What is the Vanadium Flow Battery Market Size?

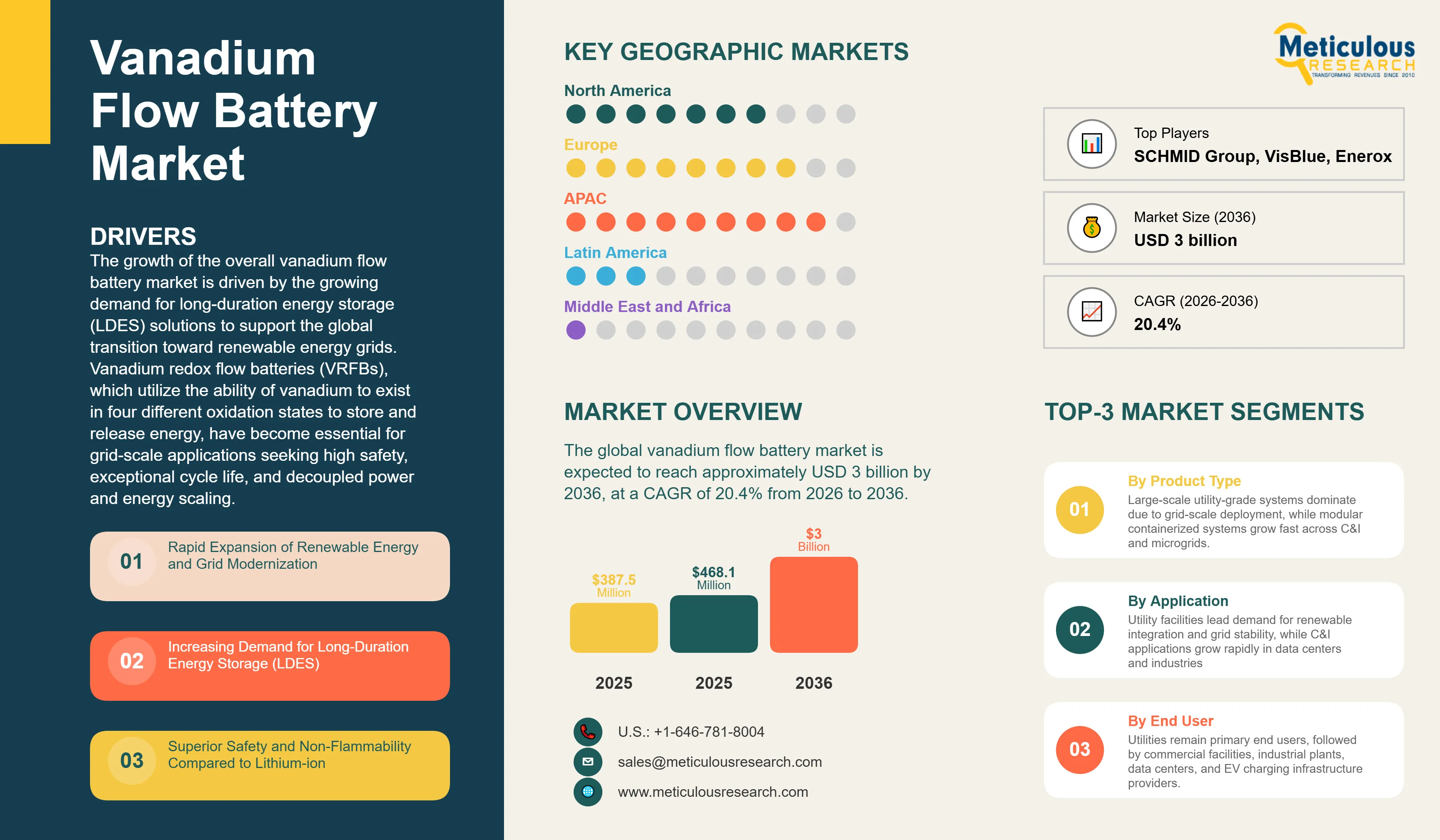

The global vanadium flow battery market was valued at USD 387.5 million in 2025. This market is expected to reach approximately USD 3 billion by 2036 from USD 468.1 million in 2026, at a CAGR of 20.4% from 2026 to 2036. The growth of the overall vanadium flow battery market is driven by the growing demand for long-duration energy storage (LDES) solutions to support the global transition toward renewable energy grids. Vanadium redox flow batteries (VRFBs), which utilize the ability of vanadium to exist in four different oxidation states to store and release energy, have become essential for grid-scale applications seeking high safety, exceptional cycle life, and decoupled power and energy scaling. The rapid expansion of utility-scale solar and wind projects, coupled with the increasing need for grid stabilization and the decarbonization of data centers, continues to fuel significant growth of this market across all major geographic regions.

Market Highlights: Vanadium Flow Battery

- In terms of revenue, the global vanadium flow battery market is projected to reach USD 3 billion by 2036.

- The market is expected to grow at a CAGR of 20.4% from 2026 to 2036.

- Asia Pacific dominates the global vanadium flow battery market with the largest market share in 2026.

- Asia Pacific is expected to witness the fastest CAGR during the forecast period, driven by massive deployments in China.

- By product type, the large-scale/utility-grade systems segment holds the largest market share in 2026.

- By product type, the modular/containerized systems segment is expected to witness the fastest growth during the forecast period.

- By application, the utility facilities segment holds the largest share of the overall market in 2026.

- By application, the commercial and industrial (C&I) segment is expected to witness the fastest CAGR during the forecast period.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Vanadium flow batteries are advanced electrochemical energy storage systems that store energy in liquid electrolytes containing vanadium ions. Unlike traditional solid-state batteries, VRFBs store energy in external tanks, allowing for the independent scaling of power (determined by the stack size) and energy capacity (determined by the electrolyte volume). This unique architecture offers a versatile combination of non-flammability, 100% depth of discharge without degradation, and an operational lifespan exceeding 20 to 30 years, making them indispensable for large-scale industrial and grid applications.

The market includes a diverse range of system configurations, ranging from kilowatt-scale modular units for commercial use to gigawatt-hour scale utility installations. These systems are integrated with advanced power electronics and battery management systems to provide services such as peak shaving, load leveling, and frequency regulation. The ability to provide stable, long-duration discharge, typically ranging from 4 to 12 hours, has made vanadium flow batteries the technology of choice for grid operators and renewable energy developers seeking to manage the intermittency of wind and solar power.

The overall vanadium flow battery market is expected to witness robust growth during the forecast period, driven by several factors. The global energy sector is pushing hard to integrate higher proportions of renewable energy, aiming to meet net-zero emission targets. This drive has increased the adoption of long-duration storage, with advanced VRFBs helping to stabilize grids by storing excess renewable generation for use during peak demand or low-generation periods. At the same time, the rapid growth in the data center market is increasing the need for sustainable backup power solutions. VRFBs offer crucial features like high safety and massive throughput to support the 24/7 uptime requirements of modern digital infrastructure. Meanwhile, industrial players are increasingly adopting flow batteries to manage volatile electricity costs and enhance energy security through behind-the-meter storage.

What are the Key Trends in the Vanadium Flow Battery Market?

Scaling to Gigawatt-Hour Capacity and Grid Integration

A major trend reshaping the vanadium flow battery market is the shift toward gigawatt-hour (GWh) scale projects. Manufacturers are increasingly moving beyond pilot-scale demonstrations to massive utility-grade installations. Leading companies are deploying systems that can provide hundreds of megawatts of power, serving as the backbone for regional grid stability. The recent commissioning of the world’s first GWh-scale vanadium flow battery project in China marks a key milestone in this transition. These large-scale deployments allow for significant economies of scale, reducing the levelized cost of storage (LCOS) and making VRFBs increasingly competitive with lithium-ion and other storage technologies for long-duration applications.

Innovation in Electrolyte Leasing and Circular Economy Models

Another major trend transforming the market is the development of electrolyte leasing business models. Since the vanadium electrolyte accounts for a significant portion of the upfront capital cost but does not degrade over time, manufacturers and financial institutions are creating programs that allow customers to lease the electrolyte rather than purchasing it outright. This approach significantly lowers the initial investment barrier and supports circular economy principles, as the vanadium can be easily recovered and reused at the end of the battery's life. Furthermore, manufacturers are investing in advanced recycling and purification technologies to ensure a sustainable supply of high-purity vanadium, often sourcing it from industrial waste streams like fly ash and slag, further enhancing the environmental profile of the technology.

Market Summary:

|

Parameters

|

Details

|

|

Market Size by 2036

|

USD 3 Billion

|

|

Market Size in 2026

|

USD 468.1 Million

|

|

Market Size in 2025

|

USD 387.5 Million

|

|

Market Growth Rate (2026-2036)

|

CAGR of 20.4%

|

|

Dominating Region

|

Asia Pacific

|

|

Fastest Growing Region

|

Asia Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Product Type, Application, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Renewable Energy Expansion and Long-Duration Storage Needs

A key driver of the vanadium flow battery market is the rapid movement of the global energy industry toward renewable energy integration and long-duration storage. Global regulations requiring the decarbonization of power grids have created significant incentives for the adoption of storage technologies that can handle the variability of solar and wind power. The U.S. Inflation Reduction Act (IRA), the European Green Deal, and China’s 14th Five-Year Plan for Energy Storage drive manufacturers toward scalable solutions that VRFBs can uniquely provide. It is estimated that as renewable penetration exceeds 20-30%, the need for storage durations beyond 4 hours increases exponentially; therefore, vanadium flow batteries, with their ability to scale energy capacity independently of power, are considered a crucial enabler of modern grid strategies.

Opportunity: Decarbonization of Data Centers and Industrial Microgrids

The rapid growth of AI-driven data centers and industrial automation provides great opportunities for the vanadium flow battery market. Indeed, the global surge in data center capacity has created a compelling demand for sustainable, non-flammable backup power systems. These applications require high reliability, long operational life, and the ability to perform frequent cycling, all attributes that are met with advanced VRFBs. The data center energy storage market is set to expand significantly through 2036, with vanadium flow batteries poised for an expanding share as operators seek alternatives to diesel generators and lithium-ion batteries. Furthermore, the increasing demand for industrial microgrids that power manufacturing facilities and remote communities is stimulating demand for modular VRFB systems that provide energy independence and resilience.

Product Type Insights

Why Do Large-Scale/Utility-Grade Systems Dominate the Market?

The large-scale/utility-grade systems segment accounts for around 65-70% of the overall vanadium flow battery market in 2026. This dominant position reflects the primary value proposition of this technology in grid-scale energy storage. These systems, often exceeding 10 MW in power and 40 MWh in energy, offer the most efficient way to manage bulk energy shifts and provide grid services. The utility sector alone consumes the vast majority of VRFB production, with major projects in China, North America, and Europe demonstrating the technology's capability to replace traditional peaker plants.

However, the modular/containerized systems segment is expected to grow at the fastest CAGR during the forecast period, driven by expanding applications in commercial buildings, EV charging stations, and remote microgrids. The ease of deployment, "plug-and-play" integration, and scalability of containerized units make them highly attractive for smaller-scale users who require reliable long-duration storage without the complexity of custom-built utility installations.

Application Insights

How Do Utility Facilities Lead the Market?

Based on application, the utility facilities segment holds the largest share of the overall vanadium flow battery market in 2026, accounting for around 75-80% of total consumption. From renewable energy smoothing and load leveling to grid frequency regulation and transmission deferral, the use of VRFBs in the utility sector is central to modernizing energy infrastructure. Current grid-scale projects are increasingly specifying flow batteries for their safety and long-term cost advantages over lithium-ion for durations exceeding 6 hours.

The commercial and industrial (C&I) segment would see the fastest growth during the forecast period owing to the growing focus on corporate sustainability, rising peak demand charges, and the need for resilient onsite power. Vanadium flow batteries are finding critical applications in powering large manufacturing plants, supporting green hydrogen production, and providing sustainable backup for data centers. The modularity of new VRFB designs starts pushing up the requirement for standardized systems that allow businesses to scale their storage capacity as their energy needs grow.

Regional Insights

How is Asia Pacific Maintaining Dominance in the Global Vanadium Flow Battery Market?

Asia Pacific holds the largest share of the global vanadium flow battery market in 2026. The largest share of this region is primarily attributed to the massive government-led investments in energy storage infrastructure, particularly in China. China alone accounts for more than 60% of global VRFB deployments, with its position as the world's largest producer of vanadium and a leading hub for flow battery manufacturing driving sustained growth. The presence of leading manufacturers including Dalian Rongke Power Co., Ltd., VRB Energy, and numerous specialized electrolyte producers provides a well-developed supply chain serving regional and global customers.

Japan also contributes significantly to this market through its pioneering work in VRFB technology, led by Sumitomo Electric Industries, Ltd., which has deployed systems globally for decades. India represents a rapidly emerging market within Asia Pacific, driven by its ambitious renewable energy targets and the need for grid stabilization in its expanding industrial corridors.

Which Factors Support North America and Europe Vanadium Flow Battery Market Growth?

Together, North America and Europe account for around 25 to 30% of the global vanadium flow battery market. The growth of these markets is mainly driven by the need for long-duration storage to support high-penetration renewable grids and the stringent safety requirements for indoor and urban storage installations. The demand for VRFBs in North America is mainly due to its large-scale utility projects and the presence of innovators like Invinity Energy Systems and UniEnergy Technologies.

In Europe, the leadership in sustainable energy policies and the push for energy independence are driving the adoption of flow batteries. Countries like the UK, Germany, and Spain are at the forefront, with significant projects aimed at integrating offshore wind and providing grid services. The European market also benefits from a strong focus on circular economy models and the development of local vanadium supply chains.

Key players

The global vanadium flow battery market is characterized by the presence of a mix of established industrial players and specialized energy storage technology providers. Companies such as Dalian Rongke Power, Sumitomo Electric Industries, VRB Energy, and Invinity Energy Systems lead the market with large-scale and utility-grade installations, particularly for grid stabilization and renewable energy integration. Meanwhile, players including Enerox (CellCube), SCHMID Group, VisBlue, and VFlowTech focus on modular and containerized systems targeting commercial, industrial, and microgrid applications. Emerging manufacturers and integrated players such as Australian Vanadium (VSUN Energy) and Largo Clean Energy are strengthening the market through vertical integration across vanadium supply, electrolyte production, and battery systems. Overall, competition in the market is driven by system scalability, project execution capability, long-duration performance, and the ability to support diverse applications ranging from utilities and C&I facilities to EV charging infrastructure and defense installations.

Key Questions Answered in the Report: