Resources

About Us

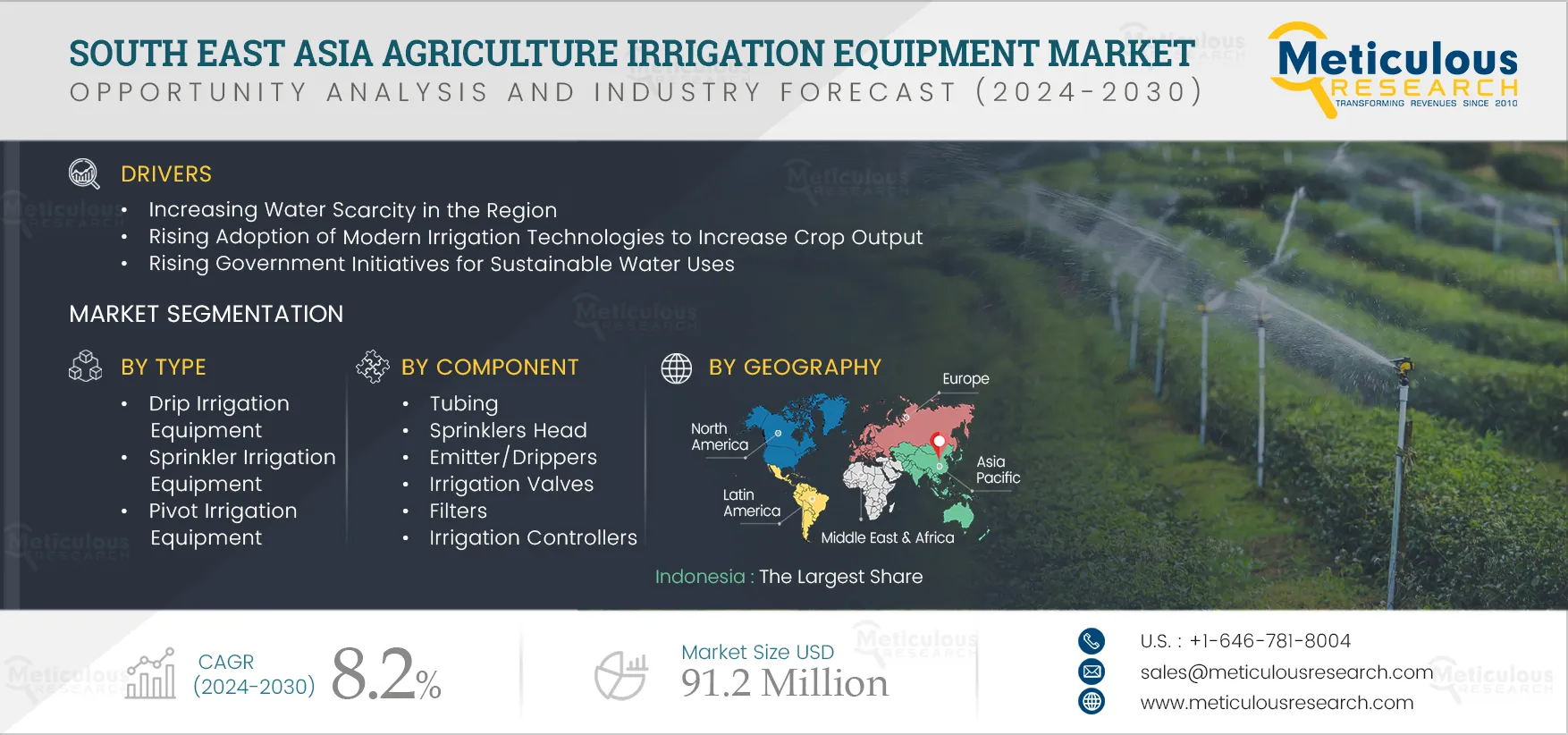

South East Asia Agriculture Irrigation Equipment Market by Type (Drip, Sprinkler, Furrow, Pivot Irrigation), Component (Tubing, Emitter, Sprinklers, Filter), Application (Open-field {Cereals & Grains, Fruits and Vegetables}, Closed-field) - Forecast to 2032

Report ID: MRAGR - 1041011 Pages: 198 Jan-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe South East Asia Agriculture Irrigation Equipment Market is projected to reach $91.2 million by 2032, at a CAGR of 8.2% during the forecast period of 2025 to 2032. The growth of this market is driven by the increasing water scarcity in the region, the rising adoption of modern irrigation technologies to increase crop output, and rising government initiatives for sustainable water use. However, the high maintenance cost of irrigation equipment and high initial costs of advanced agriculture irrigation equipment hinder this market's growth.

Moreover, technological advancements in irrigation equipment and the rising automation of irrigation systems are expected to provide market growth opportunities for the stakeholders operating in this market. However, the low awareness of advanced agriculture irrigation technologies is a major challenge for the players in this market. Additionally, the increasing adoption of precision farming techniques is a prominent trend in the South East Asia agriculture irrigation equipment market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players between 2020 and 2025. The key players profiled in the South East Asia agriculture irrigation equipment market research report are Netafim Ltd. (Israel), Nelson Irrigation Corporation (U.S.), Jain Irrigation Systems Limited (India), T-L Irrigation Company (U.S.), Valmont Industries, Inc. (U.S.), Rivulis Irrigation Ltd. (Israel), The Toro Company (U.S.), Rain Bird Corporation (U.S.), Galcon Bakarim Agricultural Cooperative Society Ltd. (Israel), and Chinadrip Irrigation Equipment (Xiamen) Co., Ltd. (China).

Click here to: Get Free Sample Pages of this Report

Agriculture’s water scarcity is becoming an increasingly major problem in many South East Asian countries, including Indonesia and Thailand. The agriculture sector in South East Asia is the major consumer of freshwater. The continuously growing population and economic growth have led to increased water use in various industrial applications. Further, the increasing impact of climate change affects the availability of water resources in the region. Thus, these factors led to an increase in water scarcity for the agriculture sector in the region.

In Indonesia, the rapid expansion of industrialization and urbanization has led to increased water demand, leaving farmers with limited access to water for irrigation. This has resulted in decreased agricultural productivity and a growing reliance on imported food. Moreover, in the country, total irrigation demand in Java, South East Sumatra, South Sulawesi, Bali, and West Nusa Tenggara is high. In addition, these areas lack freshwater resources. Moreover, Java is a significant water stress area in the country, containing more than half of the population and only 10% of the country’s water supplies.

Moreover, Indonesia’s Ministry of Public Works and Housing projected that the water levels in Java will drop to 476 m3 per person per year by 2040, far below the annual level of 1,169 m3 per person per year in 2019. The ministry also says the ideal per capita amount of water is 1,600 m3 per person per year. Furthermore, almost 10% of Indonesia is expected to experience a water crisis by 2045. Considering these water shortage challenges, in 2025, the Ministry of National Development Planning (BAPPENAS) is collaborating with the United Nations Food and Agriculture Organization (FAO) to implement the Water Scarcity Program in Indonesia. Thus, all these factors are expected to drive the demand for agricultural irrigation equipment in the country.

Similarly, in Thailand, the combination of droughts and inefficient irrigation systems has further increased the water scarcity issue, posing a significant threat to the country's agricultural sector and food security. Moreover, a severe drought hit Thailand in 2020, which caused severe damage to the country’s agriculture sector, particularly sugar, rubber, and rice crops. According to the Bank of Ayudhya’s Krungsri Research (Thailand), this drought cost the country around USD 1.5 billion (46 billion Thai baht), or 0.27% of GDP in 2020. The drought also affected off-season field crops, fruit trees, and freshwater fish farming production. Thus, the low availability of agricultural water resources has put pressure on the government as well as on farmers to adopt sustainable irrigation systems in the country. Thus, the rising water scarcity challenges in the major South East Asian countries are expected to drive the growth of the agricultural irrigation equipment market.

In 2025, the Drip Irrigation Equipment Segment is Expected to Dominate the South East Asia Agriculture Irrigation Equipment Market

Based on type, the South East Asia agriculture irrigation equipment market is segmented into drip irrigation equipment, sprinkler irrigation equipment, pivot irrigation equipment, furrow irrigation equipment, and terraced irrigation equipment. In 2025, the drip irrigation equipment segment is expected to account for the largest share of the South East Asia agriculture irrigation equipment market. The large market share of this segment is attributed to factors such as rising awareness regarding micro irrigation systems, including drip irrigation, easy availability and accessibility of drip irrigation systems and spare parts, presence of key providers of drip irrigation systems, increasing adoption of drip irrigation in row and horticultural crops in the region, and rising government support to mitigate the impact of water scarcity.

Furthermore, the drip irrigation equipment segment is anticipated to register the highest CAGR during the forecast period of 2025-2032 owing to the rising technological advancements in micro-irrigation systems, rising awareness about advanced irrigation technologies, and the vast need for efficient water management in the agriculture sector in the region.

In 2025, the Tubing Segment is Expected to Dominate the South East Asia Agriculture Irrigation Equipment Market

Based on component, the South East Asia agriculture irrigation equipment market is segmented into tubing, sprinklers head, emitter/drippers, irrigation valves, filters, irrigation controllers, and other components. In 2025, the tubing segment is expected to account for the largest share of the South East Asia agriculture irrigation equipment market. The large market share of this segment is attributed to the increasing adoption of drip and sprinkler irrigation techniques in the region, where tubing plays a crucial role as an essential component for delivering water directly to plant roots.

Moreover, the tubing segment is projected to register the highest CAGR during the forecast period of 2025–2032. This growth is driven by innovations in tubing technology and the absence of viable substitutes for tubing in irrigation systems. Moreover, with ongoing advancements in tubing materials and design, manufacturers are offering more durable, flexible, and efficient tubing solutions, which are further expected to support the growth of this market in the region.

In 2025, the Open-field Agriculture Segment is Expected to Dominate the Agriculture Irrigation Equipment Market

Based on application, the South East Asia agriculture irrigation equipment market is segmented into open-field agriculture and closed-field agriculture. In 2025, the open-field agriculture segment is expected to account for the larger share of the South East Asia agriculture irrigation equipment market. The large market share of this segment is attributed to the high area of crops under open-field agriculture, the rising demand for the region’s rice across the globe, and the increasing government initiatives aimed at reducing water wastage through conventional irrigation methods to address water scarcity challenges in the region.

The open-field agriculture segment is further sub-segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and other crops. In 2025, the cereals & grains segment is expected to account for the largest share of the open-field agriculture market. The large market share of this segment is attributed to the increasing demand for food grains due to a growing population, the increasing cultivation of staple crops, including rice, which serve as the primary food source for a significant portion of the world's as well as region’s population, and the rising water scarcity challenges for cereal and grain production.

Indonesia Expected to Dominate the South East Asia Agriculture Irrigation Equipment Market

Based on country, the South East Asia agriculture irrigation equipment market is segmented into Indonesia, Thailand, Vietnam, Philippines, Malaysia, and the rest of South East Asia. In 2025, Indonesia is expected to account for the largest share of the South East Asia agriculture irrigation equipment market. Indonesia’s significant market share is attributed to the high area under crop cultivation, increasing adoption of various irrigation systems due to rising water scarcity for agriculture in the country, rising government initiatives for water conservation, and increasing automation in irrigation systems.

Scope of the Report:

South East Asia Agriculture Irrigation Equipment Market Assessment, by Type

South East Asia Agriculture Irrigation Equipment Market Assessment, by Component

South East Asia Agriculture Irrigation Equipment Market Assessment, by Application

South East Asia Agriculture Irrigation Equipment Market Assessment, by Country

Key Questions Answered in the Report-

Agriculture irrigation equipment encompasses various components and systems, such as drip irrigation, sprinkler irrigation, pivot irrigation, furrow irrigation, and terraced irrigation. They are specifically designed to meet the water requirements of different agricultural crops while minimizing water wastage. These components and systems enhance the efficiency and productivity of agriculture by providing the precise water requirements for each crop.

This report provides detailed market insights, dynamics, and forecasts of the agriculture irrigation equipment market segmented by type, components, application, and country.

The South East Asia agriculture irrigation equipment market is projected to reach $91.2 million by 2032, at a CAGR of 8.2% during the forecast period.

Based on component, the tubing segment is expected to witness the fastest growth during the forecast period.

o Increasing Water Scarcity in the Region

o Rising Adoption of Morden Irrigation Technologies to Increase Crop Output

o Rising Government Initiatives for Sustainable Water Uses

o High Maintenance Cost of Irrigation Equipment

o High Initial Costs of Advanced Agriculture Irrigation Equipment

The key players operating in the South East Asia agriculture irrigation equipment market are Netafim Ltd. (Israel), Nelson Irrigation Corporation (U.S.), Jain Irrigation Systems Limited (India), T-L Irrigation Company (U.S.), Valmont Industries, Inc. (U.S.), Rivulis Irrigation Ltd. (Israel), The Toro Company (U.S.), Rain Bird Corporation (U.S.), Galcon Bakarim Agricultural Cooperative Society Ltd. (Israel), and Chinadrip Irrigation Equipment (Xiamen) Co., Ltd. (China).

Indonesia is expected to account for the largest share of the South East Asia agriculture irrigation equipment market in 2025. Indonesia’s significant market share is attributed to the huge area under crop cultivation, increasing adoption of various irrigation systems due to increasing water scarcity, rising government initiatives for water conservation, and increasing automation in irrigation systems.

Published Date: Jan-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates