Resources

About Us

Blockchain in Energy and Power Market Size, Share, Forecast & Trends Size - By Category (Private, Public), By Application (Power, Oil & Gas) - Global Forecast to 2035

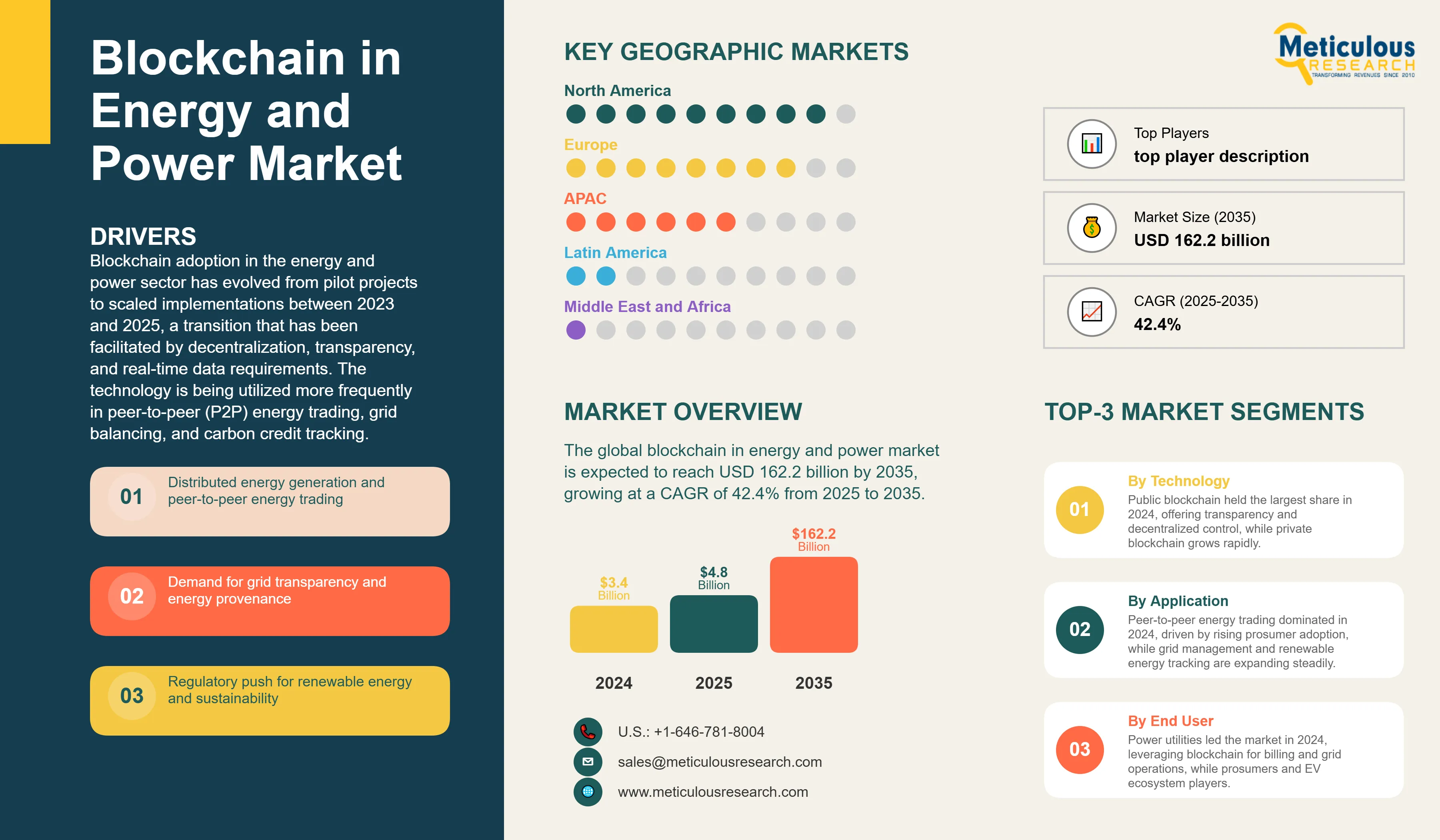

Report ID: MREP - 1041563 Pages: 180 Aug-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global blockchain in energy and power market size was estimated to be USD 4.8 billion in 2025 and is expected to reach USD 162.2 billion by 2035, growing at a CAGR of 42.4% from 2025 to 2035.

Blockchain adoption in the energy and power sector has evolved from pilot projects to scaled implementations between 2023 and 2025, a transition that has been facilitated by decentralization, transparency, and real-time data requirements. The technology is being utilized more frequently in peer-to-peer (P2P) energy trading, grid balancing, and carbon credit tracking.

The World Economic Forum reports that more than 60% of energy blockchain initiatives in 2024 concentrated on decentralized energy exchanges and smart grid applications. The emergence of distributed energy resources (DERs) and electric vehicles (EVs) has heightened the demand for secure, automated transaction systems, positioning blockchain as a promising solution. In 2023, the European Union initiated the Energy Data Space project, incorporating blockchain technology to facilitate secure data sharing among member states. In the meantime, the Power Ledger pilot project in India facilitated the local trading of solar energy for more than 200 households. With the enhancement of regulatory clarity and the resolution of interoperability challenges, blockchain is set to serve as a fundamental component in the digitalization of the energy sector.

Click here to: Get Free Sample Pages of this Report

The competitive landscape of blockchain in energy and power market is influenced by a combination of established energy companies, blockchain startups, and technology integrators. Energy Web Foundation, Power Ledger, and LO3 Energy are at the forefront of platform development, with utilities such as Shell, TEPCO, and Engie actively adopting these innovations. In 2024, Shell broadened its blockchain-based carbon tracking initiatives to five additional markets, while Power Ledger established partnerships in Southeast Asia. Technology companies such as IBM and Siemens are incorporating blockchain technology into energy IoT solutions. Strategic partnerships and the transition from pilot programs to full-scale implementations are essential differentiators, as stakeholders emphasize interoperability and compliance with regulations.

Recent Developments

Siemens Blockchain Grid Management

In March 2024, Siemens introduced a blockchain-based grid management module that is integrated with its Spectrum Power platform, facilitating secure data exchange between grid operators and distributed energy resources (DERs). The system facilitates automated demand response and enables real-time load balancing. Pilots conducted in Austria and Singapore demonstrated a 15% enhancement in grid efficiency. Siemens intends to expand this initiative throughout smart cities and industrial parks by 2025.

Energy Web + Vodafone Partnership

In 2023, to incorporate blockchain technology into IoT-enabled smart meters and EV chargers, Energy Web teamed up with Vodafone. Through the partnership, Vodafone's energy clients in Europe may log transactions and securely identify their devices. Early tests in the UK revealed better asset traceability and a 20% decrease in billing errors. This signifies the confluence of the energy and telecommunications industries around blockchain technology.

Key Market Drivers

Demand for Decentralized Energy Trading: The growth of rooftop solar and microgrids has necessitated the development of localized energy trading platforms. Blockchain facilitates secure and automated peer-to-peer transactions, eliminating the need for centralized intermediaries. In 2024, Brooklyn Microgrid announced a 25% increase in local energy trades utilizing blockchain technology, which has led to a reduction in grid dependency and an enhancement in energy resilience. This model is being implemented worldwide, particularly in areas with significant DER penetration. The capability to timestamp and verify the origin of energy contributes to renewable energy certification, thereby strengthening consumer confidence and ensuring adherence to regulatory standards.

Integration of EV Charging and Smart Meters: Blockchain is being utilized more frequently to oversee EV charging transactions and smart meter data. In 2023, Germany’s Share & Charge platform facilitated the processing of over 1 million EV charging sessions through blockchain technology, allowing for dynamic pricing and cross-provider billing. Smart meters that utilize blockchain technology enable secure consumption tracking and facilitate automated billing processes. The International Energy Agency reports that smart meter installations increased by 18% worldwide in 2024, with blockchain-based systems gaining momentum in Europe and Asia.

Carbon Credit and Renewable Certification: The immutable ledger of blockchain is well-suited for the tracking of carbon credits and renewable energy certificates (RECs). In 2023, the Energy Web Foundation collaborated with Shell to tokenize Renewable Energy Certificates (RECs), facilitating real-time verification and trading. The UN Climate Change Secretariat has indicated a 30% rise in blockchain-based carbon credit platforms in 2024, propelled by corporate sustainability objectives and ESG reporting requirements. This level of transparency minimizes the risk of fraud and double counting, thereby enhancing the efficiency and reliability of carbon markets.

Key Market Restraints

Challenges of Scalability and Interoperability: Notwithstanding advancements, blockchain platforms in the energy sector frequently exhibit a deficiency in interoperability, constraining cross-platform data exchange. A 2023 study by the European Blockchain Observatory revealed that 40% of energy blockchain pilots were unsuccessful in scaling due to protocol incompatibility. Although Layer 2 solutions and consortium blockchains present potential, standardization continues to be a hindrance.

Regulatory Ambiguity and Data Confidentiality: Energy regulators are still contending with the classification of blockchain-based energy transactions and the ownership of data. In 2024, India's Central Electricity Authority raised concerns regarding consumer data privacy in blockchain-integrated smart grids. The absence of explicit guidelines regarding tokenization, international energy transactions, and liability in automated contracts hinders adoption.

Base CAGR: 42.4%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Demand for Decentralized Energy Trading |

Increased adoption of peer-to-peer energy platforms |

Established decentralized energy marketplaces |

▲ +7.0% |

|

2. Integration of EV Charging and Smart Meters |

Growing deployment of smart charging infrastructure |

Fully integrated EV-grid ecosystem |

▲ +6.5% |

|

|

3. Carbon Credit and Renewable Certification |

Early adoption of blockchain for certification |

Standardized, transparent carbon and renewable tracking |

▲ +6.2% |

|

|

4. Grid Optimization and Load Balancing |

Pilot projects using blockchain for load management |

Widespread grid efficiency and balancing via blockchain |

▲ +6.0% |

|

|

Restraints |

1. Challenges of Scalability and Interoperability |

Performance bottlenecks and siloed systems |

Enhanced interoperability standards emerge |

▼ −3.0% |

|

2. Regulatory Ambiguity and Data Confidentiality |

Delays in policy clarity and compliance concerns |

Clear regulations and robust data privacy frameworks |

▼ −2.8% |

|

|

Opportunities |

1. Smart contract-enabled automated settlements |

Improved efficiency in transaction settlements |

Fully automated, trustless energy market transactions |

▲ +5.8% |

|

2. Integration with IoT, AI, and advanced metering |

Enhanced data accuracy and real-time insights |

Fully converged smart energy systems |

▲ +5.5% |

|

|

Trends |

1. Tokenization of energy assets and incentives |

Growing issuance of tokenized energy credits |

Broad adoption of token economies in energy |

▲ +5.0% |

|

Challenges |

1. Cybersecurity and privacy for critical infrastructure |

Increasing concerns over attacks and data breaches |

Mature security protocols and privacy-preserving tech |

▼ −2.5% |

Deregulated Markets and Innovation Drive North America’s Leadership in Blockchain Energy Trading, EV Charging, and Carbon Tracking

Deregulated markets and technological innovation continue to propel North America to the forefront of blockchain energy applications, driving regional growth at a CAGR of 35.8% from 2025 to 2035. In the U.S., around 30 utilities experimented with blockchain pilots in 2023–2024, concentrating on P2P trading, EV charging, and carbon tracking. California’s grid operator CAISO teamed with IBM to test blockchain for real-time dispatch and settlement. Canada’s Hydro Québec introduced a blockchain-based energy certificate platform in 2024, matching its sustainable energy export plan. The region benefits from substantial venture capital support, with energy blockchain businesses raising over USD 500 million in 2023 alone. However, regulatory divergence between states offers hurdles to growth. Federal programs like the DOE’s Blockchain Energy Lab strive to standardize protocols and foster interoperability.

Urbanization, Smart Grids, and Distributed Energy Resources Fuel Asia-Pacific’s Rapid Blockchain Energy Adoption Despite Infrastructure Gaps

Asia-Pacific is emerging as a high-growth region for blockchain in energy, and is expected to grow at a CAGR of 44.8% through 2035, driven by rising urbanization, smart grid investments, and DER expansion. The national agency State Grid Corporation in China is testing blockchain technology for grid data reconciliation, alongside various blockchain patent applications and trial deployments. In India, Power Ledger and Tata Power established P2P solar trading pilots in Delhi and Mumbai, enabling localized energy markets. Southeast Asia is seeing blockchain use in off-grid electrification and microgrid management, especially in Indonesia and the Philippines. Japan’s TEPCO and Korea Electric Power Corporation (KEPCO) are incorporating blockchain into EV charging and demand response systems. The region’s regulatory organizations are growing receptive, with Singapore’s Energy Market Authority proposing recommendations for blockchain-based energy trading in 2024. However, infrastructure discrepancies and cybersecurity concerns remain impediments to widespread adoption.

The U.S. Blockchain Energy Pilots Expand in Deregulated States Amid Federal Push for Standards and Interoperability

The U.S. has witnessed significant blockchain experimentation in energy and held over 85% market share of the North America blockchain in energy and power market in 2025. California utility PG&E used blockchain to manage solar energy settlements, cutting reconciliation time by 40%. The Department of Energy's Blockchain Energy Lab is developing protocols for grid data sharing. EV charging networks like Electrify America are looking into blockchain for dynamic pricing and cross-network billing. Despite innovation, regulatory heterogeneity among states and a lack of federal clarity on tokenized energy assets remain challenges.

China Integrates Blockchain into Smart Grids and Carbon Tracking to Support Digital Energy and Carbon Neutrality Goals

China is aggressively investigating blockchain in energy, which aligns with its digital infrastructure and carbon neutrality objectives. The country is expected to hold 35-40% share of the Asia Pacific blockchain in energy and power market in 2025. The government's Digital Energy Action Plan considers blockchain as a key enabler for smart grid and carbon tracking. Blockchain is being used for EV charging stations and renewable energy certificate issuance. Over 300 blockchain energy patents were registered in China between 2023 and 2024, demonstrating a high R&D momentum. However, centralized control and data localization rules may impede cross-border blockchain applications.

Germany Uses Blockchain for Smart Grids, EV Charging, and Prosumer Integration with Strong Regulatory Backing

Germany is a key European market for blockchain in energy, accounting for substantial market share and is expected to grow at a CAGR of 34.7% through 2035, owing to its Energiewende transition and smart grid initiatives. The German Energy Agency (DENA) stated that blockchain-enabled smart meters reduced billing disputes by 18% in test areas. The country is also looking into blockchain for balancing energy markets and integrating prosumers. The Federal Network Agency has issued recommendations for blockchain-based energy transactions, indicating strong regulatory support. Germany's emphasis on data protection and interoperability makes it a model for scalable blockchain deployment across Europe.

Blockchain-Enabled Peer-to-Peer Energy Trading Boosts Renewable Adoption in the Power Segment

P2P energy trading is the most dynamic use of blockchain in the energy industry. It enables prosumers to sell extra energy directly to their neighbours, circumventing traditional utilities. In 2024, Power Ledger claimed a 35% increase in P2P transactions across its global platforms, with significant growth in India, Australia, and Thailand. Blockchain enables secure, automated settlements and confirms energy provenance, hence promoting renewable energy adoption. Regulatory sandboxes in the United States, Singapore, and the European Union have allowed startups to test P2P models.

Smart Contracts and DLT Platforms Automate Energy Transactions, Reducing Costs and Driving Interoperability Initiatives across the Public Sector

The public sector accounted for 35-40% share of the overall blockchain in energy and power market in 2025. Smart contracts and distributed ledger technologies (DLTs) are the foundation of blockchain energy applications. The most widely utilised platforms are Ethereum, Hyperledger Fabric, and Energy Web Chain. In 2023, Energy Web Chain handled more than 2 million energy transactions, including EV charging, carbon tracking, and grid coordination. Smart contracts automate billing, demand response, and certificate issuance, which reduces administrative costs. According to an IEEE study published in 2024, smart contract-based energy platforms lower transaction costs by 28% when compared to legacy systems.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 4.8 billion |

|

Revenue forecast in 2035 |

USD 162.2 billion |

|

CAGR (2025-2035) |

42.4% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Category (Private, Public), Application (Power, Oil & Gas), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Power Ledger Pty Ltd; WePower UAB; LO3 Energy, Inc.; Electron (Chaddenwych Services Ltd); GridPlus, Inc.; Siemens Energy AG; Shell plc (Shell Energy); Engie SA; SunContract (SunContract LLC); Iberdrola, S.A.; IBM Corporation; Microsoft Corporation; Oracle Corporation; Accenture plc; Infosys Limited; SAP SE; Deloitte Touche Tohmatsu Limited; BigchainDB GmbH; FlexiDAO S.L.; Energy Web Foundation |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The Blockchain in Energy and Power Market is estimated to be USD 4.8 billion in 2025 and grow at a CAGR of 42.4% to reach USD 162.2 billion by 2035.

In 2024, the Blockchain in Energy and Power Market size was estimated at USD 3.4 billion, with projections to reach USD 4.8 billion in 2025.

Power Ledger Pty Ltd, WePower UAB, LO3 Energy, Inc., Electron (Chaddenwych Services Ltd), GridPlus, Inc., Siemens Energy AG, Shell plc (Shell Energy), Engie SA, SunContract (SunContract LLC), Iberdrola, and IBM Corporation among others are the major companies operating in the Blockchain in Energy and Power Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

The power segment held 40-45% market share in 2024 and is set to grow exponentially in the analysis period.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Blockchain in Energy and Power Market, by Offering

3.2.2. Blockchain in Energy and Power Market, by Deployment

3.2.3. Blockchain in Energy and Power Market, by Application

3.2.4. Blockchain in Energy and Power Market, by End-user

3.2.5. Blockchain in Energy and Power Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Distributed energy generation and peer-to-peer energy trading

4.2.1.2. Demand for grid transparency and energy provenance

4.2.1.3. Regulatory push for renewable energy and sustainability

4.2.2. Restraints

4.2.2.1. Lack of standard regulations and interoperability

4.2.2.2. Scalability and transaction throughput limitations

4.2.3. Opportunities

4.2.3.1. Smart contract-enabled automated settlements

4.2.3.2. Integration with IoT, AI, and advanced metering

4.2.4. Trends

4.2.4.1. Tokenization of energy assets and incentives

4.2.5. Challenges

4.2.5.1. Cybersecurity and privacy for critical infrastructure

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Blockchain in Energy and Power Market

4.4.1. Smart Contracts and Automated Settlements

4.4.1.1. Real-time billing and transactions

4.4.1.2. Payment automation for distributed energy resources

4.4.1.3. Contract auditability and dispute resolution

4.4.2. Public and Private Blockchain Platforms

4.4.2.1. Public blockchains for transparency and open markets

4.4.2.2. Private networks for utility consortia/Energy-as-a-Service

4.4.2.3. Interoperability solutions and hybrid models

4.4.3. Integration with Emerging Technologies

4.4.3.1. IoT sensors and metering for real-time data feeds

4.4.3.2. AI-based optimization in energy trading

4.4.3.3. Secure data sharing across the supply chain

5. Impact of Sustainability on Blockchain in Energy and Power Market

5.1. Support for renewable energy certificates and carbon trading

5.2. Facilitating grid decarbonization and green energy tracing

5.3. Digitalizing energy attribution for ESG compliance

5.4. Enabling microgrids and community-based sustainable energy

5.5. Reduced transaction emissions vs. legacy systems

5.6. Vendor leadership in energy-positive blockchain initiatives

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Blockchain in Energy and Power Market Assessment—By Category

7.1. Overview

7.2. Public

7.3. Private

8. Blockchain in Energy and Power Market Assessment—By Application

8.1. Overview

8.2. Power

8.2.1. Grid Transactions

8.2.2. Peer to Peer Transactions

8.2.3. Energy Financing

8.2.4. Sustainability Attribution

8.2.5. Electric Vehicle Charging

8.2.6. Others

8.3. Oil & Gas

8.3.1. Supply Chain

8.3.2. Operations

8.3.3. Trading

8.3.4. Security

9. Blockchain in Energy and Power Market Assessment—By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Netherlands

9.3.5. Switzerland

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. South Korea

9.4.4. Taiwan

9.4.5. India

9.4.6. Singapore

9.4.7. Australia

9.4.8. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Argentina

9.5.4. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Saudi Arabia

9.6.3. Israel

9.6.4. South Africa

9.6.5. Rest of Middle East & Africa

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

10.1. Power Ledger Pty Ltd

10.2. WePower UAB

10.3. LO3 Energy, Inc.

10.4. Electron (Chaddenwych Services Ltd)

10.5. GridPlus, Inc.

10.6. Siemens Energy AG

10.7. Shell plc (Shell Energy)

10.8. Engie SA

10.9. SunContract (SunContract LLC)

10.10. Iberdrola, S.A.

10.11. IBM Corporation

10.12. Microsoft Corporation

10.13. Oracle Corporation

10.14. Accenture plc

10.15. Infosys Limited

10.16. SAP SE

10.17. Deloitte Touche Tohmatsu Limited

10.18. BigchainDB GmbH

10.19. FlexiDAO S.L.

10.20. Energy Web Foundation

10.21. Others

11. Appendix

11.1. Available Customization

11.2. Related Reports

Published Date: Jul-2024

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates