Resources

About Us

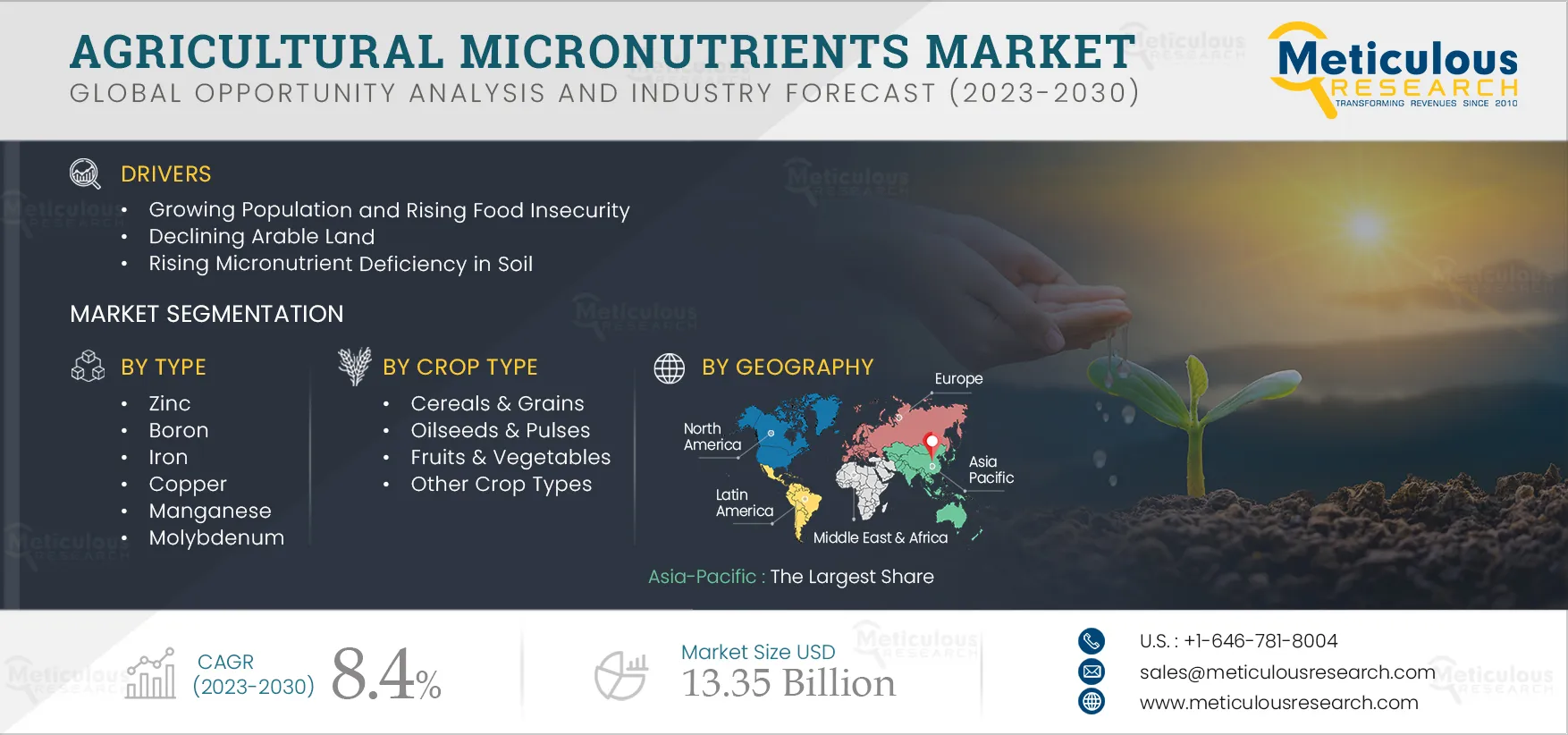

Agricultural Micronutrients Market by Type (Zinc, Iron, Copper, Molybdenum), Crop Type (Cereals & Grains, Fruits & Vegetables), Form (Non-chelated, Chelated), Mode of Application (Soil, Foliar, Fertigation, Seed Treatment) - Global Forecast to 2030

Report ID: MRAGR - 104293 Pages: 260 Jun-2023 Formats*: PDF Category: Agriculture Delivery: 24 to 48 Hours Download Free Sample ReportThe Agricultural Micronutrients Market is projected to reach $13.35 billion by 2030, at a CAGR of 8.4% during the forecast period of 2023–2030. The growth of this market is mainly driven by the growing population and rising food insecurity, declining arable land, rising micronutrient deficiency in the soil, and positive outlook of government policies and various organizations encouraging the use of micronutrients. However, the lack of awareness among farmers restrains the growth of this market. Additionally, the sustainable sourcing of raw materials requirement is a challenge for the growth of this market.

Further, the growing contract farming is expected to create growth opportunities for the players operating in this market. Additionally, the emergence of nanotechnology in micronutrient fertilization is a major trend in the global agricultural micronutrients market.

The global population is growing rapidly. According to the World Bank, by 2050, the global population is projected to reach 9.7 billion, an increase of 35%, which requires an increase in agricultural production of at least 50%. As the world’s population grows, the demand for food increases subsequently. Farmers need to enhance crop yields and ensure optimal plant growth to meet the increasing food demand. Micronutrients play a crucial role in providing essential nutrients to plants, improving their health, and increasing productivity. Therefore, the growing population and the need to increase crop yield drive the demand for agricultural micronutrients.

In the last few decades, the term food insecurity has raised one of the major concerns globally among scientists, researchers, agronomists, and policymakers. In recent years, there has been an increasing focus on food security owing to the changing climatic conditions and the perpetually looming anthropogenic activities. A majority of countries across the world are continually paying much more attention to food security; thus, they are working under the common mission of global food security. Micronutrient deficiencies in crops can lead to lower yields, reduced nutritional value, and increased susceptibility to pests and diseases. Applying agricultural micronutrients helps address nutrient deficiencies in soil and plants, promoting healthy growth and enhancing crop resilience against adverse conditions. By improving crop productivity and nutritional content, agricultural micronutrients contribute to reducing food insecurity.

Therefore, the growing population and rising food insecurity drive the demand for agricultural micronutrients. Micronutrients play a vital role in enhancing crop productivity to meet the increasing demand for food production, ensuring food security and mitigating the effects of nutrient deficiencies in plants.

Click here to: Get a Free Sample Copy of this report

Declining Arable Land Globally Fuels the Growth of the Agricultural Micronutrients Market

Arable land is one of the most important resources for agricultural production. Many agricultural methods have developed over the years, which has led to an overutilization of land resources. Due to rising consumption and constant demand, land has been exploited, which has led to a decline in quantity and a deterioration in the quality of the land.

According to the Global Land Assessment of Degradation published by the United Nations Food and Agricultural Organization (FAO), around two billion hectares of land have been degraded globally since the 1950s. It is one of the world’s most serious environmental problems and will continue to worsen without rapid remedial action. Almost 25% of the world's land has been degraded globally. Land degradation significantly contributes to climate change by releasing soil carbon and nitrous oxide into the atmosphere.

Furthermore, according to the Global Environment Facility, around 24 billion tons of fertile soil are wasted each year due to unsustainable agricultural methods, and by 2050, 95% of the land areas will be degraded. The use of agricultural micronutrients supports sustainable agriculture practices by improving soil and plant health, reducing the need for harmful chemicals, and increasing yield. By providing the necessary nutrients to the soil, micronutrients aid in maintaining the long-term productivity of arable land.

Therefore, the application of agricultural micronutrients helps to mitigate this issue by promoting healthy soil and plant growth, enhancing productivity, and supporting sustainable agriculture practices. Thus, the growing demand for sustainable agriculture and declining arable land are expected to drive the growth of the global agricultural micronutrients market.

In 2023, the Zinc Segment is Expected to Dominate the Agricultural Micronutrients Market

Based on type, the global agricultural micronutrients market is segmented into zinc, boron, iron, copper, manganese, molybdenum, and other types. In 2023, the zinc segment is expected to account for the largest share of the global agricultural micronutrients market. The large market share of this segment is attributed to the rising awareness about the wide range of functions that zinc plays in plant growth and how zinc deficiency in soils affects plants, the growing demand to meet issues with food security challenges, and the rising demand for zinc nutritious food products due to its health benefits. Moreover, the increasing government initiatives globally to enhance zinc concentrate in the soil to increase quantitative and qualitative crops further support the growth of this segment.

In 2023, the Cereals & Grains Segment to Dominate the Agricultural Micronutrients Market

Based on crop type, the global agricultural micronutrients market is segmented into cereals & grains, fruits & vegetables, oilseeds & pulses, and other crop types. In 2023, the cereals & grains segment is expected to account for the largest share of the agricultural micronutrients market. The large market share of this segment is attributed to the rising demand for food grains due to the growing population, increasing industrial application of cereals and grains, and huge production of staple crops such as wheat, maize, rice, and barley, which form the primary food source for a major population of the world.

However, the fruits and vegetables segment is projected to register the highest CAGR during the forecast period of 2023–2030. The rapid growth of this segment is driven by the increasing production of fruits and vegetables due to the rising consumption of healthy foods, growing demand for organic fruits and vegetables, and micronutrient deficiency in fruit and vegetable crops.

In 2023, the Non-chelated Micronutrients Segment to Dominate the Agricultural Micronutrients Market

Based on form, the global agricultural micronutrients market is segmented into non-chelated micronutrients and chelated micronutrients. In 2023, the non-chelated micronutrients segment is expected to account for the larger share of the global agricultural micronutrients market. The large market share of this segment is attributed to the increasing application of non-chelated micronutrients because of their low price over chelated form micronutrients.

However, the chelated micronutrients segment is projected to register the higher CAGR during the forecast period due to its high stability over the non-chelated micronutrients, the growing need to increase micronutrient utilization efficiency, and the development and application of new generations of chelates.

In 2023, the Soil Treatment Application Segment to Dominate the Agricultural Micronutrients Market

Based on mode of application, the global agricultural micronutrients market is segmented into soil treatment, fertigation, foliar spray, seed treatment, and other modes of application. In 2023, the soil treatment application segment is expected to account for the largest share of the agricultural micronutrients market. Soil treatment is the most widely used application compared to other modes of application and is easy and cost effective. The rapid growth of this segment is mainly driven by the rampant use of traditional agriculture methods in the current farming system, the availability of very limited resources, and the lower adoption of advanced fertilizer application methods. Moreover, this segment is projected to register the highest CAGR during the forecast period.

Asia-Pacific: The Dominating Market in the Region

Based on geography, the agricultural micronutrients market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, Asia-Pacific is expected to account for the largest share of the agricultural micronutrients market, followed by Europe, North America, Latin America, and the Middle East & Africa. The major market share of this market is mainly due to the huge area under crop cultivation, growing population, increasing demand for high-quality food, and rising focus on agricultural micronutrients to improve crop productivity and crop yield in emerging economies like China and India. Additionally, the increasing agricultural practices and the necessity of high-quality agricultural produce are anticipated to further support the growth of this market. Moreover, this region is projected to register the highest CAGR during the forecast period due to the vast depletion of arable land, rising micronutrient deficiency in soil and huge areas of infertile soil, and the increasing government support for the fertilizer industry.

Key Players

The key players operating in the global agricultural micronutrients market are AgroLiquid (U.S.), Aries Agro Limited (India), BASF SE (Germany), BMS Micro-Nutrients NV (Belgium), Coromandel International Limited (India), Haifa Group (Israel), Helena Agri-Enterprises, LLC (U.S.), Koch Industries, Inc. (U.S.), Nouryon (Netherlands), Nufarm Limited (Australia), Nutrien Ltd. (Canada), The Mosaic Company (U.S.), VALAGRO S.P.A (Part of Syngenta AG) (Italy), and Yara International ASA (Norway).

Scope of the Report:

Agricultural Micronutrients Market Assessment, by Type

Agricultural Micronutrients Market Assessment, by Crop Type

Agricultural Micronutrients Market Assessment, by Form

Agricultural Micronutrients Market Assessment, by Mode of Application

Agricultural Micronutrients Market Assessment, by Geography

Key Questions Answered in the Report:

Agricultural micronutrients are essential plant nutrients that are found in trace amounts in tissue but play an important role in plant growth and development. A deficiency of micronutrients leads to a decline in crop productivity. The major agricultural micronutrients are zinc, iron, boron, copper, manganese, molybdenum, chlorine, and nickel. The agricultural micronutrients market study provides valuable insights into the market based on type, crop type, form, mode of application, and geography.

The agricultural micronutrients market is projected to reach $13.35 billion by 2030, at a CAGR of 8.4% during the forecast period 2023–2030.

Based on crop type, the fruits and vegetables segment is projected to record the highest growth rate during the forecast period of 2023–2030.

· Growing Population and Rising Food Insecurity

· Declining Arable Land

· Rising Micronutrient Deficiency in Soil

· Positive Outlook of Government Policies and Various Organisations Encourage the Use of Micronutrients

· Lack of Awareness Among Farmers

The key players operating in the global agricultural micronutrients market are AgroLiquid (U.S.), Aries Agro Limited (India), BASF SE (Germany), BMS Micro-Nutrients NV (Belgium), Coromandel International Limited (India), Haifa Group (Israel), Helena Agri-Enterprises, LLC (U.S.), Koch Industries, Inc. (U.S.), Nouryon (Netherlands), Nufarm Limited (Australia), Nutrien Ltd. (Canada), The Mosaic Company (U.S.), VALAGRO S.P.A (Part of Syngenta AG) (Italy), and Yara International ASA (Norway).

Asia-Pacific is projected to record the highest growth rate during the forecast period of 2023–2030. The growth of this regional market is attributed to the huge area under crop cultivation, growing population, increasing demand for high-quality food, and rising focus on agricultural micronutrients to improve crop productivity and crop yield in emerging economies like China and India. Additionally, the increasing agricultural practices and the necessity of high-quality agricultural produce are anticipated to further support the growth of this market. Moreover, this region is projected to register the highest CAGR during the forecast period due to the vast depletion of arable land, rising micronutrient deficiency in soil and huge areas of infertile soil, and the increasing government support for the fertilizer industry.

Published Date: Dec-2024

Published Date: Mar-2024

Published Date: Feb-2024

Published Date: Feb-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates