Resources

About Us

Hydrogen Compressor Market Size, Share, & Forecast by Compressor Type (Reciprocating, Ionic, Diaphragm), Pressure Output, Flow Rate, and Efficiency - Global Forecast (2026-2036)

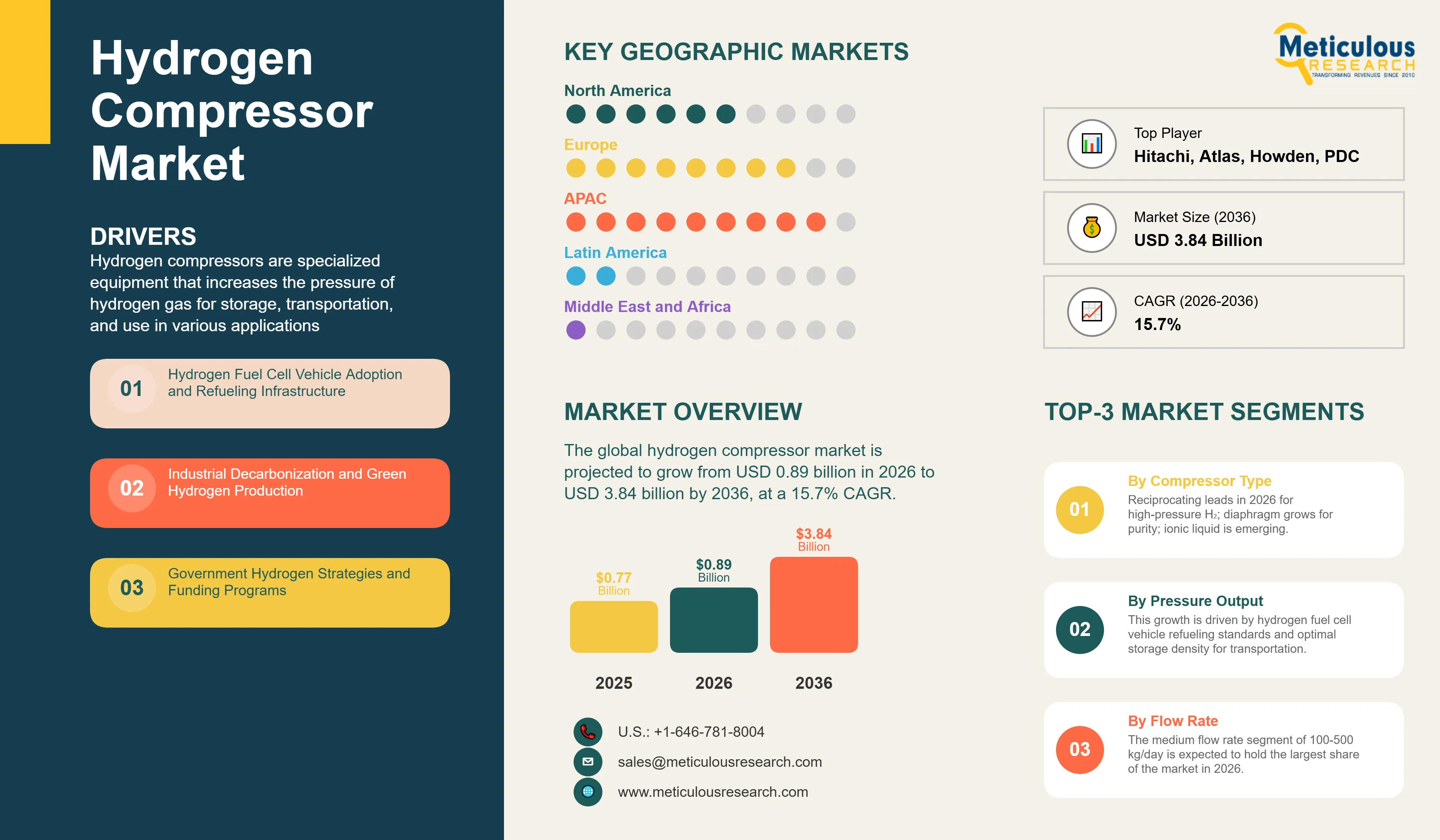

Report ID: MREP - 1041689 Pages: 284 Jan-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global hydrogen compressor market is expected to reach USD 3.84 billion by 2036 from USD 0.89 billion in 2026, at a CAGR of 15.7% from 2026 to 2036.

Hydrogen compressors are specialized equipment that increases the pressure of hydrogen gas for storage, transportation, and use in various applications. These include refueling fuel cell vehicles, injecting into pipelines, processing in industries, and energy storage systems. Their main goals are to allow safe and efficient handling of hydrogen, reach target storage pressures—350-700 bar for vehicles and over 900 bar for specialized uses—reduce hydrogen loss and contamination, ensure reliable operation given hydrogen's unique properties, and support the growing hydrogen economy infrastructure.

These systems employ various technologies. They include reciprocating pistons with special seals compatible with hydrogen, ionic liquid compression using electrochemical or hydraulic methods, diaphragm compression that keeps hydrogen separate from lubricants, and centrifugal compression for high-volume needs. They also utilize advanced control systems to manage different compression stages and cooling.

Hydrogen compressors can reach pressures from 200 bar for industrial uses to over 900 bar for high-pressure storage. They handle flow rates ranging from small refueling stations (dozens of kg per day) to large industrial facilities (tons per hour). These systems operate efficiently to reduce energy use, provide oil-free compression to avoid contamination, and ensure safety with materials that work well with hydrogen and leak detection systems.

The system acts as a critical link between hydrogen production and end-use. It allows for practical hydrogen storage in reasonable amounts, supports the rollout of fuel cell vehicle infrastructure, assists in transporting and distributing hydrogen, and helps make hydrogen energy cost-effective. This supports the hydrogen economy, aids in decarbonizing transportation, offers long-lasting energy storage, contributes to industrial decarbonization, and helps meet climate goals.

Click here to: Get Free Sample Pages of this Report

Hydrogen compressors are essential technology for the growing hydrogen economy. They tackle the main issue that hydrogen's low density requires significant compression for effective storage and transport. At atmospheric pressure, hydrogen holds very little energy per unit volume, so compression is necessary. Compressing hydrogen to 700 bar increases its density 700-fold, making it practical for vehicle onboard storage. Hydrogen's unique properties create specific compression challenges. These include its small molecular size, which causes permeation and leakage issues; its wide flammability range, which demands safety measures; the embrittlement of many materials, limiting component options; its low viscosity, which affects seal performance; and its high specific heat, requiring extensive cooling. These traits necessitate compressors designed specifically for hydrogen rather than adapted industrial models. Hydrogen compressors enable important applications such as refueling fuel cell vehicles quickly to 700 bar, compressing hydrogen for storage in tube trailers or underground, ensuring proper pressure for pipeline injection, meeting industrial process pressures, and helping power-to-gas systems store renewable energy. As hydrogen moves from a niche industrial gas to a main energy source, compression technology becomes a crucial part of infrastructure, similar to electrical transformers or natural gas compressor stations.

Several key trends are transforming the hydrogen compressor market. These trends include the development of new compression technologies, like ionic liquid and electrochemical compressors, which offer better efficiency and reliability. There is also a push to scale manufacturing to lower costs and meet infrastructure needs. Additionally, integrating with renewable energy and electrolyzer systems is creating complete hydrogen production solutions. Standardizing refueling protocols and pressures is making interoperability possible. The emergence of hydrogen hubs and corridors is increasing the need for large-scale compression capacity. Strong government strategies for hydrogen, the automotive industry's commitment to fuel cell vehicles for heavy-duty uses, falling green hydrogen production costs nearing fossil fuel prices, recognition of hydrogen's role in decarbonizing difficult sectors, and advancements in technology that enhance compressor performance and costs have elevated hydrogen compression from specialized equipment to vital clean energy infrastructure.

The hydrogen compressor market is moving toward technologies that provide higher efficiency, lower maintenance, and better compatibility with hydrogen's unique properties. Modern compression systems feature innovative designs that include ionic liquid compression using conductive liquids to avoid mechanical seals and lubrication, electrochemical compression with proton exchange membranes for stable operation, linear motor-driven compressors for precise control and less wear, metal hydride compression that uses chemical absorption and desorption, and modular multi-stage systems that optimize efficiency across different pressure ranges. These advanced technologies solve common issues with traditional compressors, such as wear from moving parts, contamination from lubricants, energy waste from heat, and reliability problems due to seal failures. Moving from conventional mechanical compression to advanced solid-state and fluid-based technologies represents a key shift that improves performance and lowers overall ownership costs.

Integrating with renewable energy and electrolyzer systems is leading to comprehensive hydrogen production and compression solutions. Modern setups connect electrolyzers that generate hydrogen from renewable power with compressors that prepare hydrogen for storage or use. This creates integrated units or containerized systems that link compression with production rates and renewable availability. It also optimizes energy use through coordinated control systems, offering complete solutions that make deployment easier. This integration is especially valuable for distributed hydrogen production at refueling stations or industrial sites, where space limits and the need for simple operations favor these combined systems. Leading manufacturers provide packages that combine electrolyzers and compressors for specific uses, including on-site refueling, energy storage, and industrial supply.

Standardizing hydrogen refueling protocols is pushing compressor specifications toward convergence, allowing for large-scale manufacturing. Industry standards such as SAE J2601 (fueling protocol) and ISO 19880 (refueling station) set performance requirements for refueling compressors. These requirements include pressure levels of 700 bar for passenger vehicles and 350 bar for heavy-duty applications, fill rates that support refueling in 3-5 minutes, temperature management to prevent overheating, and safety systems that ensure reliable operation. This standardization allows compressor manufacturers to create standardized products for global markets instead of custom solutions for every application. This approach drives economies of scale, reduces costs, and speeds up deployment.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 0.89 Billion |

|

Revenue Forecast in 2036 |

USD 3.84 Billion |

|

Growth Rate |

CAGR of 15.7% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Compressor Type, Pressure Output, Flow Rate, Application, Hydrogen Type, End-User, Efficiency Class, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Netherlands, Japan, South Korea, China, Australia, Saudi Arabia, UAE, Brazil, Chile |

|

Key Companies Profiled |

NEL Hydrogen ASA, PDC Machines, Howden Group, Atlas Copco AB, Burckhardt Compression Holding AG, Hitachi Ltd., Sundyne LLC, HAUG Sauer Kompressoren AG, Linde Engineering, Air Liquide S.A., Ariel Corporation, Galileo Technologies S.A., HydrogenPro ASA, Haskel (Ingersoll Rand), Bauer Compressors Inc., Gardner Denver (Ingersoll Rand), Kobe Steel Ltd., Chart Industries Inc., Nikkiso Co. Ltd., Cummins Inc. |

Driver: Fuel Cell Vehicle Adoption and Refueling Infrastructure Deployment

The increasing use of fuel cell electric vehicles (FCEVs), especially in heavy-duty transport, is driving significant demand for hydrogen refueling infrastructure and related compression equipment. Battery electric vehicles lead in light-duty transportation, but fuel cells have benefits for heavy-duty uses such as long-haul trucking, buses, trains, ships, and eventually aviation where factors like weight, range, and refueling time make hydrogen a better choice. Major car and commercial vehicle makers, including Toyota, Hyundai, Nikola, and Daimler Truck, are working to launch fuel cell vehicles with plans for mass production. These vehicles need refueling infrastructure similar to gasoline or diesel with fast refueling (3-5 minutes), many stations, and dependable operation. Each refueling station requires compression equipment to fill vehicles to 700 bar for passenger vehicles or 350 bar for heavy-duty vehicles from storage or production at lower pressures. The requirements for compressors at these stations vary by volume—small stations serving dozens of vehicles daily need a capacity of 50-100 kg/day, while high-volume heavy-duty stations may require tons of hydrogen per day. Government programs worldwide are funding this refueling infrastructure. California aims for 200 stations, Germany 1,000 stations, Japan and South Korea are developing extensive networks, and China is building hydrogen city clusters. This growth in infrastructure will create a direct need for thousands of compressors globally over the forecast period.

Driver: Green Hydrogen Production Scaling and Renewable Energy Storage

The rapid growth of green hydrogen production from renewable energy-powered electrolyzers is increasing the demand for compression in hydrogen handling and storage. The capacity for green hydrogen production is expanding quickly, jumping from gigawatts now to hundreds of gigawatts by 2030 as costs move closer to fossil hydrogen prices. Electrolyzer systems typically generate hydrogen at low pressures (10-30 bar), necessitating compression for many uses including tube trailer transport needing 200-500 bar, specific pressures for pipeline injection, and storage facilities requiring anywhere from 100 to over 900 bar depending on the technology. Large green hydrogen projects, at the hundreds of megawatts to gigawatts scale, will need large compressors that can handle tons of hydrogen per hour. Additionally, hydrogen offers a way to store renewable energy over long periods—storing excess power as hydrogen through electrolysis, compressing it for storage, and using it in fuel cells or turbines for power generation during times when renewable generation dips. This power-to-gas-to-power cycle needs compression both for storage and possible final use. The growth of the green hydrogen economy will create ongoing demand for compression equipment in all areas: production, storage, transport, and usage.

Opportunity: Advanced Compression Technologies Offering Superior Performance

The development and rollout of advanced compression technologies like ionic liquid compressors and electrochemical systems open new market opportunities through better performance and cost-effectiveness compared to traditional mechanical compressors. Ionic liquid compressors use electrically conductive liquids for compression, offering benefits like near-isothermal compression that boosts efficiency by 20-30% compared to standard systems, oil-free operation that keeps hydrogen pure, fewer moving parts that cut maintenance needs, quiet operation suitable for places with limited noise, and a compact design. Electrochemical compressors use proton exchange membranes similar to those in fuel cells, compressing hydrogen through electrochemical pumping to achieve very high pressures (over 1000 bar), with minimal moving parts enhancing reliability, pure hydrogen output, and the potential to integrate with electrolyzers. These advanced technologies are moving from research to commercial use with companies like Linde and HyET introducing systems. The excellent performance, especially efficiency improvements that lower operating costs and enhanced reliability that reduce maintenance needs, creates competitive advantages that encourage adoption despite possibly higher initial costs. As production ramps up and costs drop, advanced compressors are likely to take more market share from traditional technologies, providing growth opportunities for industry leaders.

Opportunity: Emerging Markets and Hydrogen Economy Buildout

Emerging markets that are exploring hydrogen economies as part of economic development and decarbonization strategies present significant growth potential. Countries in the Middle East, like Saudi Arabia and the UAE, are building large green hydrogen export industries that tap into abundant solar resources. Projects such as NEOM aim for over 4 GW of electrolysis capacity, and similar initiatives will need extensive compression infrastructure. Australia is also targeting green hydrogen exports to Asia by using renewable resources and being close to demand centers. Meanwhile, Chile is working on green hydrogen projects that make use of strong winds in Patagonia. These export-oriented projects require compression for hydrogen liquefaction (for shipping) or conversion to ammonia, which also needs compression. At the same time, the development of domestic hydrogen economies in countries like India, Brazil, and various Southeast Asian nations will require infrastructure. These emerging market opportunities often prefer cost-effective solutions and local manufacturing, which can benefit companies that set up regional supply chains and partnerships.

By Compressor Type:

The reciprocating compressor segment is expected to hold the largest market share in 2026. This is due to its proven reliability in ultra-high pressure applications and its ability to handle a wide pressure range. Reciprocating compressors use a piston-cylinder system with inlet and discharge valves. They achieve compression through positive displacement. These compressors offer several advantages. They can handle pressures from low levels up to 1,000 bar or more through multi-stage compression. Their efficiency ranges from 70-85% thanks to optimized valve timing and intercooling. They have established reliability from decades of industrial hydrogen service and design flexibility that accommodates various flow rates and pressure needs. Modern reciprocating hydrogen compressors incorporate features such as oil-free designs with PTFE piston rings and rider bands to eliminate contamination risks. They also use metal diaphragm or labyrinth seals to prevent hydrogen leakage and have automated control systems for managing multi-stage compression along with interstage cooling. Their applications include hydrogen refueling stations, where they boost delivery pressure to 700-900 bar, industrial hydrogen where large frame compressors deliver high flow rates for refineries and chemical plants, and pipeline injection which achieves transmission pressures. Major manufacturers such as Burckhardt Compression, Ariel Corporation, Howden, and Neuman & Esser produce reciprocating compressors specifically designed for hydrogen service. These compressors use materials and sealing systems that address hydrogen's unique properties, including embrittlement and small molecular size. However, they do have limitations. Maintenance is required for wear components like valves, piston rings, and seals, which need periodic replacement. They also result in pulsating discharge flow that necessitates downstream buffering. Additionally, noise and vibration may require proper foundations and acoustic enclosures. Despite these challenges, their proven performance and reliable supply chains have made reciprocating compressors leaders in the market, especially for high-pressure applications.

The diaphragm compressor segment is experiencing strong growth as the preferred technology for producing fuel cell grade hydrogen without contamination. Diaphragm compressors work with flexible metallic diaphragms that oscillate between contoured plates. This design achieves compression without process gas contacting lubricants or seals. They offer distinct advantages. Their oil-free operation ensures purity for fuel cell applications. They have a leak-tight design that prevents hydrogen losses and atmospheric contamination. Their simple construction features minimal moving parts, which helps reduce maintenance. Modern diaphragm compressors can reach pressures up to 1,000 bar through multi-stage designs with flow rates suitable for refueling stations and distributed production facilities. Their applications include hydrogen refueling, where fuel cell vehicle requirements do not allow for oil contamination, semiconductor manufacturing that needs ultra-high purity hydrogen, and laboratory and specialty uses. Limitations of this technology include lower flow rates compared to reciprocating compressors of similar size, diaphragm fatigue which requires eventual replacement, and higher costs per unit capacity. Companies like Howden (Sundyne), PDC Machines, and Fluitron specialize in diaphragm compression technology. Emerging applications in distributed electrolysis favor diaphragm designs due to their purity requirements and compact configurations.

The ionic liquid compressor segment represents emerging technology that may disrupt traditional mechanical compression. Ionic liquid compression relies on electrochemical processes. Here, hydrogen dissolves in an ionic liquid at a low-pressure electrode and releases at a high-pressure electrode. This process achieves compression through chemical potential differences, not mechanical work. Potential advantages include significantly higher efficiency, reaching 90% compared to 70-85% for mechanical compressors. There are no mechanical moving parts, which eliminates wear components and reduces maintenance. The design is compact with high power density and operates silently without vibration. Technology development continues, with companies like HyET Hydrogen demonstrating commercial prototypes for refueling station applications. Current limitations include a relatively low technology readiness level, unproven long-term reliability, and higher upfront costs. However, potential improvements in efficiency and maintenance could greatly enhance hydrogen system economics if the technology successfully scales. This segment represents an important long-term opportunity as the technology matures.

By Pressure Output:

The high-pressure 700-900 bar segment is predicted to lead the market in 2026. This growth is driven by hydrogen fuel cell vehicle refueling standards and optimal storage density for transportation. The global automotive industry has standardized on 700 bar (70 MPa) as the refueling pressure for passenger fuel cell vehicles. This balances on-board storage capacity with vehicle weight and cost. Such standardization allows for interoperable refueling infrastructure and vehicle designs worldwide. Refueling stations must achieve higher pressures than vehicle storage to enable fast filling. They typically compress to 900 bar to account for pressure drops and thermal effects during transfer. Storage density at 700 bar allows for reasonable driving ranges of 400-600 km with acceptable tank sizes and weights. Compressing to these ultra-high pressures requires specialized designs. This includes multi-stage reciprocating compressors that usually have 4-6 stages with intercooling, diaphragm compressors with contoured cavity designs that manage stress limits, and advanced materials that resist hydrogen embrittlement at high pressures. Applications mainly include passenger vehicle refueling stations, though some commercial vehicle applications also target 700 bar. Compression energy requirements rise with pressure, and 700 bar compression uses about 10-15% of hydrogen's energy content. Technology development focuses on improving efficiency to minimize energy losses. Safety systems are crucial at these pressures, with comprehensive leak detection, pressure relief systems, and monitoring for structural integrity. The segment's growth reflects the direction of the automotive industry and significant investments in passenger vehicle refueling infrastructure.

The medium-pressure 200-500 bar segment serves various applications, including bus and truck refueling at 350 bar, industrial hydrogen delivery, and pipeline transmission. Heavy-duty vehicles such as buses and trucks typically use 350 bar storage. This balances capacity against tank weight, which is a major concern for payload-sensitive applications. Lower pressure reduces compression energy use by about 40% compared to 700 bar. Industrial applications often specify delivery pressures in the 200-400 bar range based on process requirements. Tube trailer transport generally uses 200-300 bar to balance capacity against trailer weight and safety regulations. Compressing to these intermediate pressures usually involves 2-4 stage compression, resulting in modest equipment size and energy consumption. This segment benefits from the broader applicability of compressor technologies and lower system costs. Applications include commercial vehicle refueling—which is growing quickly—industrial hydrogen supply, and emerging uses such as power-to-gas energy storage and chemical synthesis. While it represents significant market volume from various applications, it lacks the growth dynamics of passenger vehicle refueling driving the 700-900 bar segment.

By Flow Rate:

The medium flow rate segment of 100-500 kg/day is expected to hold the largest share of the market in 2026. It meets the needs of hydrogen refueling stations and distributed production sites. This flow range aligns with typical refueling station capacity needs. Early stations in low-traffic areas might serve 20-50 vehicles daily, requiring about 100-200 kg/day. Mature stations in busy locations could serve 100-200 vehicles, needing 400-500 kg/day. Distributed electrolysis systems that generate hydrogen at these stations usually size their capacity in this range to match local demand. Industrial uses, such as small chemical plants, metal treatment facilities, and specialty manufacturing, also fall within this capacity range. Compressor designs for this segment include multi-stage reciprocating compressors with cylinder sizes optimized for these flows, diaphragm compressors for smaller applications, and packaged systems that combine compression with storage and controls. The cost per kilogram capacity decreases with scale, but the medium flow range provides the best balance between capital cost and market volume. This segment benefits from the growth of refueling stations and trends in distributed hydrogen production. Technology developments focus on reliability for unmanned operations, efficiency to lower operating costs, and compact designs to fit limited station space. Manufacturers like PDC Machines and Sundyne offer compression systems specifically for refueling stations. The segment's market position reflects the distributed nature of hydrogen refueling infrastructure, not centralized high-capacity facilities.

The high flow rate category, exceeding 500 kg/day, serves large industrial facilities, high-capacity refueling hubs, and centralized production sites. Large petroleum refineries consume hydrogen in tons per day, requiring significant compression capacity for distribution within the facility. Chemical plants producing ammonia, methanol, or other products require hydrogen at similar levels. Centralized electrolysis facilities that generate hydrogen for regional distribution, using tube trailers or pipelines, need compression capacity that matches production. Future high-capacity refueling stations for heavy commercial vehicle fleets may need multi-ton per day capacity. Compressor technology for high flow applications typically uses large-frame reciprocating compressors with multi-cylinder setups, centrifugal compressors that provide high throughput with fewer stages at lower pressure ratios, and custom-engineered systems tailored for specific needs. These systems involve the highest upfront investment but have the lowest cost per kilogram due to economies of scale. Efficiency becomes crucial at large scales, where the energy consumed for compression significantly affects economics. Market features include a smaller number of high-value projects, longer sales cycles with detailed engineering, and ongoing service relationships. Manufacturers include major industrial compressor companies with strong engineering capabilities.

By Application:

The hydrogen refueling station segment is set to experience considerable growth during the forecast period. This growth is fueled by the rise of fuel cell electric vehicles and infrastructure deployment programs. Hydrogen refueling stations are the visible part of hydrogen infrastructure that helps vehicle adoption. Station deployment is speeding up globally, with several thousand stations currently in operation and ambitious expansion goals. The compression requirements for refueling stations present unique challenges, such as achieving high pressure of 700 bar for passenger vehicles and 350 bar for commercial vehicles. Rapid compression is necessary to support refueling times of 3-5 minutes, similar to gasoline. Thermal management is essential to prevent overheating during quick fills, and high reliability is crucial since equipment failures directly affect customer experience. Stations usually use cascade storage systems that incorporate multiple pressure banks to optimize fill times and compressor sizing. Compression systems need to integrate with storage, pre-cooling equipment that chills hydrogen to -40°C for safe fast fills, and dispensing controls that manage pressure and temperature protocols. Station configurations vary, with throughput ranging from 200 kg/day for early-stage stations to a potential 1,000+ kg/day for high-capacity facilities. Economic factors greatly influence station viability, as compression typically accounts for 15-25% of capital costs, and electricity use for compression impacts operating costs. Compression efficiency is vital for station economics; a 5% efficiency improvement can potentially lower operating costs by thousands of dollars each year. Reliability is critical for stations, with uptime targets exceeding 95%. This requires strong designs and thorough maintenance programs. Government programs often fund station deployment, with subsidies covering 30-70% of capital costs in many areas. Automotive manufacturers sometimes assist with infrastructure development to ensure that vehicle launches align with market readiness. The segment’s growth prospects reflect trends in the transportation sector's decarbonization and the automotive industry's commitment to hydrogen.

The industrial hydrogen segment represents an established, large-scale market with changing growth drivers. Traditional industrial applications of hydrogen include petroleum refining, where hydrogen aids hydrocracking to convert heavy crude into lighter products and desulfurization to meet fuel specifications. Ammonia synthesis consumes about 35 million tons of hydrogen annually for fertilizer production, along with methanol and chemical manufacturing, and electronics and specialty gases. These established applications use reliable compression technology with large stationary compressors in industrial sites. Growth drivers include industrial decarbonization efforts that promote green hydrogen to replace fossil-fuel-derived hydrogen, eliminating CO2 emissions. New hydrogen applications, such as direct reduction steelmaking that replaces coal, and distributed industrial hydrogen production from electrolysis, also drive growth. Compression needs vary widely across applications, with refineries requiring high-flow compression at moderate pressures, chemical plants needing specific pressures that match their processes, and specialty applications demanding contamination-free compression. Industrial users prioritize reliability and efficiency, coordinating maintenance schedules with facility shutdowns. Technology choice focuses on proven designs with established service infrastructure. Market characteristics include long-term supply agreements, project-based sales cycles, and extensive service contracts. Decarbonization trends create chances for equipment replacement as facilities shift from centralized steam methane reforming to distributed electrolysis, leading to new compression needs.

In 2026, Asia-Pacific is expected to hold the largest share of the global hydrogen compressor market. This leadership comes from significant government hydrogen programs in China, Japan, and South Korea, which together fund over $30 billion for hydrogen infrastructure development. These countries lead the automotive industry's hydrogen vehicle sector, with Toyota, Hyundai, and Honda at the forefront of fuel cell technology. There is also high industrial hydrogen consumption in the petrochemical and refining sectors, along with competitive products from local compressor manufacturers. China aims for 1 million fuel cell vehicles by 2030, which will need extensive refueling infrastructure. Japan continues to lead in the hydrogen economy, supported by a well-established refueling network and strong participation from industry. The South Korean government invests heavily in hydrogen infrastructure and vehicle incentives. Industrial hydrogen demand remains strong across regional refineries and chemical plants, as well as in new applications like pilot projects for steel manufacturing. The region prioritizes domestic technology development, with government support for local compressor companies. Chinese firms, including Sichuan Jinxing, are working on compression technology to lessen reliance on Western imports. Japanese companies like Kobe Steel and Mitsubishi are leveraging their existing capabilities. Cost competitiveness influences technology decisions, with regional suppliers providing alternatives to the established Western brands. Applications include all segments, such as refueling infrastructure for automotive programs, industrial hydrogen for traditional uses, and projects focused on energy storage. The region's combination of government commitment, industrial capability, and large potential markets positions it as a leader in the global hydrogen economy.

Europe is expected to see significant growth during the forecast period, fueled by the European Union's Green Deal hydrogen objectives and the need for industrial decarbonization. The EU Hydrogen Strategy aims for 40 gigawatts of electrolyzer capacity by 2030, producing 10 million tons of renewable hydrogen annually. Member states are implementing their own national hydrogen plans, with Germany pledging €9 billion, France €7 billion, and the Netherlands, UK, and others developing substantial programs. Refueling infrastructure is expanding rapidly, especially in Germany, which maintains European leadership with several hundred stations. The Netherlands, France, UK, and Scandinavia are also seeing growth. Industrial decarbonization is driving hydrogen use in steel manufacturing, with major projects from companies like SSAB, ThyssenKrupp, and ArcelorMittal. The chemical industry, including BASF and others, is exploring hydrogen feedstocks. The refining sector is adjusting to stricter emission regulations. Several countries are piloting hydrogen for seasonal renewable energy storage. Regional factors include strong environmental regulations pushing for decarbonization, carbon pricing mechanisms that make clean hydrogen more appealing, and research programs advancing technology. European compressor manufacturers like Burckhardt, Howden, Neuman & Esser, and Atlas Copco lead in hydrogen compression technology. The regional market benefits from established industrial infrastructure supporting the transition to a hydrogen economy and solid policy frameworks offering investment stability. Applications focus on green hydrogen from renewable sources, setting Europe's approach apart from industrial hydrogen use in other regions.

The major players in the hydrogen compressor market include NEL Hydrogen ASA (Norway), PDC Machines (U.S.), Howden Group (UK), Atlas Copco AB (Sweden), Burckhardt Compression Holding AG (Switzerland), Hitachi Ltd. (Japan), Sundyne LLC (U.S.), HAUG Sauer Kompressoren AG (Germany), Linde Engineering (Germany), Air Liquide S.A. (France), Ariel Corporation (U.S.), Galileo Technologies S.A. (Argentina), HydrogenPro ASA (Norway), Haskel (Ingersoll Rand) (U.S.), Bauer Compressors Inc. (Germany/U.S.), Gardner Denver (Ingersoll Rand) (U.S.), Kobe Steel Ltd. (Japan), Chart Industries Inc. (U.S.), Nikkiso Co. Ltd. (Japan), and Cummins Inc. (U.S.), among others.

The hydrogen compressor market is expected to grow from USD 0.89 billion in 2026 to USD 3.84 billion by 2036.

The hydrogen compressor market is expected to grow at a CAGR of 15.7% from 2026 to 2036.

Major players include NEL Hydrogen, PDC Machines, Howden, Atlas Copco, Burckhardt Compression, Hitachi, Linde Engineering, Air Liquide, and Cummins, among others.

Main factors include fuel cell vehicle adoption and refueling infrastructure deployment, green hydrogen production scaling, advanced compression technologies (ionic liquid, electrochemical), hydrogen economy government strategies, and industrial decarbonization.

Asia-Pacific leads in 2026 due to Japan/South Korea’s hydrogen strategies and China's green hydrogen initiatives, while Europe is expected to show significant growth during 2026-2036.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Compressor Type

3.3. Market Analysis, by Pressure Output

3.4. Market Analysis, by Flow Rate

3.5. Market Analysis, by Cooling Type

3.6. Market Analysis, by Lubrication

3.7. Market Analysis, by Application

3.8. Market Analysis, by End-Use Industry

3.9. Market Analysis, by Geography

3.10. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Hydrogen Compressor Market: Impact Analysis of Market Drivers (2026-2036)

4.2.1. Hydrogen Fuel Cell Vehicle Adoption and Refueling Infrastructure

4.2.2. Industrial Decarbonization and Green Hydrogen Production

4.2.3. Government Hydrogen Strategies and Funding Programs

4.3. Global Hydrogen Compressor Market: Impact Analysis of Market Restraints (2026-2036)

4.3.1. High Capital and Operating Costs

4.3.2. Hydrogen Embrittlement and Material Challenges

4.4. Global Hydrogen Compressor Market: Impact Analysis of Market Opportunities (2026-2036)

4.4.1. Hydrogen Energy Storage for Renewable Integration

4.4.2. Distributed and Mobile Hydrogen Production

4.5. Global Hydrogen Compressor Market: Impact Analysis of Market Challenges (2026-2036)

4.5.1. Compression Energy Efficiency and Parasitic Losses

4.5.2. Safety and Leak Prevention Requirements

4.6. Global Hydrogen Compressor Market: Impact Analysis of Market Trends (2026-2036)

4.6.1. Development of Oil-Free and Contamination-Free Technologies

4.6.2. Integration with Renewable Energy and Electrolysis Systems

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. Hydrogen Compression Technologies and System Architectures

5.1. Introduction to Hydrogen Compression Fundamentals

5.2. Thermodynamic Principles and Compression Cycles

5.3. Reciprocating Compression Mechanisms and Design

5.4. Diaphragm Compression Technology and Applications

5.5. Ionic Liquid and Electrochemical Compression

5.6. Materials for Hydrogen Service and Embrittlement Mitigation

5.7. Safety Systems and Leak Detection

5.8. Integration with Electrolysis and Storage Systems

5.9. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global Hydrogen Compressor Market, by Compressor Type

7.1. Introduction

7.2. Reciprocating Compressor

7.2.1. Single-Stage Reciprocating

7.2.2. Multi-Stage Reciprocating

7.2.3. Oil-Free Reciprocating

7.3. Diaphragm Compressor

7.3.1. Metal Diaphragm

7.3.2. Composite Diaphragm

7.4. Ionic Liquid Compressor

7.5. Hydraulic Compressor/Intensifier

7.6. Centrifugal Compressor

7.7. Rotary Screw Compressor

7.8. Linear Compressor

8. Global Hydrogen Compressor Market, by Pressure Output

8.1. Introduction

8.2. Low Pressure (< 200 bar)

8.3. Medium Pressure (200-500 bar)

8.3.1. 350 bar (Commercial Vehicle Refueling)

8.3.2. 450 bar (Industrial Applications)

8.4. High Pressure (500-900 bar)

8.4.1. 700 bar (Passenger Vehicle Refueling)

8.4.2. 900 bar (Refueling Station Cascade Storage)

8.5. Ultra-High Pressure (> 900 bar)

9. Global Hydrogen Compressor Market, by Flow Rate

9.1. Introduction

9.2. Low Flow (< 100 kg/day)

9.2.1. Laboratory and R&D Applications

9.2.2. Small-Scale Distributed Production

9.3. Medium Flow (100-500 kg/day)

9.3.1. Hydrogen Refueling Stations

9.3.2. Small Industrial Applications

9.4. High Flow (500-2,000 kg/day)

9.4.1. Large Refueling Stations

9.4.2. Medium Industrial Applications

9.5. Very High Flow (> 2,000 kg/day)

9.5.1. Large Industrial Facilities

9.5.2. Pipeline Injection Stations

10. Global Hydrogen Compressor Market, by Cooling Type

10.1. Introduction

10.2. Air-Cooled Compression

10.3. Water-Cooled Compression

10.4. Refrigerant-Cooled Compression

10.5. Adiabatic Compression

11. Global Hydrogen Compressor Market, by Lubrication

11.1. Introduction

11.2. Oil-Free Compression

11.2.1. Dry Running (PTFE/Composite Seals)

11.2.2. Water-Lubricated

11.3. Oil-Lubricated Compression

11.3.1. Synthetic Lubricants

11.3.2. Mineral Oil Lubricants

12. Global Hydrogen Compressor Market, by Application

12.1. Introduction

12.2. Hydrogen Refueling Station

12.2.1. Light-Duty Vehicle Stations (700 bar)

12.2.2. Heavy-Duty Vehicle Stations (350 bar)

12.2.3. Multi-Pressure Stations

12.3. Industrial Hydrogen

12.3.1. Petroleum Refining

12.3.2. Ammonia Production

12.3.3. Chemical Manufacturing

12.3.4. Metal Processing and Heat Treatment

12.4. Hydrogen Storage and Distribution

12.4.1. Tube Trailer Filling

12.4.2. Stationary Storage Compression

12.4.3. Pipeline Injection

12.5. Energy Storage and Power-to-Gas

12.5.1. Grid-Scale Energy Storage

12.5.2. Renewable Curtailment Capture

12.5.3. Synthetic Fuel Production

12.6. Mobility and Transportation

12.6.1. Marine and Shipping Applications

12.6.2. Rail Applications

12.6.3. Aviation Ground Support

13. Global Hydrogen Compressor Market, by End-Use Industry

13.1. Introduction

13.2. Transportation and Mobility

13.3. Oil and Gas/Petroleum Refining

13.4. Chemical and Petrochemical

13.5. Power Generation and Utilities

13.6. Steel and Metals

13.7. Electronics and Semiconductors

13.8. Food and Beverage

13.9. Glass Manufacturing

13.10. Others

14. Hydrogen Compressor Market, by Geography

14.1. Introduction

14.2. North America

14.2.1. U.S.

14.2.2. Canada

14.2.3. Mexico

14.3. Europe

14.3.1. Germany

14.3.2. France

14.3.3. U.K.

14.3.4. Netherlands

14.3.5. Italy

14.3.6. Spain

14.3.7. Rest of Europe

14.4. Asia-Pacific

14.4.1. China

14.4.2. Japan

14.4.3. South Korea

14.4.4. India

14.4.5. Australia

14.4.6. Rest of Asia-Pacific

14.5. Latin America

14.5.1. Brazil

14.5.2. Chile

14.5.3. Rest of Latin America

14.6. Middle East & Africa

14.6.1. Saudi Arabia

14.6.2. UAE

14.6.3. South Africa

14.6.4. Rest of Middle East & Africa

15. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

15.1. Atlas Copco AB

15.2. Burckhardt Compression AG

15.3. Howden Group

15.4. Ariel Corporation

15.5. Sundyne LLC

15.6. Hydro-Pac Inc.

15.7. Neuman & Esser Group

15.8. PDC Machines

15.9. Corken Inc.

15.10. Haskel (Ingersoll Rand)

15.11. HAUG Sauer Kompressoren AG

15.12. Fluitron Inc.

15.13. HyET Hydrogen B.V.

15.14. Linde Engineering

15.15. Chart Industries Inc.

15.16. Air Liquide Advanced Technologies

15.17. Hitachi Industrial Equipment Systems

15.18. Mitsubishi Heavy Industries Compressor Corporation

15.19. SIAD Macchine Impianti S.p.A.

15.20. Gardner Denver (Ingersoll Rand)

15.21. Others

16. Appendix

16.1. Questionnaire

16.2. Available Customization

Published Date: Jan-2026

Published Date: Jul-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates