Resources

About Us

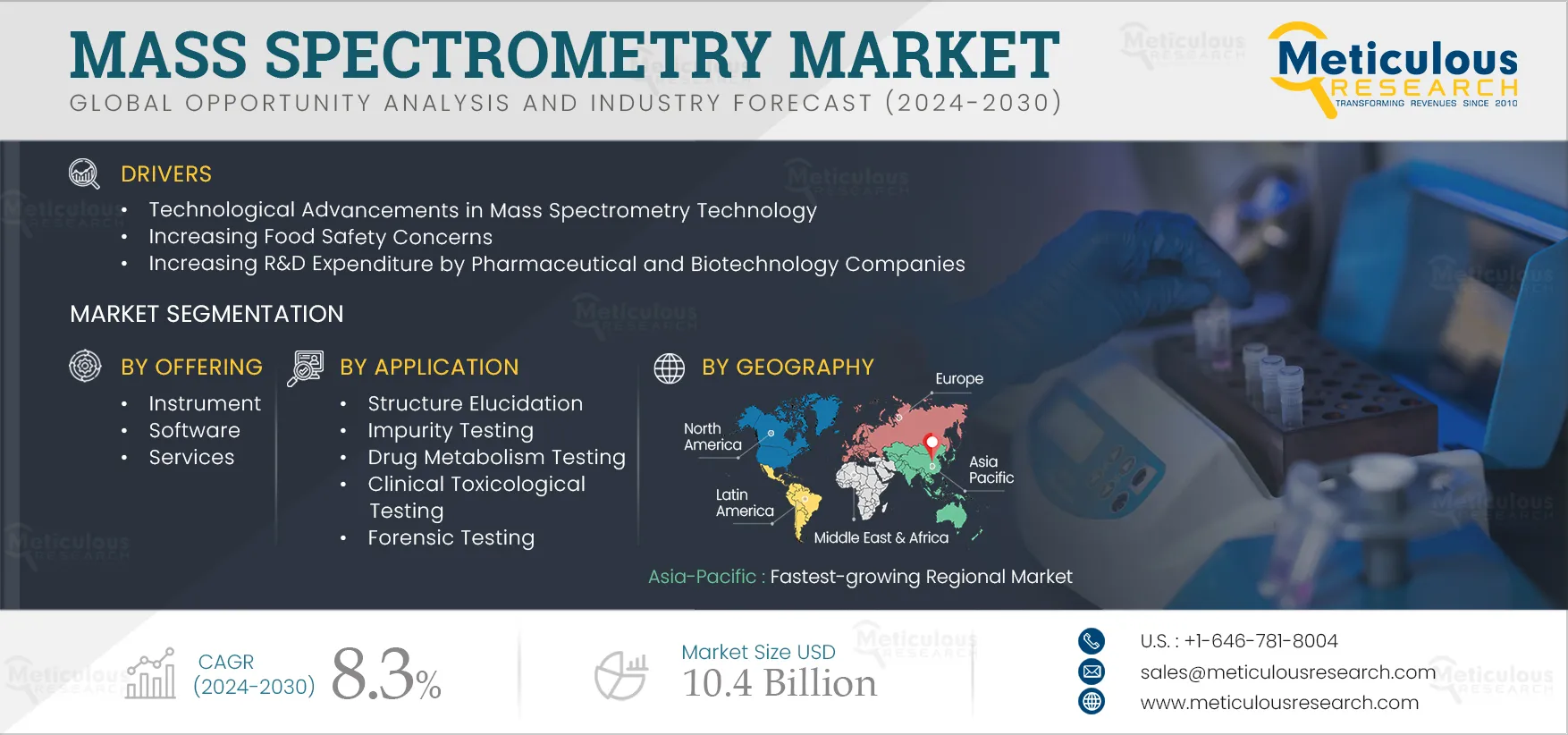

Mass Spectrometry Market by Offering [Instrument, Software] Technology [Quadrupole, LC MS, Ion Trap, GC MS, Time of Flight, MALDI, Integrated] Application [Impurity, Toxicology, Forensic, Clinical Testing] End User [Pharma, Biotech] - Global Forecast to 2032

Report ID: MRHC - 104854 Pages: 230 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Mass Spectrometry Market is projected to reach $10.4 billion by 2032, at a CAGR of 8.3% from 2025 to 2032. Mass spectrometry's applications have risen to a spectacular position owing to its increasing applications and usage in analytical studies. The rising adoption of mass spectrometry is due to its exceptional detection limits, unequaled sensitivity, speed and diversity of its applications. Also, the most recent applications of mass spectrometry have proven their capabilities in metabolome, proteome, and high throughput in drug metabolism and discovery studies, and so on. Also, other applications of the technology in food control, natural products and process monitoring, pollution control, and forensic science have led to its penetration into diverse fields.

The growth of this market is driven by factors such as technological advancements in mass spectrometry technology, increasing food safety concerns, increasing applications of mass spectrometry, increasing R&D expenditure by pharmaceutical and biotechnology companies, and high reliability and sensitivity of mass spectrometers. However, the high costs of instruments are restraining the growth of this market. The rising adoption of mass spectrometers in emerging markets is a significant opportunity for players in this market. However, the lack of skilled professionals is a challenge to the growth of this market. Additionally, the rising adoption of portable mass spectroscopy devices is a trend prevailing in the market.

Mass Spectrometry has wider applications in food testing. Globally, foodborne diseases are a major public health problem that results in the need for food testing to a greater extent. Also, food industries are expanding globally due to urbanization and the rising population, resulting in increased processed food products. As these products contain additives and preservatives, their composition should be within the limit for human safety. Hence, with the globalization of the food industry, testing practices are being adopted across the industry ecosystem consisting of food traders, processing organizations, transporters, and distributors. In such cases, mass spectrometry is extensively used in the food sector for the qualitative and quantitative analyses of various elements such as nutritional value, profiles of micronutrients (vitamins), macronutrients (lipids, proteins, and carbohydrates), and nutraceutical active compounds. Thus, the increased emphasis on food safety testing drives the mass spectrometry market. With the increased use of mass spectrometry due to its various applications, continuous advancements in its methodologies and technology have made it a standard laboratory technique to be used across sectors, allowing it to remain relevant and useful in meeting the analytical demands across various scientific scenarios.

Various developed countries from North America and Europe are major contributors to the mass spectrometry market. However, low-penetrated emerging economies are expected to offer significant market growth opportunities due to increasing R&D funding and the growing pharmaceutical industry, food demand, and technological advancements. Emerging economies such as China, India, and the Association of Southeast Asian Nations (ASEAN) member countries in Asia-pacific, and Brazil and Mexico in Latin America have been major contributors to growth in the mass spectrometry market during the past few years. This is mainly due to an increase in the number of research institutes, testing laboratories, CROs & CDMOs, and pharmaceutical & biopharmaceutical companies in the regions.

Also, growth in public & private R&D funding and contract research in these countries is expected to further support pharmaceutical & biotechnology research and boost the demand for related products in these regions. Additionally, increasing applications of mass spectrometry are supporting its adoption by its end users in multiple applications, such as characterizing complex petroleum materials and cutting-edge biotech research. Recent technological advancements can enable end users better use the specificity and power of MS to solve their technical challenges. The recent use of MS in proteomics has enabled researchers to gain information on the protein identity, its structure and chemical modifications.

Additionally, the advanced technology and increasing applications of mass spectrometry have opened new doors for its adoption in molecular analysis of complex tissues for disease characterization and in identifying new prognostic, diagnostic, and predictive markers. Mass spectrometry has paved the way for its use in guiding treatment decisions by detecting clinically actionable molecular profiles from cells and tissues. These factors have triggered the adoption of mass spectrometry in emerging markets, further contributing to the growth of mass spectrometer market.

Click here to: Get a Free Sample Copy of this report

Based on offering, in 2025, the instrument segment is expected to account for the largest share of the mass spectrometry market. The capacity to study several molecules from the same or different structural family and detect specific metabolites of disease and large-scale analysis capabilities are factors contributing to the large market share of this segment.

Based on technology, in 2025, the quadrupole mass spectrometry segment is expected to account for the largest share of the mass spectrometry market. The large share of the segment is attributed to the benefits offered by the high usage of quadrupole mass analyzers in targeted and quantitative applications and quadrupole mass spectrometry’s use in measuring one or more ions in a mixture. Furthermore, quadrupole mass spectrometry is fast, simple and reliable and does not require a high vacuum.

Based on application, in 2025, the drug metabolism testing segment is expected to account for the largest share of the mass spectrometry market. The large market share of this segment is attributed to the increasing applications of mass spectrometry in drug testing, increasing pharmaceutical and biotechnology research, and the high usage of mass spectrometers in target validation.

Based on end user, in 2025, the pharmaceutical & biotechnology industry segment is expected to account for the largest share of the mass spectrometry market. The large market share of this segment is attributed to the increasing role of mass spectrometry in drug discovery and development pipeline, increasing adoption of mass spectrometry in metabolomics, proteomics, and analysis of clinical tissue samples, and mass spectrometers’ ability to determine pharmacokinetic properties and structure of compounds.

Asia-Pacific: Fastest-growing Regional Market

The increasing focus of government bodies of Asia-Pacific countries such as China, India, Singapore, and South Korea on the healthcare sector in terms of increased investment for the adoption of advanced technology, to build better healthcare infrastructure and the increasing applications of mass spectrometry. Furthermore, rising investments in healthcare and a surge in research activities by key pharmaceutical and biotechnology companies are also boosting the growth of this regional market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players between 2021 and 2022. Some of the key players operating in the mass spectrometry market are Agilent Technologies, Inc. (U.S.), Bruker Corporation (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Waters Corporation (U.S.), Perkin Elmer Inc. (U.S.), INFICON Holding AG (Switzerland), Pfeiffer Vacuum GmbH (Germany), LECO Corporation (U.S.), Rigaku Corporation (Japan), Shimadzu Corporation (Japan), SCIEX (A subsidiary of Danaher Corporation) (U.S.), LECO CORPORATION (U.S.), and Advion, Inc. (U.S.).

Scope of the Report:

Key questions answered in the report:

This study offers a detailed assessment of the mass spectrometry market and analyzes the market sizes & forecasts based on offering, technology, application and end user. This report also involves the value analysis of various segments and subsegments of the mass spectrometry market at the regional and country levels.

The mass spectrometry market is projected to reach $10.4 billion by 2032, at a CAGR of 8.3% during the forecast period.

In 2025, the instruments segment is expected to account for the largest share of the market.

In 2025, the quadrupole mass spectrometry segment is expected to account for the largest share of the market.

In 2025, the drug metabolism testing segment is expected to hold the largest share of the market. The largest share of this application is attributed to the wide usage of mass spectrometry in metabolite identification, toxicology, metabolic stability, and efficacy profiles. Additionally, the availability of mass analyzers and data mining tools has accelerated the process of metabolite identification and changed the landscape of drug metabolism, leading to the market's growth.

In 2025, the pharmaceutical & biotechnology industry segment is expected to hold the largest share of the market.

The growth of this market is attributed to the technological advancements in mass spectrometry technology, increasing food safety concerns, increasing R&D expenditure by pharmaceutical and biotechnology companies, high reliability and sensitivity of mass spectrometers, and increasing applications of mass spectrometry.

The key players profiled in the mass spectrometry market study are Agilent Technologies, Inc. (U.S.), Bruker Corporation (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Waters Corporation (U.S.), Perkin Elmer Inc. (U.S.), INFICON Holding AG (Switzerland), Pfeiffer Vacuum GmbH (Germany), LECO Corporation (U.S.), Rigaku Corporation (Japan), Shimadzu Corporation (Japan), SCIEX (A subsidiary of Danaher Corporation) (U.S.), LECO CORPORATION (U.S.), and Advion, Inc. (U.S.).

Emerging economies such as China and India are projected to offer significant growth opportunities to the market players due to rising investments in the healthcare sector and increasing research projects in these countries.

Published Date: Jan-2024

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates