Resources

About Us

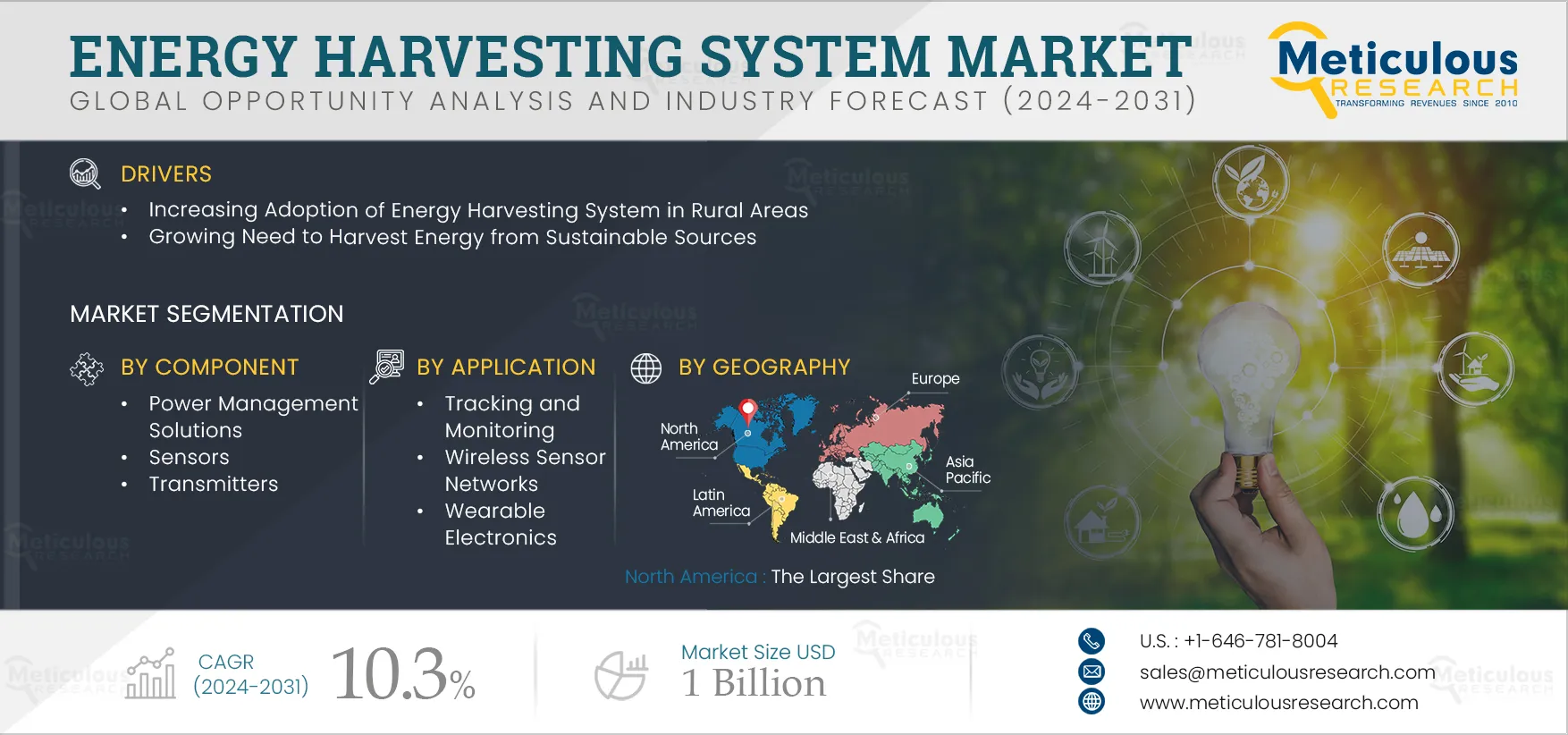

Energy Harvesting System Market Size, Share, Forecast, & Trends Analysis by Component, Energy Source (Solar, Thermal), Application (Tracking and Monitoring, Smart Building, and Infrastructure), End User (Consumer Electronics, Healthcare), and Geography - Global Forecast to 2031

Report ID: MREP - 104548 Pages: 280 Jul-2024 Formats*: PDF Category: Energy and Power Delivery: 24 to 48 Hours Download Free Sample ReportThe Energy Harvesting System Market is projected to reach $1 billion by 2031, at a CAGR of 10.3% from 2024 to 2031.The growth of this market is driven by the increasing adoption of energy harvesting systems in rural areas and the growing need to harvest energy from sustainable sources. Furthermore, the integration of sensors in wearable electronics and advancements in ocean energy harvesting technologies are expected to create market growth opportunities.

In recent years, there has been an increasing adoption of energy harvesting systems in rural areas to enhance sustainability and improve quality of life. In rural areas, the lack of reliable access to grid electricity boosts energy harvesting systems such as solar panels, wind turbines, and kinetic energy to provide a reliable and sustainable source of power. Several governments are increasingly taking the initiative to reduce carbon footprints and environmental conservation. Thus, governments are increasingly investing in energy harvesting systems in rural areas, which will help to mitigate climate change impacts on rural ecosystems and agricultural productivity.

Additionally, the increasing developments for energy harvesting systems provide opportunities for local communities in installation, maintenance, and management, fostering skill development, local employment opportunities, and community ownership of energy resources. Thus, the increasing adoption of energy harvesting systems in rural areas holds great promise for sustainable development, energy security, and improved quality of life.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

The growing need for sustainable sources of energy harvesting, such as solar, wind, hydro, and geothermal power, is crucial for reducing greenhouse gas emissions. These sources generate electricity without burning fossil fuels, thereby helping to mitigate climate change and its associated impacts. The growing use of sustainable energy sources provides a stable and secure energy supply, reducing vulnerability to supply disruptions and enhancing energy independence. Thus, the growing shift towards sustainable energy sources fosters innovation and economic growth in sectors such as renewable energy technologies, energy storage solutions, and energy efficiency measures.

Additionally, the rising need for sustainable energy sources like solar and wind harness abundant and renewable resources that are naturally replenished and ensure long-term availability compared to finite fossil fuels. Moreover, increasing access to clean and affordable energy is essential for addressing energy poverty and promoting social equity. Sustainable energy solutions can provide reliable electricity to underserved communities. Thus, the growing need to harvest energy from sustainable sources is driven by environmental, economic, social, and technological imperatives.

The rising trend towards green energy and favorable government initiatives for energy harvesting reflect a global shift towards sustainable development and addressing climate change. Several governments are increasingly taking initiatives to transition to renewable energy sources such as solar, wind, hydro, and geothermal power to reduce greenhouse gas emissions. Additionally, favorable government initiatives help diversify the energy mix with renewable sources to enhance energy security by reducing dependence on imported fossil fuels and mitigating risks associated with energy price volatility and supply disruptions.

Governments worldwide are providing various financial incentives, subsidies, tax credits, and grants to support renewable energy projects. These incentives reduce the initial costs and improve the financial viability of energy harvesting systems. For instance, in December 2023, the Government of India announced a USD 794 million (Rs. 6600 crore) clean energy and infrastructure expansion plan, including a 750 MW solar project, 100 MW solar plant, substation enhancements, collaborations with HPCL, Avera AI Mobility's electric vehicle expansion, and SECI contract for solar energy. Such growing investments and initiatives by governments help to increase the demand for green energy, which helps to boost the energy harvesting systems market during the forecast period.

Based on component, the energy harvesting systems market is segmented into power management solutions, sensors, transmitters, and other components. In 2024, the power management solutions segment is expected to account for the largest share of over 27.0% of the energy harvesting systems market. This segment's large market share can be attributed to the growing demand for highly efficient power management devices and the increasing adoption of power management solutions to control power flow from storage devices, convert energy from sources, and regulate boosted output voltage.

However, the sensors segment is projected to register the highest CAGR during the forecast period. This segment’s growth is driven by the increasing adoption of sensors to measure various parameters within heat exchangers and actuators and their integration into a wide range of energy harvesting systems for signal processing, communication, and data collection functions.

Based on energy source, the energy harvesting systems market is segmented into solar energy, thermal energy, chemical energy, magnetic energy, tidal energy, and other energy sources. In 2024, the solar energy segment is expected to account for the largest share of over 35.0% of the energy harvesting systems market. This segment’s large market share can be attributed to the increasing need for efficient battery charging solutions and the rising use of solar energy in applications such as water & space heating.

However, the thermal energy segment is expected to register the highest CAGR during the forecast period. This segment’s growth is driven by the increasing utilization of thermal energy to power wearable devices, the rising investments in promoting thermal energy harvesting for IoT applications, and the growing demand for energy harvesting systems for industrial applications such as waste heat recovery and solar thermal energy harvesting.

Based on application, the energy harvesting systems market is segmented into tracking and monitoring, wireless sensor networks, wearable electronics, smart building and infrastructure, environmental monitoring systems, industrial automation, healthcare and medical devices, and other applications. In 2024, the tracking and monitoring segment is expected to account for the largest share of over 24.0% of the energy harvesting systems market. This segment’s large market share can be attributed to the rising need to track & monitor the physical location and status of mobile objects and the increasing adoption of energy harvesting technologies to enable autonomous operation without frequent battery replacements or external power sources. These systems can seamlessly integrate with IoT networks and wireless communication protocols used in asset tracking.

However, the smart building and infrastructure segment is expected to register the highest CAGR during the forecast period. This segment’s growth is driven by the increasing adoption of energy harvesting systems to support green building initiatives aimed at reducing reliance on conventional energy sources. Moreover, energy harvesting offers long-term cost savings by enabling lower energy bills and reduced maintenance expenses typically associated with battery replacements. Additionally, these systems mitigate the risk of system downtime and disruptions, ensuring consistent operation of critical building functions such as lighting, HVAC, and security systems. These benefits are expected to drive the demand for energy harvesting systems for smart building and infrastructure applications during the forecast period.

Based on end user, the energy harvesting systems market is segmented into consumer electronics, military & aerospace, automotive, healthcare, agriculture, energy & utilities, transportation, and other end users. In 2024, the consumer electronics segment is expected to account for the largest share of over 51.0% of the energy harvesting systems market. This segment’s large market share can be attributed to the increasing demand for consumer electronics, including smart wearables, smartphones, and remote-control units, and the rising investments in developing solar-powered energy harvesting solutions for consumer electronics.

However, the healthcare segment is expected to register the highest CAGR during the forecast period. This segment’s growth is driven by the increasing integration of energy harvesting systems into medical devices, enabling them to operate autonomously without the need for frequent battery changes. Additionally, the rising integration of energy harvesting systems into IoT platforms and healthcare information systems for real-time data transmission and analysis contributes to this segment’s growth.

In 2024, North America is expected to account for the largest share of over 34.0% of the energy harvesting systems market. North America’s significant market share can be attributed to the growing adoption of energy harvesting systems in home automation, industrial, and transportation applications, government initiatives aimed at promoting the use of zero-emission energy sources, including hydro, wind, solar, and nuclear energy, and the increasing demand for green energy across industrial, residential, and consumer sectors in the region.

However, Asia-Pacific is expected to register the highest CAGR of over 14.0% during the forecast period. The growth of this regional market is driven by the rising demand for electricity in the region's industrial sector, the increasing adoption of ultra-low-power devices to enhance energy efficiency, initiatives to expand interconnected grids to improve flexibility & energy security, and the rising use of cost-effective power sources to reduce reliance on fossil fuels.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the energy harvesting systems market are ABB Ltd (Switzerland), Analog Devices, Inc. (U.S.), Texas Instruments Incorporated (U.S.), STMicroelectronics International N.V. (Switzerland), e-peas SA (Belgium), Infineon Technologies AG (Germany), Honeywell International Inc. (U.S.), Microchip Technology Inc. (U.S.), Renesas Electronics Corporation (Japan), EnOcean GmbH (Germany), Advanced Linear Devices, Inc. (U.S.), Piezo.com (U.S.), Powercast Corporation (U.S.), Laird Thermal Systems, Inc. (U.S.), and DCO Systems Limited (U.K.).

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

10.3% |

|

Market Size (Value) |

USD 1 Billion by 2031 |

|

Segments Covered |

By Component

By Energy Source

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Netherlands, Spain, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, Australia & New Zealand, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, Israel, and Rest of the Middle East & Africa) |

|

Key Companies |

ABB Ltd (Switzerland), Analog Devices, Inc. (U.S.), Texas Instruments Incorporated (U.S.), STMicroelectronics International N.V. (Switzerland), e-peas SA (Belgium), Infineon Technologies AG (Germany), Honeywell International Inc. (U.S.), Microchip Technology Inc. (U.S.), Renesas Electronics Corporation (Japan), EnOcean GmbH (Germany), Advanced Linear Devices, Inc. (U.S.), Piezo.com (U.S.), Powercast Corporation (U.S.), Laird Thermal Systems, Inc. (U.S.), and DCO Systems Limited (U.K.). |

This study focuses on market assessment and opportunity analysis by analyzing the sales of energy harvesting systems across various regions and countries. This study also offers a competitive analysis of the energy harvesting systems market based on an extensive assessment of the leading players' product portfolios, geographic presence, and key growth strategies.

The energy harvesting system market is projected to reach $1 billion by 2031, at a CAGR of 10.3% from 2024 to 2031.

In 2024, the solar energy segment is expected to account for the largest share of over 35.0% of the energy harvesting systems market. This segment’s large market share can be attributed to the increasing need for efficient battery charging solutions and the rising use of solar energy in applications such as water & space heating.

The smart building and infrastructure segment is expected to register the highest CAGR during the forecast period. This segment’s large market share can be attributed to the rising need to track & monitor the physical location and status of mobile objects and the increasing adoption of energy harvesting technologies to enable autonomous operation without frequent battery replacements or external power sources. These systems can seamlessly integrate with IoT networks and wireless communication protocols used in asset tracking.

The growth of this market is driven by the increasing adoption of energy harvesting systems in rural areas and the growing need to harvest energy from sustainable sources. Furthermore, the integration of sensors in wearable electronics and advancements in ocean energy harvesting technologies are expected to create market growth opportunities.

The key players operating in the energy harvesting systems market are ABB Ltd (Switzerland), Analog Devices, Inc. (U.S.), Texas Instruments Incorporated (U.S.), STMicroelectronics International N.V. (Switzerland), e-peas SA (Belgium), Infineon Technologies AG (Germany), Honeywell International Inc. (U.S.), Microchip Technology Inc. (U.S.), Renesas Electronics Corporation (Japan), EnOcean GmbH (Germany), Advanced Linear Devices, Inc. (U.S.), Piezo.com (U.S.), Powercast Corporation (U.S.), Laird Thermal Systems, Inc. (U.S.), and DCO Systems Limited (U.K.).

Asia-Pacific is expected to register the highest CAGR of over 14% during the forecast period, subsequently offering significant growth opportunities for vendors operating in this market. The growth of this regional market is driven by the rising demand for electricity in the region's industrial sector, the increasing adoption of ultra-low-power devices to enhance energy efficiency, initiatives to expand interconnected grids to improve flexibility & energy security, and the rising use of cost-effective power sources to reduce reliance on fossil fuels.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates