Resources

About Us

Anesthesia Machines Market by Offering (Anesthesia Workstation, Delivery Systems, Portable, Monitor, Ventilator, Circuit, Mask, Vaporizer) Application (Orthopedic, Neurology, Cardiology, Urology) End User (Hospital, Clinic, ASC) - Global Forecast to 2032

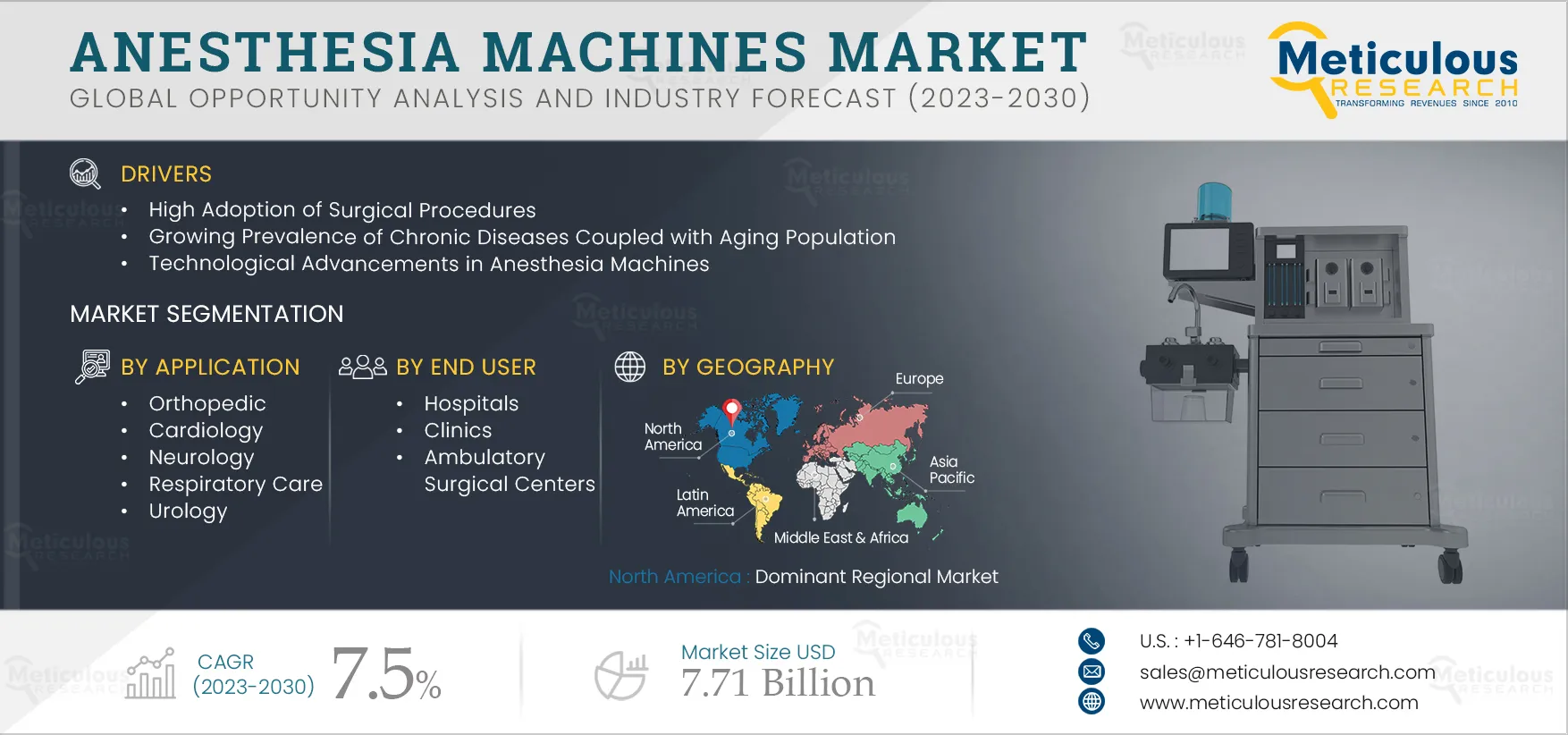

Report ID: MRHC - 104850 Pages: 250 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Anesthesia Machines Market is projected to reach $7.71 billion by 2032, at a CAGR of 7.5% from 2025 to 2032. Anesthesia machines or anesthesia delivery systems are medical devices used to administer anesthesia to patients during surgical procedures. They deliver precise concentrations of anesthetic gases and drugs, ensuring patient comfort and pain relief, and monitor and manage patients' vital functions during surgery. Additionally, anesthesia ventilators are a key aspect of anesthesia delivery systems to supply oxygen to patients during surgical procedures. Physicians in hospitals, specialty clinics, and ambulatory surgical centers use anesthesia machines.

The growth of the anesthesia machines market is attributed to the high adoption of surgical procedures, the growing prevalence of chronic diseases, the aging population, and technological advancements in anesthesia devices. Additionally, increasing focus on patient comfort is expected to provide significant opportunities for players operating in the market.

Furthermore, the growing focus on patient comfort is expected to provide significant opportunities for market players. However, the high cost of anesthesia machines, adverse anesthesia reactions, and stringent regulations restrain the market’s growth. Moreover, low awareness and adoption, a shortage of skilled professionals, and high maintenance of anesthesia machines are the major challenges to the market’s growth.

As of 2020, around 310 million major surgeries are performed each year globally. High adoption of surgical procedures can be attributed to the following reasons:

Lifestyle Changes and Prevalence of Chronic Conditions: Changing lifestyles, including sedentary habits, poor diet, and increased stress levels, lead to a rise in chronic diseases such as diabetes, hypertension, and respiratory disorders. Surgical procedures often become necessary to manage and treat these conditions.

High and Growing Disease Burden: The burden of cardiovascular diseases, cancer, obesity-related conditions, and orthopedic disorders is growing worldwide. Many of these conditions require surgical procedures as part of the treatment plan, leading to a higher demand for surgeries.

Advancements in Surgical Techniques: Advances in surgical techniques have made performing a broader range of surgeries possible. Minimally invasive procedures, robotic-assisted surgeries, and other innovative techniques have resulted in the adoption of surgical treatments.

With the growing number of surgical procedures, the demand for anesthesia machines is increasing. Healthcare facilities, including hospitals, ambulatory surgical centers, and specialty clinics, are investing in technologically advanced anesthesia machines to provide superior patient care, a successful outcome of surgical procedures, and patient comfort, driving the anesthesia machines market globally.

Click here to: Get Free Sample Copy of this report

According to the United Nations, the global population of people aged 65 and above is estimated to reach 1.5 billion in 2050, compared to 703 million in 2019. Older people are more prone to arthritis, cardiac anomalies, and cancer. For instance, according to the National Poll on Healthy Aging by the University of Michigan (U.S.), in 2022, 70% of total respondents aged between 50-80 years of age reported symptoms of arthritis and joint pain in the U.S. These conditions often require surgical procedures in the treatments offered by their doctors have less effect in the management of the condition.

Therefore, the growing geriatric population prone to chronic conditions leads to increasing adoption of surgical procedures. Anesthesia delivery systems provide automated and precise dosages of anesthetic for surgical procedures and monitor the oxygen concentration in the inspired gas and the blood during all anesthetics, which is crucial during a surgical procedure. This is expected to increase the adoption of anesthesia machines globally, driving market growth.

Chronic diseases tend to be of longer duration than most infectious diseases. Chronic diseases can occur due to genetic, lifestyle, and environmental factors. The major chronic diseases are cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes. The burden of these chronic diseases is high globally, resulting in life loss. Following are the statistics as of 2022 reported by the World Health Organization:

These chronic diseases generally require surgeries as a part of their treatment plan. The high burden of chronic diseases leads to the high adoption of surgeries. Anesthesia is administered to patients before surgery for pain management and comfort. Anesthesia machines help administer accurate dosages of anesthetics. Additionally, anesthesia monitors are crucial in monitoring patients’ vitals during surgical procedures. Therefore, the high burden of chronic diseases results in a high number of surgical procedures, leading to the adoption of anesthesia devices driving market growth.

The report offers a competitive landscape based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them in the last three to four years. The key players profiled in the anesthesia machines market report are Medtronic PLC (Ireland), Draegerwerk AG (Germany), Koninklijke Philips NV (Netherlands), GE HealthCare Technologies Inc. (U.S.), Becton Dickinson and Company (U.S.), Fisher & Paykel Healthcare (New Zealand), B. Braun SE (Germany), HEYER Medical AG (Germany), Mindray Medical International Limited (China), Smiths Group plc (U.K.), OSI Systems, Inc. (U.S.), Getinge AB (Sweden), Ambu A/S (Finland), and BPL Medical Technologies (India).

The high rate of surgical procedures carried out each year, the growing prevalence of chronic diseases, and the high adoption of anesthesia workstations in developed countries due to its benefits are responsible for the largest share of the segment. Anesthesia workstations consist of a broad range of equipment, including anesthesia machines, physiologic monitors, and accessories such as active suction equipment and adjunctive bag-valve-mask devices. They provide oxygenation, ventilation, and administration of volatile anesthetics. Due to the multiple functions carried out by the workstations, medical professionals highly prefer them for surgical procedures globally.

The large share of the segment is attributed to the high prevalence of orthopedic injuries leading to surgeries and musculoskeletal disorders such as osteoarthritis. According to the AAOS American Joint Replacement Registry, in 2022, 2.8 million hip and knee replacement procedures were performed in the U.S., an increase of 14% from 2021.

The large market share of this segment can be attributed to the high preference of patients for hospitals for surgical procedures compared to ambulatory surgical centers, increasing surgical procedures globally, and hospital and specialty clinics’ increasing focus on patient comfort. Patients prefer hospitals to treat major life-threatening diseases such as cardiovascular diseases, cancers, and severe diabetic complications. These conditions usually require surgical interventions.

Based on geography, North America is expected to dominate the anesthesia machines market in 2025. North America’s major market share is attributed to advancements in medical and surgical technologies, the high prevalence of chronic diseases, the high number of surgeries performed each year, and high healthcare expenditures.

|

Particular |

Details |

|

Page No |

~250 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2022 |

|

CAGR |

7.5% |

|

Market Size (Value) |

$7.71 billion by 2032 |

|

Segments Covered |

By Offering

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Sweden, Belgium, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa (UAE, South Africa, Rest of Middle East & Africa) |

|

Key Companies |

Medtronic PLC (Ireland), Draegerwerk AG (Germany), Koninklijke Philips NV (Netherlands), GE HealthCare Technologies Inc. (U.S.), Becton Dickinson and Company (U.S.), Fisher & Paykel Healthcare (New Zealand), B. Braun SE (Germany), HEYER Medical AG (Germany), Mindray Medical International Limited (China), Smiths Group plc (U.K.), OSI Systems, Inc. (U.S.), Getinge AB (Sweden), Ambu A/S (Finland), and BPL Medical Technologies (India). |

This study offers a detailed assessment of the anesthesia machines market, including the market sizes & forecasts for market segments such as offering, application, and end user. The study also provides an in-depth analysis of various segments & subsegments of the anesthesia machines market at the regional and country levels.

The anesthesia machines market is projected to reach $7.71 billion by 2032, at a CAGR of 7.5% during the forecast period.

Based on offering, which segment is expected to account for the largest share of the market in 2025?

In 2025, the anesthesia workstations segment is expected to account for the largest share. The large number of surgical procedures carried out each year, the growing prevalence of chronic diseases, and the high adoption of anesthesia workstations in developed countries due to its benefits are responsible for the largest share of the segment.

The growth of this market is attributed to several factors, including the growing number of surgical procedures, the growing prevalence of chronic diseases coupled with aging population, and technological advancements in anesthesia devices. Additionally, increasing focus on patient comfort is expected to provide significant opportunities for players operating in the market.

The key players profiled in the anesthesia machines market study are Medtronic PLC (Ireland), Draegerwerk AG (Germany), Koninklijke Philips NV (Netherlands), GE HealthCare Technologies Inc. (U.S.), Becton Dickinson and Company (U.S.), Fisher & Paykel Healthcare (New Zealand), B. Braun SE (Germany), HEYER Medical AG (Germany), Mindray Medical International Limited (China), Smiths Group plc (U.K.), OSI Systems, Inc. (U.S.), Getinge AB (Sweden), Ambu A/S (Finland), and BPL Medical Technologies (India).

In 2025, North America is expected to dominate the anesthesia machines market. Its major market share is attributed to the advancements in medical and surgical technologies, the growing prevalence of chronic diseases, the increasing volume of surgeries performed each year, and high healthcare expenditure.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for this Study

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. High Adoption of Surgical Procedures

4.2.2. Growing Prevalence of Chronic Diseases Coupled with Aging Population

4.2.3. Technological Advancements in Anesthesia Machines

4.3. Restraints

4.3.1. High Cost of Anesthesia Equipment

4.3.2. Stringent Regulations

4.3.3. Adverse Reactions of Anesthesia

4.4. Opportunity

4.4.1. Increasing Focus on Patient Comfort

4.4.2. Rising Healthcare Expenditure in Developing Countries

4.5. Challenges

4.5.1. Dearth of Skilled Personnel

4.5.2. High Maintenance of Anesthesia Machines

4.6. Trends

4.7. Pricing Analysis

4.8. Regulatory Analysis

4.8.1. North America

4.8.1.1. U.S.

4.8.1.2. Canada

4.8.2. Europe

4.8.3. Asia-Pacific

4.8.3.1. China

4.8.3.2. Japan

4.8.3.3. India

4.8.4. Latin America

4.8.5. Middle East & Africa

4.9. Porter’s Five Forces Analysis

5. Anesthesia Machines Market Assessment—by Offering

5.1. Introduction

5.2. Anesthesia Workstations

5.3. Portable Anesthesia Machines

5.4. Anesthesia Delivery Systems

5.5. Anesthesia Ventilators

5.6. Anesthesia Monitors

5.7. Accessories

5.7.1. Breathing Circuits

5.7.2. Oxygen Cells & Censors

5.7.3. Vaporizers

5.7.4. Anesthesia Masks

5.7.5. Endotracheal Tubes

5.7.6. Laryngeal Mask Airways

5.7.7. Other Accessories

6. Anesthesia Machines Market Assessment—by Application

6.1. Introduction

6.2. Orthopedic

6.3. Cardiology

6.4. Neurology

6.5. Respiratory Care

6.6. Urology

6.7. Other Applications

7. Anesthesia Machines Market Assessment—by End User

7.1. Introduction

7.2. Hospitals

7.3. Clinics

7.4. Ambulatory Surgical Centers

8. Anesthesia Machines Market Assessment—by Geography

8.1. Introduction

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Switzerland

8.3.7. Netherlands

8.3.8. Sweden

8.3.9. Belgium

8.3.10. Rest of Europe

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.4.4. Australia

8.4.5. South Korea

8.4.6. Rest of Asia-Pacific

8.5. Latin America

8.5.1. Brazil

8.5.1. Mexico

8.5.1. Rest of Latin America

8.6. Middle East & Africa

8.6.1. UAE

8.6.2. Saudi Arabia

8.6.3. South Africa

8.6.4. Rest of Middle East & Africa

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Vanguards

9.4.3. Market Differentiators

9.4.4. Emerging Companies

9.5. Market Share Analysis (2022)

10. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

10.1. Medtronic PLC

10.2. Becton, Dickinson, and Company

10.3. Draegerwerk AG

10.4. Koninklijke Philips NV

10.5. GE HealthCare Technologies Inc.

10.6. Fisher & Paykel Healthcare

10.7. B. Braun SE

10.8. HEYER Medical AG

10.9. Mindray Medical International Limited

10.10. Smiths Group plc

10.11. OSI Systems, Inc.

10.12. Getinge AB

10.13. Ambu A/S

10.14. BPL Medical Technologies

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Global Anesthesia Machines Market Drivers: Impact Analysis (2022–2032)

Table 2 Global Anesthesia Machines Market Restraints: Impact Analysis (2022–2032)

Table 3 Global Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 4 Global Anesthesia Workstations, by Country/Region, 2021–2032 (USD Million)

Table 5 Global Portable Anesthesia Machines Market, by Country/Region, 2021–2032 (USD Million)

Table 6 Global Anesthesia Delivery Systems Market, by Country/Region, 2021–2032 (USD Million)

Table 7 Global Anesthesia Ventilators Market, by Country/Region, 2021–2032 (USD Million)

Table 8 Global Anesthesia Monitors Market, by Country/Region, 2021–2032 (USD Million)

Table 9 Global Anesthesia Accessories Market, by Country/Region, 2021–2032 (USD Million)

Table 10 Global Breathing Circuits Market, by Country/Region, 2021–2032 (USD Million)

Table 11 Global Anesthesia Masks Market, by Country/Region, 2021–2032 (USD Million)

Table 12 Global Oxygen Cells & Sensors Market, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Anesthesia Vaporizers Market, by Country/Region, 2021–2032 (USD Million)

Table 14 Global Endotracheal Tubes Market, by Country/Region, 2021–2032 (USD Million)

Table 15 Global Laryngeal Mask Airways Market, by Country/Region, 2021–2032 (USD Million)

Table 16 Global Other Accessories Market, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 18 Global Anesthesia Machines Market Size for Orthopedic, by Country/Region, 2021–2032 (USD Million)

Table 19 Global Anesthesia Machines Market Size for Cardiology, by Country/Region, 2021–2032 (USD Million)

Table 20 Global Anesthesia Machines Market Size for Neurology, by Country/Region, 2021–2032 (USD Million)

Table 21 Global Anesthesia Machines Market Size for Urology, by Country/Region, 2021–2032 (USD Million)

Table 22 Global Anesthesia Machines Market Size for Other Applications, by Country/Region, 2021–2032 (USD Million)

Table 23 Global Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 24 Global Anesthesia Machines Market Size for Hospitals & Clinics, by Country/Region, 2021–2032 (USD Million)

Table 25 Global Anesthesia Machines Market Size for Ambulatory Surgical Centers, by Country/Region, 2021–2032 (USD Million)

Table 26 North America: Anesthesia Machines Market, by Country, 2021–2032 (USD Million)

Table 27 North America: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 28 North America: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 29 North America: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 30 North America: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 31 U.S.: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 32 U.S.: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 33 U.S.: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 34 U.S.: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 35 Canada: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 36 Canada: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 37 Canada: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 38 Canada: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 39 Europe: Anesthesia Machines Market, by Country/Region, 2021–2032 (USD Million)

Table 40 Europe: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 41 Europe: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 42 Europe: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 43 Europe: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 44 Germany: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 45 Germany: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 46 Germany: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 47 Germany: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 48 France: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 49 France: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 50 France: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 51 France: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 52 U.K.: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 53 U.K.: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 54 U.K.: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 55 U.K.: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 56 Italy: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 57 Italy: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 58 Italy: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 59 Italy: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 60 Spain: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 61 Spain: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 62 Spain: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 63 Spain: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 64 Switzerland: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 65 Switzerland: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 66 Switzerland: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 67 Switzerland: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 68 Sweden: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 69 Sweden: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 70 Sweden: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 71 Sweden: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 72 Netherlands: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 73 Netherlands: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 74 Netherlands: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 75 Netherlands: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 76 RoE: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 77 RoE: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 78 RoE: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 79 RoE: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 80 Asia-Pacific: Anesthesia Machines Market, by Country/Region, 2021–2032 (USD Million)

Table 81 Asia-Pacific: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 82 Asia-Pacific: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 83 Asia-Pacific: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 84 Asia-Pacific: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 85 Japan: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 86 Japan: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 87 Japan: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 88 Japan: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 89 China: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 90 China: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 91 China: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 92 China: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 93 India: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 94 India: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 95 India: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 96 India: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 97 Australia: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 98 Australia: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 99 Australia: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 100 Australia: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 101 South Korea: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 102 South Korea: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 103 South Korea: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 104 South Korea: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 105 RoAPAC: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 106 RoAPAC: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 107 RoAPAC: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 108 RoAPAC: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 109 Latin America: Anesthesia Machines Market, by Country/Region, 2021–2032 (USD Million)

Table 110 Latin America: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 111 Latin America: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 112 Latin America: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 113 Latin America: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 114 Brazil: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 115 Brazil: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 116 Brazil: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 117 Brazil: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 118 Mexico: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 119 Mexico: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 120 Mexico: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 121 Mexico: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 122 Rest of Latin America: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 123 Rest of Latin America: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 124 Rest of Latin America: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 125 Rest of Latin America: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 126 Middle East & Africa: Anesthesia Machines Market, by Country/Region, 2021–2032 (USD Million)

Table 127 Middle East & Africa: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 128 Middle East & Africa: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 129 Middle East & Africa: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 130 Middle East & Africa: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 131 UAE: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 132 UAE: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 133 UAE: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 134 UAE: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 135 Saudi Arabia: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 136 Saudi Arabia: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 137 Saudi Arabia: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 138 Saudi Arabia: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 139 South Africa: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 140 South Africa: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 141 South Africa: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 142 South Africa: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 143 Rest of Middle East & Africa: Anesthesia Machines Market, by Offering, 2021–2032 (USD Million)

Table 144 Rest of Middle East & Africa: Anesthesia Accessories Market, by Type, 2021–2032 (USD Million)

Table 145 Rest of Middle East & Africa: Anesthesia Machines Market, by Application, 2021–2032 (USD Million)

Table 146 Rest of Middle East & Africa: Anesthesia Machines Market, by End User, 2021–2032 (USD Million)

Table 147 Recent Developments, by Company (2020–2025)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for this Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global Anesthesia Machines Market, by Offering, 2025 Vs. 2032 (USD Million)

Figure 8 Global Anesthesia Machines Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 9 Global Anesthesia Machines Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 10 Global Anesthesia Machines Market, by Geography

Figure 11 Market Dynamics: Anesthesia Machines Market

Figure 12 Global Anesthesia Machines Market, by Offering, 2025 Vs. 2032 (USD Million)

Figure 13 Global Anesthesia Machines Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 14 Global Anesthesia Machines Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 15 North America: Anesthesia Machines Market Snapshot

Figure 16 Europe: Anesthesia Machines Market Snapshot

Figure 17 Asia-Pacific: Anesthesia Machines Market Snapshot

Figure 18 Latin America: Anesthesia Machines Market Snapshot

Figure 19 Middle East & Africa: Anesthesia Machines Market Snapshot

Figure 20 Key Growth Strategies Adopted by Leading Players (2020–2022)

Figure 21 Global Anesthesia Machines Market: Competitive Benchmarking Based on Offerings

Figure 22 Global Anesthesia Machines Market: Competitive Benchmarking Based on Geography

Figure 23 Market Share Analysis: Anesthesia Machines Market (2022)

Figure 24 Medtronic PLC: Financial Overview (2022)

Figure 25 Becton, Dickinson, and Company: Financial Overview (2022)

Figure 26 Draegerwerk AG: Financial Overview (2022)

Figure 27 Koninklijke Philips NV: Financial Overview (2022)

Figure 28 GE HealthCare Technologies Inc.: Financial Overview (2022)

Figure 29 Fisher & Paykel Healthcare: Financial Overview (2022)

Figure 30 Mindray Medical International Limited: Financial Overview (2022)

Figure 31 Smiths Group plc: Financial Overview (2022)

Figure 32 OSI Systems, Inc.: Financial Overview (2022)

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: May-2024

Published Date: Nov-2013

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates