Resources

About Us

Bicycle Security System Market by System Type (Physical Locking Systems, Smart Locking Systems, Alarm-based Security Systems, GPS-Based Tracking Systems, Electronic Immobilizers), End User, and Geography - Global Forecast to 2035

Report ID: MRAUTO - 1041625 Pages: 210 Nov-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Bicycle Security System Market Size?

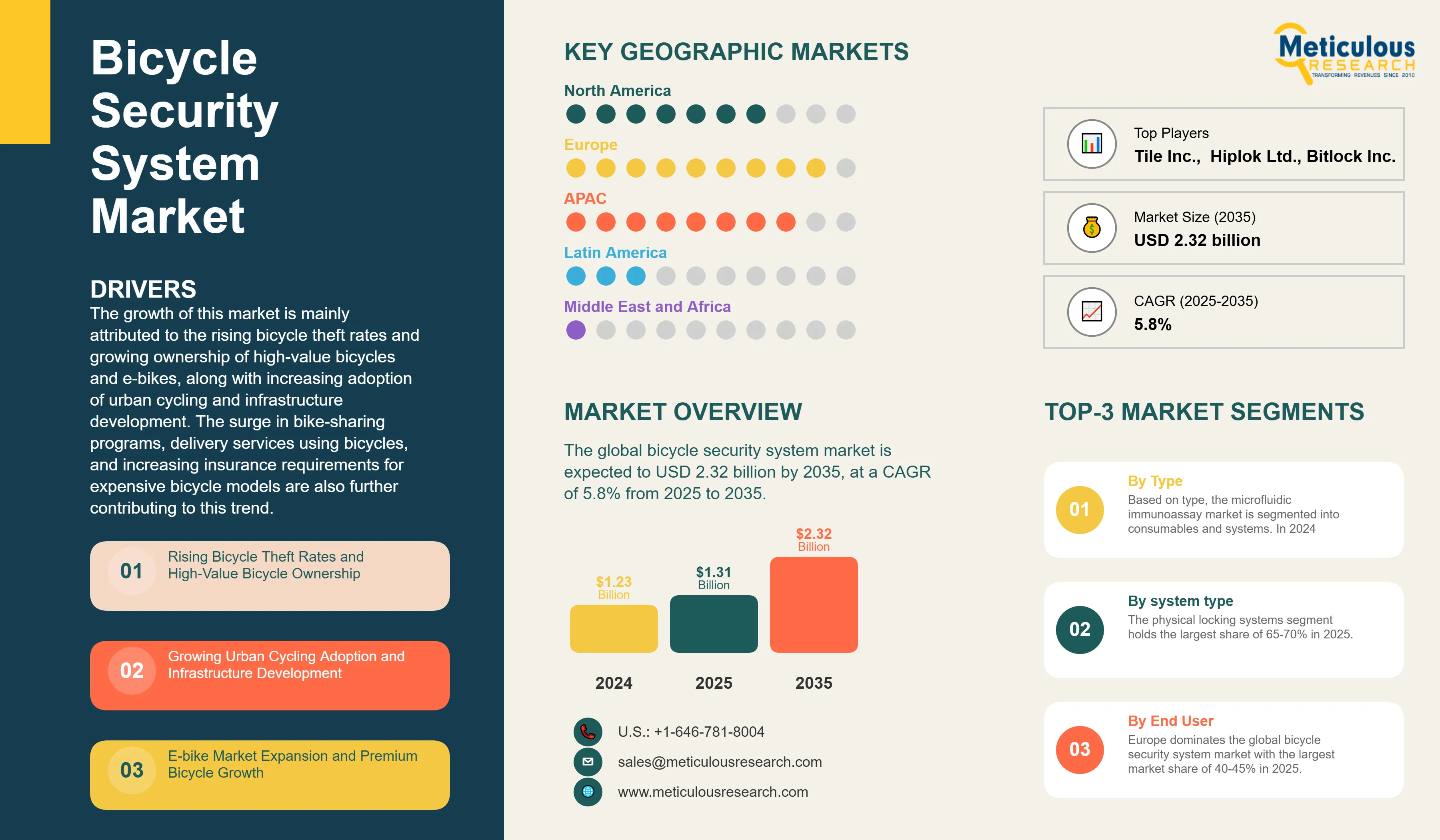

The global bicycle security system market was valued at USD 1.23 billion in 2024. This market is expected to increase from USD 1.31 billion in 2025 to USD 2.32 billion by 2035, at a CAGR of 5.8% from 2025 to 2035. The growth of this market is mainly attributed to the rising bicycle theft rates and growing ownership of high-value bicycles and e-bikes, along with increasing adoption of urban cycling and infrastructure development. The surge in bike-sharing programs, delivery services using bicycles, and increasing insurance requirements for expensive bicycle models are also further contributing to this trend.

Bicycle Security System Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The bicycle security systems range from traditional mechanical locks to smart security devices with GPS tracking, alarm systems, and IoT connectivity. The market serves individual cyclists, bike-sharing operators, delivery services, commercial fleets, and rental operations in urban and suburban areas.

Bicycle security systems use different methods to prevent theft. Physical locks provide mechanical barriers made from hardened steel and specialized locking mechanisms. Smart locks offer convenience with keyless entry and smartphone connectivity. GPS trackers allow for location monitoring and recovery. Alarm systems discourage thieves with loud alerts. The growth of this market is mainly driven by rising bicycle values (particularly e-bikes, increasing theft rates with over 2 million bicycles stolen annually in Europe and North America, growing urban cycling infrastructure, expansion of bike-sharing programs, and insurance requirements for high-value bicycles.

How is IoT and Smart Technology Transforming the Bicycle Security System Market?

Integrating Internet of Things (IoT) and smart technology into bicycle security systems enables remote monitoring, real-time theft alerts, GPS tracking for recovering stolen bikes, and easy integration with smartphone applications. Smart locks use Bluetooth, NFC, or cellular connections for keyless entry, allowing cyclists to unlock their bikes with smartphones or RFID cards. These systems remove the need for physical keys, which can be lost or copied.

GPS-enabled security systems track the location of bicycles in real time, sending immediate alerts to owners if unauthorized movement is detected. Geofencing features notify users when bikes leave designated safe areas. Motion sensors and accelerometers detect tampering, activating loud alarms that exceed 100 decibels to scare off thieves. Machine learning algorithms examine usage patterns to tell the difference between legitimate use and theft attempts, which reduces false alarms.

Cloud-based platforms support fleet management for bike-sharing operators and commercial users. They allow centralized monitoring of multiple bicycles, provide usage analytics, and send alerts for maintenance. Integration with insurance telematics enables variable premium pricing based on security measures and theft risks. Blockchain technology is also being looked at for verifying bicycle ownership and reporting theft. These smart features increase recovery rates from under 5% with traditional locks to between 30% and 50% with active GPS tracking while giving cyclists convenience and peace of mind.

What are the Key Trends in the Bicycle Security System Market?

E-bike Security Demand Surge: One major trend in the bicycle security market is the fast-growing demand for advanced security solutions specifically for electric bicycles. E-bikes, which average between USD 2,500 and 4,000, with premium models costing over USD 10,000, are far more likely to be stolen than regular bicycles. The global e-bike market is expected to reach USD 88.3 billion by 2032, creating a significant demand for security systems. E-bike security systems are increasingly integrating with the bike's electronic systems. This includes battery immobilizers that prevent motor operation when locked, electronic wheel locks that engage with the bike's control system, and GPS trackers powered by the e-bike's battery. Some manufacturers are including security features directly in the e-bike frames during production, making them harder to defeat or remove. Insurance companies are also requiring approved security devices for e-bike coverage, with some offering 10-20% discounts on premiums for bikes equipped with GPS tracking. This trend is particularly strong in European markets where e-bike adoption is the highest.

Integrated Bike-Sharing Security Systems: Another significant trend is the creation of integrated security systems designed specifically for bike-sharing operations. With over 2,000 bike-sharing programs around the world and major cities deploying thousands of shared bicycles, operators need advanced security solutions that combine theft prevention with user convenience. Modern bike-sharing security systems integrate smart locks with docking stations, GPS tracking for monitoring fleets, automated theft detection using usage pattern analysis, and smooth payment integration. Some systems utilize smartphone-based locking without physical docking stations, relying completely on GPS geofencing and electronic locks. Bike-sharing security must manage high volumes of automated locking and unlocking, endure weather exposure and vandalism, provide real-time visibility for operators, and enable quick responses to theft or maintenance issues. The subscription-based bike-sharing business model justifies investments in advanced integrated security, which pushes innovation that eventually benefits consumer products.

Market Scope

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 2.32 Billion |

|

Market Size in 2025 |

USD 1.31 Billion |

|

Market Size in 2024 |

USD 1.23 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 5.8% |

|

Dominating Region |

Europe |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

System Type, Lock Type, End User, and Region |

|

Regions Covered |

Europe, North America, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Bicycle Theft Rates and High-Value Bicycle Ownership

The market for bicycle security systems is primarily driven by the consistently high rate of bicycle theft and rising bicycle values. In North America and Europe combined, more than 2 million bicycles are stolen each year, with theft rates being especially high in urban areas. Tens of thousands of bicycle thefts occur each year in major cities like London, New York, Amsterdam, and San Francisco; recovery rates for bicycles without tracking devices are less than 5%.

Since e-bikes and high-end conventional bicycles have become more popular, the average value of stolen bicycles has increased dramatically. With average prices between USD 2,500 and USD 4,000 and premium models costing over USD 10,000, e-bikes currently account for 20–30% of new bicycle sales in major European markets. Mountain bikes, cargo bikes, and high-performance road bikes all fetch high prices. Bicycle owners are more inclined to invest in complete security as a result of the rise in bicycle values, which also makes theft more profitable for criminals.

High-value bicycles are the target of organized theft rings, which use power tools to break traditional locks in less than 60 seconds. Expert thieves are able to swiftly disassemble bicycles for parts sold on internet marketplaces after identifying valuable components. The need for cutting-edge security solutions that integrate electronic tracking and alarms with physical barriers is fueled by this sophistication. Quality security systems are in high demand as insurance companies increasingly require approved security devices for coverage of pricey bicycles. For policies that cover bicycles worth more than $1,000–$2,000, many insurers require particular security ratings (like Sold Secure Diamond or ART ratings).

Restraint

Price Sensitivity and Perceived Value Mismatch

Due to consumer price sensitivity and perceived value mismatches, the bicycle security system market faces significant adoption barriers despite high theft rates. Although industry guidelines advise allocating 10–20% of a bicycle's value to security, actual consumer spending usually is much less than this amount. Despite owning bicycles worth hundreds or thousands of dollars, many cyclists buy cheap cable locks that offer little security for around $10–$20.

This value gap is a result of a number of factors, such as sticker shock due to the high cost of quality locks, which range from USD 80-150 for physical locks and USD 150-300 for smart locks, the inconvenience of carrying heavy, high-security locks weighing 2-4 kilograms, and optimism bias, which makes cyclists believe that they won't be stolen. Despite providing superior theft recovery capabilities, premium GPS tracking systems that charge subscription fees of USD 5–10 per month encounter particular resistance.

Online lockpicking tutorial videos and obvious lock defeats worsen the perceived value mismatch by undermining consumer trust that even pricey locks offer sufficient security. Concerns about battery life (usually 1-3 months), connectivity dependability with Bluetooth and cellular connections, and technology obsolescence all contribute to the skepticism surrounding smart locks. Due to price sensitivity and doubts about protection's efficacy, these factors produce a difficult market dynamic where consumers who need security the most- owners of expensive bicycles in high-theft urban areas frequently underspend on protection.

Opportunity

Urban Cycling Infrastructure Expansion and Commuter Growth

The bicycle security systems market offers significant potential due to the growing number of commuter cyclists and the rapid development of urban cycling infrastructure. As part of sustainable transportation initiatives, cities around the world are spending billions on bike-sharing programs, secure parking lots, and protected bike lanes. Since 2020, more than 200 cities have made major investments in bicycle infrastructure, and by 2030, there will likely be one billion urban cyclists worldwide.

Secure bicycle parking infrastructure represents a particularly significant opportunity. The need for compatible security systems is growing as more cities install monitored bike parking facilities with access control, security cameras, and individual bicycle locking points. Bicyclists can lock their bikes to racks that automatically check for theft at certain facilities that offer integrated security. In an effort to promote cycling, secure bike parking is becoming more and more common on university campuses, corporate campuses, and transit stations; therefore, security solutions are needed for these establishments.

The commuter cyclist segment shows particular willingness to invest in quality security, recognizing the need for reliable daily bicycle access. Commuters typically own mid-to-high value bicycles used regularly, justifying security investment. Growing bike-to-work programs and employer bicycle benefits create institutional purchasing of security systems. Some cities offer security system subsidies as part of cycling promotion programs. E-bike adoption is particularly strong among commuters due to longer distances and hillier terrain, further driving security demand.

System Type Insights

Why Do Physical Locking Systems Dominate the Market?

With a market share of roughly 65–70% in 2025, the physical locking systems segment leads the overall bicycle security systems market. This is primarily attributed to their demonstrated mechanical security that doesn't require batteries or connectivity, wide compatibility with bike types and parking infrastructure, lower price points (quality locks range from USD 30-150), established consumer familiarity and trust in mechanical security, and the fact that there are no ongoing subscription fees or concerns about technology obsolescence.

However, the smart locking systems segment is expected to grow at the fastest CAGR through 2035. Smart locks, which are popular with tech-savvy cyclists and bike-sharing operators, do away with physical keys by using a smartphone, NFC card, or numerical code entry. Keyless convenience allows family members or renters to share bicycles and avoid lockouts due to misplaced keys. Usage tracking, automated locking reminders, and theft alerts are all made possible by smartphone integration. Certain smart locks combine cellular connectivity for remote monitoring and GPS tracking with Bluetooth for close-range unlocking. Smart locks are especially preferred by bike-sharing companies for automated fleet management; though consumer adoption faces barriers including higher prices, battery life concerns, and connectivity reliability questions.

End User Insights

Why Do Individual Consumers Dominate Market Demand?

Based on end user, the individual consumers command the largest share of the overall market. Since hundreds of millions of bicycle owners worldwide need theft prevention, the vast majority of market volume is made up of individual cyclists purchasing security for personal bicycle protection. Consumer purchases range widely, from those on a tight budget who choose cable locks for less than $20 to cyclists who prioritize security and spend $100–300 on high-security locks and GPS trackers.

Based on factors like bicycle value, local theft risk, parking conditions (secure garage vs. street parking), and convenience priorities, individual consumer security needs differ greatly. In cities with high rates of theft, urban cyclists are more willing to spend money on high-quality security and put up with the inconvenience of bulky locks. Owners of e-bikes can more easily defend their premium security investments because they are safeguarding assets worth an average of USD 2,500–4,000. Enthusiastic cyclists who own pricey road or mountain bikes frequently employ layered security strategies that combine secondary cable locks for wheels and accessories with primary U-locks.

Nonetheless, through 2035, the bike-sharing operators segment is anticipated to grow at the fastest CAGR. Thousands of bicycles are operated by bike-sharing programs in major cities across the globe, necessitating integrated security solutions that strike a balance between operational effectiveness and preventing theft. Smart locks with GPS tracking, automated locking and unlocking via RFID cards or smartphone apps, fleet monitoring dashboards, and usage analytics are all part of contemporary bike-sharing security. Because bicycle loss has a direct impact on profitability, the subscription-based revenue model justifies a large investment in per-bike security. Demand for scalable, dependable, automated security systems that can manage sizable fleets with little human intervention is being driven by the growth of bike sharing, especially in Asian markets.

Europe Bicycle Security System Market Size and Growth 2025 to 2035

The Europe bicycle security system market is projected to be worth around USD 1.05 billion by 2035, growing at a CAGR of 5.4% from 2025 to 2035.

How is Europe Bicycle Security System Market Growing Dominantly Across the Globe?

Europe holds the largest market share of around 40-45% of the global bicycle security system market in 2025. A range of factors support this dominance, including the world’s highest cycling adoption rates (with the Netherlands and Denmark exceeding 25% of the modal share), extensive cycling infrastructure featuring protected bike lanes and secure parking in major cities, and a mature bicycle retail ecosystem offering diverse security products. Additionally, widespread bike-sharing programs across most European cities, high bicycle ownership with e-bikes accounting for over 20% of new sales, strict insurance regulations mandating approved security devices, and heightened public awareness of bicycle theft as a major urban concern all reinforce this strong market position.

European cities record some of the highest bicycle theft rates worldwide, with tens of thousands of incidents reported annually in Amsterdam, London, Paris, Berlin, and Copenhagen. This persistent threat creates a continuous demand for advanced bicycle security solutions. The high value of European bicycle fleets, driven by strong premium and e-bike ownership further increases their attractiveness to thieves and reinforces investment in robust protection.

In several European countries, bicycle insurance coverage requires compliance with specific security certification standards, such as Sold Secure, ART, and VdS, thereby driving demand for certified products. Leading manufacturers including ABUS (Germany), Axa (Netherlands), Litelok (UK), and Hiplok (UK) are at the forefront of innovation, continually developing new locking mechanisms, materials, and smart security features. In contrast to weight-sensitive American cyclists, European riders show greater acceptance of heavier, more secure locking systems.

Strong cycling advocacy networks and a well-established cycling culture promote informed purchasing and adherence to security best practices. Moreover, as cycling becomes increasingly integrated into European smart city initiatives, opportunities are emerging for connected security systems that interact with parking infrastructure and urban management platforms.

Which Factors Support the Asia Pacific Bicycle Security System Market Growth?

The Asia Pacific region is expected to record the fastest CAGR between 2025 and 2035, driven by a mix of expanding urban mobility programs and changing consumer behavior. While current spending on bicycle security per unit remains relatively low, China’s vast e-bike market—home to more than 300 million e-bikes represents the world’s largest potential market for bicycle security products. As consumers in China shift toward higher-end e-bikes, premiumization is boosting both awareness of security risks and willingness to invest in theft prevention.

Across major Asian cities such as Beijing, Shanghai, Tokyo, Singapore, Mumbai, and Bangkok, investments in cycling infrastructure and bike-sharing programs are accelerating. In several Chinese cities, millions of shared bicycles have already been deployed, creating strong demand for integrated and connected security systems that can safeguard shared fleets. At the same time, governments are promoting cycling as a sustainable solution to urban congestion and pollution, reinforcing the growing focus on secure and well-managed bicycle mobility networks.

Across Asia, a growing middle class in countries such as China, India, and those in Southeast Asia is driving demand for higher-value bicycles, including imported models from global brands. This shift is naturally increasing the need for better security solutions. E-bike adoption continues to surge, particularly in China and India, creating sustained demand for reliable protection of these high-value assets. Responding to this trend, several Chinese smart lock manufacturers are developing affordable, feature-rich products tailored to regional consumer preferences and infrastructure realities.

Segments Covered in the Report

By System Type

By End User

By Region

The bicycle security system market is expected to increase from USD 1.23 billion in 2024 to USD 2.32 billion by 2035.

The bicycle security system market is expected to grow at a CAGR of 5.8% from 2025 to 2035.

The major players include ABUS August Bremicker Söhne KG, Allegion plc (Kryptonite), OnGuard (Focused Bike Security), Hiplok Ltd., Master Lock Company LLC, Litelok Ltd., Axa Stenman Group, Squire Locks, Oxford Products Ltd., Knog Pty Ltd., VanMoof B.V., Bosch eBike Systems, Tile Inc., Apple Inc. (AirTag for Bicycle Tracking), Alterlock Inc., Sherlock Bike, See.Sense Ltd., Bitlock Inc., I LOCK IT GmbH, and Lock8 GmbH.

The driving factors include rising bicycle theft rates particularly in urban areas, growing ownership of high-value bicycles and e-bikes, expanding urban cycling adoption and infrastructure development, surge in bike-sharing programs and delivery services, and increasing insurance requirements for expensive bicycle models.

Europe region will lead the global bicycle security system market during the forecast period 2025 to 2035, supported by high cycling adoption rates, established cycling infrastructure, and strong security awareness among consumers.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates