Resources

About Us

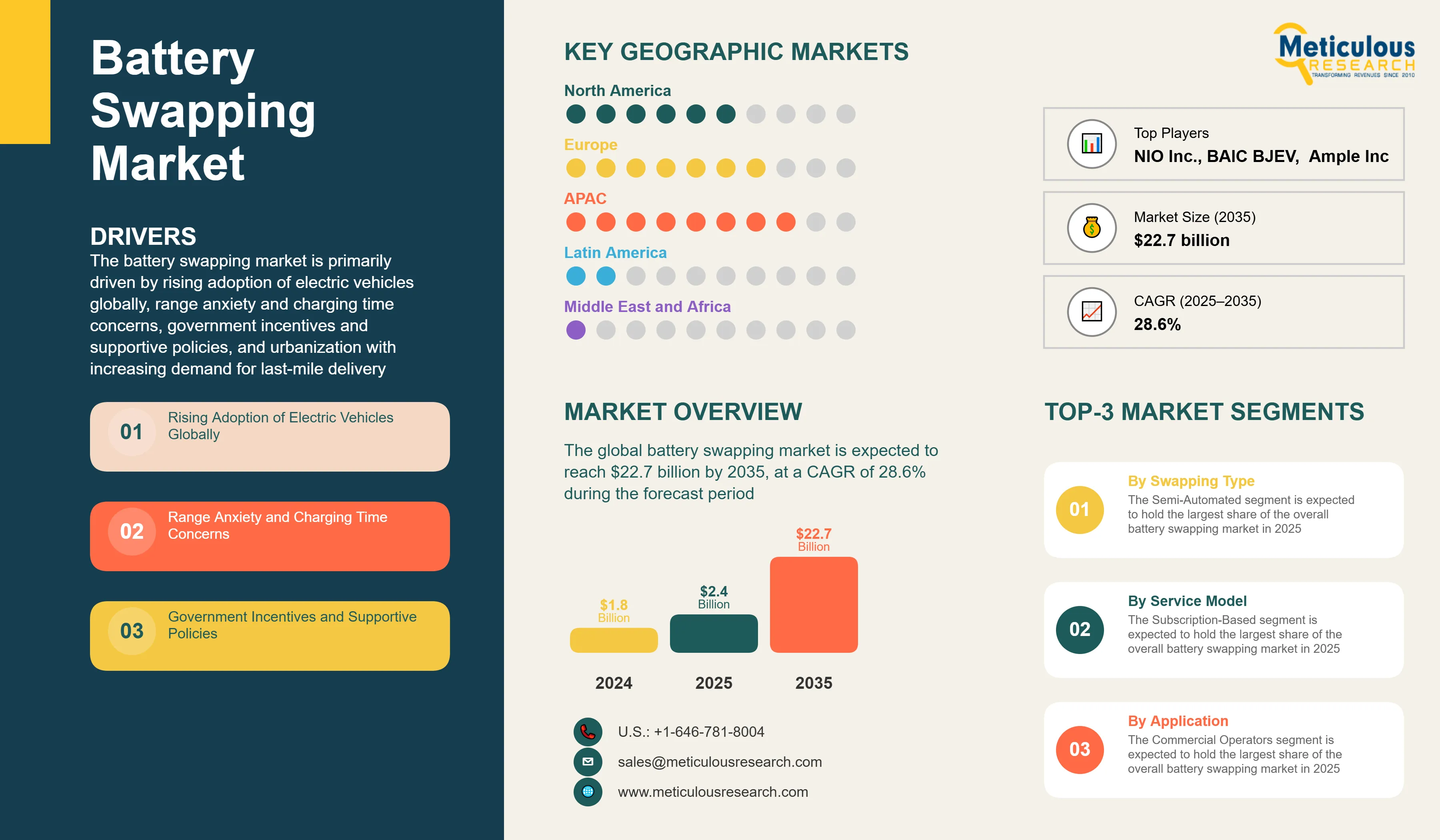

Battery Swapping Market by Swapping Type (Manual, Semi-Automated, Fully Automated), Vehicle Type (2W, 3W, 4W, Commercial Vehicles), Service Model (Subscription, Pay-Per-Use), Application, & Geography – Global Forecast to 2035

Report ID: MREP - 1041489 Pages: 265 May-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThis report analyzes the global battery swapping market, evaluating how solution providers are addressing electric vehicle adoption challenges, range anxiety concerns, and evolving sustainable transportation requirements across various regions. The report provides a strategic analysis of market dynamics, growth projections till 2035, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The battery swapping market is primarily driven by rising adoption of electric vehicles globally, range anxiety and charging time concerns, government incentives and supportive policies, and urbanization with increasing demand for last-mile delivery. IoT and AI integration in battery management is reshaping the industry, while subscription-based business models are gaining significant traction. Additionally, autonomous swapping technologies and second-life battery applications are further driving market growth, especially in Asia-Pacific and emerging markets with limited charging infrastructure.

Key Challenges

While the battery swapping market holds substantial growth potential, the overall market faces some challenges including lack of standardization in battery design, high initial infrastructure investment, and limited vehicle models supporting battery swapping. Additionally, battery ownership and liability concerns, grid integration and power management issues, battery quality control and maintenance requirements, and consumer perception and adoption barriers present significant obstacles, potentially slowing down market adoption in different regions across the globe.

Growth Opportunities

The battery swapping market offers several high-growth opportunities. Integration with renewable energy sources is driving innovation across multiple segments. Another major opportunity lies in partnerships between vehicle OEMs and energy companies. Additionally, growing demand in commercial fleet operations and expansion in emerging markets with limited charging infrastructure are creating new revenue streams for solution providers, as organizations increasingly seek efficient alternatives to traditional charging methods.

Market Segmentation Highlights

By Swapping Type

The Semi-Automated segment is expected to hold the largest share of the overall battery swapping market in 2025, due to its balance between cost-effectiveness and operational efficiency. However, the Fully Automated segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand for seamless user experiences, technological advancements in robotics, and the push for operational efficiency in high-traffic swapping stations.

By Vehicle Type

The Two-Wheelers segment is expected to dominate the overall battery swapping market in 2025, primarily due to its growing adoption in heavily populated urban areas, particularly in Asia-Pacific regions. However, the Commercial Vehicles segment is expected to grow at the fastest CAGR through the forecast period, driven by increasing focus on fleet electrification, operational cost benefits, and the need for minimal downtime in commercial operations.

By Service Model

The Subscription-Based segment is expected to hold the largest share of the overall battery swapping market in 2025, due to its ability to provide predictable operational costs for users and consistent revenue for service providers. The Pay-Per-Use segment follows as it provides flexibility for occasional users and serves as an entry point for new customers exploring battery swapping solutions. However, the Subscription-Based model is also expected to experience the fastest growth rate during the forecast period, driven by the increasing preference for service-oriented business models and the predictability they offer to both providers and users.

By Application

The Commercial Operators segment is expected to hold the largest share of the overall battery swapping market in 2025, due to the operational efficiency and cost advantages battery swapping offers to fleet operators, delivery services, and shared mobility platforms. However, the Commercial Operators segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing fleet electrification initiatives, the need for minimal vehicle downtime, and the predictable operational costs that battery swapping services provide to businesses.

By Geography

Asia-Pacific is expected to hold the largest share of the global battery swapping market in 2025, driven by high adoption of electric two and three-wheeler, governmental support for battery swapping infrastructure, and significant investments from both local and international players. Additionally, dense urban environments and limited residential charging options contribute significantly to market dominance. Europe follows as the second-largest market, bolstered by advanced environmental policies and strong public commitment to sustainable transportation. However, Latin America and Middle East & Africa are witnessing faster growth rates during the forecast period, primarily driven by expanding urban centers, increasing EV adoption, and the advantages battery swapping offers in areas with underdeveloped electrical grid infrastructure.

Competitive Landscape

The global battery swapping market features a diverse competitive landscape with established vehicle manufacturers, battery technology specialists, energy solution providers, and innovative mobility startups pursuing varied approaches to battery swapping implementation.

The broader solution provider landscape is categorized into industry leaders, market differentiators, vanguards, and contemporary stalwarts, with each group employing distinctive strategies to maintain competitive advantage. Leading providers are focusing on integrated solutions that combine battery swapping technology with broader mobility services while addressing region-specific infrastructure challenges.

The key players operating in the global battery swapping market are NIO Inc., Aulton New Energy Automotive Technology Co., Ltd., Gogoro Inc., Battery Smart, SUN Mobility, BAIC BJEV (Beijing Electric Vehicle Co.), Ample Inc., Geely Technology Group, Contemporary Amperex Technology Co., Limited (CATL), Panasonic Corporation, Esmito Solutions Pvt. Ltd., Honda Motor Co., Ltd. (Honda Mobile Power Pack), Tier Mobility GmbH, Immotor Inc., Kwang Yang Motor Co., Bounce Infinity, BYD Company Ltd., Leo Motors, and Oyika Pte Ltd. among others.

|

Particulars |

Details |

|

Number of Pages |

265 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

28.6% |

|

Market Size (Value) in 2025 |

USD 2.4 Billion |

|

Market Size (Value) in 2035 |

USD 22.7 Billion |

|

Segments Covered |

Market Assessment, by Swapping Type

Market Assessment, by Vehicle Type

Market Assessment, by Service Model

Market Assessment, by Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Taiwan, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Key Companies |

NIO Inc., Aulton New Energy Automotive Technology Co., Ltd., Gogoro Inc., Battery Smart, SUN Mobility, BAIC BJEV (Beijing Electric Vehicle Co.), Ample Inc., Geely Technology Group, Contemporary Amperex Technology Co., Limited (CATL), Panasonic Corporation, Esmito Solutions Pvt. Ltd., Honda Motor Co., Ltd. (Honda Mobile Power Pack), Tier Mobility GmbH, Immotor Inc., Kwang Yang Motor Co., Bounce Infinity, BYD Company Ltd., Leo Motors, Oyika Pte Ltd. |

The global battery swapping market was valued at $1.8 billion in 2024. This market is expected to reach approximately $22.7 billion by 2035, growing from an estimated $2.4 billion in 2025, at a CAGR of 28.6% during the forecast period of 2025–2035.

The global battery swapping market is expected to grow at a CAGR of 28.6% during the forecast period of 2025–2035.

The global battery swapping market is expected to reach approximately $22.7 billion by 2035, growing from an estimated $2.4 billion in 2025, at a CAGR of 28.6% during the forecast period of 2025–2035.

The key companies operating in this market include NIO Inc., Aulton New Energy Automotive Technology Co., Ltd., Gogoro Inc., Battery Smart, SUN Mobility, BAIC BJEV (Beijing Electric Vehicle Co.), Ample Inc., Geely Technology Group, Contemporary Amperex Technology Co., Limited (CATL), Panasonic Corporation, and others.

Major trends shaping the market include IoT and AI integration in battery management, subscription-based business models, autonomous swapping technologies, and second-life battery applications.

• In 2025, the Semi-Automated segment is expected to dominate the overall battery swapping market by swapping type

• Based on vehicle type, the Two-Wheelers segment is expected to hold the largest share of the overall battery swapping market in 2025

• Based on service model, the Subscription-Based segment is expected to hold the largest share of the global battery swapping market in 2025

Asia-Pacific is expected to hold the largest share of the global battery swapping market in 2025, driven by high electric two and three-wheeler adoption, governmental support for battery swapping infrastructure, and significant investments from both local and international players. Latin America and Middle East & Africa are witnessing faster growth rates during the forecast period.

The growth of this market is driven by rising adoption of electric vehicles globally, range anxiety and charging time concerns, government incentives and supportive policies, and urbanization with increasing demand for last-mile delivery.

Published Date: Jan-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates