Resources

About Us

Robotaxi Market Analysis and Forecast Size, Share, Forecast & Trends by Application (Goods Transportation and Passenger Transportation) Level of Autonomy (Level 4 and Level 5) Vehicle Type, Propulsion, and Component - Global Forecast to 2035

Report ID: MRAUTO - 1041591 Pages: 205 Sep-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportRobotaxi Market Analysis and Forecast Booms as Autonomous Mobility Innovations Drive Growth

Market Summary

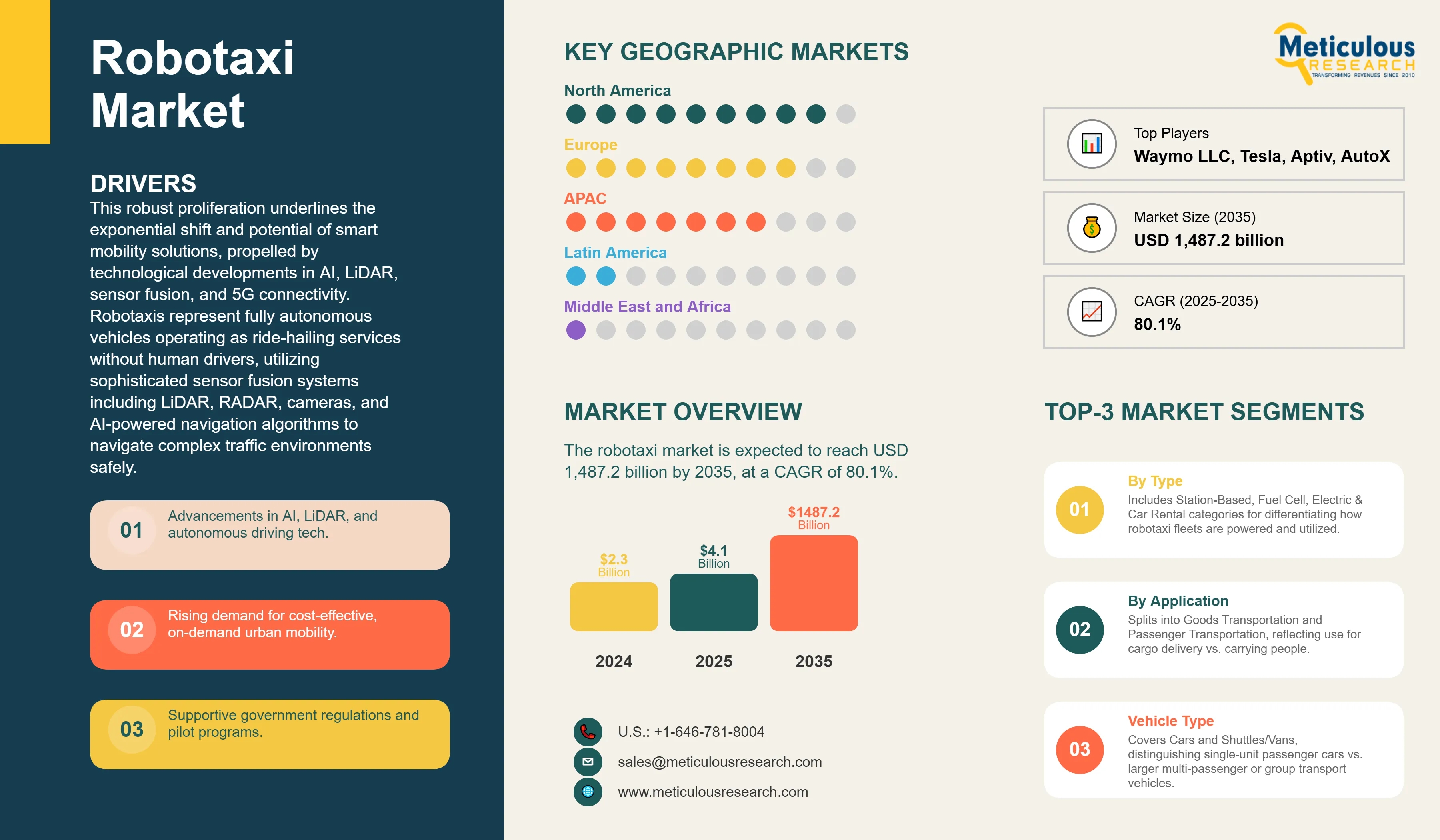

The robotaxi market was valued at USD 2.3 billion in 2024. The market is expected to reach USD 1,487.2 billion by 2035 from USD 4.1 billion in 2025, at a CAGR of 80.1%. This robust proliferation underlines the exponential shift and potential of smart mobility solutions, propelled by technological developments in AI, LiDAR, sensor fusion, and 5G connectivity. Robotaxis represent fully autonomous vehicles operating as ride-hailing services without human drivers, utilizing sophisticated sensor fusion systems including LiDAR, RADAR, cameras, and AI-powered navigation algorithms to navigate complex traffic environments safely.

Additionally, mass commercialization, incorporation into urban autonomous transportation ecosystems, and assistive supervisory frameworks are projected to fuel the utilization at scale. With the promise of lower traffic bottlenecks, reduced emissions, and sustainable & affordable urban mobility, robotaxis are anticipated to revolutionize the global transportation landscape, transitioning from experimental services into a major mode of transport that transforms urban transportation approach.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The robotaxi market is characterized by intense competition among leading technology innovators, automotive manufacturers, and mobility service providers, with players such as Waymo LLC, Tesla Inc., Aptiv, Cruise LLC, Uber Technologies Inc., Lyft Inc., AutoX Inc., Didi Chuxing Technology Co., Baidu, and Zoox Inc. driving industry transformation. These companies are pursuing aggressive strategies, including pilot programs, strategic partnerships, mergers and acquisitions, and cross-industry collaborations to accelerate commercialization.

Recent Developments

Tesla Secures Texas License to Operate Robotaxi Service

In August 2025, the Texas Department of Licensing and Regulation officially approved Tesla to allow its Robotaxi to operate as a registered company as a transportation network company across the state until August 6, 2026. This also allows full automation of the ride services in the sense of not having a human driver on board.

Uber Invests USD 300M in Lucid-Nuro Robotaxi Initiative.

In July 2025, Uber revealed that it plans to invest USD 300 million in Lucid Motors and use Nuro autonomous technology to roll out approximately 20,000 grids on an electric robotaxi utilised on the Lucid-Gravity SUV platform over the next 6 years. Prototypes are already being tested in the Las Vegas plant of Nuro, and it is planned to launch in one of the major cities of the United States later this year.

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Advancements in Autonomous Driving Technology |

Deployment of improved LiDAR, radar, and AI-based perception |

Fully autonomous navigation in complex urban environments |

▲ +3.6% |

|

2. Rising Demand for Cost-Effective Urban Mobility |

Early adoption by ride-hailing customers |

Robotaxis are replacing a significant share |

▲ +3.2% |

|

|

3. Supportive Regulatory Frameworks |

Expansion of government-approved testing |

Standardized global regulations |

▲ +2.9% |

|

|

Restraints |

1. Safety Concerns and Public Trust Issues |

Hesitancy among passengers due to accident reports |

Improved safety records and AI transparency boost trust |

▼ −1.5% |

|

2. High Development and Maintenance Costs |

Limits deployment scale in early years |

Economies of scale and tech cost reduction lower barriers |

▼ −1.3% |

|

|

Opportunities |

1. Expansion into Emerging Markets |

Initial pilot programs in cities with high congestion |

Large-scale adoption in Asia-Pacific, Latin America, and the Middle East |

▲ +3.0% |

|

2. Integration with Smart City Infrastructure |

Early collaborations with urban mobility planners |

Seamless integration into multimodal transport networks |

▲ +2.7% |

|

|

Trends |

1. Electrification of Robotaxi Fleets |

The majority of new deployments using EV platforms |

100% zero-emission robotaxi fleets as standard |

▲ +2.5% |

|

Challenges |

1. Navigating Complex Urban Environments |

Limited operations in well-mapped, less congested areas |

AI breakthroughs enabling full-scale urban and suburban coverage |

▼ −1.0% |

Regional Analysis

The Robotaxi Market is Dominated by North America in Revenue Share

The robotaxi market is currently dominated by North America in terms of revenue share, accounting for 35-40% share, supported by strong technological leadership, early regulatory adoption, and significant capital investments from leading players. Companies such as Waymo, Cruise, Tesla, Uber, and Lyft are spearheading large-scale pilot projects and commercial deployments across major cities, particularly in California, Arizona, and Texas, which have become hubs for autonomous mobility innovation. Favourable regulatory frameworks, including commercial permits for 24/7 driverless ride-hailing in San Francisco and state-level support for Transportation Network Company (TNC) licensing, have accelerated the path to monetization. The region also benefits from a mature EV infrastructure, robust venture capital ecosystem, and consumer familiarity with shared mobility services, which together create an enabling environment for early commercialization. With its combination of policy support, advanced R&D ecosystems, and high-profile industry partnerships, North America has secured the largest revenue share of the global robotaxi market, setting the benchmark for scalability and profitability.

Government Investment and Advanced Infrastructure Development Drive the Regional Market in the Asia Pacific

The Asia-Pacific region is expanding with a rapid CAGR of 84.3%, fuelled by rapid urbanization, government-backed smart mobility initiatives, and strong investments from both global and regional players. Countries such as China, Japan, and South Korea are leading the charge, with China at the forefront through large-scale pilot programs led by Baidu, AutoX, and Didi Chuxing, supported by favorable regulatory approvals in cities like Beijing, Shanghai, and Shenzhen. Japan is advancing robotaxi development in line with its Society 5.0 vision and upcoming international events, while South Korea integrates robotaxis into its broader smart-city and 5G ecosystem strategies. The region’s large population base, increasing congestion in megacities, and rising consumer acceptance of autonomous mobility solutions are accelerating adoption. With continued government incentives, aggressive R&D, and a strong EV infrastructure push, the Asia-Pacific is positioned as a key engine of global growth, likely to surpass other regions in deployment scale.

Country-level Analysis

Technology Leadership and Commercial Pioneer Status Drive the Market Development in the US

The U.S. is expected to maintain its significant market share, owing to robotaxi technology development and commercial deployment, with companies including Waymo, Cruise, and Tesla conducting extensive real-world testing and limited revenue-generating operations across multiple metropolitan areas. Advanced R&D ecosystems, benevolent regulations in some states, and the scale of fleet implementation make the United States have a significant share of the world robotaxi market. Early commercialization and adoption are demonstrated by companies such as Waymo and Cruise, which have deployed fully autonomous ride-hailing services to cities this month, including San Francisco, Phoenix, and Austin.

The U.S. market benefits from substantial venture capital investment exceeding USD 10 billion annually in autonomous vehicle startups and established companies expanding robotaxi capabilities. Federal agencies, including NHTSA, develop comprehensive safety frameworks and testing protocols that establish global standards for autonomous vehicle certification and commercial deployment. Consumer acceptance surveys indicate strong adoption potential among urban populations, while ride-hailing platform integration facilitates seamless service delivery and customer acquisition across established user bases.

Strategic Trials and Event-Based Deployment in Japan is Propelling the Industry Growth

Japan holds a substantial revenue share in the Asia-Pacific robotaxi market in 2025. The country is advancing robotaxi adoption through strategic trials and event-based deployment, aligning its mobility innovations with broader national initiatives such as Society 5.0 and long-term carbon neutrality goals. Rather than pursuing mass rollouts, Japan is prioritizing targeted pilot programs in controlled urban environments, focusing on safety validation, regulatory readiness, and consumer trust-building. High-profile international events, including the Tokyo 2020 Olympics and upcoming global sporting and cultural gatherings, have served as platforms to showcase autonomous mobility solutions to both domestic and international audiences. For instance, in December 2024, Waymo became the first major company to conduct robotaxi testing in Japan, launching pilot services in Tokyo in cooperation with local partners such as Nihon Kotsu and the Go taxi app across districts, including Shinjuku, Shibuya, and Minato. By coupling event-based demonstrations with structured pilot zones and international collaborations, Japan is positioning itself as a player, prioritizing safety and public confidence while steadily progressing toward broader commercialization of robotaxi services.

Segmental Analysis

Cars Segment Dominated the Market with 55-60% of Revenue Share

The car segment is expected to dominate the robotaxi market in 2025, with 60-80% of revenue share because of its applicability in urban and suburban mobility, passenger comfort, and flexibility in operation. Over 60% of the worldwide robot taxi income comes from cars instead of shuttle-based services. Growth in the segment is supported by mass-deployment projects of leaders such as Waymo, Cruise, or Baidu Apollo, which manage thousands of autonomous cars in major cities of the United States, China, and Europe. Waymo, as an example, runs more than 2000 Jaguar I-PACE electric self-driving vehicles in American cities such as Phoenix, San Francisco, Los Angeles, and Austin, and it already has tens of millions of completely self-driving journeys. Similarly, the number of Apollo Go fleets driven by Baidu has more than 700 land-based autonomous vehicles in China that have notched more than 11 million trips so far, with Cruise having hundreds of Chevrolet Bolt autonomous vehicles in California. This mass deployment indicates the sheer uptake of cars over shuttles since it proposes increased trip frequency, simplified routing in urban areas with high volumes of traffic, and is commercially viable, strengthening their superiority in the robotaxi industry.

Electric Segment Accounted for Significant Share Owing to Alignment with Sustainability Goals

By propulsion type, the electric segment is expected to acquire the significant revenue share in 2025, owing to the emerging environmental concern, supporting policies, and the cost-effectiveness of electrification. The shift in the industry towards electric propulsion is evident, with more than two-thirds of all robotaxis in the world currently employing electric power. For instance, Alibaba-backed AutoX has over 1,000 electric robotaxis in China, spanning such major cities as Shenzhen and Shanghai. Similarly, Pony.ai, a startup backed by Toyota, has been using electric vehicles in its autonomous fleet and has already done more than 20 million kilometers worth of driverless testing. In Japan, Monet Technologies, supported by SoftBank, is working on all-electric autonomous mobility services, in line with the nationally planned carbon neutrality. These programs underline that, in addition to emissions reduction, electric propulsion is also less costly to operate that makes it the basis of robotaxi fleets in the future.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 4.1 billion |

|

Revenue forecast in 2035 |

USD 1,487.2 billion |

|

CAGR (2025-2035) |

80.1% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Application (Goods Transportation and Passenger Transportation), Level of Autonomy (Level 4 and Level 5), Vehicle Type, Propulsion, Component, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Waymo LLC, Tesla Inc., Aptiv, Cruise LLC, Uber Technologies Inc., Lyft, Inc., AutoX, Inc., Didi Chuxing Technology Co., Baidu, Zoox, Inc., and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

Market Segmentation

The Robotaxi Market is estimated to be USD 4.1 billion in 2025 and grow at a CAGR of 80.1% to reach USD 1,487.2 billion by 2035.

In 2024, the Robotaxi Market was estimated at USD 2.3 billion, with projections to reach USD 4.1 billion in 2025.

Waymo LLC, Tesla Inc., Aptiv, Cruise LLC, Uber Technologies Inc., and Lyft are the major companies operating in the Robotaxi Market Analysis and Forecast.

The Asia Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by digital transformation and technological autonomy initiatives.

In 2025, by vehicle type, the car segment is estimated to account for the largest market share in the robotaxi market.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates