Resources

About Us

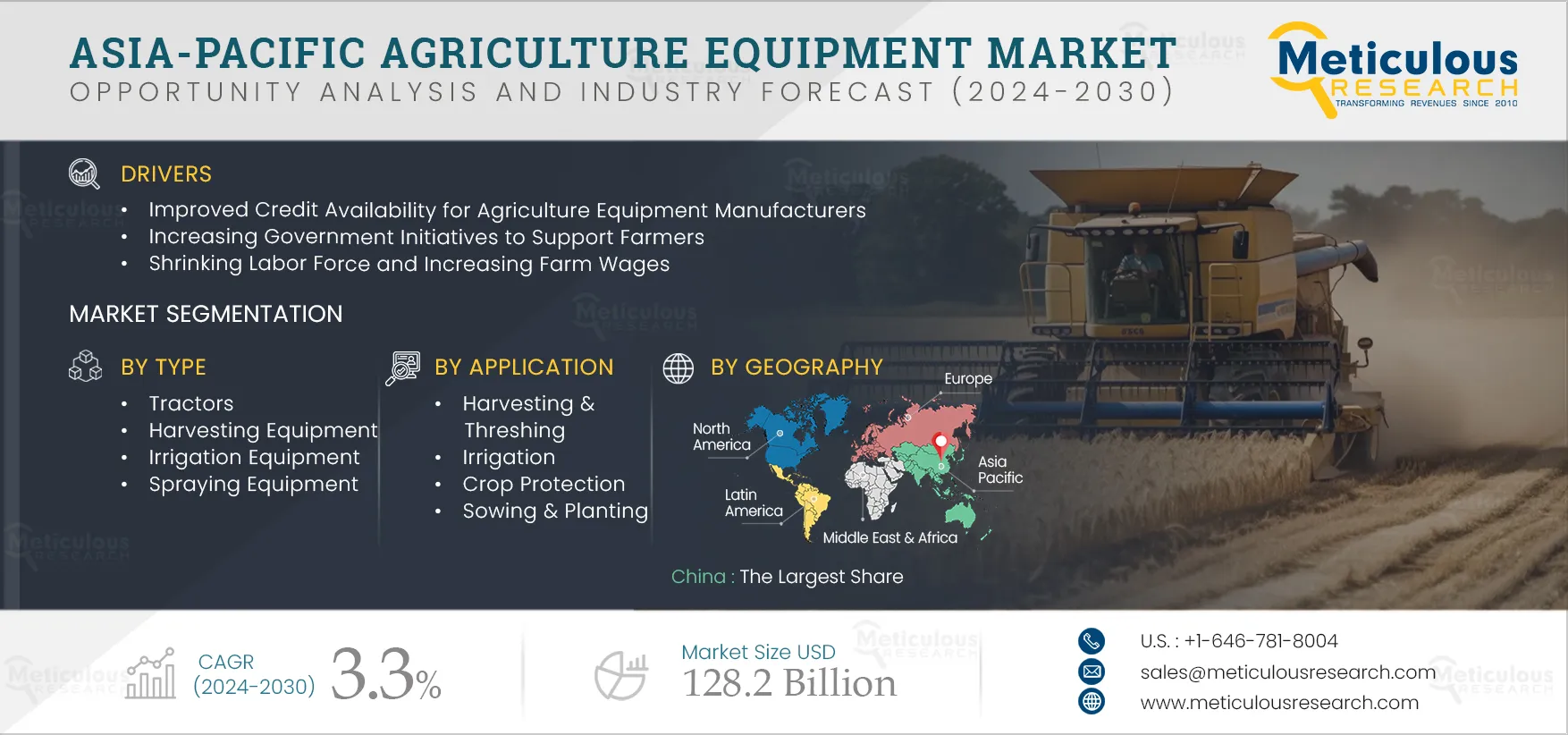

Asia-Pacific Agriculture Equipment Market by Type (Tractors, Harvesting Equipment, Irrigation Equipment), Mode of Operation (Manual, Automatic), Power Source (Electric Equipment), Application (Sowing, Planting, Harvesting, Irrigation) - Forecast to 2032

Report ID: MRAGR - 104969 Pages: 210 Jan-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Agriculture Equipment Market is projected to reach $128.2 billion by 2032, at a CAGR of 3.3% during the forecast period of 2025 to 2032. The growth of this market is driven by the improved credit availability for agriculture equipment manufacturers, increasing government initiatives to support farmers, a shrinking labor force coupled with rising farm wages, and growing awareness regarding the mechanization of agricultural operations. However, the rising fragmentation of land and the high costs of advanced agriculture equipment restrain the growth of this market.

Furthermore, technological advancements in agriculture equipment, the presence of prominent agriculture equipment manufacturers in the region, and the increasing adoption of precision farming techniques are expected to create market growth opportunities. However, challenges for market players include the low awareness of advanced agriculture technologies and limited purchases of highly advanced agriculture equipment due to high costs, resulting in a significant dependence on rental services. Additionally, digitalization in agriculture is a prominent trend in the Asia-Pacific agriculture equipment market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players over the past 3-4 years. The key players profiled in the Asia-Pacific agriculture equipment market research report are AGCO Corporation (U.S.), Agromaster (Turkey), AMAZONEN-WERKE H. DREYER SE & Co. KG (Germany), APV - Technische Produkte GmbH (Austria), CLAAS KGaA mbH (Germany), CNH Industrial N.V. (U.K.), Deere & Company (U.S.), HORSCH Maschinen GmbH (Germany), ISEKI & CO., LTD. (Japan), KUBOTA Corporation (Japan), KUHN SAS (France), Mahindra & Mahindra Ltd. (India), Mascar SpA (Italy), Morris Equipment Ltd (Canada), SDF S.p.A. (Italy), and Valmont Industries, Inc. (U.S.).

Click here to: Get Free Sample Pages of this Report

In the agricultural sector, acquiring machinery and equipment requires significant initial investments. The high cost of equipment stems from the expenses associated with its production. Establishing an agriculture equipment production facility requires substantial capital investment, although it can prove to be a profitable venture in the long term. Furthermore, specialized skills and knowledge are indispensable for agriculture equipment manufacturing, along with the need for adequate infrastructure facilities. All these factors collectively contribute to the high costs of agricultural equipment.

The agriculture equipment sector presents promising growth opportunities in the Asia-Pacific region. Recognizing these opportunities, certain private investors and companies have already begun to invest in this sector. Some recent investments by major stakeholders in the agriculture equipment sector are:

Thus, the increasing investments are expected to drive the growth of the agriculture equipment market in the Asia-Pacific in the forthcoming years.

In 2025, the Tractors Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Based on type, the Asia-Pacific agriculture equipment market is segmented into tractors, harvesting equipment, soil preparation & cultivation equipment, irrigation equipment, spraying equipment, and other agriculture equipment. In 2025, the tractors segment is expected to account for the largest share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to several factors, including the heavy reliance of farmers on tractors for agricultural purposes, increasing demand for mechanization, a rise in farm labor shortages, government initiatives aimed at improving the agricultural sector, and technological advancements in tractors.

However, the irrigation equipment segment is projected to register the highest CAGR during the forecast period of 2025–2032 due to increasing water shortages for agricultural use, extensive area of land under crop cultivation in the region, rising government initiatives promoting the adoption of drip and sprinkler irrigation, and growing automation in irrigation systems.

In 2025, the Semi-automatic Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Based on mode of operation, the Asia-Pacific agriculture equipment market is segmented into semi-automatic, manual, and automatic. In 2025, the semi-automatic segment is expected to account for the largest share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to the higher adoption of semi-automatic agricultural equipment over automated agriculture equipment due to their easy availability and accessibility. Additionally, semi-automatic agriculture equipment is more cost-effective than automatic agriculture equipment, driving their adoption among small- and medium-sized farmers, particularly in China and India.

However, the automatic segment is projected to register the highest CAGR during the forecast period of 2025–2032 due to factors such as the increasing adoption of precision agriculture, the shortage of skilled agriculture laborers, and ongoing technological advancements in agricultural equipment. Furthermore, the increasing utilization of robotics and artificial intelligence technologies within the agriculture sector is expected to create opportunities for companies operating in this market.

In 2025, the Non-electric Equipment Segment is Expected to Dominate the Asia-Pacific Agriculture Equipment Market

Based on power source, the Asia-Pacific agriculture equipment market is segmented into non-electric and electric-powered agriculture equipment. In 2025, the non-electric equipment segment is expected to account for the larger share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to the growing adoption of non-electric equipment due to its simplicity and comparatively lower cost over its electric counterparts. Additionally, non-electric equipment typically comes with lower upfront costs and power requirements, making them more affordable and accessible to a wider range of farmers with limited financial resources in the Asia-Pacific region.

In 2025, the Land Development and Seedbed Preparation Segment is Expected to Dominate the Agriculture Equipment Market

Based on application, the agriculture equipment market is mainly segmented into land development and seedbed preparation, harvesting & threshing, irrigation, sowing & planting, crop protection, and other applications. In 2025, the land development and seedbed preparation segment is expected to account for the largest share of the Asia-Pacific agriculture equipment market. The large market share of this segment is attributed to factors such as the increasing adoption of advanced cultivation techniques to reduce labor costs, the availability of technologically advanced equipment, and the advantages offered by advanced agricultural equipment during land development and seedbed preparation, such as high productivity and efficiency.

China to Dominate the Asia-Pacific Agriculture Equipment Market in 2025

The Asia-Pacific agriculture equipment market is segmented into China, India, Japan, Australia, and the Rest of Asia-Pacific. In 2025, China is expected to account for the largest share of the Asia-Pacific agriculture equipment market. China’s significant market share is attributed to the large number of farmers in the country coupled with an extensive area under agriculture cultivation, the increasing demand for advanced agriculture equipment due to labor shortages, the increase in government initiatives aimed at modernizing and mechanizing the agriculture sector, and the presence of numerous agriculture equipment manufacturers in the country.

Scope of the Report:

Asia-Pacific Agriculture Equipment Market Assessment, by Type

Asia-Pacific Agriculture Equipment Market Assessment, by Mode of Operation

Asia-Pacific Agriculture Equipment Market Assessment, by Power Source

Asia-Pacific Agriculture Equipment Market Assessment, by Application

Asia-Pacific Agriculture Equipment Market Assessment, by Country

Key questions answered in the report-

Agriculture equipment are machinery and tools, including tractors, harvesters, seeders, sprayers, irrigation systems, and grain-handling equipment specially designed to perform various agricultural tasks, including land preparation, planting, cultivation, and harvesting of agricultural produce. These machinery and tools are designed to improve the efficiency and productivity of agriculture by minimizing human labor and limiting the errors, physical shortcomings, and wastage in agriculture caused by human labor.

OEMs (Original Agriculture Equipment Manufacturers) are in the business of designing, producing, and marketing their brand of agricultural machinery and equipment. The revenue from OEMs across all the Asia-Pacific countries is included in the market size for agricultural equipment.

In this report, autonomous agriculture equipment refers to machinery and equipment capable of performing agricultural tasks without human intervention. These advanced machines leverage technologies such as GPS, sensors, artificial intelligence, and robotics to carry out operations like planting, spraying, and harvesting with high precision and efficiency.

This report provides detailed market insights, dynamics, and forecasts of the agriculture equipment market segmented by type, mode of operation, power source, application, and geography.

The Asia-Pacific agriculture equipment market is projected to reach $128.2 billion by 2032, at a CAGR of 3.3% during the forecast period.

Based on power source, the electric-powered agriculture equipment segment is expected to witness the highest growth rate during the forecast period.

o Improved Credit Availability for Agriculture Equipment Manufacturers

o Increasing Government Initiatives to Support Farmers

o Shrinking Labor Force and Increasing Farm Wages

o Rising Awareness Regarding Mechanization of Agricultural Operations

o Rising Fragmentation of Land

o High Costs of Advanced Agriculture Equipment

The key players operating in the Asia-Pacific agriculture equipment market are AGCO Corporation (U.S.), Agromaster (Turkey), AMAZONEN-WERKE H. DREYER SE & Co. KG (Germany), APV - Technische Produkte GmbH (Austria), CLAAS KGaA mbH (Germany), CNH Industrial N.V. (U.K.), Deere & Company (U.S.), HORSCH Maschinen GmbH (Germany), ISEKI & CO., LTD. (Japan), KUBOTA Corporation (Japan), KUHN SAS (France), Mahindra & Mahindra Ltd. (India), Mascar SpA (Italy), Morris Equipment Ltd (Canada), SDF S.p.A. (Italy), and Valmont Industries, Inc. (U.S.).

China is expected to account for the largest share of the Asia-Pacific agriculture equipment market in 2025. Moreover, this country is projected to register the highest CAGR during the forecast period of 2025–2032. China’s significant market share and rapid growth rate are attributed to the large number of farmers in the country coupled with an extensive area under agriculture cultivation, the increasing demand for advanced agriculture equipment due to labor shortages, the increase in government initiatives aimed at modernizing and mechanizing the agriculture sector, and the presence of numerous agriculture equipment manufacturers in the country.

Published Date: Jan-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates