Resources

About Us

Sustainable Livestock Farming Market by Technology (Precision Livestock Farming Systems, Automated Feeding & Milking Systems,), Livestock Type (Dairy Cattle, Beef Cattle, Poultry, Swine), Application — Global Forecast to 2035

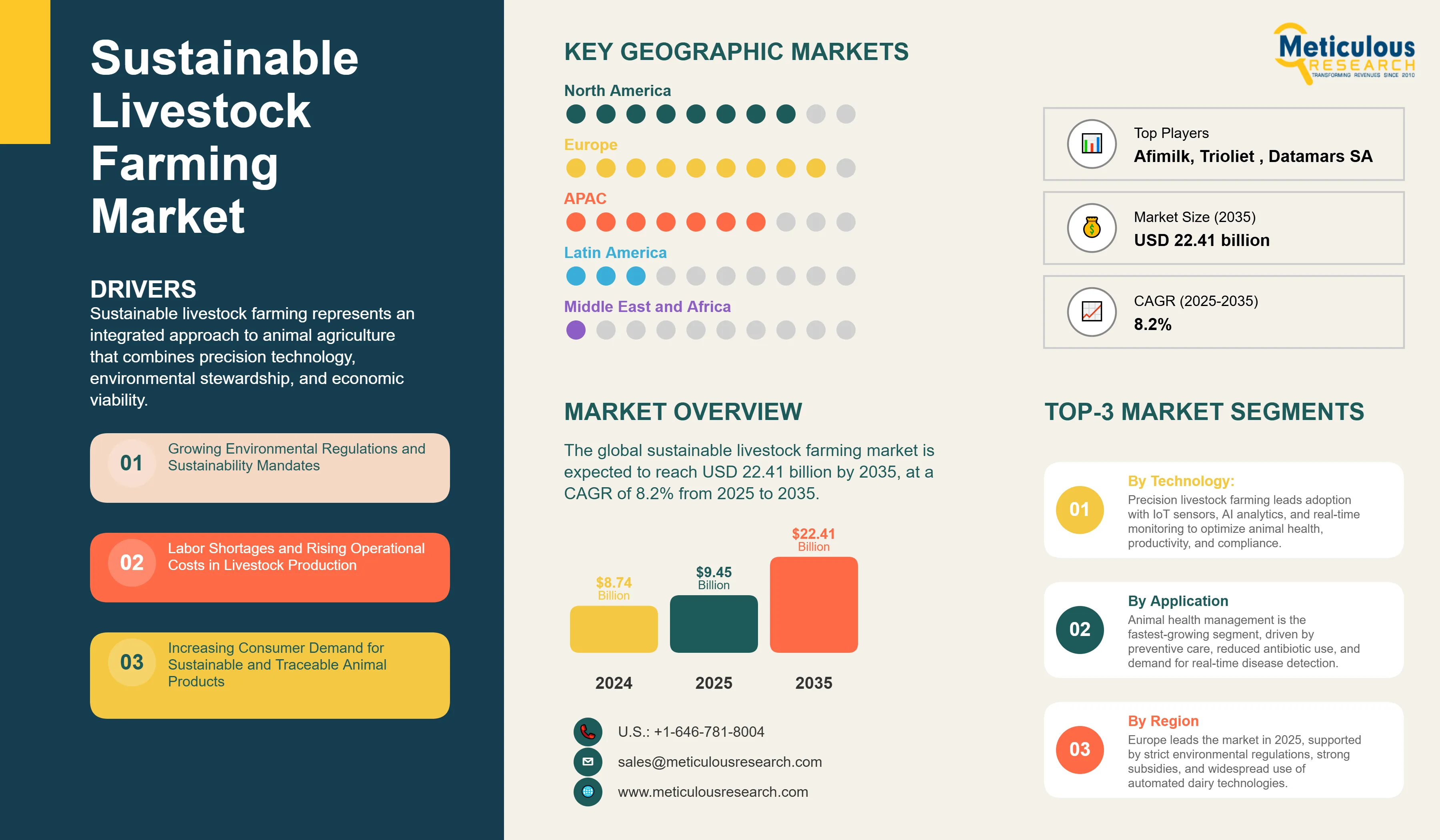

Report ID: MRAGR - 1041640 Pages: 245 Dec-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe global sustainable livestock farming market is expected to reach USD 22.41 billion by 2035 from USD 9.45 billion in 2025, at a CAGR of 8.2% from 2025 to 2035.

Sustainable livestock farming represents an integrated approach to animal agriculture that combines precision technology, environmental stewardship, and economic viability. It encompasses advanced monitoring systems that track individual animal health and behavior, automated equipment that optimizes feed efficiency and milk production, and regenerative land management practices that restore soil health while raising livestock. These systems enable farmers to produce high-quality animal products while reducing environmental impact, improving animal welfare, and maintaining profitability through data-driven decision-making and resource optimization.

Key Market Highlights:

Click here to: Get Free Sample Pages of this Report

Sustainable livestock farming integrates advanced technology with environmentally responsible practices to transform traditional animal agriculture. The livestock industry embraces the integrated use of precision livestock farming technologies to continuously track and monitor each individual livestock, the use of automation to minimize human labor and maximize effectiveness, and regenerative agriculture methods to promote greater soil health and diversity of farmland ecosystems. In short, this comprehensive approach is targeted at solving the triple problem of supporting a rising global population with food products, protecting the planet through environmentally sustainable means, and sustaining the livestock industry economically.

The market encompasses diverse technologies ranging from wearable sensors that track animal health metrics to robotic milking systems that operate autonomously around the clock. Precision livestock farming platforms integrate data from multiple sources to provide actionable insights on fertility, nutrition, and disease prevention. Meanwhile, regenerative grazing management systems use strategic animal movement to build soil organic matter, sequester carbon, and restore degraded rangelands. Together, these technologies enable farmers to increase productivity per animal while reducing resource inputs like water, feed, and antibiotics.

Key Trends Impacting the Market:

The sustainable livestock farming market is primarily driven by environmental pressures, technological innovation, and changing consumer expectations. Precision livestock farming is making it possible to move to individual animal management even when scaled up, through the use of wearable sensing devices and AI-based analytics software. Large-scale dairy production units use robots that enable cows to milk on demand and, at the same time, track milk quality, SCC, as well as production parameters for each cow. This is offered by companies such as Lely, DeLaval, and GEA Group, where advanced solutions involving ML algorithms detect illnesses even before they show any physical signs, days in advance.

Regenerative agriculture practices are rapidly expanding as livestock farmers begin to realize the benefits of regenerative agriculture in improving soil health while earning additional revenue streams through carbon credits. Rotational grazing systems that mimic natural herd behavior are being adopted across beef cattle operations, with ranchers using GPS-enabled virtual fencing and real-time pasture monitoring to optimize grazing intensity and rest periods. Studies have confirmed the capacity of regenerative grazing undertaken correctly to sequester high quantities of soil carbon while enhancing water retention capacity, biodiversity, and forage yield. This trend is being driven by the corporate sustainability commitments by major food companies and emerging carbon markets that provide financial incentives for verified soil carbon sequestration.

Integration of artificial intelligence and edge computing in livestock monitoring systems is another trend that is transforming the industry. Current technologies offered by firms like Allflex Livestock Intelligence and Nedap, enable monitoring of rumination activity, activity levels, and eating patterns to a level that allows for identification of subclinical diseases, optimal breeding, and metabolic disorders. All these are done through systems that incorporate data outputs to farm management software to enable decisions on thousands of livestock at a time. These technologies are changing animal health care practices to preventive as opposed to corrective practices, which has led to a decrease in antibiotic use and a longer productive life span for livestock.

Market Dynamics:

Driver: Growing Environmental Regulations and Sustainability Mandates

Livestock farming faces increasing regulatory pressure to reduce its environmental footprint, particularly regarding greenhouse gas emissions, water pollution from manure runoff, and excessive antibiotic use. The Farm to Fork Strategy of the European Union and similar policies in North America impose a reduction requirement in GHG emissions from agriculture, and the livestock industry is the main sector expected to cut emissions. To meet these demands, the livestock industry requires precision feeding systems where the nitrogen and phosphorus excretion is reduced to a minimum, disease-tracking systems where diseases are detected earlier and prophylactic use of antibiotics is reduced, or avoided altogether, and technologies incorporating waste methane production into energy. Sustainable livestock farming systems allow the livestock industry to meet the requirements of the regulatory bodies and also ensure productivity.

Driver: Labor Shortages and Increasing Cost of Operations

The agricultural sector globally faces acute labor shortages as rural populations decline and younger generations pursue alternative career paths. Traditional dairy farming, for instance, is a labor-intensive process involving milking, feeding, and medical checks during the early morning and late evening shifts. Automated milking technologies have been developed to tackle the problem by allowing voluntary cow flow, which involves the cows choosing the milking time independently and hence eliminating the need for manual milking during specific scheduled periods. The automated cattle feeding system optimizes the ration given to the cattle or groups of cattle accurately and hence eliminates the need for manual mixing and distribution of cattle feed, which would have been a labor-intensive task. The ROI for these technologies is improving because agricultural wages are rising globally and the expertise needed for farm operations is becoming scarce.

Opportunity: Carbon Markets and Regenerative Agriculture Incentives

The development of emerging carbon markets and corporate commitments to sustainability is opening up new avenues of revenue streams for livestock producers who adopt regenerative grazing practices. Major food corporates such as General Mills, Nestle, and McDonald’s have committed to projects to introduce regenerative farming practices in their supply chain, offering technical expertise in addition to monetary compensation to participating ranchers. At the same time, voluntary carbon markets are actually standardizing due diligence guidelines on the validation of carbon sequestration in soils on account of better grazing practices. Even though the science on permanence is still in its developmental stages, it is actually possible to sequester between 0.3 to 1.0 metric tons of carbon per hectare in one year on account of proper rotational grazing practices, which translates to potentially vital streams of revenue for major cattle ranching operations with vast tracts of land.

Opportunity: Integration of AI and Predictive Analytics

AI algorithms are enabling the translation of sensor data inputs into meaningful management information. Current precision livestock management systems can predict individual fertility dates with good accuracy on the basis of activity patterns, determine lameness on the basis of subtle gait patterns measured using accelerometers, or predict milk yields on the basis of feeding patterns and rumination times. Computer vision algorithms are being employed today for the assessment of body-condition scoring, the identification of individual animals without the need for identification tags, or the monitoring of competition at electronic feeders. AI algorithms are thus enabling personalized management even at large scale. As algorithms improve through exposure to larger datasets and computational costs decline, AI-powered livestock management is becoming accessible to mid-sized operations, not just industrial-scale facilities.

Segment Analysis:

By Technology:

In 2025, the precision livestock farming systems segment holds the largest share of the sustainable livestock farming market. This is mainly attributed to the widespread adoption of individual animal monitoring across dairy, beef, and intensive livestock operations. Precision livestock systems include reproductive and health monitoring systems consisting of wearable monitors; automated weighing systems; individual feed intake systems; and software farm management solutions. Major livestock equipment brands such as Allflex Livestock Intelligence, Nedap, and other DeLaval Group firms like SCR have already installed their monitoring systems on hundreds of thousands of farms around the world. The application of the precision livestock systems is particularly attractive as it goes beyond farm efficiency gains to provide documentation of farm compliance, genetic selection information, and traceability necessary within high-value segments.

Automated Feeding and Milking systems segment is expected to witness significant growth through 2035, mainly driven by labor economics and consistency requirements. Robotic milking systems provided by Lely, DeLaval, GEA Group, and BouMatic have completely transformed cattle farming in Europe and find increasing acceptance in North America. These systems offer voluntary milking access, automatic teat cleaning and attachment, individual milk quality analysis, and integration with herd management software.

By Livestock Type:

Dairy cattle operations account for the largest share of the sustainable livestock farming market in 2025. In the dairy segment, the monetary value per head is relatively high, making the precision technology solution very profitable. In the dairy segment, improved cattle are a huge investment cost to the farmer, estimated at $1,500 to $3,000 per head, making health monitoring and reproduction an area of extremely high importance. Dairy operations also face particularly stringent regulations regarding purity of dairy products, use of antibiotics, and environmental health, thus making monitoring and record-keeping systems extremely necessary. The daily milking requirement and need for consistent handling make dairy farms ideal candidates for automation technologies that improve both efficiency and animal welfare.

Beef cattle operations represent a growing segment, particularly for regenerative grazing technologies and extensive monitoring systems. While beef production traditionally involves less intensive management than dairy, increasing focus on carbon sequestration, grass-finished products, and verified sustainable practices is driving technology adoption for beef cattle operations.

By Application:

Animal health management is currently the fastest-growing application, attributed to the global drive to lower animal feed formulation with antibiotics and a rising demand for meat and other animal products that are raised without using antibiotics. Early disease diagnostic solutions with behavior monitoring, temperature, and rumination sensors make it possible to take corrective measures before clinical sickness manifests, sometimes making it unnecessary to administer antibiotics. The major pharmaceutical and animal health players are collaborating with technology developers to merge diagnostic tools with monitoring solutions. Merck Animal Health, for example, with Allflex monitoring solutions, enables veterinarians to access comprehensive health records of individual animals that help in making personalized treatment decisions.

Feed optimization applications are also expanding rapidly, as feed costs represent 50-70% of livestock production expenses. Precision feeding systems measure individual animal intake, adjust rations based on production stage and performance, and minimize nutrient excretion. Automated feeding equipment combined with near-infrared sensors for feed quality analysis enables dynamic ration adjustment. The technology is particularly valuable for dairy operations where optimal nutrition directly impacts milk production and composition. Feed efficiency improvements of 5-15% are commonly reported with precision feeding systems, providing rapid payback on technology investments through reduced feed costs and improved milk revenue.

Regional Insights:

In 2025, Europe commands the largest share of the global sustainable livestock farming market, led by the Netherlands, Germany, Denmark, and Sweden. The largest share of the European region is primarily attributed to the stringent environmental regulations, particularly the EU Nitrates Directive and Farm to Fork Strategy, which mandate measurable sustainability improvements. The region has the world's highest penetration of robotic milking systems, with the Netherlands approaching 50% automation on dairy farms. European governments provide substantial subsidies for the adoption of precision agriculture technologies, including grants covering 30-40% of equipment costs. The region also benefits from strong domestic manufacturers including Lely, DeLaval (Sweden), GEA Group (Germany), Nedap (Netherlands), and Fancom, which drive innovation and provide extensive local support networks.

North America is experiencing the fastest growth rate globally, driven by various factors including the regenerative agriculture movement, labor shortages, and large-scale farm consolidation. The U.S. has emerged as a global leader in regenerative grazing practices, with major ranching operations in the Great Plains, Southwest, and Southeast adopting intensive rotational grazing systems. Corporate sustainability commitments from major beef purchasers including Walmart, McDonald's, and Cargill are providing technical assistance and financial incentives for verified sustainable practices. In dairy, the trend toward larger herd sizes (many operations now manage 1,000+ cows) is accelerating adoption of automation, particularly in California, Wisconsin, New York, and Idaho. Canadian dairy operations are also rapidly adopting precision technologies despite supply management policies that limit herd expansion.

Asia-Pacific represents a high-growth emerging market, particularly in China, Australia, and New Zealand. The government of China has prioritized livestock sector modernization to address environmental pollution from traditional concentrated feeding operations and ensure food safety. Large state-owned and private livestock companies are investing heavily in automated systems and monitoring technologies. Australia and New Zealand leverage their extensive grassland resources with precision grazing management systems suited to their pastoral livestock industries. The dairy sector in New Zealand shows high adoption of monitoring technologies due to its export orientation and premium product positioning, requiring traceability and sustainability verification.

Key Players:

The major players operating in the global sustainable livestock farming market are DeLaval International AB (Sweden), Lely Holding S.à.r.l. (Netherlands), GEA Group AG (Germany), Allflex Livestock Intelligence (U.S./Israel, part of Merck Animal Health), BouMatic LLC (U.S.), Afimilk Ltd. (Israel), Nedap N.V. (Netherlands), Fancom B.V. (Netherlands), Waikato Milking Systems NZ LP (New Zealand), Dairymaster (Ireland), SCR Engineers Ltd. (Israel, now part of DeLaval Group), Trioliet B.V. (Netherlands), Big Dutchman International GmbH (Germany), Fullwood Packo (Belgium/UK), CowManager B.V. (Netherlands), Halter Ltd. (New Zealand), Connecterra B.V. (Netherlands), Datamars SA (Switzerland), Smartbow GmbH (Austria, part of Zoetis), and Moocall Ltd. (Ireland), among others.

The sustainable livestock farming market is expected to grow from USD 9.45 billion in 2025 to USD 22.41 billion by 2035.

The sustainable livestock farming market is expected to grow at a CAGR of 8.2% from 2025 to 2035.

The major players in the sustainable livestock farming market include DeLaval International AB, Lely Holding S.à.r.l., GEA Group AG, Allflex Livestock Intelligence (Merck Animal Health), BouMatic LLC, Afimilk Ltd., Nedap N.V., Fancom B.V., Waikato Milking Systems NZ LP, Dairymaster, SCR Engineers Ltd. (DeLaval Group), Trioliet B.V., Big Dutchman International GmbH, Fullwood Packo, CowManager B.V., Halter Ltd., Connecterra B.V., Datamars SA, Smartbow GmbH (Zoetis), and Moocall Ltd., among others.

The main factors driving the sustainable livestock farming market include growing environmental regulations and sustainability mandates requiring measurable emissions reductions, labor shortages and rising operational costs driving automation adoption, increasing consumer demand for sustainable and traceable animal products, carbon markets and regenerative agriculture incentive programs providing new revenue streams, integration of AI and predictive analytics enabling individualized animal management, and technological advancements in sensor accuracy, battery life, and data analytics making precision farming more accessible and cost-effective.

Europe will lead the global sustainable livestock farming market during the forecast period 2025 to 2035, driven by stringent environmental regulations, government subsidies for precision agriculture, and the presence of leading technology manufacturers.

Published Date: Mar-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Feb-2024

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates