Resources

About Us

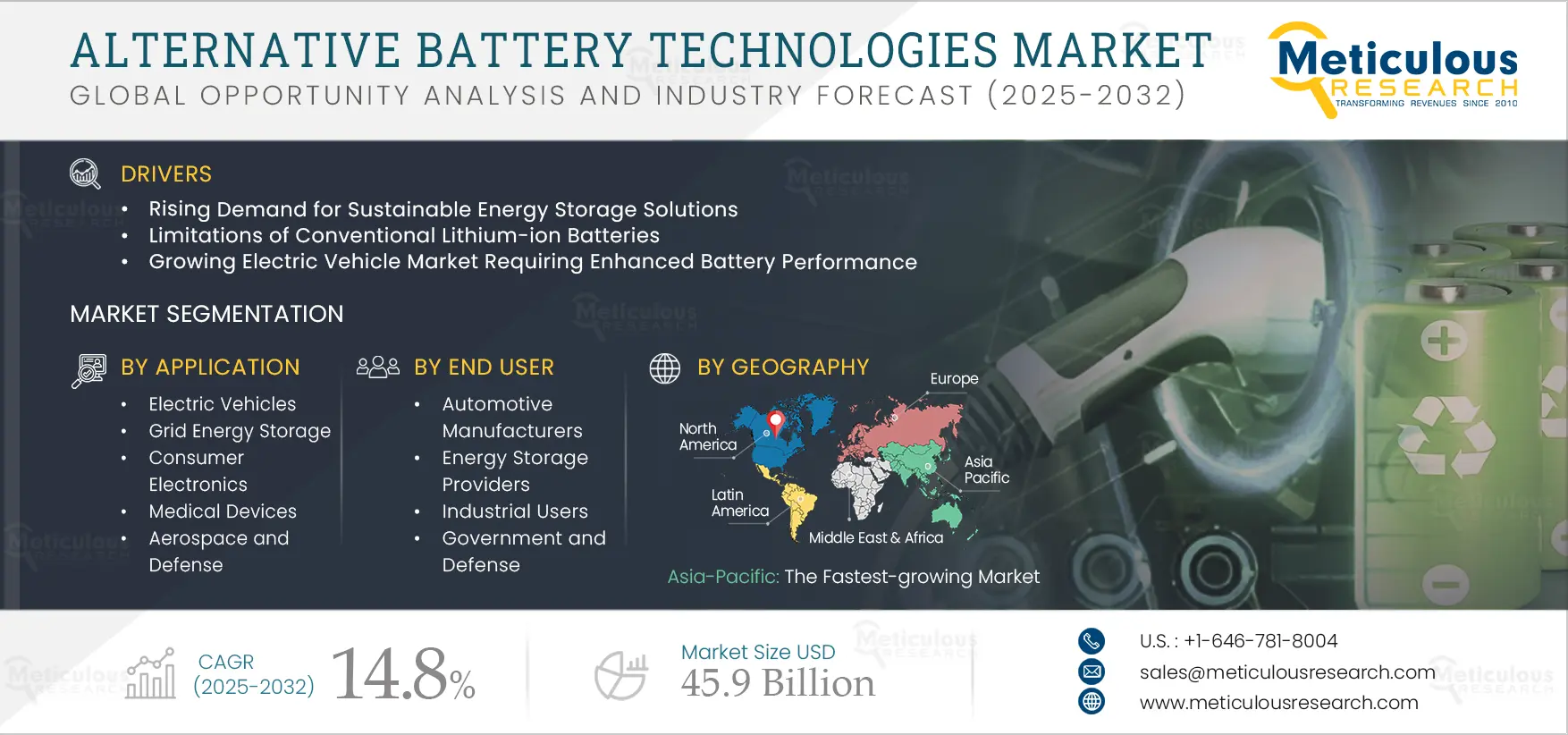

Alternative Battery Technologies Market by Battery Type (Solid-State, Metal-Ion, Flow Batteries), Application (Electric Vehicles, Grid Energy Storage), End User (Automotive Manufacturers, Energy Storage Providers), and Geography - Global Forecast to 2032

Report ID: MREP - 1041475 Pages: 225 Apr-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportReport Overview

This comprehensive market research report analyzes the rapidly expanding alternative battery technologies market, evaluating how emerging energy storage solutions are addressing the limitations of conventional lithium-ion batteries across various industries and applications. The report provides a strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends

The alternative battery technologies market is primarily driven by rising demand for sustainable energy storage solutions, limitations of conventional lithium-ion batteries, the growing electric vehicle market requiring enhanced battery performance, increasing investment in research and development, and supportive government initiatives for clean energy solutions. The shift toward solid-state battery architectures is reshaping the industry, while increasing focus on sodium and aluminum-based technologies is gaining significant traction. Additionally, advancements in flow battery systems for stationary applications, the rise of bio-inspired and organic battery materials, and growing interest in hybrid battery-supercapacitor systems are further driving market growth, especially in electric vehicle and grid energy storage applications.

Key Challenges

Despite significant growth potential, the overall alternative battery technologies market faces challenges to some extent including high development and production costs, technical difficulties in scaling up novel technologies, established infrastructure for conventional battery technologies, and uncertainty in long-term performance and reliability. Additionally, material supply chain constraints for novel chemistries presents significant barriers, potentially slowing down market penetration and widespread adoption in different countries across the globe.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Growth Opportunities

The alternative battery technologies market offers several high-growth opportunities. Emerging applications in grid-scale energy storage are driving demand for longer-duration storage solutions. Another major opportunity lies in higher energy density solutions for transportation electrification. Additionally, the growing focus on reducing critical materials dependencies is helping address geopolitical concerns and supply constraints. The integration with renewable energy systems and development of circular economy models for battery materials further expands the growth landscape for both established manufacturers and innovative startups.

Market Segmentation Highlights

By Battery Type

The solid-state batteries segment is expected to dominate the overall alternative battery technologies market in 2025, primarily due to substantial investments from automotive manufacturers and the technology's promise of significantly improved safety and energy density. These technologies are essential for overcoming range limitations and addressing safety concerns, with key variants including polymer electrolyte, oxide-based, sulfide-based, and composite electrolyte solid-state batteries. However, the alternative metal-ion batteries segment, particularly sodium-ion technologies, is expected to grow at the fastest CAGR through 2032, driven by their potential to offer cost-effective alternatives to lithium-ion technology while utilizing more abundant and geographically distributed materials.

By Application

The electric vehicles segment is expected to hold the largest share of the overall alternative battery technologies market in 2025, due to aggressive electrification strategies across the automotive industry and the critical importance of battery performance for vehicle competitiveness. These applications span passenger vehicles, commercial vehicles, and two/three-wheelers, with particular emphasis on extending range and reducing charging times. Grid Energy Storage applications are also growing significantly, especially with increasing renewable energy integration and the need for long-duration storage. However, the grid energy storage segment is expected to grow at fastest rate during the forecast period, driven by utility-scale deployment needs, commercial/industrial applications, and residential energy storage systems supporting distributed energy resources.

By End User

The automotive manufacturers segment is expected to hold the largest share of the overall alternative battery technologies market in 2025, primarily due to their early and largescale adoption of advanced battery technologies to support electric mobility. Energy storage providers follow closely, leveraging alternative battery technologies to enhance grid flexibility and renewable energy integration. However, the energy storage providers segment is expected to experience the fastest growth rate during the forecast period, driven by increasing renewable energy capacity, aging grid infrastructure, and the vital need for reliable long-duration storage solutions to address intermittency challenges and manage peak demand.

By Geography

Asia-Pacific is expected to hold the largest share of the global alternative battery technologies market in 2025, followed by North America, due to China's dominant position in battery manufacturing, aggressive electric vehicle adoption policies, and substantial government support across the region. However, the North America region is witnessing the fastest growth rate during the forecast period, primarily driven by recent legislation like the Inflation Reduction Act, which provides substantial incentives for domestic battery production and deployment. Meanwhile, Europe shows significant growth potential, particularly due to stringent emissions regulations, ambitious climate targets, and strong investments in research and development of next-generation battery technologies.

Competitive Landscape

The global alternative battery technologies market features a diverse competitive landscape with established battery manufacturers, automotive companies, well-funded startups, and research institutions pursuing varied approaches to next-generation energy storage.

The broader manufacturing landscape is evolving through increasing collaboration between battery developers and material suppliers, while automotive OEMs are making direct investments in battery startups to secure technology access. Leading manufacturers are focusing on scalable production processes that can transition from pilot to gigawatt-scale manufacturing without compromising performance or safety.

The key players operating in the global alternative battery technologies market are QuantumScape Corporation, Solid Power, Inc., Samsung SDI Co., Ltd., Toyota Motor Corporation, Contemporary Amperex Technology Co. Limited (CATL), Faradion Limited (acquired by Reliance Industries), Natron Energy, Inc., Sila Nanotechnologies Inc., Sion Power Corporation, ESS Tech, Inc., Form Energy, Inc., Ambri Inc., Ilika plc, StoreDot Ltd., ProLogium Technology Co., Ltd.

|

Particulars |

Details |

|

Number of Pages |

225 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

14.8% |

|

Market Size (Value)in 2025 |

USD 15.3 billion |

|

Market Size (Value) in 2032 |

USD 45.9 Billion |

|

Segments Covered |

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (Japan, South Korea, Australia, China, India, Rest of Asia-Pacific) |

|

Key Companies |

QuantumScape Corporation, Solid Power, Inc., Samsung SDI Co., Ltd., Toyota Motor Corporation, Contemporary Amperex Technology Co. Limited (CATL), Faradion Limited (acquired by Reliance Industries), Natron Energy, Inc., Sila Nanotechnologies Inc., Sion Power Corporation, ESS Tech, Inc., Form Energy, Inc., Ambri Inc., Ilika plc, StoreDot Ltd., ProLogium Technology Co., Ltd. |

The global alternative battery technologies Market was valued at $12.7 billion in 2024. This market is expected to reach $45.9 billion by 2032 from an estimated $15.3 billion in 2025, at a CAGR of 14.8% during the forecast period of 2025–2032.

The global alternative battery technologies market is expected to grow at a CAGR of 14.8% during the forecast period of 2025–2032.

The global alternative battery technologies market is expected to reach $45.9 billion by 2032 from an estimated $15.3 billion in 2025, at a CAGR of 14.8% during the forecast period of 2025–2032.

The key companies operating in this market include QuantumScape Corporation, Solid Power, Inc., Samsung SDI Co., Ltd., Toyota Motor Corporation, Contemporary Amperex Technology Co. Limited (CATL), Faradion Limited (acquired by Reliance Industries), Natron Energy, Inc., Sila Nanotechnologies Inc., Sion Power Corporation, ESS Tech, Inc., Form Energy, Inc., Ambri Inc., Ilika plc, StoreDot Ltd., ProLogium Technology Co., Ltd.

Major trends shaping the market include shift toward solid-state battery architectures, increasing focus on sodium and aluminum-based technologies, advancements in flow battery systems for stationary applications, rise of bio-inspired and organic battery materials, and growing interest in hybrid battery-supercapacitor systems.

Asia-Pacific is expected to hold the largest share of the global alternative battery technologies market in 2025, followed by North America, due to China's dominant position in battery manufacturing, aggressive electric vehicle adoption policies, and substantial government support across the region.

The growth of this market is driven by rising demand for sustainable energy storage solutions, limitations of conventional lithium-ion batteries, growing electric vehicle market requiring enhanced battery performance, increasing investment in research and development of alternative technologies, government initiatives supporting clean energy solutions.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Alternative Battery Technologies Market, by Battery Type

3.2.2. Alternative Battery Technologies Market, by Application

3.2.3. Alternative Battery Technologies Market, by End User

3.2.4. Alternative Battery Technologies Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Demand for Sustainable Energy Storage Solutions

4.2.1.2. Limitations of Conventional Lithium-ion Batteries

4.2.1.3. Growing Electric Vehicle Market Requiring Enhanced Battery Performance

4.2.1.4. Increasing Investment in Research and Development of Alternative Technologies

4.2.1.5. Government Initiatives Supporting Clean Energy Solutions

4.2.2. Restraints

4.2.2.1. High Development and Production Costs

4.2.2.2. Technical Challenges in Scaling Up Novel Technologies

4.2.2.3. Established Infrastructure for Conventional Battery Technologies

4.2.2.4. Uncertainty in Long-term Performance and Reliability

4.2.2.5. Material Supply Chain Constraints for Novel Chemistries

4.2.3. Opportunities

4.2.3.1. Emerging Applications in Grid-Scale Energy Storage

4.2.3.2. Demand for Higher Energy Density Solutions

4.2.3.3. Focus on Reducing Critical Materials Dependencies

4.2.3.4. Integration with Renewable Energy Systems

4.2.3.5. Development of Circular Economy Models for Battery Materials

4.2.4. Trends

4.2.4.1. Shift Toward Solid-State Battery Architectures

4.2.4.2. Increasing Focus on Sodium and Aluminum-based Technologies

4.2.4.3. Advancements in Flow Battery Systems for Stationary Applications

4.2.4.4. Rise of Bio-inspired and Organic Battery Materials

4.2.4.5. Growing Interest in Hybrid Battery-Supercapacitor Systems

4.2.5. Challenges

4.2.5.1. Achieving Cost Parity with Established Technologies

4.2.5.2. Balancing Energy Density, Safety, and Cycle Life

4.2.5.3. Establishing Recycling Infrastructure for New Battery Types

4.2.5.4. Addressing Temperature Sensitivity and Operating Limitations

4.2.5.5. Meeting Regulatory Requirements Across Global Markets

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Alternative Battery Technologies Market

4.4.1. Key Sustainability Dimensions Driving Industry Strategy

4.4.2. Material Selection and Resource Efficiency

4.4.3. Carbon Footprint of Battery Production Processes

4.4.4. End-of-Life Management and Recyclability

4.4.5. Industry Adoption Strategies and Implementation Challenges

5. Alternative Battery Technologies Market Assessment—by Battery Type

5.1. Solid-State Batteries

5.1.1. Polymer Electrolyte Solid-State

5.1.2. Oxide-Based Solid-State

5.1.3. Sulfide-Based Solid-State

5.1.4. Composite Electrolyte Solid-State

5.2. Next-Generation Lithium Technologies

5.2.1. Lithium-Sulfur

5.2.2. Lithium-Air

5.2.3. Advanced Lithium-Ion (Silicon/Graphene Anodes)

5.3. Alternative Metal-Ion Batteries

5.3.1. Sodium-Ion

5.3.2. Potassium-Ion

5.3.3. Magnesium-Ion

5.3.4. Calcium-Ion

5.3.5. Aluminum-Ion

5.3.6. Zinc-Ion

5.4. Redox Flow Batteries

5.4.1. Vanadium Redox Flow

5.4.2. Zinc-Based Flow

5.4.3. Iron-Based Flow

5.4.4. Organic Flow

5.5. Metal-Air Batteries (Non-Lithium)

5.5.1. Zinc-Air

5.5.2. Aluminum-Air

5.5.3. Iron-Air

5.6. Other Alternative Energy Storage Technologies

5.6.1. Sodium-Sulfur (High Temperature)

5.6.2. Organic and Bio-Based Batteries

5.6.3. Hybrid Ion-Capacitor Systems

6. Alternative Battery Technologies Market Assessment—by Application

6.1. Electric Vehicles

6.1.1. Passenger Vehicles

6.1.2. Commercial Vehicles

6.1.3. Two/Three Wheelers

6.2. Grid Energy Storage

6.2.1. Utility-Scale

6.2.2. Commercial/Industrial

6.2.3. Residential

6.3. Consumer Electronics

6.3.1. Smartphones and Tablets

6.3.2. Laptops and Wearables

6.3.3. Other Portable Devices

6.4. Medical Devices

6.5. Aerospace and Defense

6.6. Other Applications

7. Alternative Battery Technologies Market Assessment—by End User

7.1. Automotive Manufacturers

7.2. Energy Storage Providers

7.3. Consumer Electronics Companies

7.4. Industrial Users

7.5. Government and Defense

7.6. Healthcare Sector

7.7. Other End Users

8. Alternative Battery Technologies Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. South Korea

8.4.4. India

8.4.5. Australia

8.4.6. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

8.6.1. Saudi Arabia

8.6.2. United Arab Emirates (UAE)

8.6.3. Rest of Middle East & Africa (RoMEA)

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Contemporary Stalwarts

9.5. Market Share/Ranking Analysis, by Key Players, 2024

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

10.1. QuantumScape Corporation

10.2. Solid Power, Inc.

10.3. Samsung SDI Co., Ltd.

10.4. Toyota Motor Corporation

10.5. Contemporary Amperex Technology Co. Limited (CATL)

10.6. Faradion Limited (acquired by Reliance Industries)

10.7. Natron Energy, Inc.

10.8. Sila Nanotechnologies Inc.

10.9. Sion Power Corporation

10.10. ESS Tech, Inc.

10.11. Form Energy, Inc.

10.12. Ambri Inc.

10.13. Ilika plc

10.14. StoreDot Ltd.

10.15. ProLogium Technology Co., Ltd.

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 2 Solid-State Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 3 Polymer Electrolyte Solid-State Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 4 Oxide-Based Solid-State Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 5 Sulfide-Based Solid-State Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 6 Composite Electrolyte Solid-State Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 7 Next-Generation Lithium Technologies Market, by Country/Region, 2025–2032 (USD Million)

Table 8 Lithium-Sulfur Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 9 Lithium-Air Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 10 Advanced Lithium-Ion Batteries (Silicon/Graphene Anodes) Market, by Country/Region, 2025–2032 (USD Million)

Table 11 Alternative Metal-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 12 Sodium-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 13 Potassium-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 14 Magnesium-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 15 Calcium-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 16 Aluminum-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 17 Zinc-Ion Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 18 Redox Flow Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 19 Vanadium Redox Flow Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 20 Zinc-Based Flow Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 21 Iron-Based Flow Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 22 Organic Flow Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 23 Metal-Air Batteries (Non-Lithium) Market, by Country/Region, 2025–2032 (USD Million)

Table 24 Zinc-Air Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 25 Aluminum-Air Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 26 Iron-Air Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 27 Other Alternative Energy Storage Technologies Market, by Country/Region, 2025–2032 (USD Million)

Table 28 Sodium-Sulfur (High Temperature) Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 29 Organic and Bio-Based Batteries Market, by Country/Region, 2025–2032 (USD Million)

Table 30 Hybrid Ion-Capacitor Systems Market, by Country/Region, 2025–2032 (USD Million)

Table 31 Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 32 Alternative Battery Technologies Market for Electric Vehicles, by Type, 2025–2032 (USD Million)

Table 33 Alternative Battery Technologies Market for Passenger Vehicles, by Country/Region, 2025–2032 (USD Million)

Table 34 Alternative Battery Technologies Market for Commercial Vehicles, by Country/Region, 2025–2032 (USD Million)

Table 35 Alternative Battery Technologies Market for Two/Three Wheelers, by Country/Region, 2025–2032 (USD Million)

Table 36 Alternative Battery Technologies Market for Grid Energy Storage, by Type, 2025–2032 (USD Million)

Table 37 Alternative Battery Technologies Market for Utility-Scale Storage, by Country/Region, 2025–2032 (USD Million)

Table 38 Alternative Battery Technologies Market for Commercial/Industrial Storage, by Country/Region, 2025–2032 (USD Million)

Table 39 Alternative Battery Technologies Market for Residential Storage, by Country/Region, 2025–2032 (USD Million)

Table 40 Alternative Battery Technologies Market for Consumer Electronics, by Type, by Country/Region, 2025–2032 (USD Million)

Table 41 Alternative Battery Technologies Market for Smartphones and Tablets, by Country/Region, 2025–2032 (USD Million)

Table 42 Alternative Battery Technologies Market for Laptops and Wearables, by Country/Region, 2025–2032 (USD Million)

Table 43 Alternative Battery Technologies Market for Other Portable Devices, by Country/Region, 2025–2032 (USD Million)

Table 44 Alternative Battery Technologies Market for Medical Devices, by Country/Region, 2025–2032 (USD Million)

Table 45 Alternative Battery Technologies Market for Aerospace and Defense, by Country/Region, 2025–2032 (USD Million)

Table 46 Alternative Battery Technologies Market for Other Applications, by Country/Region, 2025–2032 (USD Million)

Table 47 Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 48 Alternative Battery Technologies Market for Automotive Manufacturers, by Country/Region, 2025–2032 (USD Million)

Table 49 Alternative Battery Technologies Market for Energy Storage Providers, by Country/Region, 2025–2032 (USD Million)

Table 50 Alternative Battery Technologies Market for Consumer Electronics Companies, by Country/Region, 2025–2032 (USD Million)

Table 51 Alternative Battery Technologies Market for Industrial Users, by Country/Region, 2025–2032 (USD Million)

Table 52 Alternative Battery Technologies Market for Government and Defense, by Country/Region, 2025–2032 (USD Million)

Table 53 Alternative Battery Technologies Market for Healthcare Sector, by Country/Region, 2025–2032 (USD Million)

Table 54 Alternative Battery Technologies Market for Other End Users, by Country/Region, 2025–2032 (USD Million)

Table 55 Alternative Battery Technologies Market, by Geography, 2025–2032 (USD Million)

Table 56 North America Alternative Battery Technologies Market, by Country, 2025–2032 (USD Million)

Table 57 U.S. Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 58 U.S. Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 59 U.S. Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 60 Canada Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 61 Canada Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 62 Canada Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 63 Europe Alternative Battery Technologies Market, by Country, 2025–2032 (USD Million)

Table 64 Germany Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 65 Germany Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 66 Germany Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 67 France Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 68 France Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 69 France Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 70 U.K. Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 71 U.K. Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 72 U.K. Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 73 Italy Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 74 Italy Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 75 Italy Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 76 Spain Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 77 Spain Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 78 Spain Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 79 Rest of Europe Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 80 Rest of Europe Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 81 Rest of Europe Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 82 Asia-Pacific Alternative Battery Technologies Market, by Country, 2025–2032 (USD Million)

Table 83 China Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 84 China Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 85 China Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 86 Japan Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 87 Japan Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 88 Japan Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 89 South Korea Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 90 South Korea Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 91 South Korea Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 92 India Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 93 India Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 94 India Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 95 Australia Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 96 Australia Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 97 Australia Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 98 Rest of Asia-Pacific Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 99 Rest of Asia-Pacific Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 100 Rest of Asia-Pacific Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 101 Latin America Alternative Battery Technologies Market, by Country, 2025–2032 (USD Million)

Table 102 Brazil Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 103 Brazil Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 104 Brazil Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 105 Mexico Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 106 Mexico Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 107 Mexico Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 108 Rest of Latin America Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 109 Rest of Latin America Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 110 Rest of Latin America Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 111 Middle East & Africa Alternative Battery Technologies Market, by Country, 2025–2032 (USD Million)

Table 112 Saudi Arabia Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 113 Saudi Arabia Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 114 Saudi Arabia Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 115 UAE Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 116 UAE Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 117 UAE Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

Table 118 Rest of Middle East & Africa Alternative Battery Technologies Market, by Battery Type, 2025–2032 (USD Million)

Table 119 Rest of Middle East & Africa Alternative Battery Technologies Market, by Application, 2025–2032 (USD Million)

Table 120 Rest of Middle East & Africa Alternative Battery Technologies Market, by End User, 2025–2032 (USD Million)

List of Figures

Figure 1 Alternative Battery Technologies Market Size, by Battery Type, 2025–2032 (USD Million)

Figure 2 Alternative Battery Technologies Market Share, by Battery Type, 2025 vs. 2032 (%)

Figure 3 Solid-State Batteries Market Size, by Type, 2025–2032 (USD Million)

Figure 4 Next-Generation Lithium Technologies Market Size, by Type, 2025–2032 (USD Million)

Figure 5 Alternative Metal-Ion Batteries Market Size, by Type, 2025–2032 (USD Million)

Figure 6 Redox Flow Batteries Market Size, by Type, 2025–2032 (USD Million)

Figure 7 Metal-Air Batteries (Non-Lithium) Market Size, by Type, 2025–2032 (USD Million)

Figure 8 Other Alternative Energy Storage Technologies Market Size, by Type, 2025–2032 (USD Million)

Figure 9 Alternative Battery Technologies Market Size, by Application, 2025–2032 (USD Million)

Figure 10 Alternative Battery Technologies Market Share, by Application, 2025 vs. 2032 (%)

Figure 11 Electric Vehicles Market Size, by Type, 2025–2032 (USD Million)

Figure 12 Grid Energy Storage Market Size, by Type, 2025–2032 (USD Million)

Figure 13 Consumer Electronics Market Size, by Type, 2025–2032 (USD Million)

Figure 14 Alternative Battery Technologies Market Size, by End User, 2025–2032 (USD Million)

Figure 15 Alternative Battery Technologies Market Share, by End User, 2025 vs. 2032 (%)

Figure 16 Alternative Battery Technologies Market Size, by Geography, 2025–2032 (USD Million)

Figure 17 Alternative Battery Technologies Market Share, by Geography, 2025 vs. 2032 (%)

Figure 18 North America Alternative Battery Technologies Market Size, by Country, 2025–2032 (USD Million)

Figure 19 Europe Alternative Battery Technologies Market Size, by Country, 2025–2032 (USD Million)

Figure 20 Asia-Pacific Alternative Battery Technologies Market Size, by Country, 2025–2032 (USD Million)

Figure 21 Latin America Alternative Battery Technologies Market Size, by Country, 2025–2032 (USD Million)

Figure 22 Middle East & Africa Alternative Battery Technologies Market Size, by Country, 2025–2032 (USD Million)

Figure 23 Global Alternative Battery Technologies Market Competitive Benchmarking, by Key Players

Figure 24 Global Alternative Battery Technologies Market Share Analysis, by Key Players, 2024 (%)

Figure 25 Market Dynamics Impact Analysis of Drivers, Restraints, Opportunities, and Challenges

Figure 26 Alternative Battery Technologies Market Growth Projections, 2025–2032 (USD Billion)

Figure 27 CAGR Comparison of Key Market Segments, 2025–2032 (%)

Figure 28 Global Electric Vehicle Market Growth vs. Alternative Battery Technologies Adoption, 2025–2032

Figure 29 Investment Trends in Alternative Battery Technologies, by Region, 2020-2024 (USD Billion)

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates