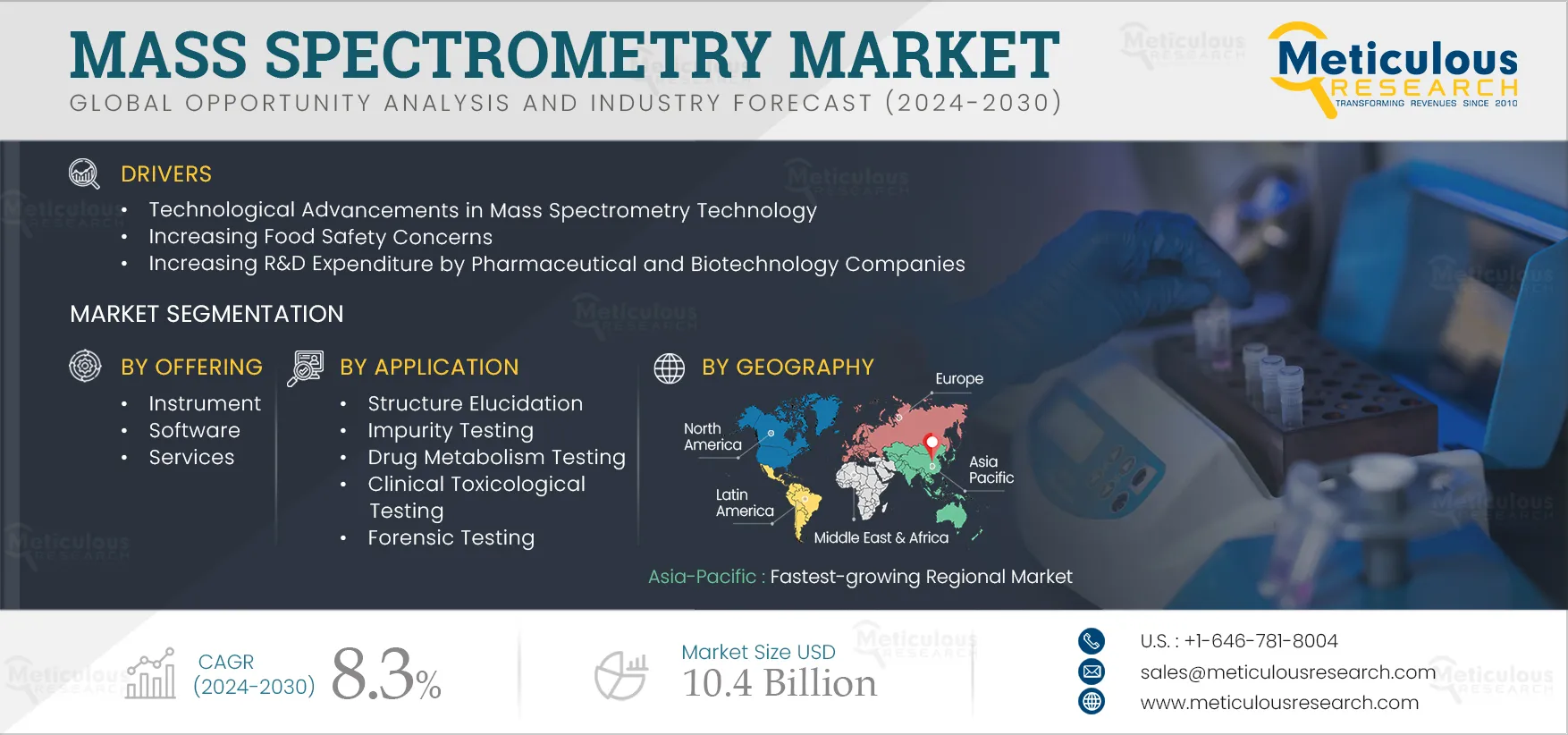

Mass Spectrometry Market by Offering [Instrument, Software] Technology [Quadrupole, LC MS, Ion Trap, GC MS, Time of Flight, MALDI, Integrated] Application [Impurity, Toxicology, Forensic, Clinical Testing] End User [Pharma, Biotech] - Global Forecast to 2032

Report ID: MRHC - 104854 Pages: 230 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Mass Spectrometry Market is projected to reach $10.4 billion by 2032, at a CAGR of 8.3% from 2025 to 2032. Mass spectrometry's applications have risen to a spectacular position owing to its increasing applications and usage in analytical studies. The rising adoption of mass spectrometry is due to its exceptional detection limits, unequaled sensitivity, speed and diversity of its applications. Also, the most recent applications of mass spectrometry have proven their capabilities in metabolome, proteome, and high throughput in drug metabolism and discovery studies, and so on. Also, other applications of the technology in food control, natural products and process monitoring, pollution control, and forensic science have led to its penetration into diverse fields.

The growth of this market is driven by factors such as technological advancements in mass spectrometry technology, increasing food safety concerns, increasing applications of mass spectrometry, increasing R&D expenditure by pharmaceutical and biotechnology companies, and high reliability and sensitivity of mass spectrometers. However, the high costs of instruments are restraining the growth of this market. The rising adoption of mass spectrometers in emerging markets is a significant opportunity for players in this market. However, the lack of skilled professionals is a challenge to the growth of this market. Additionally, the rising adoption of portable mass spectroscopy devices is a trend prevailing in the market.

Mass Spectrometry has wider applications in food testing. Globally, foodborne diseases are a major public health problem that results in the need for food testing to a greater extent. Also, food industries are expanding globally due to urbanization and the rising population, resulting in increased processed food products. As these products contain additives and preservatives, their composition should be within the limit for human safety. Hence, with the globalization of the food industry, testing practices are being adopted across the industry ecosystem consisting of food traders, processing organizations, transporters, and distributors. In such cases, mass spectrometry is extensively used in the food sector for the qualitative and quantitative analyses of various elements such as nutritional value, profiles of micronutrients (vitamins), macronutrients (lipids, proteins, and carbohydrates), and nutraceutical active compounds. Thus, the increased emphasis on food safety testing drives the mass spectrometry market. With the increased use of mass spectrometry due to its various applications, continuous advancements in its methodologies and technology have made it a standard laboratory technique to be used across sectors, allowing it to remain relevant and useful in meeting the analytical demands across various scientific scenarios.

Various developed countries from North America and Europe are major contributors to the mass spectrometry market. However, low-penetrated emerging economies are expected to offer significant market growth opportunities due to increasing R&D funding and the growing pharmaceutical industry, food demand, and technological advancements. Emerging economies such as China, India, and the Association of Southeast Asian Nations (ASEAN) member countries in Asia-pacific, and Brazil and Mexico in Latin America have been major contributors to growth in the mass spectrometry market during the past few years. This is mainly due to an increase in the number of research institutes, testing laboratories, CROs & CDMOs, and pharmaceutical & biopharmaceutical companies in the regions.

Also, growth in public & private R&D funding and contract research in these countries is expected to further support pharmaceutical & biotechnology research and boost the demand for related products in these regions. Additionally, increasing applications of mass spectrometry are supporting its adoption by its end users in multiple applications, such as characterizing complex petroleum materials and cutting-edge biotech research. Recent technological advancements can enable end users better use the specificity and power of MS to solve their technical challenges. The recent use of MS in proteomics has enabled researchers to gain information on the protein identity, its structure and chemical modifications.

Additionally, the advanced technology and increasing applications of mass spectrometry have opened new doors for its adoption in molecular analysis of complex tissues for disease characterization and in identifying new prognostic, diagnostic, and predictive markers. Mass spectrometry has paved the way for its use in guiding treatment decisions by detecting clinically actionable molecular profiles from cells and tissues. These factors have triggered the adoption of mass spectrometry in emerging markets, further contributing to the growth of mass spectrometer market.

Click here to: Get a Free Sample Copy of this report

Based on offering, in 2025, the instrument segment is expected to account for the largest share of the mass spectrometry market. The capacity to study several molecules from the same or different structural family and detect specific metabolites of disease and large-scale analysis capabilities are factors contributing to the large market share of this segment.

Based on technology, in 2025, the quadrupole mass spectrometry segment is expected to account for the largest share of the mass spectrometry market. The large share of the segment is attributed to the benefits offered by the high usage of quadrupole mass analyzers in targeted and quantitative applications and quadrupole mass spectrometry’s use in measuring one or more ions in a mixture. Furthermore, quadrupole mass spectrometry is fast, simple and reliable and does not require a high vacuum.

Based on application, in 2025, the drug metabolism testing segment is expected to account for the largest share of the mass spectrometry market. The large market share of this segment is attributed to the increasing applications of mass spectrometry in drug testing, increasing pharmaceutical and biotechnology research, and the high usage of mass spectrometers in target validation.

Based on end user, in 2025, the pharmaceutical & biotechnology industry segment is expected to account for the largest share of the mass spectrometry market. The large market share of this segment is attributed to the increasing role of mass spectrometry in drug discovery and development pipeline, increasing adoption of mass spectrometry in metabolomics, proteomics, and analysis of clinical tissue samples, and mass spectrometers’ ability to determine pharmacokinetic properties and structure of compounds.

Asia-Pacific: Fastest-growing Regional Market

The increasing focus of government bodies of Asia-Pacific countries such as China, India, Singapore, and South Korea on the healthcare sector in terms of increased investment for the adoption of advanced technology, to build better healthcare infrastructure and the increasing applications of mass spectrometry. Furthermore, rising investments in healthcare and a surge in research activities by key pharmaceutical and biotechnology companies are also boosting the growth of this regional market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players between 2021 and 2022. Some of the key players operating in the mass spectrometry market are Agilent Technologies, Inc. (U.S.), Bruker Corporation (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Waters Corporation (U.S.), Perkin Elmer Inc. (U.S.), INFICON Holding AG (Switzerland), Pfeiffer Vacuum GmbH (Germany), LECO Corporation (U.S.), Rigaku Corporation (Japan), Shimadzu Corporation (Japan), SCIEX (A subsidiary of Danaher Corporation) (U.S.), LECO CORPORATION (U.S.), and Advion, Inc. (U.S.).

Scope of the Report:

Key questions answered in the report:

This study offers a detailed assessment of the mass spectrometry market and analyzes the market sizes & forecasts based on offering, technology, application and end user. This report also involves the value analysis of various segments and subsegments of the mass spectrometry market at the regional and country levels.

The mass spectrometry market is projected to reach $10.4 billion by 2032, at a CAGR of 8.3% during the forecast period.

In 2025, the instruments segment is expected to account for the largest share of the market.

In 2025, the quadrupole mass spectrometry segment is expected to account for the largest share of the market.

In 2025, the drug metabolism testing segment is expected to hold the largest share of the market. The largest share of this application is attributed to the wide usage of mass spectrometry in metabolite identification, toxicology, metabolic stability, and efficacy profiles. Additionally, the availability of mass analyzers and data mining tools has accelerated the process of metabolite identification and changed the landscape of drug metabolism, leading to the market's growth.

In 2025, the pharmaceutical & biotechnology industry segment is expected to hold the largest share of the market.

The growth of this market is attributed to the technological advancements in mass spectrometry technology, increasing food safety concerns, increasing R&D expenditure by pharmaceutical and biotechnology companies, high reliability and sensitivity of mass spectrometers, and increasing applications of mass spectrometry.

The key players profiled in the mass spectrometry market study are Agilent Technologies, Inc. (U.S.), Bruker Corporation (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Waters Corporation (U.S.), Perkin Elmer Inc. (U.S.), INFICON Holding AG (Switzerland), Pfeiffer Vacuum GmbH (Germany), LECO Corporation (U.S.), Rigaku Corporation (Japan), Shimadzu Corporation (Japan), SCIEX (A subsidiary of Danaher Corporation) (U.S.), LECO CORPORATION (U.S.), and Advion, Inc. (U.S.).

Emerging economies such as China and India are projected to offer significant growth opportunities to the market players due to rising investments in the healthcare sector and increasing research projects in these countries.

1. Overview

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency and Limitation

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Technological Advancements in Mass Spectrometry Technology

4.2.2. Increasing Food Safety Concerns

4.2.3. Increasing R&D Expenditure by Pharmaceutical and Biotechnology Companies

4.2.4. High Reliability and Sensitivity of Mass Spectrometers

4.3. Restraints

4.3.1. High Costs of Instruments

4.4. Opportunities

4.4.1. Rising Adoption of Mass Spectrometers in Emerging Markets

4.5. Challenges

4.5.1. Lack of Skilled Professionals

4.6. Trends

4.6.1. Rising Adoption of Portable Mass Spectroscopy Devices

4.7. Pricing Analysis

4.8. Regulatory Analysis

4.9. Case Studies / Use Cases

5. Global Mass Spectrometry Market & Trend Analysis, by Offering

5.1. Overview

5.2. Instrument

5.3. Software

5.4. Services

6. Global Mass Spectrometry Market Size & Trend Analysis, by Technology

6.1. Overview

6.2. Quadrupole Mass Spectrometry

6.3. Time of Flight (ToF) Mass spectrometry

6.4. Chromatography Mass Spectrometry

6.4.1. GC MS

6.4.2. LC MS

6.5. Matrix-assisted Laser Desorption Ionization (MALDI) Mass Spectroscopy

6.6. Magnetic Sector Mass Spectrometry

6.7. Fourier Transform Mass Spectrometry

6.8. Ion Trap Spectrometry

6.9. Portable Mass Spectrometry

6.10. Integrated Technologies

7. Global Mass Spectrometry Market Size & Trend Analysis, by Application

7.1. Overview

7.2. Structure Elucidation

7.3. Impurity Testing

7.4. Drug Metabolism Testing

7.5. Clinical Toxicological Testing

7.6. Forensic Testing

7.7. Other Applications

8. Global Mass Spectrometry Market Size & Trend Analysis, by End User

8.1. Overview

8.2. Pharmaceutical & Biotechnology Industry

8.3. Academic and Research Institutes

8.4. Environmental Agencies

8.5. Food & Beverage Companies

8.6. Petrochemical Industry

8.7. Other End Users

9. Mass Spectrometry Market Size & Trend Analysis, by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. Italy

9.3.4. U.K.

9.3.5. Spain

9.3.6. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Vendor Market Positioning

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/Market Ranking (2022)

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, SWOT Analysis of Top 5 Companies, and Strategic Developments)

11.1. Agilent Technologies, Inc.

11.2. Bruker Corporation

11.3. Danaher Corporation

11.4. Thermo Fisher Scientific, Inc.

11.5. Waters Corporation

11.6. Perkin Elmer Inc.

11.7. INFICON Holding AG

11.8. Pfeiffer Vacuum GmbH

11.9. LECO Corporation

11.10. Rigaku Corporation

11.11. Shimadzu Corporation

11.12. SCIEX (A subsidiary of Danaher Corporation)

11.13. LECO CORPORATION

11.14. Advion, Inc.

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 2 Global Mass Spectrometry Instrument Market, by Country/Region, 2021–2032 (USD Million)

Table 3 Global Mass Spectrometry Software Market, by Country/Region, 2021–2032 (USD Million)

Table 4 Global Mass Spectrometry Services Market, by Country/Region, 2021–2032 (USD Million)

Table 5 Global Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 6 Global Quadrupole Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 7 Global Time of Flight Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 8 Global Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 9 Global Chromatography Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 10 Global GC MS Market, by Country/Region, 2021–2032 (USD Million)

Table 11 Global LC MS Market, by Country/Region, 2021–2032 (USD Million)

Table 12 Global Matrix-assisted Laser Desorption Ionization (MALDI) Mass Spectroscopy Market, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Magnetic Sector Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 14 Global Fourier Transform Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 15 Global Ion Trap Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 16 Global Portable Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Integrated Technologies Market, by Country/Region, 2021–2032 (USD Million)

Table 18 Global Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 19 Global Mass Spectrometry Market for Structure Elucidation, by Country/Region, 2021–2032 (USD Million)

Table 20 Global Mass Spectrometry Market for Impurity Testing, by Country/Region, 2021–2032 (USD Million)

Table 21 Global Mass Spectrometry Market for Drug Metabolism Testing, by Country/Region, 2021–2032 (USD Million)

Table 22 Global Mass Spectrometry Market for Clinical Toxicological Testing, by Country/Region, 2021–2032 (USD Million)

Table 23 Global Mass Spectrometry Market for Forensic Testing, by Country/Region, 2021–2032 (USD Million)

Table 24 Global Mass Spectrometry Market for Other Applications, by Country/Region, 2021–2032 (USD Million)

Table 25 Global Mass Spectrometry Market by End User, 2021–2032 (USD Million)

Table 26 Global Mass Spectrometry Market for Pharmaceutical & Biotechnology Industry, by Country/Region, 2021–2032 (USD Million)

Table 27 Global Mass Spectrometry Market for Academic and Research Institutes, by Country/Region, 2021–2032 (USD Million)

Table 28 Global Mass Spectrometry Market for Environmental Agencies, by Country/Region, 2021–2032 (USD Million)

Table 29 Global Mass Spectrometry Market for Food & Beverage Companies, by Country/Region, 2021–2032 (USD Million)

Table 30 Global Mass Spectrometry Market for Petrochemical Industry, by Country/Region, 2021–2032 (USD Million)

Table 31 Global Mass Spectrometry Market for Other End Users, by Country/Region, 2021–2032 (USD Million)

Table 32 Global Mass Spectrometry Market by Country/Region, 2021–2032 (USD Million)

Table 33 North America: Mass Spectrometry Market, by Country, 2021–2032 (USD Million)

Table 34 North America: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 35 North America: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 36 North America: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 37 North America: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 38 North America: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 39 U.S.: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 40 U.S.: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 41 U.S.: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 42 U.S.: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 43 U.S.: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 44 Canada: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 45 Canada: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 46 Canada: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 47 Canada: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 48 Canada: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 49 Europe: Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 50 Europe: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 51 Europe: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 52 Europe: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 53 Europe: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 54 Europe: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 55 Germany: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 56 Germany: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 57 Germany: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 58 Germany: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 59 Germany: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 60 France: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 61 France: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 62 France: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 63 France: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 64 France: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 65 U.K.: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 66 U.K.: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 67 U.K.: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 68 U.K.: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 69 U.K.: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 70 Italy: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 71 Italy: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 72 Italy: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 73 Italy: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 74 Italy: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 75 Spain: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 76 Spain: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 77 Spain: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 78 Spain: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 79 Spain: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 80 Rest of Europe: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 81 Rest of Europe: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 82 Rest of Europe: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 83 Rest of Europe: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 84 Rest of Europe: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 85 Asia-Pacific: Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 86 Asia-Pacific: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 87 Asia-Pacific: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 88 Asia-Pacific: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 89 Asia-Pacific: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 90 Asia-Pacific: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 91 Japan: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 92 Japan: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 93 Japan: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 94 Japan: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 95 Japan: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 96 China: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 97 China: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 98 China: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 99 China: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 100 China: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 101 India: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 102 India: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 103 India: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 104 India: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 105 India: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 106 South Korea: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 107 South Korea: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 108 South Korea: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 109 South Korea: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 110 South Korea: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 111 Rest of Asia–Pacific: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 112 Rest of Asia–Pacific: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 113 Rest of Asia–Pacific: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 114 Rest of Asia–Pacific: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 115 Rest of Asia–Pacific: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 116 Latin America: Mass Spectrometry Market, by Country/Region, 2021–2032 (USD Million)

Table 117 Latin America: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 118 Latin America: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 119 Latin America: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 120 Latin America: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 121 Latin America: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 122 Brazil: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 123 Brazil: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 124 Brazil: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 125 Brazil: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 126 Brazil: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 127 Mexico: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 128 Mexico: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 129 Mexico: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 130 Mexico: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 131 Mexico: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 132 Rest of Latin America: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 133 Rest of Latin America: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 134 Rest of Latin America: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 135 Rest of Latin America: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 136 Rest of Latin America: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 137 Middle East & Africa: Mass Spectrometry Market, by Offering, 2021–2032 (USD Million)

Table 138 Middle East & Africa: Mass Spectrometry Market, by Technology, 2021–2032 (USD Million)

Table 139 Middle East & Africa: Chromatography Mass Spectrometry Market, by Type, 2021–2032 (USD Million)

Table 140 Middle East & Africa: Mass Spectrometry Market, by Application, 2021–2032 (USD Million)

Table 141 Middle East & Africa: Mass Spectrometry Market, by End User, 2021–2032 (USD Million)

Table 142 Recent Developments, by Company, 2020–2025

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Global Mass Spectrometry Market, by Offering, 2025 Vs. 2032 (USD Million)

Figure 8 Global Mass Spectrometry Market, by Technology, 2025 Vs. 2032 (USD Million)

Figure 9 Global Mass Spectrometry Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 10 Global Mass Spectrometry Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 11 Global Mass Spectrometry Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 12 Impact Analysis: Mass Spectrometry Market

Figure 13 Market Dynamics: Mass Spectrometry Market

Figure 14 Global Mass Spectrometry Market, by Offering, 2025 Vs.2032 (USD Million)

Figure 15 Global Mass Spectrometry Market, by Technology, 2025 Vs.2032 (USD Million)

Figure 16 Global Mass Spectrometry Market, by Application, 2025 Vs.2032 (USD Million)

Figure 17 Global Mass Spectrometry Market, by End User, 2025 Vs.2032 (USD Million)

Figure 18 Global Mass Spectrometry Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 19 North America: Mass Spectrometry Market Snapshot

Figure 20 Europe: Mass Spectrometry Market Snapshot

Figure 21 Asia-Pacific: Mass Spectrometry Market Snapshot

Figure 22 Latin America: Mass Spectrometry Market Snapshot

Figure 23 Key Growth Strategies Adopted by Leading Players, 2020–2025

Figure 24 Global Mass Spectrometry Market: Competitive Benchmarking Based on Offering

Figure 25 Global Mass Spectrometry Market: Competitive Benchmarking Based on Geography

Figure 26 Global Mass Spectrometry Market: Market Share Analysis (2022)

Figure 27 Agilent Technologies, Inc.: Financial Overview (2022)

Figure 28 Bruker Corporation: Financial Overview (2022)

Figure 29 Danaher Corporation: Financial Overview (2022)

Figure 30 Thermo Fisher Scientific, Inc.: Financial Overview (2022)

Figure 31 Waters Corporation: Financial Overview (2022)

Figure 32 Perkin Elmer Inc.: Financial Overview (2022)

Figure 33 INFICON Holding AG: Financial Overview (2022)

Figure 34 Pfeiffer Vacuum GmbH: Financial Overview (2022)

Figure 35 LECO Corporation: Financial Overview (2022)

Figure 36 Rigaku Corporation: Financial Overview (2022)

Figure 37 Shimadzu Corporation: Financial Overview (2022)

Figure 38 SCIEX (A subsidiary of Danaher Corporation): Financial Overview (2022)

Figure 39 LECO CORPORATION: Financial Overview (2022)

Figure 40 Advion, Inc.: Financial Overview (2022)

Published Date: Jan-2024

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates