Resources

About Us

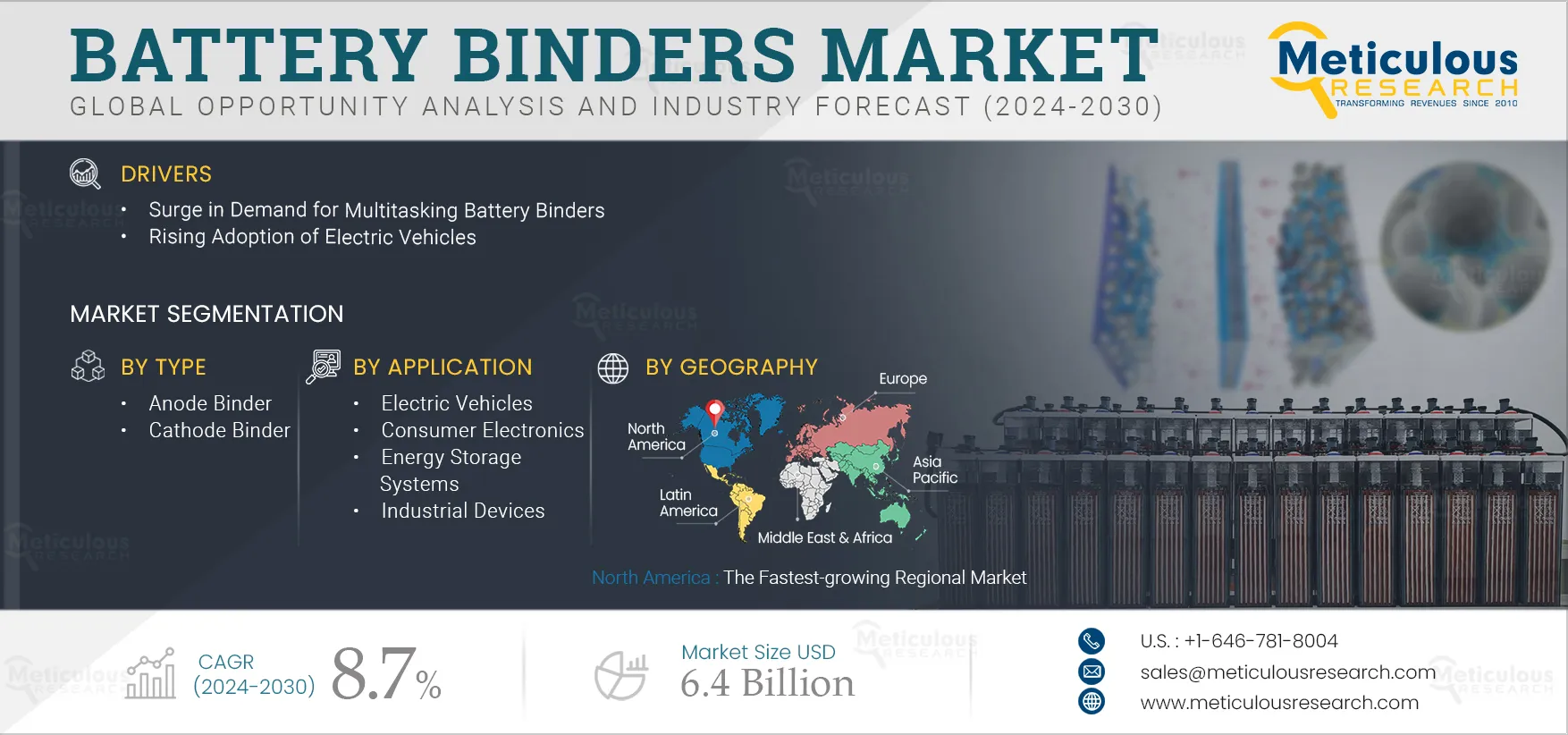

Battery Binders Market by Type (Anode Binder, Cathode Binder), Battery Type (Lithium-ion Batteries, Ni-Cd Batteries), Material (PVDF, CMC), Application (Electric Vehicles, Consumer Electronics), Sector, and Geography - Global Forecast to 2032

Report ID: MREP - 104860 Pages: 250 Jan-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the surge in demand for multitasking battery binders and the rising adoption of electric vehicles. The technological advancements in battery binders and developing infrastructure to charge electric vehicles are expected to offer significant growth opportunities for the stakeholders in the battery binders market. The growing demand for solid state lithium-ion batteries may restrain the market's growth to a certain extent. Furthermore, underdeveloped infrastructure for electric vehicles is expected to pose challenges to the growth of the battery binders market.

According to the International Energy Agency (IEA)(France), the electric cars market is witnessing exponential growth, with over 10 million sales in 2022. Nearly 14% of all new cars sold were electric in 2022, up from around 9% in 2021 and less than 5% in 2020. China was the frontrunner, accounting for around 60% of global electric car sales. More than half of the electric cars on roads worldwide are now in China, and the country has already surpassed its 2025 target for new energy vehicle sales. In Europe, the second-largest market, electric car sales increased by over 15% in 2022, meaning that more than one in every five cars sold was electric. Electric car sales in the United States—the third-largest market—increased by 55% in 2022, reaching a sales share of 8%. This increase in the popularity of electric vehicles has also created the need for more EV charging stations globally. Thus, the increased need for lithium-ion batteries for EV charging ultimately improves the demand for battery binders, supporting the market's growth.

Li-ion batteries are preferred for EVs because they have higher energy density than lead-acid and nickel-metal alternatives. Li-ion battery cells can produce 4.2 volts, significantly higher than other technologies. These batteries can deliver large amounts of electrical current for high-power applications. Li-ion batteries are also relatively low maintenance and do not require cycling to ensure performance and maintain their battery life. Thus, the rising adoption of electric vehicles and growing benefits offered by li-ion batteries significantly increase the demand for lithium-ion batteries, driving the demand for battery binders and supporting the market's growth.

Click here to: Get Free Sample Copy of this report

Some of the recent developments in this market space are as follows:

Such developments are expected to support the growth of the market.

Based on Type, the Anode Binder Segment is Projected to Register the Highest CAGR During the Forecast Period

The growth of this segment is driven by the growing demand for anode binders for lithium-ion batteries due to its significant demand in consumer electronics, electric vehicles, and energy storage systems applications. Furthermore, the growing demand for anode binders for better battery performance and the presence of industry-leading anode binder manufacturers are expected to offer significant opportunities for market players in the coming years.

Based on Battery Type, the Lithium-ion Batteries Segment is Projected to Register the Highest CAGR During the Forecast Period

The growth of this segment is driven by the increasing need for battery binders to hold the active material particles together in lithium-ion batteries and the rising demand for binders for battery cell construction and delivering a range of benefits, from safety enhancements and energy density to capacity, and rising need to lower the cost of battery manufacturing.

The growth of this segment is driven by the rising consumer preference for shared mobility, declining costs of high-capacity batteries, and significant investments by EV manufacturers in developing battery binders. Furthermore, supportive government policies and investment in deploying the public charging infrastructure, coupled with the benefits offered by electric vehicles, are expected to create significant market growth opportunities in the coming years.

Based on Sector, the Energy & Utilities Segment is Projected to Register the Highest CAGR During the Forecast Period

The growth of this segment is driven by the growing need to build grid-level energy storage systems for power generation, the increasing popularity of portable energy storage solutions, and the growing need to implement energy storage systems with high energy density. Furthermore, the growing need to develop lithium-ion batteries to balance the electric grid, provide backup power, and improve grid stability drives the demand for battery binders.

North America: The Fastest-growing Regional Market

North America is projected to register the highest CAGR during the forecast period. The presence of well-established battery binders across the U.S., an increase in sales of electric vehicles, and growing investments toward the installation of batteries in the renewable energy sector drive the growth of this regional market. Furthermore, companies are increasing their efforts to develop PVDF production facilities for battery materials in the region. For instance, in November 2022, Solvay SA (Belgium) and Orbia (Mexico) announced a joint venture framework agreement to create a partnership for the production of suspension-grade polyvinylidene fluoride (PVDF). Such initiatives from major market players are expected to support the growth of this regional market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants in the last 3–4 years. The key players operating in the global battery binders market are Arkema (France), ENEOS Holdings, Inc. (Japan), Zeon Corporation (Japan), BASF Group (Germany), UBE Corporation (Japan), Asahi Kasei Corporation (Japan), Kureha Corporation (Japan), Mitsui Chemicals, Inc. (Japan), Solvay SA (Belgium), Sumitomo Chemical Co., Ltd. (Japan), Toray Industries, Inc. (Japan), Synthomer plc (U.K.), Trinseo PLC (U.S.), Targray Technology International Inc. (Canada), and Sicona Battery Technologies (Australia).

Scope of the Report:

Battery Binders Market Assessment, by Type

Battery Binders Market Assessment, by Battery Type

Battery Binders Market Assessment, by Material

Battery Binders Market Assessment, by Application

Battery Binders Market Assessment, by Sector

Battery Binders Market Assessment, by Geography

Key questions answered in the report:

The battery binders market is projected to reach $6.4 billion by 2032, at a CAGR of 8.7% during the forecast period.

The electric vehicles segment is projected to register the highest CAGR during the forecast period due to the rising consumer preference for shared mobility, declining costs of high-capacity batteries, significant investments by EV manufacturers for developing battery binders, and supportive government policies and investment for the deployment of the public charging infrastructure.

The styrene-butadiene copolymer segment is projected to register the highest CAGR during the forecast period due to the growing demand for water-based binders to prepare anode electrodes for lithium-ion batteries and the growing demand for styrene-butadiene copolymer due to its strong adhesion and high aging-retardant properties.

The growth of this market is driven by the surge in demand for multitasking battery binders and the rising adoption of electric vehicles. Furthermore, technological advancements in battery binders and developing infrastructure to charge electric vehicles are expected to offer significant growth opportunities for the stakeholders in the battery binders market.

The key players operating in the global battery binders market are Arkema (U.S.), ENEOS Holdings, Inc. (U.S.), Zeon Corporation (Japan), BASF (Germany), UBE Corporation (Japan), Asahi Kasei Corporation (Japan), Kureha Corporation (Japan), Mitsui Chemicals, Inc. (Japan), Solvay SA (Belgium), Sumitomo Chemical Co., Ltd. (Japan), Toray Industries, Inc. (Japan), Synthomer plc (U.K.), Trinseo PLC (U.S.), Targray Technology International Inc. (Canada), and Sicona Battery Technologies (Australia).

The market in countries such as Germany, Japan, China, India, South Korea, the Netherlands, and the U.K. are expected to witness strong growth in the coming years and offer significant growth opportunities for market players.

Published Date: May-2025

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates