Resources

About Us

Automotive Gesture Recognition HMI Market by Technology (Visual Interface, Acoustic Interface), Display Size (<5, 5–10,>10), Vehicle Type (Passenger Cars, Commercial Vehicles), Application, Access Type, Sales Channel, and Geography—Global Forecast to 2035

Report ID: MRAUTO - 1041618 Pages: 205 Oct-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Automotive Gesture Recognition HMI Market Size?

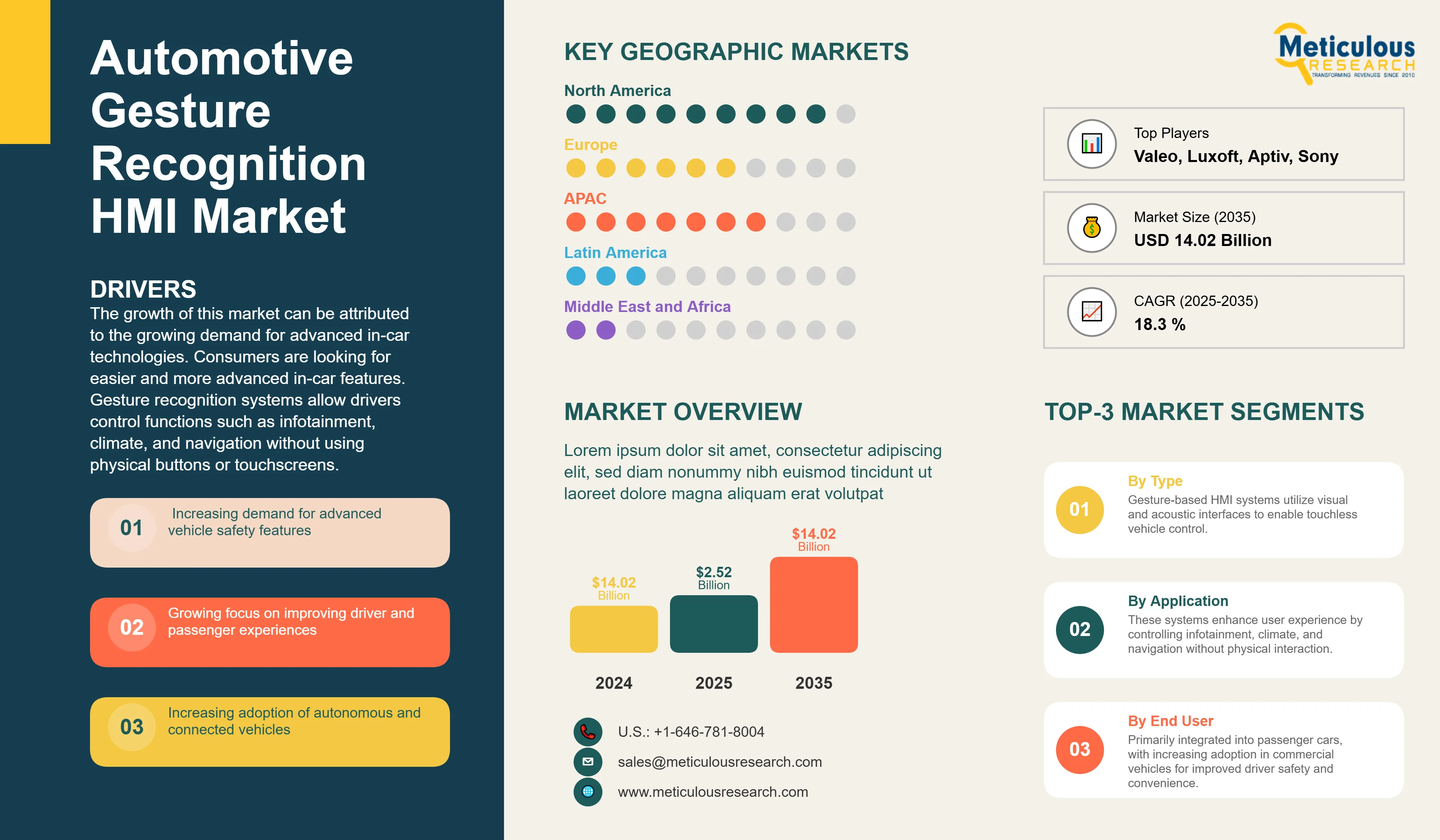

The global automotive gesture recognition HMI market was valued at USD 2.13 billion in 2024 and is expected to grow from USD 2.52 billion in 2025 to USD 14.02 billion by 2035, at a CAGR of 18.3% from 2025 to 2035. The growth of this market can be attributed to the growing demand for advanced in-car technologies. Consumers are looking for easier and more advanced in-car features. Gesture recognition systems allow drivers control functions such as infotainment, climate, and navigation without using physical buttons or touchscreens. Furthermore, automotive HMIs are increasingly using multimodal interfaces that combine different input methods for user interaction. This approach allows users to choose the most convenient and appropriate input method for each situation, whether touchscreen, voice commands, gestures, or physical controls.

Automotive Gesture Recognition HMI Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The Automotive Input Human-Machine Interface (HMI) encompasses the systems and technologies that allow the driver and passengers to interact with the vehicle and connect their efforts to the vehicle’s electronic systems. As vehicles today are becoming more advanced, the HMI has become an important role in communicating securely and efficiently with the vehicle’s electronic systems.

HMIs have a variety of different input methods touch screens, speech commands, gesture recognition, buttons on the steering wheel, and so on, which may even have advanced haptic feedback HCIs. In this way, automotive input HMIs have the vision to reduce user distraction, enhance user experience, and provide a user-friendly method to control infotainment, navigation, climate control, and vehicle diagnostics.

Along with traditional input methods, multimodal HMIs, which combine different forms of inputs, have been a prominent trend in the automotive industry. For example, a driver could use voice commands to change the temperature setting and simultaneously touch the screen to navigate to a selected destination, a helpful and efficient way to control the vehicle.

The growing road traffic accidents from inattention, fatigue, or impaired driving are driving the growth of this market. The National Safety Council reports that almost 20,900 people died in preventable traffic crashes in the U.S. in the first half of 2024. Automotive gesture recognition is an essential component of driver monitoring systems (DMS), which aim to improve road safety. DMS will monitor drivers and recognize fatigue or distraction and provide alerts to help prevent accidents.

The development of the HMIs will also be associated with the development of autonomous driving, which will also require the interface to be able to refer to the state of the vehicle and to alert passengers in a way that is comprehensible and timely. In summary, the automotive input HMI is a very important juncture of ergonomics, technology, and user experience in how the driver and passengers will experience communication with the automotive vehicle today and in the future.

How is AI Transforming the Automotive Gesture Recognition HMI Market?

Artificial Intelligence (AI) is transforming the automotive market of gesture recognition for Human-Machine Interface (HMI) systems by making in-vehicle interactions more natural, personalized, and safe. AI-based solutions enable individuals to control settings such as infotainment, climate, and navigation by simple, touchless gestures, all while reducing distractions and contributing to driver safety.

By utilizing high-resolution cameras, infrared sensors, and machine learning capabilities, these applications can identify a wide variety of gestures, even in difficult lighting and settings. The AI-based interface opens the door to awareness of gestures in combination with voice commands and other HMI systems to create a fully integrated interface that operates as seamlessly as possible.

Current estimates predict continued growth in the adoption of gesture recognition, with Europe leading in adoption due to regulatory demand for safe vehicle operation and Asia-Pacific cited as the fastest and strongest opportunity as vehicle builds and demand for advanced features continue to rise. The result has been a dramatic increase in interest for gesture recognition systems among OEMs.

Ultimately, the evolution of AI-based solutions will lead to driver experiences that are more responsive, personalized, and appropriate for the future of electric and autonomous vehicles.

What are the Key Trends in the Automotive Gesture Recognition HMI Market?

Multimodal and AI-Based Experiences: A significant development is the movement toward the use of multimodal human-machine interaction systems that combine gesture with touch control, voice commands, and haptic feedback. The advantage of multimodal interfaces is that they give drivers and passengers the option of using the most logically rational and intuitive way to complete a task, through their preferences and driving context. AI-powered gesture recognition elevates the experience by offering automotive controls that adapt to learned user behavior and the context of the situation, creating an intuitive, highly personalized set of control options.

Several new launches and high-value partnership developments have emerged in the automotive gesture recognition and multimodal AI-based HMI. In February 2025, SAIC Motor and Huawei have signed a strategic cooperation agreement on the development of smart electric vehicles based on a sophisticated multimodal HMI system. This collaboration is aimed at providing a more engaging user experience by melding gesture, voice, and touch inputs in next-generation electric vehicles, leveraging SAIC experience in automotive manufacturing and Huawei's expertise in smart technology.

Touchless Control and Health Concerns: Post-pandemic, there was significant consumer interest towards the contactless model of human-machine interaction, as gesture systems provide an intuitive, touchless form of operating a vehicle. Ultimately, employing touchless controls reinforces the perception of futuristic luxury, but importantly, it provides consumers a way in which to address the issue of health and cleanliness when using shared modes of transportation, as well as a motor vehicle (particularly for commercial vehicles utilized by multiple drivers).

Interest from consumers in touchless controls and gesture-based human-machine interfaces has increased after the pandemic due to health and cleanliness concerns while using shared devices and vehicles.

Industry leaders continue to invest in AI-supported biometric systems, emotion identification, and augmented (AR) head-up displays (HUDs) to support immersive and non-verbal interactions, all of which will make the vehicle driving experience safer and also satisfy consumer desires for a futuristic connection that is increasingly personalized to their needs and preferences. This paradigm shift serves as the automotive industry's pivot toward fully digital vehicle interfaces and touchless, hyper-connected, driver-vehicle interaction.

Innovation and Luxury Differentiation: Gesture-based human-machine interaction is already being used as a measure of tech sophistication in the luxury market. For example, OEM auto manufacturers, such as BMW, Mercedes Benz and Jaguar, have featured 3D gesture cameras, biometric recognition systems, haptic feedback (ultrasonic) controls, and a wide modality of customization platforms. This is only the beginning, as gesture controls are no longer limited to infotainment, but extend to seat control, climate control and lighting. Gesture and haptic controls are a complete in-cabin experience that can get into monetization and luxury differentiation.

In 2025, OEM automakers such as BMW, Mercedes-Benz, and Jaguar unveiled a new generation of advanced touchless HMI features. For example, during CES 2025, BMW demonstrated its Panoramic iDrive system that leverages the new BMW Operating System X and includes 3D gesture camera capabilities, biometric recognition (fingerprints), and active haptic feedback controls with steering wheel buttons for the Neue Klasse models in late 2025 and beyond. The system features support for multimodal interaction that combines voice, touch, gesture, and AI-based personalization.

Similarly, Mercedes-Benz's MBUX system includes an AI-powered voice and adaptive personalization, multimodal input methods, and gesture/touchless controls that assist in providing distraction-free driving, with a focus on user input safety. Jaguar incorporates haptic feedback and biometric user recognition in their newest electric models, providing personalized and intuitive modes of control features based on user preference.

These automakers focus on safety, user convenience, and futuristic aesthetic design by integrating combinations of ultrasonic haptic feedback, biometric authentication of the driver, and customizable modes of interaction - producing a vastly improved user experience in 2025.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 14.02 Billion |

|

Market Size in 2025 |

USD 2.52 Billion |

|

Market Size in 2024 |

USD 2.13 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 18.3 % |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Technology, Display Size, Vehicle Type, Application, Access Type, Sales Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Premium Cars Stand Out Through Advanced HMI Integration

High-end automakers are increasingly using gesture controls as a key feature in the luxury segment. BMW's Panoramic iDrive and Mercedes-Benz’s MBUX Interior Assist systems show how touchless control technologies reflect technological leadership and improve the user experience. At CES 2025, Continental displayed a demonstration vehicle with gesture recognition and biometric authentication. This allows drivers to adjust settings like seat position, climate control, and ambient lighting with hand gestures while keeping their focus on the road. Jaguar Land Rover and others have rolled out contactless touchscreen technologies. These do not replace physical controls but improve them by using ultrasonic haptics to create tactile feedback without requiring actual finger contact. These innovations show how manufacturers aim to create emotional engagement and offer perceived value, allowing them to charge premium prices, even as traditional mechanical features become more common across vehicle segments.

Restraint

Cost-Imposed Limitations to Mass Market Penetration

Gesture recognition systems in cars are leading technology for human-machine interaction. However, they come with high costs that limit their wider use, especially in mass-market and emerging vehicle segments. Basic systems usually need special parts like cameras (including high-resolution and infrared), sensors, and dedicated processors. These also require software licenses, pushing the initial costs for these modules from about USD 150 to over USD 1,000 for advanced AI-enabled platforms. Adding multiple cameras to ensure reliable recognition in different lighting and environmental conditions increases expenses even more.

Beyond hardware, companies face significant expenses in software integration, extensive testing, and compliance validation required by original equipment manufacturers (OEMs). Gesture systems must be sturdy across thousands of possible operational scenarios and meet strict automotive safety standards. This requirement can extend verification cycles by 18 to 24 months beyond the main human-machine interaction development phases. Such complexity adds both time and financial pressure to the development process.

Commercial and fleet vehicles encounter additional financial challenges since operators expect clear returns on investment. Gesture control features need to show productivity gains or regulatory advantages quickly to justify their upfront costs.

In summary, while gesture recognition in cars improves interaction safety and driver convenience by allowing touchless controls, the high costs tied to hardware, software integration, and regulatory compliance create significant obstacles for wider use outside premium segments. Lowering costs through better sensor technology, smoother integration, and increased production efficiency will be crucial for gaining acceptance in the mass market.

Opportunity

Rising innovation in field of autonomous mobility solutions

The shift to autonomous vehicles has changed the driver's role from an active controller to a passive observer or monitor. This new situation requires improved HMI solutions that provide important information to drivers and passengers, promoting engagement and safety through data processing and AI.

An evolving HMI must cover essential areas like driver-vehicle handover, where the driver needs to take control quickly, and emergency response situations that need clear and immediate communication. For instance, Waymo's second-generation HMI system gives passengers real-time route details, system responses, and voice-activated controls to adjust routes on the fly, which improves safety and comfort. Likewise, Cruise’s HMI displays real-time surroundings using multisensor and multi-camera systems, helping passengers make informed decisions during their rides.

Other developers, including Intellias in the U.S., Star in the U.S., and Boréas Technologies in Canada, are also making strides in this field. They are adding to a growing ecosystem of HMIs that focus on open communication and smooth interaction for users of autonomous vehicles. This change opens new market opportunities for HMI providers to tackle unforeseen challenges and create new income streams aimed at enhancing passenger experience and safety.

Driver monitoring systems, including those from Mobileye and FEV, use AI-powered cameras and sensors to monitor driver attention, drowsiness, and distractions. They integrate this data with information about the vehicle's surroundings to improve handover timing and emergency responses. Regulatory guidelines in various regions now require advanced driver monitoring to boost safety in semi-autonomous and autonomous vehicles.

In summary, autonomous vehicle HMIs are quickly evolving to tackle the challenges of new user roles, safety needs, and passenger comfort. This development presents significant opportunities for technology developers in this changing landscape.

Vehicle Insights

Why do Passenger Cars Dominate the Market?

The passenger cars segment holds the largest share of XX% of the overall automotive gesture recognition HMI market in 2025. The mid-priced passenger car sector, which is projected to develop fastest, will be the primary contributor to the development of the automotive HMI market. This market segment contains vehicles with a reasonable level of price versus features for a large number of potential buyers, and as such, will provide the primary growth for this market.

A number of HMI products such as center display screens, steering wheel mounted controls, multifunction switches, and instrument cluster displays, have been included in the mid-priced passenger cars segment and continue to have a degree of growth and performance. In addition, certain top trims of mid-priced vehicles, will employ effective, HMI products such as gesture recognition, heads-up display (HUD), rotary control, and advanced voice control technologies typically seen in high-end premium level vehicles as a means to set themselves apart from competitive products. As a result, the existing mid-priced passenger car segment product set along with the recent capabilities integrated into cost-effective HMI, and the growing inclination to investigate these high-end HMI solutions will solidify the mid-priced passenger car HMI market segment lead position.

Application Insights

How does Touchscreen Displays Support Automotive Input HMI?

The touchscreen displays segment commands the largest market share of the global automotive gesture recognition HMI market in 2025. By leveraging central touch screens, drivers and passengers can easily access and adjust several functions and settings of the vehicle, while providing a user-friendly experience and overall improved user experience through its convenience, interactivity, and navigation intuitiveness. Central touch screens have become an increasingly popular feature in vehicles due to developments in technology and the ability to include more advanced features, such as navigation and media playback, as well as smartphone integration. Automakers are positioned to ramp up the market for central touchscreen displays, driven by demand, innovation and new developments in the space.

Access Insights

How does Standard HMI Dominated the Market?

Based on access, the standard HMI segment holds the largest market share in 2025. This is mainly attributed to its long-term use in standard vehicle interfaces. Standard HMI which encompasses traditional touch screens, physical buttons, or rotary controls is still prevalent in today's automotive market due to its reliability, the user's comfort with it, and affordability. Hence, standard HMI is a key component in a large number of driver-vehicle interactions across the automobile companies' passenger and commercial vehicle offerings.

Although multimodal and advanced gesture-based HMIs are innovating quickly, standard HMI continues to occupy a strong spot in the market in particular, in the mid-range and entry-level market spaces that are less inclined to adopt new technologies because of cost issues. However, there will also be an increased demand for more intuitive and effortless interfaces (gesture, voice, etc.) alongside standard HMI as automation and connectivity expand.

Display Size Insights

Why does the 5–10 Inch Display Size Lead the Market?

The 5–10 inch display size segment commands the largest share of the overall automotive gesture recognition HMI market in 2025. The size range is commonly used because it is a good balance between area for visibility and cabin space. It works well for displaying infotainment content and important vehicle information without obstructing the driver's field of view. Displays in this size range allow for immediate legibility of text and graphics, which is crucial for safe and comfortable interaction. To that end, compact displays are purposeful in maintaining the design language and functional presentation of the vehicle interior, and they are particularly suited for premium vehicles.

Sales Channel Insights

Why does OEM Lead Sales Channel Adoption?

The OEM segment holds the largest market share in 2025. In the automotive gesture recognition HMI market, the OEM (Original Equipment Manufacturer) sales channel clearly leads, being an indication of the direct incorporation of gesture recognition systems in vehicles during manufacturing.

OEMs, especially premium and luxury carmakers, are at the forefront of integrating gesture and contactless control systems to improve user experience and safety by minimizing distractions. These advanced HMI technologies, often powered by AI and including biometric authentication, help make vehicles stand out in competitive markets like Europe, North America, and Asia-Pacific. Although high costs limit widespread use right now, ongoing collaboration with technology partners seeks to make these systems more affordable and increase their availability. Overall, gesture recognition is essential for improving convenience, safety, and the sense of innovation in premium automotive segments, with gradual growth expected as technology develops and costs come down.

U.S. Automotive Gesture Recognition HMI Market Size and Growth 2025 to 2035

In the U.S., consumers have quickly adopted new automotive technologies. This has created a demand for easy-to-use infotainment systems, gesture controls, and biometric authentication in cars. A tech-savvy population, comfortable with smartphones, wearables, and smart home devices, shows strong interest in touchless vehicle interfaces. North America is at the forefront of autonomous vehicle development, which makes gesture recognition and biometrics important as control shifts from drivers to AI systems.

Gesture recognition allows for touchless control of navigation, climate, and entertainment functions. This feature helps reduce driver distraction and improves safety. Automakers are increasingly adding these technologies to their vehicles to enhance convenience and personalize the in-cabin experience. Although costs and technical challenges limit immediate widespread use, ongoing innovations and trends in consumer adoption suggest significant growth potential for gesture-based human-machine interfaces by 2035.

How is the Asia Pacific Automotive Gesture Recognition HMI Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest share of the global automotive gesture recognition HMI market because of fast vehicle production and strong demand in countries like China, Japan, South Korea, and India. The region has a solid manufacturing base and a strong push for electric and connected vehicles. Major car companies like Toyota, Hyundai, and Honda make significant investments here. Consumers in this area are tech-savvy and interested in modern in-car features like gesture and biometric controls. This interest comes from rising middle-class incomes and government incentives that support electric mobility. These factors make Asia Pacific the leading player in automotive gesture technology worldwide.

Which Factors Support the North America Automotive Gesture Recognition HMI Market Growth?

The North America automotive gesture recognition HMI market is expected to grow at the fastest CAGR from 2025 to 2035. In North America, and more specifically the U.S., consumers have a propensity to adopt technology more quickly than people in other parts of the world. This leads to demand for new infotainment systems, ease-of-use interfaces, and biometric systems in vehicles. Given the tech-savviness and prevalent early adopters, North America will be the most important region for gesture recognition solutions.

The region's leadership in autonomous driving technology also speeds up this growth. Gesture recognition systems become vital for managing vehicles that depend less on manual controls. Additionally, North America has a strong network of automotive manufacturers and technology companies that are innovating in gesture recognition. This fosters continuous development and integration of advanced HMI solutions.

Recent Developments

Segments Covered in the Report

By Technology

By Display Size

By Vehicle Type

By Application

By Access Type

By Sales Channel

By Region

The automotive gesture recognition HMI market is expected to increase from USD 2.52 billion in 2025 to USD 14.02 billion by 2035.

The automotive gesture recognition HMI market is expected to grow at a CAGR of 18.3% from 2025 to 2035.

The top companies active in the automotive gesture recognition HMI market in 2025 include Continental AG, Sony Corporation, Synaptics Incorporated, Visteon Corporation, Aptiv, HARMAN International, Valeo, Luxoft, Clarion Co., Ltd., Alpine Electronics, Marelli, STMicroelectronics, NVIDIA Corporation, NXP Semiconductors, and Qualcomm Incorporated, among others.

The market for automotive gesture recognition human-machine interfaces (HMIs) largely derives from the rising need for safe, hands-free interaction as well as growing adoption of connected and smart vehicles. All of the latest advancements in artificial intelligence, 3D sensors, and motion tracking technologies has made gesture recognition more accurate and reliable, improving driver comfort and limiting distractions.

Asia Pacific region will lead the global automotive gesture recognition HMI market during the forecast period 2025 to 2035.

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Sep-2024

Published Date: Sep-2024

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates