Resources

About Us

Asia-Pacific Agriculture Equipment Market by Type (Tractors, Harvesting Equipment, Irrigation Equipment), Mode of Operation (Manual, Automatic), Power Source (Electric Equipment), Application (Sowing, Planting, Harvesting, Irrigation) - Forecast to 2032

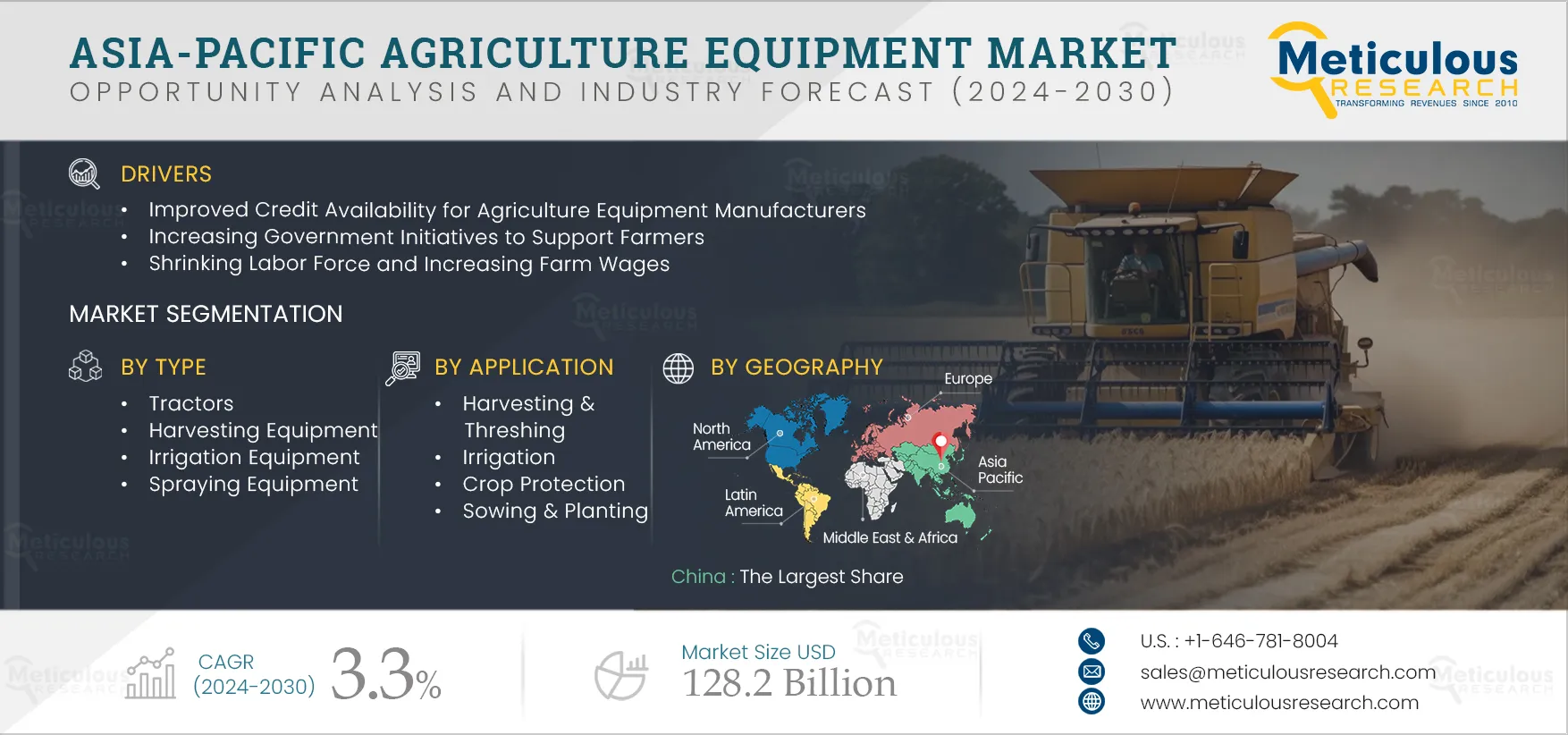

Report ID: MRAGR - 104969 Pages: 210 Jan-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Agriculture Equipment Market is projected to reach $128.2 billion by 2032, at a CAGR of 3.3% during the forecast period of 2025 to 2032. The growth of this market is driven by the improved credit availability for agriculture equipment manufacturers, increasing government initiatives to support farmers, a shrinking labor force coupled with rising farm wages, and growing awareness regarding the mechanization of agricultural operations. However, the rising fragmentation of land and the high costs of advanced agriculture equipment restrain the growth of this market.

Furthermore, technological advancements in agriculture equipment, the presence of prominent agriculture equipment manufacturers in the region, and the increasing adoption of precision farming techniques are expected to create market growth opportunities. However, challenges for market players include the low awareness of advanced agriculture technologies and limited purchases of highly advanced agriculture equipment due to high costs, resulting in a significant dependence on rental services. Additionally, digitalization in agriculture is a prominent trend in the Asia-Pacific agriculture equipment market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players over the past 3-4 years. The key players profiled in the Asia-Pacific agriculture equipment market research report are AGCO Corporation (U.S.), Agromaster (Turkey), AMAZONEN-WERKE H. DREYER SE & Co. KG (Germany), APV - Technische Produkte GmbH (Austria), CLAAS KGaA mbH (Germany), CNH Industrial N.V. (U.K.), Deere & Company (U.S.), HORSCH Maschinen GmbH (Germany), ISEKI & CO., LTD. (Japan), KUBOTA Corporation (Japan), KUHN SAS (France), Mahindra & Mahindra Ltd. (India), Mascar SpA (Italy), Morris Equipment Ltd (Canada), SDF S.p.A. (Italy), and Valmont Industries, Inc. (U.S.).

Click here to: Get Free Sample Pages of this Report

In the agricultural sector, acquiring machinery and equipment requires significant initial investments. The high cost of equipment stems from the expenses associated with its production. Establishing an agriculture equipment production facility requires substantial capital investment, although it can prove to be a profitable venture in the long term. Furthermore, specialized skills and knowledge are indispensable for agriculture equipment manufacturing, along with the need for adequate infrastructure facilities. All these factors collectively contribute to the high costs of agricultural equipment.

The agriculture equipment sector presents promising growth opportunities in the Asia-Pacific region. Recognizing these opportunities, certain private investors and companies have already begun to invest in this sector. Some recent investments by major stakeholders in the agriculture equipment sector are:

Thus, the increasing investments are expected to drive the growth of the agriculture equipment market in the Asia-Pacific in the forthcoming years.

In 2025, the Tractors Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Based on type, the Asia-Pacific agriculture equipment market is segmented into tractors, harvesting equipment, soil preparation & cultivation equipment, irrigation equipment, spraying equipment, and other agriculture equipment. In 2025, the tractors segment is expected to account for the largest share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to several factors, including the heavy reliance of farmers on tractors for agricultural purposes, increasing demand for mechanization, a rise in farm labor shortages, government initiatives aimed at improving the agricultural sector, and technological advancements in tractors.

However, the irrigation equipment segment is projected to register the highest CAGR during the forecast period of 2025–2032 due to increasing water shortages for agricultural use, extensive area of land under crop cultivation in the region, rising government initiatives promoting the adoption of drip and sprinkler irrigation, and growing automation in irrigation systems.

In 2025, the Semi-automatic Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Based on mode of operation, the Asia-Pacific agriculture equipment market is segmented into semi-automatic, manual, and automatic. In 2025, the semi-automatic segment is expected to account for the largest share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to the higher adoption of semi-automatic agricultural equipment over automated agriculture equipment due to their easy availability and accessibility. Additionally, semi-automatic agriculture equipment is more cost-effective than automatic agriculture equipment, driving their adoption among small- and medium-sized farmers, particularly in China and India.

However, the automatic segment is projected to register the highest CAGR during the forecast period of 2025–2032 due to factors such as the increasing adoption of precision agriculture, the shortage of skilled agriculture laborers, and ongoing technological advancements in agricultural equipment. Furthermore, the increasing utilization of robotics and artificial intelligence technologies within the agriculture sector is expected to create opportunities for companies operating in this market.

In 2025, the Non-electric Equipment Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Based on power source, the Asia-Pacific agriculture equipment market is segmented into non-electric and electric-powered agriculture equipment. In 2025, the non-electric equipment segment is expected to account for the larger share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to the growing adoption of non-electric equipment due to its simplicity and comparatively lower cost over its electric counterparts. Additionally, non-electric equipment typically comes with lower upfront costs and power requirements, making them more affordable and accessible to a wider range of farmers with limited financial resources in the Asia-Pacific region.

In 2025, the Land Development and Seedbed Preparation Segment is Expected to Dominate the Agriculture Equipment Market

Based on application, the agriculture equipment market is mainly segmented into land development and seedbed preparation, harvesting & threshing, irrigation, sowing & planting, crop protection, and other applications. In 2025, the land development and seedbed preparation segment is expected to account for the largest share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to factors such as the increasing adoption of advanced cultivation techniques to reduce labor costs, the availability of technologically advanced equipment, and the advantages offered by advanced agricultural equipment during land development and seedbed preparation, such as high productivity and efficiency.

China to Dominate the Asia-Pacific Agriculture Equipment Market in 2025

The Asia-Pacific agriculture equipment market is segmented into China, India, Japan, Australia, and the Rest of Asia-Pacific. In 2025, China is expected to account for the largest share of the Asia-Pacific agriculture equipment market. China’s significant market share is attributed to the large number of farmers in the country coupled with an extensive area under agriculture cultivation, the increasing demand for advanced agriculture equipment due to labor shortages, the increase in government initiatives aimed at modernizing and mechanizing the agriculture sector, and the presence of numerous agriculture equipment manufacturers in the country.

Scope of the Report:

Asia-Pacific Agriculture Equipment Market Assessment, by Type

Asia-Pacific Agriculture Equipment Market Assessment, by Mode of Operation

Asia-Pacific Agriculture Equipment Market Assessment, by Power Source

Asia-Pacific Agriculture Equipment Market Assessment, by Application

Asia-Pacific Agriculture Equipment Market Assessment, by Country

Key questions answered in the report-

Agriculture equipment are machinery and tools, including tractors, harvesters, seeders, sprayers, irrigation systems, and grain-handling equipment specially designed to perform various agricultural tasks, including land preparation, planting, cultivation, and harvesting of agricultural produce. These machinery and tools are designed to improve the efficiency and productivity of agriculture by minimizing human labor and limiting the errors, physical shortcomings, and wastage in agriculture caused by human labor.

OEMs (Original Agriculture Equipment Manufacturers) are in the business of designing, producing, and marketing their brand of agricultural machinery and equipment. The revenue from OEMs across all the Asia-Pacific countries is included in the market size for agricultural equipment.

In this report, autonomous agriculture equipment refers to machinery and equipment capable of performing agricultural tasks without human intervention. These advanced machines leverage technologies such as GPS, sensors, artificial intelligence, and robotics to carry out operations like planting, spraying, and harvesting with high precision and efficiency.

This report provides detailed market insights, dynamics, and forecasts of the agriculture equipment market segmented by type, mode of operation, power source, application, and geography.

The Asia-Pacific agriculture equipment market is projected to reach $128.2 billion by 2032, at a CAGR of 3.3% during the forecast period.

Based on power source, the electric-powered agriculture equipment segment is expected to witness the highest growth rate during the forecast period.

o Improved Credit Availability for Agriculture Equipment Manufacturers

o Increasing Government Initiatives to Support Farmers

o Shrinking Labor Force and Increasing Farm Wages

o Rising Awareness Regarding Mechanization of Agricultural Operations

o Rising Fragmentation of Land

o High Costs of Advanced Agriculture Equipment

The key players operating in the Asia-Pacific agriculture equipment market are AGCO Corporation (U.S.), Agromaster (Turkey), AMAZONEN-WERKE H. DREYER SE & Co. KG (Germany), APV - Technische Produkte GmbH (Austria), CLAAS KGaA mbH (Germany), CNH Industrial N.V. (U.K.), Deere & Company (U.S.), HORSCH Maschinen GmbH (Germany), ISEKI & CO., LTD. (Japan), KUBOTA Corporation (Japan), KUHN SAS (France), Mahindra & Mahindra Ltd. (India), Mascar SpA (Italy), Morris Equipment Ltd (Canada), SDF S.p.A. (Italy), and Valmont Industries, Inc. (U.S.).

China is expected to account for the largest share of the Asia-Pacific agriculture equipment market in 2025. Moreover, this country is projected to register the highest CAGR during the forecast period of 2025–2032. China’s significant market share and rapid growth rate are attributed to the large number of farmers in the country coupled with an extensive area under agriculture cultivation, the increasing demand for advanced agriculture equipment due to labor shortages, the increase in government initiatives aimed at modernizing and mechanizing the agriculture sector, and the presence of numerous agriculture equipment manufacturers in the country.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segment Analysis

3.2.1. Asia-Pacific Agriculture Equipment Market, by Type

3.2.2. Asia-Pacific Agriculture Equipment Market, by Mode of Operation

3.2.3. Asia-Pacific Agriculture Equipment Market, by Power Source

3.2.4. Asia-Pacific Agriculture Equipment Market, by Application

3.3. Asia-Pacific Agriculture Equipment Market, by Country Analysis

3.4. Competitive Landscape & Market Competitors

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Improved Credit Availability for Agriculture Equipment Manufacturers

4.2.1.2. Increasing Government Initiatives to Support Farmers

4.2.1.3. Shrinking Labor Force and Increasing Farm Wages

4.2.1.4. Rising Awareness Regarding Mechanization of Agricultural Operations

4.2.2. Restraints

4.2.2.1. Increasing Fragmentation of Land

4.2.2.2. High Costs of Advanced Agriculture Equipment

4.2.3. Opportunities

4.2.3.1. Technological Advancements

4.2.3.2. Presence of Multinational Agriculture Equipment Firms

4.2.3.3. Increasing Adoption of Precision Farming Techniques

4.2.4. Challenges

4.2.4.1. Low Awareness of Advanced Agriculture Technologies

4.2.4.2. Significant Dependence on Rental Services Due to High Costs of Highly Advanced Agriculture Equipment

4.3. Trend

4.3.1. Digitalization in Agriculture

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitutes

4.4.4. Threat of New Entrants

4.4.5. Degree of Competition

4.5. Value Chain Analysis

4.5.1. Overview

4.5.2. Raw Material Suppliers

4.5.3. Component Manufacturers

4.5.4. Equipment Manufacturers

4.5.5. Logistics

4.5.6. Distribution Channels

4.5.7. Consumers

4.5.8. Service and Support

5. Asia-Pacific Agriculture Equipment Market Assessment, by Type

5.1. Overview

5.2. Tractors

5.2.1. 30–50 HP

5.2.2. Less Than 30 HP

5.2.3. 51–100 HP

5.2.4. More Than 100 HP

5.3. Harvesting Equipment

5.3.1. Combine Harvesters

5.3.2. Forage Harvesters

5.3.3. Other Harvesters

5.4. Soil Preparation & Cultivation Equipment

5.5. Irrigation Equipment

5.5.1. Irrigation Equipment Market, by Type

5.5.1.1. Overview

5.5.1.2. Drip Irrigation

5.5.1.3. Sprinkler Irrigation

5.5.1.4. Other Irrigation Equipment

5.5.2. Irrigation Equipment Market, by Component

5.5.2.1. Overview

5.5.2.2. Tubing

5.5.2.3. Sprinklers

5.5.2.4. Emitter/Drippers

5.5.2.5. Irrigation Valves

5.5.2.6. Filters

5.5.2.7. Irrigation Controllers

5.5.2.8. Other Components

5.6. Spraying Equipment

5.7. Other Agriculture Equipment

6. Asia-Pacific Agriculture Equipment Market Assessment, by Mode of Operation

6.1. Overview

6.2. Semi-Automatic

6.3. Manual

6.4. Automatic

7. Asia-Pacific Agriculture Equipment Market Assessment, by Power Source

7.1. Overview

7.2. Non-electric powered Agriculture Equipment

7.3. Electric-powered Agriculture Equipment

8. Asia-Pacific Agriculture Equipment Market Assessment, by Application

8.1. Overview

8.2. Land Development and Seedbed Preparation

8.3. Harvesting & Threshing

8.4. Irrigation

8.5. Crop Protection

8.6. Sowing & Planting

8.7. Other Applications

9. Asia-Pacific Agriculture Equipment Market Assessment, by Country/Region

9.1. Overview

9.2. China

9.3. India

9.4. Japan

9.5. Australia

9.6. Rest of Asia-Pacific

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Vendor Market Positioning

10.6. Market Share Analysis

11. Company Profile (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1. AGCO Corporation

11.2. Agromaster

11.3. AMAZONEN-WERKE H. DREYER SE & Co. KG

11.4. APV - Technische Produkte GmbH

11.5. CLAAS KGaA mbH

11.6. CNH Industrial N.V.

11.7. Deere & Company

11.8. HORSCH Maschinen GmbH

11.9. ISEKI & CO., LTD.

11.10. KUBOTA Corporation

11.11. KUHN SAS

11.12. Mahindra & Mahindra Ltd.

11.13. Mascar SpA

11.14. SDF S.p.A.

11.15. Valmont Industries, Inc.

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Asia-Pacific Agriculture Equipment Market: Key Stakeholders

Table 2 Asia-Pacific Agriculture Equipment Market, by Type, 2021–2032 (USD Million)

Table 3 Asia-Pacific Agriculture Tractors Market, by Power Output, 2021–2032 (USD Million)

Table 4 Asia-Pacific Agriculture Tractors Market, Country/Region, 2021–2032 (USD Million)

Table 5 Asia-Pacific 30–50 HP Tractors Market, Country/Region, 2021–2032 (USD Million)

Table 6 Asia-Pacific Less Than 30 HP Tractors Market, Country/Region, 2021–2032 (USD Million)

Table 7 Asia-Pacific 51–100 HP Tractors Market, Country/Region, 2021–2032 (USD Million)

Table 8 Asia-Pacific More Than 100 HP Tractors Market, Country/Region, 2021–2032 (USD Million)

Table 9 Asia-Pacific Harvesting Equipment Market, by Type, 2021–2032 (USD Million)

Table 10 Asia-Pacific Harvesting Equipment Market, Country/Region, 2021–2032 (USD Million)

Table 11 Asia-Pacific Combine Harvesters Market, Country/Region, 2021–2032 (USD Million)

Table 12 Asia-Pacific Forage Harvesters Market, Country/Region, 2021–2032 (USD Million)

Table 13 Asia-Pacific Other Harvesters Market, Country/Region, 2021–2032 (USD Million)

Table 14 Asia-Pacific Soil Preparation & Cultivation Equipment Market, Country/Region, 2021–2032 (USD Million)

Table 15 Asia-Pacific Irrigation Equipment Market, Country/Region, 2021–2032 (USD Million)

Table 16 Asia-Pacific Irrigation Equipment Market, by Type, 2021–2032 (USD Million)

Table 17 Asia-Pacific Drip Irrigation Market, Country/Region, 2021–2032 (USD Million)

Table 18 Asia-Pacific Sprinkler Irrigation Market, Country/Region, 2021–2032 (USD Million)

Table 19 Asia-Pacific Other Irrigation Equipment Market, Country/Region, 2021–2032 (USD Million)

Table 20 Asia-Pacific Irrigation Equipment Market, by Component, 2021–2032 (USD Million)

Table 21 Asia-Pacific Tubing Market, Country/Region, 2021–2032 (USD Million)

Table 22 Asia-Pacific Sprinklers Market, Country/Region, 2021–2032 (USD Million)

Table 23 Asia-Pacific Emitter/Drippers Market, Country/Region, 2021–2032 (USD Million)

Table 24 Asia-Pacific Irrigation Valves Market, Country/Region, 2021–2032 (USD Million)

Table 25 Asia-Pacific Filters Market, Country/Region, 2021–2032 (USD Million)

Table 26 Asia-Pacific Irrigation Controllers Market, Country/Region, 2021–2032 (USD Million)

Table 27 Asia-Pacific Other Components Market, Country/Region, 2021–2032 (USD Million)

Table 28 Asia-Pacific Spraying Equipment Market, Country/Region, 2021–2032 (USD Million)

Table 29 Asia-Pacific Other Equipment Type Market, Country/Region, 2021–2032 (USD Million)

Table 30 Asia-Pacific Agriculture Equipment Market, by Mode of Operation, 2021–2032 (USD Million)

Table 31 Asia-Pacific Semi-Automatic Agriculture Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 32 Asia-Pacific Manual Agriculture Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 33 Patent Analysis for Autonomous Agriculture Equipment

Table 34 Asia-Pacific Automatic Agriculture Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 35 Asia-Pacific Agriculture Equipment Market, by Power Source, 2021–2032 (USD Million)

Table 36 Asia-Pacific Non-electric Powered Agriculture Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 37 Asia-Pacific Electric-powered Agriculture Equipment Market, by Country/Region, 2021–2032 (USD Million)

Table 38 Asia-Pacific Agriculture Equipment Market, Application, 2021–2032 (USD Million)

Table 39 Asia-Pacific Agriculture Equipment Market for Land Development & Seedbed Preparation, by Country/Region, 2021–2032 (USD Million)

Table 40 Asia-Pacific Agriculture Equipment Market for Harvesting & Threshing, by Country/Region, 2021–2032 (USD Million)

Table 41 Asia-Pacific Agriculture Equipment Market for Irrigation, by Country/Region, 2021–2032 (USD Million)

Table 42 Asia-Pacific Agriculture Equipment Market for Crop Protection, by Country/Region, 2021–2025 (USD Million)

Table 43 Asia-Pacific Agriculture Equipment Market for Sowing & Planting, by Country/Region, 2021–2032 (USD Million)

Table 44 Asia-Pacific Agriculture Equipment Market for Other Applications, by Country/Region, 2021–2032 (USD Million)

Table 45 Asia-Pacific: Agriculture Equipment Market, by Country, 2021–2032 (USD Million)

Table 46 China: Agriculture Equipment Market, by Type, 2021–2032 (USD Million)

Table 47 China: Agriculture Tractors Market, by Power Output, 2021–2032 (USD Million)

Table 48 China: Harvesting Equipment Market, by Type, 2021–2032 (USD Million)

Table 49 China: Irrigation Equipment Market, by Type, 2021–2032 (USD Million)

Table 50 China: Irrigation Equipment Market, by Component, 2021–2032 (USD Million)

Table 51 China: Agriculture Equipment Market, by Mode of Operation, 2021–2032 (USD Million)

Table 52 China: Agriculture Equipment Market, by Power Source, 2021–2032 (USD Million)

Table 53 China: Agriculture Equipment Market, by Application, 2021–2032 (USD Million)

Table 54 India: Agriculture Equipment Market, by Type, 2021–2032 (USD Million)

Table 55 India: Agriculture Tractors Market, by Power Output, 2021–2032 (USD Million)

Table 56 India: Harvesting Equipment Market, by Type, 2021–2032 (USD Million)

Table 57 India: Irrigation Equipment Market, by Type, 2021–2032 (USD Million)

Table 58 India: Irrigation Equipment Market, by Component, 2021–2032 (USD Million)

Table 59 India: Agriculture Equipment Market, by Mode of Operation, 2021–2032 (USD Million)

Table 60 India: Agriculture Equipment Market, by Power Source, 2021–2032 (USD Million)

Table 61 India: Agriculture Equipment Market, by Application, 2021–2032 (USD Million)

Table 62 Japan: Agriculture Equipment Market, by Type, 2021–2032 (USD Million)

Table 63 Japan: Agriculture Tractors Market, by Power Output, 2021–2032 (USD Million)

Table 64 Japan: Harvesting Equipment Market, by Type, 2021–2032 (USD Million)

Table 65 Japan: Irrigation Equipment Market, by Type, 2021–2032 (USD Million)

Table 66 Japan: Irrigation Equipment Market, by Component, 2021–2032 (USD Million)

Table 67 Japan: Agriculture Equipment Market, by Mode of Operation, 2021–2032 (USD Million)

Table 68 Japan: Agriculture Equipment Market, by Power Source, 2021–2032 (USD Million)

Table 69 Japan: Agriculture Equipment Market, by Application, 2021–2032 (USD Million)

Table 70 Australia: Agriculture Equipment Market, by Type, 2021–2032 (USD Million)

Table 71 Australia: Agriculture Tractors Market, by Power Output, 2021–2032 (USD Million)

Table 72 Australia: Harvesting Equipment Market, by Type, 2021–2032 (USD Million)

Table 73 Australia: Irrigation Equipment Market, by Type, 2021–2032 (USD Million)

Table 74 Australia: Irrigation Equipment Market, by Component, 2021–2032 (USD Million)

Table 75 Australia: Agriculture Equipment Market, by Mode of Operation, 2021–2032 (USD Million)

Table 76 Australia: Agriculture Equipment Market, by Power Source, 2021–2032 (USD Million)

Table 77 Australia: Agriculture Equipment Market, by Application, 2021–2032 (USD Million)

Table 78 Rest of Asia-Pacific: Agriculture Equipment Market, by Type, 2021–2032 (USD Million)

Table 79 Rest of Asia-Pacific: Agriculture Tractors Market, by Power Output, 2021–2032 (USD Million)

Table 80 Rest of Asia-Pacific: Harvesting Equipment Market, by Type, 2021–2032 (USD Million)

Table 81 Rest of Asia-Pacific: Irrigation Equipment Market, by Type, 2021–2032 (USD Million)

Table 82 Rest of Asia-Pacific: Irrigation Equipment Market, by Component, 2021–2032 (USD Million)

Table 83 Rest of Asia-Pacific: Agriculture Equipment Market, by Mode of Operation, 2021–2032 (USD Million)

Table 84 Rest of Asia-Pacific: Agriculture Equipment Market, by Power Source, 2021–2032 (USD Million)

Table 85 Rest of Asia-Pacific: Agriculture Equipment Market, by Application, 2021–2032 (USD Million)

Table 86 Recent Developments, by Company (2019–2025)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2025, the Tractors Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Figure 8 In 2025, the Semi-Automatic Segment Is Expected to Dominate the Market

Figure 9 In 2025, the Non-Electric Powered Agriculture Equipment Segment Is Expected to Dominate the Market

Figure 10 In 2025, the Harvesting & Threshing Segment Is Expected to Dominate the Market

Figure 11 China Dominates the Asia-Pacific Agriculture Equipment Market

Figure 12 Factors Affecting Market Growth

Figure 13 Factors Driving the Need for Farm Mechanization

Figure 14 Factors Driving Precision Farming

Figure 15 Porter’s Five Forces Analysis: Asia-Pacific Agriculture Equipment Market

Figure 16 Asia-Pacific Agriculture Equipment Market: Value Chain Analysis

Figure 17 Asia-Pacific Agriculture Equipment Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 18 Asia-Pacific Agriculture Equipment Market, by Mode of Operation, 2025 Vs. 2032 (USD Million)

Figure 19 Asia-Pacific Agriculture Equipment Market, by Power Source, 2025 Vs. 2032 (USD Million)

Figure 20 Asia-Pacific Agriculture Equipment Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 21 Asia-Pacific Agriculture Equipment Market, by Country, 2025 (%)

Figure 22 Asia-Pacific: Agriculture Equipment Market Snapshot (2025)

Figure 23 Key Growth Strategies Adopted by Leading Players (2019–2025)

Figure 24 Competitive Dashboard: Asia-Pacific Agriculture Equipment Market

Figure 25 Asia-Pacific Agriculture Equipment Market Competitive Benchmarking, by Application

Figure 26 Asia-Pacific Agriculture Equipment Market Share Analysis, by Key Players (2022)

Figure 27 AGCO Corporation: Financial Overview (2022)

Figure 28 CLAAS KGaA mbH: Financial Overview (2022)

Figure 29 CNH Industrial N.V.: Financial Overview (2022)

Figure 30 Deere & Company: Financial Overview (2022)

Figure 31 ISEKI & CO LTD: Financial Overview (2021)

Figure 32 KUBOTA Corporation: Financial Overview (2022)

Figure 33 Mahindra & Mahindra Ltd.: Financial Overview (2022)

Figure 34 SDF S.P.A.: Financial Overview (2022)

Figure 35 Valmont Industries, Inc.: Financial Overview (2021)

Published Date: Jan-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates