Resources

About Us

Agricultural In-Cab Display Market by Display Type (Touchscreen Displays, Non-Touchscreen Displays), Screen Size (7-10 Inches, 10-12 Inches, Above 12 Inches), Technology (LED, LCD, OLED), Application, End User, Application — Global Forecast to 2036

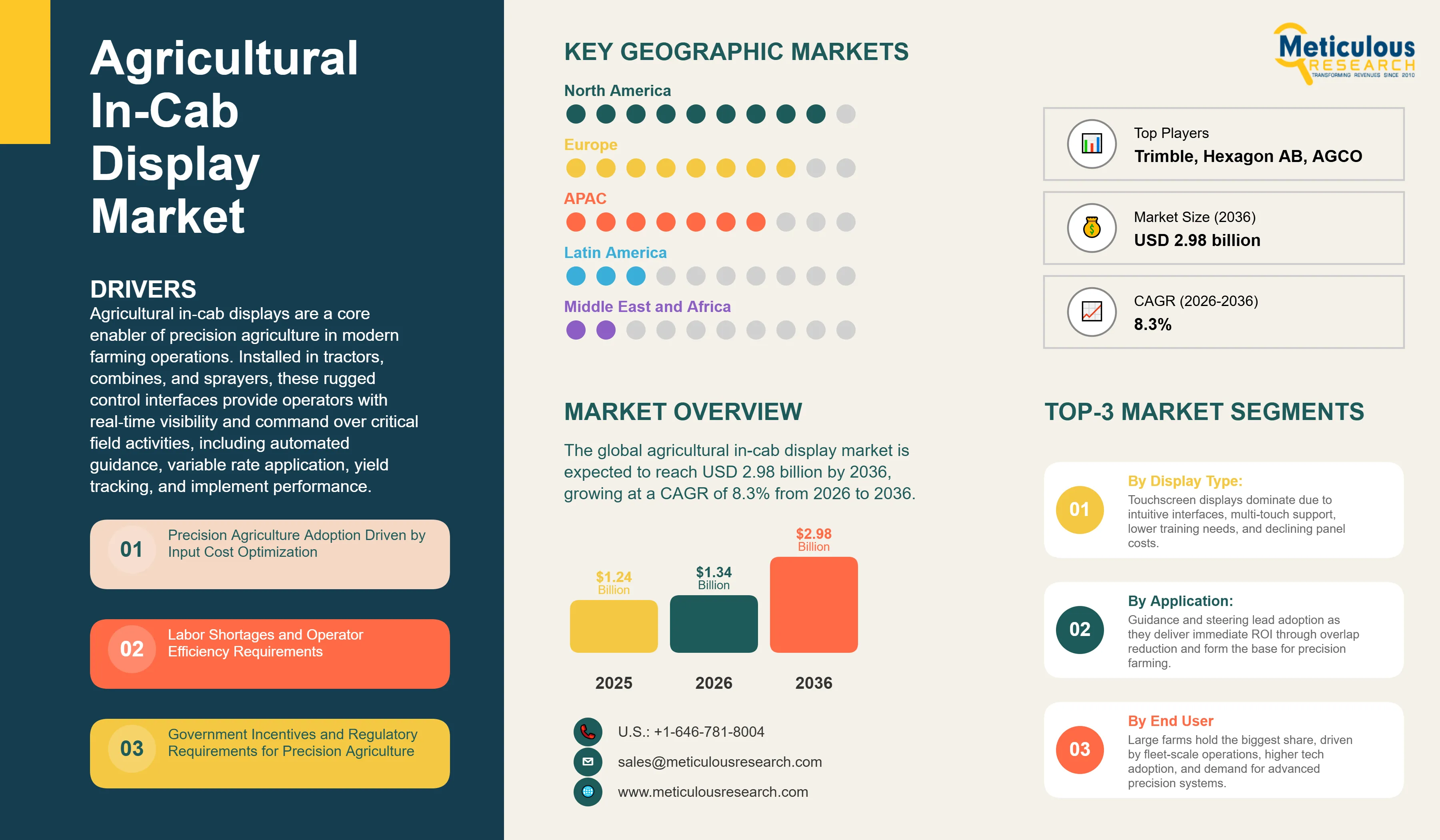

Report ID: MRAGR - 1041642 Pages: 211 Jan-2026 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe global agricultural in-cab display market is expected to reach USD 2.98 billion by 2036 from USD 1.34 billion in 2026, growing at a CAGR of 8.3% from 2026 to 2036.

Agricultural in‑cab displays are a core enabler of precision agriculture in modern farming operations. Installed in tractors, combines, and sprayers, these rugged control interfaces provide operators with real‑time visibility and command over critical field activities, including automated guidance, variable rate application, yield tracking, and implement performance. In effect, the display becomes the operational control point through which productivity, accuracy, and efficiency are managed directly from the cab.

The market covers a broad technology spectrum from compact 7‑inch displays designed for fundamental guidance and section control, to advanced 12‑inch and larger platforms built for high‑intensity operations. These flagship systems support split‑screen operation, live implementation monitoring via integrated cameras, wireless data synchronization, and expandable software environments that accommodate third‑party precision tools.

The growth of the overall agricultural in‑cab displays market is being driven by structural shifts in global agriculture. Widespread adoption of precision farming practices, stringent regulatory requirements around input efficiency and traceability, and persistent labor shortages are driving demand for automation and operator efficiency. At the same time, competition among manufacturers continues to accelerate feature innovation while reducing system costs, steadily lowering the entry barrier. As a result, in‑cab displays are no longer limited to large-scale enterprises and are increasingly viewed as a practical, value‑generating investment across farms of all sizes.

Click here to: Get Free Sample Pages of this Report

Integration with Farm Management Software and Cloud Platforms

Integration with farm management software and cloud connectivity has emerged as the most influential trend reshaping the role of agricultural in‑cab displays. What were once standalone field terminals are now positioned as edge devices within broader, data‑driven farming ecosystems. Leading display platforms integrated with solutions such as John Deere Operations Center, Trimble FarmENGAGE, AGCO Fuse, CNH AFS Connect/PLM Connect, and Climate FieldView enable automatic uploading of as‑applied field data, eliminating manual USB‑based data transfers. They also support wireless synchronization of updated prescriptions and field boundaries from office systems to machines in operation, real‑time equipment monitoring for remote diagnostics and preventive maintenance, and analytics that aggregate performance insights across multiple growing seasons.

This level of connectivity is enabling new commercial models across the agricultural value chain. Equipment manufacturers are expanding into software subscription revenues, dealers and agronomists are developing precision agriculture service offerings, and input suppliers such as seed and crop protection companies are leveraging aggregated field data to deliver more targeted, data‑driven recommendations. At the same time, adoption is constrained by structural challenges, including inconsistent rural cellular coverage that limits real‑time connectivity, farmer concerns around data ownership and privacy, and persistent interoperability issues when displays from one manufacturer are required to exchange data with farm management platforms from competing vendors.

Mixed‑Fleet Compatibility and Brand‑Agnostic Platforms

Demand for mixed‑fleet compatibility is reshaping competitive dynamics across the agricultural in‑cab display market. Farmers increasingly require display systems that operate seamlessly across equipment sourced from multiple manufacturers, reflecting the reality of mixed ownership, seasonal rentals, and long equipment replacement cycles. Trimble’s positioning, maintained following its joint venture with AGCO, has allowed it to retain broad third‑party compatibility across John Deere, CNH, AGCO, and other brands, strengthening its appeal in aftermarket upgrades and mixed‑fleet operations.

Conversely, Raven’s acquisition by CNH Industrial triggered concerns around reduced neutrality and aftermarket availability, accelerating development of alternative universal display platforms from competitors such as Ag Leader, Topcon, and various regional suppliers. ISOBUS universal terminal certification plays a central role in this shift, enabling a single display to control implements from any manufacturer using standardized communication protocols. This reduces cab complexity, lowers training requirements, and simplifies operations when equipment configurations change between seasons or across rented assets. Parallel efforts to improve data portability, most notably through initiatives such as the AgGateway ADAPT framework and manufacturer participation in open data exchange standards, aim to allow agronomic data to move between platforms without vendor lock‑in, although practical implementation remains uneven across the market.

Transition Toward Autonomous and Semi‑Autonomous Operations

The progression toward autonomous and semi‑autonomous farming is accelerating the evolution of in‑cab displays from primary control interfaces to supervisory and monitoring systems. John Deere’s autonomous tractor program illustrates this shift, positioning the display as a remote oversight station where operators supervise multiple machines simultaneously rather than actively steering a single vehicle. Similar concepts from CNH Industrial and AGCO envision displays transitioning to exception‑management tools, with human intervention required only when autonomous systems encounter conditions demanding judgment or decision‑making.

In the near term, semi‑autonomous capabilities such as automatic headland turning, GPS‑based implement engagement at field boundaries, and obstacle detection supported by live camera feeds are already redefining display requirements. These functions demand larger screens capable of presenting multiple information streams simultaneously, higher processing power to support real‑time computer vision and alerts, and reliable network connectivity for remote monitoring. As a result, the market is increasingly segmenting between premium flagship displays, designed to support advanced automation and monitoring use cases, and entry‑level systems that remain focused on core guidance and control functions.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 1.34 Billion |

|

Revenue Forecast in 2036 |

USD 2.98 Billion |

|

Growth Rate (CAGR) |

8.3% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2023–2024 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Market size estimation, revenue forecast, competitive landscape, company profiles, growth drivers, restraints, opportunities, and technology trends |

|

Segments Covered |

Display Type, Screen Size, Technology, Application, End User, Compatibility |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Italy, Spain, Poland, Netherlands, China, Japan, India, Australia, Brazil, Mexico, Argentina, South Africa |

|

Key Companies Profiled |

Deere & Company, AGCO Corporation, CNH Industrial N.V., Trimble Inc., Topcon Positioning Systems, CLAAS KGaA mbH, Kubota Corporation, Hexagon AB, AG Leader Technology, Hemisphere GNSS Inc. |

Driver: Precision Agriculture Adoption Driven by Input Cost Optimization

Rising costs for fertilizer, seed, and crop protection products are strengthening the economic case for precision agriculture technologies that reduce waste and improve application accuracy. This cost pressure has accelerated the adoption of variable rate application, which relies on in‑cab displays to execute prescription‑based inputs accurately in the field.

GPS‑enabled section control provides immediate, measurable benefits by eliminating overlaps in headlands and irregular field geometries, typically delivering 5–8% input savings. These gains often translate into payback periods of less than two growing seasons, even for smaller farming operations. Variable rate seeding further enhances the value proposition by adjusting plant populations to in‑field variability, reducing seed costs while improving stand uniformity and yield potential.

Collectively, these financial benefits have repositioned in‑cab displays from discretionary technology to economically justified investments. This is particularly evident among commercial farms operating 500 acres or more, where savings compound significantly across large acreage. Manufacturers have responded to this shift by introducing entry‑level display bundles priced below USD 5,000, typically including basic guidance and section control functions. At the same time, advanced capabilities such as variable rate control and telematics remain differentiated within premium systems, allowing suppliers to address both price‑sensitive and high‑value customer segments.

Opportunity: Retrofit Market for Aging Equipment Fleets

The large installed base of agricultural machinery lacking modern precision agriculture capabilities represents a significant opportunity for the aftermarket display segment. Average tractor ages in major agricultural markets range from 10 to 15 years, with many farms continuing to operate equipment 20 years or older that remains mechanically sound but technologically outdated. Globally, the installed base exceeds 25 million tractors, with substantial portions in Europe, North America, and Asia operating without guidance systems or relying on obsolete display technology incompatible with modern farm management platforms.

Aftermarket display systems offered by companies such as Trimble, Topcon, Ag Leader, and regional suppliers provide cost‑effective upgrade pathways, enabling precision agriculture adoption without the need for full equipment replacement. ISOBUS standardization is particularly advantageous in retrofit use cases, as universal terminals can control modern implements regardless of tractor brand or age unlike proprietary systems that require brand‑specific displays.

Several factors continue to support aftermarket growth. Precision agriculture requirements embedded in subsidy and compliance programs are making guidance systems effectively mandatory in some regions. Rising input costs are increasing the economic necessity of precision capabilities. In parallel, generational transitions across farm ownership are accelerating demand, as younger operators inheriting legacy equipment seek to integrate modern digital and precision tools into existing fleets.

Opportunity: Emerging Market Modernization and Large Farm Development

Agricultural modernization efforts across emerging markets, including China, India, Brazil, and Eastern Europe, are creating long‑term growth opportunities for agricultural in‑cab displays. As mechanization increases and farm consolidation progresses, the economic foundations required for precision agriculture adoption are steadily strengthening.

In China, government‑led modernization programs promote large‑scale farming, with subsidies supporting the adoption of precision agriculture technologies. This has driven demand for display systems among corporate farming enterprises and large family‑owned operations. India’s precision agriculture initiatives are more selectively focused, targeting high‑value crops such as cotton and sugarcane, where input optimization delivers outsized returns. However, smaller average farm sizes and price sensitivity continue to favor lower‑cost display solutions.

The expanding agricultural frontier in Brazil, particularly in the Cerrado region, features highly mechanized, large‑scale operations adopting precision agriculture at rates approaching those seen in North America. Alongside international suppliers, local display manufacturers are emerging to address regional demand. In Eastern Europe, markets such as Ukraine, Romania, and Poland are experiencing growing adoption driven by EU integration, subsidy access linked to precision practices, and increasing farm consolidation that creates operations of sufficient scale to justify technology investment.

By Display Type:

Touchscreen displays hold the largest share of the overall market in 2025, driven by intuitive use, multi‑touch efficiency (zoom, swipe, direct map interaction), and operator familiarity with smartphones/tablets. Cost declines in capacitive panels have pushed touchscreens into standard offerings from major OEMs, concentrating revenue in this segment as farms upgrade to unified, user‑friendly interfaces that cut training time and elevate in‑cab productivity.

By Screen Size:

The 10-12 inch displays dominate the market in 2025, as they balance cab ergonomics with the multi-function utility, supporting split‑screen guidance, implement control, and camera feeds with sufficient map resolution for VRA and boundary work. Revenue concentrates here as commercial farms prefer a single, full‑featured display (USD 5k–10k) over multiple smaller monitors, lifting average selling prices and software/license uptake.

Above‑12 inch displays are expected to grow at the fastest CAGR, propelled by autonomy‑ready workflows, higher information density, and camera/vision integration in large cabs. This segment expands premium hardware margins and unlocks incremental subscription/analytics revenue as fleets scale supervisory monitoring and exception management.

By Application:

Guidance/steering is the largest application in 2025 due to universal use across tillage, planting, spraying, fertilizing, and harvesting, delivering immediate 5–10% efficiency through overlap reduction and fatigue mitigation. Revenue concentration reflects high penetration (e.g., >80% on large North American farms) and the essential, “every‑pass” nature of guidance licenses and corrections services.

However, VRA application is expected to grow at the fastest CAGR through 2036, fueled by input‑cost pressure, simpler prescription generation, and compliance mandates for documented nutrient management.

By End User:

Large farms command the largest share of the overall agricultural in-cab display market in 2025, demonstrating highest precision agriculture adoption rates and investment in premium display systems. Large operations typically run equipment fleets requiring centralized precision agriculture platforms, driving demand for telematics-enabled displays supporting fleet management and real-time operational monitoring. These farms also show higher willingness to adopt emerging technologies including autonomous operation, advanced implement automation, and integration with comprehensive farm management software, positioning them as early adopters for premium displays. Geographic concentration of large farms in the North American Great Plains, Brazilian Cerrado, Ukrainian breadbasket, and Australian wheat belt creates regional demand hotspots.

Medium farms are set to grow the fastest, driven by declining hardware prices, ISOBUS‑friendly retrofits, and rising awareness of payback at smaller scales.

Regional Insights:

In 2025, North America commands the largest share of the global agricultural in-cab display market, with the U.S. at the center as precision agriculture has become mainstream across commercial operations. Large average farm sizes, mainly in Midwest corn-soybean regions, Great Plains wheat areas, and specialty crop production in the California create favorable economics justifying display investments with relatively short payback periods. Strong dealer support networks from major equipment manufacturers and precision agriculture specialists provide installation, training, and technical support critical for technology adoption. Canadian markets mirror US trends with particularly high adoption in Prairie provinces (Saskatchewan, Alberta, Manitoba) where large grain farms extensively utilize precision agriculture.

Europe is also one of the major markets for the agricultural display, driven by regulatory frameworks increasingly mandating precision agriculture practices. Common Agricultural Policy reforms incorporate digital farming requirements, making guidance systems and precision application documentation effectively mandatory for subsidy eligibility. Environmental regulations including nitrate directives and pesticide reduction targets push farmers toward variable rate application requiring display-controlled equipment. ISOBUS standardization originated in Europe with strong industry support from equipment manufacturers and implement suppliers, creating interoperability facilitating mixed-fleet operations common in European farming. Eastern European markets including Poland, Romania, and Hungary show growing adoption of displays as farm consolidation creates larger operations with economics supporting technology investment and EU integration drives modernization.

The Asia-Pacific region is the fastest-growing regional market for the agricultural in-cab display. Australia leads regional adoption with significant penetration of precision agriculture, driven by very large farm sizes (average exceeding 1,000 acres), highly mechanized operations, and strong agronomic service infrastructure supporting technology adoption. Japanese agriculture practices also shows high technology adoption in greenhouse and controlled environment sectors where precision systems including automated irrigation and climate control utilize display interfaces, though small average farm sizes limit field crop adoption. South Korea similarly shows adoption in protected agriculture and specialty crops. China represents enormous growth potential as agricultural modernization initiatives promote large-scale mechanized farming, particularly in Northeast grain regions and consolidating operations in Eastern provinces. Government subsidies supporting precision agriculture technology adoption and domestic display manufacturers emerging to serve local markets accelerate growth. India shows nascent adoption concentrated in high-value crops including cotton and sugarcane, though widespread adoption faces barriers including small farm sizes, affordability constraints, and limited technical support infrastructure. Southeast Asian markets remain early stage but demonstrate interest in precision agriculture for plantation crops and emerging mechanization in rice production.

Key Players:

The major players in the global agricultural in-cab display market include Deere & Company (U.S.), AGCO Corporation (U.S.), CNH Industrial N.V. (Netherlands), Trimble Inc. (U.S.), Topcon Positioning Systems (Japan), CLAAS KGaA mbH (Germany), Kubota Corporation (Japan), Hexagon AB (Sweden), AG Leader Technology (U.S.), and Hemisphere GNSS Inc. (U.S.), among others.

The agricultural in-cab display market is expected to grow from USD 1.34 billion in 2026 to USD 2.98 billion by 2036.

The agricultural in-cab display market is expected to grow at a CAGR of 8.3% from 2026 to 2036.

The major players in the agricultural in-cab display market include Deere & Company (U.S.), AGCO Corporation (U.S.), CNH Industrial N.V. (Netherlands), Trimble Inc. (U.S.), Topcon Positioning Systems (Japan), CLAAS KGaA mbH (Germany), Kubota Corporation (Japan), Hexagon AB (Sweden), AG Leader Technology (U.S.), and Hemisphere GNSS Inc. (U.S.), among others.

The main factors driving the agricultural in-cab display market include widespread precision agriculture adoption driven by rising input costs necessitating optimization, labor shortages requiring automation and operator efficiency improvements, government subsidies and conservation programs providing cost-share funding for precision agriculture technology, regulatory requirements for input traceability and documentation, declining display hardware costs making technology accessible across farm sizes, ISOBUS standardization enabling mixed-fleet compatibility and aftermarket retrofits, and integration with farm management software platforms creating comprehensive digital farming ecosystems.

North America will continue to lead the global agricultural in-cab display market during the forecast period 2026 to 2036, driven by highest precision agriculture adoption rates globally particularly in US Corn Belt and Canadian Prairie provinces, large average farm sizes providing favorable economics for technology investment, mature dealer support networks from major equipment manufacturers and precision agriculture specialists, government conservation programs providing cost-share funding, and strong presence of agricultural technology companies including John Deere, AGCO, CNH Industrial, and Trimble headquartered or maintaining major operations in the region.

Published Date: Feb-2026

Published Date: Feb-2026

Published Date: Dec-2024

Published Date: Mar-2024

Published Date: Feb-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates