Resources

About Us

Heavyweight Motorcycle Market Size, Share & Growth Analysis | By Engine Capacity, Type, Price Range & Distribution Channel | Forecast 2025-2032

Report ID: MRAUTO - 1041477 Pages: 210 Apr-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportReport Overview

This comprehensive market research report analyzes the dynamic heavyweight motorcycle market, evaluating how manufacturers are addressing changing consumer preferences, technological advancements, and regulatory requirements across various regions and market segments. The report provides a strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends

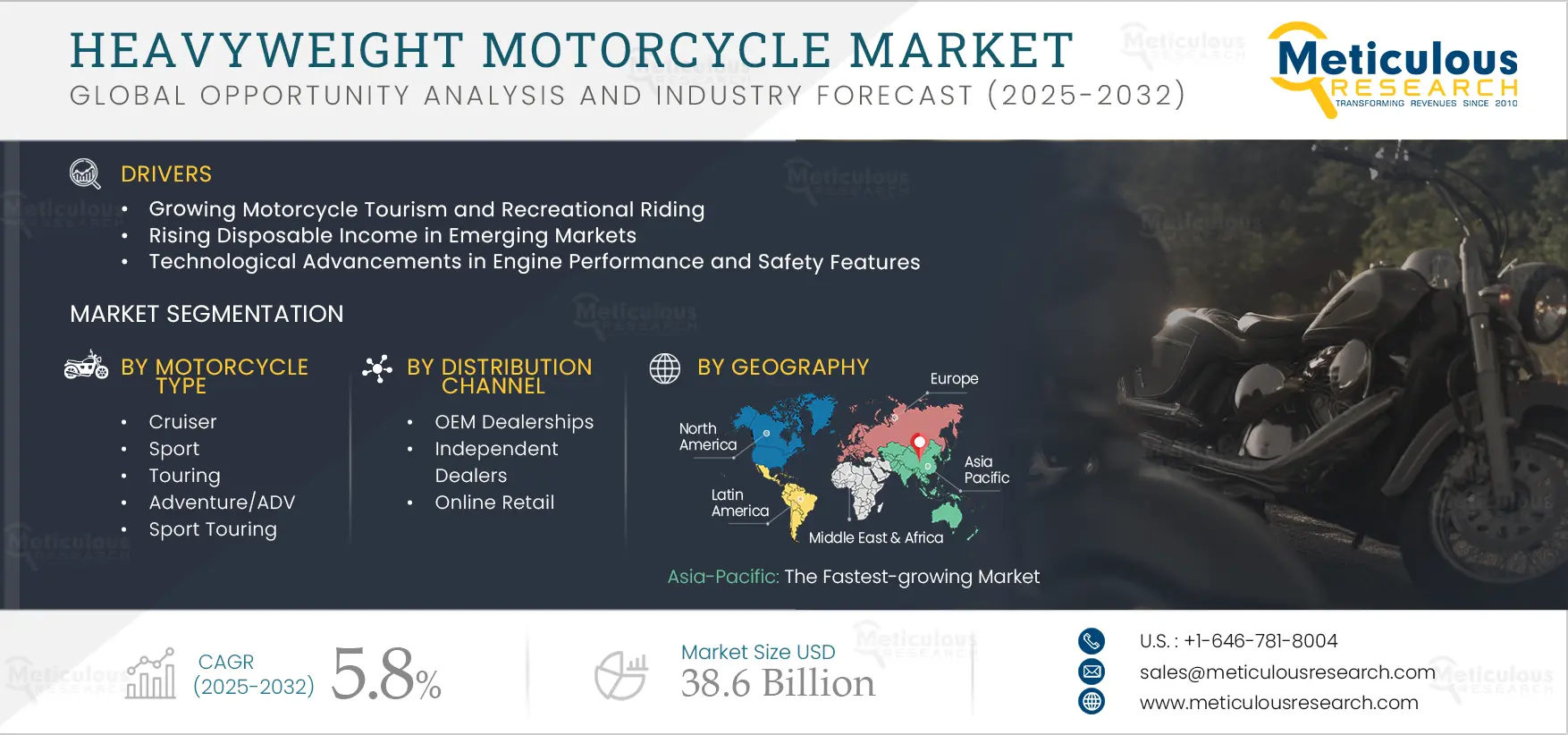

The heavyweight motorcycle market is primarily driven by growing motorcycle tourism and recreational riding, rising disposable income in emerging markets, technological advancements in engine performance and safety features, increasing popularity of motorcycle clubs and community riding, and shifting consumer preferences toward premium and luxury motorcycles. The shift toward semi-automatic and automatic transmissions is reshaping the industry, while increasing focus on lightweight materials and aerodynamics is gaining significant traction. Additionally, integration of advanced driver assistance systems (ADAS), rising demand for retro and heritage designs, and increasing adoption of digital dashboards and connectivity features are further driving market growth, especially in Asia-Pacific and North America.

Click here to: Get Free Sample Pages of this Report

Key Challenges

Despite significant growth potential, the overall heavyweight motorcycle market faces challenges including high purchase and maintenance costs, stringent emission regulations and compliance requirements, safety concerns associated with high-powered motorcycles, limited infrastructure in developing regions, and seasonal sales fluctuations in various geographies. Additionally, meeting diverse regional emission standards, balancing traditional appeal with modern technology, supply chain disruptions, intense competition from premium automobile segments, and changing consumer demographics present significant barriers, potentially slowing down market penetration in different countries across the globe.

Growth Opportunities

The heavyweight motorcycle market offers several high-growth opportunities. Integration of advanced technology and IoT features is driving innovation across premium segments. Another major opportunity lies in the growing electric heavyweight motorcycle segment with advancements in battery technology. Additionally, customization and personalization services are creating new revenue streams for manufacturers. Expansion in emerging markets and innovative financing and ownership models further expand the growth landscape for both established manufacturers and innovative startups.

Market Segmentation Highlights

By Engine Capacity

The 1001-1600cc segment is expected to hold the largest share of the overall heavyweight motorcycle market in 2025, due to the optimal balance between power delivery, touring capability, and handling characteristics that this displacement range offers. These motorcycles provide sufficient performance for highway cruising and long-distance riding without the extreme fuel consumption of larger engines. The above 1600cc segment follows closely, particularly popular in the touring category where maximum torque and long-distance comfort are prioritized. However, the 601-800cc segment is expected to grow at the fastest CAGR during the forecast period, driven by new rider demographics entering the heavyweight category and increasing fuel efficiency concerns.

By Motorcycle Type

The cruiser segment is expected to dominate the overall heavyweight motorcycle market in 2025, primarily due to their iconic styling, comfortable riding position, and strong brand heritage among traditional motorcycle enthusiasts. These motorcycles appeal to riders seeking classic aesthetics and relaxed riding experiences. The touring segment follows closely, leveraging its appeal for long-distance riders who prioritize comfort and storage capacity. However, the adventure/ADV motorcycle segment is expected to grow at the fastest CAGR through 2032, driven by increasing interest in versatile motorcycles capable of both on-road comfort and off-road capability, supporting the growing adventure tourism trend.

By Price Range

The premium segment is expected to hold the largest share of the overall heavyweight motorcycle market in 2025, as riders increasingly prioritize advanced features, build quality, and brand prestige. The mid-range segment follows, offering accessible entry points to heavyweight motorcycle ownership while still delivering substantial performance and features. However, the ultra-premium/luxury segment is expected to experience the fastest growth rate during the forecast period, driven by increasing disposable income among enthusiasts and collectors, expanding demand for exclusive limited-edition models, and the growing prestige of certain heritage and high-performance brands.

By Distribution Channel

The OEM dealerships segment is expected to hold the largest share of the overall heavyweight motorcycle market in 2025, primarily due to their comprehensive service offerings, manufacturer-backed warranties, and ability to provide financing options. Independent dealers follow closely, particularly strong in markets with established used motorcycle trading and customization cultures. However, the online retail segment is expected to grow at the fastest rate during the forecast period, driven by increasing digital purchasing behaviors, enhanced virtual showroom experiences, and manufacturers' direct-to-consumer sales strategies.

By Geography

The Asia-Pacific region is expected to hold the largest share of the global heavyweight motorcycle market in 2025, driven by China's massive manufacturing capacity, Japan's technological leadership, and rapidly growing markets in India and other Southeast Asian countries. Additionally, rising disposable incomes and expanding motorcycle culture in these regions contribute significantly to market dominance. North America follows as the second-largest market, bolstered by strong touring and cruiser segments, particularly in the United States. However, Europe is witnessing the fastest growth rate during the forecast period, primarily driven by increasing adventure and sport touring popularity, premium brand concentration, and rapid electric motorcycle adoption.

Competitive Landscape

The global heavyweight motorcycle market features a diverse competitive landscape with established legacy manufacturers, luxury automotive brands expanding into motorcycles, electric vehicle specialists, and boutique custom builders pursuing varied approaches to motorcycle design and technology.

The broader manufacturing landscape is categorized into industry leaders, market differentiators, vanguards, and contemporary stalwarts, with each group employing distinctive strategies to maintain competitive advantage. Leading manufacturers are focusing on technological integration while preserving distinctive brand identities and riding experiences.

The key players operating in the global heavyweight motorcycle market are Harley-Davidson, Inc., Honda Motor Co., Ltd., Bayerische Motoren Werke AG (BMW Motorrad), Kawasaki Heavy Industries, Ltd., Triumph Motorcycles Ltd., Yamaha Motor Co., Ltd., Ducati Motor Holding S.p.A. (Audi AG), Polaris Inc. (Indian Motorcycle), Suzuki Motor Corporation, KTM AG (Pierer Mobility AG), MV Agusta Motor S.p.A., Royal Enfield (Eicher Motors Limited), Energica Motor Company S.p.A., Benelli Q.J. Srl, and Moto Guzzi (Piaggio & C. SpA).

|

Particulars |

Details |

|

Number of Pages |

210 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.8% |

|

Market Size (Value) in 2025 |

USD 24.5 billion |

|

Market Size (Value) in 2032 |

USD 38.6 Billion |

|

Segments Covered |

By Engine Capacity

By Motorcycle Type

By Price Range

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa (Saudi Arabia, United Arab Emirates, Rest of Middle East & Africa) |

|

Key Companies |

Harley-Davidson, Inc., Honda Motor Co., Ltd., Bayerische Motoren Werke AG (BMW Motorrad), Kawasaki Heavy Industries, Ltd., Triumph Motorcycles Ltd., Yamaha Motor Co., Ltd., Ducati Motor Holding S.p.A. (Audi AG), Polaris Inc. (Indian Motorcycle), Suzuki Motor Corporation, KTM AG (Pierer Mobility AG), MV Agusta Motor S.p.A., Royal Enfield (Eicher Motors Limited), Energica Motor Company S.p.A., Benelli Q.J. Srl, and Moto Guzzi (Piaggio & C. SpA) |

The global heavyweight motorcycle market was valued at $22.8 billion in 2024. This market is expected to reach $38.6 billion by 2032 from an estimated $24.5 billion in 2025, at a CAGR of 5.8% during the forecast period of 2025–2032.

The global heavyweight motorcycle market is expected to grow at a CAGR of 5.8% during the forecast period of 2025–2032.

The global heavyweight motorcycle market is expected to reach $38.6 billion by 2032 from an estimated $24.5 billion in 2025, at a CAGR of 5.8% during the forecast period of 2025–2032.

The key companies operating in this market include Harley-Davidson, Inc., Honda Motor Co., Ltd., Bayerische Motoren Werke AG (BMW Motorrad), Kawasaki Heavy Industries, Ltd., Triumph Motorcycles Ltd., Yamaha Motor Co., Ltd., Ducati Motor Holding S.p.A. (Audi AG), Polaris Inc. (Indian Motorcycle), Suzuki Motor Corporation, KTM AG (Pierer Mobility AG), MV Agusta Motor S.p.A., Royal Enfield (Eicher Motors Limited), Energica Motor Company S.p.A., Benelli Q.J. Srl, and Moto Guzzi (Piaggio & C. SpA).

Major trends shaping the market include shift toward semi-automatic and automatic transmissions, growing focus on lightweight materials and aerodynamics, integration of advanced driver assistance systems (ADAS), rising demand for retro and heritage designs, and increasing adoption of digital dashboards and connectivity features.

• In 2025, the 1001-1600cc segment is expected to dominate the overall heavyweight motorcycle market by engine capacity

• Based on motorcycle type, the cruiser segment is expected to hold the largest share of the overall heavyweight motorcycle market in 2025

• Based on price range, the premium segment is expected to hold the largest share of the global heavyweight motorcycle market in 2025

• Based on distribution channel, OEM dealerships are expected to hold the largest share of the market in 2025

Asia-Pacific is expected to hold the largest share of the global heavyweight motorcycle market in 2025, driven by China's massive manufacturing capacity, Japan's technological leadership, and rapidly growing markets in India and other Southeast Asian countries.

The growth of this market is driven by growing motorcycle tourism and recreational riding, rising disposable income in emerging markets, technological advancements in engine performance and safety features, increasing popularity of motorcycle clubs and community riding, and shifting consumer preferences toward premium and luxury motorcycles.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Heavyweight Motorcycles Market, by Engine Capacity

3.2.2. Heavyweight Motorcycles Market, by Motorcycle Type

3.2.3. Heavyweight Motorcycles Market, by Price Range

3.2.4. Heavyweight Motorcycles Market, by Distribution Channel

3.2.5. Heavyweight Motorcycles Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Motorcycle Tourism and Recreational Riding

4.2.1.2. Rising Disposable Income in Emerging Markets

4.2.1.3. Technological Advancements in Engine Performance and Safety Features

4.2.1.4. Increasing Popularity of Motorcycle Clubs and Community Riding

4.2.1.5. Shifting Consumer Preferences toward Premium and Luxury Motorcycles

4.2.2. Restraints

4.2.2.1. High Purchase and Maintenance Costs

4.2.2.2. Stringent Emission Regulations and Compliance Requirements

4.2.2.3. Safety Concerns Associated with High-Powered Motorcycles

4.2.2.4. Limited Infrastructure in Developing Regions

4.2.2.5. Seasonal Sales Fluctuations in Various Geographies

4.2.3. Opportunities

4.2.3.1. Integration of Advanced Technology and IoT Features

4.2.3.2. Growing Electric Heavyweight Motorcycle Segment

4.2.3.3. Customization and Personalization Services

4.2.3.4. Expansion in Emerging Markets

4.2.3.5. Innovative Financing and Ownership Models

4.2.4. Trends

4.2.4.1. Shift Toward Semi-Automatic and Automatic Transmissions

4.2.4.2. Growing Focus on Lightweight Materials and Aerodynamics

4.2.4.3. Integration of Advanced Driver Assistance Systems (ADAS)

4.2.4.4. Rising Demand for Retro and Heritage Designs

4.2.4.5. Increasing Adoption of Digital Dashboards and Connectivity Features

4.2.5. Challenges

4.2.5.1. Meeting Diverse Regional Emission Standards

4.2.5.2. Balancing Traditional Appeal with Modern Technology

4.2.5.3. Supply Chain Disruptions and Raw Material Costs

4.2.5.4. Intense Competition from Premium Automobile Segments

4.2.5.5. Changing Consumer Demographics and Preferences

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Heavyweight Motorcycles Market

4.4.1. Key Sustainability Dimensions Driving Industry Strategy

4.4.2. Emission Reduction Technologies and Compliance

4.4.3. Sustainable Manufacturing Practices

4.4.4. Materials Innovation and Recycling Initiatives

4.4.5. Industry Adoption Strategies and Implementation Challenges

5. Heavyweight Motorcycles Market Assessment—by Engine Capacity

5.1. 601-800cc

5.2. 801-1000cc

5.3. 1001-1600cc

5.4. Above 1600cc

6. Heavyweight Motorcycles Market Assessment—by Motorcycle Type

6.1. Cruiser

6.2. Sport

6.3. Touring

6.4. Adventure/ADV

6.5. Sport Touring

6.6. Others

7. Heavyweight Motorcycles Market Assessment—by Price Range

7.1. Mid-range

7.2. Premium

7.3. Ultra-premium/Luxury

8. Heavyweight Motorcycles Market Assessment—by Distribution Channel

8.1. OEM Dealerships

8.2. Independent Dealers

8.3. Online Retail

8.4. Others

9. Heavyweight Motorcycles Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Australia

9.4.5. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America (RoLATAM)

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. United Arab Emirates (UAE)

9.6.3. Rest of Middle East & Africa (RoMEA)

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Contemporary Stalwarts

10.5. Market Share/Ranking Analysis, by Key Players, 2024

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

11.1. Harley-Davidson, Inc.

11.2. Honda Motor Co., Ltd.

11.3. Bayerische Motoren Werke AG (BMW Motorrad)

11.4. Kawasaki Heavy Industries, Ltd.

11.5. Triumph Motorcycles Ltd.

11.6. Yamaha Motor Co., Ltd.

11.7. Ducati Motor Holding S.p.A. (Audi AG)

11.8. Polaris Inc. (Indian Motorcycle)

11.9. Suzuki Motor Corporation

11.10. KTM AG (Pierer Mobility AG)

11.11. MV Agusta Motor S.p.A.

11.12. Royal Enfield (Eicher Motors Limited)

11.13. Energica Motor Company S.p.A.

11.14. Benelli Q.J. Srl

11.15. Moto Guzzi (Piaggio & C. SpA)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Global Market Overview

Table 1: Global Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 2: Global Heavyweight Motorcycles Market, 2023-2032 (Units)

Table 3: Global Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 4: Global Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 5: Global Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 6: Global Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Table 7: Global Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Engine Capacity Segment

Table 8: Global 601-800cc Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 9: Global 801-1000cc Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 10: Global 1001-1600cc Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 11: Global Above 1600cc Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Motorcycle Type Segment

Table 12: Global Cruiser Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 13: Global Sport Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 14: Global Touring Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 15: Global Adventure/ADV Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 16: Global Sport Touring Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 17: Global Other Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Price Range Segment

Table 18: Global Mid-range Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 19: Global Premium Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 20: Global Ultra-premium/Luxury Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Distribution Channel Segment

Table 21: Global OEM Dealerships Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 22: Global Independent Dealers Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 23: Global Online Retail Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

Table 24: Global Other Distribution Channels Heavyweight Motorcycles Market, by Region, 2023-2032 (USD Million)

North America Market

Table 25: North America Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 26: North America Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 27: North America Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 28: North America Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 29: North America Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Table 30: North America Heavyweight Motorcycles Market, by Country, 2023-2032 (USD Million)

U.S. Market

Table 31: U.S. Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 32: U.S. Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 33: U.S. Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 34: U.S. Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 35: U.S. Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Canada Market

Table 36: Canada Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 37: Canada Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 38: Canada Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 39: Canada Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 40: Canada Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Europe Market

Table 41: Europe Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 42: Europe Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 43: Europe Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 44: Europe Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 45: Europe Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Table 46: Europe Heavyweight Motorcycles Market, by Country, 2023-2032 (USD Million)

Germany Market

Table 47: Germany Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 48: Germany Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 49: Germany Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 50: Germany Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 51: Germany Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

France Market

Table 52: France Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 53: France Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 54: France Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 55: France Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 56: France Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

U.K. Market

Table 57: U.K. Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 58: U.K. Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 59: U.K. Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 60: U.K. Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 61: U.K. Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Italy Market

Table 62: Italy Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 63: Italy Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 64: Italy Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 65: Italy Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 66: Italy Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Spain Market

Table 67: Spain Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 68: Spain Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 69: Spain Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 70: Spain Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 71: Spain Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Rest of Europe Market

Table 72: Rest of Europe Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 73: Rest of Europe Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 74: Rest of Europe Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 75: Rest of Europe Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 76: Rest of Europe Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Asia-Pacific Market

Table 77: Asia-Pacific Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 78: Asia-Pacific Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 79: Asia-Pacific Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 80: Asia-Pacific Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 81: Asia-Pacific Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Table 82: Asia-Pacific Heavyweight Motorcycles Market, by Country, 2023-2032 (USD Million)

China Market

Table 83: China Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 84: China Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 85: China Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 86: China Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 87: China Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Japan Market

Table 88: Japan Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 89: Japan Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 90: Japan Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 91: Japan Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 92: Japan Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

India Market

Table 93: India Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 94: India Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 95: India Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 96: India Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 97: India Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Australia Market

Table 98: Australia Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 99: Australia Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 100: Australia Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 101: Australia Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 102: Australia Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Rest of Asia-Pacific Market

Table 103: Rest of Asia-Pacific Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 104: Rest of Asia-Pacific Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 105: Rest of Asia-Pacific Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 106: Rest of Asia-Pacific Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 107: Rest of Asia-Pacific Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Latin America Market

Table 108: Latin America Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 109: Latin America Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 110: Latin America Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 111: Latin America Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 112: Latin America Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Table 113: Latin America Heavyweight Motorcycles Market, by Country, 2023-2032 (USD Million)

Brazil Market

Table 114: Brazil Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 115: Brazil Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 116: Brazil Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 117: Brazil Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 118: Brazil Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Mexico Market

Table 119: Mexico Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 120: Mexico Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 121: Mexico Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 122: Mexico Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 123: Mexico Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Rest of Latin America Market

Table 124: Rest of Latin America Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 125: Rest of Latin America Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 126: Rest of Latin America Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 127: Rest of Latin America Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 128: Rest of Latin America Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Middle East & Africa Market

Table 129: Middle East & Africa Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 130: Middle East & Africa Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 131: Middle East & Africa Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 132: Middle East & Africa Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 133: Middle East & Africa Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Table 134: Middle East & Africa Heavyweight Motorcycles Market, by Country, 2023-2032 (USD Million)

Saudi Arabia Market

Table 135: Saudi Arabia Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 136: Saudi Arabia Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 137: Saudi Arabia Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 138: Saudi Arabia Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 139: Saudi Arabia Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

UAE Market

Table 140: UAE Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 141: UAE Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 142: UAE Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 143: UAE Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 144: UAE Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

Rest of Middle East & Africa Market

Table 145: Rest of Middle East & Africa Heavyweight Motorcycles Market, 2023-2032 (USD Million)

Table 146: Rest of Middle East & Africa Heavyweight Motorcycles Market, by Engine Capacity, 2023-2032 (USD Million)

Table 147: Rest of Middle East & Africa Heavyweight Motorcycles Market, by Motorcycle Type, 2023-2032 (USD Million)

Table 148: Rest of Middle East & Africa Heavyweight Motorcycles Market, by Price Range, 2023-2032 (USD Million)

Table 149: Rest of Middle East & Africa Heavyweight Motorcycles Market, by Distribution Channel, 2023-2032 (USD Million)

List of Figures

Figure 1: Global Heavyweight Motorcycles Market Size, 2023-2032 (USD Million)

Figure 2: Global Heavyweight Motorcycles Market Volume, 2023-2032 (Units)

Figure 3: Global Heavyweight Motorcycles Market Growth, Y-o-Y % Growth, 2023-2032

Figure 4: Global Heavyweight Motorcycles Market, by Engine Capacity, 2023 vs. 2028 vs. 2032 (%)

Figure 5: Global Heavyweight Motorcycles Market, by Motorcycle Type, 2023 vs. 2028 vs. 2032 (%)

Figure 6: Global Heavyweight Motorcycles Market, by Price Range, 2023 vs. 2028 vs. 2032 (%)

Figure 7: Global Heavyweight Motorcycles Market, by Distribution Channel, 2023 vs. 2028 vs. 2032 (%)

Figure 8: Global Heavyweight Motorcycles Market, by Region, 2023 vs. 2028 vs. 2032 (%)

Figure 9: Impact Assessment of Market Drivers on Global Heavyweight Motorcycles Market (2023-2032)

Figure 10: Impact Assessment of Market Restraints on Global Heavyweight Motorcycles Market (2023-2032)

Figure 11: Impact Assessment of Market Opportunities on Global Heavyweight Motorcycles Market (2023-2032)

Figure 12: Porter's Five Forces Analysis: Global Heavyweight Motorcycles Market

Figure 13: North America Heavyweight Motorcycles Market Snapshot, 2023-2032 (USD Million)

Figure 14: North America Heavyweight Motorcycles Market Share, by Country, 2023 vs. 2028 vs. 2032 (%)

Figure 15: Europe Heavyweight Motorcycles Market Snapshot, 2023-2032 (USD Million)

Figure 16: Europe Heavyweight Motorcycles Market Share, by Country, 2023 vs. 2028 vs. 2032 (%)

Figure 17: Asia-Pacific Heavyweight Motorcycles Market Snapshot, 2023-2032 (USD Million)

Figure 18: Asia-Pacific Heavyweight Motorcycles Market Share, by Country, 2023 vs. 2028 vs. 2032 (%)

Figure 19: Latin America Heavyweight Motorcycles Market Snapshot, 2023-2032 (USD Million)

Figure 20: Latin America Heavyweight Motorcycles Market Share, by Country, 2023 vs. 2028 vs. 2032 (%)

Figure 21: Middle East & Africa Heavyweight Motorcycles Market Snapshot, 2023-2032 (USD Million)

Figure 22: Middle East & Africa Heavyweight Motorcycles Market Share, by Country, 2023 vs. 2028 vs. 2032 (%)

Figure 23: Key Growth Strategies Adopted by Leading Players in the Global Heavyweight Motorcycles Market, 2021-2025

Figure 24: Global Heavyweight Motorcycles Market Share Analysis, by Key Player (2023)

Figure 25: Competitive Benchmarking of Key Players in the Global Heavyweight Motorcycles Market

Figure 26: Competitive Dashboard of the Global Heavyweight Motorcycles Market

Published Date: Jul-2018

Published Date: Feb-2024

Published Date: Jul-2023

Published Date: May-2022

Published Date: Aug-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates