Resources

About Us

e-Fuels Market by Type (e-Diesel, e-Gasoline, e-Kerosene, e-Methanol, e-Ammonia, Others), Production Technology (Power-to-Liquid, Power-to-Gas), Application (Aviation, Marine, Road Transport, Industrial), and Geography - Global Forecast to 2035

Report ID: MRAUTO - 1041601 Pages: 235 Sep-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the e-Fuels Market Size?

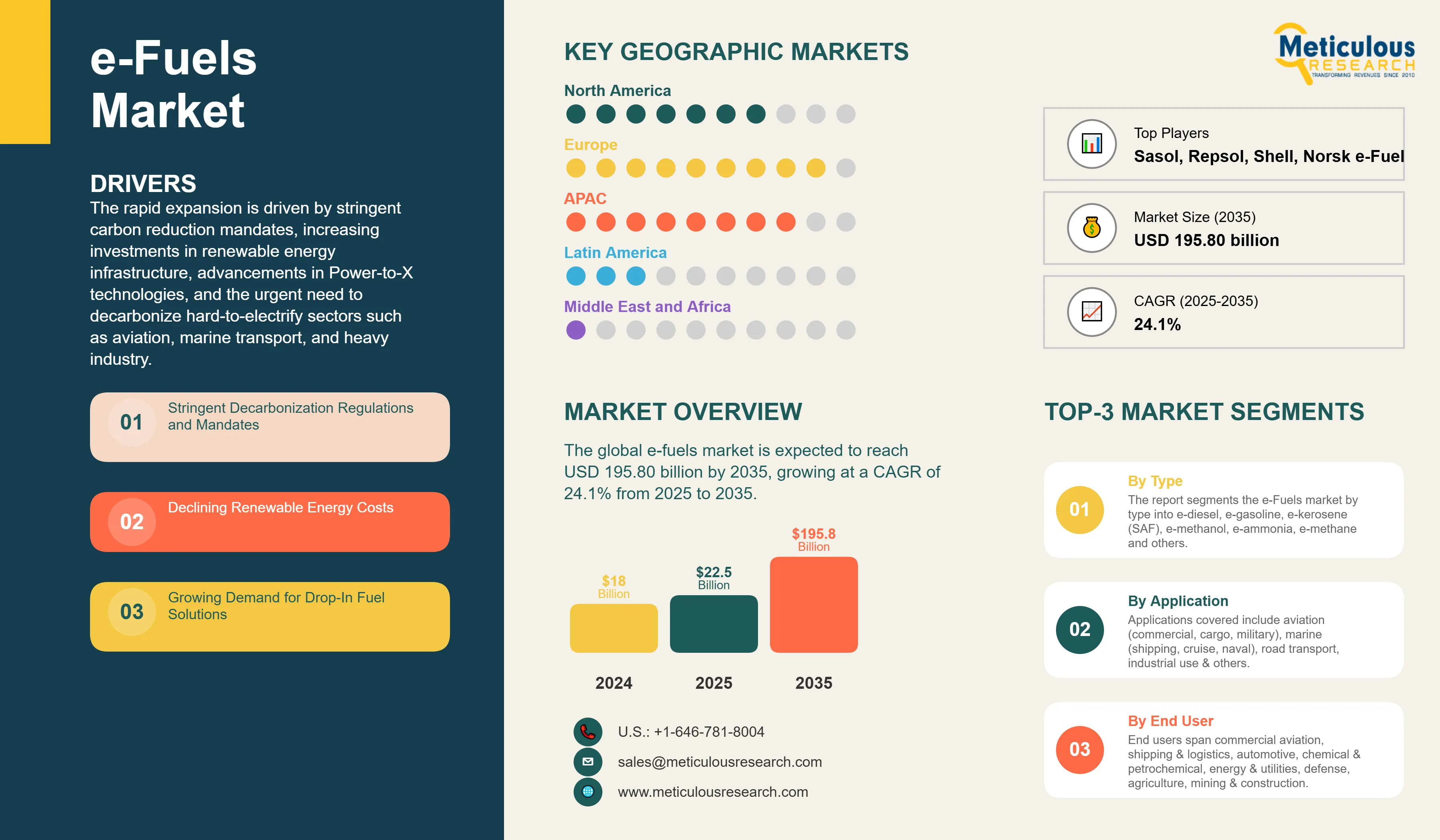

The global e-fuels market was valued at USD 18.00 billion in 2024. This market is expected to reach USD 195.80 billion by 2035 from an estimated USD 22.5 billion in 2025, growing at a CAGR of 24.1% from 2025 to 2035.

The growth of this market is primarily driven by stringent carbon reduction mandates, increasing investments in renewable energy infrastructure, advancements in Power-to-X technologies, and the urgent need to decarbonize hard-to-electrify sectors such as aviation, marine transport, and heavy industry.

Market Highlights: e-Fuels

Click here to: Get Free Sample Pages of this Report

The e-fuels market includes the production, distribution, and use of synthetic fuels made by combining renewable electricity, captured carbon dioxide, and water. These sustainable alternatives to traditional fossil fuels are created through electrochemical processes that turn renewable energy into liquid or gaseous hydrocarbon fuels. E-fuels, also called synthetic fuels, electrofuels, or Power-to-X fuels, have chemical properties similar to petroleum-based fuels. This similarity allows them to work with existing engines, aircraft, vessels, and fuel distribution systems without needing modifications.

The production process generally starts with electrolysis, which generates hydrogen from water using renewable electricity. This is followed by synthesis reactions that combine hydrogen with captured CO2 to produce different types of fuel. The market is driven by global commitments to reduce carbon emissions, regulations requiring sustainable fuel blending, the inability to fully electrify some transportation sectors, rising corporate sustainability commitments, falling renewable energy costs, and new technologies in carbon capture and synthesis. E-fuels provide a way to reach net-zero emissions in areas where battery electrification has major technical and economic challenges.

What are the Key Trends in the e-Fuels Market?

Direct Air Capture (DAC) integration: A significant trend in the e-fuels market is the increasing use of direct air capture technologies to obtain carbon dioxide directly from the atmosphere. This approach removes reliance on point-source CO2 emitters and produces truly carbon-neutral fuels when paired with renewable electricity. Leading e-fuel producers are forming partnerships with DAC technology providers and co-locating facilities. This arrangement helps cut transportation costs and establishes circular carbon economies. This trend greatly improves the sustainability of e-fuels and addresses concerns about the availability of carbon sources for large-scale production.

Strategic partnerships across value chains: Another important trend driving market growth is the creation of alliances between renewable energy producers, chemical companies, fuel distributors, and end users. Airlines are signing long-term agreements with e-fuel producers to ensure reliable sustainable aviation fuel supplies. Energy companies are teaming up with automotive manufacturers to create e-fuel supply chains. These integration strategies lower investment risk, guarantee demand, and speed up the building of large-scale production facilities. Collaborative industry efforts and consortiums are also forming to standardize production processes, share research findings, and push for favorable regulatory frameworks.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 195.80 Billion |

|

Market Size in 2025 |

USD 22.5 Billion |

|

Market Size in 2024 |

USD 18.0 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 24.1% |

|

Dominating Region |

Europe |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Production Technology, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent Decarbonization Regulations and Mandates

A main factor driving the e-fuels market is the push for strong carbon reduction rules and sustainable fuel requirements around the world. The European Union's ReFuelEU Aviation regulation sets minimum blending percentages for sustainable aviation fuel, starting at 2% in 2025 and rising to 70% by 2050. It also has specific mandates for synthetic fuels. The International Maritime Organization's decarbonization plan aims for a 70% cut in shipping emissions by 2040. The U.S. Sustainable Aviation Fuel Grand Challenge targets an annual production of 3 billion gallons by 2030. Germany's climate protection program provides significant funding for e-fuel demonstration projects. These rules create guaranteed market demand, lower investment risks for producers, and encourage quick scaling of production. Carbon pricing and emissions trading systems make e-fuels more economically competitive compared to traditional fossil fuels.

Restraint

High Production Costs and Energy Intensity

Despite its growth potential, the e-fuels market faces major challenges with production costs. Making e-fuels is very energy-intensive. It requires about 3 to 5 times more electricity per unit of energy than direct electrification. Currently, the production costs for e-kerosene are between $3 and $6 per liter. This makes e-fuels 3 to 6 times more expensive than regular jet fuel without subsidies. The costs depend a lot on access to cheap renewable electricity, which is still limited in many areas. Building production facilities also requires a lot of money. Commercial-scale plants need investments of over $500 million. There are efficiency losses because of the several conversion steps needed (from electricity to hydrogen and then to synthetic fuel), resulting in a round-trip efficiency of only 10% to 20%. These economic challenges require ongoing technological improvements, significant scaling up to lower costs, and steady policy support through subsidies, tax credits, and carbon pricing to close the cost gap with fossil fuels.

Opportunity

Hard-to-Decarbonize Sectors and Existing Infrastructure Compatibility

The biggest chance for e-fuels is in reducing carbon emissions in areas where using electricity isn’t possible or is too expensive. Aviation is a huge market, with global jet fuel consumption over 350 billion liters each year. Long-haul flights need fuels that are energy-dense, and current battery technology can't provide that. Maritime shipping, especially for transoceanic vessels, has the same issues. E-fuels work well with existing engines, aircraft, fuel distribution systems, and storage facilities. This means there’s no need to pay for new vehicles or major changes to infrastructure. This benefit is especially important for industries with long-lasting assets, like commercial airplanes and cargo ships. E-fuels can also act as large-scale energy storage, turning excess renewable electricity into stable liquid fuels for future use. The chemical industry offers chances for e-methanol and e-ammonia to replace fossil-based materials sustainably.

Type Insights

Why is e-Diesel Gaining Traction in Road Transport Applications?

The e-diesel segment holds the largest share, accounting for 28-32% of the overall e-fuels market in 2025. E-diesel's market dominance comes from its compatibility with existing diesel engine fleets, especially in heavy-duty trucking, construction equipment, and agricultural machinery, where electrification struggles with range and payload issues. The fuel's chemical properties closely match those of conventional diesel, allowing for easy integration without needing engine changes or performance sacrifices. Commercial fleet operators value e-diesel's ability to reduce emissions while keeping operational flexibility and using existing refueling infrastructure. European markets lead in e-diesel adoption due to strict emissions regulations and a strong renewable energy capacity for production.

The e-kerosene segment is expected to grow at the fastest rate through 2035. This growth is driven by the aviation industry's need to reduce carbon emissions and regulatory requirements for sustainable aviation fuel blending. Aviation accounts for about 2-3% of global CO2 emissions, and there are limited alternatives to liquid fuels for long flights. Major airlines have pledged to reach net-zero emissions by 2050, which creates significant demand for e-kerosene. The sector benefits from high fuel prices that enhance e-kerosene's competitiveness and increase willingness to pay for sustainable options. Advances in technology, including Fischer-Tropsch and methanol-to-jet processes, are improving production efficiency and lowering costs.

Production Technology Insights

How Does Power-to-Liquid Technology Dominate e-Fuels Production?

The Power-to-Liquid (PtL) segment is expected to hold the largest share of 65-70% of the overall e-fuels market in 2025. PtL technology stands out because it produces liquid hydrocarbon fuels that can directly replace gasoline, diesel, and jet fuel without needing to modify infrastructure. This technology combines water electrolysis to produce green hydrogen with CO2 synthesis, creating liquid fuels through Fischer-Tropsch or methanol-to-gasoline methods. PtL fuels have better energy density, are easier to store and transport, and work well with existing distribution networks when compared to gaseous alternatives. The technology benefits from years of industrial experience with similar chemical processes in petroleum refining and gas-to-liquids production, which lowers technical risk. Major demonstration and commercial projects in Germany, Chile, Norway, and Saudi Arabia are confirming the large-scale viability of PtL technology.

The Power-to-Liquid segment will likely maintain its lead throughout the forecast period. Market demand is focused on applications that need liquid fuels, such as aviation, marine transport, and heavy-duty road transport. Here, PtL products are uniquely suitable. While Power-to-Gas technologies play important roles in balancing the grid and in industrial applications, the higher value and regulatory backing for drop-in liquid fuels keep PtL at the forefront of the market. Ongoing innovations in high-temperature co-electrolysis and new catalytic processes could lead to further efficiency gains and cost reductions.

Application Insights

How Does Aviation Lead e-Fuels Market Adoption?

The aviation segment has the largest market share, making up about 35-40% in 2025. Aviation leads because of a strong need to cut emissions and because there are no good alternatives for electrifying commercial aircraft. E-kerosene, or sustainable aviation fuel, is the only reliable option to reach net-zero aviation by 2050. Regulations are very strong, especially in Europe and increasingly worldwide, requiring a minimum percentage of e-fuel in blends. Airlines feel pressure from corporate customers, investors, and environmental groups to lower emissions. The industry's readiness to pay higher prices for certified sustainable fuels makes aviation the most appealing market for e-fuel producers. Major airlines like Lufthansa, Air France-KLM, United Airlines, and Emirates have signed long-term e-fuel supply agreements, ensuring stable revenue for production investments.

The aviation sector is also expected to grow the fastest during the forecast period. The projected doubling of global air traffic by 2040, along with stricter emissions regulations, will significantly boost e-fuel demand. Technology advancements are expected to cut production costs by 30-50% over the next decade, improving economic feasibility. Investments in airport infrastructure for sustainable fuel handling and blending will ease distribution challenges. The combination of regulatory pressure, corporate commitments, and better economics creates strong momentum for growth in the aviation sector.

End User Insights

Why Does Commercial Aviation Dominate e-Fuels Consumption?

The commercial aviation segment will hold the largest share of about 25-30% in 2025. Commercial airlines make up the most concentrated and organized group of users. Major carriers are actively looking for sustainable fuel sources to meet their sustainability goals and follow regulations. These operators have set up purchasing processes, quality standards, and blending infrastructure specifically for sustainable aviation fuels. The sector gains from international cooperation through industry groups like IATA (International Air Transport Association) and a stronger purchasing power from airline alliances. Long-term contracts with fixed pricing reduce the revenue risks for producers and help with project financing. Carriers in Europe and North America lead the way in adoption, aided by government incentives and carbon pricing that make e-fuel more cost-effective.

The chemical and petrochemical segment is expected to grow at the fastest rate through 2035. Chemical manufacturers are increasingly using e-methanol and e-ammonia as sustainable feedstocks to replace fossil-based materials in making plastics, fertilizers, and specialty chemicals. This sector has a simpler integration process compared to transportation as chemical plants can tailor their systems for specific e-fuel properties. Rising corporate commitments to cut Scope 3 emissions are driving the demand for sustainable chemical feedstocks. The segment also benefits from higher value-added applications, where premium pricing is easier to accept. Major chemical companies such as BASF, Evonik, and Covestro are investing in projects to integrate e-fuels.

U.S. e-Fuels Market Size and Growth 2025 to 2035

The U.S. e-fuels market is projected to be worth around USD 35.20 billion by 2035, growing at a CAGR of 22.8% from 2025 to 2035.

How is Europe Leading the Global e-Fuels Market?

Europe holds the largest market share of nearly 45 to 50% in 2025. This dominance comes from its strong regulatory framework, which includes ReFuelEU Aviation mandates and the Renewable Energy Directive III that sets e-fuel targets. Countries like Germany, France, the Netherlands, and Spain are also setting national hydrogen strategies and investing billions in funding. The European Green Deal aims for climate neutrality by 2050, making e-fuels crucial for reducing carbon emissions in aviation, shipping, and chemical sectors. Germany is at the forefront with several large-scale demonstration projects, such as the HaruOni facility in Chile, which is funded by Germany and produces e-fuels for Porsche and commercial use. The region has abundant offshore wind resources in the North Sea and an established renewable energy industry, as well as access to North African solar resources for potential e-fuel imports. Major energy companies like Shell, TotalEnergies, Repsol, and ENI are heavily investing in Europe's e-fuel production capacity. Additionally, the region’s strong chemical industry and automotive sector provide both technical expertise and consistent demand.

Which Factors Support Asia Pacific e-Fuels Market Growth?

Asia Pacific is expected to grow the fastest from 2025 to 2035. This growth comes from large investments in renewable energy in China, India, and Australia. These investments will create low-cost electricity needed for affordable e-fuel production. China aims for carbon neutrality by 2060 and is developing a robust hydrogen economy, with e-fuels being important for cutting emissions in industry. Japan focuses its energy policies on hydrogen and e-fuel imports to improve energy security and meet climate goals. South Korea's Green New Deal provides significant funding for synthetic fuel technologies. Australia is becoming a major e-fuel exporter, thanks to its top-notch solar and wind resources and ample land for large-scale production. Singapore and South Korea are building e-fuel bunkering infrastructure for marine use. The rapidly growing aviation market in the region, driven by Chinese airlines and Middle Eastern hubs, creates a high demand for e-kerosene. India's ambitious renewable energy goals and expanding aviation sector position it for a strong presence in the market.

Key Players:

Recent Developments

Segments Covered in the Report

By Type

By Production Technology

By Application

By End User

By Region

The e-fuels market size is expected to increase from USD 22.5 billion in 2025 to USD 195.80 billion by 2035.

The e-fuels market is expected to grow at a CAGR of 24.1% from 2025 to 2035.

The major players in the e-fuels market include Porsche eFuel (HIF Global), Norsk e-Fuel, Sasol, Infinium, Repsol, TotalEnergies, Shell, HIF Global, Ineratec GmbH, Atmosfair, Synhelion, P2X Europe, EDL Anlagenbau Gesellschaft mbH, Carbon Recycling International, thyssenkrupp Uhde, Prometheus Fuels, Twelve, Neste, Preem AB, and Siemens Energy among others.

The main factors driving the e-fuels market include stringent decarbonization regulations and sustainable fuel mandates, increasing need to decarbonize hard-to-electrify sectors, declining renewable energy costs, growing corporate sustainability commitments, and technological advancements in Power-to-X technologies.

Europe region will lead the global e-fuels market during the forecast period 2025 to 2035.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Apr-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates